Nylon 46 Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433660 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nylon 46 Market Size

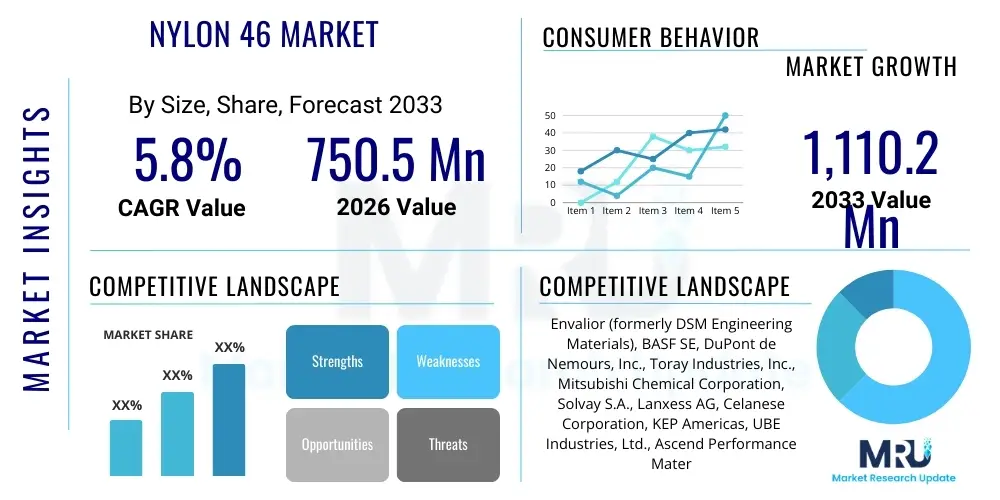

The Nylon 46 Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750.5 Million in 2026 and is projected to reach $1,110.2 Million by the end of the forecast period in 2033.

Nylon 46 Market introduction

Nylon 46 (Polyamide 46 or PA46) is a high-performance engineering thermoplastic distinguished by its superior mechanical strength, excellent heat resistance, and high crystallization rate, making it suitable for demanding applications where standard polyamides often fail. Produced primarily through the polycondensation of 1,4-diaminobutane and adipic acid, PA46 exhibits a higher melting point (around 295°C) and superior continuous use temperature compared to Nylon 6 and Nylon 66, enabling its deployment in high-heat environments typical of automotive engine compartments and sophisticated electrical components. This robust thermal stability and chemical resistance position Nylon 46 as a critical material for miniaturization and weight reduction efforts across various industries.

The major applications driving the market expansion include thermal management components in the automotive sector, such as cooling systems, sensors, and structural parts exposed to engine heat. In the Electrical & Electronics (E&E) industry, PA46 is favored for connectors, switches, and circuit breakers due to its excellent dielectric properties and high flow rate, which facilitates complex molding operations. Furthermore, the material's fatigue resistance and stiffness make it indispensable for industrial equipment like gears, bearings, and hydraulic components, ensuring longevity and performance under rigorous operational stresses. These inherent material benefits, coupled with stringent industry requirements for higher heat deflection temperatures (HDT) and better dimensional stability, are fundamentally driving the demand trajectory for Nylon 46 globally.

Key benefits that propel Nylon 46 adoption are its outstanding balance of stiffness and toughness, exceptional wear and friction behavior, and resistance to harsh chemicals, including oils, fuels, and coolants. The market growth is principally driven by the global shift towards electric vehicles (EVs) and hybrid vehicles, which require lightweight, thermally stable materials for battery housings and power electronics. Additionally, the increasing demand for high-density, miniature electronic devices necessitates materials with high flow characteristics and thermal robustness, directly aligning with the unique properties offered by Nylon 46, thereby establishing it as a material of choice in high-specification manufacturing sectors.

Nylon 46 Market Executive Summary

The Nylon 46 market is poised for steady expansion, fueled by robust business trends emphasizing material lightweighting, thermal performance enhancement, and component miniaturization across key end-use sectors, particularly automotive and electronics. The shift towards Sustainable Mobility and Industry 4.0 initiatives necessitates high-performance polymers capable of replacing metals in critical applications, directly benefiting PA46 manufacturers. However, market dynamics are often constrained by the higher cost of the specialty polymer relative to commodity nylons (PA6, PA66) and the complexity of securing consistent raw material supply. Strategic collaborations among compounders, raw material suppliers, and end-users are becoming paramount to optimize cost structures and accelerate product development cycles, ensuring PA46 maintains its competitive edge in demanding thermal environments.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, driven by massive investments in domestic automotive manufacturing, particularly in China and India, and the unparalleled expansion of the consumer electronics and industrial machinery production base across Southeast Asia. North America and Europe, while demonstrating slower volume growth, focus heavily on high-value, specialized PA46 applications, such as sophisticated electrical insulators and precision industrial components, driven by stringent regulatory frameworks concerning safety and efficiency. These mature markets prioritize innovation in reinforced and specialty grades of Nylon 46, demanding superior filler technologies and flame-retardant characteristics tailored for advanced power management systems.

In terms of segments, the Automotive application segment maintains the largest market share, predominantly due to the pervasive use of PA46 in under-the-hood components where operating temperatures consistently exceed 200°C. Within the product grade segmentation, reinforced grades (often incorporating glass fiber or carbon fiber) are expected to exhibit the highest CAGR, reflecting the industry's need for enhanced structural integrity, dimensional stability, and stiffness at elevated temperatures. The segmentation trends underline a clear preference for customized, high-specification PA46 formulations that can address specific engineering challenges, reinforcing the notion that the Nylon 46 market is highly specialized and performance-driven rather than commodity-oriented.

AI Impact Analysis on Nylon 46 Market

Analysis of common user questions regarding AI's impact on the Nylon 46 market reveals central themes surrounding process optimization, predictive failure analysis, and R&D acceleration. Users are primarily concerned with how AI can mitigate manufacturing variability, enhance quality control in complex compounding processes, and expedite the discovery of novel PA46 formulations with superior mechanical properties or reduced production costs. There is significant anticipation that AI-driven simulations and machine learning algorithms will revolutionize material design, allowing manufacturers to predict polymer behavior under extreme conditions (high heat, mechanical stress) with unprecedented accuracy, minimizing expensive physical trials. Key expectations include AI improving supply chain efficiency by forecasting raw material needs (especially 1,4-diaminobutane availability) and optimizing injection molding parameters to reduce waste and cycle times in high-volume production of intricate components.

- AI optimizes polymerization process parameters, enhancing yield and consistency of Nylon 46 production.

- Machine learning algorithms accelerate the discovery and testing of new PA46 composite formulations, particularly reinforced grades.

- Predictive maintenance programs utilizing AI reduce downtime in compounding and molding operations for Nylon 46 end-users.

- AI-driven supply chain management improves forecasting for specialized raw materials, stabilizing costs and availability.

- Generative design tools leverage AI to create lightweight and complex Nylon 46 component geometries for automotive applications.

DRO & Impact Forces Of Nylon 46 Market

The Nylon 46 market is strongly driven by the persistent demand for high-performance materials in thermal management and miniaturization trends, especially within the rapidly evolving automotive electrification landscape. Nylon 46’s ability to withstand higher continuous operating temperatures compared to competitors like PA66 makes it an indispensable component in critical under-the-hood applications, driving fundamental demand. Conversely, the market faces significant restraints primarily associated with the high cost of production and specialized raw material precursors (specifically tetramethylenediamine), which leads to a premium pricing structure compared to commodity nylons. Furthermore, performance competition from ultra-high-performance polymers, such as Polyetheretherketone (PEEK) and Polyphenylene Sulfide (PPS) in extreme temperature niches, limits PA46's penetration in the most demanding applications.

Opportunities for market expansion are centered on developing bio-based or recycled Nylon 46 grades to align with global sustainability mandates and attract environmentally conscious industries. Additionally, targeting non-traditional industrial segments, such as aerospace interiors and high-end consumer electronics (e.g., thermal elements in fast chargers or specialized computing devices), represents significant untapped potential. Innovation in nanotechnology and additive manufacturing (3D printing) compatibility for PA46 also offers routes to open up new, highly specialized markets demanding customized material properties and complex geometric freedom. Successful market players are those who can achieve backward integration into raw material production or secure long-term supply agreements to mitigate volatility.

The impact forces influencing the market trajectory are primarily technological and regulatory. Technological advancements in compounding techniques, leading to better flow characteristics and mechanical property retention in reinforced grades, serve as a strong positive force. Simultaneously, evolving governmental regulations, particularly the tightening of vehicle emissions standards (which necessitates smaller, hotter engines or electric components) and electrical safety certifications, exert compelling pressure on manufacturers to adopt high-reliability materials like PA46. The balance between maintaining competitive pricing (a restraining force) and delivering superior thermal performance (a driving force) dictates the overall market momentum and competitive intensity within the high-performance polyamide sector.

Segmentation Analysis

The Nylon 46 market is meticulously segmented based on end-use application, grade type, and geographical region, reflecting the specialized nature of its adoption. This segmentation is crucial for understanding specific market dynamics, as the performance requirements and pricing elasticity vary significantly between the automotive sector, demanding exceptional thermal and mechanical robustness, and the electrical and electronics sector, prioritizing dielectric strength and thin-wall moldability. The analysis of these segments reveals that growth is largely concentrated in areas experiencing rapid technological shifts and regulatory pressures, such as the transition to higher voltage systems in electronics and stringent thermal requirements in internal combustion engine (ICE) and hybrid vehicle cooling systems. Moreover, the segmentation by grade type highlights the increasing sophistication of material engineering, with standard grades serving less critical components, while reinforced and specialty grades capture the majority of the high-value, high-growth applications.

- By Application:

- Automotive (Engine Cooling Systems, Oil Sumps, Air Intake Systems, Connectors, Transmission Components)

- Electrical & Electronics (Connectors, Switches, Relays, Circuit Breakers, Terminal Blocks)

- Industrial (Gears, Bearings, Hydraulic Components, Pump Housings)

- Consumer Goods (Small Appliances, Power Tools)

- Others (Aerospace, Medical Devices)

- By Grade:

- Standard Grade (Unfilled PA46)

- Reinforced Grade (Glass Fiber Reinforced, Carbon Fiber Reinforced)

- Specialty Grade (Flame Retardant, Impact Modified, Lubricated)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Nylon 46 Market

The value chain for the Nylon 46 market begins with the procurement of specialized raw materials, primarily 1,4-diaminobutane and adipic acid, which are synthesized from petrochemical feedstocks. This upstream segment is highly concentrated, with only a few specialized chemical producers having the capability to consistently supply high-purity precursors necessary for the polycondensation process. Since the cost and availability of these monomers significantly influence the final polymer price, securing stable, long-term supply agreements is a key competitive differentiator for major Nylon 46 manufacturers. The subsequent stage involves polymerization, where major players, historically led by companies like DSM (now Envalior), synthesize the basic PA46 resin pellets. This stage requires significant capital investment in high-pressure reactors and proprietary process technology, creating substantial barriers to entry.

The midstream segment involves compounding and modification, where basic PA46 resin is mixed with additives, stabilizers, plasticizers, and reinforcing fillers (such as glass fibers or minerals) to create specific, application-ready grades (e.g., highly reinforced, flame-retardant, or impact-modified grades). Compounders, which can be the original polymer producer or independent specialized firms, play a crucial role in tailoring the material properties to meet precise customer specifications, especially for demanding automotive and E&E applications. This tailoring adds significant value, transforming the base polymer into a specialized engineering plastic with required flow characteristics and thermal performance profiles.

The downstream flow involves the distribution channel and the end-user manufacturing process. Distribution is handled through direct sales channels to large Original Equipment Manufacturers (OEMs) and Tier 1 suppliers, particularly in the automotive industry, ensuring technical support and bulk supply. Indirect distribution utilizes regional distributors and specialized polymer traders to reach smaller molders and secondary processors. End-users (e.g., automotive component manufacturers or electronics assemblers) process the compounded PA46 through injection molding, extrusion, or increasingly, 3D printing, to produce final components. The success of Nylon 46 hinges on seamless technical collaboration across the value chain, from raw material supply consistency to optimal component design and processing support for the final customer.

Nylon 46 Market Potential Customers

Potential customers for Nylon 46 are high-specification manufacturing entities that require engineering materials capable of performing reliably under continuous high-heat and high-stress conditions where traditional polyamides (like PA66) would degrade or fail. The primary segment comprises global Automotive Tier 1 and Tier 2 suppliers who manufacture crucial under-the-hood components, including engine covers, cooling system components (radiator end tanks, thermostats), and sensitive electronic sensor housings near the powertrain. These buyers prioritize thermal stability, dimensional accuracy, chemical resistance to automotive fluids, and compliance with strict OEM standards (e.g., VDA, ASTM requirements). The move toward thermal management in electric vehicles (EVs), requiring highly durable materials for battery cooling and power inverter enclosures, is expanding this customer base significantly.

Another major customer group resides in the Electrical and Electronics (E&E) sector, specifically manufacturers of industrial control equipment, high-density connectors, and surface-mount components. Customers in this domain, including major industrial automation and telecommunications equipment providers, seek PA46 for its superior dielectric strength, excellent flow for miniaturized components, and high heat deflection temperature (HDT) necessary for compatibility with lead-free soldering processes. The drive towards component miniaturization and higher operating temperatures in servers and consumer electronics ensures continuous, specialized demand from this segment.

Furthermore, industrial machinery manufacturers represent a robust potential customer base, utilizing PA46 for precision components such as wear pads, high-load gears, and bearings that require exceptional fatigue resistance and low friction coefficients. These buyers value the material’s ability to reduce noise, eliminate lubrication needs in certain applications, and maintain structural integrity over prolonged operational cycles. The increasing sophistication of robotics and automated manufacturing systems globally provides a sustained market for highly durable, low-wear polymeric components made from Nylon 46.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.5 Million |

| Market Forecast in 2033 | $1,110.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Envalior (formerly DSM Engineering Materials), BASF SE, DuPont de Nemours, Inc., Toray Industries, Inc., Mitsubishi Chemical Corporation, Solvay S.A., Lanxess AG, Celanese Corporation, KEP Americas, UBE Industries, Ltd., Ascend Performance Materials, SABIC, Kuraray Co., Ltd., EMS-Grivory, Goodfellow, RTP Company, Polyplastics Co., Ltd., Nilit Ltd., Evonik Industries AG, Daicel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nylon 46 Market Key Technology Landscape

The technological landscape of the Nylon 46 market is primarily defined by advancements in polymerization methods, compounding technologies, and additive integration aimed at enhancing performance characteristics. The fundamental polymerization process, based on the condensation of diaminobutane and adipic acid, requires precise control over temperature and pressure to ensure high molecular weight and consistency, with market leaders continuously refining proprietary reactor designs and catalyst systems to improve yield and reduce energy consumption. A key technological focus is the development of continuous polymerization processes rather than batch operations, which offers significant economic advantages and better material uniformity, directly impacting the quality consistency of the final PA46 resin used in specialized components.

Compounding technology represents another critical area of innovation. To meet the stringent requirements of applications like structural automotive parts, advanced techniques are employed for incorporating high levels of reinforcement, particularly long glass fibers (LGF) or carbon fibers (CF). The challenge lies in ensuring uniform fiber dispersion without causing excessive fiber length degradation during compounding, which is essential for maintaining mechanical strength and fatigue resistance in the final molded part. Technologies like twin-screw extrusion with specialized mixing elements are standard, but the future trend involves reactive extrusion processes that chemically link the PA46 matrix to the fiber surface, substantially improving interface adhesion and overall composite performance, especially at high temperatures.

Furthermore, technology development is heavily geared towards creating specialty grades, including advanced flame retardancy and high thermal conductivity formulations. Non-halogenated flame retardant systems are becoming standard due to environmental and regulatory pressures, requiring complex polymer chemistries to achieve UL94 V-0 ratings without compromising mechanical integrity. In the context of EV batteries and power electronics, the development of thermally conductive PA46 composites, often incorporating ceramic fillers or sophisticated carbon structures, is crucial for efficient heat dissipation. Lastly, the compatibility of PA46 with high-speed injection molding and additive manufacturing (selective laser sintering) is a growing technology trend, enabling the rapid prototyping and production of highly complex, high-performance parts.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Nylon 46, driven predominantly by China and India. This region benefits from explosive growth in the automotive sector, particularly the mass production of EVs and hybrids, requiring superior thermal management materials. The extensive manufacturing base for consumer electronics and industrial machinery across Southeast Asia further cements APAC’s leading position. High investment in infrastructure and the rapid adoption of localized R&D centers focusing on polymer science contribute significantly to regional market maturity and product uptake.

- Europe: Europe is a mature market characterized by stringent regulatory standards, especially related to vehicle emissions and safety (Euro 7 standards). This drives high demand for specialized, high-performance PA46 grades in precision engine components, cooling systems, and specialized industrial tools. Countries such as Germany, Italy, and France are hubs for high-end automotive manufacturing and industrial automation, prioritizing material quality, traceability, and compliance with environmental directives, often utilizing reinforced and specialty flame-retardant PA46 compounds.

- North America: The North American market is distinguished by significant investment in aerospace components and advanced electrical systems, alongside robust automotive production. Demand for Nylon 46 is strong in applications requiring high mechanical stress tolerance and durability, particularly within the US defense and aerospace supply chains, where high-temperature polymers are standard. The market focuses heavily on technological integration, including additive manufacturing using PA46 powders for specialized prototyping and low-volume, high-value components.

- Latin America (LATAM) & Middle East & Africa (MEA): These regions represent emerging markets for Nylon 46. LATAM, led by Brazil and Mexico, shows consistent growth linked to expanding domestic automotive and appliance manufacturing. The MEA region, particularly the UAE and Saudi Arabia, sees rising demand driven by infrastructure projects, oil and gas sector equipment (where chemical resistance is key), and burgeoning local electronics assembly plants, though adoption remains constrained compared to established markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nylon 46 Market.- Envalior (formerly DSM Engineering Materials): A dominant market leader known for its STANYL portfolio, offering a wide range of PA46 grades optimized for high temperature, thin-wall components in automotive and E&E applications.

- BASF SE: A global chemical giant offering high-performance polyamides, focusing on integrated solutions and specialized compounding capabilities for complex engineering challenges, although their primary focus spans various polymers.

- DuPont de Nemours, Inc.: Known for its historical strength in high-performance materials, offering specialty polymers often used in electrical insulation and structural components requiring extreme robustness.

- Toray Industries, Inc.: A major player specializing in advanced composites and performance materials, leveraging its expertise in fiber technology to create superior reinforced Nylon 46 compounds for structural applications.

- Mitsubishi Chemical Corporation: Focuses on delivering functional materials, including specialized PA46 variants tailored for fluid handling and thermal management systems in industrial settings.

- Solvay S.A.: Offers a portfolio of high-performance polyamides, competing in segments requiring exceptional chemical resistance and thermal properties, often targeting aerospace and specialized industrial parts.

- Lanxess AG: A key player in engineering plastics, utilizing its compounding expertise to develop customized, high-flow PA46 grades for intricate injection molded components.

- Celanese Corporation: Provides advanced engineering materials, focusing on material solutions that often involve blending or compounding to achieve specific thermal and electrical properties needed in connectors and switches.

- KEP Americas (Korea Engineering Plastics): Increasing presence in the global polyamide market, supplying high-quality resins used primarily in Asian automotive supply chains.

- UBE Industries, Ltd.: A comprehensive chemical manufacturer providing specialized polymer offerings, including PA46 precursors and resins tailored for high durability and performance requirements.

- Ascend Performance Materials: While largely focused on PA66, they are expanding their specialty polyamide portfolio to capture high-heat opportunities, often through strategic partnerships.

- SABIC: A global diversified chemical company, offering advanced materials used in various industries, with targeted PA solutions for high-temperature automotive applications.

- Kuraray Co., Ltd.: Focused on high-performance materials and polymers, contributing specialized additives and resins that enhance the functional properties of engineering plastics like Nylon 46.

- EMS-Grivory: A prominent manufacturer of high-performance polyamides, offering specific grades designed for light weighting and high dimensional stability under thermal stress.

- Goodfellow: Supplies materials for research, development, and specialized small-volume production, including various forms of Nylon 46 for niche technological applications.

- RTP Company: A custom compounder specializing in coloring and modifying engineering plastics, providing highly tailored PA46 compounds to meet specific customer aesthetic and functional needs.

- Polyplastics Co., Ltd.: Focuses on engineering plastics and advanced material development, serving the Asian automotive and E&E markets with high-quality Nylon 46 products.

- Nilit Ltd.: Primarily known for PA66 and PA6, but expanding into higher performance polyamides for textile and engineering uses.

- Evonik Industries AG: Provides performance additives and specialized materials that enhance the processability and end-use characteristics of PA46 resins.

- Daicel Corporation: Offers chemical products and engineering materials, including components used in the synthesis and compounding of high-performance polyamides.

Frequently Asked Questions

Analyze common user questions about the Nylon 46 market and generate a concise list of summarized FAQs reflecting key topics and concerns.What makes Nylon 46 superior to Nylon 66 (PA66) in high-temperature applications?

Nylon 46 is superior to Nylon 66 primarily due to its highly symmetrical molecular structure, which facilitates higher crystallinity and a significantly elevated melting point (approximately 295°C for PA46 versus 265°C for PA66). This results in a higher Heat Deflection Temperature (HDT) and better retention of mechanical strength under continuous thermal exposure, making PA46 ideal for components operating above 200°C.

Which industry accounts for the largest demand share of Nylon 46?

The Automotive industry accounts for the largest demand share of Nylon 46. Its high thermal resistance and stiffness are essential for critical under-the-hood components such as cooling system parts, air intake manifolds, and sensor housings that must withstand high engine temperatures and aggressive chemical environments (oils, fuels, and coolants).

What are the primary factors restraining the growth of the Nylon 46 market?

The primary restraining factors are the high manufacturing cost of Nylon 46, mainly driven by the expense and limited availability of specialized raw material precursors (like 1,4-diaminobutane). This high base cost makes PA46 less competitive than commodity nylons (PA6, PA66) for applications where thermal requirements are less extreme.

How is Nylon 46 being utilized in the evolving Electric Vehicle (EV) market?

In the EV market, Nylon 46 is crucial for advanced thermal management systems. It is used in battery cooling loops, power inverter housings, and high-voltage connectors because its excellent dielectric properties, combined with thermal stability, ensure safety and performance of critical power electronics exposed to temperature fluctuations and high currents.

What are the key differences between standard and reinforced grades of Nylon 46?

Standard grade Nylon 46 (unfilled) is utilized where flexibility and high flow are prioritized. Reinforced grades incorporate materials, typically glass fibers or carbon fibers, which significantly increase stiffness, tensile strength, and dimensional stability, particularly under high load and elevated temperature conditions, making them essential for structural and load-bearing components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager