Nutrition Chemicals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433854 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nutrition Chemicals Market Size

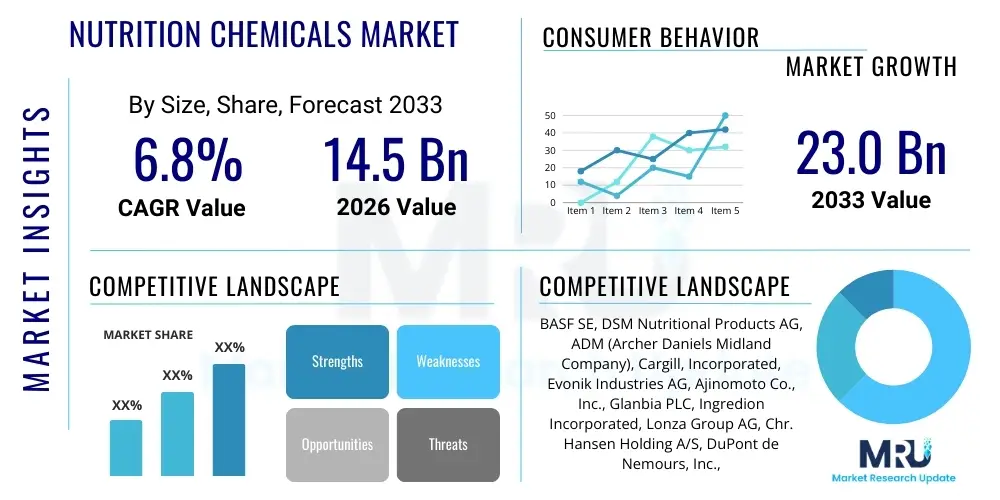

The Nutrition Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Nutrition Chemicals Market introduction

The Nutrition Chemicals Market encompasses a diverse range of chemical compounds, including vitamins, minerals, amino acids, prebiotics, probiotics, and functional lipids, which are essential components used in fortifying food products, manufacturing dietary supplements, and formulating animal feed. These specialized chemicals are critical for promoting health, preventing deficiencies, enhancing performance, and improving the overall nutritional profile of consumer goods globally. The primary product descriptions span across both synthetic and naturally derived ingredients, categorized by their biological function and application matrix. Major applications are concentrated in the Food & Beverage industry, particularly in processed foods, fortified beverages, and specialized nutrition products like infant formula and sports supplements, alongside significant usage in the robust pharmaceuticals and animal feed sectors.

The core benefits derived from the widespread adoption of nutrition chemicals include addressing malnutrition, supporting optimal physiological functions, and catering to specific dietary needs arising from increasing health consciousness and aging populations. For instance, the demand for high-purity amino acids and specialty proteins is surging due to the global trend toward personalized nutrition and fitness optimization. Furthermore, these chemicals significantly improve the stability, shelf life, and bioavailability of end products, offering substantial advantages to manufacturers seeking to comply with stringent quality and safety standards imposed by global regulatory bodies like the FDA and EFSA. The ability of these chemicals to serve as functional ingredients, extending beyond basic nutrient provision, is broadening their utility across therapeutic and preventive health domains.

Several fundamental driving factors propel the expansion of the nutrition chemicals market. Key among these is the escalating prevalence of chronic diseases linked to poor diet, necessitating preventative nutritional intervention. Simultaneously, increasing disposable incomes in emerging economies, combined with a heightened focus on proactive health management among middle and upper classes worldwide, fuel the demand for fortified and functional foods. Regulatory support in various countries mandating food fortification programs, particularly for staple foods, also provides a stable foundation for market growth. Technological advancements in synthesis, extraction, and encapsulation techniques, leading to improved ingredient efficacy and cost-effectiveness, further solidify the market's upward trajectory, enabling innovation in complex formulations and novel delivery systems that meet sophisticated consumer demands.

Nutrition Chemicals Market Executive Summary

The Nutrition Chemicals Market exhibits strong growth dynamics driven primarily by fundamental shifts in global consumption patterns toward health and wellness, underpinned by significant technological advancements in ingredient manufacturing. Business trends indicate a marked consolidation phase, with major chemical and pharmaceutical companies acquiring specialized ingredient manufacturers to integrate vertically and secure diversified product portfolios, particularly focusing on high-margin segments like specialty proteins and advanced nutrient delivery systems. Innovation in fermentation technology for producing complex vitamins and amino acids efficiently is a crucial business differentiator. Furthermore, sustainability is becoming a non-negotiable aspect, with companies investing heavily in greener manufacturing processes and transparent sourcing of bio-based nutritional components to meet stringent ESG criteria and consumer preference for ethically produced ingredients.

Regionally, Asia Pacific is poised to maintain the highest growth trajectory, fueled by massive population growth, rapid urbanization, and an accelerating middle class that is increasingly purchasing fortified and supplemental nutrition products. Government initiatives in countries like China and India to tackle micronutrient deficiencies through large-scale fortification programs provide consistent demand stabilization. North America and Europe, while mature, remain dominant in terms of value, characterized by sophisticated consumer bases demanding premium, customized, and clinically validated nutritional ingredients, driving significant investment into research and development focusing on personalized nutrition and gut health solutions, such as next-generation prebiotics and novel probiotic strains with targeted efficacy profiles.

Segmentation trends highlight the robust performance of the amino acids and vitamins segments due to their indispensable roles in both human and animal nutrition, particularly the surge in demand for essential amino acids like L-Lysine and Methionine in animal feed to enhance protein efficiency. The market is also witnessing rapid expansion in the functional ingredients segment, encompassing specialized chemicals like omega-3 fatty acids and plant-based extracts, driven by their documented health benefits in cardiovascular and cognitive health. The application segment sees the largest share held by the functional food and beverage sector, although the dietary supplements market is experiencing the fastest growth rate, reflecting consumer autonomy in choosing preventative health measures. These segment dynamics underscore a future where highly specialized, efficacious ingredients command premium pricing, necessitating rigorous quality assurance and strong scientific backing.

AI Impact Analysis on Nutrition Chemicals Market

Common user questions regarding AI’s influence on the Nutrition Chemicals Market primarily revolve around how machine learning can accelerate new ingredient discovery, optimize complex chemical synthesis processes, and revolutionize personalized nutrition formulation. Users frequently ask about the role of AI in predicting consumer preferences for functional ingredients, streamlining supply chain logistics for temperature-sensitive compounds, and enhancing quality control and traceability across the manufacturing value chain. The key themes summarized from user inquiries indicate high expectations for AI to drive efficiency gains, reduce R&D timelines for novel nutrients, and enable hyper-customization of nutritional products, fundamentally shifting the paradigm from mass production to precision nutrition chemical development. Concerns often center on data privacy regarding personalized health data and the necessary infrastructure investment required for implementing sophisticated AI-driven analytical platforms in traditional chemical manufacturing settings, particularly for small and medium enterprises.

AI is set to revolutionize the nutrition chemicals sector by drastically improving the speed and accuracy of target compound identification. Machine learning algorithms can analyze vast biological, chemical, and genomic datasets to predict the efficacy, safety, and bioavailability of potential nutritional compounds before costly laboratory synthesis begins. This accelerated R&D cycle allows manufacturers to rapidly respond to emerging scientific discoveries and consumer health trends, focusing resources on the most promising ingredients. Furthermore, AI-driven process optimization, including predictive maintenance and real-time monitoring of bioreactors and fermentation tanks, ensures maximum yield and purity, minimizing waste and enhancing the profitability of complex chemical synthesis operations, leading to higher quality nutrition chemicals.

Beyond manufacturing, AI significantly impacts the downstream applications, particularly in formulating personalized nutrition solutions. By analyzing individual health metrics, dietary habits, and genetic information, AI systems can recommend precise combinations and dosages of nutrition chemicals, moving beyond generic dietary recommendations. This capability requires robust data infrastructure and sophisticated analytical models but offers an unprecedented level of product relevance and consumer engagement. Supply chain management benefits immensely from predictive analytics, allowing manufacturers to anticipate demand fluctuations and optimize inventory levels for critical raw materials, ensuring a reliable supply of essential nutrition chemicals to end-product manufacturers worldwide, even amidst geopolitical and logistical volatility.

- AI-powered drug discovery accelerates identification of novel bioactive compounds and therapeutic nutrients, drastically shortening R&D cycles.

- Machine learning optimizes complex fermentation and chemical synthesis processes, leading to higher yield, purity, and reduced operational costs in chemical production.

- Predictive analytics enhance supply chain resilience, forecasting demand variability and managing inventory of high-value nutritional components effectively.

- AI enables hyper-personalized nutrition formulation by analyzing genomic, metabolic, and lifestyle data to tailor specific mixtures of vitamins, minerals, and amino acids.

- Advanced image recognition and data analytics improve quality control and traceability, ensuring compliance with stringent regulatory standards for nutritional ingredient safety.

DRO & Impact Forces Of Nutrition Chemicals Market

The Nutrition Chemicals Market is shaped by a powerful confluence of driving forces, significant restraining factors, and substantial growth opportunities, all governed by critical impact forces that dictate market momentum and direction. The core drivers include the undeniable global shift towards preventive healthcare, evidenced by the rising consumer demand for functional foods and supplements that proactively support immunity and well-being. Coupled with this is the continuous expansion of the global population, which necessitates sustainable and scalable solutions for addressing nutritional deficiencies in both human and animal populations. These demand-side pressures are further amplified by continuous scientific advancements that validate the efficacy of specialized ingredients, prompting greater regulatory acceptance and subsequent market adoption.

Conversely, the market faces considerable restraints that temper potential growth. Primary among these are the complex and often inconsistent regulatory frameworks across different geographical regions, which create barriers to market entry and necessitate substantial compliance costs for global manufacturers dealing with novel ingredients. Furthermore, the high cost associated with R&D, clinical trials, and manufacturing sophisticated, high-purity nutrition chemicals often limits accessibility in price-sensitive markets. Consumer skepticism regarding the actual efficacy and sourcing transparency of certain nutritional ingredients, especially following public health scandals, poses an ongoing challenge that requires robust quality assurance and transparent marketing efforts to overcome and rebuild trust.

Despite these restraints, the market is rich with opportunities, most notably the untapped potential within personalized nutrition and the application of nutrigenomics, allowing manufacturers to develop highly targeted and scientifically defensible products. The growing global awareness of animal welfare and feed efficiency is fueling demand for advanced feed additives that improve nutrient utilization and reduce antibiotic dependency in livestock. The major impact forces are the rapidly changing consumer preference for natural and clean-label ingredients, pushing manufacturers to transition away from synthetic chemicals, and geopolitical instability, which introduces volatility in raw material pricing and supply chain reliability. Successfully navigating these impact forces requires agile innovation focused on sustainability, transparency, and high efficacy, ensuring that market participants maintain a competitive edge in a rapidly evolving health landscape.

Segmentation Analysis

The Nutrition Chemicals Market is comprehensively segmented based on product type, application, form, and source, reflecting the diverse utility of these essential ingredients across various industries. Product segmentation helps define the fundamental chemical composition, ranging from macro-nutrients to specialized micro-nutrients, providing clarity on the core market drivers for basic nutritional needs versus specialized functional requirements. Application segmentation demonstrates the end-use sectors, revealing the scale and growth potential within areas like human consumption versus livestock feed. Understanding these segments is critical for manufacturers to align their R&D and production capabilities with the specific quality standards and regulatory mandates of their target industries, ensuring maximum market penetration and optimized resource allocation across the value chain.

By analyzing the market through these structured lenses, stakeholders can accurately gauge competitive intensity and identify lucrative niche markets, such as the accelerating demand for fermentation-derived ingredients driven by vegan and sustainable food trends. The form segmentation, differentiating between solid powders, granules, and liquid formulations, is crucial for assessing processing compatibility and final product stability in diverse applications like tableting, encapsulation, or beverage integration. Furthermore, the source segmentation (synthetic vs. natural/bio-based) is increasingly important as consumer preferences shift overwhelmingly towards natural, plant-derived, or sustainable alternatives, pushing innovation in biotechnological extraction and synthesis methods across all product categories. This granular analysis ensures strategic decision-making focused on high-growth, high-value segments.

- Product Type:

- Amino Acids (Lysine, Methionine, Threonine, Tryptophan, Others)

- Vitamins (Vitamin A, B Complex, C, D, E, K)

- Minerals (Calcium, Iron, Zinc, Magnesium, Selenium)

- Carotenoids (Beta-Carotene, Lycopene, Lutein)

- Specialty Chemicals (Nucleotides, Choline Chloride, Taurine)

- Prebiotics and Probiotics

- Application:

- Food and Beverages (Dairy, Bakery, Confectionery, Functional Drinks)

- Dietary Supplements

- Animal Feed (Poultry, Swine, Ruminant, Aquaculture)

- Pharmaceuticals and Personal Care

- Form:

- Powder

- Liquid

- Granules

- Source:

- Synthetic

- Natural/Plant-based

- Fermentation-derived

Value Chain Analysis For Nutrition Chemicals Market

The value chain for the Nutrition Chemicals Market begins with the upstream segment, dominated by the sourcing and processing of raw materials, which are primarily petrochemical derivatives, agricultural feedstock (like corn, soy, and sugar cane), or specialized microbial strains used for fermentation. Efficiency and sustainability in this upstream segment are paramount, as the cost and purity of basic raw materials directly influence the final product’s profitability and quality. Key upstream activities involve intensive chemical synthesis for vitamins and amino acids, or advanced biotechnological processes for natural extracts and fermentation-based ingredients. Strategic sourcing alliances and vertical integration are commonly employed by leading market players to secure a stable supply of high-quality inputs and mitigate price volatility associated with commodities.

The core midstream activity involves the actual manufacturing, purification, and formulation of nutrition chemicals, where complex chemical engineering and stringent quality control are applied. Manufacturers transform raw inputs into high-purity, functional ingredients, often utilizing proprietary technologies like microencapsulation, spray drying, and specialized blending techniques to improve stability, bioavailability, and handling properties. This stage requires significant capital investment in certified manufacturing facilities (e.g., GMP, HACCP certified) and skilled technical expertise to comply with diverse product specifications and regulatory mandates for food-grade, feed-grade, and pharmaceutical-grade ingredients, ensuring safety and efficacy before market release.

The downstream segment focuses on distribution channels, market reach, and final application. Products reach end-users through both direct and indirect distribution models. Direct sales are common for large-volume customers, such as major food and beverage manufacturers or global animal feed integrators, facilitating direct technical support and customized solutions. Indirect channels utilize specialized distributors, agents, and local brokers, crucial for penetrating fragmented smaller markets and managing regional regulatory specificities. Effective distribution relies heavily on specialized logistics for handling temperature-sensitive and high-value materials, ensuring product integrity until it is incorporated into final consumer products like fortified foods, dietary supplements, or veterinary medicines.

Nutrition Chemicals Market Potential Customers

The primary potential customers and end-users of nutrition chemicals span across four massive industrial sectors: Food & Beverage, Dietary Supplements, Animal Feed, and Pharmaceuticals. Within the Food & Beverage sector, key buyers include major global manufacturers of dairy products, functional beverages, infant formula, and fortified packaged goods, all of whom rely on these chemicals to meet regulatory fortification requirements, enhance product flavor and texture, and market specific health benefits. These customers prioritize ingredients that offer high solubility, neutral taste profiles, and consistent supply reliability, often demanding co-development and long-term contract pricing to manage complex formulation processes and cost efficiencies.

The Dietary Supplements industry represents a rapidly growing customer base, driven by consumer self-directed health management. These customers range from large multinational supplement companies specializing in vitamins and multi-minerals to niche, agile companies focusing on personalized nutrition, sports performance, and specialty botanicals. These buyers place a premium on ingredients with clinical validation, high potency, and robust documentation demonstrating source transparency and ethical production, seeking unique delivery forms like liposomal encapsulation or sustained-release technologies to differentiate their final products in a highly competitive retail environment.

The Animal Feed industry constitutes another foundational customer segment, including integrated livestock producers, aquaculture farms, and large feed premix manufacturers. Their procurement is highly cost-sensitive and driven by maximizing feed conversion ratios, improving animal health, and complying with shifting regulations on antibiotic usage. Essential nutrition chemicals, such as L-Lysine, Methionine, and specific feed-grade vitamins and trace minerals, are critical inputs for optimizing animal growth and reducing environmental impact. The Pharmaceutical sector utilizes ultra-high purity vitamins and excipients for therapeutic applications and clinical nutrition, demanding the most stringent quality standards (Pharma-grade) and comprehensive regulatory dossiers for every chemical procured.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DSM Nutritional Products AG, ADM (Archer Daniels Midland Company), Cargill, Incorporated, Evonik Industries AG, Ajinomoto Co., Inc., Glanbia PLC, Ingredion Incorporated, Lonza Group AG, Chr. Hansen Holding A/S, DuPont de Nemours, Inc., Kemin Industries, Inc., Allied Biotech Corporation, Blue California, Kyowa Hakko Kirin Co., Ltd., Novozymes A/S, Gelita AG, Tate & Lyle PLC, WACKER Chemie AG, Zhejiang Medicine Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nutrition Chemicals Market Key Technology Landscape

The technological landscape of the Nutrition Chemicals Market is rapidly evolving, driven by the need for higher purity, better bioavailability, and sustainable production methods. A core technological advancement is the widespread adoption of industrial biotechnology and microbial fermentation processes, particularly for the mass production of complex vitamins (like Vitamin B12) and essential amino acids (such as L-Lysine and L-Threonine). Fermentation technology offers a cleaner, more sustainable alternative to traditional petrochemical synthesis, aligning with increasing consumer demand for natural and non-GMO ingredients. This focus on bio-based production requires continuous innovation in strain development and optimizing bioreactor design to maximize yield and minimize energy consumption, crucial for maintaining cost competitiveness against established synthetic routes.

Another pivotal technological area is advanced delivery systems, which address the historical challenge of nutrient stability and absorption. Techniques like microencapsulation, nanoencapsulation, and liposomal delivery are essential for protecting sensitive compounds (e.g., Omega-3 fatty acids, certain vitamins) from degradation due to heat, light, or oxidation during processing and storage. These technologies also enhance the bioavailability of nutrients, ensuring higher efficacy once consumed. Manufacturers are investing heavily in these specialized coating and stabilization technologies to allow for the incorporation of highly functional but historically unstable ingredients into challenging food matrices, such as clear beverages or baked goods, without compromising their nutritional integrity or sensory attributes.

Furthermore, digital technologies and automation are fundamentally transforming manufacturing efficiency and quality control. Automated spectroscopic analysis (e.g., Near-Infrared Spectroscopy or Raman spectroscopy) allows for real-time monitoring of chemical reactions and purification steps, guaranteeing batch-to-batch consistency and minimizing contamination risks, which is critical for compliance with strict pharmaceutical and food safety standards. The integration of high-throughput screening and genomics in the R&D phase accelerates the identification and validation of new functional ingredients derived from natural sources, leveraging computational chemistry to predict molecular efficacy and toxicity profiles, thereby speeding up the time-to-market for innovative nutrition chemical solutions.

Regional Highlights

The Nutrition Chemicals Market exhibits significant geographic variation in demand, regulatory structure, and growth rates, driven by diverse dietary habits, economic maturity, and governmental health policies. The Asia Pacific (APAC) region is forecasted to be the engine of global market growth, primarily fueled by the demographic scale of China and India, where rapid economic development has led to higher disposable incomes and a corresponding increase in discretionary spending on health-related products. Governments across APAC are actively addressing widespread micronutrient deficiencies through mandatory fortification programs, especially for basic staples like rice and flour, providing a sustained high-volume demand base for essential vitamins and minerals. Furthermore, the massive and rapidly industrializing animal feed sector in Southeast Asia requires vast quantities of feed additives, particularly amino acids, to support efficient poultry and swine production, underscoring the regional importance of this market.

North America maintains its position as the largest market in terms of value and technological adoption, characterized by a highly sophisticated consumer base that demands premium, clinically validated, and often personalized nutritional solutions. The market here is highly innovation-driven, focusing intensely on specialty chemicals, sports nutrition supplements, and cutting-edge ingredients targeting specific conditions like cognitive decline and gut health. Regulatory clarity provided by the U.S. FDA, particularly concerning Generally Recognized As Safe (GRAS) status, encourages continuous investment in novel ingredients. This region sets global trends for clean-label, plant-based, and sustainably sourced ingredients, pressuring manufacturers to adopt transparent and ethical sourcing practices throughout their chemical supply chains. The maturity of the supplements market and strong presence of major pharmaceutical firms contribute significantly to the premium pricing structure observed here.

Europe represents a stable yet growth-oriented market, governed by the rigorous and unified regulatory framework established by the European Food Safety Authority (EFSA). European consumers are highly attuned to food safety, sustainability, and origin, driving strong demand for high-quality, bio-based ingredients and clean-label solutions, which often command a premium price point. Key growth areas include the rapid uptake of prebiotics and probiotics across multiple food categories, driven by strong scientific research linking gut health to overall immunity. Although growth rates are slightly less aggressive than APAC, the focus on sustainable chemistry and advanced functional food technology ensures Europe remains pivotal for innovation. Conversely, Latin America and the Middle East & Africa (MEA) are emerging regions experiencing accelerating growth, primarily stemming from improved economic conditions, increasing awareness of preventive health, and expanding industrial-scale animal farming, although these markets often face logistical challenges and are more sensitive to global commodity price fluctuations.

- Asia Pacific (APAC): Dominates volume and growth due to large consumer base, mandatory government fortification programs (India, China), and massive expansion of industrial animal feed production, particularly for amino acids.

- North America: Leads in market value and innovation; characterized by high demand for personalized nutrition, sports supplements, functional lipids, and sophisticated regulatory structures promoting novel ingredient development (GRAS system).

- Europe: Driven by strict EFSA regulations, strong consumer demand for sustainability, clean-label ingredients, and rapid adoption of gut-health-focused chemicals (prebiotics, probiotics) in functional foods and supplements.

- Latin America (LATAM): Exhibits rapid growth driven by urbanization, expanding middle class, and rising investment in modern agriculture requiring enhanced feed efficiency additives, though hampered by currency volatility.

- Middle East & Africa (MEA): Emerging market growth primarily attributed to improving health infrastructure, government initiatives to address malnutrition, and increasing reliance on imported food and feed additives, particularly in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nutrition Chemicals Market.- BASF SE

- DSM Nutritional Products AG

- ADM (Archer Daniels Midland Company)

- Cargill, Incorporated

- Evonik Industries AG

- Ajinomoto Co., Inc.

- Glanbia PLC

- Ingredion Incorporated

- Lonza Group AG

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Kemin Industries, Inc.

- Allied Biotech Corporation

- Blue California

- Kyowa Hakko Kirin Co., Ltd.

- Novozymes A/S

- Gelita AG

- Tate & Lyle PLC

- WACKER Chemie AG

- Zhejiang Medicine Co. Ltd.

- IFF (International Flavors & Fragrances)

- Kerry Group plc

- Beneo GmbH

- Arla Foods Ingredients Group P/S

Frequently Asked Questions

Analyze common user questions about the Nutrition Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Nutrition Chemicals Market?

The market growth is primarily driven by three core factors: the global increase in health and wellness consciousness leading to higher demand for fortified foods and dietary supplements; the necessity to address widespread micronutrient deficiencies, especially in emerging economies; and continuous technological advancements in ingredient synthesis that improve efficacy and reduce production costs, making specialized ingredients more accessible across various application sectors.

How does regulatory scrutiny affect the introduction of new nutrition chemicals?

Regulatory scrutiny significantly impacts market dynamics by demanding extensive clinical evidence, safety data, and traceability protocols for novel ingredients. Regulatory bodies like the EFSA in Europe and the FDA in North America require rigorous approval processes (e.g., Novel Food status or GRAS certification), which can extend time-to-market and increase R&D costs, yet simultaneously ensuring high quality and consumer safety, thereby building market confidence in approved chemicals.

Which product segment holds the largest market share in the nutrition chemicals industry?

The Amino Acids segment, particularly essential amino acids like L-Lysine and Methionine, consistently holds a significant market share. This dominance is due to their critical, high-volume application in the massive global animal feed industry, where they are indispensable for maximizing protein utilization and growth efficiency in livestock, alongside their growing use in high-protein human sports nutrition supplements.

What role does sustainability play in the manufacturing of nutrition chemicals?

Sustainability is becoming a crucial differentiating factor. Manufacturers are increasingly adopting green chemistry principles, utilizing fermentation over petrochemical synthesis, and sourcing raw materials transparently and ethically. This shift is driven by consumer demand for environmentally friendly and clean-label products, and by corporate requirements to meet Environmental, Social, and Governance (ESG) targets, affecting investment decisions and supply chain choices.

How is personalized nutrition changing the demand profile for specialized chemicals?

Personalized nutrition is shifting demand from high-volume standardized ingredients to smaller batches of highly specialized, high-purity chemicals tailored to individual genomic and metabolic needs. This trend requires manufacturers to produce complex functional lipids, custom vitamin blends, and targeted probiotic strains, necessitating flexible, high-precision manufacturing processes supported by AI-driven formulation and consumer data analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager