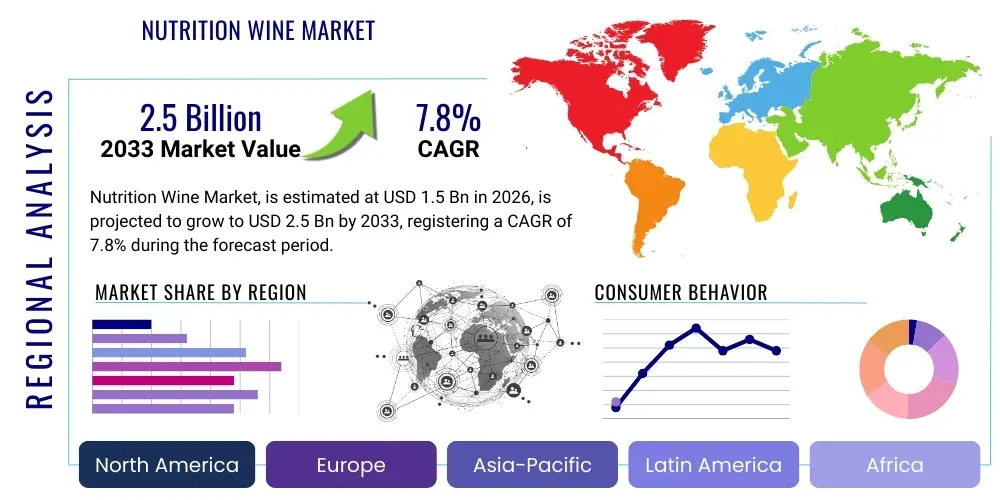

Nutrition Wine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435402 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Nutrition Wine Market Size

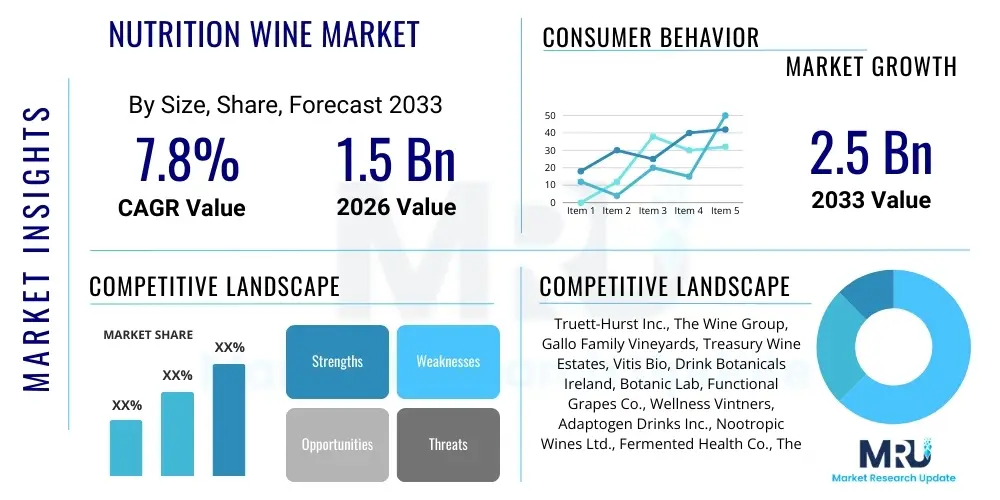

The Nutrition Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 billion in 2026 and is projected to reach USD 2.5 billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing consumer interest in functional beverages that offer perceived health benefits beyond standard hydration or recreational consumption. The fusion of traditional wine structures with nutraceutical ingredients, such as adaptogens, vitamins, and antioxidants, positions nutrition wine as a premium offering in the evolving health and wellness beverage sector, particularly appealing to younger, affluent demographics seeking sophisticated, health-conscious alternatives to conventional alcoholic drinks.

Nutrition Wine Market introduction

The Nutrition Wine Market encompasses alcoholic or non-alcoholic beverages formulated to combine the sensory experience of wine with enhanced nutritional value or specific health attributes. These products are typically infused with natural ingredients, including herbs, botanical extracts, vitamins, minerals, and polyphenols, designed to support functions such as improved immunity, stress reduction, digestive health, or enhanced antioxidant intake. The core product description involves a base liquid, often grape-derived or fruit-fermented, that undergoes a specialized production process to retain or augment beneficial compounds, ensuring the final product meets both palatability and functional criteria. This category differentiates itself from traditional fortified wines by explicitly marketing its health and wellness properties, rather than solely its alcoholic content or aging process.

Major applications of nutrition wine span across several consumer segments, including its utilization as a dietary supplement, a component of wellness regimes, and as a sophisticated, health-conscious alternative in social settings. Consumers integrate these wines into their daily routines for targeted benefits, such as leveraging herbal infusions for relaxation or utilizing vitamin-rich formulations for nutritional supplementation. The primary benefits associated with these products include targeted nutritional delivery, antioxidant protection, perceived moderation in consumption compared to standard wine, and alignment with clean label trends due to the emphasis on natural, functional ingredients. The market success hinges on the dual promise of enjoyment and therapeutic advantage.

Driving factors for the substantial growth of the Nutrition Wine Market are deeply rooted in pervasive societal shifts toward proactive health management and preventative nutrition. The global surge in demand for functional foods and beverages, coupled with an increasing awareness regarding the therapeutic potential of botanicals and natural extracts, provides a strong foundation for market expansion. Furthermore, continuous innovation in flavor profiles and non-alcoholic options broadens the market appeal, overcoming previous barriers related to taste or alcohol content. Regulatory environments, particularly those supporting the labeling and marketing of functional claims, also play a crucial role in legitimizing and accelerating consumer acceptance of nutrition wine products as essential items in the modern health beverage landscape.

Nutrition Wine Market Executive Summary

The Nutrition Wine Market is experiencing vigorous expansion, characterized by significant business trends focused on product premiumization and clean label advocacy. Key industry movements include substantial venture capital investments in specialized fermentation and extraction technologies, enabling manufacturers to integrate highly potent nutraceuticals without compromising the desirable sensory qualities of wine. Regional trends show robust adoption in North America and Europe, driven by high disposable incomes and mature health and wellness ecosystems, while Asia Pacific emerges as the fastest-growing region, stimulated by the popularity of traditional herbal remedies being formalized into Western-style beverages. These geographical shifts necessitate localized formulation strategies to align with diverse cultural preferences and regulatory frameworks pertaining to functional claims.

Segment trends indicate a strong consumer preference for herbal and botanical-infused nutrition wines, particularly those emphasizing adaptogenic and immunity-boosting properties, reflecting immediate post-pandemic health priorities. The distribution channel dynamics are shifting, with direct-to-consumer (DTC) online sales gaining significant traction due to the ability to effectively communicate complex nutritional benefits and build dedicated brand communities. Concurrently, the application segment focused on 'Wellness and Lifestyle' dominates the market share, underscoring the product's positioning as an everyday functional beverage rather than solely a specialized health supplement. Sustainability and ethical sourcing, particularly concerning the botanicals and grape sources used, are rapidly becoming non-negotiable consumer expectations, compelling firms to establish transparent and traceable supply chains.

Overall, the market is defined by convergence—the merging of the traditional beverage industry with the specialized nutraceutical sector. Strategic focus remains on technological innovation to improve ingredient bioavailability and shelf stability, alongside aggressive marketing campaigns targeting health-conscious millennials and Gen Z consumers who prioritize product functionality and ingredient transparency. Regulatory clarity around permissible health claims for alcoholic or non-alcoholic functional beverages remains a critical determinant of long-term market structure and competitive dynamics, driving cautious yet ambitious expansion strategies among established beverage giants and agile functional food startups alike.

AI Impact Analysis on Nutrition Wine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Nutrition Wine Market predominantly revolve around three critical themes: personalized consumer experience, optimized production efficiency, and predictive market forecasting. Consumers are keenly interested in how AI can facilitate the development of personalized nutritional wine profiles based on individual biometric data, dietary restrictions, and stated health goals. Manufacturers, conversely, are focused on leveraging AI-driven analytics for precise ingredient formulation, ensuring optimal nutrient retention during complex fermentation processes, and reducing operational waste through demand forecasting. There is also significant anticipation concerning AI's role in fraud detection, particularly verifying the authenticity and source traceability of high-value botanical extracts, a critical concern given the premium positioning of these functional beverages. These themes underscore a collective expectation that AI will enhance both the sophistication of product development and the personalization of consumer engagement within this niche market.

- AI-powered ingredient formulation optimization, ensuring synergistic effects between nutritional components.

- Predictive analytics for consumer demand forecasting, reducing inventory holding costs and minimizing waste in perishable ingredients.

- Personalized recommendation engines for DTC platforms, suggesting specific nutrition wine profiles based on health data and purchase history (Precision Nutrition Wine).

- Enhanced supply chain visibility and traceability using machine learning to verify the authenticity and ethical sourcing of botanicals.

- Automated quality control systems (e.g., spectral analysis) during fermentation to monitor microbial activity and nutrient levels in real-time.

- Development of AI-driven flavor profiles tailored to regional palates while preserving the functional efficacy of ingredients.

DRO & Impact Forces Of Nutrition Wine Market

The Nutrition Wine Market growth is principally driven by escalating consumer interest in functional foods, coupled with advanced technological capabilities enabling the stable infusion of sensitive nutraceuticals into wine bases. Restraints primarily involve regulatory hurdles concerning health claims for alcoholic beverages and the high cost of premium, ethically sourced functional ingredients. Opportunities abound in product diversification, including expanding non-alcoholic functional wine options and targeting niche segments such as sports nutrition or elderly health. These factors exert significant influence, necessitating strategic balancing between innovation to capture opportunity and stringent adherence to regulatory boundaries to mitigate restraints, ensuring sustainable market penetration and consumer trust.

Drivers: The dominant driver is the sustained global trend of consumers shifting towards preventative health and wellness routines, actively seeking beverages that contribute positively to their physical and mental state. This includes a growing segment of the population actively reducing conventional alcohol intake and seeking 'better-for-you' alternatives that still offer a sophisticated social consumption experience. Furthermore, scientific validation regarding the efficacy of specific botanicals and adaptogens enhances consumer confidence, pushing demand for products that effectively integrate these proven ingredients. Manufacturers are also capitalizing on the clean label movement, emphasizing natural sourcing and minimal processing, which resonates strongly with the target demographic. Technological advancements in microencapsulation and cold-press extraction techniques are crucial, as they allow delicate vitamins and antioxidants to remain potent and stable within the wine matrix over the product’s shelf life, solving previous formulation challenges.

Restraints: Significant restraints impede accelerated market expansion, most notably the complex and often restrictive regulatory landscape governing the intersection of alcohol and health claims. Marketing functional attributes associated with alcohol consumption is strictly controlled or prohibited in many major jurisdictions, forcing companies to adopt ambiguous or highly cautious promotional strategies. Another major constraint is the significantly higher cost of goods sold (COGS) compared to traditional wine, primarily due to the sourcing of high-purity, standardized nutraceutical extracts and the specialized, often low-volume, production processes required. This elevated price point can restrict mass-market appeal. Moreover, potential consumer skepticism regarding the genuine efficacy of functional benefits combined with the sensory expectations of a premium wine product pose a continuous challenge to brand credibility and sustained acceptance.

Opportunities and Impact Forces: Substantial opportunities lie in the vast, untapped non-alcoholic segment of functional wines, catering to consumers who want the health benefits and sophisticated taste without any alcohol content, vastly expanding the total addressable market (TAM). Geographic expansion into emerging Asian economies, particularly China and India, represents a major avenue for growth, leveraging cultural familiarity with traditional herbal wellness practices. Furthermore, vertical integration and strategic partnerships between specialized nutraceutical suppliers and established wineries can streamline supply chains and lower operational costs. The primary impact force remains the ever-increasing consumer health consciousness, which is acting as a powerful pull factor, forcing the traditional beverage industry to rapidly innovate and adopt functional attributes to remain relevant in a market saturated with competitive functional beverage offerings. The force of regulatory scrutiny acts as a pervasive pressure, shaping product claims and packaging aesthetics. The cumulative impact results in a dynamic, high-growth market requiring continuous scientific rigor and marketing agility.

Segmentation Analysis

The segmentation of the Nutrition Wine Market provides a clear structure for understanding consumption patterns, product types, and distribution channels, enabling targeted marketing and product development strategies. The market is primarily segmented based on the type of functional ingredient (e.g., herbal, fruit-infused, vitamin-fortified), the nature of the beverage (alcoholic and non-alcoholic), the core application or benefit claimed (e.g., immune support, stress relief, general wellness), and the distribution route used to reach the end consumer. Analyzing these segments is essential for identifying the fastest-growing niches, such as non-alcoholic functional options, and optimizing supply chain logistics to meet diverse regional demands efficiently. This granular understanding allows stakeholders to position their premium products effectively within a competitive landscape increasingly prioritizing health and convenience.

- By Type:

- Herbal and Botanical Infused Nutrition Wine

- Fruit-infused and Polyphenol Rich Nutrition Wine

- Vitamin and Mineral Fortified Nutrition Wine

- Adaptogen and Nootropic Enriched Nutrition Wine

- By Nature:

- Alcoholic Nutrition Wine (Low ABV focus)

- Non-Alcoholic Nutrition Wine (Zero-Proof)

- By Application/Claim:

- Immunity Boosting

- Stress and Anxiety Reduction (Relaxation)

- Digestive Health and Gut Support

- General Wellness and Antioxidant Intake

- Sports and Energy Recovery

- By Distribution Channel:

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores)

- Online Retail (E-commerce Platforms, Brand Websites, Subscription Services)

Value Chain Analysis For Nutrition Wine Market

The value chain for the Nutrition Wine Market is characterized by a high degree of specialization, beginning with the meticulous selection of raw materials, moving through specialized production and formulation, and concluding with a multi-channel distribution network designed to manage perishable goods and communicate sophisticated product claims. Upstream analysis focuses intensely on the sourcing of high-quality base wine or fruit juices, along with certified, often organic, functional ingredients such as rare botanicals, standardized herbal extracts, and high-purity vitamins. Ensuring traceability and quality control at this stage is paramount, as the efficacy and premium positioning of the final product depend heavily on the potency and authenticity of these input materials. Strategic partnerships with certified agricultural suppliers are common to secure consistent, high-grade inputs and manage commodity price volatility, especially for specialty ingredients.

The midstream phase involves the specialized production and formulation process, which differentiates nutrition wine from standard alcoholic beverages. This stage includes complex processes such as customized fermentation profiles, precise temperature-controlled infusion of sensitive nutraceuticals (often requiring encapsulation technology to ensure stability), and rigorous laboratory testing to verify both alcohol content and functional ingredient concentration. Direct and indirect distribution channels are both crucial. Direct channels, primarily through e-commerce platforms and brand-owned stores, allow for direct engagement, personalized marketing, and higher profit margins, offering the best environment to educate consumers about complex health claims. Indirect channels involve conventional retail partners—supermarkets, specialty liquor stores, and health food outlets—which provide necessary volume and geographical reach, demanding strong logistical capabilities for chilled transportation and inventory management.

Downstream analysis centers on market access and consumer engagement. Due to the hybrid nature of the product, nutrition wine often navigates regulatory challenges concerning both food safety and alcohol regulations, impacting packaging, labeling, and point-of-sale placement. The ultimate success relies on effective marketing that bridges the gap between the traditional appeal of wine and the scientific credibility of a functional beverage. Strong collaboration across the value chain, from raw material verification to final retail placement, is essential for maintaining product integrity and brand reputation, particularly given the reliance on premium pricing and consumer trust in the claimed nutritional benefits. Efficient supply chain management capable of handling international sourcing and fragmented distribution across both alcohol and health supplement retail ecosystems remains a competitive advantage.

Nutrition Wine Market Potential Customers

Potential customers for the Nutrition Wine Market are primarily defined by their proactive involvement in health and wellness, typically possessing higher-than-average disposable incomes, and a desire for sophisticated, integrated lifestyle products. The largest segment comprises health-conscious millennials and Gen Z consumers (ages 25-45) who are actively seeking ways to moderate their conventional alcohol consumption while maintaining social connectivity and high nutritional standards. These consumers prioritize ingredient transparency, ethical sourcing, and products that offer tangible, scientifically supported benefits, often utilizing technology and social media for information gathering and brand discovery. They represent the early adopters willing to pay a premium for functional novelty and alignment with their self-care routines.

Another significant segment includes affluent middle-aged consumers (ages 45-65) focused on age-related health management, particularly seeking benefits related to cardiovascular health, cognitive function, and immunity enhancement. This demographic is receptive to traditional wine formats infused with recognized beneficial compounds, such as resveratrol and specific vitamins, viewing nutrition wine as an accessible, palatable addition to their existing supplement regimen. They are often influenced by recommendations from dietitians or wellness practitioners and seek established brands with strong credibility and scientific backing, preferring reliability and consistent quality over novelty in formulation.

Beyond these core demographic groups, the market also targets niche groups such as athletes and fitness enthusiasts who require fast recovery and targeted nutritional support, preferring non-alcoholic options that integrate hydration with functional ingredients like electrolytes and amino acids. Furthermore, individuals participating in sober-curious movements or those abstaining from alcohol for medical or personal reasons constitute a rapidly expanding customer base for non-alcoholic functional wine variants. These varied customer profiles require manufacturers to employ diverse marketing strategies, ranging from highly scientific messaging for the health management segment to lifestyle and experiential promotion for the younger, wellness-focused consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Truett-Hurst Inc., The Wine Group, Gallo Family Vineyards, Treasury Wine Estates, Vitis Bio, Drink Botanicals Ireland, Botanic Lab, Functional Grapes Co., Wellness Vintners, Adaptogen Drinks Inc., Nootropic Wines Ltd., Fermented Health Co., The Wellness Cellar, Vinters Select, Pure Sip Beverages, Enhanced Vintages, Health & Harmony Wines, Bio-Ferm Solutions, Nutri-Vin Inc., Global Functional Drinks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nutrition Wine Market Key Technology Landscape

The technological landscape underpinning the Nutrition Wine Market is highly focused on overcoming solubility, stability, and bioavailability challenges associated with integrating functional ingredients into a wine matrix. One of the most critical technologies is microencapsulation, which involves coating sensitive compounds like vitamins, polyphenols, and certain herbal extracts in a protective matrix (often lipids or polymers). This shielding process prevents degradation caused by light, oxidation, or interaction with alcohol and acids during storage, ensuring that the functional component remains potent until consumption. Advanced microencapsulation also assists in taste masking, mitigating the often bitter or medicinal notes associated with high concentrations of certain botanical ingredients, thereby improving the overall palatability and consumer acceptance of the product.

Another pivotal technological area involves specialized cold-press extraction and low-temperature processing techniques. Unlike traditional winemaking, which might utilize processes that degrade heat-sensitive nutrients, modern nutrition wine production employs methods like vacuum distillation for de-alcoholization (for non-alcoholic versions) or cold filtration to preserve the integrity of heat-labile vitamins and natural enzymes. Furthermore, High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are indispensable analytical technologies utilized for rigorous quality control. These analytical tools ensure precise measurement of functional ingredient dosages, verify the absence of contaminants, and confirm the stability of the active components throughout the product's shelf life, thereby supporting the veracity of the health claims made on the packaging and meeting stringent regulatory standards.

Fermentation technology is also rapidly evolving within this sector. Novel fermentation methodologies, often involving targeted yeast strains or symbiotic cultures, are being developed to naturally enhance the production of beneficial compounds, such as certain B vitamins or specific antioxidants, directly within the wine base. Biotechnology innovations focus on genetic modification or selective breeding of grape varieties themselves to boost inherent polyphenol content, offering a natural advantage before external fortification occurs. Data analytics and sensor technology are increasingly integrated into production lines for real-time monitoring of microbial and chemical processes, allowing for immediate adjustments to optimize nutrient retention and consistency. This commitment to sophisticated, data-driven manufacturing processes is a key differentiator for industry leaders seeking to scale production without sacrificing the premium quality or functional efficacy that defines the nutrition wine category.

Regional Highlights

- North America: North America, particularly the United States and Canada, holds the dominant market share in the Nutrition Wine sector, characterized by a highly engaged consumer base focused on personalized nutrition and self-care. The region benefits from strong purchasing power and a mature functional food and beverage industry, facilitating rapid innovation and market entry for new, premium products. The high demand is driven by the 'sober curious' movement and a significant shift away from traditional, high-ABV beverages. Marketing strategies are sophisticated, often relying on influencer endorsements and transparent scientific substantiation. California, with its established viticulture infrastructure and proximity to biotech hubs, serves as a major innovation center for functional wine development.

- Europe: Europe represents a strong and expanding market, primarily fueled by countries like Germany, the UK, and France, where there is a deep cultural heritage surrounding wine consumption alongside a growing emphasis on natural and organic wellness products. Regulatory challenges concerning advertising health claims on alcoholic beverages pose a significant constraint, pushing innovation heavily toward the non-alcoholic and low-ABV segments. The EU's robust standards for organic labeling and ingredient sourcing resonate strongly with nutrition wine producers, positioning sustainability and natural purity as major selling points across the continent. Eastern Europe is gradually adopting these trends as disposable incomes rise and access to global wellness information increases.

- Asia Pacific (APAC): The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is attributable to increasing urbanization, rising middle-class disposable incomes, and the cultural integration of traditional medicinal herbs (e.g., ginseng, goji berries) with modern beverage formats. Countries like China, Japan, and Australia are key contributors. In China, there is strong demand for products perceived to offer 'yin-yang balance' or specific health benefits rooted in Traditional Chinese Medicine (TCM), creating a fertile ground for market localization. Australia, benefiting from robust wine production and high health awareness, acts as an important R&D hub for functional ingredients and clean-label production.

- Latin America: The Latin American market remains nascent but shows substantial potential, driven by rising health awareness and exposure to global wellness trends, particularly in Brazil and Mexico. Economic volatility and lower consumer discretionary spending in some areas present market penetration challenges, necessitating more localized and potentially lower-priced formulations compared to North America. The focus here is often on incorporating native fruits and botanicals known for their antioxidant properties, leveraging local supply chains and traditional knowledge to create culturally relevant functional wine products.

- Middle East and Africa (MEA): The MEA region presents a highly unique landscape due to strict religious and cultural regulations regarding alcohol consumption. Consequently, the market growth in this region is almost exclusively concentrated in the non-alcoholic or zero-proof nutrition wine segment. Key growth areas are the UAE and Saudi Arabia, where high disposable incomes support premium functional beverage consumption. The demand is primarily centered around sophisticated non-alcoholic substitutes for luxury consumption occasions, emphasizing high-quality ingredients and advanced production technology to deliver a superior sensory experience without alcohol.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nutrition Wine Market.- Truett-Hurst Inc.

- The Wine Group

- Gallo Family Vineyards

- Treasury Wine Estates

- Vitis Bio

- Drink Botanicals Ireland

- Botanic Lab

- Functional Grapes Co.

- Wellness Vintners

- Adaptogen Drinks Inc.

- Nootropic Wines Ltd.

- Fermented Health Co.

- The Wellness Cellar

- Vinters Select

- Pure Sip Beverages

- Enhanced Vintages

- Health & Harmony Wines

- Bio-Ferm Solutions

- Nutri-Vin Inc.

- Global Functional Drinks

Frequently Asked Questions

Analyze common user questions about the Nutrition Wine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines Nutrition Wine and how is it regulated?

Nutrition Wine is a beverage, typically wine-based, that is infused with specific functional ingredients such as botanicals, vitamins, or adaptogens to provide targeted health benefits beyond standard consumption. Regulation is complex, sitting at the intersection of alcohol beverage laws (governing ABV, taxes, and distribution) and food supplement regulations (governing health claims and ingredient standardization). Due to restrictions, manufacturers often focus on low-ABV or non-alcoholic formats to minimize regulatory friction concerning explicit health claims.

Are non-alcoholic nutrition wines expected to dominate the market?

Yes, non-alcoholic (zero-proof) nutrition wines are projected to be the fastest-growing segment. This dominance is driven by the global 'sober curious' movement, increased consumer demand for sophisticated non-alcoholic alternatives in social settings, and the reduced regulatory burden on health claims when alcohol is absent. Non-alcoholic versions allow companies to market functional benefits more transparently and reach broader consumer bases, including those in alcohol-restricted regions.

What are the primary functional ingredients used in these wines?

The primary ingredients fall into several categories: adaptogens (like Ashwagandha, Reishi mushrooms) for stress relief, polyphenols and antioxidants (like Resveratrol, grape seed extract) for cardiovascular health, and specific vitamins (B-complex, D) for general wellness and immune support. Herbal extracts focusing on gut health (prebiotics, certain fibers) and cognitive function (nootropics) are also increasingly popular, with manufacturers prioritizing clinically supported, highly bioavailable forms of these compounds.

How does technological innovation impact the stability of nutritional compounds?

Technological innovation, particularly microencapsulation and advanced cold processing, is critical for maintaining the stability and efficacy of nutritional compounds. These technologies protect heat-sensitive vitamins and oxidation-prone botanicals from degradation during fermentation, bottling, and shelf storage. This ensures the product delivers the advertised functional dose to the consumer, validating the premium pricing and supporting sustained consumer trust in product integrity.

Which distribution channels are most effective for premium nutrition wine products?

Online retail, including direct-to-consumer (DTC) websites and specialized e-commerce platforms, is highly effective for premium nutrition wine. Online channels facilitate detailed storytelling and scientific communication regarding ingredients and claims, which is essential for these complex products. However, specialty health food stores and high-end liquor outlets also play a crucial role in providing immediate access and tactile experience, supporting both targeted sampling and broad market exposure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager