ODN Optical Communication Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437315 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

ODN Optical Communication Box Market Size

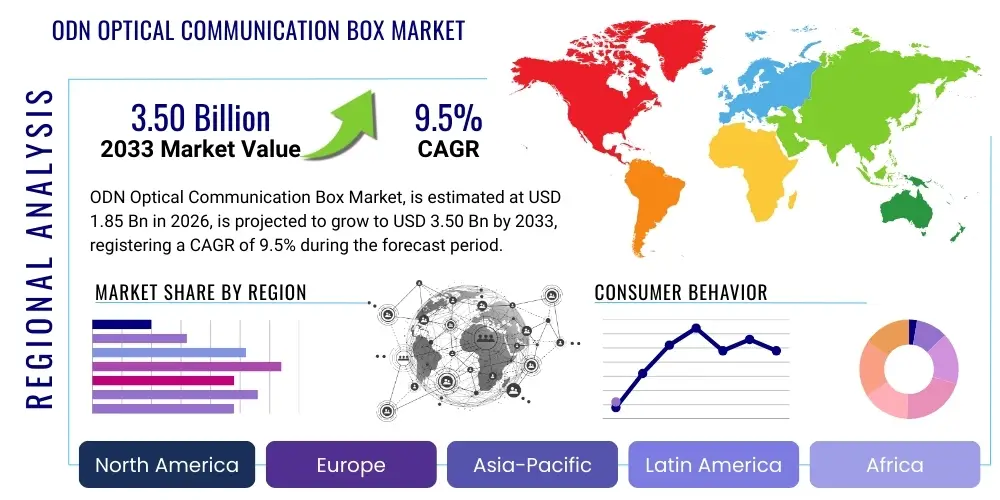

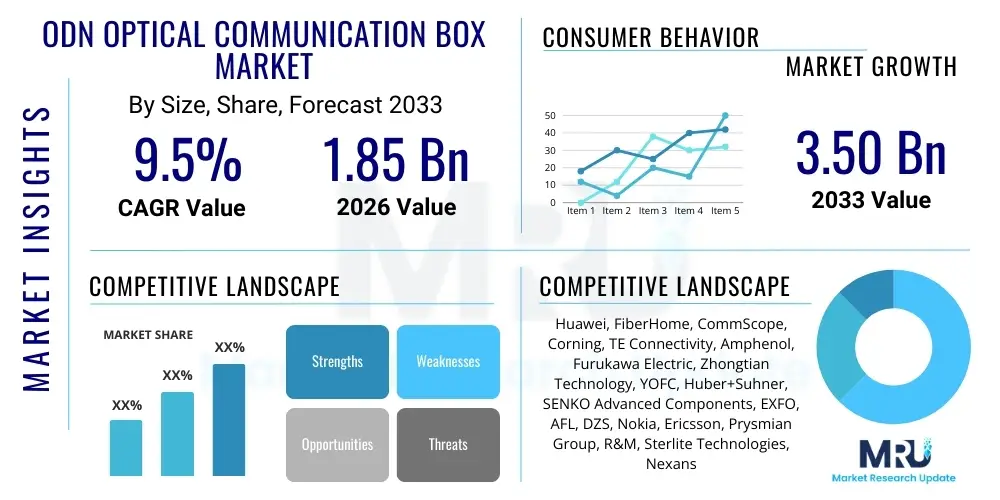

The ODN Optical Communication Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.50 Billion by the end of the forecast period in 2033.

ODN Optical Communication Box Market introduction

The Optical Distribution Network (ODN) Optical Communication Box Market encompasses crucial infrastructure components essential for connecting the fiber optic cables from the Central Office (CO) or local exchange to the end-user premises, forming the passive optical network (PON). These enclosures are fundamental building blocks of Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), and Fiber-to-the-Curb (FTTC) architectures, serving as organized, protected points for performing critical fiber management functions such as splicing, termination, splitting, and patching. They are engineered to provide environmental protection and physical security for delicate fiber optic splices, connectors, and passive optical splitters, which are susceptible to damage from moisture, dust, and mechanical stress in diverse deployment scenarios. The market is driven by the global imperative to upgrade legacy copper networks to high-capacity fiber infrastructure capable of supporting the exponentially growing data requirements of modern digital economies, positioning the ODN box as an indispensable component in telecommunication capital expenditure planning.

Product variety within this highly specialized market segment is substantial, tailored to meet specific environmental and technical demands. The portfolio includes robust pole-mounted enclosures, optimized for aerial distribution in suburban and rural areas where above-ground cabling is cost-efficient; wall-mounted boxes, frequently deployed in the basements or exterior walls of multi-dwelling units (MDUs) or commercial properties; and high-density, rack-mounted distribution units, integral to organized cable management within controlled indoor environments such as carrier central offices or major data centers. Each type is designed with specific functional features, such as varying levels of ingress protection (IP ratings), tamper-proof locking mechanisms, and innovative fiber storage methods to maintain the minimum permissible bend radius, thus ensuring optimal optical signal transmission performance and long-term network reliability. These devices facilitate the systematic organization of complex fiber branching, making troubleshooting and future capacity expansion more efficient and less labor-intensive for network technicians.

The major applications span the entire spectrum of modern connectivity infrastructure. Telecom operators utilize them extensively for residential and commercial broadband rollout, responding to the relentless consumer demand for bandwidth driven by services like 4K/8K video streaming, augmented reality (AR), virtual reality (VR), and large-scale cloud computing access. Furthermore, the accelerating global deployment of 5G mobile networks represents a rapidly expanding application segment, as 5G necessitates deep fiber penetration (front-haul and backhaul) to support dense small cell clusters, requiring robust and compact ODN boxes in highly distributed locations. The foundational benefits provided by these boxes—enhanced scalability, simplified maintenance protocols, minimized signal loss through organized management, and superior physical protection—collectively underpin the market's consistent growth trajectory, making them a strategic investment for network operators aiming to future-proof their assets against inevitable increases in network traffic volume.

ODN Optical Communication Box Market Executive Summary

The ODN Optical Communication Box Market is undergoing significant strategic evolution, primarily influenced by accelerated global FTTH deployment goals and the stringent requirements imposed by 5G network densification. Business trends are heavily focused on innovation in modularity and ease of installation, leading to a strong preference for pre-connectorized solutions that drastically cut down on field labor time and expertise required for complex fiber splicing. Key manufacturers are differentiating themselves through product design, emphasizing higher fiber density in smaller, lighter enclosures, optimizing material science for enhanced environmental resilience (e.g., advanced UV resistance and IP ratings), and developing standardized, customizable platforms that can seamlessly integrate passive components like splitters and wavelength division multiplexers (WDMs). Strategic alliances and partnerships between ODN manufacturers and large Tier 1 telecom operators are critical for securing long-term supply contracts and driving standardized product development aligned with major network architecture plans.

Regionally, the market's center of gravity remains firmly established in the Asia Pacific (APAC), which commands the largest share due to vast fiber rollout projects in populous nations such as China and India, supported by favorable regulatory environments and high competitive intensity among service providers. North America and Europe, while mature, demonstrate robust growth driven by mandatory broadband coverage expansion, government subsidy programs (like RDOF in the US), and ongoing network upgrades to next-generation PON technologies (NG-PON2, XGS-PON). The highest growth momentum, however, is being observed in emerging markets across Latin America and the Middle East & Africa (MEA), where new, large-scale greenfield network buildouts are beginning, leading to significant initial capital investment in foundational infrastructure components like high-capacity distribution boxes. These regions demand durable, cost-effective solutions capable of enduring unique local environmental challenges, such as extreme heat and dust.

Segment trends confirm that the Fiber-to-the-Home (FTTH) application retains its position as the primary market driver by volume and value, yet the Mobile Backhaul segment, particularly in relation to 5G infrastructure, is experiencing the fastest expansion. This surge is creating a distinct demand for specialized outdoor ODN boxes engineered for quick deployment near tower sites and small cells, emphasizing compact form factors and high resistance to physical tampering. Furthermore, there is a clear migration across all segments toward boxes with substantially higher fiber core capacity (48 cores and above), reflecting operators' strategic planning to build networks with sufficient headroom for future bandwidth demands and rapid technological transitions. The rack-mounted segment is also seeing innovation driven by data center requirements for ultra-high density and simplified patch cord management within confined, controlled server environments, emphasizing the multifaceted nature of demand within the overall ODN communication box ecosystem.

AI Impact Analysis on ODN Optical Communication Box Market

The pervasive discussion around Artificial Intelligence (AI) and Machine Learning (ML) impacts the ODN Optical Communication Box market primarily at the layer of network management, planning, and predictive maintenance, rather than the physical manufacturing of the passive enclosures. Common inquiries from network planners and operators focus heavily on leveraging AI to resolve network complexity arising from highly distributed infrastructure. Specific user questions include: "Can AI optimize the placement of thousands of ODN boxes to minimize fiber length and maximize coverage in a new city rollout?" and "How can AI models predict the failure of passive components, such as stress fractures or connector degradation, within these outdoor boxes before service is affected?" The core consensus is that while the box remains passive hardware, AI serves as the intelligent layer that ensures its efficient utilization and extended functional life.

AI's role in the ODN market is transformative for planning and operational efficiency. During the initial planning phase, sophisticated ML algorithms process vast datasets—including GIS mapping, existing infrastructure layouts, demographic projections, and historical network load data—to generate optimized distribution architectures. This process determines the ideal location, capacity requirements, and specific mounting type (pole vs. wall vs. underground) for every communication box across a geographical area. By automating this complex network design, AI significantly reduces engineering time, minimizes errors inherent in manual planning, and ensures capital expenditure is allocated precisely where it yields maximum coverage and network performance. Furthermore, AI systems continuously monitor the deployed network's performance against the initial design, identifying bottlenecks or underutilized segments which may inform future box placement and configuration adjustments during subsequent network expansion phases.

Operationally, AI contributes profoundly to network reliability through advanced predictive maintenance capabilities. Although ODN boxes are passive, their environment and the connectors they protect are subject to degradation. By integrating environmental sensors (temperature, humidity) near or within the enclosure and monitoring real-time optical performance parameters (like insertion loss or return loss across the splitter), AI models can detect minute deviations indicative of impending failure, such as moisture ingress or micro-bending stress on fibers due to environmental shifts. This proactive identification allows operators to dispatch maintenance crews to the exact ODN box location before a failure occurs, dramatically reducing Mean Time To Repair (MTTR) and improving overall Service Level Agreement (SLA) adherence. Moreover, AI aids in managing the complex inventory and configuration records associated with thousands of individual splice points and customer connections housed within the distributed ODN boxes, streamlining auditing and asset management processes crucial for network regulatory compliance and billing accuracy.

- AI-Driven Network Planning and Optimization: Algorithms analyze topographical and demand data to determine the most cost-effective and highest-performing locations for ODN infrastructure deployment.

- Predictive Maintenance and Failure Prediction: ML utilizes telemetry from passive network monitoring systems to predict potential degradation or environmental breaches affecting specific communication boxes.

- Automated Inventory and Asset Management: AI tracks the full lifecycle and physical connectivity maps within highly dense ODN enclosures, simplifying network documentation and scaling.

- Enhanced Troubleshooting Efficiency: AI pinpoints physical fault locations down to the specific ODN box and internal fiber component, significantly cutting down diagnostic time for field technicians.

- Optimized Resource Allocation: ML models assist in dynamically routing fiber capacity and reallocating resources utilizing the physical infrastructure provided by the box, supporting future self-optimizing network concepts.

DRO & Impact Forces Of ODN Optical Communication Box Market

The ODN Optical Communication Box Market is propelled by powerful macro-economic and technological drivers, yet restrained by critical logistical and financial bottlenecks, creating a dynamic environment full of strategic opportunities. The paramount driver remains the ceaseless, exponentially increasing global consumption of data, compelling governments and telecom giants alike to fund ambitious national fiber optic infrastructure projects. The shift from 4G to 5G, demanding fiber proximity to virtually every cell tower, acts as an accelerator, ensuring sustained high demand for distribution and termination points. Furthermore, the supportive regulatory environment in numerous countries, which often mandates minimum broadband speeds and offers subsidies for rural deployment, provides a predictable foundation for market growth, encouraging long-term investment by ODN component suppliers and manufacturers.

Despite robust demand, the market faces significant restraints. The initial capital expenditure required for laying the fiber infrastructure, which the ODN boxes terminate, is exceptionally high, potentially slowing the pace of deployment in economically volatile regions or forcing operators to delay expansion until sufficient financing is secured. Logistically, the installation of ODN boxes and the subsequent precise fusion splicing requires a highly skilled technical workforce, which is often in short supply globally, particularly in emerging markets, leading to increased labor costs and slower project timelines. Furthermore, securing permits, rights-of-way, and dealing with environmental protection regulations in densely populated or historically sensitive urban areas pose persistent logistical and time-related restraints on timely infrastructure deployment.

Key opportunities for market participants center on leveraging technological migration and geographic expansion. The transition toward next-generation Passive Optical Networks (NG-PON2, XGS-PON) necessitates the replacement or upgrade of existing ODN components to ensure compatibility with higher spectral efficiency and increased capacity, driving a replacement cycle that complements greenfield deployments. Geographically, underserved regions in Africa, Southeast Asia, and Latin America represent vast untapped markets where initial fiber penetration is low, offering significant first-mover advantage for manufacturers willing to invest in localized distribution and product customization suitable for local conditions. The rising trend of smart city initiatives further opens up opportunities for specialized ODN boxes that can house not only fiber terminations but also integration points for smart sensors, IoT backhaul, and utility management systems.

- Drivers (D): Global surge in demand for high-speed fiber broadband (FTTX); Government mandates and subsidies promoting universal connectivity; Accelerating deployment of 5G mobile networks requiring fiber densification; Increased adoption of cloud computing and bandwidth-intensive services.

- Restraints (R): High upfront capital expenditure requirements for large-scale fiber network construction; Shortage of skilled technical personnel for precise fiber installation and splicing; Regulatory bureaucracy and complexities in obtaining local deployment permissions; Price sensitivity pressure from large telecom operators demanding high volumes at lower unit costs.

- Opportunities (O): Replacement and upgrade cycle driven by migration to XGS-PON and NG-PON2 technologies; Rapid market expansion in underserved regions (LATAM, MEA, Southeast Asia); Integration of ODN components into Smart City and Industrial IoT infrastructure projects; Development of sustainable, environmentally friendly enclosure materials.

- Impact Forces: Technological standardization across ITU-T and IEEE protocols ensuring interoperability; Global supply chain resilience and material cost fluctuations (especially polymers); Environmental sustainability mandates influencing material choice and product lifespan; Competitive pressure driving modularity and pre-connectorized solutions.

Segmentation Analysis

Segmentation analysis of the ODN Optical Communication Box Market provides a critical framework for understanding demand heterogeneity across various deployment environments and functional requirements. The market is primarily segmented based on the physical configuration and method of installation, which fundamentally determines the product's design, robustness, and internal fiber management layout. Manufacturers must adhere to stringent design specifications for each segment: for instance, pole-mounted boxes require specialized mounting hardware and exceptional resistance to wind, moisture, and theft, whereas rack-mounted units emphasize rapid access, standardized sizing (1U, 2U, 4U), and cable routing within highly structured data center environments. This stratification allows for precise targeting of components to network specific needs, maximizing efficiency and minimizing field-related performance issues.

Fiber Count Capacity forms another crucial segmentation axis, directly correlating with the box's function within the network hierarchy. Smaller capacity boxes (1-16 cores) are typically utilized as Fiber Terminal Boxes (FTB) at the absolute endpoint, serving individual homes or small buildings (FTTU). Conversely, high-density boxes (48+ cores) serve as Primary or Secondary Distribution Points (FDP or FDT), managing massive fiber bundles that branch out to multiple street cabinets or access points. The accelerating trend towards higher core counts is universally observed, driven by the need for network future-proofing and the economic efficiency of running larger fiber cables during the initial civil works, subsequently requiring communication boxes capable of efficiently managing and protecting this increasing fiber volume within constrained physical spaces.

The segmentation by application further distinguishes market needs based on the end-use environment and traffic profile. FTTH/FTTB remains the bedrock of demand, dictating high volumes of standardized products. The mobile backhaul application, however, requires ODN boxes optimized for proximity to active electronics, demanding superior thermal performance, compact size, and enhanced security measures against vandalism, reflective of the critical nature of 5G infrastructure. Enterprise and data center segments focus heavily on management features like accessibility, label standardization, and compatibility with automated fiber management systems (AFMS), prioritizing operational speed and maintenance ease over purely cost-driven factors. Analyzing these segments allows manufacturers to tailor features such as splitter packaging (cassette vs. bare fiber) and cable entry methods (grommets vs. glands) to meet the highly specialized demands of each distinct application environment.

- By Type:

- Wall-mounted

- Pole-mounted/Aerial

- Rack-mounted

- Underground/Pedestal

- By Fiber Count Capacity:

- 1 to 4 Cores

- 8 to 16 Cores

- 24 to 48 Cores

- 48 Cores and above (High Density)

- By Application:

- Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB)

- Mobile Backhaul and Front-haul (5G Networks)

- Data Centers and Enterprise Networks

- Industrial and Specialized Networks

Value Chain Analysis For ODN Optical Communication Box Market

The value chain for the ODN Optical Communication Box Market is intrinsically linked to global industrial material markets and telecom infrastructure deployment cycles. It commences with the sourcing of essential raw materials, chiefly specialized engineering polymers (such as impact-resistant polycarbonate and fire-retardant thermoplastics) alongside metal alloys for internal mechanisms and securing components. Manufacturers often engage in long-term supply agreements with specialized chemical and molding companies to secure consistent quality materials that meet critical specifications, including specified UV degradation resistance and environmental safety standards (e.g., ROHS compliance). The upstream segment also includes the providers of critical optical components, namely PLC (Planar Lightwave Circuit) splitters and fusion splice sleeves, the performance of which directly impacts the box's functional capability and signal efficiency, emphasizing the need for robust quality control at this stage.

The manufacturing stage involves highly automated processes, including injection molding, precise component integration, and quality assurance testing (such as temperature cycling and ingress protection verification). A critical aspect of the midstream value chain is the integration of customization and assembly, particularly for pre-connectorized solutions, which require high-precision factory termination and testing of optical connectors before shipment. Distribution is executed through highly specialized channels, reflecting the technical nature of the product. Large Tier 1 telecom operators typically engage in direct procurement and customized supply contracts, demanding tailored logistics and just-in-time delivery for massive rollout projects. Conversely, smaller operators and network integrators rely heavily on an indirect channel of global and regional distributors, who offer inventory stocking, technical support, and localized delivery services, often bundled with other active equipment and installation services, forming a comprehensive procurement solution for localized projects.

The downstream segment encompasses the installation, system integration, and end-user utilization phases. Network integrators and EPC contractors are crucial partners, responsible for the physical deployment of the boxes, field splicing, and final network commissioning. The ultimate success of the ODN product is realized by the end-users—the telecom service providers—who leverage the boxes to deliver reliable broadband service to millions of customers. The continuous cycle of maintenance, repair, and future network expansion drives replacement and upgrade demand, particularly as operators move to higher-speed PON iterations. Efficiency in the downstream value chain relies heavily on the design features of the ODN box—namely, ease of access, clearly marked fiber routing, and technician-friendly modularity—as these attributes directly minimize maintenance complexity and operational expenditure (OPEX) over the system's intended lifespan.

ODN Optical Communication Box Market Potential Customers

The core customer base for the ODN Optical Communication Box Market consists overwhelmingly of global and national Telecommunication Service Providers (TSPs) and Mobile Network Operators (MNOs). These entities are the primary buyers, initiating vast procurement cycles to acquire the necessary passive infrastructure for their greenfield FTTH builds and brownfield network upgrades. Tier 1 TSPs, such as major national carriers, typically require customized, large-volume solutions adhering to proprietary engineering standards, focusing procurement decisions on reliability, scalability, and long-term cost of ownership. Tier 2 and Tier 3 regional and municipal network operators also represent significant buyers, often relying more heavily on standardized, off-the-shelf products supplied via specialized distribution partners due to smaller purchase volumes and less in-house engineering capacity.

A burgeoning and strategically vital customer segment includes specialized independent infrastructure owners and Tower Companies (Towercos). These companies, focused solely on infrastructure and leasing capacity to MNOs, are essential purchasers of robust, high-density ODN boxes to support 5G mobile backhaul and front-haul connectivity to their distributed cell tower and small cell assets. Their requirements prioritize extreme environmental resilience, compactness, and rapid deployment features (like pre-connectorization) to minimize civil works disruption and speed time-to-market for mobile services. Furthermore, Utilities and Energy companies, particularly those deploying Smart Grid technologies, increasingly require specialized optical communication boxes for their internal monitoring and data networks, often demanding products certified for deployment within challenging environments subject to electromagnetic interference or high voltage proximity.

Additionally, large-scale systems integrators, master distributors, and global Engineering, Procurement, and Construction (EPC) firms play an important intermediary role, acting as high-volume buyers on behalf of the ultimate network owner. These entities often manage the entire deployment process, purchasing standardized or bespoke ODN solutions bundled with fiber cable, splitters, and active electronics. Finally, the Data Center and Enterprise sectors represent a concentrated demand point for the rack-mounted segment, where IT managers purchase high-density optical distribution frames and boxes to manage the massive fiber interconnectivity required for cloud services, intra-data center links, and high-performance computing environments, placing a strong emphasis on modularity and superior cable management features to optimize space utilization within expensive rack real estate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huawei, FiberHome, CommScope, Corning, TE Connectivity, Amphenol, Furukawa Electric, Zhongtian Technology, YOFC, Huber+Suhner, SENKO Advanced Components, EXFO, AFL, DZS, Nokia, Ericsson, Prysmian Group, R&M, Sterlite Technologies, Nexans |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ODN Optical Communication Box Market Key Technology Landscape

The technological evolution within the ODN Optical Communication Box Market is characterized by continuous innovation aimed at reducing deployment complexity and enhancing long-term operational resilience, driven by the demands of ever-increasing bandwidth and distributed network architectures. A cornerstone technology is the utilization of advanced polymer chemistry for the enclosure material. Manufacturers are increasingly adopting high-performance engineered thermoplastics and fiberglass-reinforced polyester (SMC) composites that offer superior resistance to environmental stressors. These materials provide high impact strength, excellent fire-retardancy (meeting UL 94 standards), and, critically for outdoor use, enhanced ultraviolet (UV) stabilization, ensuring the physical integrity and aesthetic appearance of the box are maintained over decades of exposure to harsh solar radiation and temperature extremes, directly impacting the network's overall lifespan and mean-time-between-failure (MTBF).

Furthermore, the focus on rapid and foolproof installation has driven significant technological advancements in connectivity methods. The move away from mandatory field fusion splicing towards pre-connectorized and hardened drop cable assemblies is revolutionizing deployment efficiency. Pre-connectorized ODN boxes utilize factory-terminated optical connectors (often IP-rated and hardened, such as HMFOC or OptiTap equivalents) that require simple plug-and-play mating in the field. This technology drastically cuts the time required for subscriber connection, eliminates the need for expensive splicing equipment on-site, and minimizes the risk of human error associated with precision fiber work. This shift is critical for operators engaged in mass-market FTTH deployments, where deployment speed directly translates into faster revenue generation and reduced overall installation costs, making the design and optimization of internal fiber management trays and routing mechanisms a key competitive technology area.

Internal fiber management and passive component integration represent another critical technological frontier. Modern ODN boxes incorporate sophisticated, tiered splice trays and fiber slack storage systems engineered to maintain the minimum bend radius required for high-performance G.657.A2 fibers, preventing signal attenuation and loss. Miniaturization of optical components, such as micro-splitters and compact wave division multiplexers (WDMs), allows manufacturers to achieve ultra-high fiber density (e.g., 96 cores in a standard enclosure size) without compromising fiber manageability or accessibility for technicians. The integration of advanced features, such as modular stacking capabilities for future expansion and passive monitoring test ports (for in-service network verification), highlights the ongoing technological push to make the ODN communication box not just a passive protector, but a flexible, scalable, and technician-friendly hub capable of supporting future generations of optical transmission standards.

Regional Highlights

Asia Pacific (APAC) stands as the undeniable leader in the ODN Optical Communication Box Market, accounting for the largest share in both production capacity and consumption volume. This dominance is primarily attributed to the massive scale of fiber infrastructure projects initiated by governments and state-owned enterprises, particularly in China and India, which view nationwide broadband access as a strategic national priority. The region benefits from a highly competitive manufacturing base, leading to rapid iteration of high-density, cost-optimized products. Market maturity varies significantly; while countries like South Korea and Japan are focused on upgrading to advanced 10G-PON systems requiring component compatibility and replacement cycles, nations in Southeast Asia (e.g., Vietnam, Indonesia) are in aggressive greenfield deployment phases, generating sustained, high-volume demand for foundational distribution boxes and terminal units.

North America and Europe constitute high-value markets where growth is driven by quality, reliability, and network optimization rather than sheer volume alone. In North America, the market is characterized by significant capital expenditure programs aimed at expanding fiber deep into rural and suburban areas, often backed by substantial governmental funding mechanisms designed to close the digital divide. European growth is sustained by regulatory pressures and national goals to achieve 100% gigabit connectivity by the end of the decade. Both regions exhibit a strong preference for pre-connectorized solutions and modular ODN systems that adhere to rigorous quality standards (e.g., Telcordia GR-326 in North America) and prioritize rapid deployment to manage high labor costs. Competition in these areas focuses on advanced features, ease of integration with existing network monitoring systems, and superior physical durability against temperate weather conditions.

The Latin America (LATAM) and Middle East & Africa (MEA) regions collectively represent the areas of highest projected percentage growth over the forecast period. LATAM's expansion is decentralized, driven by numerous smaller, dynamic regional operators aggressively overbuilding legacy infrastructure, particularly in Brazil, Mexico, and Colombia. These markets seek robust, mid-range capacity ODN boxes that offer a strong balance between cost and performance, with a growing emphasis on anti-vandalism features due to security concerns. The MEA market, driven by oil-wealthy nations and large infrastructure investments in high-growth African economies, demands high-performance solutions tailored to withstand extreme environmental challenges, such as desert heat and high dust levels, requiring specialized materials and superior sealing technology (IP68). The deployment scale in MEA, particularly for large smart city projects, makes it a critical long-term strategic target for global ODN manufacturers.

- Asia Pacific (APAC): Highest volume and market share; driven by FTTH mandates in China and India; focus on competitive pricing, high fiber density, and mass production efficiency; leading in component manufacturing and supply chain integration.

- North America: Stable, high-value market; growth accelerated by rural broadband subsidies and aggressive overbuilds; stringent quality requirements and high adoption rate of labor-saving pre-connectorized technology.

- Europe: Growth sustained by national regulatory mandates for ubiquitous gigabit access; emphasis on standardized, easily deployable, and environmentally compliant optical connectivity solutions across urban and regional networks.

- Latin America (LATAM): High growth potential fueled by economic development and new private telecom investments; demand for cost-effective, durable products; anti-vandalism features are increasingly important.

- Middle East and Africa (MEA): Fastest percentage growth driven by large-scale government infrastructure and smart city development; demand for highly resilient, high IP-rated products capable of functioning reliably in extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ODN Optical Communication Box Market.- Huawei Technologies Co. Ltd.

- FiberHome Telecommunication Technologies Co. Ltd.

- CommScope Holding Company Inc.

- Corning Incorporated

- TE Connectivity Ltd.

- Amphenol Corporation

- Furukawa Electric Co. Ltd.

- Zhongtian Technology (ZTT)

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

- Huber+Suhner AG

- SENKO Advanced Components Inc.

- EXFO Inc.

- AFL Telecommunications (Fujikura)

- DZS Inc.

- Nokia Corporation

- Ericsson AB

- Prysmian Group

- R&M (Reichle & De-Massari AG)

- Sterlite Technologies Limited (STL)

- Nexans SA

Frequently Asked Questions

Analyze common user questions about the ODN Optical Communication Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an ODN Optical Communication Box?

The primary function of an ODN Optical Communication Box, or FDB, is to serve as a passive junction point in the fiber optic network, protecting, splicing, distributing, and managing the optical fibers that run between the central office and the end-user premises, ensuring signal integrity in the last mile of FTTX infrastructure.

How does 5G deployment impact the demand for ODN Communication Boxes?

5G deployment significantly increases demand because 5G requires ultra-dense fiber connectivity (backhaul/front-haul) to small cell sites, necessitating the widespread deployment of rugged, high-capacity, pole-mounted ODN boxes closer to the user to support high bandwidth and low latency requirements, driving segmentation growth in outdoor solutions.

What are the key differences between wall-mounted and pole-mounted ODN boxes?

Wall-mounted boxes are typically designed for indoor or building entry points, often featuring lower fiber counts and less stringent IP ratings. Pole-mounted boxes are robust, outdoor-rated (usually IP65/IP67 or higher), and built to withstand harsh weather and UV exposure, accommodating medium to high fiber counts for distributing signals across wide geographical areas.

What key material features are critical for modern outdoor ODN enclosures?

Critical material features include high Ingress Protection (IP) ratings (e.g., IP67) for water and dust resistance, excellent UV stabilization to prevent plastic degradation from solar radiation, fire-retardant properties (UL 94), and high mechanical strength to resist physical impact and tampering over a long operational lifespan.

What is the role of pre-connectorization technology in the ODN market?

Pre-connectorization technology simplifies and accelerates network deployment by replacing complex on-site fusion splicing with factory-terminated, plug-and-play connections. This lowers installation costs, reduces required technician skill levels, and minimizes deployment errors, greatly enhancing overall project efficiency and speed-to-market for network operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager