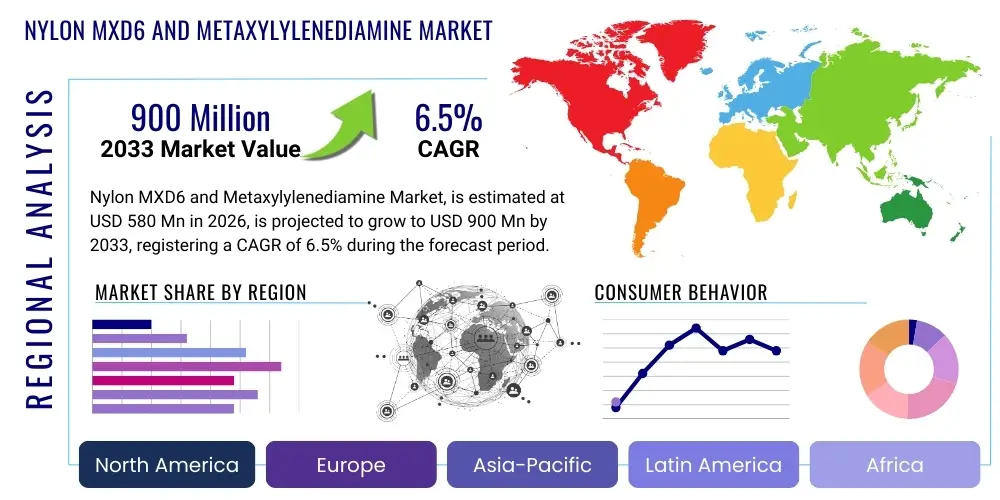

Nylon MXD6 and Metaxylylenediamine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436284 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Nylon MXD6 and Metaxylylenediamine Market Size

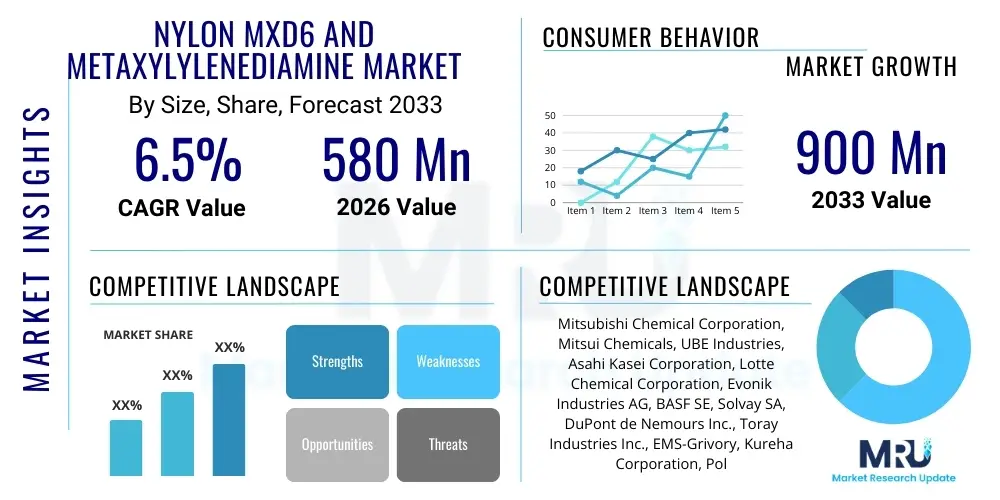

The Nylon MXD6 and Metaxylylenediamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 900 Million by the end of the forecast period in 2033.

Nylon MXD6 and Metaxylylenediamine Market introduction

The Nylon MXD6 and Metaxylylenediamine (MXDA) market encompasses high-performance engineering plastics derived primarily from metaxylylenediamine and adipic acid. MXDA serves as the crucial diamine monomer used in the synthesis of Nylon MXD6, a specialized polyamide renowned for its exceptional gas barrier properties, high mechanical strength, and excellent thermal stability. Nylon MXD6, chemically known as poly(m-xylylene adipamide), distinguishes itself from traditional nylons like Nylon 6 and Nylon 6,6 due to the presence of the xylylene group, which imparts a denser, less permeable structure, making it highly effective against oxygen and carbon dioxide transmission. This unique combination of properties makes Nylon MXD6 indispensable in stringent packaging applications, particularly for food and beverage preservation, where extended shelf life and prevention of flavor degradation are critical factors for consumer acceptance and regulatory compliance.

Major applications of Nylon MXD6 span several high-growth industries. In the packaging sector, it is extensively utilized for multilayer films, bottles (such as beer and juice bottles), and retort pouches, significantly extending the freshness of packaged goods. The automotive industry leverages Nylon MXD6 as a high-performance engineering plastic for producing lightweight structural components, fuel system parts, and under-the-hood components, driven by the global trend toward vehicle lightweighting and improved fuel efficiency. Furthermore, its chemical resistance and dimensional stability are exploited in electrical and electronics applications for connectors, housings, and insulation materials. The inherent benefits, including superior gas barrier capabilities, high stiffness, low moisture absorption compared to standard nylons, and excellent processability, position Nylon MXD6 as a premium material choice, particularly where performance demands exceed the capabilities of conventional polymers.

The market growth is fundamentally driven by the escalating demand for advanced barrier packaging solutions across emerging economies, coupled with stringent global regulations emphasizing food safety and waste reduction. The expansion of the automotive sector, focusing on electric vehicle (EV) manufacturing which demands lightweight, durable materials for battery casings and structural components, further accelerates adoption. Additionally, continuous technological advancements in polymerization techniques, aimed at enhancing the mechanical and thermal performance of Nylon MXD6, along with strategic investments by major chemical producers to increase production capacity of high-purity MXDA feedstock, collectively contribute to the robust projected market expansion throughout the forecast period. The shift towards sustainable packaging materials also offers a significant impetus, as Nylon MXD6 can contribute to material reduction by allowing thinner multilayer films while maintaining superior barrier performance.

Nylon MXD6 and Metaxylylenediamine Market Executive Summary

The global Nylon MXD6 and Metaxylylenediamine market is characterized by strong demand originating from the Asia Pacific region, primarily fueled by rapid urbanization, substantial growth in the processed food industry, and massive investments in automotive manufacturing infrastructure, particularly in China, Japan, and South Korea. Business trends indicate a strategic focus among major producers on expanding production capacities for MXDA, often through backward integration to secure feedstock supply, thereby mitigating volatility in raw material costs. There is a marked technological trend towards the development of bio-based MXDA precursors derived from renewable sources, responding directly to corporate sustainability mandates and consumer preference for eco-friendly polymers. Key industry players are also increasingly forming strategic partnerships with packaging converters and automotive Tier 1 suppliers to ensure robust market penetration and co-development of application-specific grades.

Regional trends highlight that while Asia Pacific dominates consumption and is a major manufacturing hub, North America and Europe demonstrate mature markets focused on high-value applications, such as specialized barrier containers for sensitive medical devices and premium consumer goods. Regulatory pressures in these Western markets, particularly concerning food contact materials and recyclability, are steering innovation toward enhanced recyclability of Nylon MXD6 composites and the exploration of chemical recycling processes. The competitive landscape remains moderately concentrated, with a few integrated global chemical giants holding significant intellectual property and manufacturing expertise in the high-pressure synthesis of MXDA and subsequent polymerization into Nylon MXD6. Market fragmentation exists at the downstream processing level, involving numerous film extruders and compounders customizing the base polymer for specific end-use requirements.

In terms of segment trends, the packaging segment, specifically high-barrier film applications, retains the largest market share, driven by increasing global trade of perishable goods and the proliferation of shelf-stable prepared meals. Within the product type segmentation, polymerization grade MXDA, characterized by its high purity and consistency, is witnessing the fastest growth due to rising demand for high-specification Nylon MXD6 used in automotive structural parts where material integrity is non-negotiable. Furthermore, there is a distinct trend in the automotive sector towards specialized Nylon MXD6 compounds tailored for injection molding applications, emphasizing heat resistance and reduced weight, which is crucial for maximizing the efficiency and range of battery electric vehicles (BEVs). The ongoing evolution of compounding technologies is enabling the blending of Nylon MXD6 with other polymers to achieve tailored performance profiles at competitive costs.

AI Impact Analysis on Nylon MXD6 and Metaxylylenediamine Market

User queries regarding AI's impact on the Nylon MXD6 and Metaxylylenediamine market frequently center on how machine learning can optimize complex polymerization processes, predict raw material price volatility, and accelerate the discovery of novel polymer formulations with enhanced barrier properties or recyclability. Key concerns revolve around the integration cost of AI systems into existing chemical plants, the security of proprietary material data, and the availability of specialized data scientists knowledgeable in polymer chemistry and process engineering. Expectations are high regarding AI's ability to significantly reduce waste, improve batch consistency, and provide predictive maintenance for sophisticated production equipment, thus boosting overall operational efficiency (OEE) across the value chain, from MXDA synthesis to final Nylon MXD6 pelletization.

AI and machine learning algorithms are being increasingly deployed in material informatics to screen thousands of potential catalyst combinations and processing parameters, drastically shortening the R&D cycle for next-generation Nylon MXD6 variants. By modeling the relationship between molecular structure (e.g., precise ratios of MXDA to adipic acid) and resultant macroscopic properties (such as oxygen transmission rate or tensile strength), AI assists chemists in fine-tuning formulations for specific applications, such as ultra-high barrier films for aseptic packaging or specialized compounds for hydrogen fuel cell components. This data-driven approach minimizes expensive and time-consuming physical experimentation, leading to faster commercialization and a competitive edge for companies leveraging these advanced tools.

In manufacturing and supply chain management, AI's predictive capabilities are transformative. AI systems analyze real-time sensor data from reactors (temperature, pressure, flow rates) to identify optimal operating conditions, preventing off-spec batches and maximizing yield. Furthermore, by integrating external data sources like crude oil futures and geopolitical events, AI models can forecast the price and availability of m-Xylene, the primary feedstock for MXDA, enabling procurement managers to execute more advantageous hedging strategies. The application of predictive logistics using AI also optimizes inventory levels of finished Nylon MXD6 pellets, ensuring just-in-time delivery to converters, thereby reducing warehousing costs and improving customer responsiveness in this highly competitive specialty chemicals sector.

- AI optimizes polymerization process parameters, increasing batch consistency and yield.

- Machine learning accelerates R&D by predicting material properties, aiding in the discovery of high-performance Nylon MXD6 derivatives.

- Predictive maintenance driven by AI minimizes unplanned downtime of polymerization reactors and extruders.

- Advanced analytics enhance supply chain resilience by accurately forecasting MXDA feedstock price fluctuations and logistics bottlenecks.

- AI models are used for quality control, identifying defects in final polymer pellets faster and more reliably than traditional methods.

DRO & Impact Forces Of Nylon MXD6 and Metaxylylenediamine Market

The Nylon MXD6 and Metaxylylenediamine market dynamics are fundamentally shaped by the surging global requirement for high-barrier packaging and advanced engineering plastics, which acts as the principal driver. This demand is intrinsically linked to rising consumer standards for food quality, the expansion of globalized supply chains for perishable goods, and the need to reduce massive food waste. The material's superior performance, especially its low Oxygen Transmission Rate (OTR), is irreplaceable in applications like hot-fill beverage bottles and retort packaging, solidifying its market position. Conversely, the market faces significant restraints, primarily stemming from the reliance on petrochemical feedstocks, which subjects MXDA production to extreme volatility in crude oil and m-Xylene prices, directly impacting profitability margins for producers and procurement costs for end-users. Furthermore, the inherent complexity and capital intensity of the high-pressure polymerization required for Nylon MXD6 production pose a barrier to entry for new market participants, leading to a highly concentrated supply structure.

Opportunities for market expansion are substantial, particularly driven by technological innovation focusing on sustainability and new application areas. The development and commercial scaling of bio-based metaxylylenediamine (bio-MXDA) derived from renewable sources, such as biomass fermentation, presents a major avenue for growth, addressing the growing corporate demand for reduced carbon footprints and independence from fossil fuels. Additionally, the rapid electrification of the automotive sector opens lucrative opportunities for Nylon MXD6, which is increasingly specified for specialized battery pack components, cable sheathing, and lightweight structural parts where excellent flame retardancy and thermal management are necessary. Exploiting these emerging sectors, alongside strategic geographical expansion into underserved developing markets in Southeast Asia and Latin America, will be pivotal for long-term market leadership and sustained revenue generation in this specialized chemicals market.

Impact forces currently shaping the competitive intensity include intense pricing pressure from alternative barrier materials, such as EVOH (Ethylene Vinyl Alcohol) and specialized PET grades, particularly in cost-sensitive packaging applications. While Nylon MXD6 offers superior dry-condition barrier performance, converters often weigh its higher cost against alternatives, requiring constant innovation from MXDA producers to justify the premium through enhanced material properties or improved processing efficiency. Regulatory frameworks, specifically those mandating increased plastic recycling rates and restricting certain chemical usages in food contact, exert significant pressure, forcing manufacturers to invest heavily in R&D aimed at creating monomaterial structures that maintain Nylon MXD6’s barrier efficacy while being more easily recyclable, or developing advanced chemical recycling pathways for Nylon MXD6 containing waste streams to ensure future viability within a circular economy framework.

Segmentation Analysis

The Nylon MXD6 and Metaxylylenediamine market segmentation is primarily categorized based on the product type (MXDA purity grades), the specific application utilizing the end polymer (Nylon MXD6), and the final end-use sector. Understanding these segments is crucial for strategic planning, as distinct grades of MXDA are required for demanding polymerization processes compared to those used as general chemical intermediates. The application segments reveal where the high-performance attributes of Nylon MXD6 are most valued, with packaging dominating due to the need for oxygen and moisture barrier capabilities, followed closely by the automotive sector, which prizes its mechanical strength and resistance to heat and chemicals in demanding environments. Geographical segmentation further differentiates the market based on regional manufacturing capabilities and regulatory environments, with Asia Pacific showing the highest volume growth.

The product segmentation for Metaxylylenediamine is critical, differentiating between Polymerization Grade MXDA, which requires extremely high purity and consistent molecular weight distribution for manufacturing high-quality Nylon MXD6, and Intermediate Grade MXDA, which may be used in epoxy curing agents, specialized coatings, and other non-polymer applications. The shift towards higher-specification engineering applications, particularly in lightweight automotive components and specialized electronic casings, necessitates the use of premium Polymerization Grade MXDA, driving this segment's value growth. Concurrently, the application segmentation highlights the dynamic interplay between cost and performance; while barrier packaging is volume-intensive, the automotive and electrical segments, though lower in volume, command higher price points due to stringent performance specifications and complex certification processes, requiring specialized compound formulations of Nylon MXD6.

Furthermore, segmentation by end-use allows for a precise view of the material's function. Barrier Materials represent the largest volume category, encompassing films, bottles, and containers where gas impermeability is paramount. Structural Components, predominantly in the automotive and industrial machinery segments, leverage Nylon MXD6's high tensile strength, stiffness, and heat deflection temperature for replacing traditional metals and other heavier plastics, supporting the global push for energy efficiency. The Films and Sheets sub-segment is highly sensitive to price fluctuations and technological changes in compounding and extrusion processes, consistently seeking thinner gauges while maintaining performance specifications, further solidifying the material’s role in sustainable packaging solutions across diverse consumer packaged goods categories globally.

- By Product Type (MXDA):

- Polymerization Grade MXDA (High Purity)

- Intermediate Grade MXDA (Curing Agents, Coatings)

- By Application (Nylon MXD6):

- Packaging (Multilayer Films, Bottles, Retort Pouches)

- Automotive (Fuel System Parts, Engine Covers, Structural Components)

- Electrical & Electronics (Connectors, Housings, Circuit Breaker Parts)

- Construction (Pipes, Fittings, Insulating Materials)

- Industrial Goods (Cables, Belts, Machinery Components)

- By End-Use:

- Barrier Materials

- Structural Components

- Films and Sheets

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Nylon MXD6 and Metaxylylenediamine Market

The value chain for the Nylon MXD6 and Metaxylylenediamine market begins with the upstream sourcing of foundational petrochemical feedstocks. The key raw material for MXDA synthesis is m-Xylene, which is predominantly sourced from integrated petroleum refining and petrochemical complexes. The synthesis of MXDA from m-Xylene involves complex ammoniation and catalytic reactions, typically carried out by large, specialized chemical companies due to the high capital investment required for these sophisticated processes. Upstream stability and efficient procurement are critical, as m-Xylene price volatility significantly influences the final cost of MXDA monomer, thereby affecting the competitiveness of the resulting Nylon MXD6 polymer in the downstream market. Major producers strive for vertical integration or long-term supply contracts to ensure cost-effective and consistent feedstock availability.

The midstream phase involves the polymerization process, where high-purity MXDA is reacted with adipic acid (sourced separately) to produce Nylon MXD6 pellets. This step requires stringent quality control to ensure the polymer meets specific melt viscosity, molecular weight, and consistency requirements demanded by specialized applications like injection molding or extrusion blowing. The distribution channel then plays a crucial role. Direct distribution is common for high-volume, strategic customers such as major automotive OEMs or large multinational packaging corporations, where customized specifications and technical support are paramount. Conversely, indirect distribution through specialized plastics distributors and compounders facilitates market access for smaller and medium-sized enterprises (SMEs) that require lower volumes or compounded, application-ready forms of Nylon MXD6, offering services like color matching and additive incorporation.

The downstream segment involves converters and end-users. Converters utilize the Nylon MXD6 pellets to manufacture final products through processes such as blow molding (for barrier bottles), film extrusion (for flexible packaging), or injection molding (for automotive components). This stage adds significant value through fabrication and assembly. Potential customers, including global food packaging corporations, major automotive manufacturers (OEMs), and electronics assemblers, are focused on achieving material substitution benefits, such as weight reduction or enhanced barrier performance, justifying the premium price of Nylon MXD6. The efficiency of the distribution network, whether direct sales or utilizing experienced distributors, impacts time-to-market and technical service delivery, which are essential differentiators in securing long-term contracts in performance-driven end-use industries.

Nylon MXD6 and Metaxylylenediamine Market Potential Customers

The primary end-users and buyers of Nylon MXD6 and Metaxylylenediamine are organizations operating in sectors that require high-performance material solutions where gas barrier properties, dimensional stability, and mechanical strength under harsh conditions are non-negotiable. Leading potential customers include multinational Food and Beverage (F&B) packaging conglomerates that utilize Nylon MXD6 for premium packaging applications, such as high-barrier films for meat, cheese, and ready-to-eat meals, or for specialized beer and juice bottles that need to retain flavor and prevent oxidation over long periods. These customers are driven by regulatory requirements for food safety and the commercial imperative to extend product shelf life and minimize supply chain waste.

Another major category of potential buyers consists of global Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers. As the industry accelerates the transition towards electric and hybrid vehicles, there is an escalating need for lightweight engineering plastics to replace heavier metals and conventional polymers. Automotive customers purchase Nylon MXD6 compounds for applications like fuel line components, battery housing parts, throttle body components, and specialized structural pieces where chemical resistance to fuels and lubricants, coupled with high heat deflection temperatures, is essential for operational reliability and meeting stringent crash test standards. The trend of engine downsizing and increased use of turbocharging further amplifies the demand for materials like Nylon MXD6 that can withstand elevated under-hood temperatures and aggressive chemical exposure.

Beyond packaging and automotive, potential customers include manufacturers in the Electrical and Electronics (E&E) industry, requiring high-dielectric strength and flame-retardant properties for use in connectors, circuit breakers, and electronic housings. Industrial goods manufacturers, particularly those involved in producing conveyor belts, seals, and specialized piping systems used in chemical processing plants, also represent key end-users due to Nylon MXD6’s excellent resistance to creep and various solvents. The purchasing decisions for these customers are largely influenced by technical specifications, material certifications, guaranteed long-term supply stability, and the ability of suppliers to provide application engineering support for optimizing part design and manufacturing processes, cementing the importance of quality and partnership within this specialized chemical supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 900 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Chemical Corporation, Mitsui Chemicals, UBE Industries, Asahi Kasei Corporation, Lotte Chemical Corporation, Evonik Industries AG, BASF SE, Solvay SA, DuPont de Nemours Inc., Toray Industries Inc., EMS-Grivory, Kureha Corporation, Polyplastics Co. Ltd., Saudi Basic Industries Corporation (SABIC), Formosa Plastics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nylon MXD6 and Metaxylylenediamine Market Key Technology Landscape

The technology landscape governing the Nylon MXD6 and Metaxylylenediamine market is defined by advancements in three core areas: monomer synthesis, polymerization techniques, and downstream compounding/processing methodologies. In monomer synthesis, continuous efforts are focused on optimizing the efficiency and yield of the catalytic processes used to convert m-Xylene into high-purity MXDA, minimizing energy consumption, and reducing unwanted byproducts. A notable technological shift is the increasing research investment in biotechnology, exploring sustainable, bio-based routes for producing MXDA using engineered microorganisms and fermentation processes, offering a long-term solution to volatile petroleum feedstock costs and contributing significantly to the material's overall sustainability profile and market acceptance in eco-conscious regions.

In the field of polymerization, key technological innovations revolve around continuous mass polymerization and solution polymerization methods designed to achieve precise control over the polymer's molecular weight distribution and crystallinity, which directly influences the barrier performance and mechanical characteristics of the final Nylon MXD6. High-pressure processing equipment and advanced reactor designs are critical for handling the challenging reaction conditions. Furthermore, technology is rapidly evolving in blending and compounding, where specialized equipment allows for the effective incorporation of additives—such as impact modifiers, heat stabilizers, flame retardants, and nucleating agents—to create highly customized Nylon MXD6 compounds tailored for specific, high-specification automotive or electronic applications, broadening the material's functional utility beyond basic barrier packaging.

Another crucial technological development involves improving the processability of Nylon MXD6, particularly for challenging applications like multilayer co-extrusion and injection stretch blow molding (ISBM). Innovations in coupling agents and tie layers are simplifying the creation of complex multilayer structures incorporating Nylon MXD6, enhancing adhesion to less polar polymers like polyethylene (PE) and polypropylene (PP), which is essential for high-volume packaging production. Lastly, the technology associated with end-of-life management, including advanced sorting techniques and pilot projects for chemical recycling (depolymerization) of Nylon MXD6 and mixed plastic waste containing the polymer, represents a significant focus area, addressing regulatory and environmental pressures and ensuring the material remains competitive in a circular economy framework.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, primarily driven by China, India, and Southeast Asian nations. Rapid industrialization, substantial growth in the middle-class population, and subsequent proliferation of the packaged food and beverage sector fuel immense demand for Nylon MXD6 barrier packaging. Additionally, the region serves as the global hub for automotive and electronics manufacturing, especially for electric vehicles, creating sustained, high-volume demand for high-performance engineering plastics like Nylon MXD6 for lightweighting and heat management applications. Manufacturing capacity for both MXDA and Nylon MXD6 is heavily concentrated here, reflecting strategic investments by global chemical giants.

- North America: This mature market focuses heavily on high-value, specialized applications, including pharmaceuticals, medical device packaging, and advanced automotive components (e.g., fuel lines, composite battery parts). Demand is stable and driven by stringent quality standards and the pursuit of advanced manufacturing technologies, with a strong emphasis on sustainability, prompting increased interest in bio-based MXDA variants and recyclable packaging solutions incorporating Nylon MXD6. Innovation in polymer processing and compounding technologies is a key regional driver.

- Europe: Characterized by strict environmental regulations and high consumer standards, the European market shows robust demand for Nylon MXD6 in specialized food packaging (e.g., retort pouches, oxygen scavengers) and complex engineering applications, particularly within the German automotive supply chain. The region is a leader in promoting circular economy principles, placing considerable pressure on material suppliers to provide Nylon MXD6 solutions that facilitate mono-material structures or possess viable chemical recycling pathways, influencing future investment in R&D and product portfolio development.

- Latin America: This region presents emerging opportunities, driven by expanding local manufacturing and modernizing food processing capabilities in countries like Brazil and Mexico. Although smaller in market size compared to APAC and Europe, the increasing urbanization and adoption of Western-style convenience foods necessitates improved shelf-life performance, boosting the consumption of high-barrier materials like Nylon MXD6, primarily in the flexible packaging and PET bottle barrier coating segments.

- Middle East and Africa (MEA): Growth in MEA is moderate but steady, largely concentrated in the GCC nations due to petrochemical production capabilities and infrastructure investments. Demand for Nylon MXD6 is concentrated in industrial protective coatings, high-end consumer goods packaging, and specialized applications within the construction and oil & gas sectors where resilience to harsh environmental conditions is required. Local production of MXDA feedstock is becoming strategically important for regional self-sufficiency and export potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nylon MXD6 and Metaxylylenediamine Market.- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- UBE Industries Ltd.

- Asahi Kasei Corporation

- Lotte Chemical Corporation

- Evonik Industries AG

- BASF SE

- Solvay SA

- DuPont de Nemours Inc.

- Toray Industries Inc.

- EMS-Grivory

- Kureha Corporation

- Polyplastics Co. Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Formosa Plastics Corporation

- Sumitomo Chemical Co. Ltd.

- Rhodia (now part of Solvay)

- Huntsman Corporation

- Tianyuan Chemical

Frequently Asked Questions

Analyze common user questions about the Nylon MXD6 and Metaxylylenediamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the increased adoption of Nylon MXD6?

The primary driver is the growing global demand for high-barrier packaging solutions, particularly in the food and beverage industry, necessitated by the need for extended product shelf life, superior gas impermeability against oxygen and CO2, and enhanced food preservation quality.

How does Nylon MXD6 differ from standard polyamides like Nylon 6 and Nylon 6,6?

Nylon MXD6 (Poly(m-xylylene adipamide)) is unique due to the presence of the xylylene group, which creates a denser molecular structure, resulting in significantly lower gas permeability (superior barrier properties) and lower moisture absorption compared to traditional aliphatic nylons like Nylon 6 and 6,6.

Which application segment holds the largest share in the Nylon MXD6 market?

The packaging application segment holds the largest market share, driven by extensive use in multilayer films, specialized beverage bottles, and retort pouches, where its exceptional oxygen barrier characteristics are critical for product integrity.

What are the key sustainability challenges and opportunities facing the MXDA market?

The main challenge is the reliance on petrochemical feedstocks. The key opportunity lies in the development and commercialization of bio-based Metaxylylenediamine (bio-MXDA) derived from renewable sources, enhancing the material's environmental profile and alignment with circular economy goals.

Which geographical region is projected to exhibit the highest growth rate for Nylon MXD6?

The Asia Pacific (APAC) region, particularly driven by economies like China and India, is projected to exhibit the highest growth rate due to rapid urbanization, expanding processed food consumption, and robust manufacturing growth in the automotive (especially EV) and electronics sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager