Nutritional and Dietary Supplements Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434293 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nutritional and Dietary Supplements Market Size

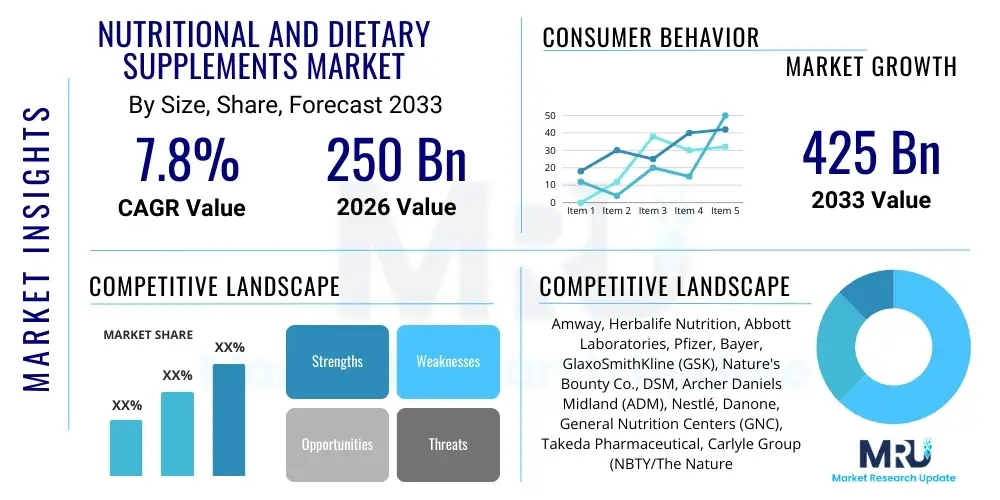

The Nutritional and Dietary Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 250 Billion in 2026 and is projected to reach USD 425 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global consumer awareness regarding preventive healthcare and the growing accessibility of personalized nutritional products through e-commerce and specialized retail channels.

Nutritional and Dietary Supplements Market introduction

The Nutritional and Dietary Supplements Market encompasses a vast array of products designed to augment the standard diet, providing essential nutrients, vitamins, minerals, botanicals, amino acids, or other substances that may be lacking in typical food intake. These products, ranging from single-nutrient tablets to complex functional blends, are generally consumed orally in forms such as capsules, powders, gummies, or liquids. The primary product goal is to support general health and well-being, manage specific physiological conditions, or enhance physical performance, positioning these supplements as a crucial component of modern self-care practices.

Major applications of these supplements span several critical health domains, including immune support, digestive health (driven by probiotics and prebiotics), cardiovascular wellness (omega-3 fatty acids), bone and joint health (calcium and glucosamine), and specialized sports nutrition focusing on muscle recovery and energy enhancement. The underlying benefits are preventative in nature, aiming to reduce the risk of chronic diseases, compensate for dietary deficiencies stemming from modern processed food consumption, and support optimal cognitive and physical function throughout various life stages. As regulatory environments mature, particularly in regions like North America and Europe, consumer confidence in product safety and efficacy continues to rise, contributing to market stability.

The principal driving factors accelerating market growth include the demographic shift toward an aging global population requiring specialized nutritional support, the escalating prevalence of lifestyle diseases necessitating dietary intervention, and the profound influence of digital media and wellness influencers promoting self-directed health management. Furthermore, advancements in scientific research that substantiate the health claims of specific ingredients, coupled with technological progress in nutrient delivery systems (e.g., liposomal encapsulation), are ensuring greater product efficacy and consumer satisfaction, solid further market penetration globally.

Nutritional and Dietary Supplements Market Executive Summary

The market is characterized by dynamic business trends centered on vertical integration, where supplement manufacturers are increasingly controlling raw material sourcing and distribution to ensure product purity and transparency—a key consumer demand. A major shift is observed toward ‘clean label’ and plant-based ingredients, pushing traditional synthetic manufacturers to reformulate their offerings. Furthermore, high-profile mergers and acquisitions (M&A) are consolidating the market, allowing larger entities to leverage comprehensive product portfolios and extend their geographical reach, particularly into fast-growing Asian markets, while simultaneously investing heavily in digital marketing strategies tailored for direct-to-consumer (DTC) engagement.

Regionally, North America maintains its dominance due to high consumer spending on health and wellness, established regulatory frameworks, and robust penetration of sports nutrition segments. However, the Asia Pacific (APAC) region is projected to register the highest growth rates, driven by surging middle-class disposable incomes, rapid urbanization, and an increasing adoption of Westernized self-care routines, particularly in populous nations like China and India. European growth is steady, focusing heavily on specialized ingredients and regulated health claims, while Latin America and the Middle East and Africa (MEA) represent emerging opportunities, contingent upon improvements in cold chain logistics and consumer education.

In terms of segmentation, the most prominent trends include the explosive growth of the personalized nutrition segment, utilizing genetic and microbiome data to create hyper-targeted supplements, and the rising popularity of non-pill formats, such as gummies and functional beverages, which enhance user compliance and appeal to a broader demographic, including children and adolescents. Condition-specific segments, particularly those targeting sleep health, cognitive function, and stress management, are experiencing accelerated demand, reflecting the contemporary lifestyle challenges faced by the global workforce.

AI Impact Analysis on Nutritional and Dietary Supplements Market

Analysis of common user questions related to the integration of Artificial Intelligence (AI) in the nutritional supplements domain reveals three primary thematic areas: the authenticity and safety of personalized dosage recommendations, the ability of AI to verify complex health claims across vast research datasets, and the potential for AI-driven automation to enhance supply chain transparency and combat counterfeit products. Users frequently express concerns about whether AI algorithms can adequately account for individual metabolic variability and drug interactions when recommending supplements. Key expectations center on AI optimizing research and development (R&D) processes, streamlining clinical trial analysis, and enabling hyper-customization of formulations based on real-time biological data (e.g., wearable tech inputs), thereby moving the market toward truly predictive wellness solutions.

AI's influence is transforming the entire product lifecycle, from initial ingredient discovery to post-purchase consumer engagement. In R&D, machine learning accelerates the identification of novel bioactive compounds and helps predict their efficacy and toxicity profiles, significantly reducing the time and cost associated with product development. Furthermore, AI-powered predictive analytics are optimizing inventory management and forecasting demand seasonality, minimizing waste, and ensuring fresher product availability. This integration is crucial for maintaining competitive advantage in a market increasingly defined by speed and customization capabilities.

- AI-Driven Personalized Nutrition: Algorithms analyze user genetic data, lifestyle factors, and blood biomarkers to formulate highly customized supplement stacks.

- Enhanced Ingredient Discovery: Machine learning models screen vast biochemical databases to identify novel ingredients and potential synergistic combinations.

- Supply Chain Optimization: AI predicts demand fluctuations, optimizes logistics routes, and uses blockchain integration for enhanced ingredient traceability and anti-counterfeiting measures.

- Improved Clinical Trial Efficiency: AI assists in patient stratification, data analysis, and identifying statistically significant outcomes in efficacy studies.

- Automated Customer Service: Chatbots and virtual assistants provide personalized dosage advice and answer product queries 24/7, improving consumer engagement.

DRO & Impact Forces Of Nutritional and Dietary Supplements Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic decision-making. The primary driving force remains the fundamental shift in global consumer behavior toward proactive and preventative health management, augmented by rapid digitalization that provides accessible health information and direct-to-consumer sales channels. Coupled with this is the rising awareness among athletes and fitness enthusiasts regarding the critical role of specialized supplements in performance enhancement and recovery, generating sustained demand for protein, amino acids, and specialized energy boosters. However, these forces are constantly being challenged by significant restraints.

The most persistent restraint is the rigorous and often inconsistent regulatory landscape across different regions. The classification of supplements varies, leading to challenges in international trade and marketing, particularly concerning permissible health claims and ingredient safety substantiation. Furthermore, the market faces skepticism regarding product efficacy and purity, fueled by high-profile instances of mislabeling or contamination, necessitating substantial investment in transparent sourcing and third-party testing protocols to regain and maintain consumer trust. This creates a high barrier to entry for smaller firms seeking to establish credibility.

Opportunities abound, specifically within niche and high-value segments such as cognitive health (nootropics), specialized geriatric nutrition, and customized functional foods integrated with supplements. Technological advancements, particularly in genomics and microbiomics, offer opportunities to develop novel, scientifically validated products. The impact forces acting on the market—competitive intensity, consumer bargaining power, and the threat of substitutes (e.g., fortified foods)—are high. Competitive pressure stems from both large pharmaceutical companies entering the space and smaller, agile e-commerce brands utilizing sophisticated digital outreach. This environment mandates continuous innovation in delivery formats and scientific backing to sustain growth.

Segmentation Analysis

The Nutritional and Dietary Supplements Market is meticulously segmented across various dimensions including ingredient type, product form, application, end-user, and distribution channel, providing a granular view of consumer preferences and market focus areas. This segmentation helps manufacturers tailor their product offerings to specific demographic needs and regulatory requirements. The inherent complexity of nutrient classification leads to sub-segments within vitamins (B, C, D, E), minerals (calcium, magnesium, zinc), and botanicals (herbal extracts, medicinal mushrooms), each exhibiting unique growth trajectories influenced by current health trends and clinical evidence.

Segmentation by product form highlights a significant shift away from traditional tablets and capsules toward more palatable and convenient formats. Gummies are witnessing exceptional growth, particularly among younger consumers and those seeking an easier way to incorporate supplements into their daily routines. Simultaneously, liquid supplements, effervescent tablets, and functional beverage mixes are gaining traction due to perceived higher bioavailability and ease of consumption. Application-based segmentation underscores the dominance of the general health and wellness category, although the fastest growth is observed in immunity, digestive health (probiotics being a key driver), and the burgeoning segment of stress and sleep management supplements.

- Ingredient Type:

- Vitamins (Multivitamins, Vitamin D, Vitamin C, B-Complex)

- Minerals (Calcium, Iron, Magnesium, Zinc)

- Proteins & Amino Acids (Whey Protein, BCAAs, Collagen)

- Botanicals/Herbal Supplements (Ginseng, Turmeric, Echinacea, CBD)

- Probiotics and Prebiotics

- Fatty Acids (Omega-3, Omega-6)

- Other Specialty Supplements (Enzymes, CoQ10)

- Product Form:

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gummies and Chewables

- Application:

- General Health and Wellness

- Sports Nutrition

- Immunity

- Bone and Joint Health

- Cardiovascular Health

- Cognitive Health

- Digestive Health

- End-User:

- Infants and Children

- Adults (18-65)

- Geriatric Population (65+)

- Distribution Channel:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail (E-commerce)

- Direct Selling

Value Chain Analysis For Nutritional and Dietary Supplements Market

The value chain for nutritional and dietary supplements begins with complex upstream activities focused heavily on the sourcing and processing of raw materials. This includes the cultivation or wild harvesting of botanical sources, the fermentation or synthesis of vitamins and amino acids, and the extraction of specialized compounds like fish oil (omega-3). Critical challenges in the upstream sector involve ensuring sustainable sourcing, verifying ingredient purity, and managing price volatility linked to agricultural commodities. Manufacturers often engage in vertical integration here to secure high-quality, traceable raw materials, which is a major differentiator in this trust-based market.

The midstream focuses on manufacturing and formulation, encompassing blending, encapsulation, compression, and packaging. Good Manufacturing Practices (GMP) compliance is paramount at this stage, dictating facility hygiene, process control, and quality assurance testing. Formulation science is increasingly sophisticated, focusing on achieving optimal bioavailability and stability, often involving partnerships with specialized technology firms. Downstream activities involve warehousing, logistics, and distribution, moving the finished products to various points of sale, including brick-and-mortar retailers and vast e-commerce fulfillment centers.

The distribution channel landscape is bifurcated into direct and indirect routes. Direct distribution involves manufacturers selling straight to consumers (DTC) via their own websites, subscriptions, or specialized direct sales networks, offering higher margins and greater control over the brand message. Indirect channels, which remain the market's backbone, include sales through large pharmacy chains, hypermarkets, specialized health food stores, and third-party online marketplaces (like Amazon or dedicated supplement platforms). E-commerce has significantly compressed the value chain, enabling smaller brands to achieve global reach without extensive physical retail investment, thereby increasing competitive intensity across all market tiers.

Nutritional and Dietary Supplements Market Potential Customers

Potential customers for the Nutritional and Dietary Supplements Market are highly diverse, spanning all age groups and socioeconomic backgrounds, but can be broadly categorized based on their primary health goals. The largest customer segment consists of general wellness consumers—typically middle-aged adults who are proactive about preventative health, seeking multivitamins, immune boosters, and basic mineral supplements to maintain energy and vitality in busy professional lives. These buyers often prioritize convenience and are highly receptive to subscription models and transparent product labeling, favoring brands that align with general practitioner recommendations or credible third-party certifications.

A second major customer cohort comprises the geriatric population (65 years and older), who are primary buyers of condition-specific supplements targeting age-related issues such as bone density loss (calcium, Vitamin D), cardiovascular health (CoQ10, Omega-3s), and cognitive decline. This group often requires specialized, high-dose formulations and relies heavily on recommendations from healthcare professionals and trusted retail pharmacists. Their purchasing behavior is generally less price-sensitive than younger groups, placing a premium on product efficacy and established brand reputation within the medical community.

The third critical segment is performance and lifestyle-driven buyers, predominantly athletes, fitness enthusiasts, and younger adults focused on body composition and energy levels. These end-users drive demand for highly specialized products like whey protein isolates, branched-chain amino acids (BCAAs), creatine, and pre-workout formulas. They are highly educated about ingredients, often use supplements in cyclical protocols, and are extremely influenced by social media, fitness trainers, and peer recommendations, making the online retail channel essential for engaging this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Billion |

| Market Forecast in 2033 | USD 425 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amway, Herbalife Nutrition, Abbott Laboratories, Pfizer, Bayer, GlaxoSmithKline (GSK), Nature's Bounty Co., DSM, Archer Daniels Midland (ADM), Nestlé, Danone, General Nutrition Centers (GNC), Takeda Pharmaceutical, Carlyle Group (NBTY/The Nature's Bounty Co.), Bionova, H&H Group, Pharmavite, Blackmores, NOW Foods, USANA Health Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nutritional and Dietary Supplements Market Key Technology Landscape

The nutritional and dietary supplements market is undergoing significant technological disruption, primarily focused on improving ingredient efficacy, stability, and personalized delivery. The key technological advancement driving innovation is personalized testing platforms, utilizing genomics, metabolomics, and gut microbiome sequencing to provide highly individualized nutritional reports. These reports inform the creation of bespoke supplement formulations, moving the industry away from a one-size-fits-all approach. Companies are heavily investing in proprietary algorithms and AI models that translate complex biological data into actionable consumer recommendations, a crucial step for maintaining relevance in the modern wellness economy.

Furthermore, major breakthroughs are occurring in delivery systems and encapsulation technologies aimed at enhancing the bioavailability and shelf stability of sensitive ingredients. Microencapsulation and liposomal delivery systems are increasingly utilized to protect unstable compounds like certain vitamins, probiotics, and omega-3 fatty acids from degradation by stomach acid or oxidation, ensuring higher absorption rates in the small intestine. This technological refinement allows manufacturers to deliver nutrients more effectively, justifying premium pricing and improving clinical outcomes, particularly for high-value ingredients.

Another crucial area of technological advancement involves manufacturing processes and supply chain transparency. Advanced processing techniques, such as supercritical fluid extraction (SFE) used for botanical extracts, yield purer and more potent active ingredients. Simultaneously, the integration of blockchain technology is gaining momentum. Blockchain provides an immutable digital ledger to track ingredients from their source (farm or lab) through manufacturing and distribution to the consumer, addressing persistent consumer concerns regarding product authenticity and ensuring compliance with stringent regulatory requirements across international borders.

Regional Highlights

- North America: This region holds the largest market share, characterized by high consumer awareness, disposable income allocated to preventative health, and well-established distribution networks. The US market is particularly mature in sports nutrition, weight management, and specialty supplements (e.g., joint health, sleep aids). Regulatory bodies like the FDA significantly influence product development, emphasizing strict labeling and claim substantiation, maintaining consumer confidence.

- Europe: Europe is a highly regulated market where the European Food Safety Authority (EFSA) sets stringent rules on health claims, leading manufacturers to focus heavily on scientific validation. Key growth drivers include demand for botanicals, mood and stress supplements, and high adoption rates of probiotics, particularly in Western European nations like Germany and the UK. Emphasis is placed on organic and natural sourcing.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid urbanization, increased internet penetration leading to greater health awareness, and the burgeoning middle class in China and India. Traditional medicine integration, coupled with Western supplement consumption (vitamins, immunity boosters), creates a hybrid market. Japan and South Korea lead in advanced cosmetic and anti-aging supplement consumption.

- Latin America (LATAM): Growth is accelerating, though hampered by economic volatility and complex trade regulations. Brazil and Mexico are the largest markets, focusing primarily on protein supplements for fitness and general vitamins/minerals. The market is developing, with increased investment in local production capabilities and enhanced cold chain logistics.

- Middle East and Africa (MEA): This is an emerging market with potential, particularly in the UAE and Saudi Arabia due to high per capita spending on wellness. The region shows strong demand for immunity products, sports nutrition (driven by a young population), and specialized Halal-certified products. Market growth is closely tied to infrastructure development and improving consumer education levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nutritional and Dietary Supplements Market.- Amway

- Herbalife Nutrition

- Abbott Laboratories

- Bayer AG

- GlaxoSmithKline (GSK)

- The Nature's Bounty Co. (acquired by Nestlé)

- DSM Nutritional Products

- Archer Daniels Midland (ADM)

- Nestlé S.A.

- Danone S.A.

- General Nutrition Centers (GNC Holdings)

- Takeda Pharmaceutical Company Limited

- Church & Dwight Co., Inc. (Vitafusion)

- Pharmavite LLC

- Blackmores Ltd.

- NOW Foods

- USANA Health Sciences, Inc.

- Doppelherz (Queisser Pharma)

- International Flavors & Fragrances (IFF)

- Nutraceutical International Corporation

Frequently Asked Questions

Analyze common user questions about the Nutritional and Dietary Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the major growth in the Nutritional and Dietary Supplements Market?

The market growth is primarily driven by three factors: the increasing global emphasis on preventative healthcare and self-care, the expansion of the geriatric population requiring specialized nutrient support, and rapid advancements in e-commerce and digital personalized nutrition platforms that enhance product accessibility and customization.

Which segment of the supplements market is expected to exhibit the highest CAGR through 2033?

The personalized nutrition segment, which includes customized vitamins and supplements formulated based on individual genetic or microbiome analysis, is projected to register the highest Compound Annual Growth Rate due to high consumer interest in tailored wellness solutions and technological integration (AI and testing kits).

What are the primary restraints impacting the market?

The primary restraints include the highly complex and disparate global regulatory standards regarding health claims and ingredient safety, alongside persistent consumer skepticism regarding the efficacy and purity of products following reported cases of mislabeling or contamination.

How is technology, specifically AI, changing the production and supply chain?

AI is optimizing the supply chain by predicting demand accurately, thereby reducing waste and improving inventory management. Furthermore, AI and blockchain technology are being implemented to enhance ingredient traceability from source to consumer, ensuring transparency and combating counterfeit products.

Why is the Asia Pacific region becoming a significant growth hub for supplements?

APAC's rapid growth is attributed to rising disposable incomes among the middle class, growing urbanization leading to increased lifestyle diseases, and a shift towards Western health trends, combined with strong demand for immunity and general wellness products in populous nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager