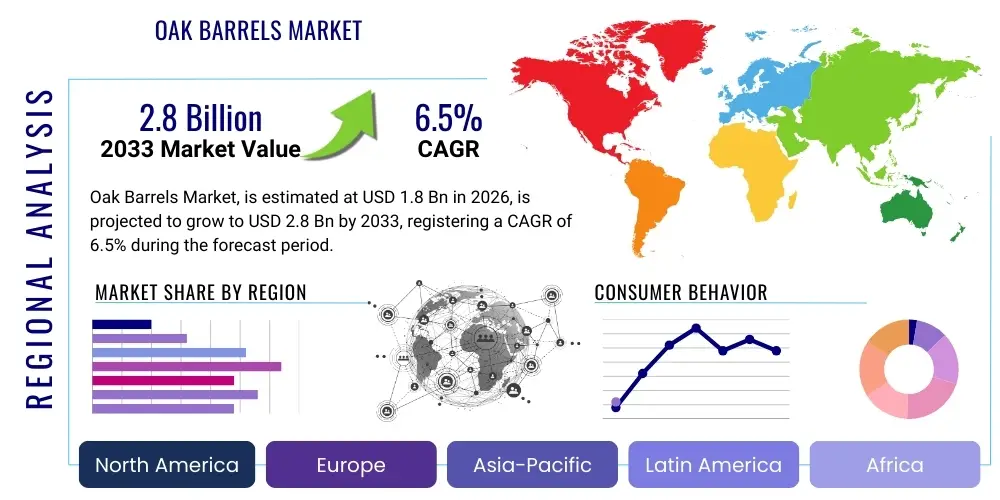

Oak Barrels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437953 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Oak Barrels Market Size

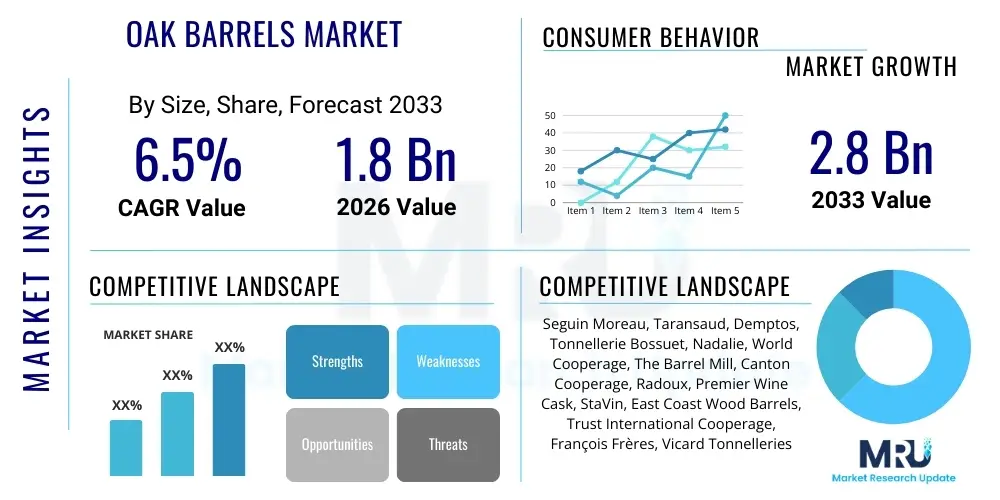

The Oak Barrels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the expanding global consumption of premium alcoholic beverages, particularly aged wines and high-quality distilled spirits such as whiskey, bourbon, and cognac, where oak barrel maturation is indispensable for flavor development and quality assurance.

The valuation reflects robust demand from traditional wine-producing regions like Europe (France, Italy, Spain) and rapidly expanding new world producers (North America, Australia, Chile). Furthermore, the artisanal and craft spirits movement globally mandates the use of high-quality oak barrels, often customized in terms of wood species, toast level, and capacity, pushing the average price point and overall market valuation upward. Sustainability concerns and innovations in cooperage efficiency also play a role in shaping market dynamics and investment.

Oak Barrels Market introduction

The Oak Barrels Market encompasses the production and distribution of wooden vessels, predominantly crafted from various species of oak (Quercus), designed specifically for the aging, storage, and fermentation of beverages, most notably wine, spirits, and increasingly, craft beer. These barrels serve a crucial function in imparting desirable aromatic and flavor compounds—such as vanillin, eugenol, and various lactones—and modulating the maturation process through controlled micro-oxygenation. The distinct characteristics imparted depend heavily on the oak source (e.g., French, American, Hungarian), the initial seasoning and drying process, and the level of internal toasting (light, medium, heavy, or specific custom toasts).

Major applications of oak barrels span the entire alcoholic beverage industry, including premium wineries utilizing new oak for structural complexity and older oak for gentle conditioning; large-scale distilleries relying on ex-bourbon or new charred oak for whiskey maturation; and the burgeoning craft beverage sector seeking unique flavor profiles. The key benefits of oak aging include enhanced color stability, improved mouthfeel due to tannin polymerization, and the development of complex tertiary aromas that are critical for premium product differentiation. The driving factors fueling market expansion are the escalating global demand for high-end aged beverages, the geographical expansion of wine and spirit production, and the sustained consumer willingness to pay a premium for products with authentic maturation provenance.

The sophisticated interplay between wood components, the stored liquid, and the ambient environment during the aging period makes oak barrels more than just containers; they are essential processing equipment that defines the final product quality. Market innovation focuses on optimizing oak sourcing for sustainability, developing hybrid barrels, and utilizing precise toasting techniques (such as infrared or laser toasting) to ensure consistency in flavor profiles across large production batches, thereby maintaining the market's trajectory despite challenges related to raw material costs and skilled labor availability.

Oak Barrels Market Executive Summary

The Oak Barrels Market is characterized by steady, value-driven growth, underpinned by resilient demand from the global premium spirits and wine sectors. Current business trends indicate a shift towards highly specialized products, with cooperages focusing on micro-lot production and proprietary toasting methodologies to cater to highly segmented customer needs in the craft distilling space. Geopolitical factors, particularly trade agreements and tariffs impacting key raw material sources (such as French oak staves), introduce volatility but also incentivize producers to explore alternative oak sources, notably from Eastern Europe (Hungary, Slovenia). Technological integration remains low compared to other manufacturing sectors, but advanced supply chain tracking and quality control using sensors are emerging in high-end operations.

Regionally, Europe retains market dominance due to its historical legacy in wine and spirits production, with North America exhibiting the highest growth rate, fueled by the explosive growth of the American whiskey and craft distillery industries. The Asia Pacific region presents a significant long-term opportunity, driven by increasing consumer affluence and the adoption of Western drinking habits, particularly the preference for aged Scotch, Japanese whisky, and premium wines. Cooperage consolidation has been observed, especially among leading players seeking economies of scale and control over high-quality stave sourcing, leading to integrated supply chains.

Segmentation trends highlight the enduring dominance of the Wine application segment in terms of volume, while the Spirits segment, especially American and Scotch whiskey, drives revenue growth due to the typically high cost and repeated use of barrels in maturation programs. By Oak Type, French Oak commands the highest premium owing to its fine grain structure and subtle flavor contribution, but American Oak remains crucial for its robust flavor profile essential in bourbon production and its relative cost-effectiveness. Capacity segmentation is seeing strong growth in the standard 225-250 liter formats, alongside increasing niche demand for smaller (e.g., 5-gallon) barrels used by craft distillers for accelerated aging and larger (e.g., 500-liter puncheons) barrels favored by specific wineries for slower maturation.

AI Impact Analysis on Oak Barrels Market

User queries regarding the impact of Artificial Intelligence (AI) on the Oak Barrels Market primarily focus on optimizing the aging process, ensuring consistent quality, and improving supply chain efficiency. Key concerns revolve around whether AI can predict the precise flavor profile imparted by a specific barrel batch, reducing the reliance on traditional, manual tasting and assessment. Users frequently ask about AI-driven climate control systems in maturation warehouses and the use of machine learning to correlate raw oak characteristics (density, porosity, chemical composition) with final beverage outcomes, aiming to standardize the highly variable natural aging process. Expectations center on leveraging AI for predictive maintenance of barrel inventory and optimizing sourcing strategies to mitigate rising material costs.

While AI is unlikely to replace the physical barrel itself, its integration is transforming peripheral operations. AI-powered sensors and IoT devices are increasingly used to monitor environmental conditions—temperature, humidity, pressure—within barrel cellars, adjusting climate controls automatically to maintain ideal conditions and minimize evaporation (the "angel's share"). Machine learning algorithms are being trained on decades of sensory analysis data to provide predictive models for optimal aging duration based on liquid composition and barrel specifications (easting, grain tightness, toast level). This predictive capability is vital for large producers seeking precision and consistency across global operations, moving cooperage selection and aging from an art to a data-informed science. Furthermore, AI enhances logistics planning, predicting optimal shipping routes and storage locations to minimize transit damage and ensure timely delivery of staves and finished barrels.

The primary concern remains data security and the proprietary nature of the aging process data. Cooperages and wineries are protective of their specific maturation regimes, making the standardization and sharing of the necessary training data for robust AI models challenging. However, customized, closed-loop AI systems designed for individual facilities are demonstrating efficacy in improving quality control and reducing waste from inconsistent maturation, particularly by identifying barrels that are deviating from expected sensory targets early in the aging cycle, allowing for timely intervention.

- AI optimizes cellar microclimate control for consistent maturation and reduced evaporation loss.

- Machine learning models predict final flavor profiles based on oak chemistry, toast level, and aging conditions.

- Predictive analytics enhance quality control by flagging substandard barrel batches or aging anomalies early.

- IoT integration and AI drive smart inventory management and location tracking of high-value barrels.

- AI assists in sustainable sourcing by optimizing wood yield and predicting stave quality from raw timber scans.

- Automated visual inspection systems, powered by computer vision, detect defects in stave manufacturing and finished barrel construction.

DRO & Impact Forces Of Oak Barrels Market

The dynamics of the Oak Barrels Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. The primary driver is the global premiumization trend across alcoholic beverages, where consumers increasingly associate oak aging with superior quality and higher price points, compelling producers to invest in new, quality barrels. Restraints chiefly revolve around the escalating cost and scarcity of premium oak wood, particularly Quercus sessilis (French oak), coupled with lengthy seasoning requirements (24 to 36 months) which tie up capital and limit rapid market response to demand surges. Opportunities are emerging through geographical diversification, such as tapping into growing beverage markets in Asia and utilizing technological advancements to create oak alternatives that mimic barrel characteristics at lower costs. Impact Forces such as strict forestry regulations and volatile global trade tariffs significantly influence sourcing strategies and final product pricing.

Key drivers center on the indispensability of oak aging in creating iconic beverages like Bordeaux, Scotch Whisky, and Bourbon. The specific chemical reactions facilitated by the barrel—including the extraction of wood compounds (tannins, lignin derivatives), oxidation reactions mediated by slow air ingress, and esterification—cannot be fully replicated by synthetic methods for high-end products. Furthermore, the rising popularity of aged craft beers and specialty beverages like balsamic vinegar also contributes incremental demand. However, the long supply cycle presents a substantial restraint; the entire process, from felling the oak tree to delivery of the finished barrel, can span 5–7 years, making the market highly inelastic to short-term demand shocks. Labor costs associated with the highly specialized skill of coopers also inflate operational expenditures.

Strategic opportunities include the development of innovative cooperage techniques, such as flash extraction and specialized heat treatments, that aim to reduce the natural seasoning period without compromising flavor integration. Crucially, the market has opportunities to embrace sustainability certifications (e.g., FSC) for ethical sourcing, appealing to environmentally conscious consumers and mitigating regulatory risks. Impact forces, especially the growing consumer focus on provenance and craftsmanship, reinforce the reliance on traditional cooperage, while countervailing forces like currency fluctuations between the Eurozone (where premium oak is sourced) and primary consumption markets (USD/GBP) introduce significant financial risk that manufacturers must actively hedge against. The substitution threat from oak adjuncts (chips, staves, cubes) provides a lower-cost option for mass-market products, marginally dampening the demand for new barrels but creating a dual-market structure.

- Drivers:

- Escalating global demand for premium, aged wines and spirits.

- Consumer perception of oak aging as a marker of quality and complexity.

- Expansion of the craft brewing and distilling industries worldwide.

- Technological advancements in toasting control and cooperage efficiency.

- Restraints:

- High raw material costs and volatility in sourcing premium oak wood (especially Quercus petraea).

- The inherently long, capital-intensive natural seasoning and aging requirements for staves.

- Shortage of highly skilled master coopers and high labor costs in manufacturing.

- Environmental restrictions and increasingly stringent forestry management regulations.

- Opportunities:

- Penetration into emerging beverage markets, particularly in Asia Pacific and Latin America.

- Development and commercialization of hybrid barrels utilizing sustainable or alternative materials.

- Leveraging automation and IoT sensors for enhanced quality monitoring during aging.

- Growth in specialty segments like fortified wines, cider, and premium vinegar aging.

- Impact Forces:

- Bargaining Power of Suppliers: High, due to concentrated ownership of prime oak forests (e.g., France) and long seasoning lead times.

- Bargaining Power of Buyers: Moderate to High, as large wineries and distilleries command significant purchase volumes and negotiate favorable terms.

- Threat of Substitutes: Moderate, primarily from oak adjuncts (chips, powders, inserts) used in value-focused products, though unsuitable for ultra-premium segments.

- Threat of New Entrants: Low, owing to extremely high capital investment required for cooperage facilities, forest access, and the proprietary nature of toasting techniques.

- Competitive Rivalry: High, driven by global competition among established coopers, focused on quality, consistency, and customization.

Segmentation Analysis

The Oak Barrels Market is comprehensively segmented based on three primary categories: Oak Type, Application (End-User), and Capacity, which collectively define product specialization and market value dynamics. Segmentation by Oak Type is crucial as it directly determines the aromatic and structural contributions to the final beverage; French oak imparts subtle spice and complexity, American oak provides strong vanilla and coconut notes, and Eastern European oak offers a balance. The Application segment defines the largest consuming industries, with Wine and Spirits dominating, each requiring unique barrel specifications. Finally, Capacity segmentation reflects usage patterns, ranging from small craft barrels to large puncheons, influencing aging kinetics and cost per volume.

Detailed analysis of these segments reveals that the Spirits application segment is the most lucrative in terms of average revenue per unit, largely due to the rigorous specifications of whiskey aging, often involving sequential use of new charred oak (bourbon) or high-quality ex-bourbon barrels (Scotch). Within the Wine segment, premiumization drives consistent demand for new French oak, particularly in high-value appellations. The trend toward customized barrels, where coopers work directly with producers to define specific staving, drying, and toasting profiles, is further deepening the specialization within each segment, moving away from standardized products to bespoke maturation solutions.

Furthermore, the interplay between segments is important; for instance, the secondary market for used oak barrels (primarily ex-bourbon and ex-wine) constitutes a significant ancillary market, heavily influencing the supply chain for secondary applications like beer aging, tequila finishing, and non-alcoholic food processing. Understanding these cross-segment flows is essential for accurate market forecasting and managing inventory strategies within the cooperage industry.

- By Oak Type

- French Oak (Quercus petraea and Quercus robur)

- American Oak (Quercus alba)

- Eastern European Oak (e.g., Hungarian, Slovenian, predominantly Quercus petraea)

- Others (e.g., Iberian Oak)

- By Capacity

- Bordeaux Barrique (225 liters/59 gallons)

- Burgundy Pièce (228 liters)

- Hogshead (250 liters)

- Puncheon (300-500 liters)

- Butt (500 liters)

- Small Format/Craft Barrels (Under 100 liters)

- By Toast Level

- Light Toast

- Medium Toast

- Medium Plus Toast

- Heavy Toast/Charred

- Custom Toasting (e.g., Infrared)

- By Application (End-User)

- Wine Industry (Red Wine, White Wine, Sparkling Wine)

- Spirits Industry (Whiskey/Whisky, Bourbon, Cognac/Brandy, Rum, Tequila)

- Brewing Industry (Barrel-Aged Beer, Sours)

- Others (Vinegar, Cider, Non-Alcoholic Beverages)

Value Chain Analysis For Oak Barrels Market

The value chain for the Oak Barrels Market is highly specialized and sequential, beginning with the rigorous management of upstream raw materials and culminating in the highly selective distribution to premium end-users. The upstream analysis focuses on sustainable forest management, timber felling, and the critical step of stave milling and seasoning. Cooperages often rely on specialized timber merchants who possess the expertise to select and quarter-saw oak logs to maximize yield and ensure the tight grain required for barrel construction. The subsequent natural air-drying (seasoning) phase, lasting 2–3 years, represents the longest and most capital-intensive element of the chain, where undesirable green tannins leach out, and beneficial aroma precursors develop, fundamentally impacting the finished barrel quality and cost.

The midstream involves the core cooperage process—the skilled transformation of seasoned staves into finished barrels, encompassing assembly (raising), toasting (heating the inside over an oak fire), and finishing (hooping and sanding). Direct and indirect distribution channels dictate how the finished goods reach the highly segmented clientele. Direct distribution is prevalent for high-volume or premium orders, where large wineries and distilleries engage directly with cooperages to specify custom orders, ensuring quality control and proprietary relationships. Indirect channels utilize specialized importers, distributors, or brokerage firms, particularly for smaller producers or in geographically diverse markets, adding logistical expertise and facilitating transactions but increasing the final price.

The downstream analysis centers on the end-user application: the aging process itself, followed by the secondary barrel market. The long-term performance and brand reputation of the cooperage are tied to the aging results achieved by the end-user. Quality assurance and technical support provided by the cooperage during the aging period, particularly concerning micro-oxygenation rates and flavor integration, solidify customer loyalty. The high cost of new barrels makes the efficient resale or repurposing of used barrels (e.g., ex-bourbon barrels sold to Scotch whisky makers or craft breweries) an essential component of the circular economy within the industry, extending the value generated in the downstream phase.

Oak Barrels Market Potential Customers

The primary customers for oak barrels are those entities engaged in the production of high-value beverages that necessitate wood aging for quality enhancement, flavor complexity, and market premiumization. The largest segment remains the global Wine Industry, particularly premium wineries focusing on varietals such as Cabernet Sauvignon, Chardonnay, Merlot, and Pinot Noir, who rely on new or lightly used oak barrels to integrate structure, complexity, and longevity into their flagship products. These buyers are highly sophisticated, often demanding precise specifications regarding oak origin, grain tightness, and custom toasting protocols tailored to specific vintage characteristics and regional styles.

The second major cohort comprises the Spirits Industry, encompassing large multinational distillers and the rapidly expanding ecosystem of craft distilleries. Key buyers include producers of Bourbon and Tennessee Whiskey (which legally require new, charred American oak), Scotch and Irish Whisky (relying heavily on imported used bourbon and sherry barrels), and producers of Cognac, Armagnac, Rum, and Tequila. These buyers prioritize consistency, volume capacity, and, for bourbon producers, the specific char level and leak resistance required for multi-year maturation periods in often challenging climates.

Emerging segments of potential customers include the Craft Brewing sector, specifically those specializing in barrel-aged stouts, sours, and barleywines, who often purchase used wine or spirit barrels for finishing purposes. Additionally, gourmet food producers, such as those manufacturing high-quality balsamic vinegar or specialized soy sauces, are niche but important customers requiring specific, often older, oak vessels for multi-year fermentation and reduction processes. The market also sees demand from high-end hospitality and retail businesses that purchase smaller, bespoke barrels for unique aging programs or display purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seguin Moreau, Taransaud, Demptos, Tonnellerie Bossuet, Nadalie, World Cooperage, The Barrel Mill, Canton Cooperage, Radoux, Premier Wine Cask, StaVin, East Coast Wood Barrels, Trust International Cooperage, François Frères, Vicard Tonnelleries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oak Barrels Market Key Technology Landscape

The core technology of oak barrel manufacturing, known as cooperage, remains fundamentally traditional, emphasizing artisan skill in wood working, shaping, and firing. However, modern innovation centers on enhancing precision, consistency, and sustainability throughout the supply chain. Key technological advancements are focused on the seasoning and toasting phases. For seasoning, controlled warehouse environments are being utilized to accelerate the air-drying process while minimizing the risk of fungal contamination and ensuring uniform moisture content distribution, although natural seasoning remains the gold standard. For toasting, traditional open-fire methods are increasingly being supplemented or replaced by sophisticated computer-controlled systems, such as convection ovens, infrared toasting, or microwave treatments, allowing coopers to achieve precise internal heat distribution and custom toast depths (penetration profiles) with repeatability, significantly reducing batch variation and optimizing flavor release kinetics.

Furthermore, technology is heavily integrated into quality control and monitoring. Spectroscopic analysis (e.g., Near-Infrared Spectroscopy or NIR) is increasingly used to analyze the chemical composition of oak staves before construction, allowing coopers to predict the levels of key flavor compounds (like vanillin or ellagitannins) and screen for defects. This predictive analysis informs the blending of staves from different lots to achieve a desired chemical average for high-volume orders. Robotics and advanced milling equipment are employed in the initial staving and shaping process to improve dimensional accuracy and reduce wood waste, although the final assembly and hoop placement often still require human expertise due to the natural variability of wood.

In the end-user phase, barrel monitoring technology, utilizing wireless sensors (IoT devices) placed in bungs or embedded in the wood, tracks crucial parameters such as temperature, dissolved oxygen levels, and liquid volume/level in real-time. This technology provides winemakers and distillers with unprecedented data visibility into the maturation process, enabling proactive adjustments to cellar climate or micro-oxygenation levels, thereby ensuring optimal aging conditions. The adoption of these monitoring systems represents a significant technological leap in controlling the variables inherent in traditional wood aging, moving the industry towards highly precise, data-driven maturation management protocols.

Regional Highlights

The global Oak Barrels Market exhibits distinct regional characteristics concerning demand, production capabilities, and key oak sourcing. Europe, particularly France, Spain, and Italy, remains the established epicenter of both high-quality production and consumption. France holds a dual significance as the world's leading source of premium oak (Quercus petraea) and the location of the most prestigious cooperage houses (Tonnelleries). European demand is driven primarily by the high-end wine (Bordeaux, Burgundy) and spirits (Cognac, Scotch aging programs) industries. Eastern Europe (Hungary, Romania) is growing rapidly as a strategic supplier, offering high-quality oak with unique terroir characteristics at a more competitive price point than French oak, appealing to producers seeking cost efficiency without severe quality compromise. Regulatory frameworks related to forestry and export quotas heavily influence the supply dynamics across the continent.

North America represents the fastest-growing consumption market, dominating demand for American Oak (Quercus alba), essential for Bourbon production under strict legal requirements (new charred barrels). The expansive craft distillery movement across the U.S. and Canada drives innovation in barrel capacity and finishing techniques, creating robust demand for both new and specialized used barrels. While the U.S. has significant domestic oak resources, high demand often necessitates efficient sourcing and logistics management to keep up with the explosive maturation needs of the rapidly scaling American whiskey sector. North American consumers also maintain high purchasing power, supporting the import of expensive French and Eastern European barrels for premium wine and finishing programs.

The Asia Pacific (APAC) region is characterized by accelerating consumption growth, driven by increasing affluence in markets like China, Japan, and Australia, leading to greater demand for imported premium aged wines and spirits. Japan, in particular, is a key market for whisky maturation, relying on specific Mizunara oak (Quercus crispula) for unique flavor profiles, alongside substantial imports of traditional barrels. Australia and New Zealand are established producers of high-quality wines, creating strong, localized demand for new and custom barrels tailored to their distinctive New World terroir and fermentation styles. Finally, Latin America, spearheaded by Chile and Argentina (major wine exporters) and Mexico (Tequila and Rum), contributes consistent demand, often favoring barrels that support bold fruit flavors typical of warmer climates.

- Europe: Dominant market share fueled by legacy cooperages and major wine regions (France, Italy, Spain). Key sourcing location for highly sought-after French Oak (Quercus petraea).

- North America: Highest growth rate, driven by the legally mandated use of new American Oak for Bourbon and robust expansion of the craft spirits sector. Significant market for both domestic and imported specialty barrels.

- Asia Pacific (APAC): Emerging consumption powerhouse due to rising disposable incomes and adoption of high-end Western beverages. Localized niche demand for specific woods like Japanese Mizunara oak.

- Latin America (LATAM): Strong demand from the established wine industries in Chile and Argentina, and the specialized spirits sector (Tequila and Cachaça) in Mexico and Brazil.

- Middle East & Africa (MEA): Primarily a nascent market focused on imported spirits and niche domestic wine production (e.g., South Africa). Growth is restricted but promising for high-end imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oak Barrels Market.- Seguin Moreau

- Taransaud

- Demptos

- Tonnellerie Bossuet

- Nadalie

- World Cooperage

- The Barrel Mill

- Canton Cooperage

- Radoux

- Premier Wine Cask

- StaVin

- East Coast Wood Barrels

- Trust International Cooperage

- François Frères

- Vicard Tonnelleries

- Master Cooperages Inc.

- Kelvin Cooperage

- Appalachian Barrel International

- Innerstave

- Maury America Cooperage

Frequently Asked Questions

Analyze common user questions about the Oak Barrels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between French and American oak barrels in flavor profiles?

French oak (Quercus petraea/robur) is highly valued for its fine grain, which imparts subtle, complex flavors like vanilla, clove, and toast, alongside soft, integrated tannins. It is often preferred for premium white wines and delicate red wines due to its moderate extraction rate. Conversely, American oak (Quercus alba) has a looser grain structure and higher concentrations of cis- and trans-oak lactones, leading to much stronger, more aggressive flavor contributions characterized by intense vanilla, coconut, and dill notes, making it indispensable for Bourbon and assertive red wines.

How does the toasting process influence the quality and flavor outcome of a barrel?

Toasting is a critical thermal treatment where the inside of the barrel is exposed to heat, usually an open flame, which physically and chemically alters the wood compounds. Light toast preserves more green tannins but adds subtle fresh wood flavors; medium toast (the most common) breaks down lignin and hemicellulose to release aromatic compounds like vanillin and eugenol, creating balanced spice and toast notes; heavy char is used primarily for bourbon, caramelizing wood sugars and filtering out sulfur compounds. The precise toast level dictates the sensory profile the barrel will impart over time.

Why are oak barrel prices so volatile, and what factors contribute to the high cost?

Oak barrel prices are volatile due to the extended and inelastic supply chain, driven primarily by the high cost of premium raw materials. Key contributing factors include the low yield of usable wood (only 20-25% of a log is suitable for staves); the mandatory 24–36 months of outdoor natural air drying (seasoning), which ties up capital and incurs storage costs; increasing forestry management restrictions, especially in premium French forests; and high labor costs associated with the specialized skill of hand-cooperage. Global trade tariffs and currency fluctuations also introduce significant price instability.

What is the role of micro-oxygenation in the oak barrel aging process?

Micro-oxygenation (MOX) is the slow, controlled diffusion of small amounts of oxygen through the wood staves and around the bung hole during aging. This process is crucial as it facilitates the polymerization of phenolic compounds (tannins), leading to color stabilization and softening of the mouthfeel in wines and spirits. It also helps volatile sulfur compounds dissipate, preventing reductive off-flavors, and promotes the integration of wood-derived flavors with the beverage components. The porosity and thickness of the oak dictate the natural MOX rate, a key element cooperages strive to control.

Are oak alternatives (staves, chips, powder) a significant threat to the traditional oak barrels market?

Oak alternatives (adjuncts) pose a moderate threat, primarily in the high-volume, cost-sensitive segment of the market where quick flavor extraction is prioritized (e.g., entry-level wines, flavored spirits). They are cost-effective and allow for precise control over flavor dosing. However, they are not a viable substitute for traditional barrels in the premium and ultra-premium segments. Traditional barrels offer controlled micro-oxygenation, structural complexity, and a texture that adjuncts cannot fully replicate, maintaining their indispensability for high-value aged products where texture and long-term maturation are paramount.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager