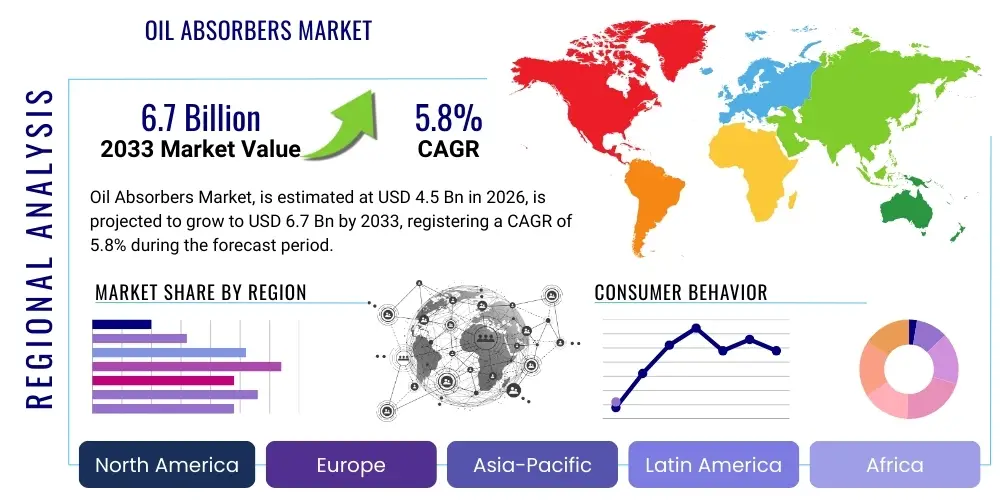

Oil Absorbers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437536 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Oil Absorbers Market Size

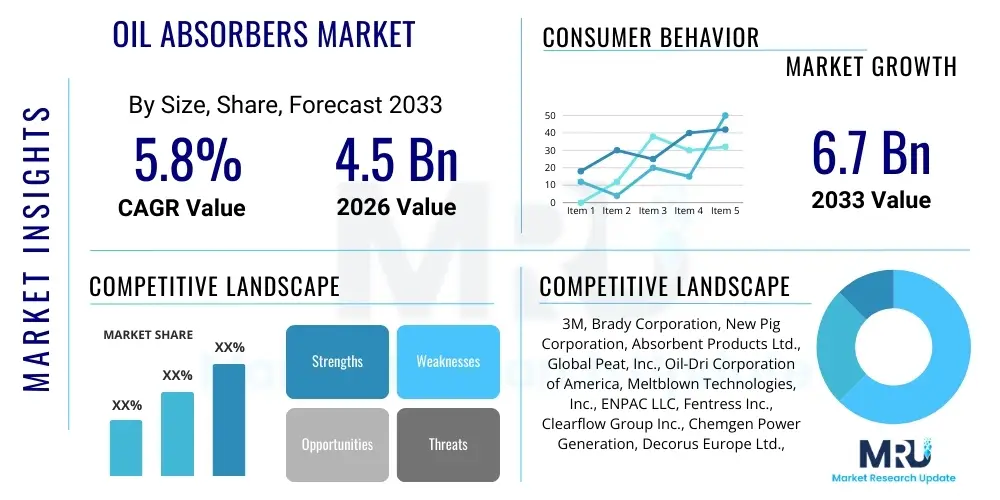

The Oil Absorbers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.7 Billion by the end of the forecast period in 2033.

Oil Absorbers Market introduction

Oil absorbers, also known as oil sorbents, are specialized materials designed to encapsulate and retain oil-based liquids while rejecting water. These products are crucial components in environmental protection, industrial safety, and maintenance operations, primarily utilized to manage and clean up accidental spills of petroleum products, lubricants, and various hydrocarbons. The fundamental purpose of oil absorbers is to mitigate environmental damage, prevent safety hazards, and ensure compliance with stringent pollution control regulations across diverse industries globally.

The market encompasses a wide array of product forms, including pads, rolls, booms, pillows, and loose particulate materials, each tailored for specific containment and cleanup scenarios, ranging from small shop leaks to large-scale marine oil spills. Major applications span the oil and gas exploration and production sector, maritime transportation, general industrial manufacturing, automotive workshops, and environmental remediation projects. The effectiveness of an oil absorber is typically measured by its absorption capacity, speed, and reusability potential, driving ongoing innovation in material science.

The market is significantly driven by increasing industrial safety mandates, the growth of offshore drilling activities necessitating robust spill response mechanisms, and a heightened global environmental consciousness. Key benefits of utilizing high-performance oil absorbers include rapid cleanup time, reduced disposal costs through efficiency, enhanced workplace safety by eliminating slip hazards, and minimizing ecological impact on sensitive environments like coastlines and waterways. Furthermore, the push towards bio-based and sustainable absorbent materials is shaping product development and market dynamics.

Oil Absorbers Market Executive Summary

The Oil Absorbers Market is poised for substantial growth, characterized by strong demand originating from industrial maintenance and stringent environmental compliance requirements, particularly within the oil & gas and maritime sectors. Current business trends indicate a definitive shift toward synthetic polymer-based sorbents and advanced fibrous materials, offering superior absorption capacity and selectivity compared to traditional mineral-based products. Furthermore, suppliers are increasingly focusing on customizable spill kits and integrated safety solutions that bundle absorbers with containment tools, driving higher average transaction values and establishing stronger client relationships, especially in heavy manufacturing and energy production environments.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid industrialization, burgeoning oil refining capacity, and the necessity to manage industrial effluents and hazardous waste according to newly enacted local environmental laws. North America and Europe, representing mature markets, maintain dominance in terms of overall market value, driven by high adoption rates of premium, reusable sorbents and substantial expenditure on robust environmental cleanup programs. Conversely, regions like the Middle East and Africa (MEA) are seeing accelerated growth due to expansions in petrochemical production and the vital role of maritime traffic in energy exports, demanding immediate large-scale spill response capabilities.

Segment trends highlight the dominance of the Synthetic segment, particularly polypropylene meltblown materials, owing to their high oleophilic and hydrophobic properties. However, the Organic segment, utilizing materials like peat moss, coir, and recycled cellulose, is gaining traction due to growing corporate sustainability commitments and favorable disposal characteristics. In terms of application, the Environmental Cleanup segment, covering large-scale governmental and private remediation projects, remains the primary revenue generator, while the Industrial Maintenance segment provides stable, recurring demand for daily operational spill management.

AI Impact Analysis on Oil Absorbers Market

User inquiries regarding the intersection of AI and the Oil Absorbers Market primarily revolve around questions concerning predictive spill modeling, optimization of logistics for response deployment, and the potential integration of smart sensing technologies with absorbent systems. Users are keen to understand how AI can enhance the efficiency of environmental remediation by accurately predicting high-risk areas (e.g., pipeline vulnerabilities or maritime routes prone to collision), thereby preemptively positioning absorbent stockpiles. Furthermore, interest lies in how machine learning could analyze the efficacy of different absorbent materials under various environmental conditions (temperature, viscosity) to recommend the optimal cleanup product instantly, moving beyond manual material selection. The key themes are operational optimization, predictive maintenance to reduce spills, and improved speed and accuracy in emergency response planning, focusing on reducing the overall volume of required cleanup materials and minimizing ecological footprint through better resource allocation.

- AI-driven predictive modeling for pipeline leaks and maritime collision probabilities, optimizing preemptive placement of oil containment booms and absorbers.

- Machine learning algorithms analyzing spill characteristics (oil type, water currents, temperature) to recommend the highest-efficiency oil absorber product in real-time.

- Automation in inventory management and supply chain logistics for absorbent materials, ensuring just-in-time delivery to spill sites via AI-optimized routing.

- Integration of smart sensors (IoT) into containment systems (booms, pillows) to monitor saturation levels, signaling when replacement or removal of the absorbent material is necessary, thereby maximizing material utility.

- AI analysis of historical cleanup data to refine material composition and design, leading to the development of next-generation, super-absorbent composites with higher specificity and reduced disposal weights.

DRO & Impact Forces Of Oil Absorbers Market

The dynamics of the Oil Absorbers Market are dictated by a balanced interaction between compelling drivers and persistent restraints, creating opportunities influenced by significant impact forces. The primary drivers include the implementation of stricter international environmental regulations, such as those governed by IMO (International Maritime Organization) and regional bodies like the EPA, which necessitate immediate and comprehensive spill response capabilities in industrial and marine settings. Concurrently, the increasing scale and complexity of industrial operations, particularly the extraction and transport of hydrocarbons in environmentally sensitive areas, amplify the risk of major accidents, thereby boosting the mandatory stocking and usage of specialized oil absorbers. This regulatory push and industrial expansion form the core engine of market growth.

However, the market faces notable restraints, chiefly concerning the high cost associated with advanced synthetic sorbents and the substantial logistical burden and expense related to the appropriate disposal of saturated absorbent materials, which are often classified as hazardous waste. Traditional disposal methods, such as incineration or landfilling, are environmentally contentious and costly, prompting end-users to seek reusable or biodegradable alternatives, though these often present trade-offs in absorption efficiency or initial purchasing cost. Furthermore, a lack of standardized global testing methodologies for absorption capacity creates complexities in product comparison and procurement across international borders, hindering market transparency.

Opportunities in the market are largely concentrated around the innovation in sustainable chemistry, specifically the development of bio-based, recycled, and reusable oil absorbers that significantly reduce the environmental burden of cleanup activities. Technological advancements leading to superhydrophobic and superoleophilic materials, potentially integrated with nanotechnology, promise higher efficiency and lower material usage per cleanup event. The major impact forces include geopolitical stability influencing oil exploration and transport activities, fluctuations in crude oil prices affecting profitability and safety expenditure in the oil & gas sector, and shifting public perception demanding greater corporate accountability regarding environmental protection.

Segmentation Analysis

The Oil Absorbers Market is systematically segmented based on material composition, product format, end-use application, and distribution channel, providing a granular view of demand patterns across diverse industrial landscapes. The segmentation by material is crucial as it defines the absorption efficiency, cost, and disposal feasibility of the product, with synthetic materials currently holding the largest market share due to superior performance characteristics, though bio-based materials are rapidly gaining ground. Understanding these segments is vital for suppliers to tailor product specifications—such as capacity and flow rate resistance—to meet the exacting needs of specialized end-user environments like offshore drilling platforms versus factory floors.

Product format segmentation dictates the immediate utility of the absorber, ranging from large containment booms used in open water marine spills to small pads and pillows deployed for routine maintenance drips and leaks in manufacturing facilities. The continuous shift in industrial compliance toward preventative maintenance and immediate cleanup practices ensures stable demand across all product formats. Furthermore, the segmentation by application highlights the critical role absorbers play across the entire hydrocarbon value chain, from upstream drilling and midstream transportation to downstream refining and general industrial processing, each requiring distinct types of absorption products with varying degrees of chemical resistance and physical durability.

- By Material:

- Organic (e.g., Peat Moss, Sawdust, Cotton, Recycled Cellulose)

- Inorganic (e.g., Clay, Vermiculite, Diatomaceous Earth)

- Synthetic (e.g., Polypropylene, Polyethylene, Polyurethane)

- By Type/Format:

- Pads and Rolls

- Booms and Socks

- Pillows and Drip Pans

- Loose Particulate (Granular)

- By Application:

- Industrial Maintenance and Safety (I&S)

- Environmental Cleanup (Marine and Land Spills)

- Automotive and Transportation

- Oil & Gas Exploration and Production

- By End-Use Industry:

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Marine and Shipping

- Chemical and Petrochemical

Value Chain Analysis For Oil Absorbers Market

The value chain for the Oil Absorbers Market starts with upstream activities involving the sourcing and processing of raw materials, which vary significantly depending on the absorber type. For synthetic absorbers, the process begins with petrochemical intermediates like propylene, which is then polymerized and melt-blown into high-surface-area nonwoven fabrics, requiring specialized machinery and high energy input. For organic absorbers, sourcing involves acquiring biomass such as peat or recycled paper pulp, followed by treatment and packaging. Key challenges in the upstream segment include volatile petrochemical feedstock prices and ensuring consistent quality and sustainable sourcing practices for bio-based inputs.

Midstream activities primarily focus on the manufacturing, conversion, and assembly of the finished product formats—turning rolls of material into pre-cut pads, filling socks and pillows, and constructing robust booms. Efficiency in this stage is critical, driven by economies of scale and automation in converting processes. Companies often invest heavily in patented manufacturing technologies to enhance absorption capacity (e.g., proprietary fiber structures) and improve product durability. The competitive landscape in the midstream is intense, with specialized manufacturers constantly seeking ways to differentiate their sorbents through material innovation and ergonomic design.

Downstream activities involve the distribution channel, which is crucial for delivering these emergency-response products quickly to the end-users. Direct sales channels are common for large-volume industrial clients (e.g., major oil companies) who require customized bulk orders and integrated spill response contracts. Indirect channels, including industrial distributors, safety supply houses, and large e-commerce platforms, serve the broader market, including small-to-midsize enterprises (SMEs) and routine maintenance users. The effectiveness of the distribution network, particularly its ability to ensure rapid deployment during emergencies, significantly impacts customer satisfaction and market leadership. The shift toward specialized distributors focused on environmental safety and compliance is a key trend in this segment.

Oil Absorbers Market Potential Customers

The primary customers for oil absorbers are entities operating in environments where hydrocarbon leaks, drips, or major spills are inherent operational risks, necessitating preventative measures and immediate cleanup capabilities. These include large multinational corporations in the energy sector, specifically upstream exploration companies, midstream pipeline operators, and downstream refining and petrochemical processing plants, which require high volumes of specialized booms and pads to comply with strict internal and external environmental standards. Furthermore, governmental and private environmental remediation contractors constitute a major segment, purchasing large, specialized inventories to manage large-scale land and marine pollution events.

A second substantial segment comprises the manufacturing and transportation industries. Manufacturing facilities, particularly those involved in heavy machinery, metalworking, hydraulics, and general industrial maintenance, require routine floor and workbench sorbents to manage cutting fluids, hydraulic oils, and lubricants, essential for maintaining workplace safety and preventing operational downtime. The transportation sector, including commercial trucking fleets, railways, and major ports, requires specialized spill kits to respond to fuel and cargo leaks, mandated by transportation safety authorities. These customers prioritize ease of use, product durability, and cost-effectiveness for daily operational needs rather than large-scale catastrophic response materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Brady Corporation, New Pig Corporation, Absorbent Products Ltd., Global Peat, Inc., Oil-Dri Corporation of America, Meltblown Technologies, Inc., ENPAC LLC, Fentress Inc., Clearflow Group Inc., Chemgen Power Generation, Decorus Europe Ltd., Safetec of America Inc., US Ecology Inc., SpillTech (a subsidiary of NPS Corp.), Sellars Absorbent Materials Inc., Sorbent Green, Universal Sorbent Products, CSP Technologies, Tolsa, Imbibitive Technologies, Darcy Products Ltd., Elastec, Dycem Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Absorbers Market Key Technology Landscape

The technology landscape of the Oil Absorbers Market is characterized by continuous research focused on enhancing material selectivity, capacity, and sustainability. A core technological advancement involves the refinement of melt-blown polypropylene fibers, where manufacturers manipulate fiber diameter and structure to maximize surface area and porosity. This process results in super-absorbent synthetic materials that can absorb up to 25 times their own weight in oil, significantly improving efficiency during cleanup operations. Furthermore, composite technologies, combining layers of highly absorbent synthetics with durable, fluid-resistant outer casings, are critical for products like containment booms and socks, ensuring structural integrity even when fully saturated and deployed in turbulent waters.

Another significant area of innovation is the development of advanced oleophilic and hydrophobic coatings applied to traditional materials. Nanotechnology is playing an emerging role here, facilitating the creation of coatings that dramatically repel water while strongly attracting oil, thus ensuring high selectivity and minimal waste volume. This "smart" surface technology is particularly valuable in marine environments where minimizing water uptake is paramount. Alongside synthetic advancements, technologies in the organic segment are focusing on chemical modification or thermal treatment of natural biomass (e.g., coconut coir, cellulose) to increase their oil absorption kinetics and capacities, often aiming for materials that can be biologically remediated or repurposed post-cleanup, aligning with circular economy principles.

Lastly, the market is witnessing the adoption of smart sensing technologies integrated into the overall spill response systems, even if not directly in the absorber itself. This includes developing IoT-enabled monitoring systems for storage and deployment readiness and utilizing drones equipped with thermal imaging to map the extent and thickness of oil spills, allowing for precise placement and optimal use of absorbent materials. These adjacent technologies improve the entire cleanup ecosystem, driving demand for specialized, high-performance absorbers that can be deployed effectively based on real-time data analysis and modeling.

Regional Highlights

The Oil Absorbers Market exhibits distinct growth trajectories influenced by regional industrial maturity, regulatory frameworks, and geographical concentration of hydrocarbon activities.

- North America: This region maintains a leadership position, driven by the massive presence of the oil and gas sector (shale oil production, offshore drilling) and extremely rigorous safety and environmental regulations enforced by bodies like the EPA and OSHA. Demand here is characterized by a preference for high-quality, synthetic, and reusable products, with significant spending on preventative safety measures and large-scale emergency response planning. The market is mature but innovative, focusing heavily on sustainability reporting and minimizing waste generation.

- Europe: The European market is highly focused on sustainability and compliance with strict EU directives on environmental protection (e.g., REACH). The strong maritime industry, particularly the northern European ports and shipping lanes, drives demand for marine-specific booms and containment products. Growth is primarily centered on eco-friendly solutions, with bio-based and recycled-content absorbers gaining rapid market penetration due to favorable governmental incentives and high consumer preference for sustainable alternatives.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unparalleled expansion in manufacturing, chemical processing, and refinery capacity, particularly in China, India, and Southeast Asian nations. The increasing need to manage industrial waste and newly adopted, stricter environmental accountability laws are key demand catalysts. While price sensitivity remains a factor, the sheer scale of industrial activity ensures massive consumption of both granular inorganic and affordable synthetic absorbers.

- Middle East and Africa (MEA): This region is a vital hub for oil exploration, production, and export, making it critical for large-volume purchases of specialized oil absorbers, particularly marine containment systems. Investment in spill response infrastructure is accelerating due to the high risk associated with major oil transport routes (e.g., Suez Canal, Persian Gulf). Demand is heavily skewed towards industrial and environmental cleanup applications, often procured through large, multi-year government and national oil company tenders.

- Latin America (LATAM): Growth in LATAM is driven by expanding oil and gas projects in countries like Brazil (pre-salt reserves) and Mexico. The market is developing, characterized by fluctuating demand influenced by local political and economic stability, but showing significant potential as environmental enforcement gradually strengthens across major economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Absorbers Market.- 3M

- Brady Corporation

- New Pig Corporation

- Absorbent Products Ltd.

- Oil-Dri Corporation of America

- Meltblown Technologies, Inc.

- ENPAC LLC

- Fentress Inc.

- Clearflow Group Inc.

- Chemgen Power Generation

- Decorus Europe Ltd.

- Safetec of America Inc.

- US Ecology Inc.

- SpillTech (a subsidiary of NPS Corp.)

- Sellars Absorbent Materials Inc.

- Sorbent Green

- Universal Sorbent Products

- CSP Technologies

- Tolsa

- Imbibitive Technologies

- Darcy Products Ltd.

- Elastec

- Dycem Ltd.

- Reliance Industries Limited (Specialty Chemicals Division)

Frequently Asked Questions

Analyze common user questions about the Oil Absorbers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Oil Absorbers Market?

Market growth is primarily driven by increasingly stringent international environmental protection regulations, heightened industrial safety standards across high-risk sectors like oil & gas and manufacturing, and continuous expansion of maritime transportation and offshore exploration activities globally.

How does the segmentation by material impact product performance and disposal?

Material segmentation is crucial: Synthetic absorbers (polypropylene) offer the highest absorption capacity and speed but are typically non-biodegradable, leading to high disposal costs. Organic materials (peat, cellulose) are environmentally friendly but possess lower absorption capacities and require specialized handling post-saturation.

Which geographic region exhibits the fastest growth potential for oil absorbers?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, expansion of the petrochemical and refining sectors, and the recent adoption of strict governmental regulations governing industrial effluent and hazardous spill management.

What major technological trends are influencing the development of next-generation oil absorbers?

Key technological trends include the development of superhydrophobic and superoleophilic materials, often utilizing nanotechnology to enhance oil selectivity, and the increased focus on creating high-capacity, bio-based, and reusable absorbent products to reduce environmental waste associated with disposal.

What is the main restraint impacting the profitability and widespread use of high-performance oil absorbers?

The main restraint is the substantial cost and logistical complexity associated with the disposal of saturated absorbent materials. Since most spent sorbents are classified as hazardous waste, disposal typically involves expensive incineration or specialized landfilling, prompting the demand for reusable or biodegradable alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager