Nucleic Acid Contamination Cleaners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436587 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Nucleic Acid Contamination Cleaners Market Size

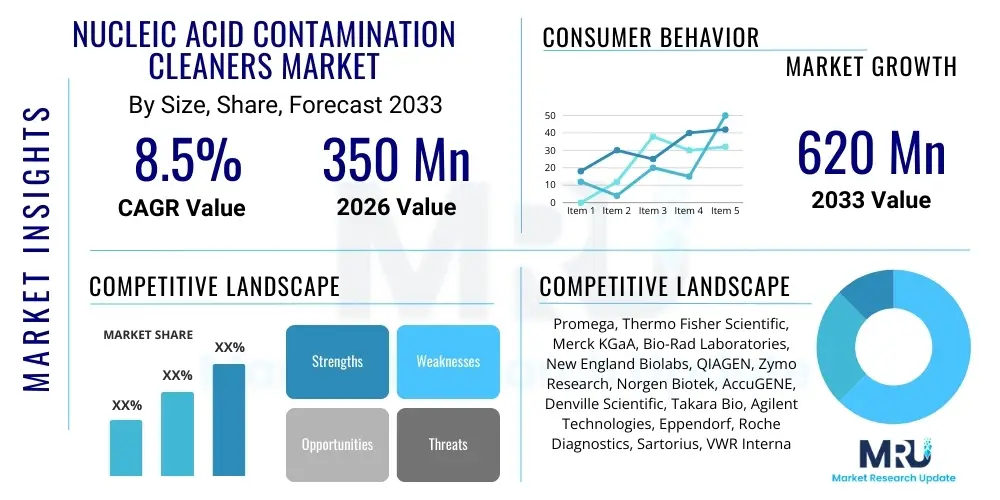

The Nucleic Acid Contamination Cleaners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-fidelity molecular diagnostics and genomic research worldwide, necessitating rigorous control over environmental nucleic acid contamination to ensure reliable experimental outcomes. The inherent sensitivity of modern amplification techniques, such as Polymerase Chain Reaction (PCR) and next-generation sequencing (NGS), makes laboratories highly susceptible to cross-contamination, thereby boosting the mandatory usage of specialized decontamination solutions across clinical and research settings.

The market valuation reflects increasing regulatory stringency regarding quality control in clinical laboratories, particularly those handling infectious disease testing and forensic analysis. Adoption rates are accelerating due to technological improvements in cleaner formulations that offer broad-spectrum efficacy against DNA and RNA while minimizing toxicity and equipment corrosion. The shift towards large-scale automated genomics platforms in pharmaceutical research further cements the need for industrial-strength, validated cleaning protocols, contributing significantly to the sustained market growth trajectory. Geographic expansion into emerging economies with burgeoning biotechnology sectors is also expected to provide substantial incremental revenue opportunities throughout the forecast period.

Nucleic Acid Contamination Cleaners Market introduction

The Nucleic Acid Contamination Cleaners Market addresses the critical need for decontamination solutions specifically engineered to eliminate DNA and RNA residues from laboratory surfaces, equipment, and instrumentation. These specialized products are essential tools in molecular biology, genomics, proteomics, and diagnostics, where minute traces of contaminating nucleic acids can lead to erroneous results, false positives, and compromised assay integrity. Products typically include ready-to-use surface decontaminants, sprays, and wipes formulated with potent yet non-toxic reagents designed to rapidly degrade or chemically modify genetic material, ensuring that work environments maintain the highest levels of experimental purity.

Major applications of these cleaners span highly sensitive research domains, including quantitative PCR (qPCR), cloning procedures, forensic identification, and sophisticated genetic testing associated with oncology and rare diseases. The primary benefit derived from their usage is the minimization of carryover contamination, particularly problematic in high-throughput settings where repeated handling of samples increases the risk of aerosol or surface-borne cross-contamination. Driving factors for market expansion encompass the explosive growth in global genomic sequencing projects, the rapid development and implementation of advanced molecular diagnostic tests, and the mandatory requirement for compliance with standardized laboratory practices (GLP/GMP), particularly within regulated clinical environments. Moreover, the increasing public health focus on rapid and accurate pathogen detection, especially following global pandemics, underscores the indispensability of these cleaning agents.

The core mechanism of action for most advanced cleaners involves chemical modification, typically through non-enzymatic agents that fragment the phosphodiester backbone or chemically alter the nitrogenous bases of nucleic acids, rendering them non-amplifiable and inert. This ensures robust decontamination without leaving residues that could interfere with subsequent enzymatic reactions. The continuous innovation aimed at developing eco-friendly, rapid-acting, and broader-spectrum formulations that target both DNA and RNA concurrently represents a key technological thrust in this market. The demand from pharmaceutical companies leveraging precision medicine techniques further solidifies the market’s positive growth outlook.

Nucleic Acid Contamination Cleaners Market Executive Summary

The Nucleic Acid Contamination Cleaners Market is characterized by robust business trends centered on automation compatibility, regulatory compliance, and product efficacy optimization. A significant trend involves the integration of these cleaning protocols into automated liquid handling systems and robotics used in high-throughput screening and genomics, necessitating bulk packaging and specific non-corrosive formulations. Furthermore, rising investments in biorepositories and biobanking facilities require stringent contamination control, driving demand for validated, certification-grade decontamination protocols. The competitive landscape is intensely focused on proprietary chemical formulations that offer superior degradation capabilities and reduced contact times, providing a distinct operational advantage to end-users seeking efficiency gains.

Regionally, North America maintains market dominance due to its mature biotechnology industry, extensive funding for academic research, and the presence of major pharmaceutical innovators and specialized contract research organizations (CROs). However, the Asia Pacific region is demonstrating the highest growth velocity, fueled by increasing government investment in precision medicine initiatives, the expansion of clinical diagnostic services in countries like China and India, and the establishment of sophisticated molecular testing centers. European markets exhibit steady growth, largely driven by the adoption of unified European Union directives regarding laboratory safety and quality management systems, specifically impacting diagnostic and food safety testing laboratories.

Segment trends highlight the leading position of the Solution segment, valued for its versatility and ability to clean complex surfaces and equipment interiors effectively. Conversely, the Ready-to-Use Wipes segment is experiencing the fastest growth, primarily due to their convenience, reduced preparation time, and minimal risk of cross-contamination during application, making them highly favored in fast-paced clinical settings and point-of-care testing environments. Application-wise, research laboratories remain the largest consumers, while the rising volume of decentralized molecular diagnostics is rapidly elevating the consumption rate within diagnostic centers and hospitals, signaling a diversification of the primary end-user base across the forecast period.

AI Impact Analysis on Nucleic Acid Contamination Cleaners Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Nucleic Acid Contamination Cleaners Market frequently revolve around how AI can enhance the detection and prevention of contamination before it necessitates extensive cleaning, and whether AI algorithms can optimize cleaning schedules and reagent usage. Users are keenly interested in predictive analytics capabilities, such as using machine learning (ML) to correlate environmental factors (humidity, airflow, personnel traffic) with contamination risks in real-time. Key concerns also include the integration challenges between existing laboratory information management systems (LIMS) and novel AI-powered monitoring devices. The overarching expectation is that AI will transition contamination management from reactive cleaning to proactive prevention and smart optimization of laboratory hygiene protocols, thereby maximizing experimental throughput and reducing costly reagent waste caused by compromised assays. This transition will require specialized sensor technology and sophisticated analytical models capable of identifying contamination hotspots with unprecedented accuracy.

AI's primary influence is expected to be indirect but transformative, focusing on optimizing the application and scheduling of cleaning protocols rather than altering the chemical composition of the cleaners themselves. AI can analyze vast datasets generated by automated molecular diagnostics platforms—identifying patterns in false positives or high variance readings—to pinpoint potential sources of contamination (e.g., specific liquid handling tips, microplates, or robotic arms) that require targeted decontamination. This predictive maintenance approach drastically reduces overall cleaning frequency while focusing intensive cleaning efforts precisely where they are needed, enhancing the cost-effectiveness of specialized contamination cleaners.

Furthermore, AI algorithms are instrumental in the R&D phase for cleaner manufacturers. They can be used to model the interaction of novel chemical compounds with various nucleic acid structures and surface materials, optimizing formulations for maximum degradation efficiency and minimal corrosion. This speeds up product development cycles for next-generation cleaners. By integrating AI-driven environmental monitoring systems, laboratories can achieve 'Smart Lab' status, ensuring compliance records are automatically generated and audit-ready, further solidifying the link between advanced technology and stringent molecular quality control standards, directly benefiting market stability and growth.

- AI-driven Predictive Maintenance: Utilizing machine learning to forecast contamination events based on usage patterns, optimizing the timing and location of decontamination procedures.

- Real-time Contamination Monitoring: Deployment of AI-linked environmental sensors to detect volatile organic compounds or subtle changes in laboratory parameters indicative of potential cross-contamination.

- Optimized Reagent Usage: Algorithms calculate the minimal effective concentration and contact time required for specific contamination scenarios, minimizing cleaner consumption and operational costs.

- Automated Compliance Documentation: AI systems automatically record cleaning efficacy, product usage, and scheduling adherence, simplifying regulatory audits (AEO impact).

- Enhanced R&D of Formulations: Machine learning assists in screening chemical libraries to design highly effective, non-corrosive nucleic acid degradation agents.

- Integration with LIMS: AI tools facilitate seamless data exchange between cleaning protocols and Laboratory Information Management Systems, improving workflow management and quality assurance.

- Robotics Integration: AI enhances the precision of robotic platforms in performing targeted decontamination procedures, particularly in high-volume sequencing centers.

DRO & Impact Forces Of Nucleic Acid Contamination Cleaners Market

The dynamics of the Nucleic Acid Contamination Cleaners Market are fundamentally shaped by a powerful interplay of drivers, restraints, and opportunities. The core driver is the exponential growth of molecular techniques like PCR, qPCR, and NGS, which inherently demand ultra-clean environments due to their extreme sensitivity. This is compounded by increasingly stringent global regulatory standards (e.g., CLIA, ISO 15189) governing clinical and diagnostic laboratory operations, mandating documented contamination control protocols. Key restraints include the relatively high per-unit cost of specialized nucleic acid decontamination solutions compared to generic laboratory disinfectants, and concerns regarding the potential for some formulations to corrode sensitive, expensive instruments if not used strictly according to manufacturer guidelines. Conversely, major opportunities arise from the proliferation of decentralized diagnostics, particularly point-of-care molecular testing, and the unmet need for highly stable, long-shelf-life cleaners suitable for remote or resource-limited settings. These forces combine to push manufacturers towards developing safer, more effective, and cost-efficient broad-spectrum formulations.

The impact forces influencing the market are multifaceted. The rising frequency of infectious disease outbreaks and subsequent rapid deployment of molecular testing panels exert immense pressure on laboratories to maintain zero contamination rates, directly boosting demand for preventative cleaning measures. Simultaneously, technological substitution risk is low, as chemical degradation remains the most reliable method for rendering nucleic acids non-amplifiable, providing market stability. However, the requirement for comprehensive validation data demonstrating cleaner efficacy across diverse surface materials (plastics, metals, glass) represents a significant barrier to entry for new competitors. Established players leverage brand trust and documented validation studies to maintain market share, emphasizing efficacy against both DNA and RNA across various environmental conditions.

The environmental sustainability movement is emerging as a significant opportunity and mild restraint. There is a growing preference for 'green chemistry' cleaners that are biodegradable and non-hazardous upon disposal, driving innovation towards enzyme-based or bio-based decontamination solutions. While these bio-based alternatives present a strong opportunity for market differentiation, current constraints involve achieving the same level of rapid, high-efficacy degradation offered by traditional chemical cleaners. Navigating this balance between environmental responsibility, cost-effectiveness, and absolute efficacy will define competitive strategies over the next decade. The successful deployment of products that meet both high performance and environmental mandates will capture substantial market traction, particularly among government and academic institutions sensitive to sustainability objectives.

Segmentation Analysis

The Nucleic Acid Contamination Cleaners Market is primarily segmented based on Product Type, Application, and End-Use. Understanding these segments provides critical insights into purchasing behaviors, technological preferences, and growth pockets across the molecular diagnostics and life science sectors. Product segmentation reflects the diverse forms in which these cleaners are utilized, ranging from bulk solutions used for equipment immersion or spray application, to convenient pre-saturated wipes tailored for surface decontamination and quick cleanup. The application segmentation demonstrates the varied necessity across research, diagnostic, and industrial settings, each requiring unique volumes and performance characteristics. End-use segmentation highlights the disparity in demand volume and budgetary allocation between highly funded industrial biotechnology firms and academic research institutions.

The Solution segment, including concentrates and ready-to-use liquids, currently holds the largest market share due to its flexibility and economic viability for large-scale decontamination of complex instruments, large surfaces, and laboratory floors. However, the Wipes segment is the fastest-growing category, driven by increasing regulatory scrutiny demanding standardized, single-use, non-aerosol generating cleaning tools that minimize human error and cross-contamination during the cleaning process itself. Geographically diverse end-users, from forensic labs needing meticulous spot cleaning to large sequencing centers requiring robust daily environmental control, reinforce the need for comprehensive product portfolio offerings that cater to specific operational demands and workflow requirements, leading to continued diversification within the product type segment.

- Product Type

- Solutions (Concentrated and Ready-to-Use)

- Wipes (Pre-saturated and Dry)

- Sprays and Aerosols

- Reagent Additives (Used to prevent contamination within specific assays)

- Application

- Molecular Biology Research

- Clinical and Diagnostic Laboratories

- Pharmaceutical and Biotechnology Manufacturing

- Forensic and Public Health Laboratories

- Environmental and Food Safety Testing

- End-Use

- Academic and Research Institutions

- Hospitals and Diagnostic Centers

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Government Agencies and Reference Laboratories

Value Chain Analysis For Nucleic Acid Contamination Cleaners Market

The value chain for the Nucleic Acid Contamination Cleaners Market is anchored by the sourcing of specialized chemical precursors in the upstream segment. These precursors often include proprietary oxidizing agents, surfactants, chelating agents, or specialized enzymes that require stringent quality control and high-purity synthesis. Manufacturing involves complex formulation chemistry, requiring specialized facilities to blend these potent ingredients safely and efficiently while maintaining stability and shelf-life. Key challenges in upstream analysis involve securing reliable, cost-effective supplies of highly specialized reagents and managing intellectual property related to proprietary non-corrosive, high-efficacy formulations.

Midstream activities encompass the actual production, packaging, and regulatory certification processes. Quality assurance is paramount, requiring extensive validation testing to confirm nucleic acid degradation efficacy (often measured in log reduction) across various surface materials and environmental conditions. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves sales teams engaging directly with large pharmaceutical clients and national reference laboratories for bulk orders and customized solutions. Indirect distribution relies heavily on global and regional specialized laboratory supply distributors (such as VWR, Fisher Scientific, and specific local distributors) who provide crucial warehousing, inventory management, and last-mile delivery services to thousands of smaller academic labs and clinical diagnostic centers worldwide.

Downstream analysis focuses on end-user adoption and post-sale technical support. The success of a cleaner product relies heavily on integration into existing Standard Operating Procedures (SOPs) and demonstration of compatibility with highly sensitive instruments (e.g., DNA sequencers, thermal cyclers). Customer service involves providing detailed protocols, efficacy data, and prompt support for validation inquiries, especially in regulated environments. The crucial difference between direct and indirect channels often lies in the volume and technical customization required; large industrial buyers usually prefer direct engagement for technical consultation and bespoke packaging, while academic and smaller diagnostic labs utilize indirect channels for convenience and consolidated procurement of consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Promega, Thermo Fisher Scientific, Merck KGaA, Bio-Rad Laboratories, New England Biolabs, QIAGEN, Zymo Research, Norgen Biotek, AccuGENE, Denville Scientific, Takara Bio, Agilent Technologies, Eppendorf, Roche Diagnostics, Sartorius, VWR International, Corning Inc., Sarstedt AG & Co. KG, Bioneer Corporation, Biotium |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nucleic Acid Contamination Cleaners Market Key Technology Landscape

The technological landscape of the Nucleic Acid Contamination Cleaners Market is continually evolving, driven by the need for enhanced efficacy, reduced toxicity, and material compatibility. The primary technology involves proprietary chemical formulations utilizing non-enzymatic methods, such as oxidizing agents (e.g., chlorine dioxide, hypochlorites) or specialized, patent-protected detergents, that physically and chemically destroy the nucleic acid structure. Recent advancements focus heavily on optimizing pH and concentration to achieve complete degradation of both DNA and RNA rapidly, often within one minute of contact time, without degrading sensitive plasticware or corroding metal components found in expensive thermal cyclers and sequencing instruments. Manufacturers are increasingly emphasizing validated efficacy against extremely low concentrations of nucleic acids, reflecting the high sensitivity of modern molecular assays.

A significant emerging trend involves the development of enzyme-based cleaning systems, leveraging highly stable nucleases that specifically target and digest contaminating DNA and RNA. While traditionally facing challenges related to enzyme stability and cost, newer formulations encapsulate these enzymes or use stabilized cocktails that exhibit efficacy over a longer shelf life and broader temperature range. These enzyme-based cleaners are perceived as safer and less corrosive alternatives, aligning with the growing demand for green and environmentally conscious laboratory consumables. However, successful market penetration requires demonstrating that the enzyme residue left behind is completely inactive and does not inhibit subsequent molecular reactions, a key performance metric scrutinized by end-users.

Furthermore, technology is focusing on delivery systems, particularly in the pre-saturated wipes segment. Innovation here includes using specialized substrate materials that release the cleaning agent uniformly and maintain saturation effectively, ensuring consistent decontamination across the entire treated surface area. For high-throughput automated systems, technology development is geared toward non-foaming, low-residue liquid concentrates suitable for integration into automated wash cycles. The future technology landscape is moving towards integrated contamination control solutions that combine chemical cleaners with advanced monitoring systems, ensuring a continuous, validated state of nucleic acid purity within controlled laboratory environments, pushing the boundaries of current Good Laboratory Practices (GLP).

Regional Highlights

The global distribution of the Nucleic Acid Contamination Cleaners Market exhibits significant regional variation influenced by the density of biotechnology activities, regulatory environments, and healthcare expenditure on advanced diagnostics. North America, particularly the United States, represents the largest market share due to its preeminent position in pharmaceutical research, substantial public and private funding for genomics, and the concentration of major market players. Strict adherence to federal and state regulations regarding laboratory safety and sample integrity in clinical and forensic settings mandates the systematic use of certified contamination control products, creating a consistently high baseline demand.

Europe holds the second-largest market position, characterized by robust academic research output, especially in countries like Germany, the UK, and France. The European market is highly quality-conscious, driven by EU directives that standardize molecular diagnostic procedures. The strong presence of established biotech companies and leading diagnostic service providers ensures steady adoption. However, market growth acceleration in Europe is sometimes tempered by bureaucratic procurement processes in public healthcare systems, favoring products that offer long-term cost-effectiveness and validated environmental safety profiles.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapidly expanding healthcare infrastructure, rising government investments in national genomics programs (e.g., in China and South Korea), and the increasing establishment of contract research and manufacturing organizations (CROs/CMOs) serving global pharmaceutical outsourcing needs. While pricing sensitivity remains a factor in developing APAC economies, the sheer volume growth in molecular testing necessitated by infectious disease surveillance and cancer diagnostics far outweighs this constraint, driving massive uptake of essential consumables like contamination cleaners.

Latin America and the Middle East & Africa (MEA) currently represent smaller but growing markets. Growth in Latin America is concentrated in Brazil and Mexico, fueled by expanding clinical laboratory networks and increasing access to advanced molecular testing. The MEA market, though smaller, is seeing gradual increases in adoption, particularly in the Gulf Cooperation Council (GCC) countries, due to significant investments in specialized clinical pathology centers and research hubs focused on genetic diseases pertinent to the local populations. These regions require robust supply chain logistics and products optimized for challenging local storage conditions.

- North America: Market leader due to advanced R&D infrastructure, high adoption of NGS, and strict regulatory enforcement in clinical and forensic labs.

- Europe: Steady growth driven by harmonized EU quality standards and a strong focus on sustainable and non-toxic cleaning solutions.

- Asia Pacific (APAC): Fastest-growing region, powered by rapid expansion of molecular diagnostics, significant biotech investments, and increasing awareness of contamination risks in high-volume testing centers.

- Latin America: Emerging market with demand concentrated in major economic hubs, focusing on infectious disease and genetic testing applications.

- Middle East & Africa (MEA): Growth driven by government healthcare modernization projects and investments in specialized genomic research facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nucleic Acid Contamination Cleaners Market.- Promega

- Thermo Fisher Scientific

- Merck KGaA

- Bio-Rad Laboratories

- New England Biolabs

- QIAGEN

- Zymo Research

- Norgen Biotek

- AccuGENE

- Denville Scientific

- Takara Bio

- Agilent Technologies

- Eppendorf

- Roche Diagnostics

- Sartorius

- VWR International

- Corning Inc.

- Sarstedt AG & Co. KG

- Bioneer Corporation

- Biotium

Frequently Asked Questions

Analyze common user questions about the Nucleic Acid Contamination Cleaners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of nucleic acid contamination cleaners in a laboratory setting?

The primary function is to chemically or enzymatically degrade and render inert any residual DNA or RNA present on laboratory surfaces, equipment, or consumables, thereby preventing cross-contamination that could compromise the accuracy and reliability of sensitive molecular assays like PCR and NGS.

How do specialized nucleic acid cleaners differ from standard laboratory disinfectants?

Standard disinfectants (e.g., ethanol, bleach) primarily target microbial organisms, while specialized cleaners are formulated specifically to break down the nucleic acid backbone. This distinction is crucial because dead cells still contain amplifiable genetic material, which must be destroyed using dedicated degradation agents to ensure molecular purity.

Which segment of the Nucleic Acid Contamination Cleaners Market is experiencing the fastest growth?

The Ready-to-Use Wipes segment is currently experiencing the fastest growth. This is driven by their convenience, reduced potential for user error, elimination of cross-contamination risk associated with spray application, and suitability for stringent quality control protocols in clinical and high-throughput diagnostic environments.

What major restraints impede the widespread adoption of these cleaners?

The primary restraints include the higher unit cost of specialized chemical formulations compared to generic cleaning agents, and ongoing user concerns regarding the potential corrosiveness of certain high-efficacy cleaners on expensive, precision laboratory instrumentation if not applied strictly according to validated protocols.

How is Artificial Intelligence (AI) expected to influence contamination control protocols in molecular labs?

AI is anticipated to enhance contamination control by enabling predictive maintenance, utilizing machine learning to analyze experimental data and environmental sensor readings to pinpoint contamination risk hotspots. This allows for proactive, targeted cleaning schedules, optimizing resource usage and minimizing assay failures proactively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager