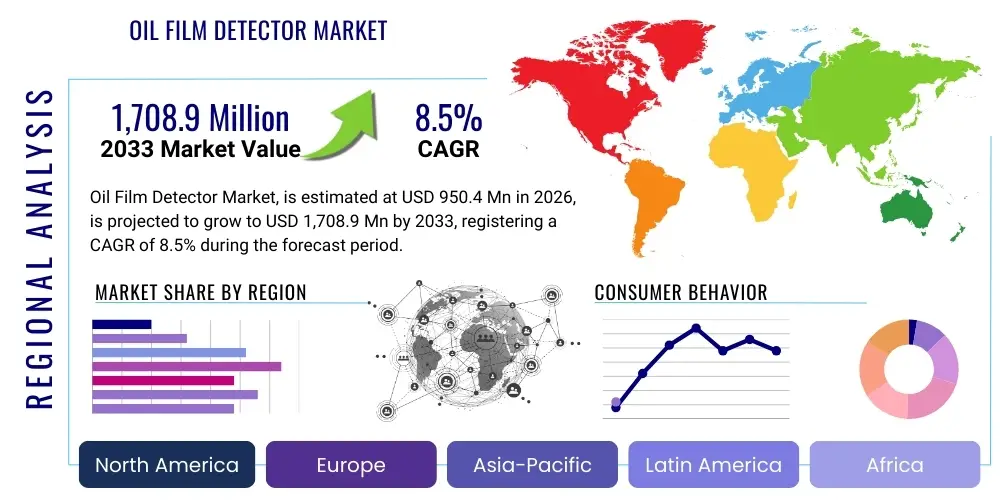

Oil Film Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437765 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Oil Film Detector Market Size

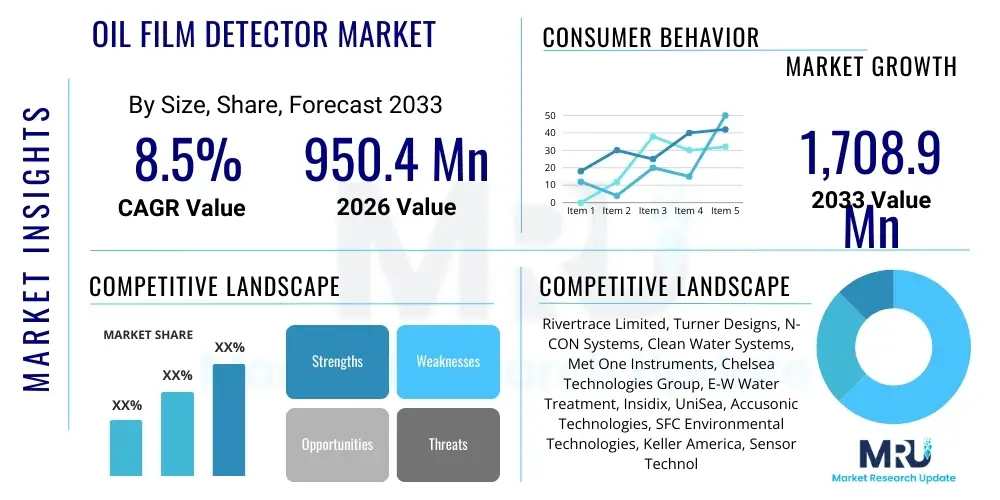

The Oil Film Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 950.4 Million in 2026 and is projected to reach USD 1,708.9 Million by the end of the forecast period in 2033.

Oil Film Detector Market introduction

The Oil Film Detector Market encompasses specialized sensing technologies designed to identify, quantify, and monitor thin layers of oil or hydrocarbon films on water surfaces or critical industrial components. These systems are crucial across various sectors, primarily driven by stringent environmental regulations aimed at preventing marine and freshwater pollution from accidental spills or chronic industrial discharge. Oil film detectors utilize non-contact measurement principles, employing methods such as UV fluorescence, optical reflection, and laser scattering to provide real-time data regarding oil presence, thickness, and composition, often without requiring physical sampling. The core product functions include instantaneous detection of even minute oil traces, continuous monitoring in high-traffic areas like ports and industrial discharge points, and triggering automated alarms when predefined contamination thresholds are breached. This reliability is paramount for rapid response in environmental emergency scenarios, safeguarding fragile ecosystems.

Major applications for oil film detectors span environmental protection, industrial machinery monitoring, and marine safety. In environmental contexts, they are indispensable for monitoring effluent discharge from refineries, power plants, and municipal treatment facilities to ensure compliance with global regulatory bodies such as the Environmental Protection Agency (EPA) and the International Maritime Organization (IMO). Industrially, these detectors play a vital role in predictive maintenance for critical infrastructure, including steam turbines, hydraulic systems, and heat exchangers, where the presence of an oil film can indicate leaks, lubrication failure, or compromised system integrity, leading to costly downtime or catastrophic equipment failure. The integration of advanced optics and software algorithms allows modern detectors to differentiate between oil films and other surface contaminants, improving accuracy and reducing false positives in dynamic operational settings.

The primary driving factors propelling the market growth are the increasing global emphasis on sustainable industrial practices and robust legal frameworks imposing severe penalties for environmental non-compliance. Benefits derived from deploying these technologies include enhanced environmental stewardship, reduced operational risks through proactive maintenance alerts, and significant cost savings by mitigating potential fines and cleanup expenses associated with oil spills. Furthermore, technological advancements leading to miniaturization, increased sensitivity, and improved connectivity (IoT integration) are expanding the adoption of portable and remote sensing oil film detection systems, making continuous surveillance feasible even in highly remote or harsh environments such as offshore platforms and arctic regions.

Oil Film Detector Market Executive Summary

The Oil Film Detector Market is experiencing robust growth driven primarily by escalating global environmental compliance requirements and rapid technological advancements in sensor fusion and data analytics. Business trends indicate a strong shift towards the integration of smart, IoT-enabled detectors capable of remote diagnostics and seamless communication with centralized monitoring platforms, moving away from standalone, periodic inspection models. The market is characterized by intense competition focused on developing highly sensitive, spectroscopic detection methods that can identify specific types of hydrocarbons, offering superior functional performance compared to traditional reflective sensors. Manufacturers are also prioritizing the development of low-power, ruggedized devices suitable for deployment in challenging industrial and marine environments, often incorporating self-cleaning and self-calibrating features to minimize maintenance overheads and ensure long-term operational stability.

Regionally, the Asia Pacific (APAC) region is poised for the most rapid market expansion, fueled by massive industrialization, particularly in chemical processing, oil and gas exploration, and power generation sectors in countries like China, India, and South Korea, necessitating stringent environmental monitoring infrastructure deployment. North America and Europe, while mature markets, continue to lead in adopting advanced, high-precision detection technologies due to historical commitments to environmental protection and sophisticated regulatory enforcement frameworks. Segment trends reveal that the Fixed/Online monitoring systems segment dominates revenue generation, reflecting the industry's preference for continuous, automated surveillance of critical infrastructure and effluent discharge points. However, the Portable systems segment is exhibiting faster growth, largely due to their utility in emergency response, sporadic site inspections, and facilitating compliance audits across diverse locations, addressing immediate and localized detection needs effectively.

Furthermore, segmentation by technology underscores the increasing commercial viability of UV Fluorescence techniques over traditional optical methods, offering enhanced sensitivity and the ability to detect oil films at monomolecular layer thickness. The oil and gas industry remains the single largest application segment, requiring sophisticated detectors for leak detection in pipelines, storage facilities, and offshore operations. Future market trajectory is expected to be heavily influenced by the integration of Artificial Intelligence (AI) for complex data pattern recognition, enabling predictive modeling of pollution events and optimizing the deployment and sensitivity settings of detection networks, moving beyond mere reactive reporting to proactive risk mitigation and environmental management across large operational footprints.

AI Impact Analysis on Oil Film Detector Market

Users frequently inquire about how Artificial Intelligence (AI) will enhance the accuracy and reliability of oil film detection, specifically focusing on its ability to minimize false positives caused by natural elements like algae or debris and its role in predictive maintenance of the detector hardware itself. Common questions revolve around the use of deep learning for pattern recognition in complex aquatic environments, the integration of AI with remote sensing data (e.g., satellite imagery, drone footage) to validate ground-level sensor readings, and the expected reduction in human intervention required for system calibration and data interpretation. Key concerns often center on data security, the computational requirements for implementing advanced AI models at the edge, and the standardization of AI-driven alert systems across heterogeneous sensor networks. The overarching user expectation is that AI will transform oil film detection from a reactive measurement tool into a proactive, intelligent environmental monitoring and predictive asset management system, capable of providing nuanced, context-aware insights into contamination sources and trends over extended periods.

- AI-driven image processing enhances the differentiation between oil films and non-hydrocarbon contaminants (e.g., biofilm, floating debris), dramatically reducing false alarm rates.

- Machine learning algorithms optimize sensor calibration parameters automatically based on environmental variables (temperature, water turbidity, salinity), ensuring consistent accuracy in dynamic conditions.

- Predictive maintenance schedules for detector units are generated by AI analyzing operational data (power consumption, component lifespan, drift), minimizing unexpected equipment failures.

- Integration of deep learning facilitates the analysis of spectrographic data, allowing for the classification of oil type (e.g., crude, diesel, refined oil) based on unique spectral signatures.

- AI enables data fusion across networks of multiple detectors and ancillary sensors (flow meters, weather stations), providing comprehensive situational awareness and tracking pollution plume movement.

DRO & Impact Forces Of Oil Film Detector Market

The Oil Film Detector Market dynamics are shaped by a complex interplay of environmental regulatory drivers, technological limitations, and emerging opportunities in digitalization. The primary drivers include the escalating global mandate for corporate environmental responsibility, coupled with severe financial and legal repercussions imposed by international and national bodies like the IMO, EPA, and various European directives for unauthorized discharge or pollution events. This regulatory pressure compels industries such as maritime, energy, and chemicals to invest proactively in continuous monitoring solutions. However, market growth is constrained by significant factors, notably the high initial capital investment required for deploying high-precision, robust detector networks, particularly in remote or offshore locations. Furthermore, the inherent challenge of maintaining calibration and accuracy in extremely harsh operating environments—characterized by rapid temperature swings, high salinity, or excessive biological growth—poses an ongoing operational restraint, requiring frequent, costly servicing, potentially mitigating the long-term cost-effectiveness of these advanced systems.

Opportunities for market expansion are substantial, primarily focused on the integration of Oil Film Detectors into the broader framework of Industry 4.0 and the Internet of Things (IoT). This integration facilitates real-time data transmission, remote diagnostics, and sophisticated data analytics, transforming raw sensor measurements into actionable business intelligence for environmental compliance and operational optimization. A crucial emerging opportunity lies in developing specialized subsea and unmanned surface vessel (USV)-mounted detectors for monitoring deep-sea oil and gas activities, where traditional surface methods are ineffective. The market is also propelled by powerful impact forces. Technological innovation acts as a potent driving force, continuously improving sensor sensitivity and selectivity, enabling detection at parts-per-billion levels. Conversely, market volatility in the upstream oil and gas sector, often leading to fluctuations in capital expenditure for exploration and monitoring equipment, acts as a constraining force, affecting major purchasers' procurement cycles. Socio-political pressures from environmental advocacy groups also constitute a driving force, consistently pushing governments and corporations toward stricter adherence to pollution control measures, ensuring sustained demand for detection technologies.

The synergy between technological readiness and regulatory demand creates a compelling case for market acceleration. For instance, the transition towards non-toxic, biodegradable lubricants in maritime shipping presents an interesting challenge, necessitating detectors capable of differentiating traditional hydrocarbon films from these newer compounds—a technological opportunity being aggressively pursued by manufacturers. Addressing the restraint of maintenance cost through the development of self-cleaning systems, leveraging ultrasonic transducers or automated wiper mechanisms, and incorporating advanced AI for anomaly detection and preventive maintenance alerts, are key strategic imperatives for overcoming current market hurdles. Ultimately, the impact forces of environmental stewardship and technological leapfrogging are fundamentally reshaping the market, favoring suppliers who can offer integrated, high-reliability monitoring platforms over basic detection hardware.

Segmentation Analysis

The Oil Film Detector Market segmentation provides a granular view of diverse product applications and technological capabilities, which are essential for targeted market penetration and strategic planning. The market is primarily divided based on the underlying detection technology employed, the type of deployment or portability, and the specific end-user industry application. Technological segmentation highlights the shift from older, simpler detection methods to highly sophisticated, spectrographic, and radar-based solutions, reflecting the demand for increased accuracy and reduced environmental interference. Deployment segmentation differentiates between fixed, permanently installed systems crucial for continuous monitoring of effluent and industrial water intakes, and portable units valued for rapid, flexible response and site auditing.

- By Technology:

- UV Fluorescence

- Optical Sensors (Infrared/Visible Spectrum)

- Laser Scattering/Raman Spectroscopy

- Microwave/Radar Technology

- Hydrocarbon Sniffers (Vapor Detection)

- By Deployment:

- Fixed/Online Systems

- Portable/Handheld Devices

- Remote Sensing (Drone/Satellite based)

- By Application:

- Environmental Monitoring (Rivers, Harbors, Reservoirs)

- Industrial Machinery Monitoring (Turbines, Hydraulic Systems)

- Oil & Gas Industry (Offshore Platforms, Pipelines, Refineries)

- Marine & Shipping (Bilge Water Monitoring, Port Security)

- Water and Wastewater Treatment Plants

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Oil Film Detector Market

The value chain for the Oil Film Detector Market begins with the upstream procurement and manufacturing of highly specialized components, which include advanced optical sensors, high-powered UV light sources (for fluorescence detection), specialized lens systems, and durable materials capable of resisting corrosion and fouling in harsh environments. Critical upstream activities involve R&D focused on nano-sensor technology and the integration of sophisticated microprocessors and communication modules (IoT/5G) necessary for real-time data processing and transmission. Key challenges at this stage involve securing a stable supply of high-purity optical components and managing the intellectual property associated with unique sensor designs, ensuring the detectors achieve the sensitivity levels required by modern environmental standards, which demand detection capabilities down to micron and sub-micron thickness levels.

Midstream activities primarily encompass the detector assembly, system integration, rigorous calibration, and the development of proprietary software and firmware essential for data interpretation, alarm management, and connectivity. Manufacturers focus heavily on quality control and testing, simulating various real-world environmental conditions to guarantee detector accuracy and longevity before deployment. The transition from component manufacturing to system integration requires specialized expertise in electrical, optical, and mechanical engineering to create a rugged, reliable monitoring solution. This stage often involves collaboration between hardware manufacturers and software developers to build intuitive user interfaces and robust data logging systems compliant with regulatory reporting standards, ensuring data integrity and traceability throughout the device lifecycle.

Downstream activities involve distribution, sales, installation, and post-sales maintenance services. Distribution channels are bifurcated into direct sales, typically utilized for large industrial clients (e.g., major oil companies, government environmental agencies) requiring customized solutions and installation support, and indirect channels relying on specialized system integrators, distributors, and value-added resellers (VARs) who bundle the detectors with broader environmental monitoring platforms. Post-sales services, including regular calibration, maintenance contracts, and technical support, constitute a significant and high-margin component of the value chain. Successful market players emphasize training end-users and providing comprehensive technical documentation to ensure optimal system performance. The overall efficiency of the downstream relies heavily on establishing strong relationships with local environmental consultants and engineering firms who influence procurement decisions and facilitate on-site deployment in complex regulatory landscapes.

Oil Film Detector Market Potential Customers

Potential customers for Oil Film Detectors span a wide array of industrial, governmental, and commercial entities whose operations involve the production, transportation, or usage of hydrocarbons, or those responsible for regulating and maintaining water quality. The largest end-user segment is the Oil & Gas industry, including upstream exploration and production companies, midstream pipeline operators, and downstream refineries and petrochemical plants, all requiring continuous monitoring for leakage prevention and regulatory compliance within their operational territories, both onshore and offshore. Another critical customer group comprises governmental and municipal bodies, specifically port authorities, environmental protection agencies (such as the EPA or European Environment Agency members), and water resource management departments, which utilize these detectors for public water safety monitoring, marine protection, and rapid spill response along coastlines and major waterways, often dictating the mandatory installation of such equipment by industrial dischargers.

Furthermore, the Power Generation sector, particularly facilities utilizing steam turbines or extensive cooling water systems, represents a significant buying segment. These plants rely on oil film detection to ensure the purity of boiler feed water and cooling water, as even minor oil contamination can severely damage expensive equipment and reduce operational efficiency, leading to mandatory shutdowns. The broader Manufacturing and Processing industries, including chemical manufacturers, automotive plants, and heavy machinery operations that use large volumes of hydraulic fluid or lubrication oils, constitute a growing customer base focused on occupational safety and ensuring that their industrial effluent meets stringent discharge permits. Finally, the Maritime and Shipping industry, including commercial vessel operators, cruise lines, and shipyards, are constant users of bilge water and effluent monitoring systems to comply strictly with MARPOL regulations, making them essential recurring buyers of certified detector technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.4 Million |

| Market Forecast in 2033 | USD 1,708.9 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rivertrace Limited, Turner Designs, N-CON Systems, Clean Water Systems, Met One Instruments, Chelsea Technologies Group, E-W Water Treatment, Insidix, UniSea, Accusonic Technologies, SFC Environmental Technologies, Keller America, Sensor Technology Ltd, HORIBA, Ltd., Xylem Inc., Hach Company, Teledyne Technologies, Siemens AG, Swan Analytical Instruments, AMETEK, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Film Detector Market Key Technology Landscape

The technological landscape of the Oil Film Detector Market is dominated by non-contact, optical measurement techniques, which provide the speed and sensitivity required for regulatory compliance. Among these, UV Fluorescence is arguably the most widely adopted and mature technology. It operates on the principle that many hydrocarbons naturally fluoresce (emit light) when exposed to short-wavelength ultraviolet radiation. The intensity of the emitted visible light is directly proportional to the concentration of the oil film. Modern advancements in UV fluorescence technology involve using pulsed UV sources and sophisticated filtering techniques to minimize interference from naturally occurring fluorescent compounds in water, such as dissolved organic matter (DOM) and certain algae, thereby significantly enhancing the signal-to-noise ratio and improving the reliability of detection in natural water bodies. Furthermore, multi-wavelength UV excitation is being explored to allow detectors to differentiate between different classes of oils based on their unique fluorescence signatures, moving beyond simple presence detection to chemical characterization.

Another significant area of technological evolution involves advanced spectroscopy, including Raman spectroscopy and Fourier Transform Infrared (FTIR) spectroscopy, which offer highly detailed chemical fingerprinting capabilities. While traditionally more expensive and computationally intensive, these technologies are being miniaturized and hardened for industrial deployment. Raman spectroscopy, for instance, provides molecular vibrational information, enabling precise identification of hydrocarbon types even in complex mixtures or thin films. Parallel to spectroscopic methods, laser-based scattering and reflection techniques are used, particularly in systems deployed in areas prone to high turbidity. These systems measure the change in light intensity or polarization when a laser beam interacts with an oil film on the water surface. Recent innovation focuses on utilizing oblique incidence lasers combined with high-speed detection arrays to accurately map the thickness and uniformity of the oil film, providing quantitative data rather than just a qualitative alarm.

The future technology landscape is heavily invested in sensor fusion and autonomous monitoring platforms. Integrating detection hardware with real-time positioning systems (GPS/GNSS) and communication protocols (LoRaWAN, 5G) allows for highly effective remote sensing, particularly via Unmanned Aerial Vehicles (UAVs) and Autonomous Underwater Vehicles (AUVs). These mobile platforms utilize high-resolution hyperspectral imaging sensors, which can cover vast areas quickly, complementing the point-source data provided by fixed detectors. This combined approach leverages the strengths of different technologies—the instantaneous, high-precision measurement of fixed sensors and the wide-area surveillance capabilities of remote platforms—to create a robust, layered monitoring strategy. The critical shift is toward intelligent systems that utilize AI for data normalization, anomaly detection, and self-diagnosis, ensuring the reliability and operational efficiency demanded by continuous environmental regulatory oversight and advanced industrial maintenance protocols.

Regional Highlights

- Asia Pacific (APAC): The APAC region is forecast to exhibit the highest growth rate, primarily driven by rapid industrial expansion in developing economies such as China, India, and Southeast Asian nations. The region's extensive coastline, coupled with massive investments in maritime trade, offshore oil and gas exploration (e.g., in the South China Sea), and the proliferation of large-scale manufacturing facilities, necessitates robust environmental monitoring infrastructure. Regulatory compliance, though historically less strict than in Western nations, is rapidly evolving and tightening under local and international pressure, compelling industries to adopt high-precision oil film detection systems for controlling effluent discharge from manufacturing zones and power generation facilities, creating immense untapped market potential for both fixed and portable units, especially for coastal surveillance.

- North America: North America represents a mature yet technologically leading market, characterized by strict enforcement of environmental laws such as those managed by the EPA and the US Coast Guard. High demand stems from the significant presence of the oil and gas sector (pipeline integrity, shale operations) and the need for continuous monitoring in critical freshwater resources like the Great Lakes. The market here focuses heavily on replacing older systems with advanced, AI-integrated detectors offering superior sensitivity and diagnostic capabilities. Investment is concentrated on leveraging drone-based remote sensing technologies and utilizing spectroscopic techniques for definitive spill identification and attribution, aiming for minimal environmental impact across large geographical areas.

- Europe: European market growth is steady, underpinned by the stringent regulatory framework imposed by the European Union (EU) directives relating to water quality (e.g., Water Framework Directive) and marine protection (e.g., Marine Strategy Framework Directive). Europe is a key adopter of fixed, continuous online monitoring systems installed at industrial discharge points and within port environments. Demand is driven by maritime traffic control and sophisticated wastewater treatment plant monitoring. European companies often lead in developing green technologies and sustainable solutions, positioning the region at the forefront of incorporating IoT and low-power wide-area network (LPWAN) technologies into detector systems for remote, autonomous operations in sensitive environmental zones.

- Middle East and Africa (MEA): The MEA region is a significant revenue generator, largely due to its concentrated oil and gas production and export infrastructure. Demand is exceptionally high for robust detectors designed to withstand extreme temperatures and salinity, essential for monitoring coastal refineries, desalination plants, and strategic export terminals along critical waterways like the Persian Gulf and the Red Sea. Market activity is heavily tied to upstream capital expenditures, focusing on detectors used for pipeline leak detection, offshore platform monitoring, and ensuring the safety of vast quantities of cooling water required by the region’s thermal power generation sector, often prioritizing durability and reliability over immediate cost.

- Latin America (LATAM): The LATAM market, while smaller, shows considerable potential, driven by expanding oil exploration activities in countries like Brazil and Mexico, coupled with increasing public awareness and governmental efforts to modernize environmental infrastructure. Adoption is concentrated in coastal regions and major river systems, primarily focusing on managing pollution risks associated with oil spills from energy transportation and mining activities. The market tends to favor cost-effective, easily maintainable portable detection solutions for government surveillance, though large state-owned energy companies are adopting complex fixed systems for major operational areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Film Detector Market.- Rivertrace Limited

- Turner Designs

- N-CON Systems

- Clean Water Systems

- Met One Instruments

- Chelsea Technologies Group

- E-W Water Treatment

- Insidix

- UniSea

- Accusonic Technologies

- SFC Environmental Technologies

- Keller America

- Sensor Technology Ltd

- HORIBA, Ltd.

- Xylem Inc.

- Hach Company

- Teledyne Technologies

- Siemens AG

- Swan Analytical Instruments

- AMETEK, Inc.

- General Electric (GE)

- Endress+Hauser Group

- Honeywell International Inc.

- Krohne Group

- ABB Ltd.

- Drägerwerk AG & Co. KGaA

- Ocean Optics (Halma plc)

- In-Situ Inc.

- Eureka Water Probes

- Aqua-Tronics Inc.

- Optiqua Technologies

- Vaisala Oyj

- Bruker Corporation

- Müller & Ziebart GmbH

- Global Water Instrumentation Inc.

- YSI (Xylem Brand)

- Thermo Fisher Scientific Inc.

- Photon Systems Instruments (PSI)

- Coastal Environmental Systems

- Ecom Industrial Tools Inc.

- Procon Analytical Systems

- Aalborg Instruments

- PPM Technology Ltd.

- Analytik Jena AG

- Shimadzu Corporation

- Yokogawa Electric Corporation

- SpectraSensors (Emerson)

- Environics Oy

- Systech Illinois

- Servomex Group Ltd.

- INFICON Holding AG

- Gasmet Technologies Oy

- LumaSense Technologies

- Raytheon Technologies Corporation

- Safran S.A.

- BAE Systems plc

- Northrop Grumman Corporation

- Oceana Sensor Technologies

- Liquid Instruments

- Hydrocarbon Detection Systems Inc.

- Water Sensor Technology Pty Ltd.

- Oil Spill Detection Systems Ltd.

- Spectra-Tech Inc.

- Delta-T Devices Ltd.

- OTT Hydromet GmbH

- SonTek (Xylem Brand)

- Extech Instruments

Frequently Asked Questions

Analyze common user questions about the Oil Film Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology used in highly sensitive oil film detectors?

The most widely adopted highly sensitive technology is UV Fluorescence, which utilizes ultraviolet light to excite hydrocarbons, causing them to emit light (fluoresce). The intensity of this emitted light is measured to quantify the presence of oil films, offering superior detection limits compared to traditional optical reflection methods.

How does the integration of IoT and AI benefit the Oil Film Detector Market?

IoT integration allows for real-time remote monitoring and data transmission, crucial for continuous surveillance. AI leverages this data for predictive maintenance, automatic sensor calibration, and significantly reduces false positives by distinguishing oil films from natural water contaminants like algae or silt.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid industrialization, increasing maritime traffic, and the swift adoption of more stringent governmental environmental regulations across major economies like China and India.

What are the main applications for fixed versus portable oil film detection systems?

Fixed (online) systems are primarily used for continuous, automated monitoring of critical points such as industrial effluent discharge pipes, cooling water intakes, and bilge water outflow on vessels. Portable systems are utilized for rapid site assessments, emergency spill response, regulatory compliance inspections, and environmental auditing in diverse, non-permanent locations.

What challenges restrain the widespread adoption of advanced oil film detection technology?

Key restraints include the high initial capital expenditure required for installing sophisticated sensor networks, the ongoing complexity and cost associated with maintaining sensor calibration and accuracy in harsh, fouling-prone environments, and the need for specialized technical expertise for data interpretation and system management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager