NVOCC Aggregator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435920 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

NVOCC Aggregator Market Size

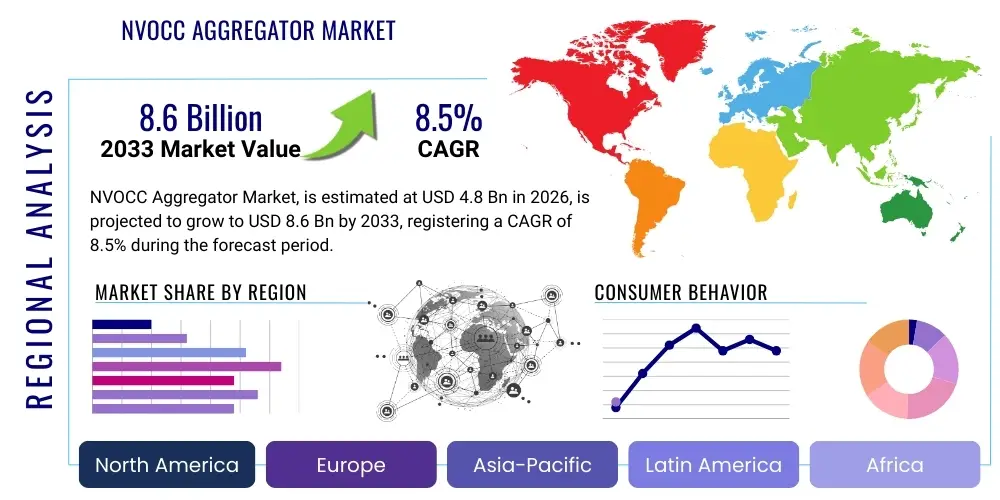

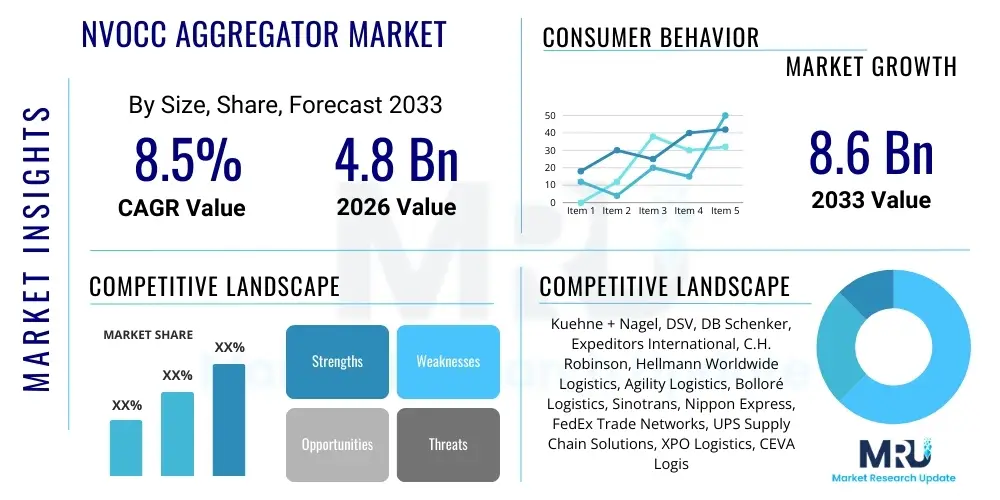

The NVOCC Aggregator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

NVOCC Aggregator Market introduction

The NVOCC Aggregator Market encompasses specialized logistics platforms and services that consolidate cargo bookings from multiple Non-Vessel Operating Common Carriers (NVOCCs) and smaller freight forwarders to secure more favorable rates and dedicated space from primary ocean carriers (Vessel Operating Common Carriers, or VOCCs). This market functions as a vital intermediary, streamlining the complex processes of container shipping, documentation, and compliance for businesses that lack the volume or negotiating leverage to deal directly with major shipping lines. The primary objective of aggregation is efficiency and cost optimization, allowing small to medium-sized enterprises (SMEs) and independent forwarders access to competitive global supply chain solutions, thereby democratizing access to international container shipping services, which is crucial in fragmented and volatile global trade environments. The complexity of international trade, coupled with the need for reliable capacity in unpredictable market cycles, positions aggregators as essential partners in managing maritime logistics.

Product offerings within the NVOCC aggregator space typically include comprehensive rate management tools, integrated digital booking platforms, standardized documentation services, and risk management solutions like cargo insurance and tracking. Major applications span across various industries, including retail, manufacturing, e-commerce, and fast-moving consumer goods (FMCG), particularly for cross-border logistics requiring Full Container Load (FCL) or Less than Container Load (LCL) services. These aggregation services are increasingly utilizing advanced digital tools to improve visibility and predictability, reducing the administrative burden on shippers and enabling faster decision-making in time-sensitive supply chains. The standardization of processes provided by aggregators minimizes errors, accelerates customs clearance, and enhances overall shipment reliability, making their platforms invaluable for companies managing high-volume, global shipments across diverse regulatory environments.

The market's expansion is fundamentally driven by the rising complexity of global supply chains, the persistent demand for cost-effective logistics solutions, and the accelerating digitization of the freight industry. The benefits are significant: enhanced capacity utilization, optimized route planning, reduced operational costs for small players, and simplified access to global trade lanes. Furthermore, the volatility in global freight rates, particularly post-pandemic and due to geopolitical tensions, has heightened the need for flexible, aggregated services that can secure stable pricing and guaranteed capacity. This inherent instability forces smaller logistics players to rely heavily on aggregators to maintain business continuity, positioning NVOCC aggregators as essential components for maintaining resilience and competitiveness in international trade flows.

NVOCC Aggregator Market Executive Summary

The NVOCC Aggregator Market is characterized by robust growth, primarily driven by the proliferation of digital logistics platforms and the sustained shift toward outsourcing complex supply chain operations. Key business trends indicate a consolidation among larger aggregators seeking economies of scale, alongside significant investment in technology aimed at enhancing rate transparency, real-time shipment visibility, and predictive capacity forecasting. The market is witnessing increasing competition not only from established logistics giants that are formalizing their aggregation arms but also from tech-focused startups offering disruptive, AI-driven aggregation models. Furthermore, geopolitical shifts and trade route fluctuations necessitate agile, multi-carrier strategies, which aggregators are uniquely positioned to provide, cementing their role as critical shock absorbers in volatile trading environments by securing diversified capacity pools.

Regionally, Asia Pacific (APAC) remains the dominant force, propelled by its status as the global manufacturing hub and the massive volume of container traffic originating from countries like China, India, and Vietnam. The high level of export activity mandates sophisticated aggregation services to manage capacity demands. However, North America and Europe are showing accelerated adoption rates, driven by stringent regulatory compliance needs and the high concentration of technologically mature freight forwarders demanding sophisticated digital integration tools, particularly for integrated multimodal solutions (ocean, rail, truck). Emerging economies in Latin America and the Middle East and Africa (MEA) are also exhibiting high growth potential as international trade infrastructure develops, creating new opportunities for aggregators to streamline previously disjointed local logistics networks and simplify customs procedures.

Segment trends reveal that the 'More than 5000 TEUs' capacity segment holds a significant market share, reflecting the operational scale required to negotiate substantial volume contracts with VOCCs, thereby offering the best cost efficiencies to large forwarders. Conversely, the smaller capacity segments (Less than 1000 TEUs) are experiencing faster penetration rates, largely due to the influx of e-commerce businesses and SMEs leveraging aggregation platforms for their initial steps into international shipping. In terms of application, independent freight forwarders constitute the core customer base, relying on aggregators to bolster their service portfolios without the massive capital investment required for direct carrier negotiations. The demand for Value-Added Services, such as integrated customs brokerage and supply chain financing, is also rapidly growing across all segments, pushing aggregators to evolve beyond mere capacity provision into holistic logistics solution providers.

AI Impact Analysis on NVOCC Aggregator Market

User queries regarding AI's influence in the NVOCC Aggregator market predominantly revolve around three key areas: optimizing pricing and capacity procurement, automating documentation and compliance (customs declarations, bills of lading), and enhancing predictive analytics for supply chain risk management. Users are specifically concerned about whether AI can truly democratize access to prime shipping capacity, ensuring small forwarders receive fair treatment compared to multinational corporations. Expectations center on AI's ability to provide dynamic, real-time rate comparisons that factor in complex variables like historical capacity utilization, fluctuating bunker fuel costs, and specific port congestion data, moving beyond static contract pricing models. Furthermore, there is a strong interest in AI-driven tools that can identify and recommend optimal routing strategies instantly, significantly reducing transit times, fuel consumption, and unexpected delays by modeling complex network flows.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is fundamentally transforming the core operations of NVOCC aggregators, shifting the business model from manual negotiation to automated, data-driven capacity acquisition. AI algorithms are now deployed to analyze vast datasets encompassing global trade patterns, carrier performance records, geopolitical events, and current equipment availability to predict future capacity shortages and price fluctuations with remarkable accuracy. This predictive capability allows aggregators to strategically purchase or block space from VOCCs far more effectively than traditional methods, ensuring that their clients benefit from stable, competitive rates even during peak seasons or unforeseen market disruptions. This strategic advantage is central to maximizing profitability, minimizing risk exposure for clients, and maintaining superior service level agreements (SLAs).

Moreover, AI is instrumental in significantly streamlining the extremely document-heavy nature of international shipping. Automated document processing, powered by Natural Language Processing (NLP) and Optical Character Recognition (OCR), extracts critical data from invoices, packing lists, and manifests, automatically generating accurate Bills of Lading and ensuring compliance with varied international regulations and customs requirements. This automation drastically reduces the human error factor, accelerating customs clearance processes and enhancing the overall efficiency of the supply chain. Ultimately, AI enables aggregators to offer superior service levels at highly competitive prices, consolidating their competitive position against direct carrier booking systems by offering efficiency that the legacy systems cannot match, while simultaneously providing robust data security measures.

- AI enables dynamic, predictive pricing models for optimized capacity purchasing and long-term contract negotiation.

- Machine Learning algorithms forecast global trade demand, carrier performance risk, and equipment imbalances across key ports.

- Natural Language Processing (NLP) automates documentation, reducing error rates in Bills of Lading, manifests, and customs filings.

- AI-driven route optimization minimizes transit times and identifies potential congestion points and alternative intermodal routes in real-time.

- Enhanced demand sensing allows aggregators to secure favorable long-term contracts based on predicted volume stability and regional growth.

- Automated compliance checks ensure adherence to diverse international customs regulations, trade sanctions, and port-specific mandates.

- Personalized dashboard analytics, generated by ML models, provide customers with real-time insights into supply chain vulnerabilities and performance metrics, aiding proactive decision-making.

- AI assists in fraud detection by cross-referencing shipping data with historical risk profiles and suspicious activity indicators.

DRO & Impact Forces Of NVOCC Aggregator Market

The NVOCC Aggregator Market is influenced by a dynamic interplay of factors collectively known as Drivers, Restraints, and Opportunities (DRO). Key drivers include the exponential growth in global trade volumes, particularly driven by e-commerce penetration and expanding cross-border supply chains, demanding flexible and scalable shipping solutions. Furthermore, the persistent fragmentation of the global freight forwarding industry creates a crucial need for aggregation services that consolidate smaller volumes to achieve better pricing and reliable capacity. The universal drive among shippers for supply chain resilience following recent global disruptions also significantly fuels demand for multi-carrier, aggregated options which minimize reliance on a single VOCC contract.

Restraints primarily involve the high upfront capital expenditure required for developing and maintaining sophisticated digital platforms, including AI integration and robust cybersecurity measures. Additionally, the inherent cyclical volatility of global shipping rates, heavily influenced by oil prices, economic slowdowns, and fluctuating capacity (due to new vessel deliveries), complicates long-term financial planning and pricing strategies for aggregators. Furthermore, regulatory hurdles, complex international trade compliance mandates (e.g., changes in customs filing requirements, environmental regulations like IMO 2020), and the requirement for deep regional expertise pose continuous operational challenges, forcing aggregators to invest heavily in specialized legal and compliance teams.

Opportunities are abundant, particularly in integrating blockchain technology to enhance the transparency and security of transactions and documentation, providing a robust, immutable record for all parties involved, thus speeding up trade finance. Significant potential also lies in expanding specialized aggregation services for niche markets, such as refrigerated cargo (reefer containers), liquid bulk, or hazardous materials, which require highly specific expertise and tailored logistics solutions. The strategic development of digital marketplaces that facilitate instantaneous capacity matching between carriers, aggregators, and shippers represents a major avenue for innovation and market penetration. Impact forces, such as the ongoing digitalization wave (the shift from traditional manual processes to cloud-based booking and tracking systems), increasing pressure from environmental, social, and governance (ESG) mandates driving demand for sustainable shipping options, and the structural threat posed by VOCCs developing direct booking platforms, significantly shape market strategy and dictate the need for continuous service differentiation.

Segmentation Analysis

The NVOCC Aggregator market segmentation provides a comprehensive view of operational dynamics based on container handling capacity and end-user type, allowing stakeholders to target specific niches effectively. Capacity segmentation reflects the scale of aggregation, directly correlating with the negotiating leverage aggregators hold with primary ocean carriers. Smaller capacity aggregation focuses on maximizing utilization for Less than Container Load (LCL) shippers, handling the complexity of consolidation and deconsolidation. In contrast, larger capacity aggregation deals primarily with securing FCL contracts for high-volume customers, often requiring bespoke contracts and integrated inland logistics planning. This dual operational structure is essential for serving the entire shipping ecosystem.

The segmentation by TEU capacity (Twenty-foot Equivalent Unit) is critical for understanding market maturity and competitiveness. High-volume aggregation (More than 5000 TEUs) typically characterizes established market players that have achieved significant network effects and global coverage, often serving major import/export corridors like Asia-Europe and Transpacific routes. This segment benefits most from economies of scale. Conversely, the growth of the Less than 1000 TEUs segment is indicative of the rising tide of smaller, digitally native businesses entering international trade, relying heavily on the aggregator model due to its low barrier to entry, simplified logistics framework, and superior LCL management capabilities. This trend underscores the role of aggregators in fostering global SME trade.

End-user analysis highlights the market’s primary beneficiaries and their distinct requirements. While independent freight forwarders constitute the largest and most frequent users, utilizing aggregators to backfill capacity and secure competitive rates on unfamiliar routes, Small and Medium-sized Enterprises (SMEs) are the fastest-growing customer base. SMEs view aggregators as essential partners, mitigating the operational complexities and financial risks associated with international shipping that they cannot manage internally, particularly in documentation and customs filing. Large enterprises, while often dealing directly with carriers, utilize aggregators for overflow capacity during peak seasons or for specialized, complex routes where securing space quickly and reliably is paramount, emphasizing the value of aggregated capacity as a supply chain contingency plan.

- By TEU Capacity:

- Less than 1000 TEUs

- 1000-5000 TEUs

- More than 5000 TEUs

- By Application:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Independent Freight Forwarders

- By Service Type:

- FCL (Full Container Load) Aggregation

- LCL (Less than Container Load) Consolidation

- Value-Added Services (Customs Brokerage, Insurance, Trade Finance, Warehousing)

- By Geographical Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For NVOCC Aggregator Market

The Value Chain of the NVOCC Aggregator Market begins with upstream activities focused on securing primary ocean capacity. This involves aggregators negotiating large-volume contracts and preferential pricing agreements directly with Vessel Operating Common Carriers (VOCCs) such as Maersk, CMA CGM, and COSCO. This upstream relationship dictates the foundation of the aggregator’s offering—competitive rates, guaranteed space, and preferential allocation during capacity crunches. Effective upstream management requires sophisticated capacity forecasting and rate benchmarking tools, often leveraging AI, to ensure maximum profitability and service stability, particularly in turbulent market conditions where spot rates fluctuate wildly. The primary value addition at this stage is the consolidation of fragmented demand into high-leverage volumes that VOCCs prioritize.

Midstream activities involve the core aggregation and digital platform management, which are the primary areas of competitive differentiation. This stage encompasses booking management, sophisticated documentation handling (generating and processing Bills of Lading, manifest declarations, export/import permits), customs brokerage coordination, and integrated real-time cargo tracking. Aggregators must maintain highly scalable and secure digital systems (often cloud-based TMS platforms) to manage thousands of simultaneous bookings across multiple carriers and routes. The distribution channel is predominantly indirect, utilizing user-friendly web-based portals and Application Programming Interfaces (APIs) to connect instantaneously with independent freight forwarders and direct shippers globally. However, for key global accounts, larger aggregators maintain direct sales teams, introducing a direct element to tailor complex multi-modal and financial solutions.

Downstream activities focus on the final delivery and maximizing customer experience. This includes coordinating integrated landside logistics (drayage, trucking, rail connections), managing warehousing, distribution, and fulfillment services, and providing integrated invoicing, dispute resolution, and trade finance solutions. The primary end-users—freight forwarders, SMEs, and large enterprises—benefit from the aggregator's ability to offer a single point of contact for complex international moves. Direct interaction often centers on real-time visibility updates, exception management (e.g., delays, port omissions), and personalized logistics consultation, distinguishing superior service leaders from basic platform providers. The efficiency of the downstream operations, particularly last-mile delivery coordination, directly impacts customer satisfaction, repeat business, and overall retention rates in a highly competitive sector.

NVOCC Aggregator Market Potential Customers

Potential customers for NVOCC aggregators span a wide spectrum of international trade participants, with the core market comprising independent and regional freight forwarders who lack the purchasing power to negotiate directly with major global ocean lines. These freight forwarders rely heavily on aggregators to secure highly competitive FCL and LCL rates, enabling them to compete effectively against multinational logistics providers while maintaining healthy margins. For these professional buyers, the efficiency, speed, and reliability of capacity procurement across diverse trade lanes are the primary purchasing criteria, making aggregators indispensable partners for network expansion and operational scalability across geographically diverse markets.

The secondary, yet rapidly expanding, customer segment includes Small and Medium-sized Enterprises (SMEs) engaged in cross-border e-commerce and manufacturing. These businesses typically ship lower volumes and require straightforward, user-friendly booking processes and comprehensive support for complex tasks like customs documentation, cargo insurance, and compliance, services which aggregators typically package efficiently into digital self-service solutions. SMEs value simplicity, cost transparency, and the minimized administrative burden provided by aggregator platforms over the complex, contract-based systems of VOCCs. The digital platforms offered by NVOCC aggregators fulfill this requirement perfectly, providing a low-friction, high-support entry point into international logistics, thus democratizing global trade access for smaller players and supporting their global expansion strategies.

Finally, large multinational corporations (MNCs) and integrated logistics providers represent strategic, high-value customers, although they use aggregators differently. While MNCs may have established carrier contracts, they often utilize aggregators during periods of acute peak demand (e.g., Q3/Q4 holiday season buildup) when their contracted capacity is fully utilized, or for shipping to highly specialized, low-frequency ports or complex intermodal routes where their primary carriers lack competitive coverage or pricing. For these customers, aggregators act as a reliable, flexible backup capacity source, mitigating supply chain disruptions and ensuring continuity of goods movement during critical periods, thus emphasizing the aggregator's crucial role in bolstering overall supply chain resilience and mitigating spot market risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuehne + Nagel, DSV, DB Schenker, Expeditors International, C.H. Robinson, Hellmann Worldwide Logistics, Agility Logistics, Bolloré Logistics, Sinotrans, Nippon Express, FedEx Trade Networks, UPS Supply Chain Solutions, XPO Logistics, CEVA Logistics, GEODIS, J.B. Hunt Transport Services, Worldwide Logistics Group, Hapag-Lloyd (via digital platforms), Maersk (via Twill), A.P. Møller – Mærsk. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

NVOCC Aggregator Market Key Technology Landscape

The technological evolution of the NVOCC Aggregator market is centered on enhancing digital connectivity, data processing speed, and platform scalability to manage global complexity. Cloud computing infrastructure forms the foundational layer, allowing aggregators to manage massive fluctuating booking volumes and integrate seamlessly with hundreds of carrier and customs systems globally without extensive local hardware investments. This reliance on the cloud enables real-time data access for tracking, reporting, and predictive analysis, which is crucial for meeting customer expectations for instant visibility into their cargo location and status. The development of robust, secure APIs (Application Programming Interfaces) is paramount, facilitating automated data exchange between the aggregator's platform and the operating systems of VOCCs, terminal operators, and third-party logistics partners, thus significantly reducing manual input errors and speeding up the overall documentation and booking workflow.

Furthermore, the rapid adoption of specialized software solutions, including high-performance Transportation Management Systems (TMS) and dedicated Rate Management Engines (RME), is redefining competitive differentiation. RMEs leverage advanced algorithms, often incorporating machine learning, to instantly search, compare, and lock in the most advantageous rates across multiple carrier contracts, a core function of the aggregation model. These systems move beyond simple rate comparison, integrating factors like historical vessel reliability scores, dynamically changing transit time variations, and real-time fuel and congestion surcharges (BAFs/CAFs) to provide a true, total landed cost-of-shipping analysis. The increasing utilization of predictive analytics helps in proactively identifying choke points in the supply chain, such as port congestion or adverse weather events, allowing aggregators to suggest alternative routing options before delays materialize, thereby minimizing service disruptions.

Looking ahead, emerging technologies such as Blockchain are being pilot-tested to revolutionize documentation management. Distributed Ledger Technology (DLT) offers an immutable, secure record for Bills of Lading and commercial invoices, drastically improving security, reducing fraud risks, and accelerating complex trade finance processes by providing transparent and instantly verifiable transaction histories. Simultaneously, the focus remains heavily on optimizing user experience, with market leaders investing in highly intuitive, mobile-optimized digital portals that cater to the on-the-go needs of modern freight forwarders and shippers. The convergence of AI for decision support, cloud for scalability, and DLT for security is setting the standard for the next generation of NVOCC aggregation platforms, demanding continuous, proactive investment in cyber resilience and data privacy protection to safeguard sensitive international trade data.

Regional Highlights

- Asia Pacific (APAC): Dominant market share fueled by manufacturing output (China, Vietnam, India) and high export volume. Characterized by aggressive digital adoption among local NVOCCs and aggregators to manage the massive, complex flow of container traffic along high-frequency trade lanes. Infrastructure development and regulatory simplification efforts in key exporting nations are further catalyzing demand for efficient aggregation platforms, cementing APAC's role as the global volume leader in this market.

- North America: High demand for integrated, transparent logistics solutions, particularly those offering sophisticated visibility and multi-modal integration (ocean to rail/truck). Growth is strongly driven by the high concentration of advanced logistics providers and large retailers requiring resilient supply chains to manage significant import volumes. Stringent regulatory environments necessitate aggregators offering superior compliance documentation support and robust security protocols.

- Europe: Highly mature market focused on complex intra-European and transatlantic trade flows. There is a strong preference for platforms offering multimodal solutions (short sea shipping, road, rail) and increasingly, demanding aggregators integrate verifiable sustainable shipping options (ESG metrics). The market is fragmented but technologically sophisticated, driving consolidation and integration efforts among key players seeking efficiency gains through shared capacity.

- Latin America (LATAM): Exhibits high growth potential driven by trade liberalization and improved port infrastructure, especially in Brazil and Mexico. Aggregators are essential for streamlining complex and often inconsistent customs procedures and local distribution challenges. The demand is concentrated around efficient capacity management for commodities and manufactured goods trading with APAC and North America, necessitating high flexibility and regional expertise.

- Middle East & Africa (MEA): Emerging market leveraging strategic location near major shipping lanes (Suez Canal) and driven by regional economic diversification (e.g., Saudi Arabia, UAE). Growth is fueled by increasing demand for reliable energy and commodity logistics services, alongside developing consumer markets. Aggregators are crucial for connecting fragmented African local logistics markets into global networks and for providing stability amidst regional geopolitical tensions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the NVOCC Aggregator Market.- Kuehne + Nagel

- DSV

- DB Schenker

- Expeditors International

- C.H. Robinson

- Hellmann Worldwide Logistics

- Agility Logistics

- Bolloré Logistics

- Sinotrans

- Nippon Express

- FedEx Trade Networks

- UPS Supply Chain Solutions

- XPO Logistics

- CEVA Logistics

- GEODIS

- J.B. Hunt Transport Services

- Worldwide Logistics Group

- Hapag-Lloyd (via digital platforms)

- Maersk (via Twill)

- A.P. Møller – Mærsk

Frequently Asked Questions

Analyze common user questions about the NVOCC Aggregator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role and competitive advantage of an NVOCC Aggregator?

The primary role of an NVOCC Aggregator is to consolidate the booking demands of multiple smaller shippers and independent freight forwarders to achieve critical mass. This allows them to secure highly competitive rates and guaranteed capacity directly from Vessel Operating Common Carriers (VOCCs). The competitive advantage lies in providing simplified access, price transparency, multi-carrier options, and operational flexibility, particularly for small to medium-sized cargo volumes that cannot negotiate directly with major ocean lines.

How does AI technology specifically benefit NVOCC aggregation platforms?

AI technology enhances aggregation platforms primarily through predictive analytics for rate forecasting, allowing aggregators to lock in optimal capacity strategically before market price spikes. AI also automates complex, multi-variable processes like global route optimization, documentation generation (using NLP), and customs compliance checks, drastically reducing operational costs, minimizing human error, and improving overall shipment reliability for customers.

Which geographical region leads the NVOCC Aggregator Market growth and why?

The Asia Pacific (APAC) region leads the market growth due to its unparalleled volume of international container traffic, stemming from major manufacturing and export economies like China, India, and Vietnam. The sheer scale of exports necessitates efficient consolidation and aggregation services to manage high capacity demands, driving both technological investment and market size in the region, particularly for LCL services.

What are the main restraints hindering the growth of the NVOCC Aggregator Market?

Key restraints include the extreme volatility and unpredictability of global ocean freight rates, which complicates accurate long-term pricing and risk management for aggregators. Additionally, the requirement for substantial, continuous investment in advanced IT infrastructure, cybersecurity, and deep integration capabilities to interface with diverse carrier and port systems poses a significant financial barrier to entry and market expansion.

How are SMEs benefiting from the services provided by NVOCC Aggregators?

SMEs benefit significantly by gaining access to reliable global shipping capacity and streamlined services that were previously available only to large enterprises. Aggregators offer low-friction, digital booking processes, simplified documentation, and affordable Less than Container Load (LCL) options, essentially democratizing global logistics and mitigating the high administrative burden and financial risk associated with complex international trade for smaller businesses.

What is the expected Compound Annual Growth Rate (CAGR) for the forecast period (2026–2033)?

The NVOCC Aggregator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven by ongoing digitalization, the structural need for consolidation in the fragmented logistics sector, and the increasing demand for reliable, cost-effective capacity procurement solutions in volatile supply chains.

Does the emergence of direct carrier digital portals pose a threat to NVOCC Aggregators?

While direct carrier portals (like Maersk's or Hapag-Lloyd's) pose a competitive challenge, they generally do not eliminate the need for aggregators. Aggregators retain critical value by offering essential multi-carrier options, ensuring capacity flexibility across numerous routes, providing specialized LCL consolidation services, and integrating crucial landside logistics, services that typically transcend a single carrier's platform.

What role does blockchain play in future NVOCC aggregation services?

Blockchain (Distributed Ledger Technology) is poised to enhance the transparency and security of NVOCC aggregation by creating immutable records for crucial documents such as Bills of Lading and commercial invoices. This drastically speeds up documentation verification, reduces the risk of fraud, and streamlines the complex, high-risk trade finance aspect of international shipping, improving trust across the entire ecosystem.

What is the difference between FCL and LCL aggregation services?

FCL (Full Container Load) aggregation focuses on securing entire containers at optimized rates for high-volume shippers, leveraging bulk purchasing power. LCL (Less than Container Load) aggregation, or consolidation, involves grouping smaller shipments from multiple customers into one container, making international shipping accessible and cost-effective for micro-volumes that cannot fill a whole container, requiring specialized consolidation and deconsolidation management.

Which end-user segment utilizes NVOCC aggregators most frequently?

Independent and regional Freight Forwarders are the most frequent users of NVOCC aggregators. They rely on these platforms to fill capacity gaps, access better pricing on trade lanes where they lack direct carrier relationships, and quickly secure guaranteed space to maintain competitive service quality and network reach for their own diverse client base.

What is the significance of API integration for aggregators?

API (Application Programming Interface) integration is significant because it enables real-time, automated communication and secure data exchange between the aggregator's platform and those of ocean carriers, ports, customs systems, and customer ERPs. This critical automation eliminates manual data entry, minimizes errors, and ensures instant, accurate tracking and documentation updates, accelerating the entire logistics cycle.

What is the projected market size for the NVOCC Aggregator Market by 2033?

The NVOCC Aggregator Market is projected to reach a substantial market value of USD 8.6 Billion by the end of the forecast period in 2033, reflecting the continuous, structural reliance of the global trade system on outsourced and digitally managed shipping capacity aggregation services.

What market trend indicates a consolidation among aggregators?

A key business trend is the increasing occurrence of mergers and acquisitions among mid-sized NVOCC aggregators, often followed by their integration into large global logistics groups. This consolidation is driven by the necessity to achieve greater economies of scale, broaden global geographical coverage, and gain technological capabilities (AI, DLT) to maintain a superior competitive edge.

How do NVOCC aggregators contribute to the efficiency of the supply chain?

NVOCC aggregators enhance efficiency by maximizing container utilization (especially LCL), optimizing routing through algorithmic analysis, accelerating documentation processing via automation, and providing consolidated, single-platform tracking and predictive reporting, effectively simplifying the complex logistics interface between a vast number of small shippers and a concentrated number of ocean carriers.

What security concerns must NVOCC Aggregators address regarding technology?

NVOCC aggregators must prioritize robust cybersecurity measures to protect sensitive trade data, including commercial invoices, proprietary rate information, and customer payment details, from breaches. High-level security protocols, data encryption, and regular vulnerability testing are mandatory, particularly with the increased reliance on cloud services and numerous third-party API integrations across the global supply chain network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager