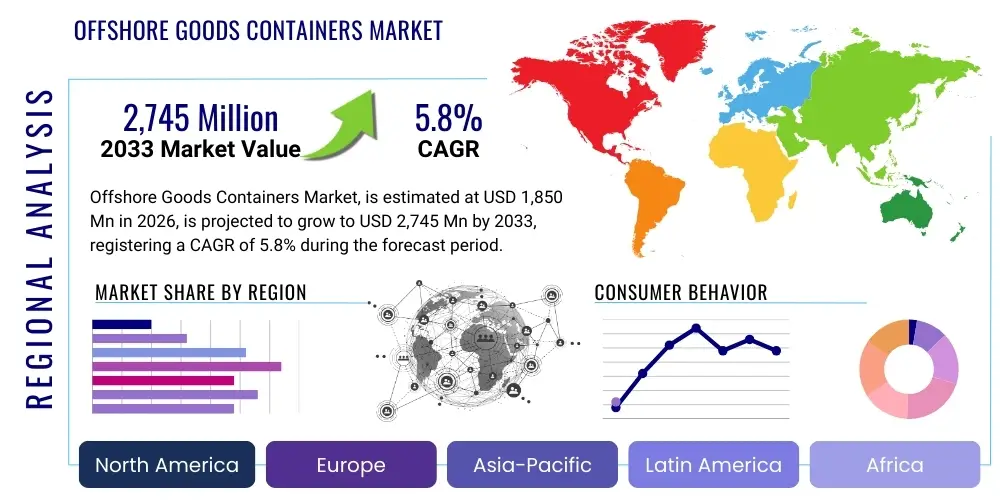

Offshore Goods Containers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437135 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Offshore Goods Containers Market Size

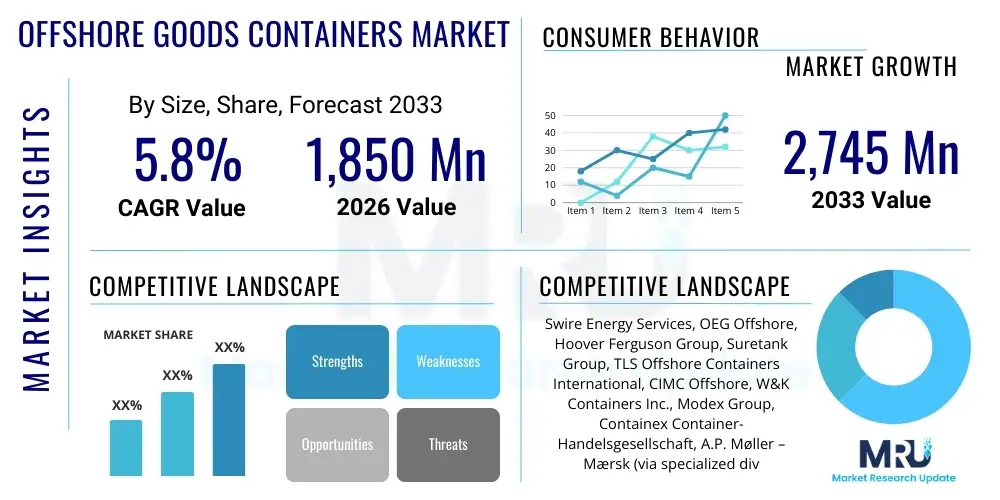

The Offshore Goods Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,850 Million in 2026 and is projected to reach USD 2,745 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the resurgence in global upstream oil and gas exploration activities, particularly in deepwater and ultra-deepwater fields, where specialized equipment transport is non-negotiable for operational safety and efficiency. Furthermore, the burgeoning investment in offshore renewable energy infrastructure, specifically offshore wind farms requiring large-scale logistics for component delivery and maintenance, provides a significant complementary revenue stream accelerating market expansion across all major maritime regions.

Market expansion is also supported by stringent international safety regulations, primarily the DNV 2.7-1 certification standard, which mandates regular replacement and inspection cycles for containers operating in harsh marine environments. As existing fleets age, the requirement for compliant, newly manufactured containers ensures a consistent demand floor. Technological advancements focusing on lightweight yet durable materials, enhanced anti-corrosion coatings, and integration of tracking and monitoring technologies (IoT sensors) further bolster the premium segment, driving up the average revenue per container unit and contributing positively to the overall market valuation.

Offshore Goods Containers Market introduction

The Offshore Goods Containers Market encompasses the supply, leasing, and sale of specialized containers designed and certified for the transportation and storage of equipment, supplies, and waste materials across marine and offshore installations. These containers are crucial for maintaining operational continuity in demanding environments suchuding oil and gas platforms, Floating Production Storage and Offloading (FPSO) units, drilling rigs, and offshore wind substations. Unlike standard ISO shipping containers, offshore units must comply with rigorous international standards, notably DNV 2.7-1, EN 12079, or similar regional equivalents, to withstand extreme dynamic loading, harsh weather conditions, and significant impact forces typical of lifting operations at sea.

The primary products in this market include Standard Dry Goods Containers, specialized containers such as Mud Skips, Cargo Baskets, Waste Handling Units, and customized Workshop and Laboratory Modules. Major applications span the entire offshore lifecycle, from exploration and development drilling (transporting casing, tools, and chemicals) to production phases (carrying maintenance spares and consumables) and ultimately decommissioning activities (handling scrap and recovered materials). The key benefit provided by these certified containers is ensuring the safety of personnel and the environment by preventing structural failure and subsequent cargo loss during complex offshore lifts, thereby minimizing operational downtime and catastrophic risk.

Driving factors propelling this sector include sustained demand for energy resources necessitating offshore development, favorable regulatory mandates pushing for higher safety standards in maritime logistics, and the parallel boom in large-scale offshore wind projects globally. The increasing complexity of subsea infrastructure also requires highly specialized, purpose-built containers for delicate equipment, reinforcing the high-value segment of the market and ensuring robust growth irrespective of short-term volatility in commodity prices.

Offshore Goods Containers Market Executive Summary

The Offshore Goods Containers Market is characterized by robust growth underpinned by strong fundamental demand drivers in both hydrocarbon extraction and renewable energy sectors. Current business trends indicate a critical shift toward leasing models over outright purchases, driven by operators seeking greater flexibility and capital expenditure minimization, which benefits major container rental providers. Furthermore, there is an increasing demand for specialized container types, such as high-cube units, workshop containers integrated with advanced monitoring systems, and specialized waste skips designed for hazardous material handling, reflecting the increasing complexity of offshore operations and environmental compliance requirements.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market segment, primarily propelled by massive investments in new offshore gas fields (e.g., Australia, Southeast Asia) and aggressive offshore wind development strategies in countries like China, Taiwan, and South Korea. North America, while mature, maintains significant market share due to sustained activity in the Gulf of Mexico, focusing increasingly on deepwater maintenance and decommissioning. Europe remains a key innovation hub, leading in specialized container solutions for the North Sea's demanding offshore wind environment and strict environmental regulations governing container manufacturing and disposal.

Segment trends demonstrate that the Type segment is dominated by Standard Dry Freight Containers (typically 10ft or 20ft units), but the Specialized Containers category (including baskets and skips) is exhibiting the highest growth rate due to requirements specific to drilling and subsea construction. By Application, the Offshore Oil and Gas segment remains the largest revenue contributor, although Offshore Wind is poised to capture significantly greater market share by the end of the forecast period, leveraging government incentives and the global energy transition push. Market competitiveness remains high, characterized by strategic mergers and acquisitions aimed at consolidating global fleet capacity and enhancing geographic reach, particularly among the top-tier DNV-certified leasing companies.

AI Impact Analysis on Offshore Goods Containers Market

Common user questions regarding AI's influence in the Offshore Goods Containers Market typically revolve around operational efficiency, safety enhancements, and lifecycle management. Users frequently inquire about how AI can predict container failure rates, optimize logistics scheduling across multiple offshore assets, and automate compliance checks. There is significant interest in using machine learning to analyze sensor data related to dynamic loading and corrosion levels to shift from routine calendar-based maintenance to predictive, condition-based maintenance strategies. Furthermore, users seek clarity on the integration cost and ROI of implementing AI-driven inventory tracking systems to minimize losses and improve turnaround times at supply bases.

The core themes summarized from these inquiries underscore expectations for AI to deliver immediate cost savings through improved utilization rates and extended asset life, while simultaneously elevating safety standards by proactively flagging potential structural integrity issues. AI is viewed not merely as a tracking tool but as a critical analytical layer that transforms raw telematics and structural health monitoring (SHM) data into actionable insights. This technological integration is expected to redefine the procurement and deployment strategies of major offshore operators, favoring suppliers who incorporate Smart Container features that facilitate real-time monitoring and predictive analytics, thus influencing capital expenditure decisions throughout the supply chain.

- AI enables predictive maintenance scheduling by analyzing sensor data on vibration, humidity, and structural strain, significantly reducing unexpected downtime and compliance failures.

- Machine learning algorithms optimize the allocation and repositioning of container fleets globally, minimizing empty runs and maximizing utilization rates across diverse assets (rigs, FPSOs, shore bases).

- Automated visual inspection using computer vision models assists in remote damage assessment, speeding up certification renewal processes required by DNV and ABS standards.

- AI-driven routing and inventory systems enhance supply chain resilience, ensuring critical equipment is delivered precisely when needed, overcoming typical logistical bottlenecks in complex offshore projects.

- Digital twinning capabilities, facilitated by AI, allow operators to simulate the lifecycle fatigue and operational stress on container designs before deployment, leading to safer and more durable products.

DRO & Impact Forces Of Offshore Goods Containers Market

The dynamics of the Offshore Goods Containers Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. Key drivers include the mandatory nature of DNV certification for safety compliance, ensuring continued demand for replacement units, alongside the substantial increase in global CapEx focused on offshore field development, particularly in high-pressure, high-temperature (HPHT) and deepwater environments that require sophisticated tools transport. A major structural opportunity is the global transition towards clean energy, specifically the exponential growth of the offshore wind sector, which requires specialized containers for transporting turbine components, foundations, and heavy lift equipment, offering a diversified revenue stream away from volatile oil markets.

However, the market faces significant restraints. Volatility in global crude oil and gas prices historically causes sudden halts or severe reductions in exploration and production (E&P) spending, directly impacting the demand for new container leases and purchases. Furthermore, the high initial manufacturing cost and stringent quality control requirements associated with achieving and maintaining DNV 2.7-1 certification create substantial barriers to entry, limiting competition but also constraining supply flexibility during peak demand cycles. The lengthy certification process for new designs or modified containers also imposes lead-time restraints on market responsiveness to specific operational requirements.

The combined impact forces dictate a cycle where safety and compliance act as primary market stabilizers, while energy price fluctuation introduces short-term turbulence. The long-term trajectory, however, is firmly positive, reinforced by mandatory safety renewals, fleet modernization needs, and the structural demand from the burgeoning offshore renewable sector. The increasing focus on sustainability and material efficiency acts as an accelerating force, pushing manufacturers towards lighter, stronger, and more traceable container solutions, ultimately enhancing market value proposition.

Segmentation Analysis

The Offshore Goods Containers Market is systematically segmented based on Container Type, Material, Application, and Operating Model. This segmentation is crucial for understanding specific demand pockets, procurement preferences, and regional supply concentrations. The Container Type segmentation helps differentiate between high-volume, general-purpose units and low-volume, high-value specialized units necessary for complex subsea operations. Analyzing the Application segments provides clear insights into the relative dependence of the market on traditional oil and gas CapEx versus the rapidly expanding market derived from offshore renewable energy projects and specialized subsea construction activities, which often require unique specifications.

Segmentation by Operating Model—namely Rental/Leasing versus Purchase—is vital for understanding the financial and operational strategies of end-users. Large, integrated oil companies often prefer leasing to maintain flexible operational costs, whereas smaller service companies or specific government entities might opt for outright purchase to secure dedicated fleet capacity. Furthermore, the segmentation by Material (e.g., high-grade structural steel versus aluminum alloys for specialized applications) reflects ongoing technological efforts to reduce container tare weight while maintaining structural integrity required for dynamic offshore lifting environments, influencing pricing and manufacturing costs across the value chain.

- By Container Type:

- Standard Dry Goods Containers (10ft, 20ft)

- Specialized Containers (Baskets, Skips, Workshops, Half-Height Containers)

- Refrigerated Containers (Reefers)

- Waste & Bulk Handling Units (Mud Skips, Drum Skips)

- By Application:

- Offshore Oil and Gas (Exploration, Drilling, Production, Decommissioning)

- Offshore Wind Energy

- Subsea Construction and Marine Logistics

- By Operating Model:

- Rental/Leasing

- Purchase

- By Material:

- Steel (Structural Grades: S355J2, etc.)

- Aluminum (Lightweight specialized units)

Value Chain Analysis For Offshore Goods Containers Market

The value chain for the Offshore Goods Containers Market begins with the upstream procurement of high-grade raw materials, primarily specialized structural steel (such as S355J2 or equivalent specifications) and high-performance marine coating systems necessary to resist severe corrosion. Suppliers in the upstream segment are dominated by major global steel mills and specialized component manufacturers providing certified shackles, lifting sets, and specialized doors. The quality and consistent supply of these certified materials are critical, as they directly impact the ability of manufacturers to achieve the necessary DNV certifications, creating a high reliance on a limited pool of approved suppliers.

The midstream stage involves the design, fabrication, and certification of the containers. Manufacturers must adhere to rigorous design specifications and quality management systems to meet DNV 2.7-1 and local maritime authority standards. This stage involves specialized welding, non-destructive testing (NDT), and application of marine-grade paint systems. Direct distribution channels involve large manufacturers selling directly to major oil companies or, more commonly, to key leasing companies that manage vast global fleets. Indirect distribution is facilitated through specialized logistics firms or localized agents who handle the regional delivery and maintenance of container fleets.

The downstream segment is dominated by leasing and rental services, which constitute the largest revenue stream. Major fleet owners manage, inspect, repair, and relocate containers based on client demand. End-users (oil and gas operators, offshore wind developers, subsea contractors) interact predominantly with these leasing providers for short-term and long-term rentals. The focus downstream is increasingly on lifecycle management, including regular inspection and certification renewals, ensuring the continued compliance and operational readiness of the container assets throughout their demanding service life.

Offshore Goods Containers Market Potential Customers

The primary end-users and buyers of offshore goods containers are diverse but highly specialized entities operating within the marine and energy sectors. Major International Oil Companies (IOCs) and National Oil Companies (NOCs) are significant customers, utilizing containers for all phases of offshore field development, from drilling support to production maintenance and eventual decommissioning. These large operators often engage in long-term lease agreements with major fleet providers to ensure global coverage and standardized equipment quality, emphasizing reliability and adherence to strict corporate safety protocols. Their purchasing decisions are driven by project scale, geographical location, and the need for standardized logistical solutions.

A rapidly growing customer base includes offshore renewable energy developers and wind farm operators. As offshore wind projects increase in size and move further into deep water, the requirement for robust, certified containers to transport large, delicate subcomponents, maintenance tools, and operational spares has surged. These customers prioritize specialized units capable of handling unique dimensions and harsh conditions encountered in North Sea and APAC wind farm locations. Furthermore, third-party drilling contractors, subsea construction companies, and specialized maritime logistics providers serve as crucial intermediaries, purchasing or leasing containers tailored to specific project needs, often focusing on customized units like ROV baskets or specialized pipe transport modules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,850 Million |

| Market Forecast in 2033 | USD 2,745 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swire Energy Services, OEG Offshore, Hoover Ferguson Group, Suretank Group, TLS Offshore Containers International, CIMC Offshore, W&K Containers Inc., Modex Group, Containex Container-Handelsgesellschaft, A.P. Møller – Mærsk (via specialized divisions), SEA-BOX Inc., Boxman Containers, Zamil Offshore, Altrad Group, Specialized Rental Services (SRS), Hempel Marine Coatings (indirect), DNV (certification services). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Goods Containers Market Key Technology Landscape

The technological landscape of the Offshore Goods Containers Market is evolving rapidly, driven primarily by the need for enhanced durability, reduced maintenance costs, and improved supply chain visibility. The core technology remains the use of high-strength, low-alloy structural steel (e.g., S355J2 or equivalent), selected for its superior yield strength and weldability under extreme conditions, ensuring compliance with the stringent DNV 2.7-1 standards for dynamic stress resistance. Advances in anti-corrosion technology are also paramount; this includes specialized multi-layer marine epoxy and polyurethane coating systems, often featuring zinc-rich primers, designed to prolong the structural integrity of containers in highly corrosive saltwater and atmospheric conditions, significantly extending the required lifespan between costly re-certifications.

A major emerging technological trend is the proliferation of "Smart Containers" integrating Internet of Things (IoT) sensors and connectivity solutions. These smart features allow for real-time monitoring of critical parameters such as internal temperature, humidity, shock events (indicating mishandling or severe weather impacts), and geo-location tracking. This data transmission is often facilitated via satellite or GSM networks, providing end-users with unparalleled visibility into cargo status and security. The deployment of passive or active RFID tags further aids in automated inventory management, particularly crucial for large logistics hubs and complex offshore installations requiring strict asset tracking protocols. This technology shift is redefining competition, placing greater value on data integration capabilities than merely physical manufacturing prowess.

Further innovation is focused on enhancing the functional safety and design robustness. This includes developments in lightweighting through composite materials or optimized steel structures, particularly for specialized units like offshore baskets used in cranes with load limitations. The adoption of advanced digital tools, such as Finite Element Analysis (FEA) during the design phase, allows manufacturers to simulate the effects of extreme dynamic loads, reducing the need for costly physical prototypes and ensuring first-time compliance with certification bodies like DNV. These technological advancements ensure containers not only meet current safety standards but are also prepared for the increasingly demanding requirements of ultra-deepwater and Arctic operational environments.

Regional Highlights

- North America (Primarily US and Canada): This region holds a significant market share, heavily driven by sustained deepwater drilling and maintenance activities in the Gulf of Mexico. Key trends include high demand for specialized containers for subsea tooling and chemicals, coupled with rigorous enforcement of safety standards mandated by BSEE regulations, reinforcing demand for DNV-certified units.

- Europe (Especially Norway, UK, and Netherlands): Europe is characterized by stringent environmental and safety regulations, driving premium demand for high-specification containers, particularly in the North Sea. The region is the global leader in offshore wind capacity installation, making it a critical growth market for large, specialized containers required for foundation and turbine component logistics.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC benefits from burgeoning offshore oil and gas developments (e.g., Malaysia, Indonesia, Australia) and massive governmental investments in new offshore wind farms (China, Taiwan, South Korea). The region’s rapid industrialization necessitates large-scale marine logistics, fueling both manufacturing capacity and end-user demand.

- Middle East and Africa (MEA): Growth in this region is primarily tied to state-owned oil company investments in expanding offshore production capabilities, particularly in the Arabian Gulf and West Africa. Demand is characterized by a need for durable, standard containers used for rig support and desert-to-offshore supply chains, requiring specialized coatings to withstand high temperatures and salinity.

- Latin America: Dominated by activity in Brazil (Pre-salt developments) and Mexico. This region requires significant investment in container fleets to support ultra-deepwater operations, often involving specialized units for handling large volumes of drilling mud and process chemicals, driven by Petrobras and Pemex investment cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Goods Containers Market.- Swire Energy Services

- OEG Offshore

- Hoover Ferguson Group

- Suretank Group

- TLS Offshore Containers International

- CIMC Offshore

- W&K Containers Inc.

- Modex Group

- Containex Container-Handelsgesellschaft

- A.P. Møller – Mærsk (via specialized logistics divisions)

- SEA-BOX Inc.

- Boxman Containers

- Zamil Offshore

- Altrad Group

- Specialized Rental Services (SRS)

- Target Logistics

- Unicorn Offshore

- Global Offshore Logistics

- Hempel Marine Coatings (Key coating supplier influence)

- DNV (Key certifier influence on standards)

Frequently Asked Questions

Analyze common user questions about the Offshore Goods Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary certification requirement for offshore goods containers?

The predominant global certification requirement is DNV 2.7-1, issued by DNV (Det Norske Veritas), ensuring the container is structurally sound, certified for offshore lifting, and capable of withstanding the extreme dynamic and environmental loads inherent in marine operations. Compliance with EN 12079 is often an accompanying requirement.

How does the shift to offshore wind energy impact container demand?

Offshore wind expansion drives demand for specialized, non-standard containers, including extra-long baskets for cable handling, customized tool containers for turbine maintenance, and units designed to be stored directly on turbine platforms, diversifying the market away from traditional oil and gas standardized units.

What role does corrosion resistance play in the market?

Corrosion resistance is critical for container longevity and safety compliance. Manufacturers utilize high-grade structural steel and advanced multi-layer marine-grade epoxy coating systems to minimize material degradation from saltwater exposure, extending the asset life and reducing frequency of costly inspections and refurbishments.

Are most offshore containers purchased or leased, and why?

The majority of offshore goods containers are leased or rented. This operating model allows energy operators to manage capital expenditures, maintain fleet flexibility relative to project lifecycles, and outsource complex maintenance, recertification, and global logistics management to specialized leasing companies.

How are 'Smart Containers' enhancing operational efficiency?

Smart Containers, equipped with IoT sensors and GPS, enhance efficiency by providing real-time data on location, temperature, and shock events. This facilitates predictive maintenance, optimizes container utilization rates, minimizes lost cargo, and ensures regulatory compliance through traceable operational monitoring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager