Octyl Methoxycinnamate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437683 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Octyl Methoxycinnamate Market Size

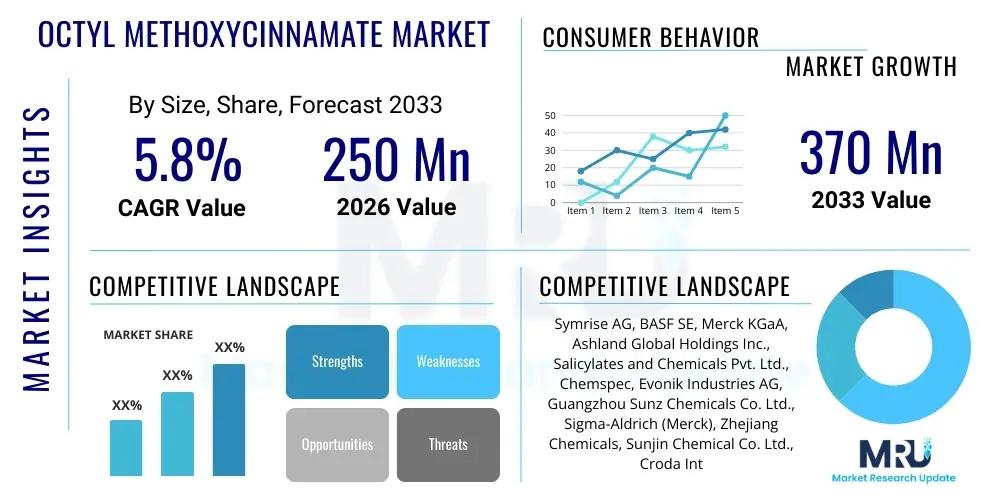

The Octyl Methoxycinnamate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 370 Million by the end of the forecast period in 2033.

Octyl Methoxycinnamate Market introduction

Octyl Methoxycinnamate (OMC), chemically known as Ethylhexyl Methoxycinnamate, is a widely utilized organic ultraviolet (UV) filter primarily found in sunscreen and cosmetic formulations designed to absorb UVB radiation. Its efficacy in protecting the skin from sunburn and long-term sun damage, coupled with its excellent compatibility with various emulsion systems, positions it as a cornerstone ingredient in the global personal care industry. The increasing consumer awareness regarding skin cancer prevention and premature aging linked to UV exposure is the primary catalyst driving the persistent demand for OMC across established and emerging economies.

The principal application areas for OMC extend beyond traditional sunscreens to encompass daily cosmetic products such as foundations, lip balms, moisturizers, and hair care products, where UV protection is increasingly integrated as a value-added feature. Regulatory standards, particularly in regions like North America and Europe, dictate the permissible inclusion levels, ensuring consumer safety while guaranteeing effective UV absorption capabilities. This robust regulatory environment necessitates continuous innovation in formulation science to maximize the photostability and efficacy of OMC within complex product matrices.

Driving factors for market growth include the robust expansion of the cosmetic and personal care sector in the Asia Pacific region, characterized by rising disposable incomes and a growing trend toward preventative skincare routines. Furthermore, the sustained adoption of broadband protection products, combining both UVA and UVB filters, mandates the inclusion of highly effective UVB absorbers like OMC, reinforcing its indispensable role in modern dermatological and cosmetic science. The market dynamic is further shaped by the ongoing exploration of microencapsulation technologies aimed at improving the safety profile and reducing systemic absorption of UV filters.

Octyl Methoxycinnamate Market Executive Summary

The Octyl Methoxycinnamate (OMC) market exhibits steady growth, primarily fueled by stringent regulatory requirements mandating UV protection in daily consumer products and high consumer expenditure on premium skincare. Business trends indicate a strong move toward sustainable sourcing and manufacturing practices, particularly in developed regions, putting pressure on key manufacturers to optimize synthetic pathways for higher purity and reduced environmental impact. Strategic collaborations between chemical suppliers and major cosmetic houses are frequent, aimed at developing photostable and synergistic UV filter blends, addressing growing concerns over the environmental fate of organic UV filters, particularly their potential impact on coral reef ecosystems.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market segment, driven by large population bases, rapid urbanization, and a cultural emphasis on skin whitening and sun protection. North America and Europe, while mature, remain dominant in terms of consumption value, characterized by high regulatory oversight and consumer demand for multifunctional, high-performance sun protection products. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by increasing discretionary spending and heightened awareness campaigns related to skin health, thereby expanding the consumer base for OMC-containing products.

Segment trends demonstrate the dominance of the emulsified formulation segment (creams, lotions) due to its high use in conventional sunscreens. However, the market is witnessing accelerated growth in hybrid and powder-based formulations, catering to niche demands for lightweight, non-greasy cosmetic applications. Demand based on purity level is becoming critical, with high-purity, pharmaceutical-grade OMC attracting premium pricing for use in sophisticated anti-aging and clinical dermatology products, underscoring the market's differentiation based on quality and certification.

AI Impact Analysis on Octyl Methoxycinnamate Market

User queries frequently revolve around how Artificial Intelligence (AI) can enhance the discovery of next-generation UV filters, optimize OMC production efficiency, and personalize sunscreen formulations. Key concerns include AI's role in addressing the environmental persistence of OMC and predicting potential toxicity profiles, often searched under "AI for sustainable UV filters" or "Machine learning toxicity prediction OMC." Users also inquire about the integration of AI in cosmetic R&D to quickly simulate ingredient stability and interaction, thereby reducing lengthy, traditional lab testing cycles. The overall expectation is that AI will streamline the chemical synthesis process, ensure regulatory compliance through predictive modeling, and revolutionize personalized sun care recommendations based on individual skin types, geographical location, and UV index exposure data, leading to a highly optimized supply chain and improved consumer outcomes.

- AI-driven structure-activity relationship modeling accelerates the identification of novel, safer UV filters, potentially reducing reliance on existing components like OMC.

- Machine learning algorithms optimize OMC batch synthesis parameters, enhancing yield and purity while minimizing energy consumption and waste generation.

- Predictive analytics aids in forecasting consumer preferences for UV protection factors (SPF) and formats, optimizing inventory management and reducing overstocking of specific formulations.

- AI-powered cosmetic formulation systems simulate the photostability and compatibility of OMC with other ingredients, drastically cutting down R&D time and cost.

- Image recognition and deep learning models facilitate personalized sun care recommendations based on real-time skin analysis and environmental data, boosting market specificity.

DRO & Impact Forces Of Octyl Methoxycinnamate Market

The Octyl Methoxycinnamate market is powerfully influenced by the increasing global emphasis on preventative health and wellness, driving consistent demand for UV-protective cosmetics (Driver). However, the market faces significant headwinds due to growing regulatory scrutiny and increasing consumer preference for mineral-based (zinc oxide and titanium dioxide) sunscreens, driven by concerns about organic filters' potential endocrine disruption and environmental impact (Restraint). The core opportunity lies in the development of sophisticated delivery systems, such as nano-encapsulation, that can enhance OMC's efficacy and safety profile while addressing environmental concerns regarding coral bleaching.

The driving forces are multifaceted, centered around escalating consumer awareness regarding the health risks associated with chronic UV exposure, including photoaging and skin cancer. This awareness, propagated by dermatologists and health organizations globally, translates directly into increased market penetration for daily-use SPF products, even outside traditional summer seasons. Furthermore, the inherent stability and cost-effectiveness of OMC compared to some broad-spectrum alternatives ensure its continued preference by mass-market cosmetic manufacturers, maintaining its foundational role in numerous formulations across various price points. Technological advancements focused on increasing the solubility of OMC in different bases also contribute significantly to its versatility and market continuity.

Key restraining forces are predominantly regulatory and environmental. Specific geographical regions, such as Hawaii and parts of the Caribbean, have implemented bans or restrictions on OMC due to its proven negative impact on coral reef ecosystems, compelling manufacturers to seek substitutes or drastically reformulate. Moreover, consumer sentiment, particularly in Western markets, leans towards 'clean beauty' labels and naturally derived ingredients, often leading to skepticism regarding synthetic organic UV filters. These dynamics force industry participants to invest heavily in research to prove the environmental and human safety of OMC or to pivot towards approved mineral alternatives, increasing complexity and compliance costs.

Opportunities for market expansion include targeting underserved geographical regions, particularly in Southeast Asia and Africa, where sunscreen penetration rates are historically low but awareness is rapidly increasing. Furthermore, the development of synergistic filter combinations that reduce the required concentration of OMC while maintaining high SPF ratings presents a substantial commercial opportunity. The pharmaceutical sector also presents a niche opportunity, utilizing high-purity OMC in specialized dermatological treatments and medications requiring photoprotection properties, extending the ingredient's application scope beyond mass-market cosmetics into high-value clinical segments.

Segmentation Analysis

The Octyl Methoxycinnamate (OMC) market is segmented based on application type, formulation type, and grade. Application segmentation is crucial as it determines the volume and regulatory constraints applied to the ingredient, with sun care products representing the largest segment due to the mandated high concentration of UV filters. Formulation type analysis reveals how OMC is incorporated, with oil-in-water emulsions being predominant, though water-in-oil and anhydrous formulations are growing in popularity for specific high-performance or waterproof product lines. Grade segmentation distinguishes between standard cosmetic grade and high-purity pharmaceutical or high-end cosmetic grade, reflecting different pricing and regulatory pathways.

The market bifurcation by formulation type allows manufacturers to strategically align their product development with consumer preferences for texture, feel, and water resistance. While traditional creams and lotions remain market staples, the rising demand for lightweight sprays, gels, and sticks, particularly among younger demographics and athletes, drives innovation in ensuring OMC's even dispersion and photostability in non-traditional carriers. Furthermore, the push towards multifunctional products necessitates specialized formulations where OMC must coexist effectively with other active ingredients like antioxidants, vitamins, and anti-pollutants, adding complexity to the synthesis and blending processes.

Geographic segmentation remains a pivotal element of market analysis, recognizing the vast differences in regulatory acceptance, environmental restrictions, and consumer habits across continents. For instance, the high SPF requirement and daily usage pattern in the Asia Pacific region contrast sharply with the seasonal, high-volume consumption characterizing beach-focused consumption in many Western countries. Understanding these granular differences is essential for effective supply chain management and targeted marketing efforts, ensuring that the specific grade and format of OMC align with regional compliance and end-user expectations.

- By Application:

- Sun Care Products (Sunscreens, After-sun lotions)

- Daily Care Cosmetics (Moisturizers, Foundations, Lip products)

- Hair Care Products (Shampoos, Conditioners, Hair Sprays)

- Anti-aging and Specialized Dermatological Products

- By Formulation Type:

- Creams and Lotions (Emulsified Formulations)

- Gels and Sprays (Aerosols and Non-aerosols)

- Sticks and Waxes (Anhydrous Formulations)

- Powder Formulations

- By Grade:

- Cosmetic Grade (Standard Purity)

- High-Purity Grade (Pharmaceutical/Premium Cosmetics)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Octyl Methoxycinnamate Market

The value chain for Octyl Methoxycinnamate (OMC) initiates with the upstream procurement of essential raw materials, primarily 2-ethylhexanol and methoxycinnamic acid derivatives, which are often petrochemical-derived. The efficiency and cost of OMC production are heavily dependent on the stability and purity of these raw chemical inputs. Major chemical synthesis manufacturers then undertake the esterification process to produce the final OMC product. This upstream segment is highly competitive and relies on large-scale chemical infrastructure, rigorous quality control, and adherence to global manufacturing standards (e.g., GMP) to ensure the required cosmetic grade purity and batch consistency for downstream users.

The middle segment involves the distribution and formulation stages. OMC producers supply the synthesized material directly or indirectly through specialized chemical distributors to contract manufacturers or major cosmetic and personal care brands. These downstream users incorporate OMC into complex formulations alongside other UV filters, solvents, emollients, and stabilizing agents. The formulation stage is critical, requiring advanced R&D capabilities to ensure product stability, photostability, appropriate texture, and compliance with varying regional maximum inclusion limits. Direct distribution channels are often preferred by large, integrated chemical companies supplying multinational cosmetic corporations, ensuring traceability and streamlined logistics.

Indirect channels involve specialized chemical suppliers who often handle smaller volumes or provide customized blends to small-to-mid-sized cosmetic brands, particularly in fragmented regional markets. The end of the chain involves retail and consumer interaction, where the formulated product is marketed through mass retail, pharmacies, specialized beauty stores, and, increasingly, e-commerce platforms. The strong influence of regulatory bodies (FDA, EMA, ASEAN) throughout the value chain, from raw material sourcing to final product labeling, acts as a continuous quality gate, emphasizing safety, efficacy, and environmental accountability, which often necessitates significant investment in testing and certification.

Octyl Methoxycinnamate Market Potential Customers

The primary customers and end-users of Octyl Methoxycinnamate are concentrated within the Personal Care and Cosmetic Manufacturing industry. This includes global multinational corporations (MNCs) specializing in skincare, such as those owning major sun care and daily moisturizer brands, who require high volumes of OMC consistently for their flagship product lines. Secondary, but rapidly growing, customers include specialty contract manufacturers who produce private label cosmetic goods for retailers and small independent beauty brands, leveraging OMC's widespread regulatory acceptance and effectiveness to meet diverse client demands across various SPF ranges.

Dermatological and Pharmaceutical companies constitute a high-value, albeit smaller, customer segment. These entities utilize high-purity OMC in therapeutic applications, such as specialized creams for photosensitivity conditions or pharmaceutical formulations where UV protection is essential to maintain drug efficacy or protect vulnerable skin. These buyers demand stringent purity standards and comprehensive documentation regarding safety and clinical data, often necessitating long-term supply agreements with certified chemical producers.

Furthermore, indirect customers include formulators in the plastics and coatings industry. Although less significant than cosmetics, small volumes of OMC derivatives are sometimes used as UV stabilizers in certain plastics, paints, and textiles to prevent material degradation caused by sunlight exposure. However, the bulk of the market value and consumption volume is consistently driven by the consumer-facing sun care and daily cosmetic sectors, dictating market pricing and production capacity utilization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 370 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symrise AG, BASF SE, Merck KGaA, Ashland Global Holdings Inc., Salicylates and Chemicals Pvt. Ltd., Chemspec, Evonik Industries AG, Guangzhou Sunz Chemicals Co. Ltd., Sigma-Aldrich (Merck), Zhejiang Chemicals, Sunjin Chemical Co. Ltd., Croda International Plc, Hallstar Company, Kobo Products Inc., Clariant AG, Spectrum Chemical Mfg. Corp., B&B Group, Lubrizol Corporation, Sino Lion USA, Greentech SAS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Octyl Methoxycinnamate Market Key Technology Landscape

The technological landscape surrounding the Octyl Methoxycinnamate market is predominantly focused on enhancing its photostability, improving formulation efficacy, and addressing environmental compatibility issues. A crucial technology is microencapsulation, which involves coating OMC particles within inert materials. This technique serves several purposes: it prevents the direct contact of OMC with the skin, reducing the risk of irritation or systemic absorption; it prevents OMC degradation when exposed to UV light, enhancing the SPF longevity; and crucially, it mitigates the ingredient's direct interaction with the environment, thereby potentially reducing its impact on marine ecosystems like coral reefs. Major manufacturers are actively investing in proprietary encapsulation methods to gain a competitive edge by offering safer and more stable versions of the widely used filter.

Another significant technological advancement involves synergistic blending techniques utilizing novel solvent systems and photostabilizers. OMC, when used alone, can exhibit a degree of photo-instability, leading to reduced UV absorption efficiency over time. Research is heavily focused on identifying co-filters (such as octocrylene or specific antioxidants) that, when combined with OMC, form highly stable filter complexes, ensuring the sunscreen maintains its labeled SPF rating throughout the intended period of use. This technology not only boosts performance but also allows formulators to use lower overall concentrations of individual filters while achieving broad-spectrum protection, which can be advantageous in meeting regulatory concentration limits.

Furthermore, advancements in high-throughput screening and computational chemistry are revolutionizing the R&D process. These technologies enable rapid evaluation of OMC derivatives and combination stability, dramatically shortening the product development cycle. Automated formulation robotics are being deployed to test hundreds of variations of OMC-containing emulsions in a fraction of the time required by traditional methods, ensuring optimal dispersion and homogeneous integration into the final cosmetic base. This technological push is vital for rapidly responding to evolving regulatory demands and shifts in consumer preference toward specific textures and application methods.

Regional Highlights

Regional dynamics are critical to understanding the varying usage rates and growth trajectories of Octyl Methoxycinnamate globally. Consumption patterns are heavily influenced by climate, local regulatory frameworks, and cultural beauty standards, leading to distinct market characteristics across major continents.

- Asia Pacific (APAC): APAC represents the highest growth potential due to increasing disposable income, high population density, and a deeply ingrained cultural emphasis on skin protection and whitening. Countries like China, Japan, and South Korea exhibit high per capita spending on daily cosmetic products containing UV filters, driven by preventative skincare routines and preference for high SPF values. The regulatory environment is generally favorable toward OMC use, supporting large-scale manufacturing and consumption.

- North America: A mature market characterized by high consumer awareness and stringent regulatory scrutiny by the FDA. Demand is seasonal, spiking in summer months, but daily usage is growing due to increased awareness of photoaging. The market favors high-quality, broad-spectrum products, but environmental concerns (like the Hawaii ban) are causing some manufacturers to shift towards non-OMC alternatives, particularly in high-end, clean beauty segments.

- Europe: Europe is a highly regulated market under the European Cosmetics Regulation, with clear maximum inclusion limits for OMC. Consumption is stable, driven by both sun care and daily cosmetics. Innovation here focuses on sustainable sourcing and formulations that address the environmental impact narrative. Germany, France, and the UK are major consumption hubs, prioritizing safety and formulation transparency.

- Latin America (LATAM): Showing rapid acceleration, particularly in Brazil and Mexico, driven by increasing middle-class populations and high levels of year-round solar radiation. The market is price-sensitive but increasingly values imported and high-efficacy sun care products, making OMC a cost-effective and reliable choice for local manufacturers seeking to scale production.

- Middle East and Africa (MEA): Emerging market where growth is spurred by high UV intensity and improved consumer access to international cosmetic brands. Key demand centers include the UAE and Saudi Arabia. The primary challenge remains establishing reliable distribution channels and overcoming lower historical usage rates, though awareness campaigns are quickly changing consumer behavior toward daily sun protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Octyl Methoxycinnamate Market.- Symrise AG

- BASF SE

- Merck KGaA

- Ashland Global Holdings Inc.

- Salicylates and Chemicals Pvt. Ltd.

- Chemspec

- Evonik Industries AG

- Guangzhou Sunz Chemicals Co. Ltd.

- Sigma-Aldrich (Merck)

- Zhejiang Chemicals

- Sunjin Chemical Co. Ltd.

- Croda International Plc

- Hallstar Company

- Kobo Products Inc.

- Clariant AG

- Spectrum Chemical Mfg. Corp.

- B&B Group

- Lubrizol Corporation

- Sino Lion USA

- Greentech SAS

Frequently Asked Questions

Analyze common user questions about the Octyl Methoxycinnamate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Octyl Methoxycinnamate (OMC) and what are its primary uses in cosmetics?

Octyl Methoxycinnamate, also known as Ethylhexyl Methoxycinnamate, is a synthetic organic chemical compound widely used as a UVB filter in cosmetic and personal care products. Its primary function is to absorb UVB radiation, protecting skin from sunburn and preventing photoaging, making it a key ingredient in sunscreens, foundations, and daily moisturizers globally.

Is Octyl Methoxycinnamate considered safe for human use?

OMC is generally recognized as safe (GRAS) for use in cosmetics within established regulatory concentration limits (typically up to 7.5% or 10%, depending on the region). While some studies have raised concerns about potential endocrine disruption at high concentrations, major health bodies like the FDA and European Commission currently approve its use under specified conditions, prioritizing effective UV protection.

How do environmental regulations impact the future growth of the OMC market?

Environmental regulations, particularly those banning or restricting OMC due to its potential link to coral reef bleaching (e.g., in Hawaii and certain Caribbean nations), pose a significant restraint. These regulations drive market innovation toward microencapsulation technologies and biodegradable alternatives, influencing long-term formulation strategies for manufacturers operating in eco-sensitive regions.

Which segment contributes most significantly to the Octyl Methoxycinnamate market share?

The Sun Care Products segment contributes the most significant share to the OMC market. This dominance is attributed to the high concentration of OMC required in sunscreens to achieve medium to high Sun Protection Factor (SPF) ratings, driving substantial volume demand compared to lower inclusion rates in daily care cosmetics like lip balms and facial creams.

What are the current technological trends driving innovation for OMC?

The primary technological trend is the use of microencapsulation to improve OMC photostability, reduce systemic absorption, and mitigate environmental toxicity. Additionally, advances in synergistic blending with photostabilizers and computational chemistry are utilized to create high-performance, broad-spectrum, and regulatory-compliant UV filter systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager