Oil and Gas Drones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435597 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Oil and Gas Drones Market Size

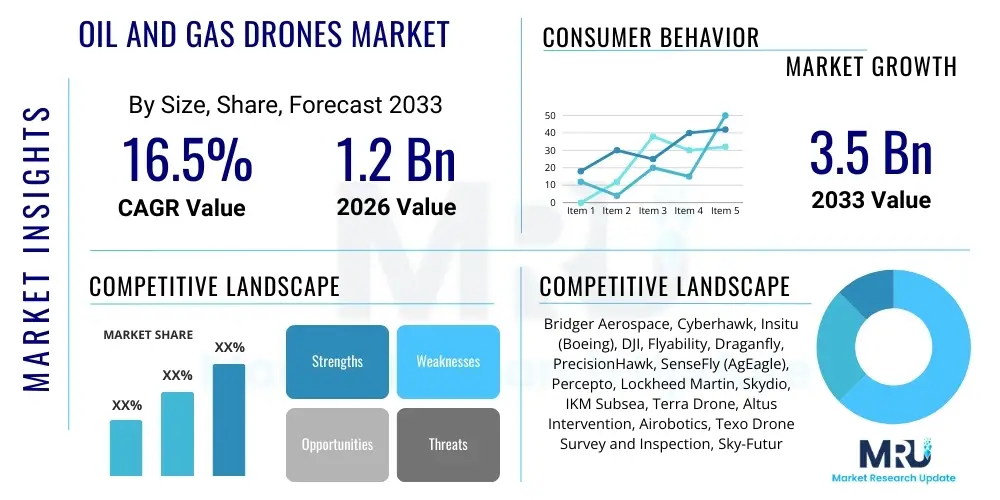

The Oil and Gas Drones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Oil and Gas Drones Market introduction

The Oil and Gas Drones Market encompasses the deployment of Unmanned Aerial Vehicles (UAVs) across the upstream, midstream, and downstream sectors of the petroleum industry for critical functions such as infrastructure inspection, monitoring, surveying, and security surveillance. These specialized drones are equipped with advanced sensors, including thermal cameras, LiDAR, and gas detection systems, enabling high-precision data acquisition in hazardous or inaccessible environments, significantly improving operational efficiency and safety standards. Major applications span from inspecting offshore rigs, pipelines, and storage tanks to conducting detailed flare stack inspections without operational shutdown, minimizing risk and reducing the substantial costs associated with traditional manned inspections.

The market benefits significantly from the inherent advantages of drone technology, primarily focused on enhancing worker safety by removing personnel from dangerous situations, reducing inspection time dramatically, and providing superior, verifiable data quality. Drones offer real-time insights into asset integrity, allowing operators to transition from time-based maintenance schedules to more cost-effective condition-based monitoring. This paradigm shift in operational management is a key driver, alongside the increasing complexity of global oil and gas infrastructure, which necessitates constant, high-resolution surveillance to prevent leaks, failures, and environmental incidents.

Driving factors include stringent environmental regulations demanding frequent leak detection and repair (LDAR) surveys, rapid technological advancements in drone payload capacity and flight endurance, and the declining costs of UAV platforms. Furthermore, the push towards digitalization and integrated asset performance management (APM) within the oil and gas sector accelerates the adoption of drones as essential data collection tools. The market is characterized by a strong interplay between hardware innovation (enhanced battery life, weather resistance) and sophisticated software solutions (AI-powered data analysis, automated flight planning).

Oil and Gas Drones Market Executive Summary

The global Oil and Gas Drones Market is experiencing robust growth driven by the urgent need for operational efficiency and regulatory compliance across geographically dispersed assets. Business trends indicate a strong move towards integrated drone-as-a-service (DaaS) models, where specialized third-party providers handle the deployment, data capture, and subsequent analytical processing, relieving operators of managing complex drone fleets and certifications. Mergers and partnerships between drone manufacturers, sensor developers, and industrial software firms are becoming common, aimed at creating end-to-end solutions that are seamlessly integrated into existing Enterprise Asset Management (EAM) systems. Furthermore, there is a distinct trend towards the use of beyond visual line of sight (BVLOS) capabilities, contingent upon evolving regulatory frameworks, which promises to unlock significant value in linear asset inspection, specifically long-distance pipelines.

Regionally, North America maintains market leadership, largely due to high infrastructure density, early technological adoption, and clear regulatory pathways established by bodies such as the FAA and Transport Canada regarding commercial drone operations. The Asia Pacific region is forecast to exhibit the highest CAGR, propelled by massive investments in new offshore drilling projects, expansion of LNG infrastructure, and governmental mandates in countries like China and India to modernize existing infrastructure using advanced monitoring techniques. Europe shows steady growth, fueled by stringent environmental standards requiring detailed methane emission monitoring and strong adoption in the North Sea offshore sector.

In terms of segmentation, the Inspection & Monitoring services segment dominates the market by application type, covering essential activities such as flare stack, storage tank, and offshore platform inspections. The Rotary Wing segment, specifically multi-rotor drones, leads the product type segment due to their vertical take-off and landing (VTOL) capabilities and inherent maneuverability, making them ideal for complex, confined industrial settings. Meanwhile, the Upstream sector remains the largest end-user segment, primarily due to the high frequency and criticality of inspection required for drilling operations and production facilities, though Midstream investment is rapidly accelerating to address pipeline integrity issues.

AI Impact Analysis on Oil and Gas Drones Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Oil and Gas Drones Market frequently center on automation levels, data overload management, and predictive maintenance capabilities. Key user themes include the extent to which AI can autonomously navigate complex environments, how machine learning algorithms handle the massive volumes of visual and thermal data generated by drone flights, and whether AI can reliably predict asset failure before it occurs. Concerns often revolve around data security, the accuracy of automated defect recognition, and the integration complexity with legacy IT infrastructure. Users expect AI to move drone operations from basic data collection to sophisticated, prescriptive analytics, drastically reducing manual review time and enhancing inspection consistency across global operations, thereby maximizing return on investment.

- AI-Powered Defect Recognition: Machine learning algorithms automatically identify anomalies (cracks, corrosion, leak indications) in imagery captured by drones, replacing tedious manual inspection review and increasing consistency.

- Autonomous Navigation and Mission Planning: AI enables drones to perform complex inspections, such as internal tank checks or flare stack proximity flights, without continuous human intervention, enhancing safety and repeatability.

- Predictive Maintenance Scheduling: Analysis of historical and real-time drone data by AI models predicts the remaining useful life of assets, shifting maintenance strategies from reactive or calendar-based to condition-based.

- Data Fusion and Geospatial Correlation: AI processes and correlates data from multiple drone payloads (LiDAR, thermal, visual) and integrates it with existing GIS data, providing a holistic and accurate view of asset integrity.

- Methane Emission Quantification: Specialized AI models rapidly process hyperspectral or infrared data captured by drones to accurately locate, quantify, and map methane leaks, facilitating rapid repair and regulatory compliance.

- Fleet Management Optimization: AI algorithms optimize charging cycles, flight paths, and maintenance schedules for large drone fleets, ensuring maximum operational uptime and logistical efficiency.

DRO & Impact Forces Of Oil and Gas Drones Market

The Oil and Gas Drones Market is propelled by powerful Drivers, yet faces significant Restraints, opening up considerable Opportunities, all modulated by potent Impact Forces influencing market adoption rates. The primary Driver is the imperative to improve worker safety and drastically reduce inspection costs, particularly in challenging environments like offshore platforms and remote pipelines, where conventional methods are dangerous and resource-intensive. Restraints include the restrictive regulatory landscape governing flight beyond visual line of sight (BVLOS) in many jurisdictions, which limits the efficiency of long-distance monitoring, alongside the high initial capital investment required for advanced drone hardware and associated sophisticated data processing software.

Opportunities for growth are primarily concentrated in the deployment of fully autonomous systems for continuous, permanent monitoring, especially for detecting fugitive emissions such as methane, offering a solution to escalating global environmental demands. Furthermore, the integration of 5G and satellite communication technologies with drone systems promises reliable data transmission from the most remote locations, broadening the potential service area substantially. The market is strategically positioned to capture value through specialized services in midstream integrity management and the eventual large-scale logistical deployment of heavy-lift drones for transporting small, critical parts to remote sites.

The major Impact Forces shaping the market include rapidly advancing sensor technology, which allows smaller drones to carry higher fidelity payloads, increasing the cost-effectiveness of data collection. Regulatory harmonization and easing of BVLOS restrictions globally will act as a major positive force, exponentially expanding the addressable market for pipeline and power line inspection. Conversely, cybersecurity concerns related to drone data transmission and storage, coupled with resistance to technological change in legacy oil and gas organizations, act as limiting impact forces that necessitate robust security protocols and comprehensive operator training programs.

DRO & Impact Forces Summary:

- Drivers: Enhanced safety protocols, reduction in inspection time and costs, increasing regulatory demand for leak detection (LDAR), and expansion of complex infrastructure requiring frequent monitoring.

- Restraints: Stringent and inconsistent BVLOS regulations globally, high initial capital expenditure for advanced systems, integration challenges with legacy operational technology (OT) systems, and resistance to adopting new technologies.

- Opportunities: Development of specialized payload sensors (e.g., highly sensitive methane detectors), growth of Drone-as-a-Service (DaaS) models, integration with AI for predictive analytics, and expansion into logistical applications (delivery of small parts).

- Impact Forces: Rapid sensor miniaturization and integration, evolving global aviation regulations, cybersecurity threats to sensitive infrastructure data, and the accelerating digitalization trends in the energy sector.

Segmentation Analysis

The Oil and Gas Drones Market segmentation offers a granular view of demand based on functional specialization, platform mechanics, and industrial application. Analysis across these segments reveals specific pockets of growth, enabling stakeholders to strategically position their offerings. Segmentation by Product Type is crucial, differentiating between fixed-wing drones, rotary-wing (multi-rotor) drones, and hybrid platforms, each suited for distinct mission profiles based on duration, payload capacity, and required maneuverability. The dominance of rotary-wing drones highlights the necessity for precise, stationary inspection capabilities around complex industrial structures.

Segmentation by Application elucidates the primary use cases driving procurement, including crucial activities like surveying and mapping, pipeline inspection, storage tank inspection, and flare stack monitoring. Inspection and monitoring consistently represent the largest segment, as regulatory compliance and asset integrity management are non-negotiable operational requirements. This segment is expected to lead growth due to the continuous cycle of maintenance and auditing required for aging oil and gas assets worldwide. Furthermore, security and surveillance applications are growing rapidly, particularly in politically sensitive regions or areas prone to vandalism.

Segmentation by End-User (Upstream, Midstream, Downstream) dictates the volume and type of drone utilized. The Upstream sector, covering exploration and production (E&P), is a major consumer due to the inherent risks and remote locations of drilling sites and offshore installations. The Midstream sector, encompassing pipeline and transportation networks, is characterized by demand for long-endurance fixed-wing or hybrid platforms capable of covering vast linear distances efficiently. The Downstream sector utilizes drones for inspecting refineries, petrochemical plants, and storage facilities, emphasizing thermal and gas detection capabilities to ensure operational safety and emission control.

- Product Type:

- Fixed-Wing Drones

- Rotary-Wing Drones (Multi-Rotor)

- Hybrid Drones

- Application:

- Inspection and Monitoring

- Surveying and Mapping

- Security and Surveillance

- Emergency Response and Disaster Management

- Logistics and Transport (Emerging)

- End-User:

- Upstream

- Midstream

- Downstream

- Solution Type:

- Hardware (Drone Platforms)

- Software (Data Analytics, Flight Management)

- Services (Data Acquisition, Training, Maintenance)

Value Chain Analysis For Oil and Gas Drones Market

The value chain for the Oil and Gas Drones Market is complex, spanning from initial component manufacturing to highly specialized data analytics delivered to the end-user. Upstream activities begin with the fundamental design and manufacturing of drone airframes, propulsion systems, and sophisticated navigation electronics. This stage includes the critical integration of high-performance sensors—such as advanced infrared (IR) cameras, specialized gas detectors (e.g., TDLAS), and high-resolution LiDAR systems—which are tailored specifically for the harsh and requirements of oil and gas environments. Innovation at this stage, particularly regarding battery technology and weatherproofing, directly impacts the overall utility and safety of the final product.

Midstream activities primarily involve drone system integrators and specialized service providers who take the core hardware and software and customize it for specific oil and gas missions, such as long-range pipeline inspection or complex internal storage tank checks. The distribution channel plays a vital role here, often favoring indirect distribution through specialized industrial suppliers and integrators who possess the requisite regulatory expertise and understanding of regional operational mandates. Direct sales are typically reserved for large, centralized oil and gas majors purchasing high volumes or proprietary systems, though the service model (DaaS) remains the dominant procurement method for most operational units.

Downstream activities focus heavily on data processing and delivery, representing the highest value addition. This stage includes post-flight processing, where massive volumes of collected data are analyzed using specialized software, often incorporating AI and machine learning for automated defect recognition and anomaly detection. The output—actionable inspection reports, 3D models of assets, or quantifiable leak data—is then delivered to the end-user (oil and gas operator) to inform maintenance decisions. The quality and speed of this analytical feedback loop determine the success of the entire drone deployment, making advanced software and data integrity crucial downstream components.

Oil and Gas Drones Market Potential Customers

Potential customers for Oil and Gas Drones primarily reside within organizations responsible for the design, operation, and maintenance of energy infrastructure globally. These end-users are characterized by high asset value, significant safety and environmental risks, and operational environments that are often remote or hazardous. The core buyers are integrated oil and gas companies (IOCs and NOCs), who utilize drones across all three segments (Upstream, Midstream, Downstream) for diverse applications ranging from seismic surveying support to flare tip inspection and refinery auditing. Their purchasing decisions are driven by total cost of ownership reduction and regulatory compliance enforcement.

Beyond the majors, the market serves specialized niche buyers. Pipeline operators, focusing exclusively on the Midstream sector, constitute a large customer base specifically seeking long-range, BVLOS-capable systems for pipeline integrity management and right-of-way surveillance. Furthermore, independent power producers (IPPs) and petrochemical plant operators also represent significant downstream customers, leveraging drones for inspecting cooling towers, stacks, and complex pipe racks to minimize downtime. Engineering, Procurement, and Construction (EPC) firms also engage drone service providers during construction phases for progress monitoring, 3D mapping, and final asset verification, completing the comprehensive list of potential buyers who prioritize safety, efficiency, and data accuracy.

Potential End-Users/Buyers include:

- International Oil Companies (IOCs) and National Oil Companies (NOCs)

- Independent Exploration and Production (E&P) Firms

- Pipeline and Transportation System Operators

- Refinery and Petrochemical Plant Owners

- Engineering, Procurement, and Construction (EPC) Companies serving the energy sector

- Specialized Third-Party Inspection and Maintenance Service Providers

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridger Aerospace, Cyberhawk, Insitu (Boeing), DJI, Flyability, Draganfly, PrecisionHawk, SenseFly (AgEagle), Percepto, Lockheed Martin, Skydio, IKM Subsea, Terra Drone, Altus Intervention, Airobotics, Texo Drone Survey and Inspection, Sky-Futures, UAV-IQ, MFE Inspection Solutions, RIEGL Laser Measurement Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil and Gas Drones Market Key Technology Landscape

The technological evolution of the Oil and Gas Drones market is centered on enhancing three core capabilities: endurance, payload intelligence, and autonomous operation. Regarding endurance, advancements in high-density lithium polymer batteries and the increasing adoption of hydrogen fuel cell technology are enabling fixed-wing and hybrid platforms to achieve flight times exceeding two hours, critical for efficient pipeline and linear asset inspection over vast distances. Coupled with this is the continuous development of rugged, resilient drone airframes built from advanced composites, ensuring operational stability and reliability in high winds, extreme temperatures, and corrosive marine environments typical of offshore operations.

Payload technology is perhaps the most dynamic area, moving beyond standard RGB cameras to specialized, application-specific sensors. Key technologies include Tunable Diode Laser Absorption Spectroscopy (TDLAS) and optical gas imaging (OGI) cameras specifically designed for high-sensitivity methane and volatile organic compound (VOC) detection, which are crucial for meeting stringent LDAR requirements. Furthermore, high-definition thermal imaging and advanced LiDAR systems are becoming standard for structural integrity inspections, allowing for the creation of highly accurate, geo-referenced 3D digital twins of infrastructure, enabling detailed dimensional analysis and change detection over time.

The landscape is increasingly dominated by software-driven capabilities, essential for turning raw sensor data into actionable business intelligence. Key technologies here involve real-time kinematic (RTK) and post-processing kinematic (PPK) GPS systems for centimeter-level navigational accuracy, essential for repeatable inspection paths. More importantly, sophisticated mission planning software allows operators to define complex inspection geometries (e.g., spiraling around a flare stack) autonomously. Finally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) platforms processes data collected from drones, automating the identification and classification of defects (such as cracks, leaks, or corrosion), dramatically speeding up the inspection cycle and minimizing human error in the analytical process.

Regional Highlights

Regional dynamics play a crucial role in shaping the Oil and Gas Drones market, reflecting differences in infrastructure age, regulatory maturity, and investment levels in new energy projects. The deployment rate and application focus of UAV technology vary significantly across major geographical markets, influencing vendor strategies and technological development priorities. The ability of vendors to navigate regional regulatory bodies, such as the FAA in North America or EASA in Europe, is often the primary determinant of market access and growth potential within these distinct regions.

North America

North America is the dominant market leader, driven by the vast network of pipelines requiring inspection, especially across the U.S. shale oil and gas fields, and the high concentration of major IOCs focused on digitalization. The region benefits from relatively established regulatory guidelines for commercial drone operations, although BVLOS restrictions remain a bottleneck. The key demand drivers include asset integrity management for aging infrastructure and stringent environmental monitoring requirements, particularly methane emission detection across remote extraction sites. The market is characterized by high adoption of Drone-as-a-Service (DaaS) models and a strong competitive landscape favoring firms with advanced AI analytics capabilities.

Europe

Europe represents a mature market, heavily focused on the offshore sector, specifically in the North Sea (Norway, UK). The demand is centered on maximizing operational safety and minimizing environmental impact, driven by strict EU directives and national regulations regarding fugitive emissions. Technological uptake is high, with a strong focus on advanced thermal and ultrasonic testing payloads, designed for harsh maritime environments. Regulatory alignment through EASA provides a framework for scaling operations across member states, though the regional market is highly sensitive to fluctuating oil prices and renewable energy transition policies, which impact exploration budgets.

Asia Pacific (APAC)

APAC is projected to be the fastest-growing region, fueled by massive capital investment in expanding energy infrastructure, particularly in China, India, and Southeast Asia. This region is developing new liquefied natural gas (LNG) facilities, petrochemical plants, and expanding pipeline networks rapidly. The primary market driver is the need for rapid, cost-effective surveying and mapping during construction phases, followed by routine integrity inspections for new assets. Regulatory bodies are still catching up with the rapid pace of adoption, leading to both opportunities and challenges in standardizing operational procedures, favoring local partnerships for market entry.

Middle East and Africa (MEA)

MEA is a significant market, dominated by large national oil companies (NOCs) managing vast reserves and complex, geographically dispersed assets, particularly in Saudi Arabia, UAE, and Qatar. Investment is robust, driven by the need for advanced security surveillance, especially for critical infrastructure like oil terminals and storage farms, in addition to operational integrity checks. The climate demands highly specialized, resilient drone technology capable of operating reliably in high temperatures and desert environments. Procurement often involves large, strategic contracts with major international drone providers, emphasizing data security and local content requirements.

Latin America (LATAM)

The LATAM market shows cautious but steady growth, influenced largely by the national energy policies of countries like Brazil (Petrobras) and Mexico (Pemex). Adoption is driven by the need to monitor remote infrastructure, often located in difficult terrain, such as jungle or mountainous regions. While budgetary constraints can limit widespread adoption, the high cost and difficulty of conventional inspection methods in these areas make drones an essential and compelling solution for pipeline surveillance and environmental compliance monitoring, particularly concerning biodiversity protection near operational sites.

- North America: Market leader; driven by vast pipeline infrastructure, shale operations, and established regulatory framework (FAA). Strong adoption of DaaS and AI analytics for methane detection.

- Asia Pacific: Fastest growing region; driven by rapid expansion of new LNG and pipeline infrastructure, particularly in emerging economies like China and India. Focus on construction monitoring and new asset integrity.

- Europe: Mature market; strong focus on offshore platform inspection (North Sea) and strict environmental regulations (methane emissions). High emphasis on safety and advanced sensor payloads.

- Middle East and Africa (MEA): High investment by NOCs; focus on critical infrastructure security surveillance and operation in extreme heat conditions. Procurement of large, strategic security and integrity monitoring systems.

- Latin America (LATAM): Emerging market; driven by monitoring remote infrastructure in challenging terrains (Brazil, Mexico). Adoption rates tied to national energy investment cycles and cost-efficiency mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil and Gas Drones Market.- Bridger Aerospace

- Cyberhawk

- Insitu (Boeing Subsidiary)

- DJI

- Flyability

- Draganfly

- PrecisionHawk

- SenseFly (AgEagle)

- Percepto

- Lockheed Martin

- Skydio

- IKM Subsea

- Terra Drone

- Altus Intervention

- Airobotics

- Texo Drone Survey and Inspection

- Sky-Futures

- UAV-IQ

- MFE Inspection Solutions

- RIEGL Laser Measurement Systems

Frequently Asked Questions

Analyze common user questions about the Oil and Gas Drones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific safety advantages do drones offer over traditional oil and gas inspection methods?

Drones fundamentally enhance safety by eliminating the need for human personnel to work at height, in confined spaces (like storage tanks), or in close proximity to high-temperature or volatile industrial processes (like flare stacks). This removal of human exposure drastically reduces the risk of fatalities, injuries, and operational incidents associated with scaffolding, rope access, and manual surveying.

How are Beyond Visual Line of Sight (BVLOS) regulations affecting the market growth for pipeline inspection?

BVLOS regulations are currently the most significant restraint, as strict rules in major regions limit the efficiency of drones for long-range, linear asset monitoring such as pipelines and large transmission networks. Easing these restrictions, driven by proven safety cases and advanced detect-and-avoid technologies, is crucial. Successful BVLOS implementation would unlock exponential growth by enabling cost-effective, continuous monitoring over hundreds of kilometers.

Which drone payload technologies are critical for meeting methane emission detection standards?

The most critical payload technologies for methane and fugitive emission detection include Optical Gas Imaging (OGI) cameras, which visualize hydrocarbon leaks, and advanced sensor systems like Tunable Diode Laser Absorption Spectroscopy (TDLAS), which offer highly sensitive and quantitative measurements of gas concentrations. These technologies, integrated onto UAV platforms, ensure compliance with strict Leak Detection and Repair (LDAR) regulations efficiently.

Is the market shifting toward purchasing drone platforms or adopting Drone-as-a-Service (DaaS) models?

The market shows a distinct shift toward adopting Drone-as-a-Service (DaaS) models. Most oil and gas operators prefer outsourcing drone operations to specialized service providers who manage the complex regulatory compliance, pilot certification, sophisticated data processing software, and hardware maintenance, allowing the operators to focus solely on receiving actionable inspection data.

What role does Artificial Intelligence play in maximizing the value derived from drone inspection data?

AI is essential for analyzing the massive volume of high-resolution imagery and sensor data collected by drones. Machine learning algorithms automate the process of identifying, localizing, and classifying anomalies (e.g., corrosion, paint failure, cracks), significantly accelerating reporting time, ensuring consistency, and transforming raw data into structured, predictive asset intelligence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager