Nucleic Acid Extraction Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431998 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Nucleic Acid Extraction Equipment Market Size

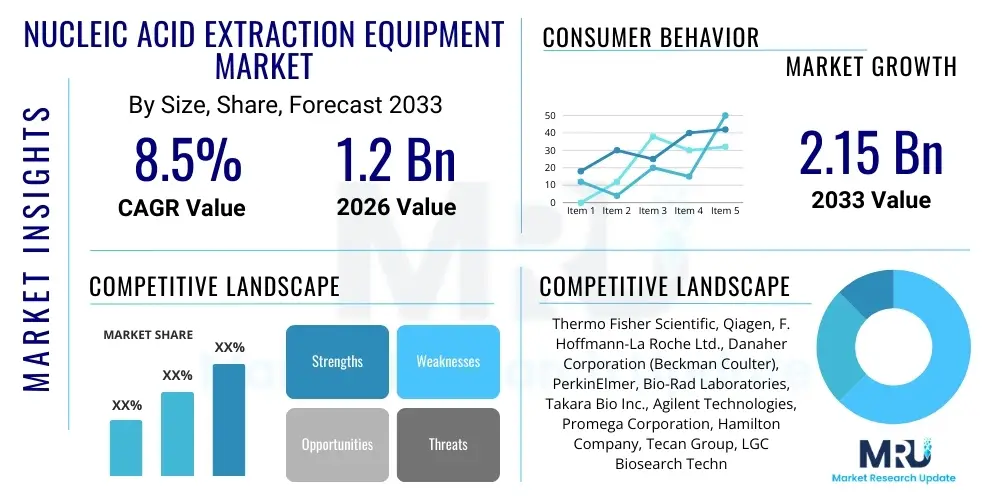

The Nucleic Acid Extraction Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

Nucleic Acid Extraction Equipment Market introduction

The Nucleic Acid Extraction Equipment Market encompasses instruments and automated systems designed for the efficient purification and isolation of genomic DNA, plasmid DNA, mitochondrial DNA, and various forms of RNA from biological samples such as blood, tissue, plants, or forensic specimens. This equipment is critical for preparing high-quality nucleic acids necessary for downstream molecular applications, including PCR, quantitative PCR (qPCR), next-generation sequencing (NGS), and microarrays. The core functionality of these machines centers on automating the complex steps of cell lysis, protein removal, washing, and final elution, significantly reducing manual labor and the risk of cross-contamination inherent in traditional manual methods.

Major applications driving the demand for nucleic acid extraction equipment span clinical diagnostics, basic and translational research, forensic analysis, drug discovery, and agriculture. In the clinical setting, these systems are indispensable for infectious disease testing (e.g., COVID-19, HIV), prenatal screening, and cancer molecular diagnostics, where high throughput and reliable purification are paramount. The ability of modern equipment to process large numbers of samples rapidly and consistently addresses the escalating need for rapid diagnostic results in hospital and public health laboratories globally, particularly during infectious disease outbreaks where speed is essential for effective containment strategies.

Key benefits associated with the adoption of automated nucleic acid extraction systems include enhanced throughput capacity, superior reproducibility across different runs and operators, and significant improvements in the purity and yield of the extracted nucleic acids. These factors are crucial for ensuring the reliability of sensitive downstream molecular assays. Driving factors for market growth include the global surge in genomic research, the accelerating demand for personalized medicine requiring deep molecular insights, the continuous development of novel molecular diagnostic tests, and technological advancements leading to compact, faster, and more versatile extraction platforms capable of handling diverse sample types and volumes.

Nucleic Acid Extraction Equipment Market Executive Summary

The Nucleic Acid Extraction Equipment Market is characterized by a strong shift towards high-throughput, fully automated solutions, driven primarily by the rising prevalence of infectious and chronic diseases and the expanding scope of genomic and proteomic research worldwide. Business trends indicate aggressive mergers and acquisitions among established life science companies aiming to integrate automation technologies and broaden their product portfolios to cover the entire workflow from sample preparation to sequencing. A key competitive differentiator is the development of benchtop, point-of-care (PoC) compatible devices that offer rapid turnaround times and decentralized testing capabilities, crucial for resource-limited settings and emerging diagnostic applications outside central laboratories.

Regional trends highlight North America and Europe as dominant forces, largely due to robust research funding, the presence of advanced healthcare infrastructure, and high adoption rates of cutting-edge molecular technologies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by substantial governmental investments in biotechnology, improving healthcare access, and the increasing establishment of biobanks and large-scale population health initiatives in countries like China, India, and Japan. Segment trends reveal that the instruments segment, particularly medium and high-throughput automated systems, commands the largest market share due to their widespread adoption in centralized diagnostic labs and commercial research service providers, while the consumables and reagents segment shows consistently high growth, driven by the recurring need for proprietary kits tailored to specific instrument platforms and sample types.

AI Impact Analysis on Nucleic Acid Extraction Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the nucleic acid extraction market primarily focus on three major themes: how AI enhances process efficiency and automation quality, the role of AI in quality control and minimizing human error, and the potential for predictive analytics to optimize extraction protocols for novel or challenging sample matrices. Users are keen to understand how AI can move beyond simple mechanical automation to intelligent systems that can self-diagnose mechanical failures, dynamically adjust parameters (e.g., temperature, mixing speeds, buffer volumes) based on real-time sample characteristics, thereby maximizing yield and purity, especially for low-concentration samples or those with high inhibitory substance content.

The adoption of AI and ML is transforming the workflow of nucleic acid purification by introducing smart quality assurance layers. ML algorithms can analyze sensor data collected during the extraction process—such as fluid dynamics, optical density, and pressure changes—to identify potential bottlenecks or procedural deviations far faster and more accurately than human operators. This capability is pivotal in regulated clinical environments where consistency and auditability are non-negotiable. Furthermore, AI facilitates the optimal coupling of extraction platforms with downstream analysis by generating standardized metadata describing the input sample quality and the resulting extract metrics, enabling robust data integration and predictive performance modeling for subsequent PCR or sequencing steps, thus accelerating the overall time-to-result in complex molecular workflows.

- Enhanced Protocol Optimization: AI algorithms dynamically adjust extraction parameters (e.g., incubation time, wash cycles) based on input sample complexity and desired output purity, maximizing yield and speed.

- Automated Quality Control: Machine learning systems analyze real-time processing data (temperature, mixing) to detect and correct deviations, minimizing batch failure rates and ensuring high consistency.

- Predictive Maintenance: AI monitors equipment performance, predicting component failure before breakdown, thereby reducing downtime and maintenance costs in high-throughput laboratories.

- Data Integration and Workflow Management: AI facilitates seamless integration of extraction data with LIMS (Laboratory Information Management Systems) and downstream sequencing platforms, improving traceability and analysis throughput.

- Error Reduction: Reduces reliance on manual steps and subjective decision-making, significantly lowering the potential for human operational errors and cross-contamination.

DRO & Impact Forces Of Nucleic Acid Extraction Equipment Market

The Nucleic Acid Extraction Equipment Market is propelled by powerful growth drivers, particularly the expansive growth in molecular diagnostics, stemming from increased global awareness and screening programs for infectious diseases, coupled with significant advancements in personalized medicine. The imperative to develop high-throughput, automated solutions in response to public health crises, as evidenced during recent pandemics, has accelerated technology adoption across clinical and public health laboratories. Furthermore, continuous governmental and private sector funding directed towards genomic and translational research acts as a foundational driver, ensuring a constant demand pipeline for advanced nucleic acid preparation instruments and associated consumables that provide high purity and scalability.

However, the market faces significant restraints that temper its growth trajectory. The initial high capital investment required for purchasing and installing fully automated, state-of-the-art extraction systems poses a barrier to adoption, particularly for smaller laboratories, research institutions in developing economies, and point-of-care settings. Furthermore, the reliance on proprietary consumables, including specialized reagent kits and cartridges specific to each instrument platform, leads to vendor lock-in and high recurring operational costs. Technical complexity in operation and maintenance, coupled with the necessity for highly trained personnel to manage these intricate systems, further limits widespread adoption, especially where skilled labor is scarce.

Opportunities for market expansion are abundant, centered around the development of fully integrated, cartridge-based systems for true Sample-to-Answer diagnostics, minimizing human intervention and maximizing ease of use. The growing trend toward decentralized testing and the establishment of molecular diagnostics in emerging markets present a significant opportunity for manufacturers focused on developing low-cost, robust, and portable extraction solutions. Impact forces influencing market dynamics include the rapidly evolving regulatory landscape for diagnostic equipment, competitive pressures driving down the cost of basic magnetic bead technology, and the influence of academic publications and clinical guidelines on technology standardization and procurement decisions across different healthcare systems globally.

Segmentation Analysis

The Nucleic Acid Extraction Equipment Market is extensively segmented based on the type of product, the level of throughput offered, the nature of the application, and the ultimate end-user utilizing the technology. This granular segmentation allows for precise market sizing and strategic targeting. The product segmentation is foundational, dividing the market into Instruments (automated and semi-automated systems) and Consumables (reagent kits, buffers, magnetic beads, and plastics), with consumables typically generating the majority of recurring revenue and driving platform adoption through proprietary specifications. Throughput segmentation ranges from low-throughput systems utilized in academic research and small clinics to ultra-high-throughput systems essential for biobanks, large reference laboratories, and mass screening programs.

Application-based segmentation highlights the dominant areas of use, notably infectious disease diagnostics, oncology testing, pharmacogenomics, and basic research. Infectious disease diagnostics remain a massive driver due to the continuous threat of new pathogens and the scaling of routine viral and bacterial testing. End-user segmentation reveals that academic and research institutes, while being key early adopters, often lag behind hospitals, diagnostic laboratories, and biotechnology/pharmaceutical companies in terms of high-volume purchases, as clinical and commercial labs prioritize speed, regulatory compliance, and high throughput capabilities for routine patient sample processing. These segmentation details underscore the heterogeneity of demand and the necessity for manufacturers to offer scalable solutions ranging from highly specialized research tools to rugged, high-volume clinical automation.

- Product Type:

- Instruments (Automated Extraction Systems, Semi-Automated Systems)

- Consumables (Kits and Reagents, Magnetic Beads, Spin Columns, Buffers, Plastics)

- Technology:

- Magnetic Bead-Based Extraction

- Spin Column-Based Extraction

- Reagent-Based Extraction

- Microfluidics and Lab-on-a-Chip

- Application:

- Infectious Disease Diagnostics

- Oncology Testing and Personalized Medicine

- Genetic Testing and Genomics

- Forensics and Paternity Testing

- Drug Discovery and Development

- Throughput:

- High Throughput (96-well and above)

- Medium Throughput (24-96 wells)

- Low Throughput (1-24 wells)

- End User:

- Hospitals and Diagnostic Centers

- Academic and Research Institutes

- Biotechnology and Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Forensic Laboratories

Value Chain Analysis For Nucleic Acid Extraction Equipment Market

The value chain for the Nucleic Acid Extraction Equipment Market begins upstream with raw material suppliers, encompassing manufacturers of specialized chemicals, magnetic nanoparticles, high-grade plastics for disposable consumables (e.g., reaction tubes, microplates), and sophisticated electronic components and robotics required for the automation platforms. Key upstream activities involve the stringent sourcing of high-purity reagents and the development of proprietary magnetic bead coatings that maximize binding affinity and minimize non-specific adsorption, crucial steps that determine the final quality and purity of the extracted nucleic acid. Collaboration between instrument manufacturers and specialty chemical suppliers is vital to maintain cost-effective and consistent production of proprietary kits, which often represent the primary source of operational profit.

The core manufacturing stage involves the assembly of complex mechanical and electronic systems, including precision fluid handling modules, temperature control units, and robotic arms, followed by rigorous quality assurance and regulatory approval processes (e.g., FDA, CE marking). Distribution channels are highly specialized, often involving direct sales forces for large institutional purchases (hospitals, major research centers) due to the high capital cost and necessity for technical support and training. Indirect channels, such utilizing third-party distributors and regional agents, are crucial for penetrating geographically dispersed or smaller markets, ensuring localized inventory management and rapid supply of consumables.

Downstream activities center on the end-users—primarily hospitals, diagnostic centers, and research laboratories—where the equipment is utilized for high-stakes clinical and research applications. The after-sales service component, including maintenance contracts, software updates, and technical troubleshooting, constitutes a significant part of the value chain, ensuring high uptime and reliable results. Customer satisfaction is heavily reliant on the seamless supply of consumables and the efficiency of the service network. The movement is increasingly towards cloud-connected instruments, facilitating remote diagnostics and preventive maintenance, thereby strengthening the direct relationship between manufacturers and end-users and capturing valuable usage data for future product development.

Nucleic Acid Extraction Equipment Market Potential Customers

The primary potential customers and end-users for nucleic acid extraction equipment are entities requiring high-quality, high-throughput molecular sample preparation for diagnostic or research purposes. Hospitals and centralized clinical diagnostic centers represent the largest customer base, driven by the increasing integration of molecular testing into routine clinical practice, particularly for cancer screening, infectious disease surveillance, and genetic disorder testing. These customers prioritize fully automated systems that integrate easily into existing laboratory information management systems (LIMS) and offer validated, clinically reliable results with fast turnaround times, essential for critical patient care pathways.

Academic research institutions and government-funded biobanks constitute another crucial segment. These customers often utilize the equipment for large-scale genomic studies, population screening, and drug target validation. While these settings may sometimes tolerate lower throughput manual methods, the massive data generation requirements of modern genomics (e.g., sequencing thousands of samples) necessitate automated extraction to ensure sample consistency and throughput scalability. Furthermore, biotechnology and pharmaceutical companies are significant buyers, utilizing the equipment in drug discovery pipelines, toxicology testing, and the production and quality control of advanced therapies like cell and gene therapy products, where extreme purity of nucleic acids is mandatory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Qiagen, F. Hoffmann-La Roche Ltd., Danaher Corporation (Beckman Coulter), PerkinElmer, Bio-Rad Laboratories, Takara Bio Inc., Agilent Technologies, Promega Corporation, Hamilton Company, Tecan Group, LGC Biosearch Technologies, Bioneer Corporation, AutoGen, Analytik Jena AG, Zymo Research, Diagenode, Biosynex, DiaSorin S.p.A., Norgen Biotek Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nucleic Acid Extraction Equipment Market Key Technology Landscape

The technology landscape of nucleic acid extraction is dominated by two mature yet evolving methodologies: solid-phase extraction, primarily utilizing spin columns or magnetic beads, and the emerging, highly innovative microfluidics approach. Magnetic bead-based extraction remains the industry standard for high-throughput clinical and research applications. This technology relies on paramagnetic particles coated with specific chemistries that reversibly bind nucleic acids in the presence of specific buffers. Automated magnetic bead processors offer exceptional scalability, minimal shear force on long DNA molecules, and are highly adaptable to various sample types, making them the preferred choice for large-scale sequencing projects and clinical sample processing. Continuous innovations in bead size, surface chemistry, and automation platform design are aimed at reducing processing time and increasing the purity of yields from challenging samples.

Spin column technology, while often less amenable to full automation than magnetic beads, remains a reliable and cost-effective method favored by smaller research labs and those requiring moderate throughput. It utilizes silica-based membranes packed into small columns where nucleic acids selectively bind under high salt conditions. Manufacturers are focusing on optimizing the binding matrix and buffer chemistries to improve recovery rates, especially for RNA samples which are notoriously labile. Parallel to these established methods, the integration of automation platforms, particularly robotic liquid handlers, is critical, transforming basic magnetic and spin column protocols into fully hands-free workflows, which significantly reduces the risk of human error and sample variability.

The most transformative area is the deployment of microfluidics, often encapsulated in lab-on-a-chip or cartridge systems, which facilitates true Sample-to-Answer capabilities. Microfluidic devices miniaturize the entire extraction process onto a small chip, requiring extremely low reagent volumes and offering ultra-fast processing times. This technology is crucial for the development of point-of-care diagnostics, where speed, portability, and minimal professional oversight are required. While currently representing a smaller market share due to manufacturing complexity, microfluidics promises to decentralize molecular diagnostics, allowing complex testing to be performed rapidly outside traditional laboratory settings, which is a major future growth vector for the extraction equipment market.

Regional Highlights

North America, particularly the United States, holds the largest share of the Nucleic Acid Extraction Equipment Market, driven by pioneering advancements in genomics research, substantial research and development expenditure in both public and private sectors, and a highly sophisticated healthcare infrastructure. The region benefits from the strong presence of major market players and early adoption of high-throughput automated systems essential for massive biobanking initiatives and clinical trials. The high incidence of chronic diseases, coupled with widespread implementation of advanced diagnostic testing methods like NGS for personalized oncology, ensures a consistently high demand for automated and precise nucleic acid purification technologies. Regulatory frameworks in the US are also relatively supportive of the rapid introduction of novel diagnostic devices, maintaining the region's market leadership.

Europe represents the second-largest market, characterized by significant governmental investment in life sciences, particularly in countries like Germany, the UK, and France. The European market exhibits strong growth due to increasing collaborative research across borders and the growing need for standardized diagnostic protocols compliant with regional regulations. The focus on integrating molecular testing into primary care settings and the robust infrastructure supporting academic research centers and contract research organizations (CROs) sustain demand for both automated platforms and specialized consumables. Furthermore, the strategic efforts to manage emerging infectious diseases and enhance biosecurity across the continent continue to drive procurement cycles for state-of-the-art extraction equipment.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rising governmental spending on healthcare infrastructure development, the increasing affordability and accessibility of molecular diagnostic services, and a massive, underserved patient population in emerging economies like China and India. The establishment of large-scale genomic projects, the rapid expansion of biotechnology and pharmaceutical manufacturing hubs, and the growing awareness of early disease detection are collectively fueling demand for automated extraction technologies that can handle high volumes efficiently. While high initial costs remain a barrier, the introduction of locally manufactured and competitively priced solutions is mitigating this constraint, leading to rapid market penetration.

- North America: Market leader due to high R&D spending, robust adoption of personalized medicine, and extensive infrastructure for genomic studies.

- Europe: Second largest market, driven by favorable governmental support for life sciences research and strong presence of major pharmaceutical companies and CROs.

- Asia Pacific (APAC): Fastest growing region, fueled by rising healthcare expenditure, large population size demanding diagnostics, and expansion of local biotechnology production capabilities.

- Latin America and Middle East & Africa (MEA): Emerging markets with growth potential, primarily focused on infectious disease monitoring and adoption of cost-effective, medium-throughput instruments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nucleic Acid Extraction Equipment Market.- Thermo Fisher Scientific

- Qiagen

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation (Beckman Coulter, Pall Corporation)

- PerkinElmer

- Bio-Rad Laboratories

- Takara Bio Inc.

- Agilent Technologies

- Promega Corporation

- Hamilton Company

- Tecan Group

- LGC Biosearch Technologies

- Bioneer Corporation

- AutoGen

- Analytik Jena AG

- Zymo Research

- Diagenode

- Biosynex

- DiaSorin S.p.A.

- Norgen Biotek Corp.

Frequently Asked Questions

Analyze common user questions about the Nucleic Acid Extraction Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving the growth of the Nucleic Acid Extraction Equipment Market?

The magnetic bead-based extraction technology is the primary driver of market growth, offering superior capabilities for automation, high-throughput processing, and scalability compared to traditional methods like spin columns. This technology is crucial for modern clinical diagnostics and large-scale genomic sequencing projects where consistent purity and high yield are mandatory.

How does automation impact the operational efficiency of nucleic acid extraction?

Automation significantly boosts operational efficiency by minimizing human error and reducing hands-on time, thereby improving reproducibility and throughput. Automated systems allow laboratories to process hundreds of samples simultaneously, making them indispensable for outbreak testing and high-volume clinical reference labs seeking cost and time savings.

Which end-user segment holds the highest demand for advanced extraction equipment?

The Hospitals and Diagnostic Centers segment exhibits the highest sustained demand for advanced extraction equipment. This is due to the increasing volume of routine molecular diagnostic tests for infectious diseases, oncology, and genetic screening, necessitating high-speed, validated, and regulated automated platforms.

What are the key barriers to entry for new competitors in this market?

Key barriers include the requirement for high capital investment in manufacturing automated systems, the necessity of securing stringent regulatory approvals (FDA, CE), and the difficulty in competing with established proprietary consumable ecosystems owned by dominant players like Thermo Fisher Scientific and Qiagen.

What role does microfluidics play in the future of nucleic acid extraction?

Microfluidics technology is pivotal in advancing the market towards decentralized and Point-of-Care (PoC) testing. By miniaturizing the extraction process onto a single chip, microfluidic systems enable rapid, low-volume, and portable nucleic acid preparation, essential for diagnostics outside traditional laboratory settings and maximizing time-sensitive clinical decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager