Odour Control Textiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436822 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Odour Control Textiles Market Size

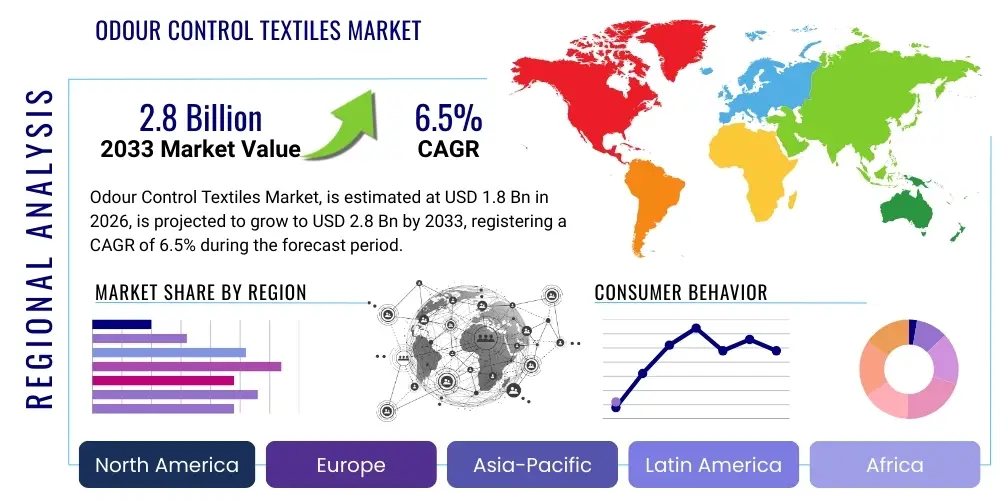

The Odour Control Textiles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 billion in 2026 and is projected to reach USD 2.8 billion by the end of the forecast period in 2033.

Odour Control Textiles Market introduction

The Odour Control Textiles Market encompasses fabrics and fibers engineered with specialized finishes or inherent structures designed to neutralize, absorb, or inhibit the growth of odor-causing microbes, primarily bacteria and fungi. These textiles are essential in applications where hygiene, freshness, and sustained comfort are paramount. The underlying technology typically involves surface modifications using antimicrobial agents, such as silver ions or copper, or adsorption mechanisms utilizing activated carbon or zeolite, effectively trapping volatile organic compounds (VOCs) and preventing their release. The increasing consumer demand for activewear and athleisure, coupled with heightened awareness regarding hygiene, particularly post-pandemic, are fundamentally driving the adoption of these advanced textile solutions across various sectors globally.

Key applications of odour control textiles span high-performance sportswear, where sweat management and repeated use necessitate durable anti-odor properties, and medical and healthcare settings, where infection control and patient comfort are critical. Additionally, their usage extends to military uniforms, protective gear, automotive upholstery, and specialized footwear. The integration of these functional properties enhances the value proposition of end products, moving beyond mere aesthetics and comfort to address functional health and longevity requirements. The market is characterized by ongoing innovation focused on developing sustainable and non-leaching technologies that maintain efficacy through numerous wash cycles while minimizing environmental impact.

The primary benefits driving this market include enhanced consumer confidence, extended textile lifespan by minimizing microbial degradation, and the reduction of washing frequency, which aligns with sustainability trends. Driving factors involve rising disposable income leading to increased expenditure on premium functional apparel, stringent health regulations in clinical environments necessitating sterile textiles, and continuous technological advancements improving the efficiency and durability of odour control finishes, making them cost-effective for mass-market adoption.

Odour Control Textiles Market Executive Summary

The Odour Control Textiles Market is experiencing robust expansion driven by converging business trends, including the rapid globalization of the high-performance apparel industry and a persistent focus on sustainable textile processing. Business trends indicate a shift toward bio-based and non-biocidal anti-odor solutions, moving away from heavy metal chemistries like silver, due to regulatory pressures and consumer preferences for eco-friendly products. Strategic collaborations between chemical manufacturers and textile producers are increasing, aiming to create integrated supply chains that embed anti-odor technology at the fiber level rather than as a topical finish, thereby enhancing durability and performance across diverse consumer goods and industrial applications.

Regionally, North America and Europe remain the dominant markets, characterized by high consumer spending on athletic wear, strict healthcare textile standards, and strong innovation ecosystems that facilitate the rapid commercialization of new technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding manufacturing capabilities, the emergence of a large middle class with increasing demand for quality apparel, and significant investment in healthcare infrastructure, particularly in countries like China and India. Latin America and the Middle East & Africa (MEA) are emerging, primarily driven by growth in sports events, military modernization programs, and localized demand for protective clothing.

Segment trends reveal that the use of antimicrobial agents, particularly silver-based solutions, currently holds the largest market share due to established efficacy and wide adoption, although nanotechnology and adsorption technologies are gaining significant traction. In terms of application, the Sportswear segment dominates, intrinsically linked to rising global participation in fitness activities and the commercial success of athleisure. Within materials, synthetic fabrics like polyester and nylon are preferred platforms for odour control treatments due to their lower inherent moisture absorption and compatibility with chemical finishes, contrasting with natural fibers which require more intensive treatments to achieve comparable odour management properties.

AI Impact Analysis on Odour Control Textiles Market

Common user questions regarding AI's influence center on how artificial intelligence can optimize the development, manufacturing, and application of odour control textiles. Users frequently inquire about AI's role in predicting the optimal combination of chemical agents for maximum microbial inhibition, customizing textile treatments based on environmental or user-specific factors, and enhancing quality control during the coating process. Key themes revolve around leveraging AI for predictive analytics concerning material durability, simulating the long-term effectiveness of non-biocidal treatments, and establishing smart, responsive textiles capable of dynamically activating odour absorption based on real-time sweat or humidity detection. Users expect AI to drive efficiency gains in R&D, leading to faster time-to-market for novel, highly specialized odour control solutions while maintaining strict adherence to regulatory compliance and sustainability goals.

- AI-driven optimization of chemical formulation processes, reducing the need for extensive physical trials and minimizing waste.

- Predictive modeling of antimicrobial efficacy and wash durability based on fiber type and treatment concentration, enhancing product lifespan.

- Automated quality inspection systems utilizing machine learning to detect inconsistencies in textile coatings or fiber integration during manufacturing.

- Development of smart textiles using AI to analyze wear patterns and environmental data, enabling dynamic control over odour management function.

- Improved supply chain management and demand forecasting for specialized anti-odor raw materials (e.g., silver salts, activated carbon powders).

- Personalized textile design recommendations based on consumer biometric data and typical activity levels, maximizing odour control efficacy for individual users.

DRO & Impact Forces Of Odour Control Textiles Market

The Odour Control Textiles Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its trajectory. Primary drivers include the surging global demand for high-performance sports apparel, where functional properties are non-negotiable, and increasing consumer focus on personal hygiene and wellness, accelerating the adoption of treated textiles in everyday clothing and home furnishings. Furthermore, the imperative within medical settings to control hospital-acquired infections (HAIs) provides substantial impetus for incorporating anti-microbial and odour control finishes into uniforms, bedding, and surgical drapes, mandating a higher standard of textile cleanliness and sustainability across the value chain. These forces collectively push manufacturers toward continuous innovation and integration of advanced functional finishes.

Conversely, significant restraints hinder growth, notably the stringent and evolving regulatory landscape surrounding biocides, particularly in major markets like the EU (BPR – Biocidal Products Regulation), which challenges the widespread use of established silver and heavy metal technologies due to concerns over environmental toxicity and potential leaching into water systems. The high cost associated with advanced odour control treatments, such as encapsulated nanoparticles or plasma-based finishes, acts as a barrier to entry, particularly for value-segment apparel manufacturers. Furthermore, consumer skepticism regarding the long-term effectiveness and potential health risks of certain chemical treatments necessitates extensive validation and transparent labeling, requiring significant investment in consumer education and robust testing methodologies.

The market presents substantial opportunities stemming from the growing trend toward sustainable and bio-based anti-odor solutions, including natural materials like chitosan, organic compounds, and plant-derived extracts, which mitigate regulatory risks associated with synthetic biocides and appeal to eco-conscious consumers. The untapped potential in industrial and protective wear, specifically in demanding environments like mining, oil and gas, and food processing, offers specialized niches for durable, high-efficacy odour control textiles. Furthermore, the integration of multi-functional textiles that combine odour control with features like UV protection, moisture-wicking, and temperature regulation presents a compelling value proposition that fuels product diversification and market expansion, especially within the rapidly growing athleisure category globally.

Segmentation Analysis

The Odour Control Textiles market is extensively segmented based on the underlying technology utilized, the material composition of the textiles, and the final application area. This segmentation provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across different product categories. Technological segmentation distinguishes between physical mechanisms (adsorption) and chemical/biological mechanisms (antimicrobial agents and nanotechnology). The choice of technology is often dictated by the required durability, the cost tolerance of the end product, and the regulatory environment of the target market. Application areas, such as sportswear versus healthcare, demand fundamentally different performance characteristics, driving specific innovations within each segment.

- By Technology:

- Adsorption Technology (e.g., Activated Carbon, Zeolites)

- Antimicrobial Agents

- Silver-based

- Copper-based

- Zinc-based

- Non-metal Organic Compounds (e.g., Chitosan, Quaternary Ammonium Compounds)

- Nanotechnology (e.g., Nano-silver, TiO2 nanoparticles)

- Encapsulation Technology

- By Material:

- Natural Fibers (e.g., Cotton, Wool, Hemp)

- Synthetic Fibers (e.g., Polyester, Nylon, Polypropylene)

- By Application:

- Sportswear and Athleisure

- Footwear

- Medical and Healthcare Textiles (e.g., Scrubs, Bedding, Wound Dressings)

- Military and Protective Clothing

- Industrial and Corporate Wear

- Home Textiles (e.g., Upholstery, Carpets)

Value Chain Analysis For Odour Control Textiles Market

The value chain for Odour Control Textiles begins with upstream activities, involving raw material sourcing, predominantly synthetic fiber polymers (polyester, nylon) and natural fibers (cotton, wool), alongside specialized chemical and material suppliers who produce the active anti-odor agents (silver ions, carbon particles, specialized polymers). Innovation in this upstream segment focuses on embedding the functional properties directly into the fiber during extrusion, or developing highly durable, compliant topical finishes. Key players here are chemical companies specializing in textile finishes, focused on meeting increasingly stringent environmental and safety standards while ensuring high wash durability.

Midstream activities involve textile manufacturing, which includes yarn production, knitting, weaving, dyeing, and the crucial finishing processes where the anti-odor treatment is applied, either through pad-dry-cure methods, exhaustion processes, or specialized coating techniques. This stage is dominated by large-scale textile mills and technical textile manufacturers who require significant capital investment in machinery and process control to ensure even application and consistency across large production batches. Quality control and performance validation, especially resistance to microbial growth after multiple washes, are critical competitive differentiators at this stage.

Downstream distribution channels involve the movement of finished functional textiles or garments to end-users. Direct channels are common for large volume buyers, such as major sportswear brands (Nike, Adidas) or military contractors, who source textiles directly from specialized mills. Indirect channels include distributors, agents, and wholesalers who supply smaller apparel manufacturers, retail chains, and specialized markets (e.g., medical supply distributors). Retail and e-commerce platforms form the final link, with marketing often emphasizing the functional benefits (freshness, hygiene) to differentiate the product, concluding the value chain flow to the final consumer or institutional buyer.

Odour Control Textiles Market Potential Customers

The primary consumers and end-users of odour control textiles are highly diversified, ranging from individual consumers seeking performance advantages in daily life to large institutional buyers with stringent health and safety requirements. The largest segment of potential customers resides within the performance apparel sector, specifically manufacturers and consumers of high-end athletic wear, outdoor gear, and casual athleisure clothing, who value sustained freshness and durability. These customers are willing to pay a premium for technology that enhances comfort and reduces laundry frequency, directly addressing key pain points associated with synthetic materials used in strenuous activities.

A second crucial customer segment involves the healthcare and medical industry. Hospitals, clinics, and long-term care facilities are major purchasers of odour control textiles for uniforms, patient gowns, bedding, and wound dressings, driven primarily by the need for infection control and maintaining sterile environments. Regulatory compliance and proven efficacy against pathogenic bacteria are paramount for these institutional buyers, making them highly selective and focused on certified, durable solutions. This segment often demands textiles that can withstand harsh industrial laundering cycles without degradation of the anti-odor or anti-microbial properties.

Finally, military and defense organizations, along with industrial sectors requiring protective clothing (e.g., food processing, chemical handling), represent significant potential customers. Military applications require textiles that perform under extreme conditions, offering extended wearability without odor buildup, which is crucial for operational effectiveness and troop morale during prolonged missions. Industrial customers seek textiles that improve worker hygiene and compliance, viewing odour control as part of a broader safety and operational efficiency mandate, driving specialized demand for highly robust, fire-retardant, and odour-managing composite materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sciessent, Polygiene AB, Sanitized AG, Microban International, BASF SE, Dow Inc., Noble Biomaterials, Rudolf GmbH, Sinterama S.p.A., Vestagen Technical Textiles, Vancogenix, Smiths Detection, Balenciaga (textile innovation division), Brrr°, Devan Chemicals, Schoeller Textil AG, Pally Hi GmbH, Huntsman Corporation, Milliken & Company, Ciba Specialty Chemicals (now part of BASF). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Odour Control Textiles Market Key Technology Landscape

The technological landscape of the Odour Control Textiles Market is highly competitive and rapidly evolving, dominated by two fundamental approaches: antimicrobial treatments and adsorption/neutralization methods. Antimicrobial technologies, such as those employing silver ions or zinc compounds, aim to kill or inhibit the proliferation of odor-causing microorganisms, thereby preventing the formation of volatile organic compounds (VOCs). Silver-based treatments remain highly prevalent due to their broad-spectrum efficacy and established track record, though the market is increasingly exploring non-leaching, encapsulated versions to address environmental concerns related to metal release. Newer chemical approaches leverage quaternary ammonium compounds (QACs) or specialized organic compounds that physically disrupt microbial cell walls.

Adsorption technologies, primarily utilizing activated carbon, charcoal, or zeolite particles, function by physically trapping and binding odor molecules within the textile structure. These materials are often integrated into textile fibers or applied as micro-encapsulated coatings, providing a passive mechanism for odour control that is non-biocidal. Activated carbon is particularly effective in highly demanding environments, such as military or industrial protective wear, where immediate and robust absorption of a wide range of chemical odors is necessary. Recent innovation focuses on developing thinner, more flexible, and regenerable adsorption layers that maintain high air permeability and comfort, overcoming previous limitations related to bulkiness or stiffness.

A significant area of innovation involves nanotechnology and the development of sustainable, bio-based alternatives. Nanotechnology utilizes extremely fine particles, such as nano-silver or titanium dioxide (TiO2), to maximize surface area contact and enhance antimicrobial activity at lower concentrations. Simultaneously, the market is shifting towards bio-based solutions derived from sources like chitosan (from crustacean shells) or essential oils, appealing to consumer desire for natural and environmentally benign products. Future growth is anticipated in smart textiles, which might integrate micro-sensors and active material layers capable of dynamically releasing neutralizing agents or cycling adsorption capabilities in response to real-time environmental inputs, driven by advancements in material science and functional finishes.

Regional Highlights

Regional dynamics significantly influence the adoption and technological development within the Odour Control Textiles Market, reflecting varying levels of industrialization, consumer spending power, and regulatory stringency across geographical areas. North America stands as a dominant market, largely driven by high consumer adoption of branded sportswear and athleisure, coupled with substantial military and defense procurement of specialized technical textiles. The region benefits from early technology adoption, high awareness of hygiene products, and significant R&D investment in advanced functional finishes, particularly in bio-based and non-leaching solutions, aligning with stringent national and state-level environmental regulations. Major apparel companies and textile innovators headquartered here continuously push the boundaries of performance and sustainability, creating a robust demand ecosystem.

Europe represents another mature and highly regulated market, where demand is fueled by sophisticated consumer preferences for quality, durability, and strong regulatory frameworks, notably the Biocidal Products Regulation (BPR). This has necessitated a strong focus on developing silver-alternative and sustainable anti-odor technologies that demonstrate minimal environmental impact. Germany, Italy, and the UK are key countries, characterized by strong textile manufacturing traditions and a leading role in technical textiles for medical and industrial applications. The emphasis in Europe is placed heavily on certified sustainability and transparency in material sourcing and processing, often exceeding global benchmarks for environmental compliance.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This expansion is attributed to the presence of large textile manufacturing hubs (China, India, Vietnam), rapidly growing disposable incomes, increasing health consciousness, and burgeoning domestic demand for performance and casual wear. Furthermore, significant investment in healthcare infrastructure and rapid urbanization across major economies are driving the institutional adoption of functional textiles. While regulatory standards are catching up to Western levels, the immediate growth driver remains the cost-effective production capacity combined with vast, untapped consumer markets demanding improved product quality and functional benefits in their clothing and home goods.

- North America: Market leader driven by high sportswear consumption, military contracts, and advanced R&D in sustainable biocidal alternatives.

- Europe: High growth focused on regulatory compliance (BPR), strong preference for sustainable and bio-based treatments, and established technical textile segments (medical, protective wear).

- Asia Pacific (APAC): Fastest growing region, fueled by expanding manufacturing capabilities, increasing middle-class expenditure on premium goods, and large-scale industrial textile consumption.

- Latin America: Emerging market growth linked to rising sports participation and local production of athletic and casual apparel.

- Middle East & Africa (MEA): Growth driven by modernization of military uniforms and localized demand for textiles suitable for hot climates, requiring robust moisture and odour management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Odour Control Textiles Market.- Sciessent

- Polygiene AB

- Sanitized AG

- Microban International

- BASF SE

- Dow Inc.

- Noble Biomaterials

- Rudolf GmbH

- Sinterama S.p.A.

- Vestagen Technical Textiles

- Vancogenix

- Smiths Detection

- Balenciaga (textile innovation division)

- Brrr°

- Devan Chemicals

- Schoeller Textil AG

- Pally Hi GmbH

- Huntsman Corporation

- Milliken & Company

- Ciba Specialty Chemicals (now part of BASF)

Frequently Asked Questions

Analyze common user questions about the Odour Control Textiles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology used for odour control in textiles?

The primary technologies include antimicrobial agents, such as silver ions or copper, which inhibit microbial growth, and adsorption methods, typically using activated carbon or zeolites, which physically trap odor molecules. Antimicrobial technologies currently hold the largest market share due to their proven efficacy.

Are odour control textiles safe and sustainable?

Safety is a key concern, driving a market shift toward sustainable, non-leaching, and bio-based treatments (like chitosan) to replace traditional heavy-metal biocides. Many manufacturers comply with strict standards like OEKO-TEX and BPR to ensure long-term consumer and environmental safety.

Which application segment drives the highest demand for these textiles?

The Sportswear and Athleisure segment is the largest driver of demand, owing to the high performance requirements of athletic apparel for moisture management, hygiene, and sustained freshness across numerous wash cycles. Medical and healthcare applications follow closely due to hygiene mandates.

How durable are odour control finishes through repeated washing?

Durability varies by technology; newer technologies, especially those where the functional agent is embedded into the fiber structure or protected by durable encapsulation, offer robust performance lasting up to 50 or more industrial wash cycles, significantly outperforming traditional topical finishes.

What is the key regulatory challenge facing the market?

The most significant challenge is the evolving global regulation of biocides, particularly the European Union's Biocidal Products Regulation (BPR), which imposes strict testing and registration requirements on active substances, pushing manufacturers to innovate non-biocidal or highly compliant alternative solutions.

The Odour Control Textiles Market is a sector defined by the intersection of performance, hygiene, and sustainability, positioning it for consistent growth driven by consumer health consciousness and regulatory pressures for environmentally sound textile processing. The shift toward bio-based and non-biocidal solutions represents a critical strategic imperative for market participants seeking competitive advantage and long-term regulatory compliance. Regional growth in APAC, coupled with continuous innovation in nanotechnology and smart textile functionalities, ensures the market remains dynamic and technologically sophisticated, moving far beyond simple deodorization to offer comprehensive, high-value textile solutions. The ongoing integration of AI in R&D promises to further accelerate the development cycle, leading to highly customized and durable functional fabrics across all major application sectors, solidifying the market's trajectory towards the projected USD 2.8 billion valuation by 2033. Investment in transparent sourcing, validated performance claims, and environmentally responsible manufacturing practices will be essential for retaining market leadership and capturing growth in sensitive institutional segments like healthcare and defense, while also appealing to the discerning modern consumer.

Technological advancement focusing on sustained efficacy without compromising textile hand-feel or breathability is crucial, particularly in the premium athleisure segment. Companies that successfully navigate the regulatory complexities associated with antimicrobial agents and invest in next-generation adsorption technologies, capable of neutralizing complex odor profiles efficiently, are likely to dominate future market share. The competitive landscape is becoming increasingly focused on vertical integration, where chemical suppliers partner closely with textile finishers and brand owners to ensure functional performance specifications are met from fiber extrusion to final garment assembly. This holistic approach to functional textile development is vital for overcoming restraints related to high production costs and ensuring the consistent quality demanded by global supply chains, ultimately benefiting end-users across all application segments, from medical facilities requiring sterile environments to elite athletes seeking peak performance gear.

Furthermore, the opportunity presented by untapped industrial and protective wear markets—where odors often stem from chemical exposures rather than microbial growth—requires specialized material science and bespoke solutions that differ significantly from consumer apparel. Developing odour control textiles that also offer inherent flame resistance, cut resistance, or enhanced visibility will unlock new revenue streams and establish specialized market niches. The increasing use of recycled and sustainable base materials in combination with advanced odour control finishes also aligns powerfully with global corporate social responsibility (CSR) goals, making these textiles highly attractive to large global brands committed to reducing their environmental footprint. The strategic importance of odour control textiles is moving from a luxury feature to a fundamental expectation, underpinning its stable and accelerating growth forecast through the next decade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager