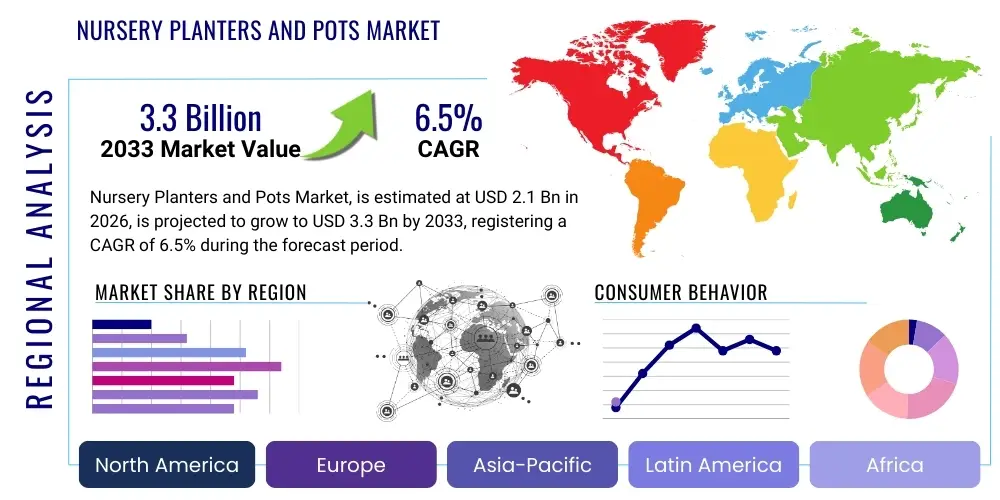

Nursery Planters and Pots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437541 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nursery Planters and Pots Market Size

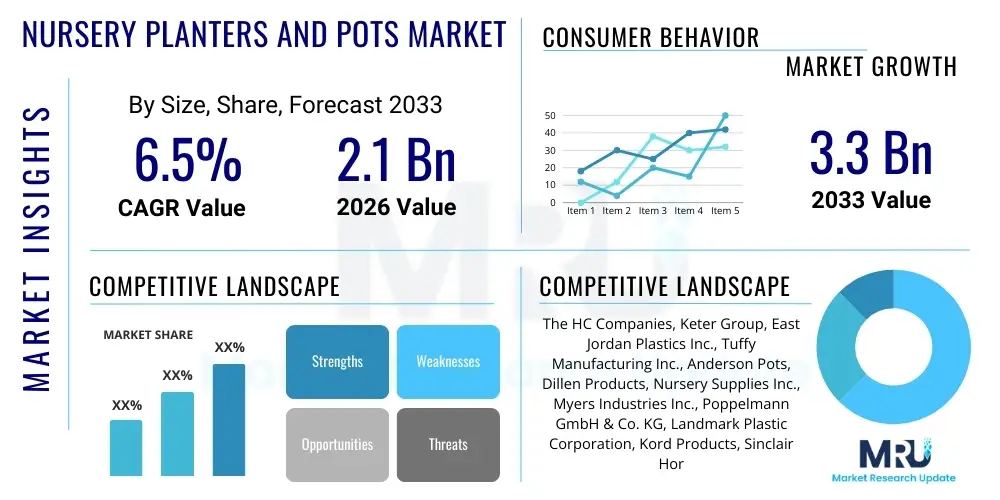

The Nursery Planters and Pots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Nursery Planters and Pots Market introduction

The Nursery Planters and Pots Market encompasses the manufacturing and distribution of various containers used for growing and transporting young plants, seedlings, and established nursery stock. These products are foundational tools in horticulture, ranging from inexpensive, functional plastic propagation trays to durable, aesthetically pleasing ceramic or composite planters designed for long-term use. The primary market participants include large-scale commercial nurseries, landscaping firms, agricultural research institutions, and the vast residential gardening sector. Market growth is intrinsically linked to global trends in urbanization, increased consumer awareness regarding environmental sustainability, and the burgeoning popularity of indoor gardening and ornamental horticulture.

Products within this market are categorized primarily by material—including plastic, clay, ceramic, fiber, and metal—and by application, such as commercial growing, retail presentation, or specialized hydroponic systems. The functional benefits of high-quality nursery containers include efficient water drainage, optimal root development support, ease of transportation, and protection against environmental stress. Furthermore, modern planters increasingly integrate smart features, such as self-watering reservoirs and sensor compatibility, catering to the demands of precision agriculture and low-maintenance residential use.

Key driving factors accelerating the market expansion include the global surge in food security initiatives requiring robust seedling production, substantial investments in commercial greenhouse infrastructure, and shifting consumer preferences towards sustainable and biodegradable pot materials. The expansion of vertical farming operations and controlled environment agriculture (CEA) also necessitates specialized, durable, and standardized containers, further boosting demand across various geographical regions.

Nursery Planters and Pots Market Executive Summary

The Nursery Planters and Pots Market is characterized by resilient growth driven by parallel demand from both commercial horticulture and enthusiastic residential gardeners globally. Current business trends indicate a significant shift towards sustainable manufacturing practices, with biodegradable and recycled plastic planters gaining substantial traction, especially in environmentally conscious regions like Europe. Innovation in materials science, focusing on enhanced durability, reduced weight, and integrated smart technologies (e.g., self-watering systems and embedded sensors), represents a critical competitive differentiator among leading manufacturers. Consolidation among smaller regional manufacturers and strategic partnerships with large nursery operations are defining the competitive landscape.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid urbanization, increasing per capita income leading to greater spending on home decor and gardening, and the massive scale of commercial agriculture in countries like China and India. North America and Europe, while mature, remain dominant in terms of technological adoption and demand for premium, decorative, and sustainable products. The Middle East and Africa (MEA) are emerging markets, primarily driven by large-scale commercial farming and ambitious landscaping projects requiring vast quantities of standardized containers.

Segment trends highlight the dominance of plastic/polymer materials due to cost-effectiveness and durability, although the fiber/composite segment is exhibiting the highest growth rate owing to sustainability mandates. Application-wise, commercial nurseries remain the largest revenue generators, but the residential gardening segment is fueling growth in specialized and decorative pot sales. The increasing penetration of e-commerce channels facilitates direct-to-consumer sales, expanding the reach of niche and specialized planter products globally, effectively bypassing traditional retail constraints.

AI Impact Analysis on Nursery Planters and Pots Market

User queries regarding the impact of AI on the Nursery Planters and Pots Market commonly revolve around themes of manufacturing efficiency, inventory management, supply chain optimization, and product development personalization. Users frequently ask if AI can predict demand for specific planter sizes or materials based on seasonal sales data, or how intelligent systems can minimize waste in the molding or firing processes. The consensus expectation is that AI will not directly transform the physical product itself, but rather revolutionize the processes surrounding its production and distribution. Key concerns center on the cost of implementing AI-driven automation in material handling and quality control, particularly for small-to-medium enterprises (SMEs), and the requirement for specialized data scientists to interpret predictive market models related to horticultural demand fluctuations.

- AI optimizes manufacturing schedules, reducing energy consumption and material waste in plastic molding and ceramic firing processes.

- Predictive analytics driven by AI improves inventory management for distributors, accurately forecasting demand spikes for seasonal gardening products.

- AI-powered quality control systems utilize computer vision to detect subtle defects in finished pots, ensuring consistent product standards.

- Integration of machine learning algorithms aids in the design and prototyping of specialized containers, optimizing structures for specific plant root systems.

- Smart environmental controls in greenhouses (utilizing AI) drive consistent demand for specialized planters designed for automated irrigation and sensor placement.

- Customer relationship management (CRM) systems leveraged by AI personalize planter recommendations based on user location, climate, and gardening proficiency.

DRO & Impact Forces Of Nursery Planters and Pots Market

The Nursery Planters and Pots Market is subject to a complex interplay of drivers, restraints, and opportunities that define its growth trajectory. The fundamental drivers include relentless global population growth necessitating expanded commercial food and ornamental crop production, coupled with a steady increase in disposable incomes that fuels consumer interest in beautifying indoor and outdoor spaces. The market benefits significantly from high demand stabilization provided by commercial nurseries which require bulk, standardized products for efficient scaling. However, the market faces significant restraints, primarily stemming from fluctuating raw material prices, particularly petrochemicals for plastic production and energy costs for ceramic manufacturing. Furthermore, environmental regulations concerning plastic waste disposal pose a persistent challenge, particularly in developed economies, forcing companies to invest heavily in sustainable alternatives.

Opportunities abound in leveraging circular economy models, such as scaling up the use of bio-based plastics and utilizing advanced recycling techniques for existing containers, thereby reducing environmental footprints and appealing to conscious consumers. The expansion of e-commerce platforms specializing in gardening supplies offers substantial untapped potential for manufacturers to reach previously inaccessible regional markets and offer niche, high-value decorative planters directly to consumers. Additionally, the development and integration of smart planters that connect to IoT networks represent a high-growth avenue, catering to the technological demands of modern, urban agriculture enthusiasts.

The key impact forces dictating market movement include the economic growth rates in developing countries, which directly correlate with residential gardening adoption, and international regulatory shifts regarding plastic use and disposal. Technological advancements in sustainable materials and automated manufacturing processes exert a moderate to high impact, enhancing cost efficiency and product quality. The enduring cultural trend towards "green" lifestyles and sustainable consumption acts as a powerful, sustained impact force compelling ongoing market innovation toward eco-friendly products.

Segmentation Analysis

The Nursery Planters and Pots Market is extensively segmented across multiple dimensions—Material, Application, Distribution Channel, Product Type, and Size—each offering distinct growth profiles and competitive dynamics. Understanding these segments is critical for manufacturers aiming to optimize their product portfolios and marketing strategies. The Material segmentation, which includes traditional plastic, clay, and modern composites, defines cost structure and environmental impact, while the Application segment dictates the required durability and aesthetic qualities of the product. The increasing specialization in horticulture, driven by vertical farming and advanced greenhouse systems, continues to carve out niche subsegments demanding tailored product specifications.

Plastic/Polymer pots dominate the volume aspect of the market due to their low cost, light weight, and excellent durability for commercial transportation and high-volume growing operations. However, the fastest growth is observed in the fiber/composite segment, which includes materials like peat, coir, and bamboo fibers, driven by regulatory pressure to reduce single-use petroleum-based plastics. Similarly, the Application segmentation differentiates between highly functional, stackable commercial products and aesthetically driven, high-margin decorative products sold to the residential sector, highlighting a dichotomy between utility and design within the broader market structure.

The structure of the distribution channel is evolving rapidly, moving from traditional reliance on agricultural wholesale suppliers and large home centers towards robust online retail platforms. This shift is particularly influential for decorative and premium pots, allowing smaller producers to gain visibility. Consequently, strategic emphasis is placed on optimizing logistics for bulky and sometimes fragile products to ensure successful delivery across diverse geographical regions, impacting overall profitability and market access.

- By Material: Plastic/Polymer, Terracotta/Clay, Metal, Wood, Fiber/Composite, Ceramic.

- By Application: Commercial Nurseries, Residential Gardening, Landscaping, Horticulture Research.

- By Distribution Channel: Online Retail, Specialty Stores, Home Centers, Direct Sales.

- By Product Type: Standard Pots, Decorative Planters, Hanging Baskets, Propagation Trays, Hydroponic Systems.

- By Size: Small (under 6 inches), Medium (6 to 12 inches), Large (over 12 inches).

Value Chain Analysis For Nursery Planters and Pots Market

The value chain for the Nursery Planters and Pots Market begins with the upstream sourcing of raw materials, which is highly dependent on the type of container being produced. For plastic pots, the process relies on petrochemical suppliers providing resins (Polypropylene, Polyethylene). Ceramic and clay production requires consistent access to high-quality geological raw materials and stable energy sources for firing. Fiber and composite materials necessitate sourcing agricultural waste products or sustainable wood pulp. Upstream efficiency is crucial, as fluctuations in energy and commodity prices directly impact manufacturing costs and, consequently, the final market price. Manufacturers focus heavily on negotiating bulk material contracts and optimizing production lines to maintain competitive pricing, often involving significant capital investment in advanced molding or extrusion equipment.

The midstream phase involves manufacturing, where standardization and quality control are paramount, especially for commercial-grade products that must meet strict nursery requirements regarding dimensions and drainage. Distribution channels form a critical link in the value chain, handling the logistics of transporting bulky, often fragile goods. Traditional channels include wholesale distributors and large agricultural supply centers, which service commercial users. Retail channels, such as specialty garden centers and big-box home improvement stores, cater primarily to residential demand, focusing on aesthetic presentation and convenience.

The downstream sector is characterized by the end-users: commercial nurseries, large landscaping contractors, and individual consumers. Direct sales channels, facilitated by modern e-commerce, are growing rapidly, shortening the chain and potentially increasing margins for manufacturers who manage their own fulfillment. Indirect distribution through third-party wholesalers remains essential for reaching disparate commercial growers. Optimization of logistics, inventory pooling, and strategic regional warehousing are key to reducing lead times and transportation costs across the entire value chain.

Nursery Planters and Pots Market Potential Customers

Potential customers for Nursery Planters and Pots span the spectrum from large, industrial agricultural operations to hobbyist gardeners. The largest segment of buyers comprises commercial nurseries and greenhouse operators. These customers demand high volume, standardized, durable, and cost-effective products, such as plastic propagation trays and injection-molded standard pots, which facilitate automated handling and efficient plant rotation. Their purchasing decisions are driven by unit cost, consistency, and reliability for large-scale production runs, making long-term supply agreements a common procurement strategy.

The second major customer group includes landscaping and construction firms. These entities require a mix of large-format transportation pots for trees and shrubs, along with aesthetically appealing, heavy-duty decorative planters for permanent installations in public spaces, corporate campuses, and high-end residential projects. This segment often prefers premium materials like heavy-duty plastic, ceramic, or metal, where longevity and visual appeal justify higher unit costs. Procurement is often project-based, requiring reliable supply chains capable of delivering diverse product mixes on strict timelines.

Residential consumers form a highly diverse customer base, ranging from apartment dwellers engaging in indoor gardening to suburban homeowners maintaining expansive yards. This segment drives the demand for specialized products, including self-watering systems, colorful decorative pots, and sustainable bio-based containers. Purchasing decisions are heavily influenced by aesthetics, ease of use, and alignment with interior design trends. The growth of this segment is particularly supported by online retail, allowing customers to easily access unique and specialized designs not available in general retail stores.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The HC Companies, Keter Group, East Jordan Plastics Inc., Tuffy Manufacturing Inc., Anderson Pots, Dillen Products, Nursery Supplies Inc., Myers Industries Inc., Poppelmann GmbH & Co. KG, Landmark Plastic Corporation, Kord Products, Sinclair Horticulture, Garant GP, Modiform, New Pro Products Inc., Bloem LLC, Akro-Mils, Orlandi Statuary, Crescent Garden, H. F. Taber Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nursery Planters and Pots Market Key Technology Landscape

The technology landscape within the Nursery Planters and Pots Market primarily focuses on advanced material science, manufacturing automation, and the integration of smart features. In manufacturing, the adoption of high-speed injection molding and thermoforming technologies allows for the mass production of standardized plastic containers with extremely high efficiency and consistency, minimizing material usage while maximizing output. For ceramic and terracotta production, energy-efficient kilns and automated robotic handling systems are crucial for reducing labor costs and managing the immense energy required for the firing process. Furthermore, the development of biodegradable polymers derived from plant starches or recycled materials requires specialized compounding and molding equipment capable of handling these newer, often less stable materials effectively.

A significant technological advancement involves the development of specialized geometries and materials to optimize plant growth. This includes air-pruning pots, which promote denser, healthier root structures by naturally inhibiting root circling. Innovations in drainage systems, such as elevated pot bases and integrated reservoirs for passive watering (self-watering systems), utilize precision engineering to improve water management efficiency, crucial for both commercial growers aiming to reduce labor and residential users seeking low-maintenance solutions. The technology here is subtle but critical, focusing on maximizing the physiological benefits for the plant while ensuring logistical ease.

The most forward-looking technology trend is the integration of Internet of Things (IoT) capabilities, creating 'smart planters.' These products embed sensors that monitor soil moisture, temperature, light levels, and nutrient profiles, relaying data to users or automated greenhouse systems. While still a niche segment, the rise of connected gardening and precision horticulture drives demand for planters designed specifically to house these electronic components seamlessly. This connectivity allows commercial growers to manage vast numbers of plants remotely and enables high-tech urban farmers to achieve optimal growing conditions with minimal manual intervention.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the rapid expansion of commercial agriculture and greenhouse farming, particularly in China, India, and Southeast Asian countries. Increasing disposable income and urbanization are fueling the demand for residential ornamental gardening and aesthetic planters. The region benefits from lower manufacturing costs, making it a major global production hub for plastic and terracotta containers.

- North America: North America holds a substantial market share, characterized by high adoption of automated greenhouse systems and significant consumer spending on gardening and home aesthetics. The market here focuses heavily on specialized products, durable large-format pots for landscaping, and a growing emphasis on high-quality, sustainably manufactured containers compliant with state-level environmental mandates.

- Europe: Europe is a mature but highly innovation-driven market, leading the adoption of biodegradable and recycled materials due to stringent EU environmental policies regarding plastic waste. Germany, the UK, and the Netherlands are key contributors, driven by advanced horticulture technology and a strong consumer preference for eco-friendly and stylish decorative planters.

- Latin America (LATAM): The LATAM market is witnessing steady growth, primarily supported by expanding agricultural exports and modernization of farming practices in countries like Brazil and Mexico. The demand is largely centered on cost-effective, durable plastic containers for commercial operations, with emerging demand for decorative pots in urban centers.

- Middle East and Africa (MEA): Growth in MEA is spurred by large-scale infrastructure and landscaping projects, particularly in the Gulf Cooperation Council (GCC) states, requiring massive quantities of large-scale planters and specialty containers for arid environments. Investment in controlled environment agriculture (CEA) to ensure food security is also a major market driver.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nursery Planters and Pots Market.- The HC Companies

- Keter Group

- East Jordan Plastics Inc.

- Tuffy Manufacturing Inc.

- Anderson Pots

- Dillen Products

- Nursery Supplies Inc.

- Myers Industries Inc.

- Poppelmann GmbH & Co. KG

- Landmark Plastic Corporation

- Kord Products

- Sinclair Horticulture

- Garant GP

- Modiform

- New Pro Products Inc.

- Bloem LLC

- Akro-Mils

- Orlandi Statuary

- Crescent Garden

- H. F. Taber Company

Frequently Asked Questions

Analyze common user questions about the Nursery Planters and Pots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward biodegradable nursery pots?

The primary driver is stringent global environmental regulation, particularly concerning single-use plastics in the horticulture sector, coupled with heightened consumer awareness and corporate sustainability goals. Biodegradable options (like coir or wood fiber pots) reduce waste and simplify the transplanting process, appealing to eco-conscious commercial and residential users.

Which material segment currently holds the largest market share?

Plastic/Polymer materials, specifically polypropylene and polyethylene, currently dominate the market volume due to their cost-effectiveness, lightweight nature, durability, and suitability for high-speed commercial automation in nurseries worldwide. However, the dominance of plastic is gradually being challenged by fiber and composite alternatives.

How is the rise of vertical farming impacting demand for planters?

Vertical farming significantly increases demand for specialized, standardized, and often reusable containers designed for closed-loop hydroponic or aeroponic systems. These planters must integrate seamlessly with automated nutrient delivery and require specific, stackable geometries optimized for space utilization and light exposure efficiency.

What are the key competitive factors in the nursery planters market?

Competition hinges on manufacturing efficiency (cost per unit), robust supply chain logistics for international distribution, product innovation (e.g., self-watering features, air-pruning design), and success in developing scalable, sustainable, and certified eco-friendly product lines to meet evolving regulatory and consumer demands.

Is the market relying more on online or traditional distribution channels?

While traditional distribution (wholesalers and home centers) still dominates commercial bulk sales, the market is increasingly leveraging online retail. E-commerce platforms are crucial for the high-margin decorative and specialty planter segment, enabling manufacturers to reach individual consumers directly with a broader range of unique products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager