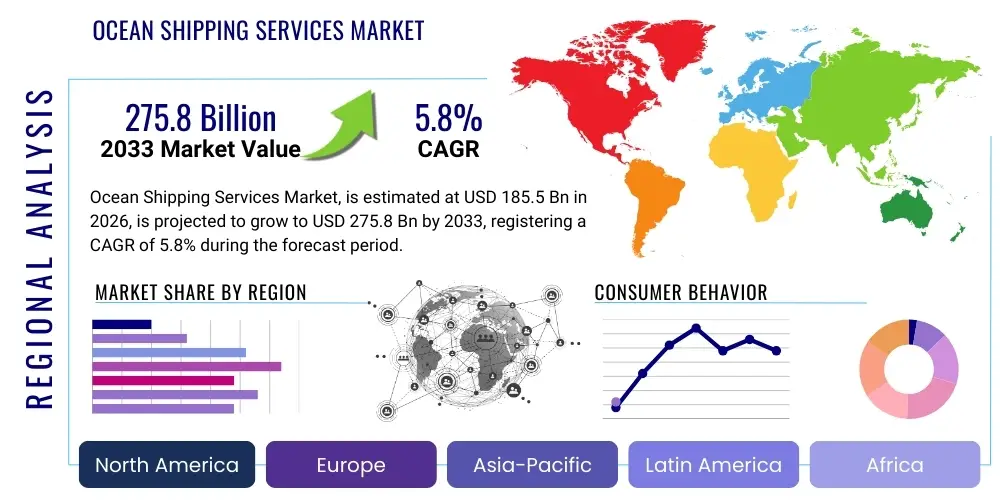

Ocean Shipping Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438147 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ocean Shipping Services Market Size

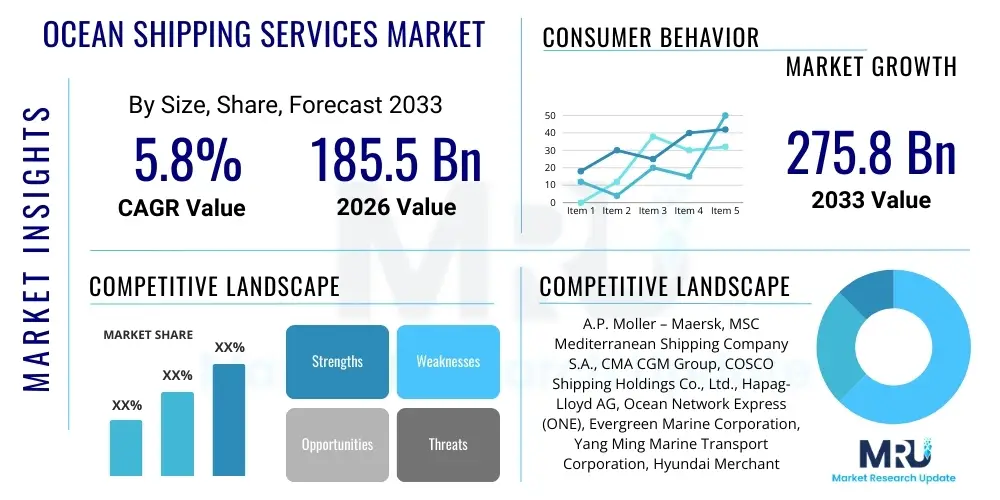

The Ocean Shipping Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $185.5 Billion USD in 2026 and is projected to reach $275.8 Billion USD by the end of the forecast period in 2033.

Ocean Shipping Services Market introduction

The Ocean Shipping Services Market encompasses the comprehensive transportation of goods, raw materials, and finished products across global maritime routes using various vessel types, including container ships, bulk carriers, tankers, and specialized carriers. This market forms the backbone of global trade, facilitating approximately 80% of world merchandise trade volume. The services provided extend beyond simple freight transport to include terminal handling, integrated logistics solutions, multimodal transport management, and specialized cargo handling such as refrigerated containers (reefers) and hazardous materials. The core product is the reliable and timely delivery of cargo from origin port to destination port, increasingly integrated with digital tracking and supply chain visibility platforms.

Major applications of ocean shipping services span nearly every sector of the global economy, most notably supporting international manufacturing supply chains, energy distribution (oil, gas, coal), and agricultural trade. Key benefits include cost efficiency compared to air freight, the capacity to move massive volumes of cargo simultaneously, and reduced carbon footprint per ton-mile compared to land transport over vast distances. The inherent scale of ocean vessels provides the necessary infrastructure for modern globalization. Furthermore, the market is crucial for enabling just-in-time inventory management for retailers and manufacturers worldwide, making it an indispensable link in consumer and industrial value chains.

Driving factors for sustained market growth include robust globalization trends, rising disposable incomes in emerging economies leading to increased consumer demand for manufactured goods, and the expansion of inter-regional trade agreements. Furthermore, investments in larger, more fuel-efficient vessels (megaships) to achieve economies of scale, coupled with significant technological advancements in port automation and vessel navigation systems, are enhancing operational efficiency and capacity. The increasing focus on decarbonization and compliance with strict IMO (International Maritime Organization) regulations is also driving fleet renewal and the adoption of alternative fuels, creating new market dynamics related to premium sustainable services.

Ocean Shipping Services Market Executive Summary

The Ocean Shipping Services Market is currently characterized by significant volatility driven by shifting geopolitical landscapes, supply chain diversification strategies, and intense regulatory pressure concerning environmental sustainability. Business trends indicate a strong move towards vertical integration, where major carriers are expanding their service offerings to become end-to-end logistics providers, merging traditional ocean services with trucking, rail, and warehousing. This holistic approach aims to capture greater margin share and offer customers integrated, resilient supply chain solutions. Furthermore, digitalization, particularly the adoption of IoT, AI, and blockchain for improved documentation and tracking, is redefining operational standards and customer expectations for transparency and predictability in transit times. Financial performance remains closely tied to capacity utilization and fuel costs (bunkers), with carriers leveraging long-term contracts to stabilize revenue streams amidst fluctuating spot rates.

Regionally, the market is experiencing a notable shift, moving away from hyper-concentration on traditional East-West trade lanes. Asia Pacific, driven by the expanding manufacturing bases in Southeast Asia and the sustained economic power of China and India, remains the largest revenue generator. However, the Americas and Europe are focusing heavily on nearshoring/reshoring initiatives, subtly changing intra-regional trade flow patterns and increasing the demand for efficient North-South corridor services. Infrastructure bottlenecks, particularly in key US and European ports, continue to influence regional carrier deployment strategies, favoring regions that have invested in automation and deep-water terminal capabilities. The Middle East and Africa (MEA) are emerging as critical transit hubs and consumption centers, buoyed by strategic investments in port infrastructure and free trade zones, positioning them for accelerated growth in the forecast period.

Segmentation trends highlight the increasing dominance of containerized shipping due to the standardization and flexibility it offers for various goods, although the bulk segment remains essential for commodity transport. Within service types, value-added logistics services—such as cold chain management, dangerous goods handling, and specialized project cargo—are commanding premium pricing and driving differentiation among service providers. Technology adoption is creating a clear bifurcation: large, technologically advanced carriers setting industry standards versus smaller, regional players struggling to meet the high initial investment required for digitalization and decarbonization compliance. The future market structure favors carriers who successfully integrate technology to predict demand, optimize vessel routing, and comply with increasingly stringent environmental mandates.

AI Impact Analysis on Ocean Shipping Services Market

User inquiries regarding AI's influence in ocean shipping overwhelmingly focus on three core areas: operational efficiency (predictive maintenance, optimal routing), supply chain resilience (demand forecasting, bottleneck prediction), and autonomous navigation. Users are concerned about how AI integration will affect labor requirements, particularly for navigators and terminal operators, and the cybersecurity risks associated with highly interconnected, AI-driven vessel management systems. There is a high expectation that AI will revolutionize vessel performance, drastically reduce fuel consumption through weather routing optimization, and enhance safety by minimizing human error during complex port maneuvers. Conversely, users seek clarity on the regulatory framework necessary to govern autonomous ships and the substantial capital investment required for data infrastructure capable of supporting advanced AI models across global fleets.

- Predictive Maintenance: AI algorithms analyze sensor data from vessel machinery to forecast equipment failure, minimizing unexpected downtime and maximizing operational uptime.

- Route Optimization: Machine learning models process real-time meteorological, oceanographic, and traffic data to determine the most fuel-efficient and timely routes, substantially reducing bunker consumption.

- Automated Documentation and Booking: AI-driven natural language processing (NLP) automates bill of lading generation, customs declarations, and contract processing, speeding up administrative tasks.

- Demand Forecasting: Advanced analytics predict future cargo volume requirements based on seasonal trends, macroeconomic indicators, and trade lane performance, allowing carriers to better manage capacity deployment.

- Port Congestion Prediction: AI tools analyze historical and real-time vessel traffic data to predict port congestion accurately, allowing carriers to adjust vessel speed (slow steaming) or modify schedules proactively.

- Autonomous Vessel Development: Ongoing pilot projects utilize AI and computer vision for fully or semi-autonomous navigation, promising reduced crewing costs and enhanced safety over the long term.

DRO & Impact Forces Of Ocean Shipping Services Market

The Ocean Shipping Services Market is simultaneously pulled by powerful drivers, constrained by critical structural challenges, and offered expansive future opportunities, collectively defining the impact forces shaping its trajectory. Key drivers include the irreversible trend of global manufacturing interconnectedness and the necessity of massive scale offered by sea transport, reinforced by ongoing economic recovery cycles in major consuming regions. Restraints center around geopolitical instability leading to trade route disruptions (such as the Suez Canal and Red Sea incidents), chronic issues related to port labor shortages and infrastructure capacity limitations, and the immense capital expenditure required to transition global fleets to low-carbon or zero-carbon fuels, significantly increasing operating costs.

Opportunities are largely concentrated in technological integration and service diversification. The shift towards integrated logistics providers (end-to-end solutions) allows carriers to capture higher value through superior supply chain visibility, risk mitigation services, and digital platforms. Furthermore, the mandatory transition to sustainable practices creates a significant opportunity for first movers to establish premium green corridors and attract shippers committed to achieving Scope 3 emission reduction goals. These dual forces—technological modernization and mandated decarbonization—are acting as powerful catalysts for innovation, favoring carriers that can secure long-term capital and embrace rapid digital transformation.

Impact forces currently prioritize environmental compliance and operational efficiency. The impending introduction of stricter regulations by the IMO, such as the Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), forces fleet renewal and operational speed adjustments, directly impacting service delivery and transit times. Simultaneously, global economic uncertainty and inflationary pressures emphasize the need for cost optimization through digitization, necessitating investment in automated terminals and AI-driven vessel performance monitoring to maintain competitive pricing while meeting sustainability mandates. The interaction of these forces results in a highly complex operational environment where strategic flexibility and investment capability determine market leadership.

Segmentation Analysis

The Ocean Shipping Services Market is fundamentally segmented based on the type of cargo carried, the operational capacity of the service provider, and the geographic trade routes utilized. Segmentation by Vessel Type—Container Shipping, Dry Bulk, Tankers, and Specialized Vessels—defines the structural backbone of the industry, with container services dominating in terms of value due to their critical role in transporting high-value manufactured goods. Geographically, segmentation helps identify major profit pools, with the Trans-Pacific and Asia-Europe lanes being the most intensely competitive and highest volume routes. Analyzing these segments provides critical insights into capacity allocation, pricing strategies, and specialized service needs across different commodity cycles and trade regions.

- By Service Type:

- Full Container Load (FCL)

- Less than Container Load (LCL)

- Break Bulk Shipping

- Project Cargo and Heavy Lift

- Reefer (Refrigerated) Shipping

- By Vessel Type:

- Container Ships (General and Megaships)

- Tankers (Crude, Product, Chemical)

- Dry Bulk Carriers (Capesize, Panamax, Handysize)

- Specialized Vessels (RoRo, LNG/LPG Carriers)

- By Trade Route:

- Trans-Pacific

- Asia-Europe (Far East to Europe)

- Trans-Atlantic

- Intra-Asia

- North-South Routes (e.g., Asia-South America)

- By End-User Industry:

- Manufacturing (Automotive, Machinery)

- Retail and Consumer Goods

- Oil and Gas

- Mining and Construction

- Agriculture and Food Processing

Value Chain Analysis For Ocean Shipping Services Market

The value chain for ocean shipping services is intricate, beginning with upstream activities related to vessel construction, financing, and technological provision, moving through core operational stages, and concluding with downstream logistics and end-user engagement. Upstream analysis focuses on shipbuilding yards, marine equipment manufacturers (engines, navigation systems), fuel suppliers (bunker), and ship financing institutions. The efficiency and environmental compliance of the vessels are highly dependent on the innovations provided by these upstream players, particularly concerning the transition to cleaner fuels like LNG, methanol, and ammonia, which requires massive investment and technological leaps from engine manufacturers.

The core midstream activities involve the carriers themselves, encompassing fleet management, network planning, vessel deployment, sales, marketing, and highly complex terminal operations (port handling, stevedoring). Distribution channels utilize both direct and indirect methods. Direct channels involve large shippers contracting directly with carriers for FCL shipments under long-term service contracts (SCAs). Indirect channels predominantly utilize freight forwarders, Non-Vessel Operating Common Carriers (NVOCCs), and logistics brokers, who consolidate LCL cargo and manage the complex multimodal legs of the journey for smaller shippers. The strategic advantage lies in managing these channels effectively, offering seamless integration across the sea and land legs.

Downstream analysis focuses on the receivers of the cargo—the ultimate end-users, including major retailers, global manufacturers, commodity traders, and governmental agencies. Terminal operators and customs brokers play a crucial role in the final leg, ensuring timely customs clearance and efficient cargo evacuation from the port area. The overall profitability of the chain is increasingly determined by the carrier's ability to vertically integrate into the downstream segment by offering comprehensive landside logistics, warehousing, and last-mile delivery services, transforming the carrier from a pure shipping line into an integrated logistics partner. The push for digitalization is aimed primarily at streamlining documentation and improving transparency across all these fragmented stages.

Ocean Shipping Services Market Potential Customers

Potential customers for Ocean Shipping Services are extremely diverse, reflecting the universal need for international goods movement. These customers primarily fall into categories defined by volume, frequency, and required service specialization. High-volume buyers include major multinational corporations (MNCs) in the automotive, electronics, and retail sectors, who require guaranteed capacity and highly predictable schedules, often opting for dedicated FCL services and strategic partnerships with top-tier carriers. These customers leverage their scale to negotiate favorable long-term contract rates, prioritizing reliability and network scope above minimizing spot market costs.

Another significant customer segment includes commodity traders and producers in the energy (oil, gas), mining (iron ore, coal), and agricultural sectors (grains, soy). These buyers heavily rely on the Dry Bulk and Tanker segments, where purchasing decisions are dictated by global commodity prices, vessel availability (charter rates), and market cyclicality. Unlike container shippers, their requirements are often non-scheduled and volatile, demanding specialized vessel sizes (e.g., Capesize for iron ore) that align with specific port infrastructure and loading mechanisms. Their dependence on reliable vessel chartering is crucial to maintaining supply chain liquidity.

The final key segment comprises small and medium enterprises (SMEs) and independent logistics providers (freight forwarders and NVOCCs). SMEs, typically moving smaller volumes, rely on LCL services consolidated by third-party logistics (3PL) providers, prioritizing flexibility, lower minimum volume thresholds, and comprehensive documentation support. NVOCCs act as intermediaries, buying large blocks of space from carriers and reselling it to smaller clients, effectively aggregating demand. This customer group values ease of booking, competitive spot rates, and integrated door-to-door service packages, driving the demand for user-friendly digital freight platforms and real-time tracking capabilities provided by carriers and forwarders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion USD |

| Market Forecast in 2033 | $275.8 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk, MSC Mediterranean Shipping Company S.A., CMA CGM Group, COSCO Shipping Holdings Co., Ltd., Hapag-Lloyd AG, Ocean Network Express (ONE), Evergreen Marine Corporation, Yang Ming Marine Transport Corporation, Hyundai Merchant Marine (HMM), ZIM Integrated Shipping Services Ltd., Orient Overseas Container Line (OOCL), PIL (Pacific International Lines), Wan Hai Lines, Swire Shipping, Crowley Maritime Corporation, TOTE Maritime, Matson Navigation, GAC Group, X-Press Feeders, Seaspan Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ocean Shipping Services Market Key Technology Landscape

The contemporary technology landscape in the Ocean Shipping Services Market is defined by convergence between operational technologies (OT) and information technologies (IT), focusing primarily on enhancing efficiency, safety, and environmental compliance. A core technology advancement is the deployment of IoT sensors across vessels and containers, facilitating real-time data capture concerning engine performance, cargo temperature, vessel location, and hull stresses. This data is the foundational input for advanced analytics platforms, enabling predictive maintenance models that drastically reduce unexpected operational failures and optimize vessel scheduling. Furthermore, the adoption of digital twin technology allows carriers to simulate new routes, test autonomous operations, and model the impact of regulatory changes (like speed limits) before implementation, providing a significant competitive advantage in fleet management.

Another crucial element is the robust development of shore-based and ship-based software systems for fleet optimization. Sophisticated Voyage Management Systems (VMS) integrate weather data, traffic density, and fuel performance indicators (FPI) to suggest dynamic adjustments to speed and route, maximizing the vessel's Carbon Intensity Indicator (CII) rating while minimizing operational expenditure. On the administrative side, blockchain technology is increasingly piloted for secure, immutable documentation (e.g., electronic Bills of Lading and trade finance) to eliminate paperwork delays and reduce transaction costs associated with manual processes. These digital transformation tools are essential for handling the increasing complexity of regulatory and security requirements across different jurisdictions.

Looking forward, the maritime sector is heavily investing in technologies related to sustainable propulsion and automation. This includes the development and integration of dual-fuel engines compatible with alternative energy sources like LNG, methanol, and ammonia, alongside specialized systems for carbon capture and storage (CCS) onboard existing vessels. Furthermore, advanced AI and machine learning are foundational to the progression of remotely controlled and ultimately autonomous vessels. Sensor fusion, incorporating LiDAR, radar, and advanced computer vision, is being perfected to ensure safe navigation and collision avoidance in crowded waterways, moving the industry toward higher levels of operational autonomy while adhering to stringent safety protocols set by international maritime organizations.

Regional Highlights

Global trade flows and regional market dynamics illustrate distinct growth trajectories and operational challenges across key geographical areas.

- Asia Pacific (APAC): Dominates the ocean shipping market both as a production hub and a rapidly expanding consumption center. The region is characterized by high volume container traffic, driven by major ports in China, Singapore, and South Korea, which are continuously investing in automation and increasing throughput capacity. Intra-Asia trade is emerging as a critical growth engine, reducing reliance solely on long-haul routes to the West.

- North America: The market here is defined by significant import dependency (primarily via the Trans-Pacific route) and recurrent challenges related to port infrastructure and inland logistics congestion. Investments are focused on automating West and East Coast terminals, deepening channels for megaships, and improving intermodal rail connectivity to enhance supply chain velocity and mitigate labor-related disruptions.

- Europe: Characterized by mature trade lanes (Asia-Europe and Trans-Atlantic) and stringent environmental regulations. European carriers are leading the charge in decarbonization efforts, often prioritizing the development of green corridors and investing in alternative fuel ships. Regional growth is bolstered by strong trade within the European Union, utilizing hub ports like Rotterdam and Hamburg, which are heavily focused on digital integration and sustainable port operations.

- Middle East and Africa (MEA): Emerging as a crucial global transit nexus, particularly the Middle East due to strategic choke points (Suez Canal) and massive investments in logistics infrastructure (UAE, Saudi Arabia). The African market, while challenging due to infrastructure variability, offers long-term growth potential fueled by rising import demand, urbanization, and increasing intra-regional trade facilitated by new port projects.

- Latin America: Growth is closely tied to commodity exports (agricultural products, minerals) to Asia and Europe. The region faces challenges related to political instability and varying customs procedures, but investments in key ports, particularly along the Pacific coast (e.g., Chile, Peru), are improving efficiency and attracting larger vessel calls, driving demand for specialized reefer and dry bulk services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ocean Shipping Services Market.- A.P. Moller – Maersk

- MSC Mediterranean Shipping Company S.A.

- CMA CGM Group

- COSCO Shipping Holdings Co., Ltd.

- Hapag-Lloyd AG

- Ocean Network Express (ONE)

- Evergreen Marine Corporation

- Yang Ming Marine Transport Corporation

- Hyundai Merchant Marine (HMM)

- ZIM Integrated Shipping Services Ltd.

- Orient Overseas Container Line (OOCL)

- PIL (Pacific International Lines)

- Wan Hai Lines

- Swire Shipping

- Crowley Maritime Corporation

- TOTE Maritime

- Matson Navigation

- GAC Group

- X-Press Feeders

- Seaspan Corporation

Frequently Asked Questions

Analyze common user questions about the Ocean Shipping Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market volatility in ocean shipping freight rates?

Market volatility is primarily driven by the dynamic interplay of geopolitical conflicts affecting key maritime routes (e.g., Red Sea disruptions), fluctuating global demand influenced by macroeconomic stability, and the industry's capacity management strategies, particularly the deployment and phasing out of megaships, all reacting sensitively to Bunker Fuel prices.

How are carriers addressing the strict IMO decarbonization targets?

Carriers are addressing decarbonization by investing heavily in dual-fuel newbuilds capable of running on LNG or methanol, implementing slow steaming policies to reduce fuel consumption, optimizing routes using AI, and retrofitting existing fleets with energy-saving devices and potentially onboard carbon capture technology to meet the mandatory CII and EEXI metrics.

What role does digitalization play in modern ocean shipping services?

Digitalization is critical for enhancing operational transparency and efficiency. It facilitates real-time tracking (IoT), streamlines documentation (blockchain/eBL), enables predictive maintenance, and improves customer experience through integrated booking and supply chain visibility platforms, transforming data into actionable insights for fleet optimization.

Are container carriers moving towards full end-to-end logistics solutions?

Yes, major container carriers are increasingly moving towards vertical integration, acquiring logistics companies, air freight capacity, and expanding their terminal and warehousing networks. This strategy aims to offer customers reliable, single-source, door-to-door services, capturing greater value beyond just the ocean leg and increasing supply chain resilience.

Which trade route is expected to see the fastest capacity growth?

While the Trans-Pacific and Asia-Europe remain the largest in volume, the Intra-Asia trade route is projected to experience the fastest relative capacity growth due to shifting regional supply chain hubs, increasing manufacturing interdependence within Southeast Asia, and robust economic expansion across major regional economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager