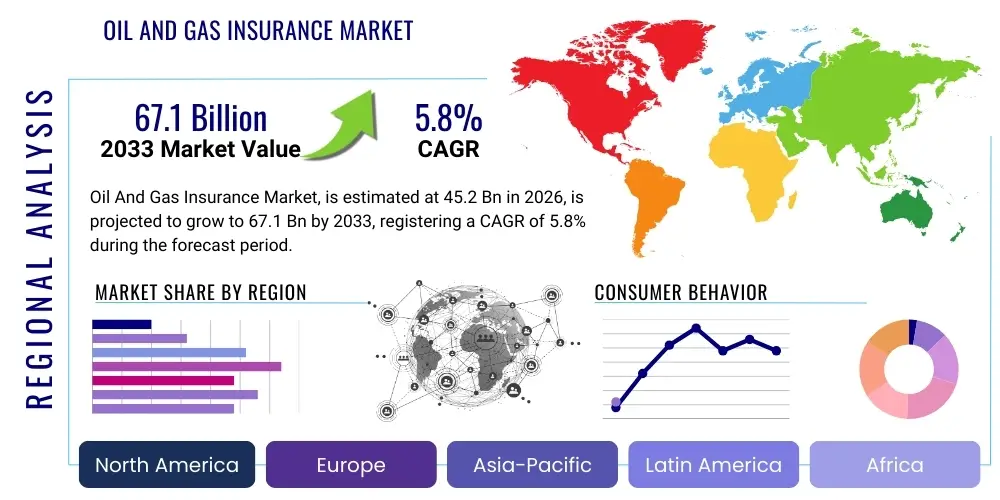

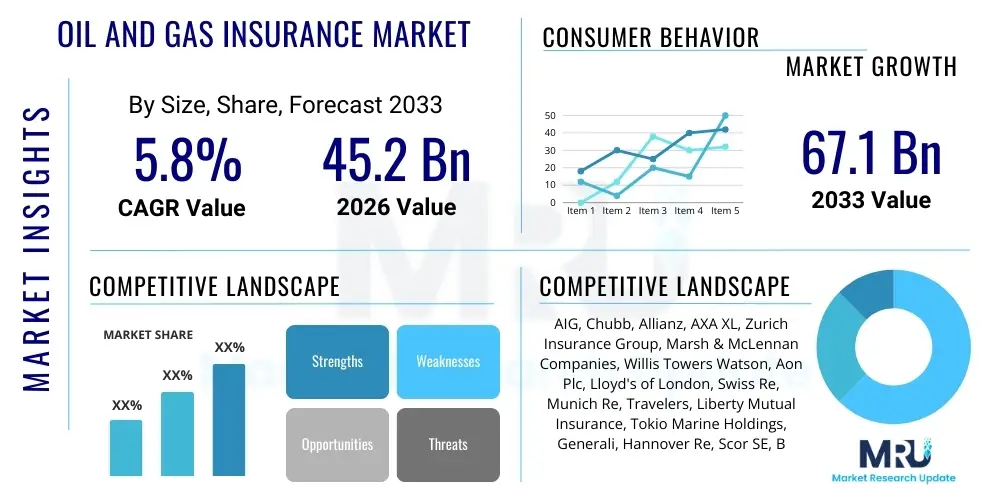

Oil And Gas Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440022 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Oil And Gas Insurance Market Size

The Oil And Gas Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 billion in 2026 and is projected to reach USD 67.1 billion by the end of the forecast period in 2033. This robust growth trajectory underscores the escalating complexities and inherent risks associated with global oil and gas operations, necessitating comprehensive risk transfer solutions across the industry's value chain. The demand for specialized insurance products is driven by increasing exploration and production activities, expansion of midstream infrastructure, and continued downstream processing, coupled with a dynamic regulatory landscape and heightened environmental concerns.

The market's expansion is further fueled by the imperative for energy security, particularly in emerging economies, alongside significant investments in new projects and the modernization of existing assets. Companies operating in this sector face a multitude of perils, ranging from catastrophic operational incidents to geopolitical instabilities and evolving cyber threats. Consequently, securing adequate insurance coverage is not merely a compliance requirement but a strategic necessity for safeguarding capital, ensuring business continuity, and maintaining stakeholder confidence amidst an increasingly volatile global energy market. The continuous evolution of risk profiles compels insurers to innovate and offer tailored solutions that address specific operational vulnerabilities and regulatory mandates, thereby underpinning market growth.

Oil And Gas Insurance Market introduction

The Oil and Gas Insurance Market serves as a critical financial safeguard for one of the world's most capital-intensive and high-risk industries. This specialized sector provides comprehensive risk management and transfer solutions tailored to the unique challenges faced by companies engaged in exploration, production, transportation, processing, and distribution of hydrocarbons. The market encompasses a broad spectrum of insurance products designed to mitigate financial losses arising from a myriad of operational, environmental, geopolitical, and technological perils. These products are indispensable for ensuring the resilience and stability of the global energy supply chain.

Key offerings within this market include property damage coverage for physical assets such as rigs, platforms, pipelines, and refineries; business interruption insurance to compensate for lost revenue due to unforeseen operational shutdowns; and general liability policies protecting against third-party claims for bodily injury or property damage. Furthermore, the market provides highly specialized coverages like marine and cargo insurance for offshore operations and hydrocarbon transportation, environmental liability insurance for pollution incidents, and political risk insurance to safeguard investments in unstable regions. The increasing complexity of drilling operations, the expansion into challenging environments, and the growing focus on environmental, social, and governance (ESG) factors have significantly broadened the scope and demand for sophisticated insurance solutions, making them an integral component of strategic planning for any entity within the oil and gas ecosystem.

Major applications span the entire oil and gas value chain: upstream activities (exploration and production), midstream operations (transportation and storage via pipelines, tankers, and terminals), and downstream processes (refining, petrochemicals, and distribution). The benefits derived by operators are multi-faceted, including financial protection against catastrophic losses, compliance with stringent international and national regulations, enhanced capacity for risk transfer, and operational continuity in the face of disruptive events. Driving factors include persistent global energy demand, significant capital investments in new and existing infrastructure, the inherent volatility of commodity markets, heightened geopolitical risks, increasingly severe weather events, and a rapidly evolving regulatory environment demanding greater accountability for environmental protection and safety. Technological advancements, while improving operational efficiency, also introduce new risks such as cyber threats, further necessitating specialized insurance solutions.

Oil And Gas Insurance Market Executive Summary

The Oil and Gas Insurance Market is experiencing dynamic shifts influenced by overarching business, regional, and segment trends. Globally, the industry is navigating a dual transition: addressing persistent energy demands while simultaneously preparing for a future with lower carbon emissions. Business trends reveal a growing emphasis on integrated risk management strategies, leveraging advanced analytics and digital tools to enhance risk assessment, underwriting, and claims management. Insurers are developing more sophisticated, bespoke policies that account for hybrid energy projects, carbon capture technologies, and renewable energy integrations within traditional oil and gas portfolios. There is also a notable trend towards consolidation among insurance providers, aiming to achieve greater economies of scale and expertise, alongside an increasing focus on Environmental, Social, and Governance (ESG) criteria influencing underwriting decisions and investment strategies.

Regional trends highlight divergent growth patterns and risk profiles. North America and Europe, as mature markets, are characterized by a strong regulatory framework and a focus on operational efficiency, aging infrastructure maintenance, and managing the risks associated with the energy transition, including decommissioning liabilities and cyber threats. In contrast, the Asia-Pacific region, alongside the Middle East and Africa, is experiencing significant growth driven by new exploration projects, expanding infrastructure, and robust energy demand, leading to a surge in demand for project-specific and political risk insurance. Latin America also presents growth opportunities, particularly in offshore exploration, though often tempered by geopolitical uncertainties and varying regulatory landscapes. Each region's unique blend of geological, political, and economic factors dictates the specific insurance products and services that are in highest demand.

Segment trends within the market underscore the evolving nature of risks. While traditional property and casualty coverage remains foundational, there is a pronounced shift towards specialized insurance lines. Environmental liability insurance is seeing heightened demand due to more stringent regulations and increased public scrutiny regarding ecological impact. Cyber insurance is rapidly becoming an indispensable component of coverage portfolios, as the industry's reliance on digital infrastructure makes it a prime target for sophisticated cyberattacks. Furthermore, political risk insurance is gaining prominence in regions with geopolitical instability, protecting investments from expropriation, war, and civil unrest. Business interruption policies are being refined to better account for supply chain disruptions and market volatility. This segmentation analysis indicates a maturing market that is adapting to new risk landscapes and client requirements with increasingly granular and comprehensive solutions.

AI Impact Analysis on Oil And Gas Insurance Market

User inquiries concerning the impact of AI on the Oil and Gas Insurance Market frequently revolve around its potential to revolutionize risk assessment, underwriting, and claims processing, alongside concerns about data privacy, algorithmic bias, and the potential for job displacement. Users are keen to understand how AI-driven predictive analytics can enhance the accuracy of risk modeling for complex oil and gas operations, allowing insurers to offer more precise pricing and tailored policies. There is significant interest in AI's role in improving fraud detection, streamlining the claims lifecycle through automation, and providing real-time insights for loss prevention. Furthermore, questions arise about the ethical implications of using AI in critical decision-making processes and the challenges associated with integrating new technologies into legacy systems. The overarching theme is one of cautious optimism regarding AI's capacity to drive efficiency and innovation while mitigating associated risks.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally reshaping the landscape of the Oil and Gas Insurance Market. These advanced tools enable insurers to process vast datasets, including operational telemetry, historical claims data, satellite imagery, weather patterns, and geopolitical intelligence, with unprecedented speed and accuracy. This capability significantly enhances the ability to identify subtle risk correlations, predict potential incidents, and model future loss scenarios more effectively than traditional actuarial methods. Consequently, AI facilitates a move towards more dynamic pricing models and the development of hyper-personalized insurance products that precisely match the risk profile and operational needs of individual oil and gas companies, moving beyond generic, one-size-fits-all policies.

Beyond underwriting, AI is transforming various facets of insurance operations. In claims management, AI-powered systems can expedite the assessment process by analyzing damage reports, images, and sensor data, leading to faster and more accurate payouts. Predictive maintenance, driven by AI algorithms monitoring IoT sensors on assets, can significantly reduce the frequency and severity of incidents, leading to fewer claims and improved safety records. Moreover, AI's ability to analyze policy language and regulatory changes helps insurers maintain compliance and adapt to new legal frameworks efficiently. While the benefits are substantial, the industry also grapples with challenges such as ensuring data quality and security, addressing potential biases in AI models, and upskilling the workforce to effectively leverage these new technologies, necessitating a balanced approach to adoption.

- Enhanced Predictive Analytics for Risk Assessment: AI models analyze vast datasets to identify complex risk patterns, improving loss prediction and enabling more accurate underwriting.

- Automated Underwriting and Policy Customization: Streamlines the policy issuance process and allows for highly tailored insurance products based on granular operational data and real-time risk exposure.

- Faster and More Accurate Claims Processing: AI algorithms analyze claims data, damage reports, and supporting evidence to expedite assessment, reduce human error, and accelerate payouts.

- Improved Fraud Detection: Machine learning identifies suspicious patterns and anomalies in claims data, significantly enhancing the ability to detect and prevent fraudulent activities.

- Proactive Loss Prevention and Risk Mitigation: AI-driven insights from IoT sensors and operational data enable predictive maintenance and proactive measures to prevent incidents.

- Dynamic Pricing Models: Allows for continuous adjustment of premiums based on real-time risk factors, operational changes, and market conditions.

- Optimized Regulatory Compliance: AI assists in monitoring and adapting to evolving regulatory landscapes, ensuring policies and practices remain compliant.

- Development of New Insurance Products: Facilitates the creation of innovative coverage solutions for emerging risks like cyber threats, climate transition, and advanced operational technologies.

DRO & Impact Forces Of Oil And Gas Insurance Market

The Oil and Gas Insurance Market is shaped by a confluence of drivers, restraints, opportunities, and broader impact forces that dictate its trajectory and evolution. Key drivers propelling the market forward include the persistent global demand for energy, which necessitates ongoing exploration, production, and infrastructure development, thereby increasing exposure to insurable risks. Significant capital investments in large-scale upstream, midstream, and downstream projects, particularly in emerging economies, further fuel demand for comprehensive risk transfer mechanisms. The increasingly complex and often hazardous operating environments—ranging from deepwater drilling to operations in politically volatile regions—also intensify the need for specialized insurance. Furthermore, stringent regulatory frameworks and growing public and governmental scrutiny regarding safety and environmental protection mandate robust insurance coverage, serving as both a financial backstop and a compliance tool. Geopolitical instability, natural disasters, and the escalating risks associated with climate change and cyber threats further underscore the critical role of insurance in safeguarding the industry's assets and operations.

However, the market also faces considerable restraints. High premium costs, driven by the inherently high-risk nature of the industry and a history of significant losses, can be a major deterrent, particularly for smaller operators or those facing economic downturns. The volatility of global commodity prices directly impacts the profitability and investment capacity of oil and gas companies, consequently affecting their budget for insurance premiums. Capacity constraints within the insurance market, especially for very large or specialized risks, can limit coverage availability and drive up costs. Additionally, the increasing trend towards self-insurance or the establishment of captive insurance companies by major integrated oil and gas firms reduces the addressable market for traditional insurers. A shortage of specialized underwriting expertise for niche oil and gas risks and intense competition within the insurance sector further contribute to market pressures.

Despite these challenges, numerous opportunities exist for market expansion and innovation. The global energy transition presents a unique avenue, as insurers can develop new products tailored for hybrid energy projects, carbon capture utilization and storage (CCUS) initiatives, and the decommissioning of fossil fuel assets. Emerging markets, with their burgeoning energy needs and infrastructure development, offer significant untapped potential. The escalating threat of cyberattacks across the industry creates a burgeoning demand for robust cyber insurance solutions. Moreover, the increasing focus on ESG compliance mandates new forms of insurance that cover liabilities related to climate change, social impact, and governance failures. Leveraging advanced data analytics, AI, and IoT for enhanced risk assessment and proactive loss prevention represents a substantial opportunity for insurers to innovate their offerings and deliver greater value to clients. The broader impact forces influencing the market include rapid technological disruption, particularly in automation and digitalization, which reshapes operational risks; evolving regulatory landscapes, which continuously redefine compliance requirements; significant geopolitical shifts that create new areas of risk and opportunity; and the profound long-term effects of climate change, which necessitate adaptation in both operations and risk management strategies. Economic cycles also play a crucial role, influencing investment levels, operational activity, and ultimately, the demand for insurance coverage.

Segmentation Analysis

The Oil and Gas Insurance Market is comprehensively segmented to address the diverse and specialized risk profiles across the industry's intricate value chain. This segmentation allows for tailored insurance solutions that accurately reflect the varying exposures, operational complexities, and regulatory environments faced by different entities. The primary segmentation dimensions typically include the type of coverage offered, the operational segment within the oil and gas industry, and the geographical region. Each segment requires a distinct approach to underwriting, risk assessment, and claims management, given the unique nature of perils associated with exploration versus refining, or offshore versus onshore operations.

Understanding these distinct segments is crucial for both insurers and insured entities. For insurers, it enables the development of specialized product lines, optimizes risk pooling, and allows for targeted market penetration. For oil and gas companies, it ensures that they acquire precise and adequate coverage, avoiding underinsurance or unnecessary premium expenditure. The market's dynamic nature, influenced by technological advancements, regulatory changes, and environmental concerns, continually reshapes these segments, leading to the emergence of new sub-segments and cross-segment solutions. This detailed segmentation is instrumental in delivering effective risk transfer mechanisms throughout the entire hydrocarbon lifecycle.

- By Coverage Type:

- Property Damage Insurance

- Business Interruption Insurance

- General Liability Insurance

- Marine and Cargo Insurance

- Environmental Liability Insurance

- Political Risk Insurance

- Cyber Insurance

- Workers' Compensation Insurance

- Directors and Officers (D&O) Liability Insurance

- Control of Well Insurance

- By Operational Segment:

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining & Processing, Petrochemicals)

- By End-Use / Client Type:

- International Oil Companies (IOCs)

- National Oil Companies (NOCs)

- Independent Exploration and Production (E&P) Companies

- Oilfield Service Companies

- Drilling Contractors

- Pipeline Operators

- Refinery Operators

- Petrochemical Manufacturers

- Marine Transportation Companies

- By Geographical Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Oil And Gas Insurance Market

The value chain for the Oil and Gas Insurance Market intricately links various stakeholders, from initial risk assessment to policy distribution and claims settlement, reflecting the specialized nature of the industry it serves. At the upstream end, the process begins with comprehensive risk identification and evaluation, where insurers and brokers analyze the specific perils associated with exploration and production activities. This includes assessing geological risks, operational complexities of drilling, environmental impact, and potential for catastrophic events like blowouts. This analytical phase is critical for accurate policy design and pricing, often involving technical experts and engineers who provide detailed risk assessments of assets such as offshore platforms, drilling rigs, and seismic vessels. The information gathered here directly influences the terms, conditions, and premiums for coverages like control of well, property damage, and business interruption insurance for upstream operations.

Moving downstream, the value chain encompasses the actual underwriting and placement of policies, often involving a complex interplay between primary insurers, reinsurers, and specialized brokers. Brokers play a pivotal role as intermediaries, leveraging their expertise to match the intricate risk requirements of oil and gas companies with suitable insurance products from various carriers, frequently structuring complex placements involving multiple insurers to achieve sufficient capacity. Reinsurers provide critical capital and risk-sharing capabilities, enabling primary insurers to underwrite large and highly exposed oil and gas risks that would otherwise exceed their individual capacity. This collaborative ecosystem ensures that even the most substantial and complex risks associated with pipelines, storage terminals, refineries, and petrochemical plants—including environmental liabilities, general liability, and property damage—can be adequately covered. The claims management phase, at the furthest downstream end, involves loss adjusting, expert investigation, and timely settlement, which is vital for business continuity and client satisfaction, often requiring specialized adjusters with deep industry knowledge.

Distribution channels for oil and gas insurance are predominantly indirect, heavily relying on specialized insurance brokers and consultants who possess deep industry knowledge and technical expertise. These brokers act as critical conduits, connecting oil and gas operators with insurers capable of underwriting their unique and often substantial risks. For very large, integrated oil companies, direct relationships with a select group of insurers might exist for certain standard coverages, but even these entities frequently engage brokers for complex and bespoke placements. Indirect channels also include the robust involvement of the global reinsurance market, where risks are transferred from primary insurers to reinsurers, allowing for greater risk diversification and capacity. The interplay between direct client engagement, broker intermediation, and reinsurance support forms a robust network designed to efficiently transfer and manage the colossal financial exposures inherent in the oil and gas sector.

Oil And Gas Insurance Market Potential Customers

The potential customers for the Oil and Gas Insurance Market are diverse, encompassing the entire spectrum of entities involved in the exploration, production, processing, transportation, and distribution of hydrocarbons. These customers share a common need for robust financial protection against the substantial and unique risks inherent in their operations. At the forefront are major International Oil Companies (IOCs) and National Oil Companies (NOCs), which often operate vast, integrated global enterprises. These large entities require comprehensive, multi-layered insurance programs that span a multitude of jurisdictions and cover everything from deepwater drilling rigs to extensive pipeline networks and sophisticated refining complexes. Their insurance needs are broad, encompassing property damage, business interruption, complex liability, environmental pollution, and political risk coverage.

Beyond the major players, a significant customer segment includes independent Exploration and Production (E&P) companies, which focus primarily on discovering, extracting, and producing oil and gas. These firms, while often smaller in scale than IOCs or NOCs, still face significant operational risks, including control of well incidents and the high capital investment associated with drilling. Midstream operators, specializing in the transportation and storage of oil and gas through pipelines, terminals, and tankers, constitute another crucial customer base, requiring specialized marine, property, and liability coverages for their extensive infrastructure. Downstream companies, including refinery operators and petrochemical manufacturers, also represent a substantial customer segment, needing insurance against fire, explosion, equipment breakdown, and the specific environmental and liability risks associated with processing highly volatile materials.

Furthermore, the market serves a wide array of service providers and contractors essential to the oil and gas industry. This includes drilling contractors, seismic survey companies, offshore support vessel operators, oilfield service companies providing specialized equipment and personnel, and engineering, procurement, and construction (EPC) firms involved in building energy infrastructure. These ancillary businesses often bear substantial operational and contractual liabilities, making insurance an indispensable part of their risk management strategy. The collective demand from these varied end-users ensures a robust and continually evolving market for specialized oil and gas insurance products, driven by their critical need to mitigate financial exposure in a capital-intensive and inherently hazardous sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 67.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Chubb, Allianz, AXA XL, Zurich Insurance Group, Marsh & McLennan Companies, Willis Towers Watson, Aon Plc, Lloyd's of London, Swiss Re, Munich Re, Travelers, Liberty Mutual Insurance, Tokio Marine Holdings, Generali, Hannover Re, Scor SE, Beazley Group, Markel Corporation, Aspen Insurance Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil And Gas Insurance Market Key Technology Landscape

The Oil and Gas Insurance Market is increasingly leveraging a sophisticated array of technologies to enhance risk assessment, optimize underwriting processes, streamline claims management, and offer more proactive loss prevention services. A cornerstone of this technological transformation is the widespread adoption of advanced data analytics and Big Data platforms. These tools enable insurers to collect, process, and analyze vast quantities of structured and unstructured data from various sources, including operational telemetry, sensor data from IoT devices on rigs and pipelines, satellite imagery, meteorological reports, geopolitical intelligence, and historical claims records. This data-driven approach provides a granular understanding of risk exposures, allowing for more precise actuarial modeling and tailored policy development, moving beyond traditional, generalized risk profiles.

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are playing a pivotal role in extracting actionable insights from these large datasets. AI-powered predictive analytics are used to forecast potential incidents, assess the likelihood of equipment failure, and identify emerging risk patterns, thereby enabling insurers to better price policies and suggest preventative measures. Natural Language Processing (NLP) is being employed to analyze policy documents, contracts, and regulatory changes, improving compliance and identifying potential coverage gaps. Furthermore, automation, through technologies like Robotic Process Automation (RPA), is being deployed to handle routine administrative tasks, such as data entry and initial claims processing, freeing up human underwriters and claims adjusters to focus on more complex, value-added activities. This enhances operational efficiency and significantly reduces turnaround times.

Other significant technological advancements include the use of Geographic Information Systems (GIS) and drone technology for remote inspection and assessment of assets, especially in challenging or hazardous environments. Drones equipped with high-resolution cameras and thermal sensors can quickly survey vast areas, providing critical data for risk assessment and post-incident damage evaluation, minimizing human exposure to danger. Blockchain technology is emerging as a potential disruptor for enhancing transparency and security in claims processing and smart contract execution, while digital twin technology offers a virtual replica of physical assets, allowing for simulation of various risk scenarios and proactive risk management. These technologies collectively contribute to a more dynamic, precise, and responsive oil and gas insurance ecosystem, moving towards a paradigm of continuous risk monitoring and adaptive coverage.

Regional Highlights

The global Oil and Gas Insurance Market exhibits distinct regional characteristics, driven by varying operational landscapes, regulatory frameworks, energy policies, and economic conditions. Each region presents unique risk profiles and insurance demands, necessitating tailored strategies from market players. Understanding these regional nuances is crucial for both insurers seeking to expand their footprint and oil and gas companies ensuring adequate local coverage.

North America, a mature and highly developed market, is characterized by extensive onshore and offshore exploration and production, particularly in shale oil and gas. The region also boasts a vast network of pipelines and advanced refining capabilities. Key insurance considerations include the unique risks associated with hydraulic fracturing, stringent environmental regulations, aging infrastructure maintenance, and a growing focus on cyber security threats. Companies in this region demand sophisticated property, liability, and specialized environmental and cyber coverage. Europe, another mature market, is heavily influenced by strict environmental regulations and a strong push towards decarbonization and renewable energy. The market here sees a rising demand for insurance related to decommissioning liabilities for aging oil and gas assets, along with coverage for climate transition risks and stringent ESG compliance. While new exploration is limited, maintaining existing infrastructure and managing complex regulatory adherence remain primary drivers for insurance demand.

The Asia Pacific (APAC) region stands out as a significant growth engine for the oil and gas insurance market. Driven by rapidly expanding energy demand, robust economic growth, and substantial investments in new upstream projects (e.g., offshore gas in Australia, Malaysia) and extensive midstream and downstream infrastructure (e.g., refineries in China, India), the region presents ample opportunities. Political risk insurance, marine and cargo coverage, and property damage insurance for large-scale projects are particularly in demand. The Middle East and Africa (MEA) region, with its colossal hydrocarbon reserves and ongoing large-scale national oil company projects, represents a critical market. Geopolitical instability in parts of the region makes political risk insurance, war and terrorism coverage, and comprehensive property and liability insurance essential. The expansion of LNG projects and new exploration initiatives in Africa also contribute significantly to insurance demand. Latin America, particularly countries like Brazil and Mexico with vast offshore oil reserves, is another dynamic market. While offering significant growth potential in offshore E&P, the region's insurance market often contends with political instability, regulatory changes, and economic volatility, necessitating strong political risk and offshore liability coverage.

- North America: A mature market with high demand for property, casualty, environmental, and cyber insurance driven by extensive shale gas operations, deepwater drilling, and aging infrastructure concerns. Regulatory compliance and managing energy transition risks are paramount.

- Europe: Characterized by stringent environmental regulations and a strong emphasis on energy transition. Demand is high for decommissioning liability, climate transition risk, and comprehensive ESG-related insurance.

- Asia Pacific (APAC): A rapidly growing market fueled by increasing energy demand, new exploration and production projects, and significant infrastructure development in countries like China, India, and Southeast Asia. Strong demand for project insurance, marine and cargo, and political risk coverage.

- Middle East and Africa (MEA): Critical market due to vast hydrocarbon reserves and large-scale national projects. Geopolitical risks necessitate strong political risk, war and terrorism, and comprehensive property/liability insurance. New offshore developments in Africa are key drivers.

- Latin America: Emerging market with substantial offshore exploration opportunities (e.g., Brazil). Political instability and varying regulatory environments drive demand for political risk insurance and specialized offshore coverages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil And Gas Insurance Market.- AIG (American International Group)

- Chubb Limited

- Allianz SE

- AXA XL (a division of AXA)

- Zurich Insurance Group

- Marsh & McLennan Companies

- Willis Towers Watson

- Aon Plc

- Lloyd's of London

- Swiss Re Ltd.

- Munich Reinsurance Company

- The Travelers Companies, Inc.

- Liberty Mutual Insurance

- Tokio Marine Holdings, Inc.

- Generali Group

- Hannover Rück SE

- Scor SE

- Beazley Group Plc

- Markel Corporation

- Aspen Insurance Holdings Limited

Frequently Asked Questions

What are the primary types of insurance coverage needed in the oil and gas sector?

The oil and gas sector requires a comprehensive suite of insurance coverages, including property damage for physical assets, business interruption for lost revenue, general liability for third-party claims, environmental liability for pollution incidents, marine and cargo for offshore operations and transportation, political risk for geopolitical instability, and cyber insurance for digital threats. Control of Well insurance is also critical for exploration and production activities.

How does geopolitical instability impact oil and gas insurance premiums?

Geopolitical instability significantly increases oil and gas insurance premiums, particularly for political risk, war and terrorism, and property damage coverages. Operating in regions prone to conflicts, civil unrest, or expropriation raises the perceived risk profile, leading insurers to charge higher rates to compensate for the elevated potential for catastrophic losses and disruptions to operations.

What role does environmental liability insurance play for oil and gas companies?

Environmental liability insurance is crucial for oil and gas companies as it provides coverage for costs associated with pollution incidents, including clean-up, remediation, and third-party bodily injury or property damage claims. With increasingly stringent environmental regulations and public scrutiny, this coverage helps companies manage financial exposure from unforeseen ecological events and ensure regulatory compliance.

Are cyber risks a significant concern for the oil and gas insurance market?

Yes, cyber risks are a significant and growing concern. The oil and gas industry's reliance on interconnected operational technology (OT) and information technology (IT) systems makes it a prime target for cyberattacks, which can lead to operational shutdowns, data breaches, environmental damage, and substantial financial losses. Consequently, specialized cyber insurance is becoming an indispensable part of risk management portfolios.

How is the transition to renewable energy affecting the oil and gas insurance market?

The transition to renewable energy is creating both challenges and opportunities for the oil and gas insurance market. It is shifting focus towards insuring hybrid energy projects, carbon capture technologies, and decommissioning liabilities for fossil fuel assets. Insurers are adapting their offerings to cover new risks associated with renewables while also refining policies for traditional oil and gas operations as investment patterns evolve and regulatory landscapes push for decarbonization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager