Nuclear LED Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433377 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Nuclear LED Lighting Market Size

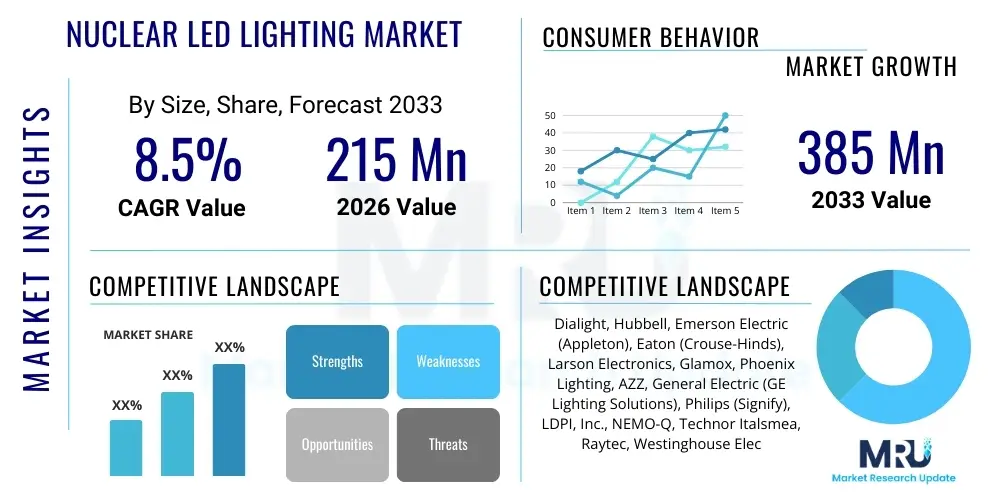

The Nuclear LED Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $215 Million USD in 2026 and is projected to reach $385 Million USD by the end of the forecast period in 2033.

Nuclear LED Lighting Market introduction

The Nuclear LED Lighting Market encompasses specialized solid-state lighting (SSL) solutions designed and certified for operation within environments exposed to ionizing radiation, high temperatures, and stringent safety requirements prevalent in nuclear power plants, research reactors, and waste handling facilities. These lighting systems are engineered using radiation-hardened components, durable housing materials, and enhanced thermal management to ensure reliability and longevity in critical infrastructure where replacement cycles must be minimized due to accessibility and safety protocols. Traditional lighting systems, such as fluorescent and incandescent bulbs, degrade rapidly under nuclear operating conditions, necessitating the adoption of robust LED technology which offers superior efficiency, reduced maintenance burden, and excellent lumen depreciation characteristics over extended periods.

The primary applications of nuclear LED lighting include reactor halls, containment areas, spent fuel storage facilities, control rooms, and security perimeter lighting around nuclear sites. A significant shift toward LED adoption is driven by global nuclear plant lifetime extension programs and modernization initiatives aimed at enhancing operational safety and reducing overhead costs associated with energy consumption and maintenance. Furthermore, the inherent safety features of LEDs, such as low heat emission and instant start-up, make them ideal for emergency and safety-critical lighting applications within these highly regulated environments. The focus on improved visibility and reduction of personnel exposure time during maintenance tasks further solidifies the need for highly reliable, long-lasting LED solutions.

Key benefits driving market penetration include the exceptional energy efficiency of LEDs compared to conventional lighting, leading to substantial reductions in electricity consumption critical for large, continuous operations like nuclear plants. Additionally, the resistance of specialized LEDs to gamma and neutron radiation ensures operational stability, minimizing the need for frequent replacements, which is hazardous and costly in radioactive zones. Major driving factors include global regulatory mandates emphasizing worker safety and environmental performance, the ongoing necessity for infrastructure upgrades in aging nuclear fleets, and technological advancements creating more durable, radiation-tolerant LED chips and driver components suitable for continuous deployment in high-stress operational areas.

Nuclear LED Lighting Market Executive Summary

The Nuclear LED Lighting Market is poised for significant expansion, fueled by global initiatives to extend the operational lifespan of existing nuclear reactors and the increasing implementation of new reactor constructions, particularly in Asia Pacific and Eastern Europe. Business trends indicate a strong move toward integrated monitoring and smart lighting systems that can interface with Plant Control Systems (PCS) to provide detailed diagnostics on lamp health and operational status, thereby optimizing predictive maintenance schedules. Key players are focusing heavily on securing specialized certifications (e.g., IEEE, IEC, ASME) essential for installation in highly regulated nuclear environments, leading to intensified competition in product standardization and reliability guarantees. Investment in R&D is concentrated on developing high-lumen, low-profile fixtures designed to withstand cumulative radiation doses over decades of service, ensuring the total cost of ownership remains attractive compared to older, less efficient technologies.

Regionally, North America and Europe currently dominate the market due to the large installed base of aging nuclear infrastructure requiring modernization and stringent safety standards mandating immediate technological upgrades. However, the Asia Pacific region, led by China and India, is projected to exhibit the fastest growth rate, driven by aggressive nuclear capacity expansion plans and the deployment of advanced reactor designs, such as Small Modular Reactors (SMRs), which also require specialized, compact LED lighting solutions. Segments trends highlight the dominance of High-Bays and Floodlights due to their necessity in large reactor halls and external security areas, while specialized fixtures for harsh environments, such as those resistant to boron-containing coolants or seismic vibrations, are gaining traction. The demand for explosion-proof and hazardous location (HazLoc) rated LED fixtures within nuclear sites remains consistently high, reflecting the industry's zero-tolerance policy for equipment failure.

Furthermore, the market exhibits a clear segmentation based on application area, differentiating between safety-critical lighting (emergency exit, pathways) and general area lighting (control rooms, offices). The crucial aspect driving growth across all segments is the superior return on investment (ROI) offered by LEDs through energy savings and dramatically reduced replacement labor costs, especially in areas with limited access due to high radiation fields. The standardization of radiation testing methodologies and improved supply chain robustness for radiation-hardened semiconductors are facilitating market entry and accelerating the commercialization of new generation lighting products tailored specifically for the extreme conditions of nuclear facilities globally.

AI Impact Analysis on Nuclear LED Lighting Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the longevity and predictive maintenance capabilities of specialized lighting systems in inaccessible nuclear zones. Common concerns revolve around AI's ability to analyze sensor data from LED drivers (temperature, voltage, current fluctuations, lumen depreciation rates) to forecast failures before they occur, thereby minimizing unscheduled shutdowns and reducing personnel exposure. Key themes emerging from these questions suggest expectations that AI will transition nuclear lighting from reactive replacement cycles to highly accurate predictive maintenance models, optimize energy consumption dynamically based on operational schedules, and integrate visual data processing (e.g., using AI-equipped cameras mounted on lighting fixtures) for security and structural monitoring within the facilities. The underlying summary is that AI is viewed as a critical enabler for maximizing the efficiency and safety performance of highly reliable LED systems in the nuclear context.

- AI-driven Predictive Maintenance: Analyzing operational data (heat signatures, power consumption variability) to forecast LED driver and module failures, optimizing replacement timing and minimizing facility downtime.

- Dynamic Energy Optimization: Utilizing ML algorithms to adjust light intensity based on environmental factors (ambient light levels) and real-time operational needs, ensuring maximum energy savings without compromising safety standards.

- Integrated Visual and Security Monitoring: Employing embedded AI in smart lighting fixtures to process visual data for anomaly detection, intrusion alerts, or structural integrity monitoring within containment areas.

- Supply Chain and Inventory Management: AI tools optimizing the stocking and distribution of specialized, radiation-hardened LED components, ensuring rapid availability for critical replacements across global fleets.

- Automated Compliance Reporting: Leveraging AI to aggregate performance metrics and generate continuous compliance reports specific to nuclear safety regulations (e.g., ensuring required illumination levels are maintained).

DRO & Impact Forces Of Nuclear LED Lighting Market

The Nuclear LED Lighting Market is heavily influenced by a combination of stringent regulatory drivers, significant operational constraints, and compelling technological opportunities, all mediated by critical impact forces related to safety and cost effectiveness. Key drivers include the global trend of nuclear power plant life extension programs, which necessitate high-reliability, low-maintenance components like LEDs, and strict safety mandates enforced by regulatory bodies like the IAEA and national atomic energy commissions requiring minimum illumination standards in all operational areas. Restraints primarily involve the extremely high upfront cost of developing, testing, and certifying radiation-hardened LED fixtures, alongside the inherent slow-moving procurement processes within the nuclear sector that demand multi-year qualification periods. Opportunities lie in the rapidly expanding market for Small Modular Reactors (SMRs) which require highly customized, compact lighting solutions, and the integration of smart lighting control systems capable of detailed diagnostics and remote health monitoring, significantly reducing human intervention in contaminated areas.

The primary impact forces shaping this market dynamic are centered around Total Cost of Ownership (TCO) and compliance risk. While the initial investment for nuclear-grade LED systems is high, the long operational life (often exceeding 50,000 hours in radiation environments) dramatically reduces maintenance expenditures and replacement labor costs, offering a compelling TCO argument over the 30-to-40-year lifespan of a reactor. Regulatory compliance acts as an irresistible impact force, as failure to meet stringent safety and illumination standards can lead to costly operational pauses or fines, effectively mandating the adoption of the most reliable technology available, which currently is radiation-hardened LED lighting. Furthermore, the global shortage of specialized components and the limited number of certified suppliers creates a supply chain force that dictates pricing and market accessibility.

Therefore, the market progression is characterized by a cautious yet determined shift towards durable LED solutions. The inherent trade-off between the high certification barrier (Restraint) and the immense cost savings from reduced maintenance and energy efficiency (Driver/Opportunity) is balanced by the overarching force of regulatory pressure demanding maximum safety and reliability. The integration of advanced thermal management and robust driver electronics capable of handling voltage spikes and cosmic ray interference constitutes a major technological opportunity that key market players are actively pursuing to gain competitive advantage in this highly specialized industrial niche.

Segmentation Analysis

The Nuclear LED Lighting Market is segmented based on product type, application area, light source type, and reactor type, reflecting the varied requirements within nuclear facilities. The market structure emphasizes specialized functionality due to the diverse environments, ranging from high-radiation containment vessels requiring specialized radiation-hardened fixtures to standard administrative buildings utilizing commercial-grade industrial LEDs. Product segmentation is dominated by robust fixtures like high-bays and floodlights, which provide general area illumination, while linear fixtures and exit signs constitute the critical safety lighting segment. Application areas differentiate between internal reactor components, external facility security, and operational areas such as control rooms and maintenance bays. This granularity allows vendors to target specific certification requirements and operational environments with optimized products, ensuring compliance and efficiency across the entire nuclear complex.

- By Product Type:

- High-Bay Fixtures

- Floodlights and Spotlights

- Linear Fixtures (Tubes and Strips)

- Emergency and Exit Lighting

- Portable and Inspection Lights (Temporary Use)

- By Application Area:

- Reactor Containment and Primary Systems

- Spent Fuel Storage and Waste Handling

- Control Rooms and Operational Centers

- Maintenance and Auxiliary Buildings

- Security and Perimeter Lighting

- By Light Source Technology:

- High-Power LEDs (50W and above)

- Mid-Power LEDs (10W - 50W)

- Low-Power LEDs (Below 10W)

- Radiation-Hardened LEDs

- By Reactor Type:

- Pressurized Water Reactors (PWR)

- Boiling Water Reactors (BWR)

- Heavy Water Reactors (HWR)

- Small Modular Reactors (SMR) and Advanced Reactors

Value Chain Analysis For Nuclear LED Lighting Market

The value chain for Nuclear LED Lighting is highly specialized, starting with the complex upstream segment focusing on the development and manufacturing of radiation-hardened semiconductor chips and high-reliability driver components. This initial stage requires significant investment in specialized material science and radiation testing facilities to ensure components can withstand high cumulative doses (typically measured in kGy or Mrad) without catastrophic failure or unacceptable lumen depreciation. Key suppliers in this upstream segment are limited, often consisting of niche semiconductor firms or major lighting conglomerates with dedicated R&D units focusing on ruggedization. The midstream involves fixture manufacturing, assembly, and rigorous regulatory certification (including seismic, thermal, and radiation tolerance testing), transforming components into compliant, installable products. Due to the high-stakes nature of the application, quality control and validation form the most critical part of this middle segment.

Downstream analysis focuses on distribution and installation within the highly regulated nuclear ecosystem. Distribution channels are predominantly indirect, relying on specialized industrial distributors and certified system integrators who possess the requisite knowledge of nuclear procurement procedures, installation protocols, and security clearances necessary to operate within nuclear sites. Direct sales are rare, typically reserved for large, custom projects or government tenders where the manufacturer engages directly with the utility or primary engineering contractor (EPC). System integrators play a vital role, not just in installation, but also in interfacing the new LED systems with existing plant infrastructure, often involving complex wiring and control upgrades. This downstream segment is characterized by long sales cycles and high barriers to entry, emphasizing trust, safety track record, and long-term support capabilities.

The procurement decision-making process is heavily centralized and risk-averse, prioritizing reliability and certification over marginal cost differences. Maintenance and lifecycle services, including provision for replacement components and technical support, form the final crucial segment of the value chain. The complexity and risk inherent in the nuclear environment necessitate robust after-market support, reinforcing the importance of established, reputable manufacturers who can guarantee long-term component availability and compliance documentation for the entire operational life of the reactor. The indirect distribution channel, leveraging expert integrators, ensures that the technologically complex products are deployed correctly and comply with all site-specific safety and operational requirements.

Nuclear LED Lighting Market Potential Customers

The primary customer base for the Nuclear LED Lighting Market consists overwhelmingly of nuclear power generation utilities and operators responsible for maintaining and modernizing existing reactor fleets, as well as entities involved in the construction of new nuclear facilities. These end-users are characterized by extremely strict safety budgets, long-term investment horizons, and a preference for vendor relationships that ensure product longevity and certified radiation tolerance. Specific buyers include the operational divisions of major global utility companies (such as EDF, Korea Hydro & Nuclear Power, Exelon, and state-owned enterprises in China and Russia) managing pressurized water reactors (PWRs), boiling water reactors (BWRs), and advanced gas-cooled reactors (AGRs). These utilities require large volumes of standardized, high-reliability fixtures for general illumination, safety pathways, and security applications across their extensive campuses.

Secondary, yet highly lucrative, customer segments include governmental research institutions, defense agencies, and national laboratories operating smaller, specialized research reactors or handling nuclear waste and decommissioning activities. These organizations require highly custom, often portable, or deeply submerged lighting solutions designed for unique environments, such as hot cells or waste encapsulation facilities. Furthermore, the burgeoning sector of Small Modular Reactor (SMR) developers and engineering procurement construction (EPC) firms represents a rapidly growing customer segment. SMRs, being smaller and having unique footprint requirements, demand compact, robust LED lighting designed to fit integrated containment structures, driving demand for innovative form factors and highly efficient thermal management solutions tailored to these next-generation designs.

In essence, the buying behavior is driven by adherence to regulatory mandates (e.g., maintaining minimum lux levels for safety), minimizing maintenance cycles in hazardous areas (reducing personnel exposure), and maximizing energy efficiency over decades. Procurement cycles are typically long, involving extensive qualification and testing periods, making the initial certification and proven track record of the vendor paramount. Purchasing decisions are often centralized, involving engineering departments, safety officers, and procurement specialists working in tandem to select solutions that offer the highest level of reliability and lowest lifetime operational risk, rather than simply the lowest upfront cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $215 Million USD |

| Market Forecast in 2033 | $385 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dialight, Hubbell, Emerson Electric (Appleton), Eaton (Crouse-Hinds), Larson Electronics, Glamox, Phoenix Lighting, AZZ, General Electric (GE Lighting Solutions), Philips (Signify), LDPI, Inc., NEMO-Q, Technor Italsmea, Raytec, Westinghouse Electric Company, Litetronics International, Cooper Lighting Solutions, R. STAHL, Tarmac Lighting, Tungsram Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nuclear LED Lighting Market Key Technology Landscape

The technological landscape of the Nuclear LED Lighting Market is defined by the necessity for extreme durability and operational stability in harsh environments, necessitating advanced solutions far beyond standard commercial LEDs. A primary focus is on utilizing radiation-hardened components, including specialized LED chip encapsulation materials (often quartz or specific inorganic compounds) and highly durable driver electronics that can resist neutron and gamma radiation-induced damage, which typically causes rapid lumen decay and thermal failure in conventional LEDs. Furthermore, thermal management technology is crucial; since nuclear lighting fixtures often operate in high ambient temperatures or confined spaces, advanced passive cooling systems, such utilizing specialized heat pipes or optimized fin designs, are essential to maintain junction temperature within safe limits, extending the fixture's overall lifespan and preventing premature failure caused by heat accumulation in sealed enclosures.

Another significant technological advancement involves the development of integrated diagnostic and smart control systems. Modern nuclear LED fixtures are increasingly equipped with embedded sensors to monitor vital signs such as operating temperature, voltage input stability, and light output efficacy in real-time. This diagnostic capability allows for remote health monitoring, enabling plant operators to assess the operational status of lights in inaccessible or highly radioactive areas without physically entering the zone. The communication protocols used must also be highly reliable and shielded against electromagnetic interference (EMI) common in heavy industrial settings. This adoption of smart technology moves the nuclear lighting systems beyond mere illumination into critical asset monitoring tools, contributing directly to operational safety and efficiency.

Material science innovation also plays a vital role, particularly concerning fixture housing and optical components. Housings must be resistant not only to radiation but also to corrosion from cleaning agents, moisture ingress (IP67 or higher ratings are common), and seismic vibrations (rated per IEEE-344 standards). Specialized optical diffusers are used to ensure uniform illumination while preventing glare, which is critical for safety and operational efficiency in large halls. The ongoing research focuses on reducing the size and weight of these ruggedized fixtures, making them more suitable for modernization projects where spatial constraints are a major issue, especially in older infrastructure or new SMR designs where every cubic meter is optimized for performance.

Regional Highlights

The Nuclear LED Lighting Market exhibits distinct consumption and growth patterns across major geographical regions, heavily influenced by local regulatory frameworks, the age of the existing nuclear fleet, and future capacity expansion plans.

- North America: This region is a mature market characterized by extensive plant life extension programs, particularly in the United States and Canada. The market is driven by strict regulatory mandates requiring continuous safety upgrades and the replacement of obsolete high-pressure sodium and metal halide lighting with high-efficiency, radiation-tolerant LED systems. Demand is focused on certified, high-quality, long-life products primarily for existing infrastructure modernization and spent fuel storage facilities.

- Europe: Europe represents a dynamic but regionally varied market. Western Europe (France, UK) focuses on decommissioning and modernization, driving demand for specialized fixtures for waste handling and reactor maintenance. Eastern Europe (Russia, Czech Republic) shows strong growth due to new build projects and large-scale plant upgrades. The stringent ATEX/IECEx certifications for hazardous locations within nuclear sites also heavily influence product design and procurement in this region.

- Asia Pacific (APAC): APAC is the fastest-growing region, dominated by massive new nuclear construction initiatives in China, India, and South Korea. These countries are building advanced Gen III and Gen IV reactors, leading to high demand for entirely new installations of specialized LED lighting. The growth here is volume-driven, coupled with an increasing emphasis on adopting smart lighting technology right from the commissioning phase of new plants.

- Latin America (LATAM): The LATAM market is nascent, driven primarily by ongoing maintenance and modest upgrades in existing nuclear facilities (e.g., Argentina, Brazil). Market size remains small, focusing on essential component replacement and security lighting upgrades, relying mostly on imports from established North American and European vendors.

- Middle East and Africa (MEA): Growth in MEA is concentrated around newly operational or commissioned nuclear facilities, such as the Barakah plant in the UAE. This region represents an emerging market demanding high-specification LED systems for both internal operational areas and robust external security perimeters, driven by comprehensive government investment in long-term energy infrastructure and safety standards mirroring international best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nuclear LED Lighting Market.- Dialight

- Hubbell

- Emerson Electric (Appleton)

- Eaton (Crouse-Hinds)

- Larson Electronics

- Glamox

- Phoenix Lighting

- AZZ

- General Electric (GE Lighting Solutions)

- Philips (Signify)

- LDPI, Inc.

- NEMO-Q

- Technor Italsmea

- Raytec

- Westinghouse Electric Company

- Litetronics International

- Cooper Lighting Solutions

- R. STAHL

- Tarmac Lighting

- Tungsram Group

Frequently Asked Questions

Analyze common user questions about the Nuclear LED Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge for LED lighting used in nuclear facilities?

The primary technical challenge is ensuring long-term operational integrity and photon output stability when exposed to high cumulative doses of ionizing radiation, specifically gamma and neutron radiation. This requires specialized radiation-hardened semiconductor materials and component shielding to prevent electronic degradation and rapid lumen depreciation typically seen in standard commercial LEDs, thereby guaranteeing regulatory-mandated safety illumination levels are maintained for decades.

How does LED lighting contribute to reducing operational costs in nuclear power plants?

LED lighting significantly reduces operational costs through two main avenues: superior energy efficiency, drastically lowering electricity consumption compared to traditional sources like high-pressure sodium lamps, and dramatically extended lifespan. The long life of radiation-hardened LEDs minimizes the frequency of replacements, which are exceptionally costly and time-consuming in nuclear environments due to security protocols, radiation exposure limits for personnel, and specialized labor requirements.

Which safety certifications are mandatory for Nuclear LED Lighting products?

Mandatory certifications extend beyond standard electrical safety and often include nuclear-specific standards such as IEEE-323 (qualification of electrical equipment for nuclear facilities), IEEE-344 (seismic qualification), and environmental testing related to temperature, humidity, and radiation tolerance. Additionally, fixtures used in specific areas may require Hazardous Location (HazLoc) ratings like ATEX or IECEx if combustible gases or dust are present.

Are Small Modular Reactors (SMRs) creating new opportunities for the Nuclear LED Lighting Market?

Yes, SMRs are a significant driver of new opportunity. SMR designs often feature smaller, more compact containment structures and integrated modular systems, demanding customized, highly durable, and thermally efficient LED lighting solutions with specialized form factors that can be easily integrated during module assembly. This shift requires vendors to innovate miniaturized, yet powerful, radiation-tolerant fixtures.

What distinguishes radiation-hardened LEDs from standard industrial-grade LEDs?

Radiation-hardened LEDs utilize specialized manufacturing processes, including doping and encapsulation techniques, to create semiconductors and drivers resistant to radiation damage, which causes crystal lattice defects and current leakage in standard chips. They are typically engineered with wider bandgap materials, higher tolerance thresholds for thermal variance, and robust metal housings specifically designed and certified for long-term deployment in high-radiation zones within nuclear facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager