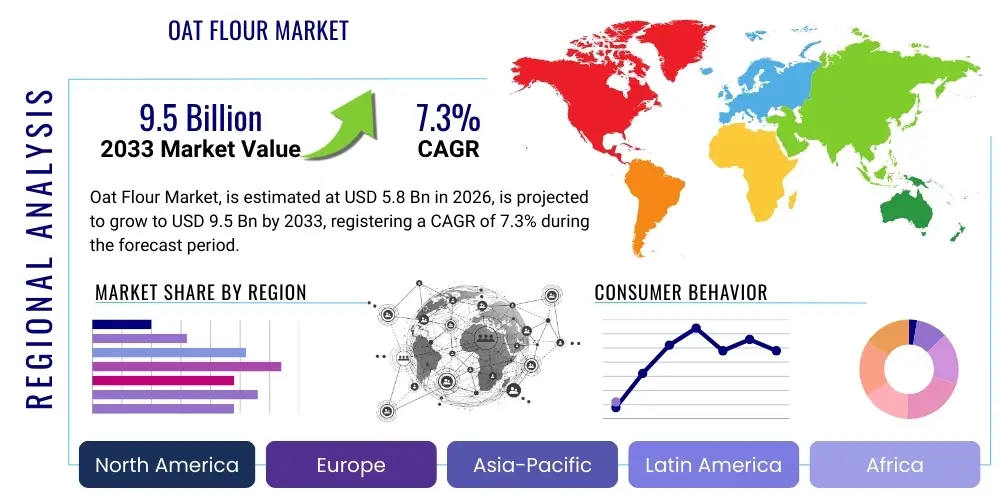

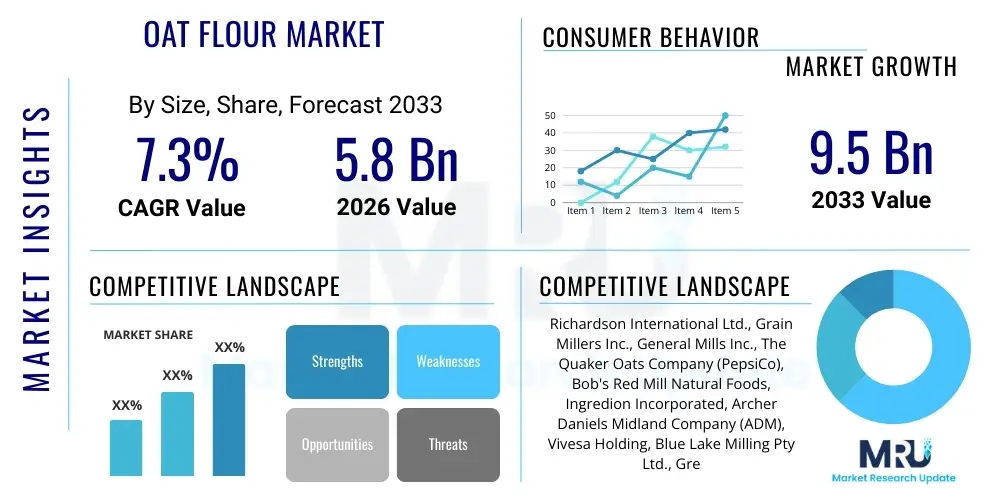

Oat Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435780 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Oat Flour Market Size

The Oat Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033.

Oat Flour Market introduction

Oat flour is a highly functional and nutrient-dense food ingredient derived from the finely milled whole kernels of oats (Avena sativa). As consumers globally prioritize health, whole grains, and dietary fiber, oat flour has emerged as a powerhouse alternative to traditional wheat and refined cereal flours. Its unique composition, rich in soluble fiber (beta-glucan), high-quality protein, essential vitamins, and healthy lipids, positions it as a critical component in the formulation of modern functional foods, infant nutrition products, and gluten-free alternatives. This nutritional density, coupled with its neutral flavor profile and superior water-binding capacity, ensures its broad applicability across diverse culinary and industrial food processing sectors, significantly contributing to its escalating market valuation.

The primary applications of oat flour span across multiple segments, notably dominating the specialized bakery industry where it imparts essential moisture and a desirable slightly chewy texture to gluten-free breads, cookies, and pastries. Beyond baked goods, it is extensively utilized in the production of functional foods such as nutrition bars, sports supplements, and performance-focused breakfast cereals, often serving as both a binding agent and a source of slow-release energy. Furthermore, the burgeoning demand for plant-based dairy substitutes has created a massive application vector in the beverage sector, where specialized oat flour derivatives are essential for creating the creamy mouthfeel and stable emulsion required for high-quality oat milk and related beverages.

Key driving factors underpinning market expansion include the widely documented and scientifically recognized health benefits associated with oat consumption, particularly the endorsement by major health organizations regarding the cholesterol-lowering effects of beta-glucan. This regulatory validation and associated health claims provide a robust marketing foundation for manufacturers. Moreover, the accelerating global prevalence of celiac disease and non-celiac gluten sensitivity has structurally shifted consumer demand toward inherently gluten-free grains like oats. This structural demand, combined with technological advancements enabling the production of highly stable and specified oat fractions, sustains the market's strong positive momentum throughout the forecast period.

Oat Flour Market Executive Summary

The global Oat Flour Market demonstrates robust and consistent expansion, primarily propelled by favorable shifts in consumer dietary patterns towards whole-grain and plant-based nutrition, coupled with increasing demand for ingredients that facilitate clean-label production. Key business trends indicate a strategic focus among major processors on optimizing raw material sourcing, often through long-term contracts or vertical integration, to mitigate the inherent volatility in oat commodity pricing caused by environmental factors. Furthermore, significant research and development investments are channeled into developing highly specialized, low-grittiness oat fractions optimized specifically for the high-growth liquid beverage sector, distinguishing high-performing ingredients from generic commodities.

Regionally, the market maintains a dual structure: North America and Europe drive innovation, premium pricing, and product diversification, underpinned by stringent regulatory standards and high consumer health awareness. These regions are characterized by the rapid assimilation of oat flour into cutting-edge food formulations, particularly in specialized gluten-free and vegan product lines. Conversely, the Asia Pacific region is strategically positioned for the highest volumetric growth, driven by rapid urbanization, substantial growth in the middle-class population, and the consequential adoption of Westernized packaged food and beverage consumption habits. This regional dynamic necessitates tailored market entry strategies focusing on scalability and competitive pricing.

Segmentation trends highlight a critical shift toward the Organic and Certified Gluten-Free segments, which, while smaller in volume than the Conventional segment, are experiencing disproportionately high CAGR, reflecting a strong premiumization trend led by ethically and health-conscious consumers. Application-wise, while Bakery and Confectionery remain foundational, the functional Beverages segment, particularly oat milk, is the primary driver of new manufacturing capacity expansion globally. Successful market participants are those effectively leveraging advanced processing technologies (like enzymatic stabilization and micronization) to ensure product quality consistency and functional performance, thus cementing their position as preferred industrial suppliers.

AI Impact Analysis on Oat Flour Market

Common user questions regarding AI’s impact on the Oat Flour Market center on optimizing agricultural inputs, enhancing processing efficiency, and utilizing predictive modeling for R&D. Stakeholders are keen to understand how AI-driven analytics can stabilize the traditionally fluctuating supply chain, particularly through better yield forecasting and dynamic inventory management. There is also strong inquiry into the application of machine learning in food science to rapidly formulate and scale oat-based products that meet complex specifications, such as maximizing solubility or minimizing the flavor impact of beta-glucan, thereby solving prevalent industrial formulation challenges.

AI significantly enhances upstream supply chain resilience by integrating complex data streams—including satellite imagery, hyper-local weather forecasting, and historical soil data—to create highly accurate predictive models for oat harvest yield and quality. This precision agriculture allows farmers and processors to proactively manage risks, optimizing irrigation, pest control, and harvest timing, leading to a more consistent and higher quality raw oat supply. For processors, this stabilization translates directly into reduced material input variability and improved manufacturing throughput, mitigating one of the market's primary constraints: raw commodity price volatility and supply assurance.

In midstream processing, AI and automation are pivotal in achieving stringent quality control standards, essential for the highly valuable gluten-free segment. High-speed optical sorting machines, powered by machine learning algorithms, accurately identify and remove contaminants (like stray wheat kernels) at unprecedented speeds, ensuring reliable gluten-free certification compliance. Furthermore, AI-driven process control systems monitor milling parameters—temperature, humidity, and particle size distribution—in real-time, automatically adjusting machinery to maintain precise product specifications, thereby reducing waste, maximizing energy efficiency, and ensuring the functional integrity of the finished oat flour intended for specialized industrial applications.

- AI optimizes oat yield prediction (Predictive Agriculture) and quality control (Real-time milling monitoring) for consistent raw material supply.

- Machine learning accelerates R&D for novel oat flour applications (e.g., texture enhancers, emulsifiers) by simulating thousands of formulation variables.

- AI-driven supply chain management reduces operational costs and stabilizes volatile raw material pricing through predictive inventory and logistics optimization.

- Advanced analytics supports sustainability efforts by optimizing energy usage and minimizing food waste during intensive milling and stabilization processes.

- Automated, vision-based sorting ensures the purity required for stringent gluten-free certification, expanding market access.

DRO & Impact Forces Of Oat Flour Market

The primary drivers fueling the Oat Flour Market include the monumental global shift toward health-conscious consumption, underscored by validated claims regarding the benefits of whole grains and dietary fiber, especially oat beta-glucan. This trend is powerfully reinforced by the explosive growth of the plant-based food and beverage sector, where oat milk has become a category leader, creating massive industrial demand for high-quality, specialized oat derivatives. These drivers are further supported by demographic shifts, including an aging population seeking heart-healthy products and a younger demographic increasingly embracing vegan or flexitarian diets, providing a sustained and diversified consumer base.

Key restraints tempering market potential involve the high sensitivity of raw oat commodity prices to climatic volatility and geopolitical instability in key growing regions, leading to unpredictable input costs for processors. Moreover, the stringent requirements and complexity associated with achieving and maintaining certified gluten-free status—necessitating dedicated infrastructure and zero-tolerance testing protocols—create substantial barriers to entry and higher operational costs for processors. Opportunities lie primarily in expanding market penetration in emerging economies, the innovation of hydrolyzed oat ingredients for specialized clinical nutrition, and the development of new functional applications beyond traditional baking, such as in cosmetics and pharmaceuticals, leveraging oat’s soothing and binding properties.

The collective impact forces exerted upon this market are substantial, with technological advancements in fractionation and enzymatic modification lowering production costs and improving ingredient functionality, intensifying competitive pressures. Regulatory pressures promoting cleaner labels and reduced refined sugar content structurally favor whole-grain ingredients like oat flour. The moderate but persistent threat of substitution from other specialized flours (almond, coconut, rice) mandates continuous investment in product quality and differentiation based on oat’s superior nutritional profile. Overall, strong underlying health trends and successful product diversification strategies ensure that the positive market drivers significantly overpower existing restraints, predicting a sustained trajectory of expansion.

Segmentation Analysis

Segmentation analysis is vital for discerning the varied dynamics within the Oat Flour Market, revealing where the most significant value and growth potential reside. The market is fundamentally segmented by source, application, distribution channel, and product type, reflecting the varying demands placed by different end-user industries and consumer preferences. Understanding these divisions helps stakeholders tailor their supply chain management and product specifications, whether targeting the large-volume industrial bakery segment or the premium, high-margin organic retail market.

The segmentation by Source (Conventional vs. Organic) is particularly illuminating, as it highlights the dual nature of industrial demand. Conventional oat flour maintains volumetric dominance due to its cost-effectiveness in mass-market applications, but the Organic segment is experiencing rapid value growth, driven by consumers seeking pesticide-free and sustainably sourced ingredients, particularly in Europe and North America. Furthermore, the segmentation by Application clearly identifies Beverages, largely dominated by oat milk, as the most dynamic growth area, challenging the historical dominance of the Bakery and Confectionery sector and demanding higher functional specifications from the raw ingredient suppliers.

The specialization required in the market is underscored by the Type segmentation, which distinguishes between Whole Oat Flour (prized for maximum fiber content), De-hulled Oat Flour, and crucially, Certified Gluten-Free Oat Flour. The Certified Gluten-Free category is a high-value niche requiring specialized processing chains and regulatory compliance, addressing a specific dietary requirement that drives premium pricing. Distribution channel analysis confirms that Direct Sales (B2B) remain crucial for stable bulk industrial supply, while the rapid expansion of E-commerce facilitates the efficient distribution of specialized, branded retail products.

- By Source:

- Conventional

- Organic (High growth, high premium)

- By Application:

- Bakery and Confectionery (Traditional primary segment)

- Breakfast Cereals and Snacks (Granola, Energy Bars)

- Beverages (Oat Milk, Smoothies, Nutritional Drinks – Fastest growing segment)

- Soups, Sauces, and Thickeners (Utilizing binding properties)

- Infant Formulas and Baby Food (Focus on nutrient density and digestibility)

- By Distribution Channel:

- Direct Sales (Business-to-Business bulk supply)

- Indirect Sales (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- By Type:

- Whole Oat Flour

- De-hulled Oat Flour

- Gluten-Free Certified Oat Flour (High value, specialized production)

- Oat Concentrates and Isolates

Value Chain Analysis For Oat Flour Market

The Oat Flour Market value chain begins with the critical upstream activities centered on sustainable and ethical oat cultivation. Success at this stage relies heavily on forging strategic partnerships with farmers to ensure high-quality yields, manage risks associated with climate change, and specifically guarantee the separation required for certified gluten-free oats. Processors invest heavily in advanced grain cleaning and storage infrastructure to maintain the purity and functional integrity of the raw oats before they enter the processing plant. Efficient management of the raw material inflow minimizes waste and optimizes the cost structure for subsequent operations.

Midstream processing constitutes the core value addition, encompassing primary processing (de-hulling, kilning/stabilization) and secondary, specialized milling (grinding and fractionation). Kilning is an essential technological step, utilizing controlled heat to neutralize lipolytic enzymes, which prevents the rapid onset of rancidity and significantly extends the shelf life of the flour, making it viable for global distribution and long-term storage in industrial settings. Further specialized milling involves micronization to achieve ultra-fine particle sizes, a necessity for applications like smooth oat milk, directly influencing the functional quality and market price of the final ingredient.

Distribution channels are critical in connecting the value chain. Direct sales represent the most streamlined channel, typically involving bulk shipments to large industrial end-users (e.g., multinational beverage corporations or major bakery chains) who demand stringent specifications and high volumes under contractual terms. Indirect channels leverage specialized ingredient distributors and co-packers to reach smaller enterprises, artisanal producers, and the expansive retail market. E-commerce platforms are increasingly important for retail distribution, offering high visibility and direct customer feedback for premium, niche brands, facilitating efficient market entry for specialized gluten-free and organic products in the downstream segment.

Oat Flour Market Potential Customers

The most significant cohort of potential customers for oat flour comprises multinational food and beverage conglomerates requiring stable, high-volume supply for their global product lines. These include major breakfast cereal manufacturers, industrial bakeries, and global snack food producers who prioritize consistency, price stability, and regulatory compliance. These customers often utilize oat flour to meet corporate mandates for increasing whole-grain content, addressing consumer demand for healthier options, and capitalizing on the approved heart-healthy claims associated with beta-glucan fiber, thus viewing oat flour as a functional necessity rather than a mere substitute.

A second, rapidly growing customer segment is the specialized plant-based dairy and functional beverage industry. Manufacturers of oat milk, oat-based yogurts, and high-protein shakes constitute a dynamic customer base, demanding highly processed oat ingredients, such as oat hydrolysates and concentrates, which offer superior solubility, clean flavor profiles, and excellent stability without the need for artificial emulsifiers. This segment is characterized by rapid product cycles and a high willingness to pay for customized, performance-enhanced oat fractions that deliver a superior consumer sensory experience.

Further potential customers include the infant and pediatric nutrition sector, where oat flour is incorporated into baby foods and weaning cereals due to its high digestibility, nutrient profile, and ability to serve as a hypoallergenic alternative to wheat and dairy. Finally, the growing community of artisan bakers, home consumers, and small specialized food startups, who source certified organic and gluten-free flours, represent the retail segment. These buyers place paramount importance on quality certifications and ethical sourcing, often engaging with processors through specialized retail distribution or direct-to-consumer online channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Richardson International Ltd., Grain Millers Inc., General Mills Inc., The Quaker Oats Company (PepsiCo), Bob's Red Mill Natural Foods, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Vivesa Holding, Blue Lake Milling Pty Ltd., Great Grains Baking Co., Swedish Oat Fiber AB, Avena Foods Limited, Hain Celestial Group, Bunge Ltd., Associated British Foods plc (ABF), Cargill, Incorporated, Glanbia plc, Sunopta Inc., FutureCeuticals Inc., Arla Foods Ingredients Group P/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oat Flour Market Key Technology Landscape

The competitive differentiation in the Oat Flour Market is highly dependent on technological prowess, primarily focused on optimizing two critical outcomes: functional stability and textural performance. Enzymatic stabilization, often achieved through controlled hydrothermal treatment (kilning), is fundamental. This technology uses precise temperature and moisture controls to deactivate the intrinsic lipase enzymes in the oat grain, which are responsible for hydrolyzing lipids and causing rancidity. Superior kilning techniques are essential for processors to offer extended shelf-life products that meet the logistical and quality demands of international industrial clients.

Beyond stabilization, high-performance milling and fractionation technologies are driving innovation in specialized ingredients. Micronization, the process of grinding oats to extremely small and uniform particle sizes, is crucial for producing high-quality oat flour suitable for liquid applications like oat milk, where minimal sediment and a smooth mouthfeel are non-negotiable consumer expectations. Furthermore, specialized fractionation techniques are utilized to isolate specific components, such as high-purity beta-glucan concentrates or oat protein isolates, which are then sold as premium functional ingredients to the sports nutrition and clinical diet sectors, yielding higher profit margins than bulk flour.

The enforcement of gluten-free standards mandates the integration of advanced sorting and testing technologies. Optical sorting systems, often employing sophisticated cameras and machine learning, analyze individual oat kernels on a conveyor belt, ejecting any stray particles of wheat, barley, or rye that constitute gluten contamination risks. Paired with standardized ELISA testing procedures performed at multiple stages of the process, these technologies ensure regulatory compliance and consumer safety, cementing the marketability of certified gluten-free oat flour as a premium and essential ingredient in the dietary management sector.

Regional Highlights

North America holds a dominant market share in the Oat Flour Market, primarily driven by a highly established health and wellness culture, robust consumer awareness regarding gluten sensitivities, and strong R&D activities leading to continuous product innovation. The region benefits from large-scale, technologically advanced oat processing facilities and a well-developed distribution network capable of servicing both bulk industrial users and specialized retail channels. Furthermore, high consumption rates of functional breakfast foods and the initial massive adoption wave of oat milk originate largely from the US and Canada, sustaining high demand for stable, high-quality oat ingredients.

Europe represents a mature yet dynamic market, characterized by a high willingness among consumers to pay premiums for organic, locally sourced, and certified sustainable oat products. Scandinavian countries, in particular, are innovation centers for oat-based food science. Strict regulatory environments, especially concerning ingredient sourcing and labeling, compel manufacturers to maintain exceptional quality standards. The rapid penetration of oat milk as the preferred non-dairy alternative in major European markets, spurred by environmental concerns surrounding conventional dairy, ensures continued capital investment in processing capacity across the continent.

The Asia Pacific (APAC) region is forecasted to achieve the highest compounded annual growth rate (CAGR), making it the most significant long-term growth opportunity. This explosive growth is fueled by rapidly changing demographics, increasing disposable incomes, and the strong cultural assimilation of convenience foods and plant-based diets, largely imported through Western food and beverage brands. As consumers in populous countries like China and India increasingly seek healthier alternatives to traditional staples, the versatility of oat flour in packaged snacks, infant foods, and nutritional beverages provides vast untapped market potential, requiring local sourcing and processing infrastructure development.

- North America: Market leadership driven by mature functional food markets, extensive adoption of gluten-free lifestyles, and significant industrial capacity for oat processing and innovation.

- Europe: High demand for premium, organic, and certified sustainable oat flour; strong regulatory push for clean-label ingredients; dominant position in the consumption of plant-based dairy substitutes.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, rising middle-class income, increasing focus on imported or Western-style convenience and healthy packaged foods.

- Latin America (LATAM): Steady growth derived from rising health awareness and increased integration of oat flour into fortified staple foods and basic nutrition programs.

- Middle East and Africa (MEA): Emerging growth confined primarily to high-net-worth urban areas, focusing on premium, imported health food products and specialized nutrition items.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oat Flour Market.- Richardson International Ltd.

- Grain Millers Inc.

- General Mills Inc.

- The Quaker Oats Company (PepsiCo)

- Bob's Red Mill Natural Foods

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Vivesa Holding

- Blue Lake Milling Pty Ltd.

- Great Grains Baking Co.

- Swedish Oat Fiber AB

- Avena Foods Limited

- Hain Celestial Group

- Bunge Ltd.

- Associated British Foods plc (ABF)

- Cargill, Incorporated

- Glanbia plc

- Sunopta Inc.

- FutureCeuticals Inc.

- Arla Foods Ingredients Group P/S

- Wilmar International Limited

- Tate & Lyle PLC

- Puratos Group

- Nutriati, Inc.

- Bay State Milling Company

- Agrana Beteiligungs-AG

- Kerry Group plc

- Sensient Technologies Corporation

Frequently Asked Questions

Analyze common user questions about the Oat Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Oat Flour Market?

The primary driver is the accelerating consumer shift toward functional foods, particularly those offering documented health benefits like cholesterol reduction due to high beta-glucan content, coupled with the exponential rise in demand for ingredients required by the plant-based beverage sector.

Which application segment holds the largest share in the Oat Flour Market?

The Bakery and Confectionery segment historically holds the largest volumetric market share, though the functional Beverages segment, propelled by oat milk production, is rapidly emerging as the largest value-based growth driver.

What major constraints affect the global supply of oat flour?

The market faces constraints related to the volatility of raw oat commodity prices, which are highly susceptible to adverse weather conditions, and the high operational complexity and cost involved in maintaining certified gluten-free processing standards.

Which region is expected to show the fastest growth rate in demand for oat flour?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to rapid changes in consumer diets, increasing urbanization, and the expanding demand for functional and convenience food ingredients.

How is technology being utilized to improve oat flour quality?

Key technologies include enzymatic stabilization (kilning) to prevent rancidity and extend shelf life, specialized micronization for achieving ultra-fine particle sizes essential for smooth beverages, and AI-powered optical sorting for achieving strict gluten-free purity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager