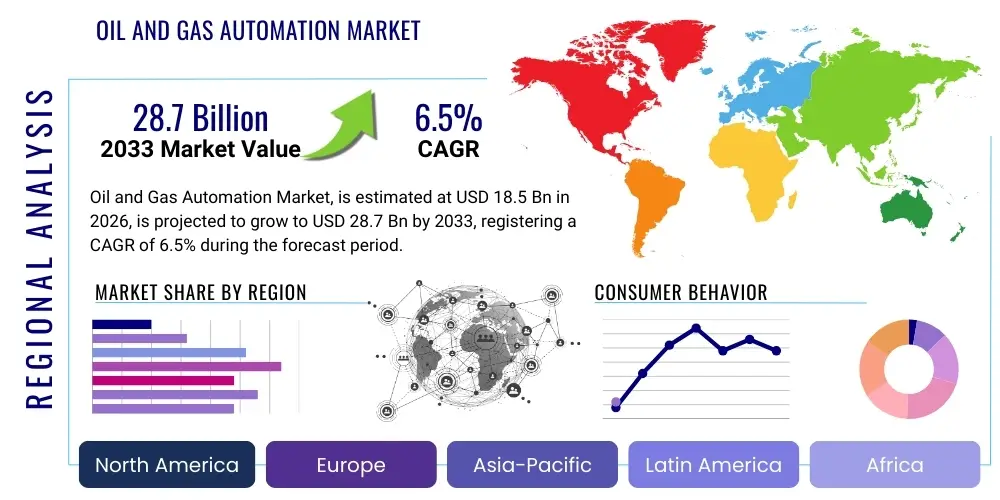

Oil and Gas Automation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437979 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Oil and Gas Automation Market Size

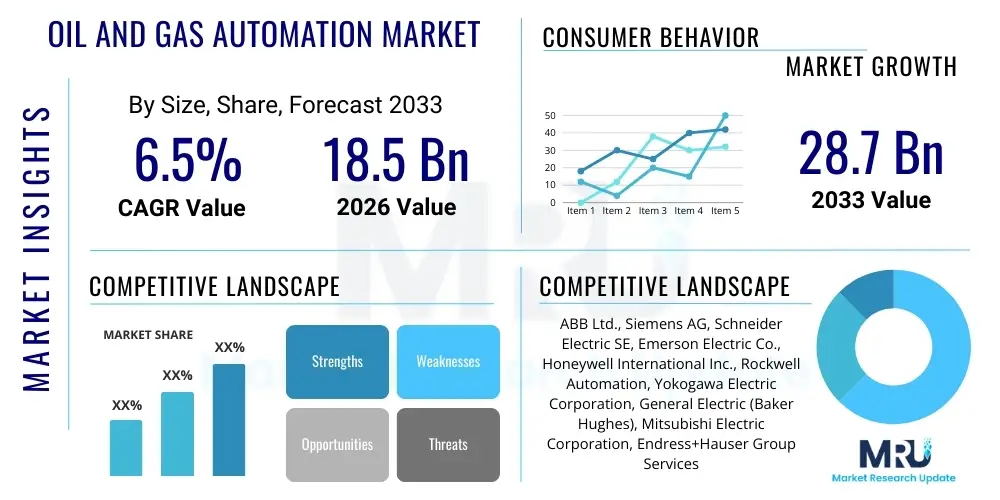

The Oil and Gas Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $28.7 Billion by the end of the forecast period in 2033.

Oil and Gas Automation Market introduction

The Oil and Gas Automation Market encompasses the deployment of advanced control systems, software solutions, and instrumentation technologies across the upstream, midstream, and downstream segments of the energy sector. These solutions are critical for optimizing production, enhancing operational safety, and minimizing environmental impact through precise process control and real-time data analytics. Key components include Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA) systems, Programmable Logic Controllers (PLC), and advanced safety systems (SIS), all integral to managing complex drilling, refining, and transportation processes with high reliability. The fundamental shift towards digitalization and Industrial Internet of Things (IIoT) frameworks is redefining how operations are monitored and controlled, moving away from legacy, manual interventions to fully integrated, intelligent ecosystems.

The core product offerings in this market focus on increasing energy efficiency and maximizing resource recovery, particularly in challenging environments such as deepwater drilling or unconventional oil extraction. Automation systems facilitate predictive maintenance strategies, drastically reducing unplanned downtime and the associated costs. Furthermore, the integration of data historians and advanced manufacturing execution systems (MES) allows operators to benchmark performance, enforce regulatory compliance, and ensure consistent product quality throughout the entire value chain. The demand for these sophisticated tools is directly linked to the fluctuating global energy prices and the industry's sustained focus on cost optimization without compromising stringent safety protocols.

Major applications of oil and gas automation span wellhead control in upstream operations, pipeline monitoring and compression station management in midstream sectors, and complex unit control within refineries and petrochemical plants downstream. The primary benefits realized by adopting these technologies include enhanced worker safety by remotely managing hazardous processes, improved asset utilization, reduced operational expenditure (OpEx), and minimized energy consumption. The driving factors fueling this market growth include the global pursuit of energy independence, the necessity for enhanced cybersecurity measures against sophisticated threats, and the widespread adoption of digital transformation initiatives mandated by major National Oil Companies (NOCs) and International Oil Companies (IOCs) seeking competitive advantages in a highly dynamic global market.

Oil and Gas Automation Market Executive Summary

The Oil and Gas Automation Market is experiencing robust growth driven primarily by the intensifying focus on operational efficiency, the necessity for stringent safety standards, and the proliferation of digitalization across all segments of the industry. Business trends indicate a strong move toward hybrid automation architectures that combine the reliability of traditional DCS and SCADA systems with the flexibility and scalability of cloud-based platforms and edge computing capabilities. There is a marked consolidation in the market concerning software solutions, where major industrial players are acquiring specialized technology firms to offer comprehensive, end-to-end integrated automation packages, focusing heavily on cybersecurity solutions embedded within the control infrastructure to mitigate increasing risk exposure.

Regional trends highlight North America as a dominant market, largely due to significant investments in shale gas exploration and production requiring advanced horizontal drilling and hydraulic fracturing automation technologies, alongside sophisticated pipeline infrastructure modernization efforts. Asia Pacific is projected to demonstrate the highest growth rate, fueled by rapid industrialization, increasing energy demand, and substantial capital expenditure by countries like China and India to expand and modernize their refining capacities and integrated petrochemical complexes. The Middle East and Africa region remain crucial, driven by large-scale upstream mega-projects managed by NOCs, where integrated operations centers (IOCs) leveraging centralized automation are becoming the operational norm to manage expansive oilfields efficiently.

In terms of segmentation, the control systems segment, particularly DCS, retains the largest market share owing to its crucial role in managing large-scale, continuous process control in refineries and large processing facilities. However, the instruments segment, encompassing sensors, transmitters, and flow meters, is exhibiting significant technological advancements due to IIoT integration, providing granular, high-fidelity data essential for advanced analytics and machine learning models. The upstream segment holds the dominant position by application, reflecting the critical need for optimizing recovery rates and ensuring safety in complex extraction processes, while the midstream segment is seeing accelerated adoption of automation, especially for leak detection and monitoring of long-distance pipeline networks using drones and remote sensing technologies.

AI Impact Analysis on Oil and Gas Automation Market

Common user inquiries concerning Artificial Intelligence (AI) in the Oil and Gas Automation Market typically revolve around practical implementation, Return on Investment (ROI), and the potential for job displacement. Users frequently ask: "How exactly can AI enhance drilling optimization or reservoir modeling?" "What are the cybersecurity risks associated with integrating AI/ML models into critical operational technology (OT) systems?" and "How quickly can predictive maintenance models built on AI reduce operational expenditure in aging infrastructure?" These questions highlight a collective industry expectation that AI will transition from a supplementary data analysis tool to a core component of real-time control and autonomous operations. Key themes emerging from these concerns include the requirement for robust, secure data infrastructure, the development of explainable AI (XAI) for regulatory acceptance, and the crucial need for workforce retraining to manage highly automated systems.

The key themes indicate that users expect AI's influence to fundamentally change decision-making processes, moving operations from reactive and rule-based to proactive and predictive. Specific expectations include the deployment of digital twins, underpinned by AI, to simulate real-world conditions for optimization and risk assessment before physical implementation. Furthermore, there is significant interest in how AI can manage the increasing complexity of data generated by IIoT sensors, enabling operations managers to gain actionable insights instantly rather than relying on retrospective analysis. This shift is crucial for optimizing flow assurance, managing complex hydrocarbon mixtures, and ensuring peak efficiency across volatile operating conditions.

The consensus is that AI will rapidly enhance operational parameters across the board, driving unprecedented levels of precision and reliability. While initial concerns about implementation complexity and data governance exist, the overwhelming expected benefit lies in leveraging machine learning algorithms to perform real-time anomaly detection, optimize energy consumption within processing plants, and facilitate autonomous control loops, thereby maximizing asset lifespan and improving environmental performance metrics. AI represents the future backbone of intelligent operational technology (OT) infrastructure, enabling true lights-out operation in remote or hazardous areas.

- AI optimizes drilling paths and reservoir simulation, increasing hydrocarbon recovery rates (EOR).

- Predictive maintenance driven by Machine Learning (ML) drastically reduces unplanned downtime and asset failure.

- Intelligent automation enhances safety by providing superior real-time risk assessments and automated shutdown capabilities.

- Digital twins powered by AI enable precise simulation and optimization of complex plant processes and infrastructure maintenance schedules.

- AI facilitates automated leak detection and monitoring in midstream pipelines, improving environmental compliance and safety.

- Real-time data analytics, accelerated by AI, improves decision support for process optimization and resource allocation.

- AI-driven cybersecurity models offer adaptive threat detection and response specific to operational technology (OT) networks.

- Autonomous control systems using reinforcement learning minimize human intervention in routine and hazardous operations.

DRO & Impact Forces Of Oil and Gas Automation Market

The dynamics of the Oil and Gas Automation Market are heavily influenced by a critical interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces defining its trajectory. A primary driver is the pervasive industry mandate for enhanced operational safety and regulatory compliance, particularly following high-profile incidents that underscored the risks inherent in manual operations. This necessity for safer, more precise control systems is coupled with the economic pressure to reduce operational expenditure (OpEx) through digitalization and efficiency gains, making automation an essential strategic investment rather than a discretionary expenditure. Furthermore, the increasing complexity of extraction methods, such as deepwater and ultra-deepwater drilling, necessitates sophisticated, highly reliable remote automation and monitoring systems, which cannot be feasibly managed manually.

Conversely, the market faces significant restraints, notably the high initial capital expenditure (CapEx) required for implementing advanced automation systems, particularly the replacement of legacy infrastructure known as "brownfield sites." This financial hurdle is exacerbated by the inherent volatility of crude oil and natural gas prices, which often leads to the deferral or cancellation of major automation projects during economic downturns, impacting vendor revenue predictability. Another critical restraint is the ongoing challenge of cybersecurity, as increased connectivity and reliance on IIoT introduce greater vulnerability to sophisticated cyberattacks targeting operational technology (OT) systems, requiring substantial, continuous investment in specialized security measures.

Opportunities for expansion are abundant, centered around the rapid adoption of cloud computing, edge analytics, and digital twin technology, offering new pathways for highly decentralized, efficient operation and maintenance. The growing trend of integrated operations (IO) and centralized remote monitoring centers allows companies to leverage specialized expertise across geographically dispersed assets. Moreover, the increasing focus on the energy transition and environmental, social, and governance (ESG) goals provides a massive opportunity for automation solutions that enable precise carbon capture monitoring, methane emission reduction, and optimal energy use within production facilities. These impact forces—economic pressure, regulatory demands, technological innovation, and geopolitical stability—create a landscape where automation is indispensable for future industry sustainability and profitability.

Segmentation Analysis

The Oil and Gas Automation Market is systematically segmented across technology, component, application, and operation type, providing a granular view of investment trends and adoption patterns within the industry. Understanding these segments is vital for stakeholders to identify high-growth areas and tailor strategies. The technology segmentation distinguishes between traditional systems like DCS and modern approaches utilizing smart sensors and IIoT platforms. Component segmentation focuses on hardware (e.g., instruments, controllers) versus software (e.g., SCADA HMI, advanced analytics). Application segmentation details the deployment across the value chain: upstream (exploration and production), midstream (transportation and storage), and downstream (refining and processing). Finally, the operational categorization often differentiates between onshore and offshore projects, each presenting unique automation challenges and requirements.

- By Component:

- Control Systems (DCS, SCADA, PLC, HMI/MMI)

- Measurement and Field Instruments (Transmitters, Sensors, Analyzers, Flow Meters)

- Safety Systems (SIS, ESD, BMS, F&G)

- Communication and Networking Systems

- Software Solutions (Advanced Process Control - APC, Optimization, Simulation)

- By Application:

- Upstream (Exploration, Production, Wellhead Control, Subsea)

- Midstream (Pipeline Management, Storage, LNG Terminals, Gas Processing)

- Downstream (Refining, Petrochemicals, Chemicals)

- By Operation Type:

- Onshore Operations

- Offshore Operations (Shallow Water, Deepwater, Ultra-Deepwater)

- By Control Type:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controller (PLC)

Value Chain Analysis For Oil and Gas Automation Market

The value chain of the Oil and Gas Automation Market initiates with the upstream segment, encompassing core technology providers and hardware manufacturers responsible for developing sophisticated field instruments, sensors, and foundational control systems (DCS, SCADA, PLC). These primary suppliers establish the technological bedrock, often investing heavily in R&D to meet the rigorous demands of hazardous environments and precise measurement requirements in areas such as wellhead control and reservoir monitoring. Following manufacturing, specialized system integrators play a crucial role, often acting as the bridge between technology suppliers and end-users, ensuring that diverse hardware and software components are seamlessly integrated into a cohesive, functional operational technology (OT) architecture specific to the project's requirements, whether it is an offshore platform or a pipeline network.

The midstream portion of the value chain involves the distribution channels, which include direct sales from major automation vendors (e.g., ABB, Siemens, Schneider Electric) to large NOCs and IOCs, especially for standardized equipment or large, pre-engineered solutions. Indirect channels involve value-added resellers (VARs) and local distributors who provide localized support, customization, and maintenance services, which is particularly vital in geographically diverse and emerging markets. These intermediaries ensure prompt delivery, localized technical expertise, and critical post-installation support, which are essential for maintaining the continuous operational integrity required in pipeline and storage management.

The downstream segment of the value chain culminates with the end-users—the operating companies, including refineries, petrochemical plants, and pipeline operators—who utilize and maintain these complex automation systems. This final stage includes continuous services like software updates, cybersecurity monitoring, predictive maintenance contracts, and advanced process control optimization services, often provided directly by the original equipment manufacturers (OEMs) or specialized service providers. Effective feedback loops between the end-users and the upstream technology developers are crucial for driving innovation, ensuring that the automation solutions evolve to meet increasing demands for energy efficiency, advanced analytics integration, and adherence to evolving industry safety standards.

Oil and Gas Automation Market Potential Customers

Potential customers for Oil and Gas Automation solutions primarily consist of large integrated energy companies, often categorized as International Oil Companies (IOCs) and National Oil Companies (NOCs), which operate across the entire hydrocarbon value chain, from exploration to retail. IOCs, such as ExxonMobil, Shell, and TotalEnergies, require sophisticated, globally standardized automation platforms capable of managing highly complex, remote, and often multinational operations, prioritizing seamless data integration and centralized monitoring. Similarly, NOCs, including Saudi Aramco, Sinopec, and Petrobras, are major buyers, investing heavily in automation to enhance national energy security, optimize production from mature fields, and modernize aging infrastructure to meet global efficiency benchmarks and regulatory demands.

Beyond the major integrated players, independent exploration and production (E&P) companies constitute a significant customer base, particularly those focused on unconventional resources like shale oil and gas, where modular, scalable, and highly repeatable automation technologies are essential for cost-effective mass deployment. These companies prioritize solutions that offer rapid deployment, low maintenance requirements, and highly accurate telemetry for optimizing multi-well pads and managing water resources. Furthermore, midstream operators, specializing in pipeline transport, storage, and liquefied natural gas (LNG) terminals, are critical buyers of SCADA systems, remote monitoring instruments, and advanced security protocols to ensure safety and prevent asset theft or environmental incidents across vast infrastructure networks.

The downstream sector, encompassing independent refinery operators and large petrochemical producers, represents the final major customer segment. These facilities rely on advanced Distributed Control Systems (DCS), Safety Instrumented Systems (SIS), and Advanced Process Control (APC) software to manage highly exothermic and continuous processes where precision and safety are paramount. Their purchasing decisions are often driven by the need to maximize yield, minimize energy consumption (utility optimization), and rapidly adapt production streams to market demands, requiring automation systems capable of dynamic reconfiguration and complex recipe management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $28.7 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Yokogawa Electric Corporation, General Electric (Baker Hughes), Mitsubishi Electric Corporation, Endress+Hauser Group Services AG, Fuji Electric Co., Ltd., WIKA Alexander Wiegand SE & Co. KG, Sensia, Kongsberg Gruppen ASA, Petrofac Limited, National Instruments (NI), NOV Inc., Schlumberger Limited, Weatherford International plc, Aker Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil and Gas Automation Market Key Technology Landscape

The technological landscape of Oil and Gas Automation is defined by the coexistence of established, highly reliable control platforms and rapidly evolving digital technologies. Traditional foundational systems include Distributed Control Systems (DCS), which are crucial for complex, continuous process control in refineries and large processing plants, offering high fault tolerance and centralized management capabilities. Alongside DCS, Supervisory Control and Data Acquisition (SCADA) systems remain the standard for geographically dispersed assets, such as pipelines and remote wellheads, providing high-level monitoring and control functionality. Programmable Logic Controllers (PLCs) are utilized for sequencing and interlock logic in local units and smaller, discrete control applications, offering rugged reliability and speed. The integration of these three core systems is currently shifting towards unified, hybrid architectures leveraging modern industrial protocols.

The primary innovation driving the current market trajectory is the Industrial Internet of Things (IIoT), which facilitates the deployment of smart, interconnected sensors and devices across assets. IIoT enables the collection of massive volumes of real-time operational data (Big Data), which is processed either at the edge using decentralized computing nodes or transmitted to cloud platforms for sophisticated analysis. This flood of high-fidelity data is essential for enabling advanced technologies like Digital Twins—virtual replicas of physical assets used for simulation, performance monitoring, and predicting equipment failure. Furthermore, the reliance on these interconnected systems has made robust, specialized cybersecurity solutions, including firewalls, intrusion detection systems, and secure remote access platforms, an integral and indispensable part of the technology offering, moving security from an afterthought to a core system requirement.

Emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being embedded into Advanced Process Control (APC) applications, moving beyond traditional model-based control to adaptive, data-driven optimization. This allows for controllers to learn and adjust to process variations autonomously, maximizing throughput and energy efficiency far better than conventional methods. Robotics and unmanned aerial vehicles (UAVs) are also transforming inspection and maintenance tasks, particularly in hazardous or remote offshore environments, reducing human exposure to risk. This diverse technological landscape requires significant capital investment in infrastructure modernization and presents substantial opportunities for vendors offering comprehensive, software-defined, and scalable automation portfolios.

Regional Highlights

The regional dynamics of the Oil and Gas Automation Market showcase differential growth rates driven by varying levels of infrastructure maturity, regulatory environments, and investment cycles in exploration and production.

- North America: This region holds the largest market share, driven by extensive investments in unconventional hydrocarbon extraction (shale gas and oil), necessitating high levels of automation for optimized multi-well pad management and efficient hydraulic fracturing processes. The region is also a pioneer in integrated operational centers (IOCs) and leads in the adoption of cloud-based automation software and advanced cybersecurity solutions for critical pipeline infrastructure modernization.

- Europe: Characterized by stringent environmental regulations and a strong focus on energy transition, Europe emphasizes automation solutions that enhance energy efficiency, reduce carbon footprint, and support the digitalization of legacy infrastructure. Automation deployment is particularly focused on decommissioning activities, offshore renewable integration, and modernizing complex downstream refining operations to meet higher quality standards.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to significant government spending on establishing new refining capacities, expanding natural gas infrastructure, and meeting rapidly escalating industrial energy demand, particularly in China, India, and Southeast Asia. The market here is driven by greenfield projects that readily adopt the latest technologies, bypassing older legacy systems.

- Middle East and Africa (MEA): This region is crucial, dominated by large National Oil Companies (NOCs) executing massive upstream mega-projects. Automation is vital for maximizing output from vast, mature oilfields and enhancing operational resilience through centralized control. There is substantial demand for advanced process control (APC) and reliability systems to maintain continuous production in remote and harsh operating environments.

- Latin America (LATAM): Growth is primarily influenced by Brazil and Mexico, focusing on deepwater exploration and exploitation activities which demand specialized, highly robust subsea and topside automation systems. Political and economic stability remains a factor, but the inherent complexity of offshore projects ensures sustained demand for high-end automation technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil and Gas Automation Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation

- Yokogawa Electric Corporation

- General Electric (Baker Hughes)

- Mitsubishi Electric Corporation

- Endress+Hauser Group Services AG

- Fuji Electric Co., Ltd.

- WIKA Alexander Wiegand SE & Co. KG

- Sensia (a joint venture of Rockwell Automation and Schlumberger)

- Kongsberg Gruppen ASA

- Petrofac Limited

- National Instruments (NI)

- NOV Inc.

- Schlumberger Limited

- Weatherford International plc

- Aker Solutions

Frequently Asked Questions

Analyze common user questions about the Oil and Gas Automation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of digitalization in driving the Oil and Gas Automation Market?

Digitalization is the foundational driver, enabling the integration of Operational Technology (OT) with Information Technology (IT). This convergence allows for real-time data analysis, supports predictive maintenance using machine learning, and facilitates remote monitoring and autonomous control, ultimately maximizing asset uptime and production efficiency across the hydrocarbon value chain.

How do Distributed Control Systems (DCS) differ from SCADA systems in oil and gas operations?

DCS are primarily used for continuous process control within a confined, localized area such as a refinery or processing plant, requiring high-speed regulatory control and fault tolerance. SCADA systems, conversely, focus on supervisory monitoring and control over large, geographically dispersed assets, such as pipelines or remote wellheads, emphasizing data acquisition and high-level decision support.

What are the major challenges facing the adoption of automation technologies in brownfield sites?

The primary challenges in brownfield (existing) sites include the high capital cost and complexity of integrating new digital and smart technologies with outdated legacy control systems. This often involves lengthy migration processes, managing system interoperability issues, and ensuring continuous operational uptime during phased upgrades, demanding specialized integration expertise.

How is the adoption of Industrial IoT (IIoT) transforming upstream exploration and production?

IIoT transforms upstream operations by deploying smart sensors and connected devices at the wellhead and downhole. This allows for unprecedented data granularity regarding reservoir pressure, temperature, and flow rates. This data enables real-time optimization of drilling parameters, improves artificial lift efficiency, and supports advanced reservoir modeling through sophisticated digital twins.

Which regional market is anticipated to exhibit the fastest growth rate for automation solutions?

The Asia Pacific (APAC) region is projected to experience the fastest growth rate. This accelerated expansion is attributed to large-scale infrastructure investments in new refining and petrochemical complexes (greenfield projects), high energy demand growth, and strategic government initiatives aimed at modernizing aging energy infrastructure across key developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager