Offset Printing Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435503 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Offset Printing Machines Market Size

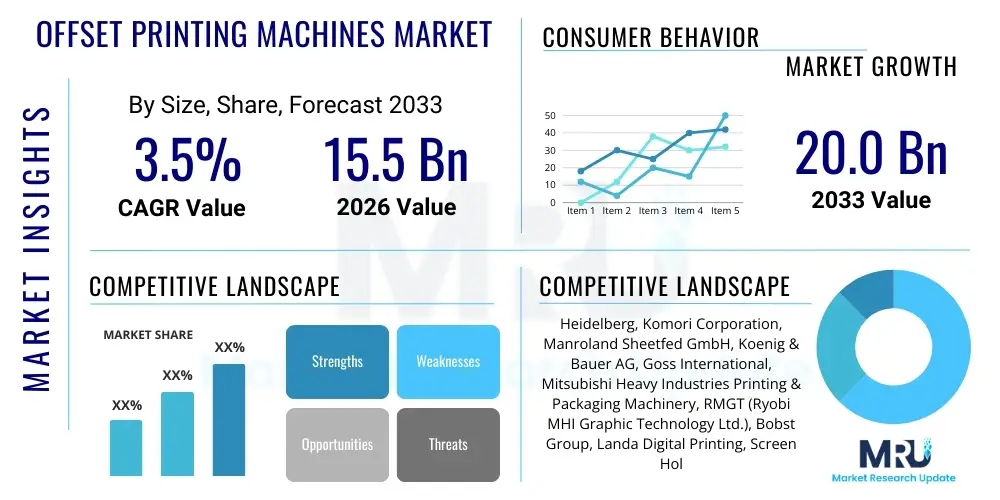

The Offset Printing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Offset Printing Machines Market introduction

The Offset Printing Machines Market encompasses sophisticated mechanical systems utilized primarily for high-volume commercial, packaging, and publishing printing applications. These machines employ the lithographic process, where the inked image is transferred from a plate to a rubber blanket, and then rolled onto the printing surface. This indirect method ensures superior image quality, consistency, and sharpness, especially crucial for detailed color reproduction and large-scale runs. Key applications span across production of magazines, newspapers, catalogs, corporate collateral, high-end commercial packaging, and specialized security printing.

The core product categories include sheet-fed offset presses, which are prevalent in high-quality short-to-medium runs and packaging applications, and web-fed (or roll-fed) offset presses, dominating high-speed, long-run tasks like newspaper and high-volume book production. Benefits of offset printing include excellent color fidelity, low cost per unit at high volumes, and versatility across numerous substrate types, including various paper stocks, cardboard, and synthetic materials. Driving factors for market stability and moderate growth include the sustained demand from the robust global packaging industry, the ongoing requirement for high-quality commercial printing for marketing materials, and continuous technological advancements enhancing automation, speed, and reduced make-ready times.

Offset Printing Machines Market Executive Summary

The Offset Printing Machines market is currently navigating a pivotal transition, characterized by intense competition from advanced digital printing technologies on one side and surging demand from the global packaging sector on the other. Key business trends indicate a focused investment by manufacturers into highly automated presses featuring Computer-to-Plate (CTP) integration, automated plate changing, closed-loop color management systems, and UV/LED curing capabilities, which collectively address customer demands for faster turnaround times and reduced operational waste. The emphasis on sustainability is also pushing the adoption of solvent-free inks and energy-efficient press designs.

Regionally, Asia Pacific maintains its dominance, serving as both a major manufacturing hub and the largest consumer market, fueled by explosive growth in manufacturing output, burgeoning consumer markets, and the corresponding need for sophisticated packaging solutions. North America and Europe, while mature, demonstrate stable demand focused heavily on specialized, high-value printing (e.g., luxury packaging, security documents) and prioritizing advanced automation to mitigate labor costs. Segment trends highlight that the Packaging application sector, particularly in flexible and corrugated materials using sheet-fed and specialized offset presses, exhibits the strongest growth trajectory, successfully offsetting volume declines observed in traditional commercial and publication printing areas due to digital substitution.

The market environment underscores that successful industry players must prioritize technological hybridization, integrating digital front-ends with conventional offset capability, and offering comprehensive service and maintenance agreements to ensure longevity and efficiency of high-capital investments. Strategic mergers and acquisitions among equipment providers and consolidation among mid-sized printers are defining the competitive landscape, creating an ecosystem where efficiency and specialized application focus are paramount for sustaining profitability and market share growth in this traditionally capital-intensive sector.

AI Impact Analysis on Offset Printing Machines Market

Users frequently inquire about how Artificial Intelligence (AI) can justify the continued investment in high-cost offset machinery when digital solutions are becoming smarter and more integrated. Common concerns revolve around AI's ability to minimize waste, optimize color calibration across long production runs, and autonomously manage complex maintenance schedules. Users seek quantifiable evidence of AI's capability to enhance operational efficiency, specifically targeting the reduction of time-consuming manual processes like color matching, quality inspection, and machine setup, which traditionally constitute the largest variable costs in offset printing operations. They anticipate that AI will serve as a crucial differentiator, extending the cost-effectiveness advantage of offset for medium to long runs.

AI's primary influence centers on predictive maintenance and advanced quality control systems. By analyzing sensor data streams from press units—monitoring variables such as temperature, vibration, ink consistency, and blanket wear—AI algorithms can predict potential component failures with high accuracy, allowing maintenance to be scheduled proactively before unexpected downtime occurs. This transition from reactive to predictive maintenance significantly boosts overall equipment effectiveness (OEE) and minimizes costly production interruptions. Furthermore, AI-driven closed-loop systems are revolutionizing quality assurance by instantly comparing scanned prints against digital proofs, identifying even minor deviations in color or registration, and automatically making micro-adjustments to ink keys and dampening systems in real-time without human intervention, ensuring consistent quality throughout millions of impressions.

Beyond the pressroom floor, AI is streamlining prepress workflows and optimizing supply chain logistics. AI tools are increasingly used to automate job imposition, analyze customer specifications for potential printing issues before plate creation, and optimize plate usage based on expected run length and material type. In logistics, machine learning models analyze historical demand, ink consumption rates, and substrate lead times to forecast material requirements, thus preventing stockouts while minimizing expensive inventory holding costs. This overarching integration of AI enhances the productivity of the entire workflow, allowing high-volume offset printers to remain competitive against the flexibility and speed offered by highly advanced digital presses, particularly in the growing personalized packaging market segment where precision and speed are critical.

- AI enhances operational efficiency through predictive maintenance scheduling, reducing unplanned downtime by anticipating mechanical failures.

- Real-time, closed-loop quality control systems utilize AI for instantaneous color and registration correction, ensuring perfect consistency across high-volume runs.

- Automation of prepress workflows, including smart imposition and plate optimization, drastically cuts down on human error and setup time (make-ready time).

- Demand forecasting and inventory management are optimized by machine learning, reducing material waste and improving supply chain responsiveness for substrates and consumables.

- Integration of AI facilitates hybridization strategies, allowing offset presses to seamlessly handle data variability often associated with digital print jobs, particularly in specialized packaging.

DRO & Impact Forces Of Offset Printing Machines Market

The dynamics of the Offset Printing Machines Market are shaped by a complex interplay of driving forces centered on output quality and efficiency, offset by persistent competitive pressures from digital solutions and high capital investment requirements. A major driver is the accelerating demand from the global packaging industry, particularly for high-end consumer goods, food, and pharmaceutical packaging, where offset printing delivers the required high resolution, specialized coatings, and color consistency on varied substrates like carton board and flexible materials. Furthermore, continuous manufacturer innovation in automation—reducing make-ready times and enhancing energy efficiency—reaffirms offset’s dominant position for cost-effective, high-volume production, ensuring that its total cost of ownership remains superior to digital alternatives for very long runs.

However, the market faces significant restraints, chiefly stemming from the rapid technological maturation and increasing acceptance of high-speed inkjet and toner-based digital printing technologies, which are highly competitive in short and medium-run segments and offer variable data printing capabilities unavailable to traditional offset. The substantial initial capital expenditure required for offset presses, coupled with the rising costs of consumables like specialized inks and printing plates, also poses a barrier to entry for smaller print service providers and delays replacement cycles for existing players. The environmental scrutiny regarding water and chemical usage in traditional offset processing also forces manufacturers to invest heavily in UV LED curing and process-less plate technologies, adding complexity and cost.

Opportunities for expansion lie in the transition toward hybrid printing solutions that seamlessly combine the high-quality, low-cost volume production of offset with the personalization capabilities of integrated digital units (often inkjet heads) on the same press platform, catering specifically to customized packaging and targeted marketing collateral. Furthermore, the expansion into specialized printing segments, such as security printing (e.g., banknotes, identification documents) and functional printing (e.g., printed electronics), offers niche growth avenues where the precision and stability of offset technology remain indispensable. The push for greater energy efficiency and reduced chemical consumption through sustainable practices also represents a key innovation opportunity, enhancing the long-term viability of the technology.

The overarching impact forces governing this market include competitive intensity, primarily defined by the ongoing struggle to define the optimal run length where digital overtakes offset, and technological evolution, demanding constant reinvestment into automation to maintain relevance. Supplier power is moderate, influenced by a few dominant press manufacturers (Heidelberg, Komori, Manroland), while buyer power is high, driven by industry consolidation and the ability of major print houses to command bespoke customization and comprehensive service contracts. The threat of substitution from advanced digital technologies remains the most potent impact force, requiring offset providers to perpetually enhance speed, reduce turnaround time, and lower overall operational complexity.

Segmentation Analysis

The Offset Printing Machines Market is structurally segmented across key dimensions including Product Type (distinguished by the sheet handling mechanism), Application (based on the end-use printed material), and Format Size (defined by the maximum size of the substrate the press can handle). Understanding these segmentations is critical for manufacturers to align their product portfolios with evolving market demands, particularly the shift toward high-speed, wide-format machinery necessary for the booming packaging sector. The primary differentiation remains between Sheet-Fed and Web-Fed presses, each catering to fundamentally different volume requirements and substrate characteristics, demanding distinct investment strategies and operational expertise.

The Application segmentation reveals the industry’s reliance on packaging, which includes corrugated boxes, folding cartons, and flexible packaging, as the central driver for continued offset demand, requiring specialized large-format sheet-fed presses capable of handling thicker substrates and demanding high-precision color management. Conversely, the Commercial Printing segment, encompassing advertising materials, brochures, and general job work, faces ongoing volatility and substitution risk from digital printing, leading to manufacturers focusing on highly automated mid-format presses designed for short-to-medium runs with minimal waste. The Publication sector, dominated by newspapers and long-run books, remains the primary domain of high-speed web-fed offset presses, though this segment continues to shrink in mature markets due to digital media consumption trends.

Format Size segmentation, ranging from small (A3/B3 and smaller) to very large format (VLF, over 50 inches), dictates the target applications and the required investment scale. The large and very large format segments are expanding rapidly, directly correlated with the growth in industrial and consumer packaging that requires oversized sheets for efficient conversion. Technological features such as automated plate changers, in-line coating units, and advanced UV curing systems are increasingly integrated across all format sizes, but are most pronounced and critical in VLF machinery to maximize operational throughput and deliver high-value finishes required by brand owners and packaging specialists seeking premium shelf presence.

- By Product Type:

- Sheet-Fed Offset Presses (Dominant in commercial and packaging sectors, offering high quality and flexibility)

- Web-Fed Offset Presses (Used for extremely high-volume, long runs, typically for publications and direct mail)

- By Application:

- Packaging (Folding cartons, flexible packaging, corrugated—the fastest growing segment)

- Commercial Printing (Brochures, catalogs, marketing materials, general job work)

- Publication Printing (Newspapers, magazines, books—facing digital substitution)

- Security and Specialized Printing (Banknotes, stamps, secure documents)

- By Format Size:

- Small Format (Up to 29 inches)

- Medium Format (29 to 40 inches—standard commercial press size)

- Large Format (40 to 50 inches)

- Very Large Format (VLF, over 50 inches—critical for high-end packaging)

- By End-Use Industry:

- Food and Beverage

- Pharmaceutical and Healthcare

- Consumer Goods

- Media and Entertainment

Value Chain Analysis For Offset Printing Machines Market

The value chain for the Offset Printing Machines Market begins with the upstream suppliers responsible for providing highly specialized components and raw materials essential for press manufacturing. This upstream segment is characterized by a reliance on highly precise mechanical engineering companies that supply critical press components such as cylinders, gearing systems, advanced dampening rollers, and high-performance electronic control systems (PLCs). Specialized chemical and material suppliers provide indispensable consumables like aluminum for printing plates, synthetic rubber for blankets and rollers, and highly engineered specialized inks (including UV/LED curable inks). The bargaining power of these specialized suppliers is relatively high due to the stringent quality specifications and proprietary nature of these technologies, necessitating close integration and partnership between press manufacturers and key component providers to ensure supply chain stability and quality consistency.

The middle segment of the chain is dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and market the complex offset printing systems. These global manufacturers invest heavily in Research and Development, focusing on enhancing automation features, integrating digital control systems, and developing proprietary technologies to improve print quality and reduce waste. Distribution is handled through a combination of direct sales forces for major national accounts and established networks of distributors and authorized agents who manage sales, installation, and financing for smaller and regional print houses. Given the high cost and complexity of the machinery, the sales cycle is long, relying heavily on demonstrations, specialized financing packages, and comprehensive after-sales service agreements.

Downstream analysis focuses on the print service providers (PSPs) and converters who utilize the machines, encompassing large commercial printers, integrated packaging companies, and newspaper publishers. The final stage involves the distribution channel, which is inherently dual: direct and indirect. Direct distribution is crucial for major OEMs selling their highest-end, VLF presses directly to Tier 1 packaging converters or major publishing houses, ensuring specialized installation and training. Indirect channels, involving authorized dealers and system integrators, handle sales to the broader commercial printing market, offering localized support, training, and integration services. The crucial aspect of the downstream value chain is the extensive after-sales support, maintenance, and supply of proprietary consumables, which often represent a significant, high-margin revenue stream for the OEMs throughout the press’s multi-decade lifecycle.

Offset Printing Machines Market Potential Customers

The primary cohort of potential customers for offset printing machines comprises large-scale commercial printing operations and expansive print houses that specialize in medium-to-long run lengths and require exceptional color consistency and detail. These businesses, which often operate multiple presses across various formats, utilize offset technology for high-volume jobs such as annual reports, high-end magazines, marketing collateral for Fortune 500 companies, and direct mail campaigns. Their buying decisions are fundamentally driven by the total cost of ownership (TCO), the ability to achieve high speeds (impressions per hour), the integration of automation features to minimize labor costs, and the capability to handle complex finishing processes, such as in-line coating and special effects, demanded by brand owners.

A rapidly growing segment of potential customers includes specialized packaging converters and manufacturers involved in the production of folding cartons, luxury rigid boxes, and flexible plastic or foil packaging used across the food, pharmaceutical, and cosmetics industries. These end-users demand precision and compatibility with non-paper substrates, making sheet-fed offset presses with UV and LED curing capabilities indispensable. For these buyers, consistency of brand color (often requiring specialized spot colors) and the ability to print on thick, structural materials are the critical purchasing criteria. Investment in VLF (Very Large Format) offset machines is particularly prevalent in this segment to maximize material utilization and efficiently manage large-scale packaging formats before the cutting and folding processes.

Additionally, large publication houses, particularly in developing economies where print media remains dominant, represent a persistent customer base for high-speed web-fed offset machinery. While mature markets have seen a decline, emerging economies still require fast, cost-effective printing of newspapers and school textbooks, necessitating robust and highly durable web presses. Finally, governmental agencies and specialized security organizations constitute a niche but essential customer base, relying on the highly stable and controlled environment of offset lithography for printing sensitive documents such as banknotes, passports, and secure identification cards, where security features and precise alignment are paramount, justifying the high capital investment required for these specialized presses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 3.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heidelberg, Komori Corporation, Manroland Sheetfed GmbH, Koenig & Bauer AG, Goss International, Mitsubishi Heavy Industries Printing & Packaging Machinery, RMGT (Ryobi MHI Graphic Technology Ltd.), Bobst Group, Landa Digital Printing, Screen Holdings Co., Ltd., Canon, Inc., Xerox Corporation (indirect competition/hybrid partners), TKS (Tokyo Kikai Seisakusho), Beiren Group, Guangming Printing Machinery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offset Printing Machines Market Key Technology Landscape

The contemporary offset printing machine market is defined by a landscape heavily invested in automation and integration to enhance productivity and reduce operational complexity, directly competing with the speed and flexibility of digital solutions. Central to this technological evolution is the ubiquitous adoption of Computer-to-Plate (CTP) systems, which bypass film processing entirely, leading to sharper image quality, faster plate creation, and significantly reduced make-ready times. Advanced press models integrate fully automated plate changing systems that can swap out entire sets of plates in minutes, drastically improving changeover efficiency for short-run, multi-job environments. Furthermore, closed-loop densitometric and spectrophotometric control systems utilize high-speed scanners to measure color accuracy on press and automatically adjust ink key settings, ensuring perfect G7 or ISO consistency throughout the print run without continuous manual intervention.

Another transformative technology involves curing mechanisms, specifically the proliferation of UV and LED curing systems. Traditional heat-set and oxidative inks require significant drying time and energy consumption. In contrast, UV and, more recently, energy-efficient LED curing systems instantly cure specialized inks upon exposure to ultraviolet light, allowing for immediate post-press finishing, reducing energy costs, and enabling printing on non-absorbent substrates like plastics and metallic foils crucial for the packaging sector. The development of low-migration UV inks is particularly vital for food and pharmaceutical packaging, meeting increasingly stringent regulatory requirements while maintaining the high aesthetic standards expected of offset output.

The long-term trajectory focuses on hybridization and connectivity. Hybrid presses integrate conventional offset units with digital print heads (often high-speed inkjet) directly onto the press line, allowing for variable data printing and personalization within a traditional offset environment, a crucial capability for targeted marketing and security printing. Furthermore, the concept of Print 4.0—the connectivity of the entire production workflow—is being realized through advanced software platforms that integrate Enterprise Resource Planning (ERP) systems with the press controller. This integration enables automated job scheduling, real-time performance monitoring (OEE data collection), predictive maintenance alerts, and seamless communication between prepress, press, and post-press departments, optimizing the utilization of high-capital machinery and providing crucial operational transparency to printing management.

Regional Highlights

The global Offset Printing Machines Market exhibits distinct regional consumption patterns dictated by industrial growth, maturity of the print industry, and localized demand for packaging and publications. Asia Pacific (APAC) currently holds the largest market share and is projected to demonstrate the highest growth rate during the forecast period. This dominance is attributable to the region's vast manufacturing base, rapidly expanding middle-class populations driving consumer goods and packaged food demand, and robust investments in advanced printing technology, particularly in China, India, and Southeast Asian nations. These countries serve as global production hubs for commercial goods and require mass volumes of high-quality packaging and labeling, leading to continuous investment in VLF and highly automated sheet-fed presses. The relatively lower labor costs also maintain the competitive advantage of offset printing for long-run jobs across the region.

North America and Europe represent mature markets characterized by replacement demand rather than massive capacity expansion. The focus in these regions is heavily skewed toward high-value, specialized printing applications, including luxury packaging, short-run, high-quality commercial jobs, and security printing. European manufacturers, particularly in Germany and Switzerland, remain leaders in technological innovation, emphasizing sustainability (solvent reduction, energy efficiency) and integration of highly sophisticated automation features to mitigate high operating expenses, including labor. Printers in these regions prioritize the efficiency improvements derived from advanced automation and the transition to hybrid systems that blend offset volume with digital personalization capabilities to meet the highly fragmented and fast-turnaround demands of modern clients.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets offering substantial growth potential, albeit from a smaller base. Growth in LATAM is driven by regional economic recovery and increasing demand for local consumer goods packaging, necessitating investments in medium-to-large format presses. In MEA, infrastructure development and urbanization, particularly in the GCC states and parts of Africa, are fostering demand for commercial and publication printing. However, market adoption in these regions is often constrained by capital availability, dependence on imported machinery, and a slower uptake of cutting-edge automation, leading to a preference for reliable, refurbished equipment or new presses offering a favorable balance between initial cost and operational reliability.

- Asia Pacific (APAC): Largest market share and highest growth rate; driven by packaging boom, high-volume manufacturing, and infrastructure development in China, India, and ASEAN countries.

- North America: Mature market characterized by steady replacement cycles; focus on high-quality commercial printing, luxury packaging, and early adoption of hybrid printing technologies and high automation.

- Europe: Leading region for technological innovation, strong emphasis on sustainability, UV/LED curing, and high-precision systems; demand concentrated in short-to-medium specialized runs and security applications.

- Latin America (LATAM): Emerging growth market fueled by rising domestic packaging needs and expanding consumer sectors; investment driven by cost-efficiency and reliable mid-range machinery.

- Middle East & Africa (MEA): Growth potential tied to urbanization and diversification efforts; market characterized by demand for standard commercial and publication presses, with increasing interest in pharmaceutical packaging printing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offset Printing Machines Market.- Heidelberg Druckmaschinen AG

- Komori Corporation

- Manroland Sheetfed GmbH (a member of the Langley Holdings plc group)

- Koenig & Bauer AG

- RMGT (Ryobi MHI Graphic Technology Ltd.)

- Bobst Group SA (Focusing on specialized packaging and converting equipment)

- Goss International (Specializing in web-fed presses)

- Mitsubishi Heavy Industries Printing & Packaging Machinery, Ltd.

- TKS (Tokyo Kikai Seisakusho)

- Beiren Group

- Landa Digital Printing (Indirect competitor and technology disruptor influencing hybrid trends)

- Screen Holdings Co., Ltd. (Major supplier of CTP and digital solutions impacting prepress)

- Xerox Corporation (Strategic alliances and digital competition)

- Guangming Printing Machinery Co., Ltd.

- Shanghai Electric Group Co., Ltd. (SEGC)

- Presstek LLC

- Aurelia SRL

- KBA-Sheetfed Solutions AG & Co. KG

- P&G Graphic Systems

- Xinjiang Printing Machine Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Offset Printing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for new offset printing machines?

The strongest driving factor is the sustained and accelerating growth of the global packaging industry, particularly for high-quality folding cartons, corrugated boxes, and flexible packaging. Offset machines, especially large-format sheet-fed presses with UV/LED curing capabilities, are essential for achieving the high color consistency and specialty finishing required by brand owners for premium packaging at cost-effective volumes.

How are offset printing machines mitigating competition from advanced digital printing technology?

Offset manufacturers are mitigating competition through heavy investment in automation, reducing make-ready times (setup) and waste, thereby increasing overall efficiency (OEE). Key strategies include CTP integration, automated plate changing, and the development of hybrid systems that combine offset volume printing with integrated digital inkjet heads for personalization and variable data printing.

What role does sustainability play in the Offset Printing Machines Market?

Sustainability is a critical focus, driving manufacturers to adopt key technological changes. This includes promoting solvent-free and waterless offset printing techniques, integrating energy-efficient UV LED curing systems that require less power than traditional methods, and developing process-less printing plates that significantly reduce chemical and water usage in the prepress stage, appealing to environmentally conscious print service providers.

Which regional market is expected to show the most significant growth for offset press installations?

Asia Pacific (APAC), particularly China and India, is expected to exhibit the most significant growth due to explosive growth in local manufacturing, urbanization, and the corresponding need for commercial and high-volume consumer packaging. APAC serves as a massive production hub, requiring continuous investment in new, high-capacity machinery.

What defines the Very Large Format (VLF) segment in offset printing and why is it important?

The Very Large Format (VLF) segment refers to presses capable of handling substrate sizes exceeding 50 inches. This segment is highly important because VLF presses enable packaging converters to print more impressions per sheet, maximizing material efficiency and reducing the cost per unit for large cartons and displays. It is crucial for high-efficiency packaging production and industrial printing applications.

What are the primary operational benefits of integrating closed-loop color control systems?

Closed-loop color control systems utilize integrated densitometers and spectrophotometers to continuously monitor and measure the color densities and spectral values of printed sheets in real-time. The primary operational benefits are instantaneous, automated adjustments to the ink keys, ensuring absolute color consistency throughout the longest print runs, reducing manual intervention, and minimizing costly color-related waste (spoiled sheets).

How does the high capital cost of offset machinery influence purchasing decisions for print service providers (PSPs)?

The high capital cost mandates that PSPs focus intensively on the Total Cost of Ownership (TCO). Purchasing decisions are heavily influenced by projected lifespan, anticipated maintenance costs, the availability of comprehensive service contracts, and the machine's guaranteed uptime (reliability). Long-term financing options and expected return on investment based on guaranteed high throughput rates are non-negotiable considerations.

In the context of the offset market, what is meant by 'Print 4.0'?

Print 4.0 refers to the integration of offset printing presses into the broader concept of the Industrial Internet of Things (IIoT). It involves seamlessly connecting the press with upstream prepress software (MIS/ERP systems) and downstream finishing equipment, enabling automated workflow management, real-time data collection (big data analytics), predictive maintenance, and autonomous job scheduling to maximize press utilization and factory efficiency.

What is the key difference between sheet-fed and web-fed offset presses regarding application?

Sheet-fed presses handle individual, cut sheets of material; they are favored for high-quality, medium-run commercial work and complex packaging applications requiring thicker substrates and precise coating/finishing. Web-fed presses (roll-fed) use continuous rolls of paper; they are optimized for extremely long, high-speed runs, typically dominating the mass production of newspapers, high-volume books, and specialized direct mail inserts due to their unparalleled speed and efficiency over long distances.

How does Artificial Intelligence contribute to predictive maintenance in offset printing?

AI contributes by processing continuous sensor data related to press operations (vibration, heat, pressure, component wear). Machine learning algorithms analyze these patterns to predict potential mechanical failures or component lifespan expirations before a visible malfunction occurs, allowing maintenance teams to schedule proactive servicing. This significantly reduces costly, unexpected downtime, thereby boosting the press’s effective output capacity.

What are the specific advantages of LED curing over traditional UV curing systems in offset printing?

LED curing offers multiple advantages over traditional mercury-lamp UV systems, primarily through reduced energy consumption and the elimination of ozone generation, improving environmental safety. Additionally, LED systems generate significantly less heat, allowing printers to utilize heat-sensitive, non-standard substrates like thinner plastics or film without the risk of warping or distortion, expanding application versatility.

How has the growing need for specialized security printing influenced the offset market?

Security printing (e.g., banknotes, tamper-evident documents) heavily relies on the unique consistency and high registration precision inherent in offset lithography. This segment drives demand for specialized offset presses, often featuring unique ink systems and complex numbering/alignment capabilities, ensuring that offset technology remains irreplaceable for applications where counterfeiting protection is paramount.

What impact does substrate flexibility have on the selection of offset presses?

Substrate flexibility is crucial, particularly in packaging. Modern offset presses must handle a wide range of materials, from thin papers to thick carton board and plastics. The selection often depends on the press’s ability to manage varied thickness and weight, its advanced sheet feeding mechanisms, and the integration of specialized drying/curing technology (like UV/LED) required to adhere ink reliably to non-porous substrates.

Beyond cost, what is the primary restraint on market growth for new offset machinery installations?

The primary restraint, beyond high capital cost, is the increasing maturity and functional overlap of high-speed digital inkjet technology. Digital presses are continuously improving their speed and quality while reducing their cost per print, making them viable competitors for what were traditionally considered medium-run offset jobs, forcing offset to retreat to only the highest volume or highest quality specialized applications.

Define the concept of 'make-ready time' and how automation is addressing it in modern offset presses.

Make-ready time is the period required to prepare a press between jobs, involving tasks such as changing plates, washing blankets, setting up ink keys, and achieving precise color and registration alignment. Automation addresses this through systems like simultaneous plate changing (SPC), automated wash-up programs, and closed-loop color scanning, reducing make-ready from hours to just minutes, maximizing the press's productive run time.

How does the shift towards shorter run lengths affect the profitability of offset printing houses?

The global shift toward shorter average run lengths erodes the inherent cost advantage of offset printing, as the high initial setup costs (make-ready) are amortized over fewer printed units, increasing the cost per piece. To maintain profitability, offset houses must invest heavily in automation to minimize non-productive make-ready time, making their break-even point against digital lower and ensuring quick turnaround.

What role do original equipment manufacturers (OEMs) play in the consumables supply chain?

OEMs play a significant role by often supplying or certifying proprietary consumables, including inks, fountain solutions, specialized coatings, and printing plates. This ensures optimal performance and quality consistency for their specific presses. The revenue from these high-margin consumables forms a vital, recurring stream for manufacturers long after the initial press sale.

Why is color fidelity so critical in the offset printing market, especially for brand owners?

Color fidelity is paramount because offset printing is heavily used for branding and marketing materials where precise color consistency (often defined by Pantone or custom spot colors) is essential for maintaining brand identity across various media and global markets. Offset's stable and repeatable lithographic process makes it the preferred technology for achieving this exacting level of spectral accuracy.

What considerations are driving the adoption of larger format presses (VLF) over medium format?

The primary consideration driving VLF adoption is efficiency for packaging and industrial applications. Printing on a larger sheet allows for more pieces (e.g., folding cartons) to be placed on a single sheet (higher imposition), leading to lower consumption of plates, faster throughput, and reduced cutting and folding waste, significantly lowering the total unit cost for very high-volume production jobs.

How does market consolidation among print service providers influence the demand for offset machines?

Market consolidation results in fewer, larger print service providers (PSPs) with significant purchasing power. These consolidated entities demand fewer but larger, more specialized, and highly automated presses. They prioritize machines with maximum throughput, efficiency, and network connectivity, focusing on centralized production efficiency rather than dispersed localized capacity, favoring Tier 1 OEM investments.

What is the significance of thermal stability in the performance of a modern offset press?

Thermal stability is critical because temperature fluctuations affect ink viscosity, blanket properties, and dampening solution performance, directly impacting color accuracy and image quality. Modern presses integrate sophisticated temperature control systems within the ink train and dampening units to maintain precise thermal conditions, ensuring consistent print quality, especially during long, high-speed production runs.

Explain the concept of 'waterless offset printing' and its environmental benefit.

Waterless offset printing uses specialized silicone-based plates instead of traditional aluminum plates that require fountain solution (dampening water mixed with chemicals). The environmental benefit lies in eliminating the need for fountain solution, reducing the consumption of chemicals, alcohol, and water, leading to less waste disposal complexity and often achieving finer screen rulings and higher quality output.

What role do sheet handling and perfecting mechanisms play in a sheet-fed press?

Sheet handling mechanisms ensure accurate feeding and registration of the substrate into the press units, critical for maintaining print quality at high speeds. Perfecting mechanisms allow the press to print on both sides of the sheet simultaneously (or in quick succession) without manually reloading the paper, dramatically increasing efficiency for two-sided jobs like brochures and book signatures without compromising registration accuracy.

How does the integration of ERP systems benefit offset printing operations under Print 4.0?

Integration of Enterprise Resource Planning (ERP) systems allows for automated data exchange between sales, job estimation, materials inventory, and the press floor. This provides real-time visibility into production capacity, enables immediate costing adjustments, optimizes scheduling based on machine availability, and minimizes material stockouts, thereby maximizing profitability and operational alignment.

Why is the pharmaceutical packaging sector a stable driver for offset machine demand?

The pharmaceutical sector requires extremely high security, quality, and regulatory compliance for its packaging (e.g., folding cartons for medication). Offset printing provides the necessary precision for fine text, verifiable color consistency, and mandatory adherence to low-migration ink standards, ensuring the packaging is safe and compliant, leading to sustained, non-cyclical demand for specialized offset equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager