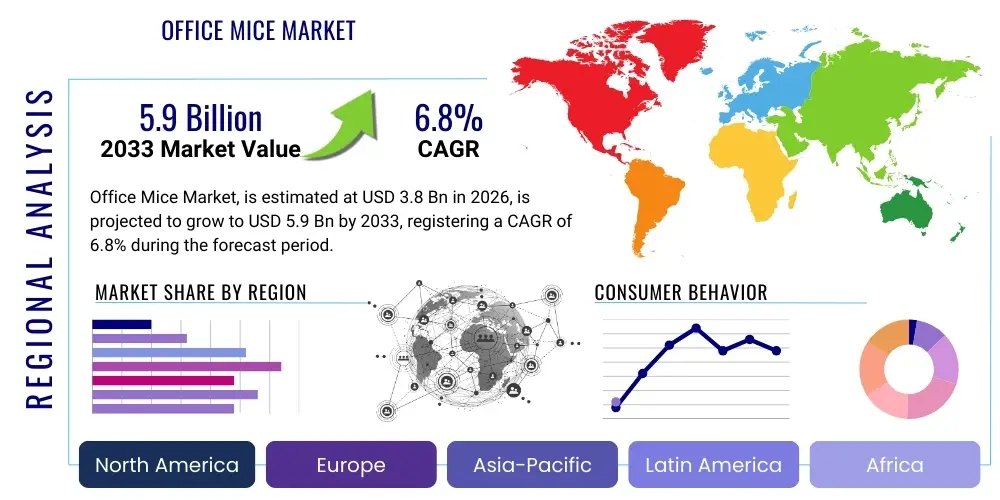

Office Mice Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434517 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Office Mice Market Size

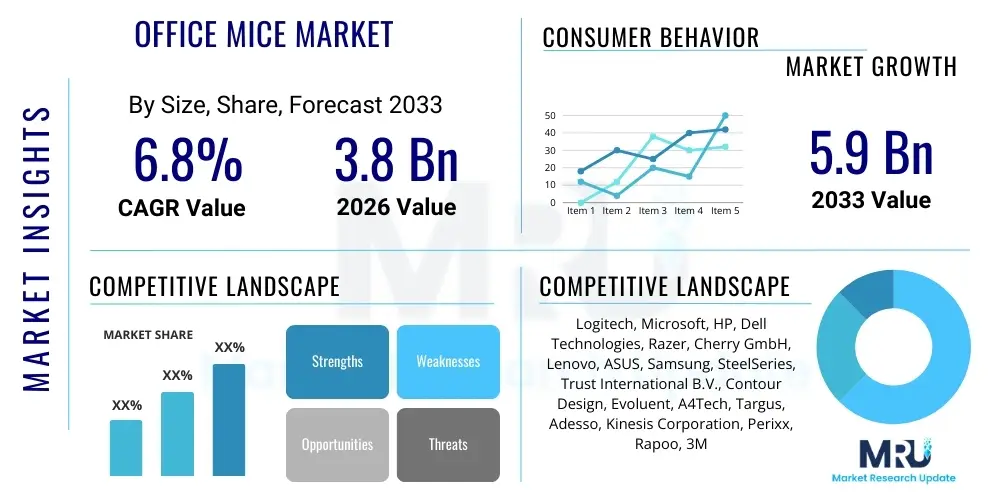

The Office Mice Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.8 Billion in 2026 and is projected to reach $5.9 Billion by the end of the forecast period in 2033.

Office Mice Market introduction

The Office Mice Market encompasses the manufacturing, distribution, and sales of input devices designed specifically for professional and corporate environments, prioritizing ergonomics, precision, and robust connectivity. These peripherals are essential tools for interacting with digital interfaces, driving productivity across various sectors, including finance, IT, education, and government. Modern office mice have evolved significantly beyond basic optical sensors, incorporating advanced features such as customizable buttons, seamless multi-device switching capabilities, long-lasting battery life, and materials promoting environmental sustainability. The fundamental purpose remains enhancing user efficiency and reducing the strain associated with prolonged computer use.

The rising prevalence of remote work models, hybrid office structures, and the continuous digitalization of business operations globally serve as primary market catalysts. As organizations invest heavily in optimizing employee workspaces, both at home and in centralized offices, the demand for high-quality, reliable, and ergonomically superior pointing devices accelerates. Product descriptions now frequently emphasize features like silent clicks, high DPI (dots per inch) tracking for large monitors, and secure wireless protocols (like proprietary 2.4 GHz connections and advanced Bluetooth standards) to meet enterprise security requirements.

Major applications of office mice span general administrative tasks, complex data analysis, graphic design, and precise content creation, differentiating them from their gaming counterparts by focusing on comfort and sustained performance rather than extreme speed or complex macros. The key benefits driving adoption include improved employee well-being due to ergonomic designs (reducing risk of Carpal Tunnel Syndrome), enhanced workflow efficiency through customizable shortcut features, and greater flexibility offered by wireless technology. The continuous influx of technology, particularly in sensor accuracy and battery technology, further fuels market expansion, making older models obsolete and necessitating upgrades.

Office Mice Market Executive Summary

The global Office Mice Market is characterized by robust growth, primarily driven by seismic shifts in working models post-2020 and a sustained corporate focus on ergonomic compliance and productivity enhancement. Business trends indicate a strong move toward premiumization, where end-users are increasingly willing to pay higher prices for advanced ergonomic features, superior build quality, and multi-host connectivity options crucial for managing multiple devices simultaneously. Competition is intense, forcing manufacturers to innovate rapidly, integrating features such as rechargeable lithium-ion batteries and bio-based plastics to appeal to environmentally conscious businesses, solidifying the trend of functional aesthetics combined with sustainability efforts.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, fueled by burgeoning IT and service industries, massive urbanization, and increased consumer disposable income leading to higher technology adoption rates in countries like India and China. North America and Europe, while mature, maintain dominant market shares due to high corporate spending on technology infrastructure upgrades and stringent occupational health standards that mandate ergonomic equipment provision. The competitive landscape in these regions necessitates strategic partnerships between hardware manufacturers and large enterprise IT procurement firms to secure bulk contracts, focusing heavily on total cost of ownership (TCO) and device management software compatibility.

Segmentation trends reveal that the Wireless Mice segment holds the largest revenue share, reflecting the widespread desire for clutter-free workspaces and mobility within hybrid work settings. Within connectivity, Bluetooth technology is gaining momentum over traditional 2.4 GHz proprietary dongles, offering better multi-device integration, particularly with modern laptops and tablets. Ergonomics remains the critical segmentation driver, with vertically oriented and sculpted mice seeing accelerated demand as users seek preventive measures against Repetitive Strain Injuries (RSI). The optical sensor type dominates due to cost-effectiveness and reliable tracking, though laser sensors retain a niche in specific high-precision, industrial design applications.

AI Impact Analysis on Office Mice Market

User inquiries regarding the impact of Artificial Intelligence on the Office Mice Market frequently revolve around whether AI will automate tasks currently performed via mouse input, the integration of smart features into peripheral devices, and how AI-driven analytics might personalize the user experience or ergonomics. Key themes emerging from this analysis include the potential for voice commands and gesture controls, powered by AI processing, to reduce dependency on physical clicking and pointing. Users are concerned about obsolescence but simultaneously expect mice to become 'smarter'—perhaps offering haptic feedback based on AI analysis of application context or automatically adjusting DPI settings based on the task being performed (e.g., fine-tuning for photo editing vs. coarse movement for window management). Expectations center on AI enhancing rather than replacing the fundamental input function, transforming the mouse into an intelligent interface tool.

The tangible impact of AI currently manifests primarily in the supply chain and manufacturing optimization, enabling manufacturers to predict demand more accurately and refine production quality. However, the future trajectory points towards embedded AI capabilities. This includes AI-powered predictive ergonomics, where the device tracks micro-movements and posture, offering real-time corrective feedback or suggesting breaks. AI algorithms can also be used to optimize power consumption in wireless mice, learning usage patterns to maximize battery life without compromising responsiveness. This shift will transform the office mouse from a passive input device into an active participant in digital workflow management, catering specifically to user efficiency and health metrics analyzed in real-time.

Furthermore, AI plays a crucial role in improving input precision through sophisticated sensor calibration and predictive movement algorithms, especially important when dealing with high-resolution monitors where minute movements translate to significant cursor displacement. While AI has not replaced the physical mouse, it is becoming foundational to the next generation of office peripherals, driving innovation in areas like adaptive input mapping and seamless device hand-off across complex computing environments. This integration will mandate stronger computational components within the mice themselves, or highly optimized connectivity to host systems capable of low-latency AI processing.

- AI enhances sensor accuracy and predictive cursor movement, particularly on high-DPI displays.

- AI-driven ergonomics monitor usage patterns to provide personalized health feedback and posture correction.

- Predictive analytics optimize inventory and manufacturing processes, improving supply chain efficiency.

- Integration potential for voice commands and gesture controls reducing reliance on conventional clicking.

- Smart power management algorithms extend wireless mouse battery life based on learned user activity profiles.

DRO & Impact Forces Of Office Mice Market

The dynamics of the Office Mice Market are shaped by powerful Drivers, structural Restraints, and significant Opportunities, which collectively form the Impact Forces dictating market trajectory. The primary driver is the global permanence of hybrid and remote work models, compelling both employers and individuals to invest in personalized, high-performance input devices to maintain productivity outside traditional office settings. Coupled with this is the accelerating demand for ergonomic solutions due to increased awareness of work-related musculoskeletal disorders (WMSDs). Conversely, the market faces restraints such as intense price competition in the basic segment, the high initial cost of advanced ergonomic peripherals, and the rapid obsolescence cycle driven by technology upgrades (e.g., the move from older Bluetooth standards to newer, more efficient versions), which creates consumer hesitation regarding large upfront investments.

Opportunities for growth lie prominently in emerging markets, where rapid commercialization and digitalization create vast untapped demand for professional-grade peripherals. Significant potential also exists in the development of sustainable products utilizing recycled and bio-based materials, aligning with corporate sustainability mandates and appealing to eco-conscious consumers. The integration of advanced security features, such as encrypted wireless transmission and biometric authentication within the mouse itself, presents a high-value niche addressing enterprise security concerns. These elements interact with the Impact Forces, where high corporate profitability and IT spending amplify the drivers, while global economic instability and supply chain disruptions can exacerbate the restraints.

The impact forces determine strategic entry and exit points for manufacturers, favoring those who can balance innovation with cost-efficiency and robust supply chain management. For instance, the stringent regulatory environment in developed economies requiring ergonomic compliance acts as an impact force pushing manufacturers towards specialized designs, creating barriers to entry for low-cost, non-compliant manufacturers. Ultimately, market evolution is centered on the continuous pursuit of productivity maximization, making any device that can prove a measurable uplift in efficiency a compelling investment for businesses, regardless of the initial cost, thus elevating the significance of quality and feature sets over mere price point.

Segmentation Analysis

The Office Mice Market is highly segmented based on key parameters including connectivity technology, sensor type, design, and end-user application, allowing manufacturers to precisely target various operational and ergonomic needs within the professional landscape. This granular segmentation is essential for understanding purchasing behavior, which ranges from cost-sensitive bulk procurement of basic wired models for educational institutions to high-investment procurement of advanced, rechargeable, ergonomic wireless mice for executive and specialized professional use. The primary segmentation criterion, connectivity, dictates device flexibility and user experience, with wireless solutions increasingly dominating due to the desire for minimalist, adaptable workspaces.

Further analysis reveals deep segmentation within design ergonomics, distinguishing between standard symmetrical mice, ergonomic sculpted mice designed for palm support, and highly specialized vertical mice aimed at mitigating forearm pronation and wrist discomfort. These design differentiations are crucial drivers of market value, with specialized ergonomic segments commanding premium pricing. Sensor type segmentation is relatively stable, with optical sensors providing the best balance of cost, performance, and surface compatibility for general office use, while laser sensors are reserved for specific environments requiring tracking on reflective or glass surfaces, though this demand is becoming less pronounced as optical technology improves.

The importance of segmentation analysis lies in identifying high-growth sub-markets and tailoring product development accordingly. For instance, the increasing adoption of unified communication platforms drives demand for mice featuring integrated shortcut buttons for quick access to virtual meeting controls (e.g., mute, video toggle). Understanding the intersection of these segments—such as rechargeable Bluetooth vertical mice targeting IT professionals—allows companies to optimize marketing spend and inventory management, ensuring product availability meets the specific requirements of the modern, sophisticated office environment.

- Connectivity Type: Wireless (Bluetooth, 2.4 GHz Proprietary), Wired (USB-A, USB-C)

- Sensor Technology: Optical Sensor, Laser Sensor

- Design Type: Standard/Symmetrical, Sculpted/Ergonomic, Vertical Mice, Trackball Mice

- End-User Application: Corporate Offices, Educational Institutions, Government Sector, Home Offices/SOHO (Small Office/Home Office)

- Sales Channel: Online Retail, Offline Retail (Specialty Stores, Electronics Outlets), Institutional/B2B Sales

Value Chain Analysis For Office Mice Market

The Value Chain for the Office Mice Market begins with upstream activities focused on raw material sourcing and component manufacturing, which are critical for determining the final product quality and cost structure. Key upstream components include advanced sensor chips (optical/laser), microcontrollers, polymer resins for casing, and rechargeable battery cells (lithium-ion). Component suppliers, often concentrated in East Asia, exert significant influence over pricing and availability, particularly for high-performance sensors. Managing stable supply chains for these crucial technical components is paramount, necessitating long-term contracts and diversification of suppliers to mitigate geopolitical or logistical risks. Furthermore, compliance with environmental regulations regarding material sourcing, such as RoHS and REACH, is integrated at this stage.

The mid-stream encompasses the assembly, manufacturing, and quality assurance processes, followed by downstream activities involving distribution and retail. Manufacturing typically involves high-volume automated assembly lines to meet global demand, with a focus on precision engineering, especially for ergonomic features and button durability. Downstream distribution is segmented into direct channels (B2B sales to large corporations and direct-to-consumer via e-commerce platforms) and indirect channels (wholesalers, regional distributors, and traditional physical retailers). B2B sales are vital for securing large, recurring revenues and providing custom enterprise solutions, while indirect channels ensure broad market reach and consumer accessibility.

The effectiveness of the distribution channel significantly impacts market penetration and brand visibility. E-commerce platforms, representing the direct channel, offer manufacturers higher margins and faster access to consumer data, enabling agile product updates and targeted marketing. Conversely, indirect sales through major electronics retailers provide essential visibility and touch-and-feel opportunities for ergonomic products. The overall profitability of the market heavily depends on optimizing logistics and inventory management across this complex web, ensuring that the premium price points commanded by ergonomic and high-performance mice are maintained through efficient component sourcing and streamlined delivery processes to both corporate and individual end-users.

Office Mice Market Potential Customers

The potential customer base for the Office Mice Market is expansive and highly diverse, encompassing virtually every entity that relies on desktop or portable computing for professional activities. The largest segment remains the traditional corporate office environment, spanning multinational corporations, small and medium enterprises (SMEs), and various professional service industries such as legal, financial, and consulting firms. These buyers prioritize bulk purchasing efficiency, enterprise-grade reliability, compatibility with existing IT infrastructure, and robust security features required for corporate deployments. Procurement decisions are often centralized, focusing on standardizing equipment to facilitate easier maintenance and technical support across the organization.

A rapidly expanding customer segment includes employees operating in hybrid and fully remote work settings, often categorized under the SOHO (Small Office/Home Office) category. These end-users typically act as individual buyers, prioritizing personal comfort, high-end ergonomics, multi-device connectivity (Bluetooth), and aesthetic design tailored to their personal workspace. Demand in this segment is less driven by bulk pricing and more by product reviews, brand reputation, and specific features that enhance individual productivity and comfort, such as vertical mice or silent-click technology necessary for shared home environments.

Other significant end-users include governmental organizations, healthcare providers, and educational institutions. Government and healthcare sectors require highly durable, secure peripherals that often meet specific accessibility standards and regulatory compliance protocols. Educational environments, ranging from universities to public schools, typically drive demand for cost-effective, durable, and easily maintainable wired mice for computer labs. Suppliers must develop distinct product lines and pricing strategies to effectively address the unique functional, budgetary, and procurement requirements of each of these diverse customer groups, ranging from large B2B contracts to direct-to-consumer retail sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.8 Billion |

| Market Forecast in 2033 | $5.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Logitech, Microsoft, HP, Dell Technologies, Razer, Cherry GmbH, Lenovo, ASUS, Samsung, SteelSeries, Trust International B.V., Contour Design, Evoluent, A4Tech, Targus, Adesso, Kinesis Corporation, Perixx, Rapoo, 3M |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Office Mice Market Key Technology Landscape

The technology landscape of the Office Mice Market is predominantly defined by advancements in sensor performance, connectivity protocols, and ergonomic engineering materials. Modern office mice rely heavily on high-precision optical sensors, often utilizing Darkfield or similar proprietary technology, capable of tracking accurately on unconventional surfaces, including glass and high-gloss finishes. This technological refinement allows users greater flexibility, reducing reliance on mouse pads. Simultaneously, the transition from older incandescent LED tracking to energy-efficient, high-resolution laser and invisible light sensors has dramatically improved both tracking speed (DPI) and power consumption, which is critical for wireless devices expected to last months on a single charge.

Connectivity standards represent another major technological battleground. While 2.4 GHz wireless with a proprietary USB receiver offers low latency favored by some professionals, Bluetooth Low Energy (BLE) connectivity is rapidly becoming the standard, providing multi-device pairing capabilities, reduced power draw, and eliminating the need for a dedicated dongle. Leading manufacturers integrate smart switching technology that allows seamless transition between multiple paired devices, such as a desktop PC, laptop, and tablet, using a single physical switch. Furthermore, the integration of USB-C charging ports is replacing micro-USB, aligning office peripherals with modern device standards for faster, reversible charging.

Ergonomic technology focuses heavily on materials science and structural design. Innovations include adjustable palm rests, modular components to fit different hand sizes, and the use of sustainable, recycled plastics (PCR plastic) to meet environmental goals without compromising durability. The development of silent-click mechanisms, which utilize dampened internal switches, addresses the noise pollution concerns prevalent in open-plan office environments. These technological improvements collectively raise the barrier to entry for new players and drive the replacement cycle for existing enterprise infrastructure, underscoring the market's continuous evolution towards devices that are smarter, quieter, and healthier for prolonged use.

Regional Highlights

- North America (NA)

- Dominant market share due to high IT expenditure and robust corporate infrastructure.

- High adoption rate of premium, specialized ergonomic mice.

- Focus on enterprise security features and software integration.

- Europe

- Growth driven by stringent ergonomic and workplace safety regulations.

- High demand for sustainable and environmentally compliant products.

- Strong consumer preference for silent-click technology in crowded office environments.

- Asia Pacific (APAC)

- Highest growth rate driven by rapid industrialization and IT sector expansion.

- Dual market demand: high volume/low cost and growing premium ergonomic segment.

- Critical region for global manufacturing and supply chain operations.

- Latin America (LATAM)

- Moderate growth rate dominated by major economies (Brazil, Mexico).

- Significant price sensitivity favoring budget and mid-range devices.

- Distribution complexity requiring strong local partnerships.

- Middle East and Africa (MEA)

- High demand for premium products in GCC countries due to infrastructure investment.

- Wired and basic mice dominate less affluent African sub-regions.

- Growth closely tied to regional economic diversification and digital transformation initiatives.

North America holds a significant share of the global Office Mice Market, driven by high corporate spending on information technology, stringent ergonomic regulations, and the early adoption of hybrid work models. The region, particularly the United States and Canada, features a high density of global corporations and tech firms that consistently invest in premium, high-specification input devices to maximize employee productivity. Demand here is characterized by a strong preference for wireless connectivity (Bluetooth and advanced proprietary 2.4 GHz) and specialized ergonomic designs, such as vertical and contoured mice, reflecting a mature market focus on employee health and wellness programs.

The competitive landscape in North America is dominated by major global brands, focusing intensely on brand loyalty, security features, and integration with enterprise device management software. Key procurement decisions often hinge on factors beyond price, prioritizing long-term durability, extended warranty services, and compliance with accessibility standards. Furthermore, the strong presence of independent professional users and creators contributes significantly to the SOHO segment, driving demand for technologically advanced mice offering high DPI precision and multi-host pairing capabilities.

The European market for office mice is characterized by steady, stable growth, heavily influenced by strict labor laws regarding workplace safety and ergonomics, particularly in Western European nations like Germany, the UK, and France. These regulations mandate employers to provide suitable, often ergonomically certified, equipment, boosting the demand for specialized, high-quality input devices. Sustainability and corporate social responsibility (CSR) initiatives are particularly strong drivers in Europe, leading to higher demand for mice made from recycled materials and featuring sustainable packaging. This preference for 'green tech' influences procurement decisions across both public and private sectors.

European consumers demonstrate a strong preference for reliable, durable products, leading to a longer replacement cycle compared to APAC, but a higher average selling price (ASP) for purchased units. The increasing popularity of open-plan offices further fuels the demand for silent-click technology, minimizing auditory distractions. Market penetration is also high for Bluetooth-enabled devices, facilitating seamless integration with the mobile computing devices prevalent across the continent.

APAC is projected to be the fastest-growing region in the Office Mice Market, propelled by rapid urbanization, massive growth in the IT and BPO (Business Process Outsourcing) sectors, and the expanding middle class’s capacity for consumer spending. Countries such as China, India, and Southeast Asian nations are experiencing massive enterprise digitization, creating vast new opportunities for both basic wired mice in high-volume settings (e.g., call centers) and advanced wireless devices for the burgeoning tech hubs.

While the market is competitive in the low-cost segment, there is increasing demand for mid-range and premium ergonomic products as corporate cultures align with Western standards of employee wellness. Manufacturing capacity in China and Taiwan also makes APAC a critical global hub for production, influencing global supply dynamics and cost structures. The increasing adoption of remote and hybrid work models, mirroring trends in North America, is beginning to accelerate demand for personalized, higher-specification input devices among professionals in major urban centers.

The Latin American market is currently in a phase of steady, moderate expansion, primarily concentrated in major economies such as Brazil and Mexico. Market growth is heavily influenced by foreign investment in technology infrastructure and the slow but consistent modernization of governmental and commercial office environments. Price sensitivity is a key factor in this region, leading to a higher penetration of mid-range and budget-friendly wired and basic wireless mice, often sourced through regional distributors.

Despite the price sensitivity, there is an observable trend toward wireless adoption, particularly in metropolitan business centers, reflecting a gradual shift towards more modern, efficient workspaces. Logistical complexities and regulatory variances across different countries within LATAM present challenges for large international manufacturers, necessitating strong local partnerships for effective distribution and market access. Education and government sectors remain major purchasers, often prioritizing bulk purchasing contracts.

The MEA region presents varied growth dynamics, with strong investment-led expansion in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) and slower, more fragmented growth in many African markets. GCC nations, driven by large-scale government digitalization projects and thriving finance sectors, exhibit high demand for premium, feature-rich office peripherals, often mirroring the trends seen in Europe and North America regarding ergonomics and wireless connectivity. These markets emphasize quality and brand prestige.

Conversely, many African markets face challenges related to infrastructure limitations and lower disposable income, resulting in demand primarily focused on durable, basic wired mice for institutional use and internet cafes. Future growth is strongly linked to improving economic stability and increasing internet penetration across the continent. Regional opportunities exist in providing tailored, robust solutions that can withstand challenging environmental factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Office Mice Market.- Logitech

- Microsoft Corporation

- HP Inc.

- Dell Technologies Inc.

- Razer Inc.

- Cherry GmbH

- Lenovo Group Ltd.

- ASUS Global

- Samsung Electronics Co., Ltd.

- SteelSeries

- Trust International B.V.

- Contour Design

- Evoluent

- A4Tech

- Targus International LLC

- Adesso Inc.

- Kinesis Corporation

- Perixx Computer GmbH

- Rapoo Technology Co., Ltd.

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Office Mice market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for premium office mice?

The principal driver is the increased global adoption of hybrid and remote work structures, which necessitates investment in high-quality, ergonomic input devices to maintain employee productivity, comfort, and compliance with health standards for prolonged computer usage.

What are the key advantages of vertical mice over traditional designs?

Vertical mice are designed to promote a neutral handshake posture, which significantly reduces forearm pronation and wrist tension, thereby lowering the risk of developing Repetitive Strain Injuries (RSI) common among heavy computer users.

How is sustainability impacting the purchasing decisions in the Office Mice Market?

Corporate procurement is increasingly favoring mice manufactured using Post-Consumer Recycled (PCR) plastics and bio-based materials, aligning with Environmental, Social, and Governance (ESG) mandates and reducing the environmental footprint of IT hardware procurement.

Which connectivity type dominates the current office mice market?

Wireless mice, specifically those utilizing Bluetooth Low Energy (BLE) technology, dominate the market due to their ability to provide multi-device connectivity, reduced cable clutter, and seamless integration with modern portable computing devices.

Will AI replace the need for physical office mice?

AI is not expected to replace the physical mouse entirely, but rather enhance it. AI integration focuses on improving sensor accuracy, optimizing battery life, and providing real-time personalized ergonomic feedback, transforming the mouse into an intelligent workflow companion.

What is the significance of DPI in office mice compared to gaming mice?

While gaming mice require extremely high DPI for rapid, precise movements, office mice benefit from moderately high DPI to accurately navigate large, high-resolution monitors (e.g., 4K displays). Consistency and smooth tracking are prioritized over raw speed.

Which geographic region exhibits the fastest growth rate for office mice?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by the massive expansion of IT, service industries, and corporate digitalization efforts across countries such as China and India.

What differentiates a professional office mouse from a standard consumer mouse?

Professional office mice prioritize robust construction, enterprise-level wireless encryption, advanced ergonomic designs, longer battery life (often rechargeable), and specific features like customizable buttons for application shortcuts and seamless multi-device switching.

Why are businesses moving away from basic wired office mice?

Businesses are transitioning to wireless solutions to reduce cable management issues, improve workspace aesthetics, enhance mobility for hot-desking, and incorporate advanced ergonomic features typically unavailable in basic wired models.

What is a primary restraint impacting the market adoption of high-end ergonomic mice?

The high initial investment cost associated with advanced ergonomic mice, which can be significantly higher than standard peripherals, acts as a restraint, particularly for price-sensitive SMEs or institutions undertaking large-scale equipment procurement.

How does the value chain for office mice differ for B2B versus D2C sales?

B2B sales often utilize direct channels with large-volume procurement contracts, focusing on technical specifications and support services. D2C (Direct-to-Consumer) sales rely heavily on e-commerce platforms and retail, prioritizing branding, individual features, and consumer reviews.

What role do microcontrollers play in modern wireless office mice?

Microcontrollers manage key functions, including sensor data processing, power efficiency (BLE communication), tracking synchronization, and handling programmable button inputs and onboard memory for customizable profiles, ensuring high responsiveness and low power consumption.

Which type of sensor technology currently dominates the market?

Optical sensors dominate the market due to their excellent balance of reliable tracking on various common surfaces, high energy efficiency, and cost-effectiveness, making them ideal for mass deployment in corporate and SOHO environments.

What impact does the obsolescence cycle have on the market?

The rapid technological obsolescence cycle, driven by continuous improvements in sensor accuracy, battery technology, and connectivity standards, compels organizations to periodically upgrade their peripherals, thereby ensuring sustained demand for new products.

What is the importance of 'silent click' technology in office environments?

Silent click technology uses specialized dampening mechanisms within the switch to dramatically reduce noise, which is highly valued in open-plan offices, libraries, and quiet home work settings, improving the overall concentration and comfort of surrounding users.

How do leading companies secure their wireless office mouse connections?

Leading companies utilize advanced encryption protocols (often proprietary 128-bit AES encryption) across their 2.4 GHz wireless connections and comply with high-security Bluetooth standards to prevent unauthorized interception of input data, meeting strict enterprise security requirements.

What distinguishes the demand characteristics of Europe from Asia Pacific?

Europe’s demand is driven by regulatory compliance, sustainability, and high ASP, focusing on premium ergonomic devices. APAC’s demand is characterized by higher volume growth, dual demand for both budget and rapidly growing premium segments, and its central role in global manufacturing.

How does multi-device pairing technology benefit a professional user?

Multi-device pairing allows a professional to seamlessly switch the mouse input between a desktop, laptop, and tablet using a single button press, significantly improving efficiency and reducing the need for multiple sets of peripherals in a dynamic, hybrid workspace.

What kind of materials innovation is being seen in office mice construction?

Innovations include the use of durable, soft-touch coatings for enhanced grip, medical-grade materials for hypoallergenic properties, and a strong push towards incorporating recycled polycarbonate and ABS plastics to meet circular economy mandates.

Which end-user segment accounts for the highest volume of procurement?

The corporate offices segment, encompassing multinational corporations and large enterprises, accounts for the highest volume of procurement due to centralized purchasing for thousands of employees across global locations, often prioritizing bulk purchasing efficiency.

What are the primary challenges for market entry in the premium segment?

Challenges include the significant investment required in R&D for certified ergonomic designs, established brand loyalty to incumbents like Logitech and Microsoft, and the necessity of building robust B2B sales channels and enterprise IT support infrastructure.

How are input methods other than clicking and tracking being integrated?

Modern office mice integrate advanced input methods such as horizontal scroll wheels for navigating spreadsheets, customizable gesture control buttons, and potential future integration of proximity sensors for AI-enhanced input pre-emption.

What is the difference between an optical and a laser sensor in practical office use?

Optical sensors are highly reliable on standard office surfaces (mats, wood). Laser sensors offer superior tracking on high-gloss or transparent surfaces like glass, although modern high-end optical sensors have largely closed this performance gap for most users.

Why is the total cost of ownership (TCO) important for corporate buyers?

Corporate buyers assess TCO based on device durability, warranty length, maintenance costs, and energy efficiency (battery life). A higher initial price is often justified if the device offers superior reliability and reduced long-term support expenditure.

What is the expected long-term trend regarding battery type in office mice?

The long-term trend favors rechargeable lithium-ion batteries over disposable alkaline batteries, driven by corporate sustainability targets, reduced environmental waste, and improved convenience for end-users through USB-C charging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager