Oil Condensing Boiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432455 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Oil Condensing Boiler Market Size

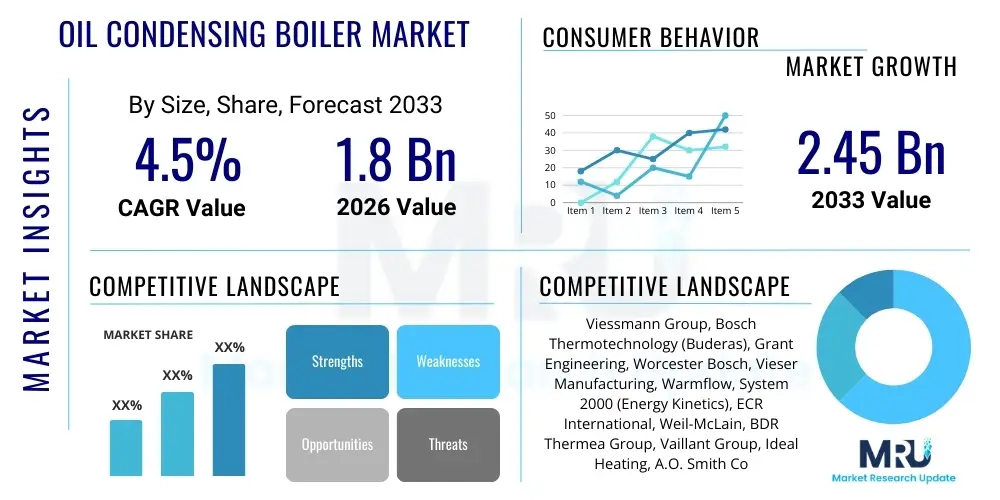

The Oil Condensing Boiler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.45 Billion by the end of the forecast period in 2033.

Oil Condensing Boiler Market introduction

The Oil Condensing Boiler Market encompasses the manufacturing, distribution, and installation of high-efficiency heating systems designed specifically to utilize heating oil (fuel oil) while capturing latent heat from exhaust gases. Unlike traditional non-condensing boilers that vent hot combustion gases directly outdoors, condensing technology cools these gases sufficiently to cause the water vapor within them to condense, releasing additional heat energy back into the system. This process significantly improves efficiency, often reaching levels of 90% or higher, thereby reducing fuel consumption and lowering operational costs for consumers. This efficiency drive is paramount, particularly in regions where heating oil remains a crucial energy source for residential, commercial, and industrial heating applications, especially in off-grid locations or areas with underdeveloped natural gas infrastructure.

Product differentiation in this market centers around modulation capability, size, compatibility with smart home systems, and compliance with stringent regional energy efficiency directives, such as the European Union's ErP (Energy-related Products) directive. Condensing oil boilers are primarily deployed in residential settings, large apartment buildings, and light commercial facilities, particularly for space heating and domestic hot water generation. Major applications include replacing aging, less efficient oil boilers in established markets like North America and Europe, where the existing infrastructure relies heavily on oil. Furthermore, these boilers are essential for properties undergoing energy efficiency retrofits seeking to maximize thermal performance without transitioning away from liquid fuels, ensuring system longevity and robust performance even in extremely cold climates.

The primary benefits driving the adoption of oil condensing boilers include substantial long-term fuel cost savings due to superior thermal efficiency, reduced greenhouse gas emissions compared to conventional oil boilers, and their robust performance in variable temperature conditions. Key driving factors involve government mandates pushing for higher efficiency standards across the heating sector, the necessity of replacing millions of inefficient legacy oil boilers, and the increasing consumer focus on sustainable yet reliable heating solutions. Although facing competition from alternative technologies like heat pumps and natural gas, the condensing oil segment maintains relevance due to the established infrastructure for oil delivery and the practical difficulties of switching fuel sources for many existing properties.

Oil Condensing Boiler Market Executive Summary

The global Oil Condensing Boiler Market is experiencing steady, albeit moderated, growth primarily driven by mandatory replacement cycles in mature economies and regulatory mandates favoring high-efficiency appliances. Business trends indicate a strong focus on incorporating hybrid capabilities, allowing oil boilers to integrate seamlessly with renewable technologies like solar thermal or heat pumps, mitigating the long-term dependency on fossil fuels while providing reliable backup heat. Manufacturers are investing heavily in research and development to reduce the physical footprint of these units, improve digital connectivity for remote diagnostics, and enhance the lifespan of critical components subjected to corrosive condensate. The competitive landscape is characterized by consolidation and strategic partnerships aimed at expanding distribution networks and offering comprehensive service packages, shifting competition toward value-added services rather than purely hardware cost.

Regionally, Europe remains the dominant force in terms of installed base and regulatory innovation, particularly driven by directives in Germany, the UK, and France which necessitate the installation of high-efficiency equipment during boiler replacements. North America, especially the Northeastern United States and Eastern Canada, represents a significant replacement market, where the large stock of older oil-fired systems presents a constant demand pipeline for condensing units. Asia Pacific exhibits niche market growth, primarily in industrialized or remote areas that rely on localized heating solutions, though the overall adoption rate lags due to differing heating practices and preference for natural gas where available. Emerging markets often prioritize immediate cost over long-term efficiency, presenting a unique challenge for widespread penetration of premium condensing units.

Segment trends highlight the growing importance of the residential sector, which commands the largest share, driven by homeowner investments in energy efficiency upgrades. Within the technology segment, wall-hung condensing boilers are gaining traction due to their space-saving design and applicability in modern residential construction and retrofits, although floor-standing models maintain dominance in larger, older homes requiring substantial heating capacity. The service and maintenance segment is rapidly expanding, reflecting the need for specialized technicians to handle the sensitive components and condensate drainage systems integral to condensing technology, ensuring optimal system performance and compliance with warranty conditions. The shift towards light commercial applications, particularly high-output modular systems, also represents a profitable niche for specialized manufacturers catering to small businesses and public sector buildings.

AI Impact Analysis on Oil Condensing Boiler Market

User queries regarding the impact of Artificial Intelligence (AI) on the Oil Condensing Boiler Market primarily revolve around predictive maintenance, optimization of combustion processes, and smart energy management integration. Users are concerned with how AI can extend the operational life of expensive condensing units and ensure maximum efficiency despite fluctuations in oil quality or ambient conditions. Key themes include the implementation of self-learning algorithms for modulating burner output based on real-time weather forecasts and household usage patterns, improving fault detection accuracy to minimize downtime, and utilizing large datasets (big data) collected from interconnected boilers for remote diagnostics and preventative service scheduling. The expectation is that AI will transform the traditionally reactive maintenance model into a highly proactive and personalized heating experience, enhancing user convenience and further cementing the efficiency advantage of modern oil boilers.

- AI-driven Predictive Maintenance: Utilizing sensors and machine learning models to forecast component failure (e.g., heat exchanger fouling, igniter wear) before operational disruption occurs.

- Optimized Combustion Control: Real-time analysis of flue gas composition and ambient air conditions, allowing AI to dynamically adjust the oil/air mixture for peak condensation efficiency.

- Smart Load Management: Integrating boiler operation with smart home energy systems and utility signals, optimizing heating cycles based on predicted occupancy and energy pricing fluctuations.

- Remote Diagnostics and Troubleshooting: Enabling manufacturers and service providers to diagnose issues remotely using AI analysis of performance logs, speeding up repair times and reducing service calls.

- Supply Chain Optimization: Using AI to predict demand for specific boiler models and spare parts across different regional markets, optimizing inventory management and production schedules.

DRO & Impact Forces Of Oil Condensing Boiler Market

The market dynamics for oil condensing boilers are shaped by a complex interplay of regulatory pressures favoring efficiency (Drivers), environmental concerns and competing technologies (Restraints), opportunities arising from infrastructure modernization, and the persistent influence of external economic and geopolitical factors (Impact Forces). The main driving force remains the legislative push, particularly in OECD countries, mandating the decommissioning of outdated, standard efficiency boilers and promoting condensing technology as the baseline for new installations. This regulatory environment creates an enforced replacement demand, ensuring a steady market flow regardless of immediate economic volatility. Simultaneously, the inherent energy savings offered by condensing technology—often achieving 20-30% improvement over older models—provides a compelling financial incentive for homeowners and businesses facing rising fuel costs.

Significant restraints include the sustained competitive threat from alternative low-carbon heating technologies, notably air source and ground source heat pumps, which are increasingly subsidized and promoted as long-term solutions for decarbonization. Furthermore, the volatility in crude oil prices and the general perception of oil as a high-carbon fuel source generate negative sentiment, influencing long-term investment decisions against oil-based heating systems, especially in new construction projects. The logistical challenges associated with storing heating oil (requiring tanks) and the higher initial purchase and installation cost of condensing units compared to traditional alternatives can deter cost-sensitive consumers in certain market segments, slowing the rate of adoption outside mandatory replacement schemes.

Key opportunities are centered on the integration of bio-oil and renewable liquid fuels (e.g., hydrotreated vegetable oil or HVO) into condensing boiler systems. As manufacturers adapt their products to be 'future fuel ready,' the market can position itself as a viable, decarbonizing alternative without demanding expensive infrastructure overhauls. Another major opportunity lies in expanding the service and aftermarket sector, leveraging digital connectivity for proactive maintenance contracts, ensuring maximum operational efficiency over the boiler's lifetime. Impact forces, such as global efforts toward climate change mitigation and the geopolitical stability affecting crude oil supply chains, exert pressure on pricing and regulatory frameworks. The overall economic health of key consuming regions directly influences consumer willingness to invest in high-capital efficiency upgrades, classifying economic stability as a critical indirect impact force.

Segmentation Analysis

The Oil Condensing Boiler Market is comprehensively segmented based on technology, capacity, application, and end-user, allowing for precise market sizing and targeting. Segmentation by technology primarily distinguishes between combination boilers (combi) that provide both space heating and instantaneous hot water, and system or regular boilers used in conjunction with a separate hot water storage tank. This distinction is crucial as it dictates the suitability of the unit for different property types and sizes—combi boilers being ideal for smaller dwellings with lower hot water demands, while system boilers cater to larger homes or commercial premises requiring simultaneous hot water delivery to multiple points. The capacity segmentation (e.g., below 50 kW, 50–150 kW, and above 150 kW) directly addresses the heating load requirements, influencing purchasing decisions across residential, commercial, and industrial end-users.

Analysis of the end-user segments reveals that the residential sector holds the largest market share, driven primarily by the mandatory replacement of millions of older oil-fired boilers in established markets, particularly single-family homes in rural or suburban areas. The commercial sector, including offices, schools, and small retail establishments, represents a stable but slower growth segment, often favoring larger capacity, modular boiler systems for improved redundancy and efficiency. The industrial application segment, while smaller in volume, demands highly robust, custom-engineered condensing systems, focusing heavily on operational reliability and specialized certifications to meet rigorous industrial standards and processing heat requirements, making it a high-value niche.

Further segmentation by geographic region highlights stark differences in market maturity and regulatory influence. Europe dominates due to strict Ecodesign and ErP regulations and high public awareness regarding energy efficiency, ensuring rapid adoption. North America represents a mature replacement market concentrated heavily in the Northeast and Mid-Atlantic regions. Effective market strategy requires tailoring product offerings—such as compact, high-output units for densely populated European areas versus robust, larger-capacity units suited for colder, larger North American dwellings—to address these regional preferences and regulatory compliance challenges, ensuring market relevance and competitiveness across diverse operating environments.

- By Technology:

- Standard Condensing Boilers

- High-Efficiency Modulating Condensing Boilers

- Combi Condensing Boilers (Combination)

- System Condensing Boilers

- By Capacity:

- Below 50 kW (Kilowatts)

- 50 kW to 150 kW

- Above 150 kW

- By Application:

- Space Heating

- Domestic Hot Water

- Combined Heating and Hot Water

- By End-User:

- Residential (Single-Family Homes, Multi-Family Housing)

- Commercial (Offices, Retail, Hospitality)

- Industrial (Small Manufacturing, Process Heating)

Value Chain Analysis For Oil Condensing Boiler Market

The value chain for the Oil Condensing Boiler Market begins with upstream activities involving raw material procurement, specialized component manufacturing, and technological development. Upstream analysis focuses on securing key inputs such as high-grade stainless steel (for heat exchangers to resist condensate corrosion), specialized burners, electronic controls, and pumps. Suppliers of these core components, particularly proprietary heat exchanger designs, hold significant bargaining power, driving innovation and cost structures. Manufacturers prioritize secure sourcing and robust quality control over these parts, as component reliability is critical to achieving the promised efficiency and lifespan of the final product. Technological advancement, often involving partnerships with control systems specialists, is embedded early in the chain to ensure compliance with digital integration and efficiency standards.

The midstream stage is dominated by the boiler manufacturer, involving final assembly, quality assurance, branding, and packaging. This stage is capital-intensive, requiring advanced manufacturing facilities and rigorous testing procedures. After manufacturing, the distribution channel becomes critical. This channel typically involves multi-layered networks: direct sales to large commercial installers, reliance on national wholesalers and distributors, and specialized relationships with regional HVAC contractors. Due to the technical nature of the installation and commissioning process, indirect channels, relying on established networks of certified heating engineers, handle the vast majority of residential sales and installations. Direct channels are generally reserved for large-scale commercial tenders or highly specialized industrial projects.

Downstream activities focus on installation, service, maintenance, and end-of-life management. Customer value is heavily influenced by the expertise of the installer and the availability of post-sales support. Certified installation is often mandatory for warranty validity and ensuring the boiler operates at peak condensing efficiency, which relies on correctly setting up the flue and condensate drainage. The aftermarket segment—including spare parts, annual servicing, and repair services—represents a substantial and high-margin part of the downstream value chain. Potential competitive advantages lie in establishing robust service networks and offering smart maintenance contracts utilizing IoT capabilities for proactive intervention, thereby maximizing customer satisfaction and system uptime.

Oil Condensing Boiler Market Potential Customers

The primary end-users and buyers of oil condensing boilers are segmented into distinct groups based on their usage patterns, heating requirements, and willingness to invest in efficiency upgrades. The largest segment comprises residential homeowners, particularly those residing in areas lacking immediate access to natural gas infrastructure or those who have long-standing dependencies on heating oil tanks. These customers are driven by the necessity of replacing end-of-life conventional boilers, seeking maximum energy efficiency to combat high fuel costs, and desiring reliability during severe weather conditions. They often rely heavily on the advice of certified HVAC technicians and prioritize brands known for durability and robust warranty provisions, making the installer network a crucial gateway to this customer base.

Another significant customer group includes property managers and owners of multi-family housing units (apartments and condominiums) and light commercial entities such as small businesses, municipal buildings, and decentralized educational facilities. These buyers are typically focused on the total cost of ownership (TCO), requiring boilers that offer high output, modularity for scaling heating capacity, and extended maintenance intervals to minimize operational disruption. Decisions in this segment are often centralized and are highly influenced by building codes, energy performance certification requirements, and the integration capacity of the new boiler with existing building management systems (BMS).

The third key segment consists of industrial users and specialized institutional buyers, such as hospitals or small processing plants requiring reliable, high-volume hot water or space heating. While representing a smaller volume of units, these customers purchase high-capacity, heavy-duty boilers, demanding strict adherence to safety regulations and customized specifications. They require solutions that can potentially utilize alternative fuels (such as blends of bio-oil) and must demonstrate exceptional longevity and minimal downtime, often engaging directly with manufacturers or specialized engineering firms rather than local installers for complex project execution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.45 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viessmann Group, Bosch Thermotechnology (Buderas), Grant Engineering, Worcester Bosch, Vieser Manufacturing, Warmflow, System 2000 (Energy Kinetics), ECR International, Weil-McLain, BDR Thermea Group, Vaillant Group, Ideal Heating, A.O. Smith Corporation, Carrier Global Corporation, Lennox International, Fulton Boiler Works, Baxi Heating, Hoval Group, NTI Boilers, Laars Heating Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Condensing Boiler Market Key Technology Landscape

The technology landscape for oil condensing boilers is defined by advancements aimed at maximizing efficiency, reducing emissions, and improving user interface and connectivity. The core technology involves highly specialized heat exchangers, typically fabricated from stainless steel or sometimes aluminum, designed to withstand the corrosive nature of the acidic condensate produced during the cooling of flue gases. Recent innovations focus on optimizing the geometry of these heat exchangers (e.g., helical or finned tube designs) to maximize the surface area for heat transfer, pushing efficiencies consistently above 93%. Furthermore, continuous efforts are made in developing reliable and efficient condensate neutralization and disposal systems, which are vital for environmental compliance and system longevity. The sophistication of these component technologies dictates the premium pricing and performance differential among competing brands.

A crucial technological trend is the implementation of modulation and variable speed controls. Modern oil condensing boilers utilize sophisticated sensors and electronic controls to continuously monitor demand and adjust the burner firing rate (modulation) and the speed of the circulating pumps and fans (variable speed). This allows the boiler to precisely match its heat output to the required load, preventing the wasteful on/off cycling common in older models. High modulation ratios (e.g., 5:1 or 7:1) significantly enhance part-load efficiency, which is where most residential boilers operate for the majority of the heating season, leading to substantial energy savings and reduced wear and tear on components. This technological refinement is key to maximizing the cost benefits of condensing technology.

Digital connectivity and smart technology integration represent the final pillar of the current technological landscape. Newer models are equipped with Wi-Fi and IoT capabilities, enabling seamless integration with smart thermostats, energy management systems, and remote diagnostics platforms. This connectivity allows homeowners and technicians to monitor performance, adjust settings remotely, and receive instant alerts regarding potential malfunctions. Manufacturers are leveraging this data to offer sophisticated predictive maintenance services, using cloud-based analytics to optimize efficiency based on historical usage patterns and ambient temperature fluctuations, ultimately transforming the boiler from a simple heating appliance into a networked energy asset.

Regional Highlights

Europe: Market Dominance and Regulatory Leadership

Europe stands as the undisputed leader in the Oil Condensing Boiler Market, both in terms of market volume and technological maturity. This dominance is fundamentally driven by the stringent regulatory framework established by the European Union, notably the Ecodesign Directive (ErP), which effectively phased out non-condensing boiler technology. Countries like Germany, the United Kingdom, and Ireland have massive installed bases of oil-fired heating systems, and the mandatory replacement cycles provide a continuous, high-volume market for high-efficiency condensing units. Demand is increasingly focused on 'bio-oil ready' models, anticipating future mandates requiring the use of sustainable liquid fuels (such as HVO) to meet ambitious national decarbonization targets. Germany, being a manufacturing and technology hub, often sets the pace for product innovation, focusing on ultra-compact designs and advanced integration with solar thermal systems.

North America: Replacement Focus in the Northeast

The North American market is highly concentrated, with demand heavily weighted toward the Northeastern United States and Eastern Canada. These regions historically relied on oil for heating due to easy maritime transport access and colder climates. The market here is almost exclusively driven by the need to replace the vast stock of aging, low-efficiency steel and cast-iron boilers, a process accelerated by state-level rebates and tax incentives for high-efficiency upgrades. Consumers in this region prioritize durability, high output capacity (given harsh winters), and compatibility with existing hydronic heating infrastructure. While facing increasing competition from natural gas expansion and heat pump penetration, the robust, floor-standing oil condensing boiler maintains a strong foothold due to its proven reliability in extreme cold and its suitability for large, older homes.

Asia Pacific and Rest of the World: Niche and Infrastructure-Dependent Growth

The Asia Pacific market for oil condensing boilers is small and highly segmented, primarily serving specific industrial or geographically isolated regions in countries like China and Japan where centralized heating is less common or access to gas is limited. Growth in this region is constrained by the widespread preference for electricity, local district heating schemes, or, conversely, rapid urbanization and expansion of natural gas networks. Similarly, the Middle East and Africa (MEA) and Latin America represent niche markets. Oil condensing boilers are utilized in specialized industrial applications or high-end residential compounds requiring reliable, localized heating solutions, particularly in countries with domestic oil production capacity. Market growth in these regions is heavily dependent on infrastructure investment and the local availability and pricing stability of heating oil relative to other energy sources.

- Europe (Germany, UK, France, Italy): Dominant market driven by strict Ecodesign regulations and high replacement demand; strong focus on bio-fuel compatibility and system integration.

- North America (Northeast US, Eastern Canada): Key replacement market characterized by large installed base of legacy systems; demand for high-output, durable, floor-standing units.

- Asia Pacific (Japan, Niche markets in China): Limited adoption, primarily focused on industrial process heat and specialized applications; constrained by alternative heating infrastructure.

- Latin America and MEA: Niche market adoption in specific industrial or high-income residential areas; growth highly sensitive to local fuel pricing and import logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Condensing Boiler Market.- Viessmann Group

- Bosch Thermotechnology (Buderus)

- Grant Engineering

- Worcester Bosch

- BDR Thermea Group (De Dietrich, Baxi)

- Vaillant Group

- System 2000 (Energy Kinetics)

- Warmflow

- Vieser Manufacturing

- ECR International

- Weil-McLain

- Ideal Heating

- A.O. Smith Corporation

- Carrier Global Corporation

- Lennox International

- Fulton Boiler Works

- Hoval Group

- NTI Boilers

- Laars Heating Systems

- Riello Group

Frequently Asked Questions

Analyze common user questions about the Oil Condensing Boiler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and efficiency of a modern oil condensing boiler?

Modern oil condensing boilers typically have a lifespan of 15 to 20 years when properly maintained. Their efficiency levels are generally 90% to 98.5% AFUE (Annual Fuel Utilization Efficiency), significantly higher than older, non-condensing models, leading to substantial energy savings over the operational life.

How do oil condensing boilers compare to natural gas boilers in terms of initial cost and operation?

Oil condensing boilers generally have a slightly higher initial purchase and installation cost than comparable natural gas models due to specialized components (like corrosion-resistant heat exchangers). Operating costs vary significantly by region and fuel price, though their high efficiency helps mitigate the cost differential associated with liquid fuels.

Can existing oil condensing boilers be adapted to run on renewable liquid fuels like HVO (Hydrotreated Vegetable Oil)?

Many contemporary oil condensing boilers are designed to be "future fuel ready" and can be adapted to run on bio-oil blends or 100% HVO with minor, sometimes necessary, modifications or adjustments to the burner settings. This adaptability is a key market driver ensuring system longevity in the face of decarbonization efforts.

What is condensate and why is its management crucial for oil condensing boilers?

Condensate is the acidic liquid byproduct formed when water vapor in the flue gases cools and changes state, releasing latent heat. Proper management, using an integrated neutralization kit and correct drainage, is crucial to prevent corrosion of the boiler components and drainage pipes, ensuring system safety and warranty compliance.

What are the primary regulatory drivers impacting the market growth of oil condensing boilers?

The primary drivers are stringent government energy efficiency mandates, such as the EU's Ecodesign Directive, which effectively requires the replacement of standard efficiency boilers with high-efficiency condensing models. These regulations create compulsory demand in replacement markets and accelerate the technological adoption curve.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager