Nylon Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436056 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Nylon Membrane Market Size

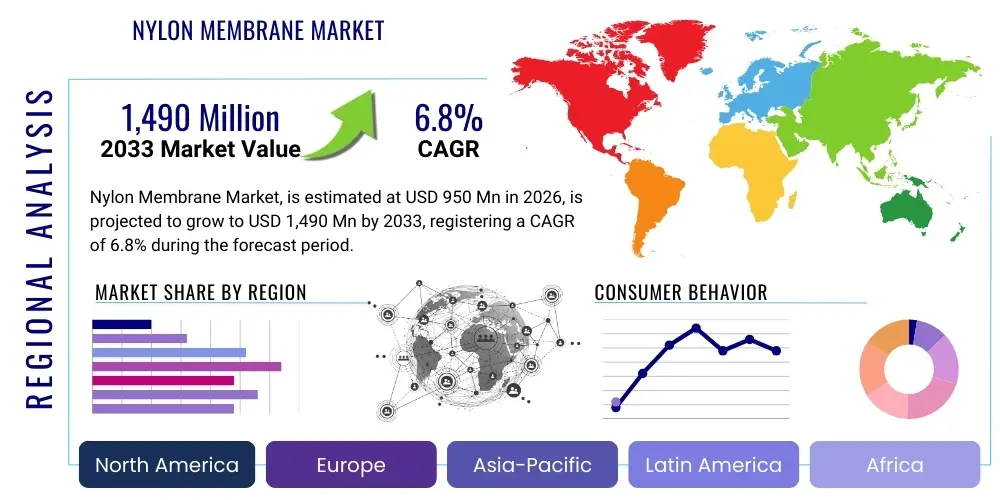

The Nylon Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,490 million by the end of the forecast period in 2033.

Nylon Membrane Market introduction

The Nylon Membrane Market encompasses the production, distribution, and consumption of synthetic membranes manufactured primarily from Nylon 6 and Nylon 6,6 polymers. These membranes are highly valued in critical separation and filtration processes due to their inherent chemical resistance, superior mechanical strength, and ability to be manufactured with controlled, uniform pore size distributions. Nylon membranes are naturally hydrophilic, which is a significant advantage in aqueous sample preparation and filtration, although they can also be surface-modified to exhibit hydrophobic properties for specific applications, such as gas filtration or non-aqueous solvent processing. The versatility and robustness of nylon make these membranes indispensable components in high-throughput laboratory settings and specialized industrial operations, particularly where stringent quality control and high purity standards are paramount.

The primary applications driving the market expansion include sterile filtration in the pharmaceutical and biotechnology sectors, sample preparation for chromatographic analysis (HPLC and UHPLC), and various analytical chemistry procedures, such as particle removal from solvents and buffers. Furthermore, nylon membranes are widely employed in environmental testing for microbial analysis and air monitoring, capitalizing on their high binding capacity for biomolecules and resistance to common solvents. Their operational effectiveness at varied pH levels and elevated temperatures ensures reliable performance across a diverse range of operational parameters. The increasing global focus on water quality, coupled with surging investments in biological research and drug discovery, continuously elevates the demand profile for these advanced polymeric separation tools.

Key driving factors supporting the sustained growth of the Nylon Membrane Market include rapid advancements in membrane fabrication technologies, such as phase inversion and track etching, which allow for greater control over morphology and pore architecture. The benefits associated with nylon membranes, particularly their low extractables profile and excellent flow rates, position them favorably against alternative materials like PTFE or PVDF in many filtration scenarios. Furthermore, the rising incidence of infectious diseases and the subsequent need for rigorous sterilization and purification processes in healthcare and diagnostics further solidify the market's trajectory, emphasizing the role of nylon membranes in maintaining product safety and integrity.

- Product Description: Nylon membranes are synthetic polymer films, typically derived from polyamides (Nylon 6 or Nylon 6,6), characterized by high mechanical strength, thermal stability, and natural hydrophilicity, making them ideal for aqueous filtration and sterilization.

- Major Applications: Sterile filtration in pharmaceuticals, microelectronics fluid purification, sample preparation (HPLC), general laboratory filtration, environmental monitoring, and diagnostics.

- Key Benefits: High binding capacity, chemical resistance to organic solvents and bases, superior mechanical integrity, compatibility with a wide pH range, and high flow rates.

- Driving Factors: Increased regulatory scrutiny in biopharmaceuticals, growing demand for purified water and beverages, technological improvements in membrane manufacturing, and expansion of the analytical testing industry.

Nylon Membrane Market Executive Summary

The global Nylon Membrane Market is experiencing robust growth fueled primarily by the burgeoning pharmaceutical and biotechnology sectors, which rely heavily on these membranes for critical sterile filtration and protein purification steps. North America and Europe currently dominate the market due to established infrastructure, stringent regulatory frameworks, and significant research and development expenditures in life sciences. However, the Asia Pacific region is projected to register the fastest growth rate, driven by expanding manufacturing bases in countries like China and India, increased public and private investments in healthcare facilities, and rising environmental monitoring needs prompted by rapid industrialization. Key business trends include the strategic development of tailored membranes, such as those with modified surface chemistries (e.g., charge-modified nylon) to enhance specific binding characteristics and filtration efficiency for complex biomolecules, leading to premium pricing in specialized niches.

Segment trends highlight the dominance of the absolute pore size membranes segment, especially those in the 0.1 µm to 0.45 µm range, essential for viral clearance and microbiological testing. Furthermore, the market for nylon membranes used in disposable filtration devices, such as syringe filters and filter cartridges, is seeing accelerated adoption due to convenience, reduced contamination risk, and increasing focus on single-use technologies in bioprocessing. Regionally, while mature markets focus on high-value applications like advanced diagnostics and personalized medicine, emerging markets emphasize high-volume applications such as industrial water purification and general laboratory solvent preparation. The market remains competitive, characterized by frequent mergers and acquisitions aimed at consolidating manufacturing expertise and expanding global distribution networks to capitalize on regional growth opportunities.

The critical success factors for manufacturers in this market involve ensuring batch-to-batch consistency and meeting rigorous regulatory standards (e.g., USP Class VI, FDA guidelines). Sustainability trends are also influencing product development, with some manufacturers exploring bio-based or recyclable polyamide sources, although nylon remains predominantly petroleum-derived. Overall, the market outlook is overwhelmingly positive, driven by the fundamental and irreplaceable role nylon membranes play in ensuring product safety and analytical accuracy across diverse, high-growth industrial sectors. Market participants are strategically investing in capacity expansion and product portfolio diversification to capture share in the rapidly evolving diagnostics and therapeutic development landscapes.

- Business Trends: Focus on customization of pore morphology and surface charge, integration into high-throughput screening systems, adoption of automation-compatible membrane formats, and increased R&D collaboration between membrane producers and biopharmaceutical companies.

- Regional Trends: Strong market maturity and high per capita expenditure in North America; rapid infrastructural development and environmental focus accelerating adoption in Asia Pacific; steady, technologically-driven demand in Europe.

- Segments Trends: Accelerated adoption of 0.2 µm membranes for sterile filtration; significant growth in disposable/single-use filter assemblies utilizing nylon membranes; increasing demand from the molecular diagnostics sector.

AI Impact Analysis on Nylon Membrane Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Nylon Membrane Market frequently revolve around optimizing membrane manufacturing processes, predicting membrane lifespan, and integrating smart filtration systems into automated laboratories. Users are keen to understand how AI can enhance the consistency of complex fabrication steps, such such as solvent casting and phase inversion, minimizing batch variability which is critical in regulated industries. A key concern centers on whether AI-driven predictive maintenance could extend the effective service life of large-scale membrane filtration systems, thereby reducing operational downtime and lowering replacement costs. Furthermore, there is significant interest in using machine learning algorithms to analyze vast datasets generated during membrane testing and application, aiming to rapidly identify optimal pore sizes and surface treatments for novel or complex fluid matrices.

The core themes emerging from this analysis indicate high expectations for AI to transform membrane quality control and application efficiency. Specifically, AI is anticipated to drastically improve the precision of quality inspection, moving beyond manual or basic automated visual checks to identifying subtle defects invisible to the human eye, thereby ensuring superior membrane integrity. The integration of AI-powered sensors within filtration modules represents another major theme, enabling real-time monitoring of flux rates, differential pressures, and fouling indicators. This predictive analytics capability allows operators to initiate cleaning cycles or replacements proactively, maximizing system throughput and maintaining product purity levels consistently, which is paramount in pharmaceutical operations where contamination risks are highly regulated.

Ultimately, the influence of AI on the Nylon Membrane Market will manifest primarily through enhanced operational excellence and the creation of highly specialized, application-specific membranes designed through computational chemistry and materials informatics. While AI will not replace the fundamental polymeric material, it will serve as a powerful tool for designing next-generation nylon membranes with superior fouling resistance, optimized surface hydrophilicity/hydrophobicity balance, and tailored molecular binding capabilities. This integration will lead to premium, performance-optimized products, accelerating innovation timelines and maintaining the competitive edge of manufacturers who successfully deploy these advanced analytical technologies in their research and production workflows. This technological shift addresses user expectations for higher efficiency and reliability in filtration and separation technologies.

- AI-driven optimization of polymer casting and solvent evaporation parameters to achieve precise pore size distribution and morphology.

- Predictive modeling using machine learning to forecast membrane fouling rates and schedule proactive cleaning or replacement, enhancing system uptime.

- Automated quality control systems utilizing computer vision and AI algorithms for defect detection, ensuring stringent batch consistency and regulatory compliance.

- Materials Informatics accelerating the discovery and formulation of specialized nylon copolymers or surface modification chemistries for enhanced performance.

- Integration of smart sensors and AI analytics into filtration skids for real-time monitoring and dynamic adjustment of operating conditions (AEO focus: Smart filtration optimization).

DRO & Impact Forces Of Nylon Membrane Market

The Nylon Membrane Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical impact forces steering its evolution. A primary driver is the accelerating expansion of the biopharmaceutical sector, particularly the surge in research and manufacturing of biologics, vaccines, and advanced therapies, all of which require meticulous sterile filtration and purification steps where nylon membranes are crucial. Coupled with this is the continuous global emphasis on regulatory compliance and quality assurance in food, beverage, and water treatment industries, mandating the use of reliable membrane technologies for microbial control and particle removal. However, the market faces significant restraints, chiefly the competitive pressure from advanced alternative membrane materials, such as Polyethersulfone (PES) and Polyvinylidene Fluoride (PVDF), which offer specific advantages in certain chemical environments or processing conditions. Furthermore, the inherent susceptibility of nylon membranes to degradation by strong acids at high temperatures, though manageable, limits their applicability in certain harsh industrial processes, posing a constraint on market penetration in those specific niches.

Opportunities for growth are predominantly centered around innovation in surface modification technologies aimed at improving fouling resistance and enhancing the selectivity of nylon membranes for complex matrices, such as high-viscosity cell culture media or challenging environmental samples. The rapid growth of diagnostic testing, especially point-of-care (POC) diagnostics and lateral flow assays, provides a fertile ground for miniature nylon membrane components due to their superior wicking properties and consistent fluid flow characteristics. The market impact forces suggest a sustained momentum driven by technological necessity; nylon membranes offer a balance of chemical resistance, mechanical strength, and cost-effectiveness that remains attractive. Key impact forces include regulatory changes demanding tighter sterility controls (driving demand) and fluctuations in raw material prices (impacting cost structure and profitability). The pressure to adopt single-use systems in bioprocessing further acts as a major force, favoring disposable nylon filter assemblies and cartridges.

The long-term success of market participants hinges on their ability to capitalize on these opportunities while mitigating restraints through strategic product development. Investment in manufacturing processes that yield ultra-low extractables nylon membranes is essential to meet the stringent purity requirements of the microelectronics and advanced therapeutics industries. Furthermore, developing sustainable manufacturing practices for nylon membranes will become increasingly important as environmental awareness influences procurement decisions globally. These forces ensure that the market remains dynamic, characterized by continuous incremental improvements in pore architecture and membrane functionalization, solidifying the nylon membrane’s role as a staple in high-precision separation applications worldwide.

- Drivers:

- Growing biopharmaceutical R&D expenditure and increased production of biologics and vaccines.

- Stringent regulatory requirements for sterile filtration and microbial testing across healthcare and food industries.

- Inherent hydrophilicity and mechanical robustness making them ideal for aqueous sample preparation.

- Restraints:

- Competition from high-performance alternative polymers (e.g., PTFE, PES, PVDF) offering greater chemical compatibility in niche applications.

- Vulnerability to degradation by concentrated strong acids at elevated temperatures.

- Fluctuations and volatility in the price of polyamide raw materials (Nylon 6, Nylon 6,6 precursors).

- Opportunities:

- Expansion in diagnostic applications, particularly in rapid testing and lateral flow assays requiring specific capillary flow properties.

- Development of charge-modified (positively charged) nylon membranes for enhanced endotoxin and viral particle removal.

- Untapped potential in high-volume industrial fluid purification in emerging economies.

- Impact Forces:

- Regulatory Compliance Force (High): Mandates high-purity, traceable products.

- Technological Innovation Force (Medium to High): Continuous pressure to improve flow rates and reduce protein binding.

- Supply Chain Volatility Force (Medium): Impacts manufacturing costs and delivery lead times.

Segmentation Analysis

The Nylon Membrane Market is comprehensively segmented based on material type, pore size, end-use industry, and application, allowing for a detailed understanding of diverse market dynamics and specialized user requirements. Segmentation by material type predominantly distinguishes between Nylon 6 and Nylon 6,6, each offering subtle variations in thermal stability and chemical resistance crucial for application-specific performance. Pore size remains the most critical functional determinant, dictating the membrane's suitability for microfiltration, ultrafiltration, or general particle removal, with segments ranging from sterile grade (0.2 µm) to macro-pore sizes used in pre-filtration. Analyzing these segments helps manufacturers tailor product lines and distribution strategies to meet the precise technical specifications demanded by various high-purity processing environments, ensuring maximized market penetration across laboratory, medical, and industrial filtration sectors.

- By Material Type:

- Nylon 6 Membranes

- Nylon 6,6 Membranes

- By Pore Size:

- 0.1 µm and Below (Ultrafiltration, Sterilization of ultra-pure water)

- 0.2 µm (Sterile Filtration)

- 0.45 µm (General Microfiltration, HPLC Sample Prep)

- 0.65 µm and Above (Pre-filtration, Particle Removal)

- By Application:

- Sterile Filtration

- Sample Preparation (Chromatography)

- Diagnostics and Immunoassays (Lateral Flow)

- Environmental Monitoring and Analysis

- Fluid Clarification and Particle Removal

- By End-Use Industry:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Food and Beverage Industry

- Hospitals and Diagnostics Laboratories

- Microelectronics and Semiconductor Industry

Value Chain Analysis For Nylon Membrane Market

The value chain for the Nylon Membrane Market begins with the upstream procurement of raw polymeric materials, primarily caprolactam (for Nylon 6) and hexamethylenediamine/adipic acid (for Nylon 6,6), derived from the petrochemical industry. This stage involves complex synthesis processes that determine the initial quality and purity of the polyamide resin. Manufacturers then engage in specialized membrane fabrication, utilizing advanced processes such as solution casting, phase inversion, or stretching techniques to form the thin, porous sheets with precisely controlled pore structures. Quality control at this stage is intensive, focusing on ensuring uniformity, flow rate, and mechanical integrity, as any inconsistency can drastically affect filtration performance in sensitive downstream applications. High costs and technological expertise are concentrated in this midstream manufacturing phase, creating significant barriers to entry for new competitors.

Moving downstream, the fabricated membrane sheets are converted into final product formats, including disc filters, syringe filters, capsule filters, and large-scale filter cartridges, often involving proprietary pleating and housing assembly techniques. The distribution channel is bifurcated: direct sales channels handle customized or large-volume industrial contracts, particularly with major pharmaceutical companies, while indirect channels utilize a network of scientific distributors and specialized laboratory supply houses to reach academic institutions, small biotech firms, and clinical labs. Effective logistics and inventory management are critical here, as many membranes are consumable items requiring consistent, timely replenishment, often under strict quality certifications.

The final consumption stage involves end-users integrating these membranes into complex filtration systems, chromatography workflows, or diagnostic kits. Success in the downstream market is highly dependent on technical support and application expertise provided by the membrane manufacturer or distributor, ensuring optimal product selection and performance troubleshooting. The value addition throughout the chain is substantial, transforming basic petrochemical polymers into high-precision, life-saving tools. The interdependence between raw material suppliers, specialized membrane converters, and application-focused distributors dictates the efficiency and responsiveness of the overall market ecosystem, emphasizing the critical role of material purity and manufacturing precision.

- Upstream Analysis (Raw Materials): Procurement of high-purity polyamide resins (Nylon 6, Nylon 6,6), specialized solvents, and stabilizing agents; high reliance on petrochemical supply chains.

- Midstream Analysis (Manufacturing and Conversion): Specialized polymer extrusion, phase inversion techniques, membrane stretching/calendaring; extensive R&D focus on pore size control and surface modification; high capital expenditure required for sophisticated cleanroom facilities.

- Downstream Analysis (Distribution and Sales):

- Direct Channels: Large-scale OEM supply, biopharmaceutical production contracts, customized large filter system sales.

- Indirect Channels: Global and regional distributors, specialized laboratory suppliers catering to academia and smaller laboratories (AEO focus: Laboratory consumable supply chain).

- End-User Adoption: Integration into chromatography systems, diagnostic devices, and critical industrial fluid purification lines.

Nylon Membrane Market Potential Customers

Potential customers for nylon membranes span a wide array of industries that require high-precision fluid separation, sterilization, and analytical sample preparation. The largest consumer base resides within the pharmaceutical and biotechnology sectors, encompassing major drug manufacturers, contract research organizations (CROs), and companies specializing in biologics development. These entities routinely utilize nylon membranes for processes such as sterile venting, media filtration, buffers preparation, and final product filtration where the naturally hydrophilic, low extractables nature of nylon is highly advantageous. The rigorous validation requirements in this sector necessitate consistent, high-quality membrane performance, making them premium and loyal customers seeking long-term supply agreements and regulatory documentation support.

A second major customer group includes academic research institutions and specialized analytical laboratories. These users rely on nylon membranes, often in the form of small disc filters or syringe filters, for sample preparation preceding highly sensitive analytical techniques like High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), and mass spectrometry. The consistency of nylon membranes ensures that particulate matter that could damage expensive chromatography columns is reliably removed, thereby preserving instrument integrity and data accuracy. This segment is characterized by frequent, smaller-volume purchases, highly influenced by pricing, ease of use, and compatibility with standard laboratory equipment and solvents, which drives demand for pre-packaged, disposable formats.

Furthermore, significant opportunities exist within the diagnostics industry, particularly manufacturers of rapid testing kits, including lateral flow assays, where modified nylon membranes serve as conjugation or sample pads due to their excellent wicking capabilities and ability to bind biomolecules effectively. The microelectronics and semiconductor industries also represent high-value customers, requiring ultra-pure water and chemicals free of sub-micron particles, utilizing nylon membranes in highly specialized, large-scale purification modules. These diverse customer profiles necessitate manufacturers to maintain a broad product portfolio, addressing everything from high-volume industrial clarity filtration to ultra-precise sterile preparation in regulated environments.

- Pharmaceutical and Biotechnology Companies (Sterile process filtration, Biologics manufacturing)

- Contract Manufacturing and Research Organizations (CMOs/CROs)

- Academic and Government Research Laboratories (Analytical sample preparation, Cell culture)

- Diagnostics and Medical Device Manufacturers (Lateral flow tests, IVD components)

- Semiconductor and Microelectronics Fabricators (Ultra-pure chemical and water filtration)

- Food and Beverage Processing Plants (Microbial quality control, Clarification)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,490 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Danaher Corporation (Pall Corporation), Sartorius AG, 3M Company, Advantec MFS, Inc., Membrane Solutions, Inc., GVS S.p.A., Sterlitech Corporation, Cytiva, Thermo Fisher Scientific Inc., Restek Corporation, Cole-Parmer, Meissner Filtration Products, Saint-Gobain, Parker Hannifin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nylon Membrane Market Key Technology Landscape

The technological landscape of the Nylon Membrane Market is defined by sophisticated manufacturing techniques aimed at optimizing pore structure, enhancing material properties, and improving the functional lifespan of the membranes. Phase inversion is the most dominant technology, allowing manufacturers to control the kinetics of polymer precipitation to achieve highly asymmetric or symmetric pore structures necessary for graded filtration efficiency and high flow rates. Variations in solvent and non-solvent composition, coupled with temperature control, dictate the final morphology, enabling the production of membranes specifically designed for high-throughput or critical sterile applications. Advanced material science focuses heavily on enhancing the native hydrophilicity of nylon while minimizing non-specific binding of proteins, crucial for reducing sample loss during purification steps in biotechnology.

A significant area of technological focus involves surface modification technologies, which are employed to introduce specific functionalities onto the neutral nylon base. Techniques such as plasma treatment, grafting polymerization, and chemical coating are used to create positively charged nylon membranes (e.g., charge-modified Nylon 6,6) essential for enhanced retention of negatively charged contaminants, such as endotoxins and viral particles, often surpassing standard size exclusion capabilities. This development addresses the increasing demand for high-selectivity membranes in advanced purification steps within pharmaceutical manufacturing. Furthermore, the push towards integrating these membranes into automated systems requires precision in housing assembly and sealing technologies to prevent bypass and ensure mechanical robustness under pressurized operating conditions.

The competitive edge is increasingly being secured by firms investing in nanofiber technology and electrospinning techniques. While traditional nylon membranes rely on conventional pore creation, electrospun nylon nanofibers offer extremely high surface area-to-volume ratios and ultra-fine filtration capabilities, opening new avenues in air filtration, high-efficiency particulate air (HEPA) filtration precursors, and advanced diagnostics where precise wicking and high loading capacity are required. The key is continuous refinement of these fabrication processes, leveraging sophisticated analytical tools like Scanning Electron Microscopy (SEM) and Porometry to guarantee reproducible pore distribution and structural integrity across large manufacturing batches, which is critical for compliance and performance consistency.

- Phase Inversion and Solvent Casting: Core technology for manufacturing uniform pore structure and controlling membrane thickness and asymmetry.

- Surface Modification (Charge Enhancement): Techniques like chemical grafting or plasma treatment to create charge-modified nylon membranes (e.g., positively charged) for enhanced viral clearance and endotoxin removal.

- Nanofiber Technology: Utilization of electrospinning to produce ultra-fine nylon fibers, leading to membranes with higher filtration efficiency and superior loading capacity for pre-filtration applications.

- Track-Etching Technology (Niche): Though less common for nylon, specialized techniques are used to create highly uniform, cylindrical pores for specific size exclusion demands.

- Automated Assembly and Pleating: Technologies ensuring the precise integration of membrane media into robust, high-integrity filter cartridges and single-use assemblies.

Regional Highlights

The Nylon Membrane Market demonstrates significant regional variation in terms of adoption rates, application focus, and growth drivers, reflecting differing levels of industrial maturity and regulatory environments worldwide. North America, particularly the United States, represents the largest market share holder, attributed to the dominance of the global pharmaceutical and biotechnology industries headquartered in the region. High R&D spending, extensive governmental funding for life science research, and the presence of stringent regulatory bodies (like the FDA) necessitate the consistent use of high-quality, validated nylon membranes for sterile manufacturing and analytical testing, creating a stable and high-value demand base. The focus here is on high-end applications, including personalized medicine and complex biologics purification, driving demand for specialized, low-extractable membranes.

Europe holds a strong second position, propelled by established chemical and analytical sectors, particularly in Germany, France, and the UK. The implementation of EU regulations concerning water quality, food safety, and pharmaceutical manufacturing standards ensures sustained market growth. European manufacturers often lead in the adoption of advanced automation in filtration processes and are heavily focused on developing environmentally sustainable membrane materials and manufacturing processes. The demand profile in Europe is balanced between academic/clinical research and large-scale industrial processing, especially in the fine chemical and high-purity solvent markets, valuing technical specifications and certified product quality.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated expansion is driven by massive infrastructure development in healthcare, increasing government investment in public health, and the rapid expansion of generic drug manufacturing and contract research organizations in countries such as China, India, South Korea, and Japan. While the initial demand in APAC often centers on cost-effective, high-volume applications like industrial water treatment and general laboratory filtration, the burgeoning domestic biopharma industry is rapidly shifting demand towards higher-quality, sterile-grade nylon membranes, similar to those demanded in Western markets. Latin America and the Middle East & Africa (MEA) currently represent smaller but developing markets, where growth is primarily tied to localized water infrastructure projects and modest expansion in domestic medical diagnostics capabilities.

- North America (Market Leader): Dominant share due to robust biopharma industry, high R&D investment, established regulatory framework (FDA), and high adoption of advanced filtration technologies for sterile processing. Focus on high-value, specialized membranes.

- Europe (Mature Growth): Strong demand from the academic sector and established pharmaceutical manufacturing base. Emphasis on regulatory compliance (EMA) and sustainability initiatives in membrane technology.

- Asia Pacific (Fastest Growth): Driven by expanding healthcare infrastructure, generic drug production, increasing environmental monitoring needs, and industrialization in China and India. Shifting towards higher-quality, sterile-grade consumables.

- Latin America & MEA (Emerging Markets): Growth spurred by water purification initiatives, local pharmaceutical manufacturing growth, and increasing access to basic diagnostic services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nylon Membrane Market.- Merck KGaA

- Danaher Corporation (Pall Corporation)

- Sartorius AG

- 3M Company

- Advantec MFS, Inc.

- Membrane Solutions, Inc.

- GVS S.p.A.

- Sterlitech Corporation

- Cytiva

- Thermo Fisher Scientific Inc.

- Restek Corporation

- Cole-Parmer

- Meissner Filtration Products

- Saint-Gobain

- Parker Hannifin Corporation

- Ahlstrom-Munksjö Oyj

- GE Healthcare (now part of Danaher)

- MDI (Membrane Devices Ltd.)

- Whatman (part of GE Healthcare/Cytiva)

- PTI Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Nylon Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of nylon membranes over PVDF or PTFE?

The primary advantage is the inherent natural hydrophilicity of nylon, which allows aqueous solutions to pass through rapidly without the need for pre-wetting with organic solvents, simplifying sample preparation procedures, especially in laboratory settings (AEO focus: Nylon hydrophilicity benefit).

Are nylon membranes suitable for filtration using aggressive organic solvents?

Nylon membranes exhibit excellent resistance to most non-halogenated organic solvents, bases, and alcohols. However, their use is generally avoided with strong concentrated acids, halogenated hydrocarbons, and phenols, which can cause membrane degradation (AEO focus: Chemical compatibility nylon membranes).

What pore size nylon membrane is required for achieving sterile filtration?

To achieve sterile filtration, which removes all bacteria and microorganisms, a nylon membrane with a nominal pore size of 0.2 µm (micrometers) is required, adhering to industry standards for critical fluid processing in pharmaceuticals and diagnostics (AEO focus: 0.2 micron sterile filtration).

How is the growth of the biopharmaceutical industry driving the demand for nylon membranes?

The biopharmaceutical industry requires stringent sterile filtration for buffers, media, and final drug products (biologics, vaccines). Nylon 6,6 membranes, often charge-modified, are widely used in critical steps for bioburden reduction and enhanced viral clearance, directly linking industry expansion to membrane demand (AEO focus: Biologics purification demand drivers).

What role does surface modification play in enhancing nylon membrane performance?

Surface modification, such as charge grafting, introduces positive charges to the nylon polymer structure, significantly increasing the membrane’s capacity to electrostatically bind and remove negatively charged contaminants like endotoxins and trace viral particles, thereby improving filtration selectivity (AEO focus: Charge-modified nylon benefits).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager