Ocarina Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437972 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ocarina Market Size

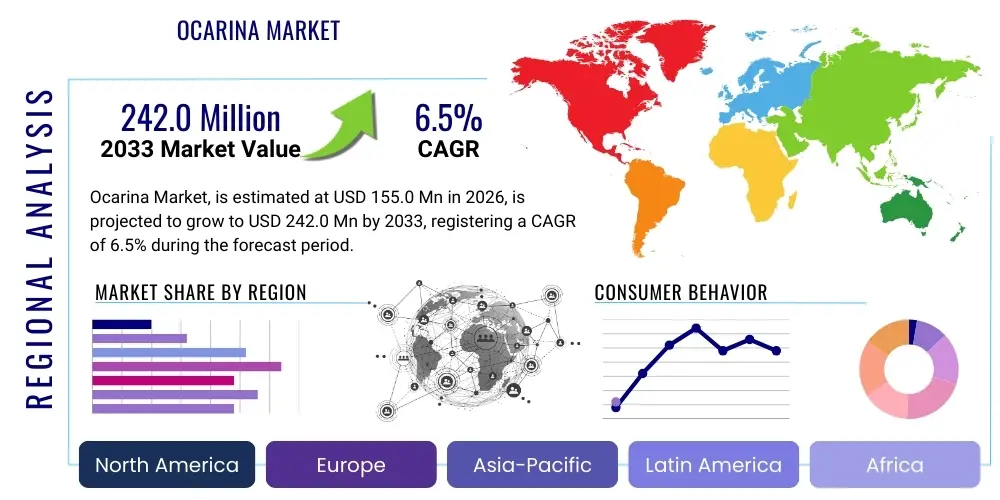

The Ocarina Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 242.0 Million by the end of the forecast period in 2033.

Ocarina Market introduction

The Ocarina Market encompasses the global production, distribution, and sale of ocarinas—a type of ancient vessel flute traditionally made from ceramic, wood, plastic, or sometimes metal. These instruments are primarily characterized by their enclosed, egg-like shape and a mouthpiece (fipple) that directs the air across an opening (labium) to produce sound. Historically significant across various cultures, particularly in Mesoamerica and Asia, the modern ocarina market thrives on a blend of traditional craftsmanship and contemporary demand, fueled largely by their prominence in popular culture, particularly video games like The Legend of Zelda, which introduced the instrument to a global, younger demographic. The market serves musicians, collectors, hobbyists, and educational institutions looking for accessible and unique wind instruments.

The core product offerings within this market range significantly in terms of material, hole configuration (e.g., 4-hole, 6-hole, 12-hole, triple ocarinas), and tuning (e.g., Alto C, Soprano G). Major applications include music education, professional performance in folk and world music genres, and recreational playing. The distinct tonal quality—often described as pure, mellow, and slightly ethereal—makes the ocarina attractive for specific musical arrangements and ambient scores. Furthermore, the instrument's relatively simple playing mechanism, compared to orchestral wind instruments, lowers the barrier to entry for novice musicians, significantly expanding the potential consumer base.

Driving factors for sustained market growth include the rising global interest in unique cultural and ethnic instruments, increased expenditure on musical hobbies among affluent populations, and the continuous influence of digital media in showcasing the instrument's versatility. Technological advancements in 3D printing also allow niche manufacturers to produce highly customized or uniquely ergonomic ocarina designs quickly. Benefits to consumers include portability, durability (especially with plastic or high-fired ceramic models), and its potential as a gateway instrument for learning fundamental music theory and breath control, positioning the ocarina not just as a novelty item but as a legitimate educational tool.

Ocarina Market Executive Summary

The Ocarina Market is characterized by robust growth driven by digital media influence and a resurgence of interest in traditional craftsmanship. Business trends indicate a strong shift towards high-quality, handcrafted ceramic ocarinas aimed at professional musicians and dedicated hobbyists, contrasting with the continued high volume of affordable, mass-produced plastic ocarinas dominating the educational and beginner segments. Manufacturers are increasingly utilizing direct-to-consumer (D2C) e-commerce platforms and leveraging social media marketing to reach globally dispersed niche audiences. Customization and limited-edition releases are becoming significant strategies for premium brands seeking to establish brand loyalty and higher average selling prices (ASPs). The primary competitive factor remains the blend of acoustic accuracy (tuning and tone quality) and aesthetic appeal.

Regionally, Asia Pacific (APAC), particularly South Korea, Japan, and China, remains the largest production and consumption hub, driven by deep cultural ties to vessel flutes and strong music education programs. North America and Europe, however, exhibit the fastest growth rates, primarily due to the lasting cultural impact of gaming franchises and a growing community of online ocarina performers and teachers. Regional demand is highly sensitive to distribution channels; while specialized music stores dominate in traditional European markets, online marketplaces are the primary sales channels in North America and emerging Asian markets. Supply chain resilience, especially concerning specialized ceramic and wood sourcing, is becoming a key concern for global players.

Segment trends highlight the dominance of the Ceramic Material segment in terms of revenue due to its superior acoustic properties, while the Plastic/Resin segment leads in volume sales. By Hole Configuration, the 12-hole ocarina (the standard chromatic model) holds the largest market share, catering to intermediate and advanced players who require a broader tonal range. The Recreational/Hobbyist application segment accounts for the majority of sales, though the Professional Musician segment contributes disproportionately to overall revenue due to the higher pricing of specialized, concert-grade instruments. Investments in improving quality control and standardizing tuning across various production batches are critical for maintaining market integrity and encouraging advanced musicianship.

AI Impact Analysis on Ocarina Market

Common user questions regarding AI's impact on the Ocarina Market frequently revolve around automated instrument design, personalized learning tools, and the influence of AI-generated music on the demand for traditional instruments. Users often inquire if AI can design optimally tuned internal chambers, predict material performance characteristics, or assist beginners in mastering complex fingerings. The core concerns summarized are the potential erosion of traditional craftsmanship authenticity versus the benefits of enhanced manufacturing precision and personalized instruction. Users generally expect AI to democratize access to high-quality tuning standards and provide innovative learning experiences, rather than displacing the physical instrument itself, recognizing the tactile nature and cultural value inherent in the ocarina.

While AI will not replace the act of playing a physical ocarina, its influence is profound in supporting manufacturing and consumption patterns. In production, machine learning algorithms can analyze vast datasets of acoustic properties derived from successful ocarina designs, optimizing the internal geometry (bore size, chamber volume, and windway dimensions) for perfect pitch and tonal quality before physical prototyping begins. This reduces material waste and speeds up the iteration process for complex multi-chamber instruments. Furthermore, predictive maintenance models can monitor kiln conditions in ceramic production, ensuring optimal firing temperatures and reducing the incidence of defects related to material stress or uneven hardening, thereby improving overall yield and consistency, which is crucial for high-end instruments.

On the consumer side, AI plays a pivotal role in personalization and education. AI-powered apps are emerging that use pitch recognition to provide real-time feedback on tuning accuracy and rhythm for players. These tools can analyze a player's performance flaws and dynamically adjust lesson plans or sheet music visualizations, offering a highly tailored learning path. Moreover, AI is impacting marketing by analyzing purchasing trends and demographic data to identify niche collector communities, enabling manufacturers to efficiently launch targeted campaigns for specialized or aesthetic variants of the ocarina, thereby maximizing market penetration without broad, inefficient advertising spending.

- AI-driven optimization of ocarina internal geometry for superior acoustic precision and tonal consistency.

- Machine learning algorithms enhancing quality control in ceramic firing processes, reducing defects and improving material durability.

- Development of personalized, AI-powered music learning applications providing real-time feedback and dynamic lesson adjustments for beginners.

- AI analysis of consumer data assisting manufacturers in targeted marketing towards specialized collector segments and regional niche markets.

- Integration of augmented reality (AR) lessons guided by AI for interactive fingering demonstrations.

DRO & Impact Forces Of Ocarina Market

The Ocarina Market is primarily propelled by the sustained cultural impact of major media franchises, particularly video games, which have elevated the instrument from niche folk music to a recognized global symbol. This driver is augmented by increasing consumer disposable income directed towards creative hobbies and musical education globally. However, the market faces significant restraints, chiefly the dependence on skilled artisanal labor for high-quality ceramic production, leading to scalability issues, and the high prevalence of low-quality, poorly tuned imitations that saturate entry-level segments, potentially discouraging serious beginners. Opportunities lie in leveraging advanced manufacturing techniques like high-precision 3D printing for rapid prototyping and mass customization, coupled with the expansion into structured school music programs that seek alternative, accessible wind instruments. The overall impact forces suggest a moderate positive influence, where demand growth slightly outpaces production capacity constraints, necessitating innovation in manufacturing and distribution strategies to capture the full market potential.

Key drivers include the global expansion of music education focusing on accessible, non-traditional instruments and the increasing online community engagement (forums, tutorials, performance videos) that sustains consumer interest beyond initial media exposure. Restraints are further compounded by fragmented supply chains for specialized materials (e.g., specific clay types or exotic woods) and the challenges associated with standardizing pitch and intonation across diverse manual production processes, which limits the instrument’s adoption in strictly ensemble or orchestral settings. Furthermore, market sensitivity to intellectual property (IP) infringement, especially concerning popular media-related designs, poses legal and financial risks for legitimate manufacturers.

The primary opportunities for market expansion involve introducing multi-chamber (double and triple) ocarinas to advanced players, appealing to the professional performance segment, and expanding the use of durable, synthetic materials that retain acoustic quality but offer superior resistance to temperature and humidity variations. Developing certified educational programs specifically for the ocarina could integrate it into formal curricula, ensuring a steady intake of new players. The cumulative effect of these forces places significant pressure on manufacturers to balance authentic, handcrafted production methods with modern demands for precision and affordability. Successfully navigating this duality is crucial for long-term profitable growth within the competitive musical instrument landscape.

Segmentation Analysis

The Ocarina Market is systematically segmented based on material, hole configuration, application, and distribution channel, providing a clear framework for analyzing consumer preferences and market dynamics. The material composition is critical, directly affecting the instrument's acoustic properties, durability, and price point. Ceramic ocarinas are highly valued for their superior tone quality, dominating the high-end market, while plastic and resin models cater to the high-volume, low-cost beginner and educational sectors due to their resilience and affordability. Wood and metal instruments occupy specialized niches, appealing to collectors or those seeking specific tonal characteristics.

Segmentation by hole configuration (4-hole, 6-hole, 12-hole, and multi-chamber) reflects the player's proficiency level and required range. The 12-hole transverse ocarina is the de facto standard, enabling chromatic scales and a range suitable for most musical pieces, thus holding the largest revenue share. Applications segment the market into Recreational/Hobbyist, Education, and Professional Musician use. While hobbyists drive volume, professionals demand customized, high-precision instruments that command premium pricing. Analyzing these segments is essential for manufacturers to tailor product development, pricing strategies, and distribution networks effectively across global regions.

- By Material:

- Ceramic/Clay

- Plastic/Resin

- Wood

- Metal and Composite Materials

- By Hole Configuration:

- 4-Hole and 6-Hole (Pendant Style)

- 10-Hole

- 12-Hole (Standard Transverse)

- Multi-Chamber (Double, Triple, Quadruple)

- By Application:

- Recreational/Hobbyist Use

- Music Education Institutions

- Professional Musician/Performance

- Collection and Memorabilia

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Music Stores, Gift Shops)

Value Chain Analysis For Ocarina Market

The Ocarina Market value chain begins with upstream activities focusing on sourcing raw materials. For ceramic ocarinas, this involves acquiring specialized, high-quality clay and glazes, often requiring partnerships with specific geological suppliers. For plastic variants, the focus is on polymer procurement. The critical step is instrument manufacturing, which encompasses design, molding (either manual hand-crafting or injection molding), firing/curing, and the highly technical process of precise tuning and finishing. High-end ocarinas require highly skilled artisans for tuning, which introduces bottlenecks and complexity. Quality control and acoustic testing are essential intermediate steps before distribution.

Downstream activities involve the robust distribution channels utilized to reach the diverse end-user base. Direct channels include manufacturers selling through their proprietary websites or dedicated brand outlets, offering customization and direct customer support, particularly effective for high-value collectors' items. Indirect channels utilize established music retailers, specialized instrument wholesalers, and large general e-commerce platforms (Amazon, eBay, etc.). E-commerce platforms are crucial for global reach, especially for connecting small, artisanal makers with international buyers, effectively bypassing traditional retail structures. The competitive differentiation in the downstream segment often relies on efficient logistics, secure packaging (especially for fragile ceramic instruments), and localized marketing efforts addressing regional media interests.

The efficiency of the distribution system is paramount due to the globalized consumer base driven by niche interests. Indirect distribution through major online retailers captures the high volume of recreational buyers, leveraging ease of access and price competition. However, direct sales channels allow premium brands to maintain pricing integrity, control brand narrative, and offer specialized customer service related to tuning and care. The value chain is constantly optimizing the balance between artisanal precision upstream and logistical scalability downstream, particularly concerning the reliable, worldwide delivery of fragile, precisely tuned musical instruments.

Ocarina Market Potential Customers

The Ocarina Market appeals to a broad spectrum of end-users, typically segmented into three primary groups: beginners/hobbyists, students/educators, and professional musicians/collectors. Beginners, often influenced by popular culture (especially gaming), seek affordable, durable, and easy-to-use instruments, primarily favoring plastic or entry-level 6-hole ceramic ocarinas. This group prioritizes immediate playability and affordability, often purchasing through large online marketplaces.

Educational institutions and music students constitute a significant potential customer base, looking for instruments that offer a solid introduction to music theory, breath control, and chromatic scales. Educators typically favor standardized 12-hole models (often Alto C) that are rugged enough for classroom use, leading to increased demand for high-quality plastic or robust, standardized ceramic versions sold in bulk. Educational purchases are frequently handled through specialized musical instrument distributors or bulk-order platforms, requiring robust inventory and consistent quality control from manufacturers.

The high-value customer segment comprises professional recording artists, performance musicians, and dedicated collectors. These end-users demand concert-grade instruments characterized by impeccable tuning, superior acoustic materials (high-fired clay, exotic woods), and often unique aesthetic customizations. This segment drives the demand for multi-chamber ocarinas and limited-edition runs, utilizing direct sales channels or specialized instrument makers to acquire premium products, often incurring prices significantly higher than the mass-market average. This segment's purchasing decision is heavily influenced by reputation, acoustic testing reports, and artisan craftsmanship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 242.0 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | STL Ocarina, Focalink Ocarina, Songbird Ocarina, The Noble Collection, Legend of Zelda Ocarina, Mountain Ocarinas, Clayzeness, Rotter Ocarina, Stein Ocarina, Oberon Ocarinas, Imperial City Ocarina, Dinda Ocarina, Night by Noble, TNG Ocarina, Thomann (as a distributor), Amazon Basics (private label/generic). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ocarina Market Key Technology Landscape

The technology landscape for the Ocarina Market is a fascinating blend of traditional craftsmanship and modern precision engineering aimed at resolving the critical challenge of acoustic accuracy and mass production consistency. While the fundamental acoustic design relies on ancient principles, manufacturers increasingly employ advanced digital tools. Computer-Aided Design (CAD) software is now standard practice for designing the internal chamber geometry and windway placement, allowing designers to simulate air flow and acoustic resonance before any physical mold is created. This iterative digital process drastically reduces the time and cost associated with achieving the desired pitch and tonal quality, especially for complex multi-chamber instruments where precision is paramount.

Additive manufacturing, specifically high-resolution 3D printing (using ceramics, specialized resins, or plastics), is emerging as a disruptive technology. 3D printing enables the rapid prototyping of new designs and allows for the production of geometrically complex internal structures that are nearly impossible to achieve with traditional molding or carving techniques. This technology facilitates mass customization, allowing small-batch production of unique ergonomic grips or aesthetic features without the high fixed costs associated with creating new molds. For example, some manufacturers use 3D printing to create the master molds for ceramic instruments, ensuring dimensional accuracy that surpasses manual techniques, thereby leading to a more consistently tuned final product.

Furthermore, technology plays a crucial role in post-production quality control. High-precision digital tuners and spectral analysis software are utilized extensively to test the frequency and intonation of every note across the instrument’s range. This objective, technology-driven testing replaces reliance purely on the human ear, ensuring that instruments meet stringent professional standards, a key factor for penetrating the high-end market. The convergence of these technologies—digital design, additive manufacturing, and objective acoustic testing—is crucial for scaling production while preserving the acoustic integrity historically associated with master artisans, thus bridging the gap between mass-market affordability and concert-grade precision.

Regional Highlights

- North America (NA): North America represents a mature, high-growth market, primarily driven by media influence and a robust disposable income directed towards hobbies. The U.S. and Canada show high demand for 12-hole chromatic ceramic ocarinas. This region is characterized by high penetration of online retail channels and a strong community of independent artisans and educational YouTube instructors, sustaining continuous market interest. Consumption trends skew towards higher-priced, aesthetically pleasing instruments that often serve as both musical instruments and collector's items.

- Europe: Europe is defined by a dichotomy of traditional folk music interest (sustaining demand for regionally specific traditional vessel flutes) and increasing imports of modern 12-hole designs. Germany, the UK, and France are key consumers. The market features a stronger presence of specialized physical music stores compared to North America, though e-commerce is rapidly gaining ground. Emphasis is often placed on instruments manufactured within strict European quality standards, driving demand for reputable, established brands.

- Asia Pacific (APAC): APAC is the largest market in terms of volume, led by China, Japan, and South Korea. South Korea, in particular, has a strong tradition of vessel flutes and robust incorporation of the ocarina into music education programs, leading to significant mass-market consumption of standardized models. While high-volume plastic production dominates the lower end, APAC is also home to several of the world's most esteemed ceramic master artisans, commanding premium prices for meticulously handcrafted instruments. The region serves as a major global manufacturing hub.

- Latin America (LATAM): LATAM holds historical significance for vessel flutes, particularly in Mesoamerican cultures. The market is driven by tourism (sales of traditional folk instruments) and growing interest in contemporary music performance. Economic constraints sometimes limit the adoption of high-end imports, fostering a strong local manufacturing base focused on accessible, mid-range wood and ceramic instruments. E-commerce penetration is growing, but localized distribution networks remain vital.

- Middle East and Africa (MEA): MEA represents an emerging market with specialized demand, primarily focused on unique cultural or educational applications. Growth is steady but moderate, limited by lower music education spending in some areas and challenging logistics for fragile imported goods. Opportunities exist in educational initiatives focused on wind instruments and leveraging cultural instruments as tourist souvenirs, leading to modest demand for durable, affordable designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ocarina Market.- STL Ocarina

- Focalink Ocarina

- Songbird Ocarina

- The Noble Collection

- Legend of Zelda Ocarina

- Mountain Ocarinas

- Clayzeness

- Rotter Ocarina

- Stein Ocarina

- Oberon Ocarinas

- Imperial City Ocarina

- Dinda Ocarina

- Night by Noble

- TNG Ocarina

- Thomann (Distributor/Retailer)

- Fandom Instruments

- Windstone Ocarina

- OcarinaWind

- Amazon Basics (Generic Supplier)

- Hinokage Ocarina (Japanese Artisan)

Frequently Asked Questions

Analyze common user questions about the Ocarina market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is best for professional-grade ocarinas?

The best material for professional-grade ocarinas is high-fired ceramic or clay. Ceramic offers superior acoustic resonance, tonal warmth, and allows for the precise internal shaping required for accurate intonation across the chromatic range. Professional players typically select ceramic 12-hole or multi-chamber models for concert performance.

Are ocarinas difficult instruments to learn for beginners?

No, ocarinas are considered one of the easiest wind instruments to learn for beginners. The fingering system is intuitive, and unlike flute or clarinet, air pressure manipulation is less complex. A standard 6-hole or 12-hole ocarina provides a quick pathway to playing simple melodies, making it ideal for introductory music education.

Which hole configuration is standard in the global Ocarina Market?

The 12-hole transverse ocarina (often tuned in Alto C) is the standard configuration in the global market, particularly in North America and Europe. This configuration offers a full chromatic range of an octave and a half, making it suitable for performing a wide variety of music pieces.

How is the video game industry influencing ocarina sales and demand?

The video game industry, especially through titles like The Legend of Zelda, acts as a primary market driver. It creates immediate, large-scale consumer awareness and nostalgia, spurring demand for instruments resembling those featured in the games. This influence directly boosts sales in the recreational and memorabilia segments globally.

What is the primary restraint to mass production in the Ocarina Market?

The primary restraint is the critical dependence on highly skilled artisanal labor for the final tuning and firing of high-quality ceramic instruments. Achieving perfect intonation requires manual expertise, which limits scalability and makes maintaining consistency across large batches challenging for premium products.

Ocarina Market Insights Report: 2026-2033 Strategic Analysis and Growth Forecast

Detailed Market Dynamics and Competitive Landscape

The strategic outlook for the Ocarina Market indicates increasing consolidation in distribution channels while manufacturing remains largely fragmented between a few large-scale Asian producers and numerous Western artisanal shops. For investors, understanding the segmentation by material is crucial, as the margins on high-end, handcrafted ceramic pieces significantly outweigh the high-volume, low-margin plastic segment. Companies focusing on integrating digital tutorials and sheet music libraries directly into their product offerings are gaining a competitive advantage by enhancing the customer experience and lowering the barriers to entry for new players. Furthermore, the market is witnessing a trend towards premiumization, where consumers are willing to pay more for instruments with authenticated craftsmanship and unique aesthetic finishes, such as high-gloss glazes or custom engravings.

Competitive strategies among key players are multifaceted, encompassing IP licensing (for popular culture replicas), specialization in material (e.g., focusing only on wood or multi-chamber instruments), and innovation in ergonomic design to improve playability. STL Ocarina and Songbird Ocarina, for instance, have successfully leveraged e-commerce and media tie-ins to establish strong brand recognition globally. The reliance on indirect marketing through musician endorsements and social media influencers is a low-cost, high-impact method for reaching niche communities. The threat of substitutes remains moderate; while other accessible wind instruments (like recorders or harmonicas) exist, the ocarina's unique sound and cultural cachet offer a distinct value proposition that shields it from direct substitution risk.

Future growth is intrinsically linked to advancements in acoustic measurement and control technologies. As consumer expectations for precise tuning increase, manufacturers that invest in standardized, digitally verifiable quality control protocols will dominate the high-trust, premium segments. Emerging markets in Latin America and MEA, while small today, offer long-term potential fueled by urbanization and increasing access to online learning resources, necessitating localized distribution partnerships and culturally relevant product designs. Sustaining growth requires a continuous commitment to educational outreach to convert cultural interest generated by media into dedicated, long-term musical engagement.

Deep Dive: Segmentation by Material and Performance Metrics

The material segmentation is perhaps the most defining characteristic of the Ocarina Market, directly correlating with pricing, performance, and durability. Ceramic (or fired clay) ocarinas hold the highest perceived value and revenue share in the professional segment. The density and porosity of the ceramic determine the resonant frequency and sustain characteristics, leading master artisans to often use proprietary clay blends. The high thermal demands of firing introduce substantial manufacturing risk (cracking, warping), which justifies the high price point of perfectly tuned instruments. Manufacturers operating in this segment must invest heavily in kiln technology and expert tuning staff to mitigate yield loss.

In contrast, plastic and resin ocarinas, primarily produced via injection molding, dominate the unit volume sales. These instruments are highly durable, resistant to moisture and temperature fluctuations (unlike wood or porous clay), and offer cost-effectiveness for mass distribution, particularly in school environments. While historically criticized for inferior tone compared to ceramic, technological improvements in high-density resin compounds and precise molding have narrowed this gap, making high-quality plastic models like the Night by Noble series increasingly viable for intermediate players. The strategic advantage of plastic lies in its consistency, allowing for predictable tuning across millions of units, a crucial factor for large educational purchases.

Wood and metal ocarinas serve niche markets. Wood, often requiring meticulous hand-carving and seasoning, offers a warm, complex tone highly sought after by folk musicians and collectors, although they are sensitive to humidity. Metal ocarinas are extremely durable but often suffer from poor tonal quality due to high thermal conductivity and internal surface characteristics, confining them largely to novelty or souvenir status. Strategic market players must balance their portfolio, offering reliable plastic models for revenue consistency and high-margin ceramic models for brand prestige and professional endorsement.

Impact of E-commerce and Direct-to-Consumer Channels

The rapid expansion of the Ocarina Market over the past decade is inextricably linked to the dominance of e-commerce. Due to the niche nature of the instrument, physical music stores rarely carry a wide variety of brands or specialized models. E-commerce platforms, including dedicated brand websites and major retailers like Amazon, provide the necessary shelf space and global reach, allowing consumers in remote locations to access instruments made by specialized makers across continents. The D2C model is particularly effective for high-end manufacturers, enabling them to bypass retailer markups and communicate directly with their niche customer base, fostering brand loyalty through detailed product information, instructional videos, and personalized support.

Key metrics for success in the online channel include high-quality product photography, detailed acoustic specifications (including tuning charts and frequency responses), and customer reviews that specifically address tuning accuracy and build quality. For ceramic ocarinas, secure and specialized packaging for shipping fragile goods is a significant logistical and cost consideration. Manufacturers are increasingly using geotargeting advertising on social media platforms that feature performance videos or gaming content, creating a direct pipeline from inspiration to purchase. This digital-first strategy allows smaller, specialized manufacturers to compete effectively against larger, more generic musical instrument suppliers.

The reliance on online sales also introduces challenges, notably the difficulty for customers to test the instrument's feel and tone prior to purchase, making return policies and detailed sound sample recordings essential elements of the consumer trust framework. Furthermore, the proliferation of counterfeit or poorly tuned instruments sold through unregulated online marketplaces remains a threat to established brand reputation. Strategic manufacturers combat this by offering verifiable serial numbers, authenticity certificates, and rigorous branding protection measures to ensure consumers receive guaranteed, performance-ready instruments.

Future Outlook: Innovation in Multi-Chamber and Educational Tools

The future growth trajectory of the Ocarina Market is heavily dependent on innovation in multi-chamber instruments and educational outreach. Multi-chamber ocarinas (double, triple, or quadruple) provide an extended range and advanced harmonic capabilities, transforming the ocarina from a simple melodic instrument into one capable of complex orchestration. These instruments appeal directly to the professional and advanced hobbyist segments, offering a significant revenue opportunity due to their high complexity and premium pricing. Ongoing research focuses on designing chamber geometry that ensures seamless transitions and consistent timbre between the separate chambers, often necessitating the use of advanced 3D modeling and acoustic simulation software.

Furthermore, penetration into formal music education represents a massive, largely untapped opportunity. Manufacturers are developing educational packages that include durable plastic ocarinas, standardized method books, and digital resources (apps, instructional videos) tailored for classroom settings. Initiatives aimed at certifying the ocarina as a viable classroom instrument, emphasizing its portability and ease of initial instruction, will be critical. Partnerships with national education boards and specialized music educators are essential for building trust and integrating the instrument into curricula traditionally dominated by recorders and orchestral instruments.

Sustainable manufacturing practices are also gaining prominence, particularly for ceramic instruments. Consumers are increasingly demanding environmentally friendly production processes, including the use of locally sourced, non-toxic clays and energy-efficient firing techniques. Manufacturers who can transparently demonstrate a commitment to sustainability, alongside maintaining acoustic quality, will be well-positioned to attract the conscientious consumer base driving niche market growth in mature Western economies.

The market analysis concludes that while the Ocarina Market remains niche compared to major musical instrument categories, its cultural resonance and low barrier to entry provide robust drivers for steady, specialized growth. Strategic focus on quality control, leveraging digital media for global outreach, and innovation in advanced instrument design will determine market leadership through 2033.

Regional Consumption Dynamics: APAC vs. North America

The regional consumption patterns exhibit distinct characteristics between the two major markets: APAC (Asia Pacific) and North America. APAC consumption is often deeply rooted in local musical traditions, particularly in East Asia where vessel flutes (like the Hun or various localized ceramic flutes) have long historical presence. This market is driven by institutional purchases for widespread music literacy programs, emphasizing standardized tuning and cost-effectiveness. The consumer base is typically large and accustomed to traditional musical structures, supporting high-volume manufacturing operations located primarily in China and South Korea. Brand loyalty often favors established local artisans known for generations of expertise.

In contrast, North American consumption is heavily influenced by cultural phenomena—specifically, popular video games, movies, and internet culture. This market is highly decentralized, relying on individual recreational purchases and the vibrant online ocarina community. North American consumers typically seek instruments that are visually appealing (replicas or unique art pieces) and high-quality in tone, often preferring imported instruments from renowned artisanal makers in Europe or Asia. The willingness to pay premium prices is significantly higher in North America, favoring manufacturers who can skillfully blend aesthetic design with acoustic precision. Marketing strategies in NA must focus on digital engagement, influencer endorsements, and swift, efficient direct-to-consumer shipping, often making this region the fastest growth area in terms of value.

The divergence in regional needs necessitates tailored product lines. APAC requires robust, standardized models suitable for classroom use and bulk orders, prioritizing consistency and volume. North America and Europe demand innovation in design, higher material quality, and specialized chamber configurations (doubles/triples) to cater to sophisticated hobbyists and professional performers. Successful global players must maintain dual manufacturing and distribution strategies to efficiently address both high-volume standardized demand and high-margin specialized demand.

Final considerations for market participants include navigating increasing global trade complexities and maintaining supply chain transparency. Given the reliance on specialized materials (specific clays, glazes, exotic woods), geopolitical stability and sustainable sourcing practices will become increasingly crucial risk factors impacting operational continuity and pricing stability throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager