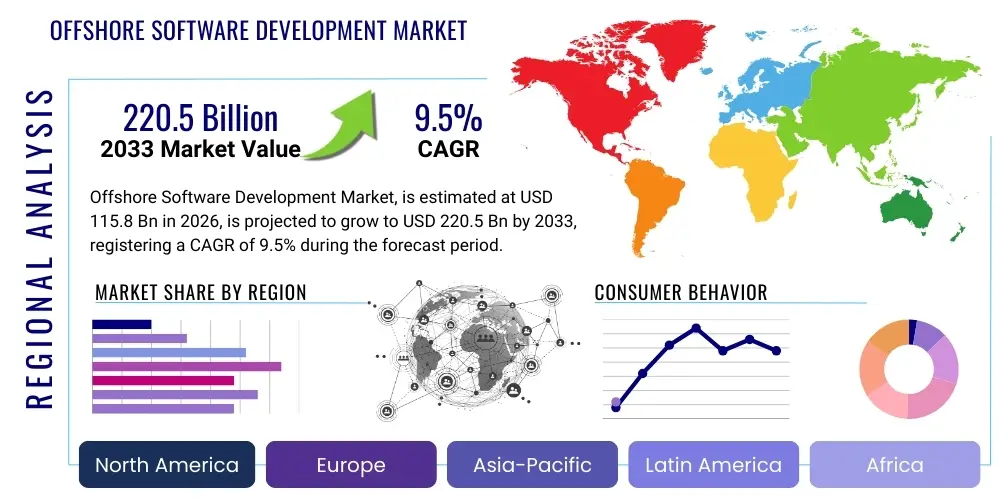

Offshore Software Development Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437097 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Offshore Software Development Market Size

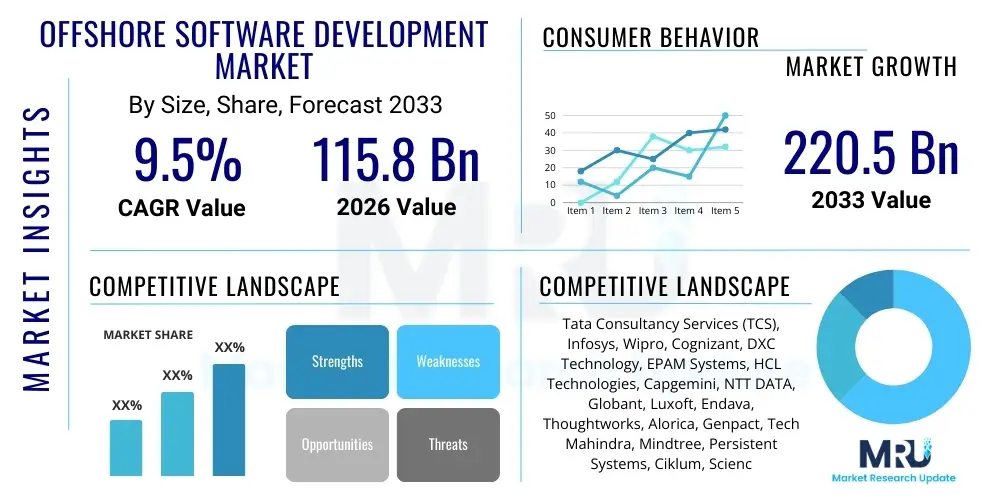

The Offshore Software Development Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 115.8 billion in 2026 and is projected to reach USD 220.5 billion by the end of the forecast period in 2033.

Offshore Software Development Market introduction

The Offshore Software Development Market encompasses the strategic practice of engaging third-party vendors located in a foreign country to handle various software-related activities, ranging from initial design and development to long-term maintenance, testing, and system integration. This model is fundamentally driven by the desire for cost optimization, access to specialized global talent pools, and the ability to scale operations rapidly without the constraints of domestic hiring processes. Historically, the primary motivator has been the significant cost arbitrage offered by regions in Asia Pacific and Eastern Europe compared to North America and Western Europe, enabling businesses to allocate resources more efficiently towards core competencies and innovation. The scope of services covered is broad, including full-cycle product engineering, dedicated team models, staff augmentation, and complex digital transformation projects utilizing emerging technologies like cloud computing, artificial intelligence, and blockchain.

Major applications of offshore development span across almost every industry vertical, including Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail and E-commerce, Telecommunications, and Media. For instance, large enterprises often utilize offshore teams to manage legacy system modernization, develop mobile applications, implement sophisticated Customer Relationship Management (CRM) tools, and ensure continuous quality assurance and testing (QA). Small and Medium Enterprises (SMEs), conversely, leverage offshore partners primarily for full product development cycles, providing them with the necessary technological backbone to compete with larger organizations without substantial capital expenditure on internal development teams. The increasing complexity of modern software ecosystems, demanding expertise in specific programming languages, security protocols, and integration frameworks, further solidifies the necessity of utilizing diverse global talent provided through offshore models.

Key benefits driving the expansion of this market include accelerated time-to-market for new products, enhanced operational efficiency through round-the-clock development cycles (follow-the-sun model), and mitigating the severe domestic shortage of specialized technical expertise, particularly in niche fields such as advanced data science and cybersecurity engineering. Furthermore, engaging specialized offshore vendors allows companies to remain agile and responsive to shifting technological landscapes and evolving consumer demands. The market is evolving beyond simple cost reduction; modern clients seek strategic partnerships that offer deep technical consultancy, predictable scaling capabilities, and robust quality management frameworks, transforming offshore development into a crucial component of global business strategy and digital competitive advantage. The focus has shifted toward high-quality output, intellectual property protection, and seamless cultural integration, moving away from purely transactional relationships to collaborative technological ecosystems.

Offshore Software Development Market Executive Summary

The Offshore Software Development Market is experiencing robust growth fueled by intensifying global competition, necessitating rapid digital adoption and cost-effective operational strategies across all business sectors. A critical business trend shaping the market involves the diversification of geographical outsourcing locations, moving beyond traditional hubs like India towards emerging secondary markets such as Vietnam, the Philippines, and various countries in Latin America (LATAM) and Eastern Europe. This diversification strategy is driven by the need to mitigate geopolitical risks, overcome escalating wage inflation in established regions, and seek specialized talent pools specific to regional compliance needs, such as GDPR adherence in Eastern European service providers or proximity and cultural alignment offered by nearshoring models in LATAM for North American clients. The demand for highly specialized services, particularly in developing cloud-native solutions, leveraging DevOps methodologies, and integrating machine learning capabilities into core business processes, dictates current investment flows within the vendor landscape, prompting significant M&A activities focused on acquiring niche expertise.

Regionally, North America remains the largest demand generator for offshore services, primarily due to high domestic labor costs and the continuous need for technological innovation within the technology, BFSI, and healthcare sectors. However, the Asia Pacific (APAC) region dominates the supply side, largely due to its massive, skilled, and cost-competitive workforce, particularly in software testing and large-scale application maintenance. Europe is seeing a rise in nearshoring activities, with Western European firms increasingly utilizing vendors in Central and Eastern Europe for enhanced data governance control and reduced time-zone differences, thus streamlining collaboration and project management efficiency. Geopolitical volatility, particularly affecting key Eastern European supply markets, has concurrently accelerated interest in secure, stable alternative locations, emphasizing business continuity planning and supplier resilience as major client considerations. This dynamic regional flux is redefining optimal offshore strategy, prioritizing vendor stability and shared risk management.

In terms of segment trends, the Application Development segment continues to hold the largest market share, driven by the continuous demand for new product launches, platform upgrades, and enterprise system customization tailored to specific operational requirements. Within this segment, the shift towards Agile and DevOps models is paramount, requiring offshore partners to adopt integrated development and operations practices to ensure continuous delivery and rapid iteration cycles. Furthermore, the BFSI and Healthcare verticals are exhibiting exponential demand growth, primarily because of stringent regulatory compliance requirements (e.g., HIPAA, PSD2) necessitating sophisticated, secure software solutions that can be developed and maintained cost-effectively offshore. The segment of managed services, including Infrastructure Management and Security Operations, is also expanding rapidly, reflecting a trend among enterprises to offload non-core, high-complexity IT functions entirely to specialized third-party providers, ensuring adherence to global best practices and cybersecurity standards.

AI Impact Analysis on Offshore Software Development Market

The integration of Artificial Intelligence, particularly Generative AI (GenAI) and large language models (LLMs), is fundamentally reshaping the landscape of the Offshore Software Development Market, eliciting significant user questions concerning job displacement, productivity gains, and the necessary evolution of developer skills. Common user inquiries revolve around whether AI tools like GitHub Copilot or advanced code generation platforms will render entry-level offshore programming obsolete, or if these technologies merely augment existing capabilities. Users are highly interested in understanding the shift from manual coding and testing tasks to higher-value activities such as prompt engineering, system architecture design, and comprehensive AI governance. The key concern centers on the future demand for traditional offshore development roles, weighed against the potential for massive efficiency improvements and the ability of offshore firms to rapidly integrate AI-driven tools to maintain their cost advantage and deliver accelerated project timelines, fundamentally changing the nature of offshore engagement models from pure labor arbitrage to intellectual contribution and oversight.

GenAI tools are already demonstrating capability in automating repetitive tasks, including boilerplate code generation, basic bug detection, and preliminary unit testing. This is leading to a significant optimization of the software development lifecycle (SDLC), potentially reducing the required number of junior developers dedicated to routine coding tasks. Offshore providers are responding by aggressively upskilling their workforce, shifting the focus from execution to complex problem-solving, architectural oversight, and becoming experts in utilizing AI accelerators. Consequently, the value proposition of offshore services is transforming; clients will increasingly seek partners who can demonstrate proficiency in AI integration, offering services that guarantee enhanced code quality, accelerated feature delivery, and optimized resource allocation through intelligent automation, rather than just offering cheaper labor rates. This paradigm shift mandates that offshore firms invest heavily in AI infrastructure and training to retain competitiveness.

The long-term impact suggests a bifurcated market outcome: providers who successfully adopt and master AI tools will capture market share by offering superior efficiency and specialized AI development services, while those resistant to adoption may face margin erosion as their traditional services become commoditized and partially automated. Furthermore, AI introduces new service lines, such as developing and maintaining custom LLMs, integrating AI into existing enterprise applications, and establishing robust AI ethics and governance frameworks, all of which require specialized, high-skill offshore talent. This refocuses the competitive advantage of offshore locations from low-cost generalists to specialized experts capable of driving cutting-edge digital transformation initiatives powered by AI, ensuring that the market, while transformed, continues to grow in value and complexity, moving towards brain arbitrage rather than just labor arbitrage.

- Increased code generation and automation of repetitive coding tasks, leading to higher developer productivity.

- Shift in required skills towards prompt engineering, AI model management, and complex system architecture design among offshore teams.

- Significant reduction in manual testing and QA efforts due to AI-driven test case generation and bug detection.

- Creation of new high-value service lines focusing on AI implementation, LLM customization, and maintenance for global clients.

- Potential initial displacement of entry-level coding roles, necessitating rapid upskilling and refocusing of junior resources.

- Enhancement of continuous integration and continuous delivery (CI/CD) pipelines through intelligent automation, accelerating time-to-market.

- Heightened requirements for data governance and intellectual property protection when utilizing AI tools for client code.

DRO & Impact Forces Of Offshore Software Development Market

The Offshore Software Development Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively influencing the strategic direction and growth trajectory of the industry, creating powerful impact forces. Key drivers include the persistent, high operational costs and acute talent shortages faced by companies in developed economies, forcing them to look outward to specialized talent pools for scaling development capabilities. The digital imperative across all sectors, accelerating the need for continuous software updates, legacy system modernization, and adoption of cutting-edge technologies (Cloud, AI, IoT), further amplifies the demand for offshore expertise. However, significant restraints impede growth, primarily revolving around data security and privacy concerns, particularly when handling sensitive consumer or proprietary corporate data across international borders with varying regulatory environments. Cultural differences, communication barriers, and the complexities associated with managing geographically dispersed teams also pose non-trivial challenges to successful project execution, requiring substantial investment in robust project management and communication infrastructure to mitigate risk.

Opportunities within the market largely stem from the increasing demand for hyper-specialized services that cannot be easily fulfilled domestically. This includes expertise in niche domains like blockchain infrastructure, specific industry regulatory technology (RegTech), or advanced cybersecurity engineering. Furthermore, the shift towards outcome-based contracting and managed services models, where offshore partners take full ownership of defined business outcomes rather than simply providing staff augmentation, offers a substantial growth avenue. The expansion of nearshoring options, particularly in Latin America for North American clients and Eastern Europe for Western European clients, provides a valuable middle ground, balancing cost savings with reduced cultural friction and improved real-time collaboration due to minimal time zone differences. These opportunities enable vendors to move up the value chain, transitioning from commodity service providers to strategic business transformation partners.

The prevailing impact forces dictate that market participants must continuously innovate to remain competitive. The primary impact force is the necessity for vendors to demonstrate robust security and compliance frameworks, including adherence to global standards like ISO 27001 and SOC 2, to overcome client anxieties regarding data sovereignty and cyber threats. Secondly, the rapid evolution of technology demands perpetual investment in upskilling and certification of technical teams in areas such as cloud infrastructure (AWS, Azure, GCP) and GenAI tools. Finally, the ability to offer flexible engagement models—spanning fixed price, time and materials, and dedicated team structures—tailored to diverse client needs and risk tolerance levels, is crucial for capturing and retaining large enterprise contracts. The overall market trajectory is driven by balancing the financial benefits of offshore engagement against the inherent operational and security risks associated with globally distributed development resources, making transparency and trust critical differentiators in vendor selection.

Segmentation Analysis

The Offshore Software Development Market is extensively segmented based on service type, organization size, and industry vertical, reflecting the varied needs and operational scales of the global clientele. Understanding these segmentation nuances is crucial for both service providers aiming to tailor their offerings and clients seeking optimal partners that align with their specific technological and sectoral requirements. The Service Type segmentation delineates the core activities outsourced, ranging from comprehensive end-to-end application development to focused tasks like quality assurance or infrastructure management, with trends indicating increasing complexity in outsourced activities as clients seek specialized expertise rather than generic programming resources. Organization size segmentation distinguishes the needs of large enterprises, which often require staff augmentation or complex, long-term legacy system overhaul projects, from Small and Medium Enterprises (SMEs), which are more likely to outsource the entire product development lifecycle due to limited internal IT resources and budgetary constraints.

The segmentation by Industry Vertical reveals significant variance in outsourcing motivations and required skillsets. For example, the Banking, Financial Services, and Insurance (BFSI) sector demands exceptionally high levels of security, regulatory compliance knowledge, and expertise in fintech integration, driving demand for vendors with proven track records in these areas, often preferring nearshore models for better data governance oversight. Conversely, the Retail and E-commerce sector prioritizes speed, scalability, and expertise in customer-facing technologies like mobile application development, sophisticated analytics, and cloud infrastructure management to handle peak traffic demands and rapid feature deployment. These differences mean that service providers must develop deep industry-specific knowledge and specialized talent pools to effectively serve targeted verticals, moving away from a one-size-fits-all approach to highly customized technological solutions.

Furthermore, geographic location plays a subtle yet critical role in segmentation, as clients often choose outsourcing locations based not just on cost but on language proficiency, cultural compatibility, and specific time zone overlap for optimized collaboration. This has led to the rise of specialized regional offerings, such as providers in Eastern Europe focusing on niche Java and C++ expertise for demanding Western European engineering firms, or vendors in Southeast Asia focusing on high-volume mobile application testing and maintenance for global tech companies. The complexity of modern enterprise architecture also fuels segmentation, with specialized niches emerging for microservices implementation, containerization via Kubernetes, and advanced cloud optimization, ensuring that the market remains highly fragmented yet richly specialized, catering to almost any technological requirement a global business might possess.

- By Service Type:

- Application Development (Custom Software, Mobile Apps, Enterprise Systems)

- Application Maintenance and Support (Legacy System Modernization, Bug Fixing, Enhancements)

- Software Testing and Quality Assurance (Functional, Performance, Security Testing)

- IT Consulting and Technology Advisory

- Infrastructure Management and Cloud Services

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecommunication

- Manufacturing and Automotive

- Government and Public Sector

- Media and Entertainment

- By Development Model:

- Offshore Outsourcing

- Nearshore Outsourcing

- Onshore Outsourcing (often used for specific management oversight)

Value Chain Analysis For Offshore Software Development Market

The Value Chain for the Offshore Software Development Market starts with rigorous Upstream Analysis, primarily focusing on talent acquisition, strategic partner selection, and infrastructure provisioning. Upstream activities involve identifying and recruiting highly skilled technical personnel in specific offshore locations, ensuring expertise aligns with global technology stacks like specialized cloud certifications or proficiency in niche programming languages such as Rust or Scala. This phase also includes securing necessary operational infrastructure, including high-speed, reliable network connections, secure data centers that comply with international regulations, and establishing robust physical and digital security frameworks to protect client intellectual property and data assets. Furthermore, sophisticated vendors engage in proactive partner ecosystem development, forging alliances with technology giants (e.g., Microsoft, Google, AWS) to ensure access to the latest tools and development platforms, thereby optimizing resource availability and technical readiness for future projects.

The Core Activities segment of the value chain involves the execution of the software development lifecycle (SDLC) itself, spanning requirements gathering, system architecture design, actual coding and development, rigorous testing and quality assurance (QA), and final deployment. Efficient offshore operations heavily rely on standardized methodologies, primarily Agile and DevOps, which necessitate constant, high-fidelity communication between the client's team and the offshore delivery center. Effective distribution channels are intrinsic to this phase, as the primary output—digital software—is delivered through secure digital pipelines, usually utilizing version control systems like Git and continuous integration/continuous delivery (CI/CD) tools. Direct distribution is the overwhelming norm, as offshore development services are highly customized and inherently rely on direct client interaction and tailored solution delivery, often managed through dedicated client success managers and project leads who facilitate the flow of information and deliverables.

Downstream Analysis primarily focuses on post-deployment activities, including long-term maintenance, technical support, bug resolution, and system enhancements to ensure ongoing operational excellence and maximize the return on investment for the client. Indirect distribution, though minimal in core development, can occur when large system integrators or consulting firms act as intermediaries, subcontracting specific components of development or testing to specialized offshore vendors—a channel often utilized for staff augmentation or niche projects requiring specialized technological stacks. Success in the downstream portion of the value chain is determined by the vendor’s ability to transition seamlessly from a development partner to a maintenance and strategic technology advisor, ensuring system stability, implementing security patches promptly, and proactively suggesting future technological roadmap enhancements. The continuous feedback loop established during this phase is critical for client retention and securing follow-on project contracts, driving sustainable revenue growth for the offshore service provider.

Offshore Software Development Market Potential Customers

Potential customers for the Offshore Software Development Market span a vast range of organizations globally, fundamentally characterized by their need to rapidly scale technological capabilities, manage high operating costs associated with domestic IT talent, and access specialized expertise necessary for complex digital transformation projects. Large Enterprises, including Fortune 500 companies, represent a significant segment, typically seeking high-volume staff augmentation, comprehensive maintenance of complex legacy systems, and specialized teams for niche areas like artificial intelligence, regulatory compliance software development, or global cloud migration strategies. These large organizations often require vendors with strong financial stability, globally recognized certifications (e.g., CMMI Level 5), and the capacity to deploy hundreds of developers quickly across multiple projects, making vendor governance and risk mitigation paramount factors in their procurement decisions.

The Small and Medium Enterprise (SME) segment is another crucial customer base, characterized by their need for cost-effective, end-to-end product development solutions. Unlike large enterprises that might augment internal teams, SMEs often lack any significant internal development capacity, leading them to outsource entire technology functions, including mobile app development, foundational website architecture, or the creation of Minimum Viable Products (MVPs). Their purchasing decision is heavily influenced by transparent pricing models, the vendor's ability to act as a complete technology partner providing consultative guidance, and a demonstrated capacity for rapid iteration and flexibility, making them key consumers of dedicated team models and project-based outsourcing services focused on accelerating their speed-to-market and conserving capital expenditure.

From an industry perspective, the Banking, Financial Services, and Insurance (BFSI) sector is a critical consumer, driven by continuous technological disruption (FinTech), the necessity for robust cybersecurity measures, and the development of compliance-heavy solutions (e.g., anti-money laundering tools, secure digital payment gateways). Similarly, the Healthcare and Life Sciences sector relies heavily on offshore development for electronic health record (EHR) system maintenance, telehealth platform development, and sophisticated data analytics for clinical trials, where compliance with HIPAA and GDPR is non-negotiable. The Retail and E-commerce segment utilizes offshore partners primarily for high-traffic platform development, integration of sophisticated supply chain logistics software, and personalization engines driven by machine learning. In essence, any organization facing intense market competition coupled with a scarcity of specific, affordable technical talent constitutes a potential customer for high-quality offshore software development services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.8 billion |

| Market Forecast in 2033 | USD 220.5 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Consultancy Services (TCS), Infosys, Wipro, Cognizant, DXC Technology, EPAM Systems, HCL Technologies, Capgemini, NTT DATA, Globant, Luxoft, Endava, Thoughtworks, Alorica, Genpact, Tech Mahindra, Mindtree, Persistent Systems, Ciklum, ScienceSoft |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Offshore Software Development Market Key Technology Landscape

The technology landscape governing the Offshore Software Development Market is highly dynamic, characterized by the rapid adoption of cloud-native architectures, the widespread implementation of DevOps practices, and the critical integration of sophisticated security measures. Cloud-native development, utilizing microservices, containers (Docker, Kubernetes), and serverless computing, is paramount, as clients seek highly scalable, resilient, and cost-efficient applications. Offshore vendors must possess deep expertise in multi-cloud environments (AWS, Azure, GCP) and demonstrate proficiency in automating infrastructure provisioning through Infrastructure as Code (IaC) tools like Terraform and Ansible. This foundational technological shift enables the continuous delivery model favored by modern businesses, ensuring that applications are deployed rapidly, tested continuously, and scaled elastically to meet fluctuating user demand, requiring offshore teams to be proficient not just in coding but in operationalizing the entire deployment pipeline.

Furthermore, the increased focus on data and intelligence drives the demand for specialized skills in Artificial Intelligence (AI) and Machine Learning (ML), alongside robust data engineering capabilities. Offshore service providers are increasingly tasked with developing custom ML models, integrating predictive analytics into enterprise platforms, and managing large-scale data lakes and pipelines. This requires competence in Python, R, and specialized frameworks (TensorFlow, PyTorch), coupled with expertise in ensuring data quality and governance, particularly in regulated industries like healthcare and finance. The proliferation of AI is not only a service offering but also an internal efficiency driver, with vendors utilizing AI-powered tools for code refactoring, automated testing, and improved project management, thereby enhancing the overall quality and speed of delivery while optimizing internal resource utilization.

Security remains a non-negotiable technological requirement, leading to the institutionalization of DevSecOps principles throughout the offshore SDLC. The technology landscape mandates that vendors implement comprehensive security practices, including automated security testing (SAST/DAST) integrated into CI/CD pipelines, adherence to Zero Trust architectural principles, and expertise in managing identity and access governance (IAM) across distributed systems. Beyond these core areas, emerging technologies such as blockchain (for supply chain transparency and secure financial transactions) and the development of immersive digital experiences using Augmented Reality (AR) and Virtual Reality (VR) are beginning to influence niche offshore segments. Vendors who strategically invest in these emerging technologies and secure specialized certifications will be best positioned to capture high-margin, complex projects during the forecast period, transitioning the market towards high-value intellectual capital rather than merely labor capacity.

Regional Highlights

The global demand and supply dynamics of the Offshore Software Development Market are highly regionalized, defined by a complex interplay of cost arbitrage, specialized talent availability, geopolitical stability, and proximity to major demand markets. North America, driven by the United States and Canada, remains the largest consuming region, characterized by high innovation rates, substantial IT spending, and a persistent shortage of domestic technical expertise, particularly in cutting-edge fields like specialized cloud security and AI engineering. Consequently, North American firms heavily utilize offshore services in APAC and nearshore partners in Latin America to access large, cost-effective talent pools capable of handling scale and complexity. The focus in this region is increasingly shifting towards managed services and dedicated R&D center outsourcing, where vendors function as strategic partners integrated into the client's long-term product roadmap.

Europe represents a highly fragmented demand market, with strong distinctions between Western European buyers (Germany, UK, France) and Central/Eastern European suppliers. Western European firms prioritize data privacy (GDPR compliance) and cultural alignment, fueling the substantial growth of nearshoring within Central and Eastern Europe (CEE). CEE countries offer highly skilled engineering talent, strong language proficiency, and close time zone proximity, making them ideal for collaborative, Agile projects. However, recent geopolitical events in Eastern Europe have necessitated risk diversification, leading some clients to explore alternatives in the Balkans and parts of LATAM, though CEE retains its strength in specialized skill sets like enterprise Java development and sophisticated systems integration. The European market focuses heavily on compliance-driven software development for finance, automotive, and regulated manufacturing sectors.

Asia Pacific (APAC) dominates the supply side of the global market, primarily led by established powerhouses like India, which offers unparalleled scale and maturity in traditional outsourcing services, particularly application maintenance and BPO integration. Emerging supply locations such as the Philippines (known for English proficiency and contact center integration), Vietnam (rising profile in embedded systems and mobile development), and Malaysia (multilingual support and favorable tax regimes) are growing rapidly, driven by favorable government policies and competitive wages. The APAC region is transitioning from being purely a cost center to a critical innovation hub, with vendors investing heavily in AI and cloud certifications to move up the value chain. Latin America (LATAM), including countries like Mexico, Brazil, and Argentina, is experiencing accelerated growth due to its time zone compatibility with North America and strong cultural affinities, making it the preferred nearshore destination for clients requiring high-synchronicity collaboration, particularly for agile teams working on front-end development and real-time support applications.

- North America (Dominant Demand Market): High adoption of emerging technologies; focused on leveraging offshore expertise to mitigate domestic talent shortages and drive rapid digital innovation.

- Asia Pacific (Largest Supply Market): Unmatched scale, cost efficiency, and mature outsourcing infrastructure (India, Philippines, Vietnam); increasingly moving into high-value AI and cloud services.

- Europe (Nearshoring Focus): Demand for GDPR-compliant, high-quality engineering (Germany, UK); supply dominated by Central and Eastern Europe (Poland, Romania) due to proximity, skills, and cultural fit.

- Latin America (Growing Nearshore Hub): Critical for US clients due to time zone overlap and cultural alignment (Mexico, Brazil); strong growth in Agile development and product engineering services.

- Middle East and Africa (Emerging Potential): Smaller current market share but growing due to regional digital transformation initiatives (UAE, South Africa); focusing on specialized enterprise solutions and government IT projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Software Development Market.- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Cognizant

- DXC Technology

- EPAM Systems

- HCL Technologies

- Capgemini

- NTT DATA

- Globant

- Luxoft

- Endava

- Thoughtworks

- Alorica

- Genpact

- Tech Mahindra

- Mindtree

- Persistent Systems

- Ciklum

- ScienceSoft

Frequently Asked Questions

Analyze common user questions about the Offshore Software Development market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Offshore Software Development Market?

The Offshore Software Development Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven primarily by persistent talent shortages in developed economies and the increasing need for cost-efficient digital transformation services globally.

How is AI impacting the productivity and structure of offshore development teams?

AI is significantly increasing the productivity of offshore teams by automating routine coding and testing tasks. This necessitates a shift in roles, moving developers towards higher-value activities such as prompt engineering, complex architecture design, and system integration oversight, focusing the value proposition on intellectual contribution rather than pure labor.

Which geographical regions are dominant in terms of offshore service supply and demand?

North America is the dominant region for demand, driving the highest volume of outsourcing contracts. Asia Pacific (led by India and the Philippines) remains the largest global supply market due to its massive, skilled talent pool and well-established outsourcing infrastructure.

What are the primary restraints affecting the growth of the Offshore Software Development Market?

The primary restraints include critical concerns related to data security and privacy compliance (e.g., adherence to GDPR and HIPAA across borders), managing cultural and communication differences among globally dispersed teams, and navigating geopolitical instability in key outsourcing regions.

What are the fastest-growing segments within the Offshore Software Development Market by vertical?

The fastest-growing segments are Healthcare and Life Sciences, driven by the need for secure telehealth platforms and regulated data analytics, and the BFSI sector, which requires specialized fintech development and robust cybersecurity solutions to maintain regulatory compliance amidst rapid digital innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager