Oil & Gas Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433149 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Oil & Gas Software Market Size

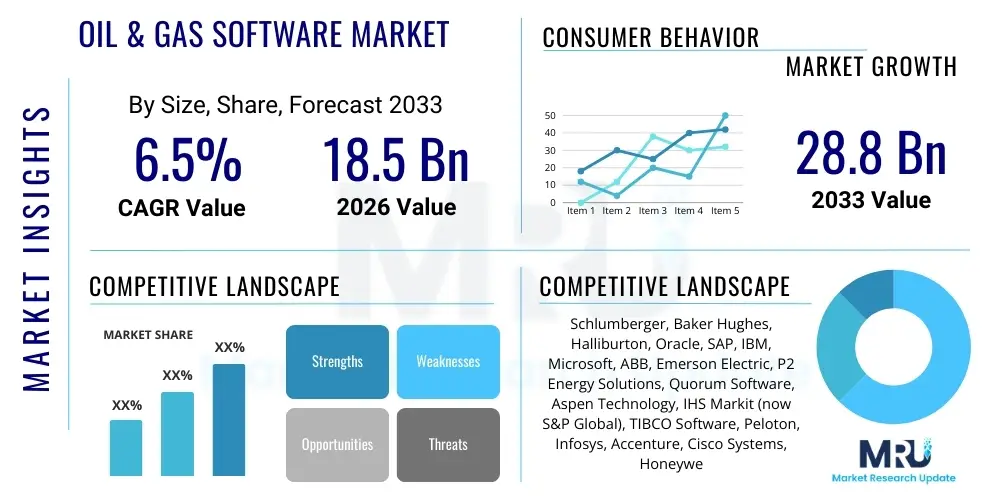

The Oil & Gas Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $28.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating need for operational efficiency, predictive maintenance, and enhanced asset performance management across the entire oil and gas value chain. As global energy demand fluctuates and regulatory pressures intensify, integrated software solutions capable of handling complex exploration, production, and distribution logistics become indispensable tools for modern energy corporations.

Oil & Gas Software Market introduction

The Oil & Gas Software Market encompasses specialized computational tools and integrated platforms designed to support, automate, and optimize various processes within the petroleum industry, spanning the entire lifecycle from upstream exploration and drilling to midstream transportation and downstream refining and retail. These solutions are critical for managing vast datasets generated by seismic surveys, well logs, production monitoring systems, and supply chain logistics, allowing energy companies to make data-driven decisions that minimize risk, reduce operational expenditure, and maximize reservoir recovery. The software suite typically includes advanced modules for reservoir modeling, production optimization, asset integrity management, enterprise resource planning (ERP), and regulatory compliance.

Major applications of Oil & Gas software reside in improving field operations, ensuring safety standards, and streamlining financial and administrative processes. For instance, sophisticated subsurface modeling software aids geoscientists in accurately locating hydrocarbon reserves, while production surveillance tools monitor well performance in real-time to prevent downtime. The primary benefit derived from adopting these technologies is the substantial improvement in capital efficiency, especially in high-cost deepwater or unconventional drilling environments. Furthermore, modern solutions often incorporate cloud architecture and mobile capabilities, enabling remote operations management and facilitating collaboration across geographically dispersed teams, thereby enhancing overall enterprise agility.

Driving factors propelling this market include the global push toward digitalization in the energy sector, the increasing complexity of unconventional drilling projects (like shale and tight oil), and the necessity for robust cybersecurity solutions integrated within operational technology (OT) systems. The volatility in crude oil prices also forces companies to seek out software tools that can optimize every barrel of production and minimize waste, making investment in efficient software a necessity rather than an optional expense. Moreover, the aging infrastructure in established production regions necessitates predictive maintenance software to extend asset lifecycles and ensure continuous, safe operation, further solidifying the market's foundational growth drivers.

Oil & Gas Software Market Executive Summary

The Oil & Gas Software Market is undergoing a rapid technological transformation, characterized by the accelerated adoption of cloud-native solutions and advanced analytics, moving away from legacy on-premise systems. Business trends indicate a strong focus on enterprise-wide integration, where previously siloed functions like geoscience, engineering, and finance are now converging onto unified digital platforms, driven by major vendors offering comprehensive industrial digitalization packages. This shift is crucial for achieving true operational visibility and resilience in the face of ongoing market volatility. Furthermore, the emphasis on energy transition and sustainability reporting is driving demand for specialized software modules that track methane emissions, manage carbon capture utilization and storage (CCUS) projects, and ensure adherence to evolving ESG (Environmental, Social, and Governance) standards, positioning sustainability management as a key growth vector.

Regionally, North America remains the dominant market owing to the high concentration of major integrated oil companies, early adoption of digital oilfield technologies, and significant investments in unconventional resource exploration requiring high-fidelity software analysis. However, the Asia Pacific region, led by rapidly industrializing economies like China and India, is projected to exhibit the highest growth rate due to extensive upstream investments, modernization of refinery infrastructure, and state-backed digitalization initiatives aimed at improving domestic energy security. Europe demonstrates robust growth driven by stringent environmental regulations and a strong emphasis on decommissioning and asset integrity management software for aging North Sea infrastructure, highlighting geographical disparity in demand types.

Segment trends reveal that the Upstream sector maintains the largest market share, predominantly utilizing reservoir modeling, drilling optimization, and production monitoring software, which are fundamental for maximizing resource extraction profitability. Nonetheless, the Midstream segment is experiencing significant growth, powered by the need for advanced pipeline integrity management systems (PIMS) and sophisticated logistics and trading software to manage complex global supply chains and fluctuating storage capacity. Cloud deployment models are increasingly preferred over traditional on-premise solutions due to scalability, lower total cost of ownership (TCO), and the flexibility required for geographically distributed operations, indicating a clear technological preference shift across all market segments.

AI Impact Analysis on Oil & Gas Software Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) fundamentally change the economics and execution of exploration and production (E&P) activities, focusing heavily on predictive capabilities, decision support, and automation risks. Key concerns revolve around the accuracy of AI models when dealing with sparse or low-quality historical geological data, the necessary skill set development within O&G firms, and the return on investment (ROI) for massive AI infrastructure deployments. There is a high expectation that AI will deliver superior outcomes in areas prone to human error or latency, such as complex drilling trajectory adjustments, predictive asset failure warnings, and optimizing the blend ratios in refining processes. Consequently, the software market is pivoting rapidly towards embedding sophisticated AI algorithms into core platforms to deliver genuine, actionable intelligence, moving beyond simple visualization tools to truly autonomous operations.

- AI enhances seismic interpretation speed and accuracy, reducing exploration lead times by automating pattern recognition in geological data.

- Machine Learning models optimize drilling parameters in real-time, minimizing non-productive time (NPT) and improving overall well construction efficiency.

- Predictive maintenance (PdM) powered by AI significantly reduces unexpected equipment failures in pumps, pipelines, and offshore platforms.

- Natural Language Processing (NLP) streamlines the analysis of vast unstructured data, including daily operational logs and regulatory documents.

- AI-driven production optimization maximizes hydrocarbon recovery rates by dynamically adjusting flow control and artificial lift systems.

- Algorithmic trading and optimization software in the Midstream and Downstream segments improve inventory management and feedstock selection.

- Intelligent automation facilitates compliance reporting and enhances worker safety through pattern recognition in surveillance footage.

DRO & Impact Forces Of Oil & Gas Software Market

The market is predominantly driven by the imperative for cost reduction and operational efficiency enhancement across the capital-intensive oil and gas lifecycle, coupled with government mandates promoting digital transformation in state-owned enterprises. A significant driver is the increasing complexity of resource extraction, particularly in challenging environments like ultra-deep water and arctic regions, which necessitates advanced simulation and modeling software to mitigate inherent geological and operational risks. Additionally, the proliferation of the Industrial Internet of Things (IIoT) sensors generates massive volumes of operational data, compelling O&G companies to adopt advanced software platforms capable of ingestion, processing, and analysis, turning raw data into strategic insights that influence asset investment decisions.

Conversely, the primary restraints include the high initial investment cost associated with implementing integrated software solutions and the inherent risk of data security breaches, especially when migrating mission-critical data to cloud environments. Furthermore, resistance to change and the critical shortage of professionals skilled in both petroleum engineering and data science pose substantial adoption hurdles, hindering the ability of companies to fully leverage sophisticated analytical tools. The fluctuating and often unpredictable global crude oil price environment also introduces market instability, causing companies to defer large-scale software modernization projects during periods of low profitability, thereby slowing overall market momentum.

The market presents significant opportunities through the growing focus on energy transition technologies, particularly software designed for carbon capture management, hydrogen production optimization, and renewable energy integration within existing O&G portfolios. The expanding adoption of cloud computing platforms specifically tailored for industrial workloads offers unprecedented scalability and accessibility for smaller independent operators. Key impact forces include technological disruption from emerging AI/ML applications, stringent environmental regulations pushing for real-time emissions monitoring, and intense competitive pressure among major software vendors to offer highly integrated, end-to-end digital twins of physical assets, ultimately forcing rapid innovation cycles in the software delivery model.

Segmentation Analysis

The Oil & Gas Software market segmentation provides a critical view of where investment and technological focus are concentrated across the industry's complex structure. The market is primarily dissected based on the type of solution offered, the deployment model adopted, and the specific sector of the value chain being targeted. Segmentation is essential for understanding the varying needs of different stakeholders, from exploration geologists requiring high-performance computing for seismic processing (Upstream sector) to refinery managers needing advanced process control and safety systems (Downstream sector). The increasing maturity of cloud infrastructure is rapidly transforming deployment preferences, heavily favoring cloud-based solutions due to their scalability, maintenance ease, and subscription-based cost models, contrasting with the high upfront capital expenditure of traditional on-premise deployments.

- By Type:

- Enterprise Resource Planning (ERP)

- Supply Chain Management (SCM)

- Customer Relationship Management (CRM)

- Project Management

- Data Management & Information Systems

- Geoscience and Reservoir Modeling

- Drilling and Production Optimization

- Refining and Manufacturing Execution Systems (MES)

- By Deployment Model:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Sector (Application):

- Upstream (Exploration, Development, Production)

- Midstream (Transportation, Storage, Processing)

- Downstream (Refining, Marketing, Distribution)

Value Chain Analysis For Oil & Gas Software Market

The value chain for Oil & Gas software begins with Upstream activities, where specialized software vendors (often focused on domain expertise like reservoir simulation or subsurface mapping) provide tools necessary for discovering and extracting resources. This segment involves high-value, highly complex computational software that drives early-stage capital expenditure decisions. Key activities include geological modeling, seismic data processing, and drilling trajectory planning, largely relying on high-performance computing (HPC) environments, either locally managed or accessed via specialized cloud services. Intellectual property and deep domain knowledge in petroleum engineering are crucial differentiators at this initial stage of the value chain.

Moving downstream, the value chain incorporates software solutions for Midstream and Downstream operations, which focus more heavily on logistics, processing efficiency, and financial management. Midstream software manages pipeline integrity, logistics scheduling, and storage inventory using sophisticated tracking and predictive maintenance systems. Downstream software encompasses refinery process control (MES), quality management, and detailed supply chain and distribution planning. The distribution channel is multifaceted, comprising direct sales by major integrated technology providers (e.g., SAP, Oracle, IBM) targeting large enterprises, and indirect sales through specialized system integrators (SIs) and value-added resellers (VARs) who customize and implement niche operational technology (OT) solutions for specific regional markets or independent operators.

Direct engagement is essential for selling large, enterprise-wide solutions such as ERP or core digital twin platforms, where close consultation and long-term support are required. In contrast, indirect channels are vital for penetrating smaller markets, delivering specialized analytical tools, or providing localized maintenance and support. The increasing prevalence of Software-as-a-Service (SaaS) models is further streamlining the distribution channel, enabling rapid deployment and reduced reliance on extensive on-premise implementation teams. This evolution shifts the focus of the value chain towards ongoing support, continuous updates, and data security management, ensuring the long-term integrity and performance of the deployed software suite throughout the asset life.

Oil & Gas Software Market Potential Customers

The primary customers and end-users of Oil & Gas software span the entire spectrum of the energy production ecosystem, classified based on their role and scale of operation. Major potential customers include National Oil Companies (NOCs), such as Saudi Aramco, Sinopec, and Gazprom, which often require highly customized, large-scale integrated solutions covering their entire national infrastructure. These entities are characterized by complex procurement processes but offer massive long-term contracts for digitalization initiatives. International Oil Companies (IOCs) like ExxonMobil, Shell, and BP, represent another core customer group, prioritizing global standardization, cybersecurity, and advanced predictive analytics to optimize their diversified global asset portfolios.

Independent Exploration and Production (E&P) companies, which focus exclusively on finding and producing crude oil and natural gas, represent a dynamic customer segment. These smaller, agile firms often favor cloud-based and modular software solutions that offer rapid deployment and lower initial capital outlay, allowing them to scale their digital capabilities alongside fluctuating production volumes. Furthermore, midstream operators (pipeline and storage companies) and downstream refining and petrochemical firms constitute specialized customer segments requiring software for logistics optimization, pipeline integrity, process manufacturing execution systems (MES), and compliance with complex safety and environmental standards.

An increasingly important customer group involves oilfield service companies (OFS), such as Schlumberger and Halliburton, which utilize specialized software tools not only for their internal operations but also as part of the service package they deliver to E&P clients, particularly in areas like directional drilling automation and real-time data monitoring. Finally, government regulatory bodies and research institutions also procure specific geological and environmental modeling software for resource assessment, safety audits, and policy planning, rounding out the diverse base of end-users reliant on advanced O&G software solutions to manage and govern the industry effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $28.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Oracle, SAP, IBM, Microsoft, ABB, Emerson Electric, P2 Energy Solutions, Quorum Software, Aspen Technology, IHS Markit (now S&P Global), TIBCO Software, Peloton, Infosys, Accenture, Cisco Systems, Honeywell International, Wipro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil & Gas Software Market Key Technology Landscape

The technological landscape of the Oil & Gas Software market is highly dynamic, centered around integrating advanced computational capabilities with industrial operational systems. A key trend is the widespread adoption of the Digital Twin concept, which utilizes real-time sensor data, historical performance logs, and physics-based models to create virtual replicas of physical assets (wells, pipelines, refineries). This technology allows operators to simulate various scenarios, optimize performance, and predict failures before they occur. The underlying infrastructure supporting these twins is increasingly cloud-native, utilizing hyperscale cloud providers for massive data storage and elastic computing resources required for complex subsurface simulations and deep learning model training. Hybrid cloud architectures are particularly favored, allowing sensitive operational data to remain on-premise while leveraging the scalability of public clouds for analytical processing.

Another crucial technology is the proliferation of the Industrial Internet of Things (IIoT), which relies on specialized edge computing software to process data directly at the source (e.g., at the wellhead or pumping station) before transmitting only critical summarized information to the central platform. This minimizes latency and bandwidth usage, essential for real-time control applications. Data integration platforms utilizing protocols like OPC UA and MQTT are fundamental for ensuring seamless communication between disparate legacy hardware and modern software applications. Furthermore, the market is heavily investing in cyber-physical security software designed specifically to protect highly interconnected OT/IT environments from targeted industrial espionage and ransomware attacks, which are becoming increasingly sophisticated threats to critical infrastructure.

The application of advanced analytics remains paramount, moving beyond traditional business intelligence tools to incorporate sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies are applied across portfolio management, predictive maintenance, and autonomous drilling optimization. Software vendors are also focusing on improving the user experience through low-code/no-code platforms, allowing domain experts (like geoscientists or process engineers) to build and customize their analytical applications without extensive programming knowledge, thereby accelerating the deployment of new digital workflows and democratizing access to complex analytical tools within the organization. Blockchain technology is also beginning to emerge, particularly in midstream trading and auditing, promising enhanced transparency and security in complex financial transactions.

Regional Highlights

- North America: North America currently holds the largest share of the Oil & Gas Software Market, primarily driven by the robust activity in the Permian Basin and other unconventional resource plays in the U.S. and Canada. The region is characterized by early and aggressive adoption of digital oilfield technologies, including advanced drilling automation and cloud-based reservoir modeling platforms. High investment in R&D, coupled with a dense population of innovative independent software vendors (ISVs) and oilfield service majors, ensures continuous technological advancement. The necessity to optimize complex hydraulic fracturing operations and manage highly interconnected logistics networks further cements North America's position as a technological leader and dominant consumer of specialized O&G software.

- Europe: The European market is mature and highly focused on sustainability, compliance, and asset integrity management, particularly concerning the aging infrastructure in the North Sea. Regulatory pressure from the European Union (EU) on emissions reduction and environmental reporting drives high demand for specialized software that tracks ESG performance, manages decommissioning projects, and optimizes energy consumption in refining processes. The region is also a key center for developing advanced digital twin technology and implementing strict cybersecurity protocols in critical energy infrastructure, making it a lucrative market for high-security, compliance-focused software solutions.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive government-led investments in modernizing national oil companies, expanding refinery capacity, and accelerating exploration efforts across countries like China, India, and Indonesia to meet surging domestic energy demand. While the initial adoption lagged behind the West, the APAC region is now leapfrogging older technologies by directly implementing cloud-native and AI-driven solutions. The demand is particularly high for integrated ERP and supply chain management software to handle the scale and complexity of regional logistics and production growth.

- Middle East and Africa (MEA): The MEA market is dominated by large-scale National Oil Companies (NOCs) that are undertaking massive digitalization initiatives aimed at maximizing long-term reservoir value and enhancing national economic diversification. Investment is concentrated in high-end seismic data processing, smart field technology, and extensive corporate-wide digitalization projects involving ERP and centralized data platforms. Given the scale of hydrocarbon reserves, the focus remains strongly on upstream optimization and the establishment of world-class, technologically advanced operational centers, driving demand for best-in-class performance monitoring and production optimization software.

- Latin America: The Latin American market exhibits steady growth, driven by key players like Brazil (deepwater exploration) and Mexico (reforms opening up the sector). The region demands specialized software for managing challenging offshore environments and addressing complex regulatory frameworks. The adoption rate is moderate but accelerating, with a preference for solutions that offer robust remote operations capabilities and localized support structures to manage geographically diverse and often challenging operational settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Software Market.- Schlumberger (SLB)

- Baker Hughes Company

- Halliburton Company

- Oracle Corporation

- SAP SE

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- ABB Ltd.

- Emerson Electric Co.

- P2 Energy Solutions

- Quorum Software

- Aspen Technology, Inc.

- S&P Global (IHS Markit)

- TIBCO Software Inc.

- Peloton (A Quorum Software Company)

- Infosys Limited

- Accenture plc

- Cisco Systems, Inc.

- Honeywell International Inc.

- Wipro Limited

Frequently Asked Questions

Analyze common user questions about the Oil & Gas Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for investment in Oil & Gas Software?

The primary driver is the critical need for operational efficiency improvement, cost reduction, and maximizing hydrocarbon recovery rates, especially amidst fluctuating commodity prices and the increasing complexity of unconventional drilling operations. Digitalization offers superior predictive capabilities to achieve these goals.

Which sector holds the largest market share in the Oil & Gas Software market?

The Upstream sector (Exploration and Production) currently commands the largest market share, driven by high demand for specialized software such as geoscience analysis, reservoir simulation, and drilling optimization tools, which are essential for initial investment decisions and asset valuation.

How is cloud computing impacting the deployment of O&G software?

Cloud computing is rapidly shifting deployment preferences towards hybrid and public cloud models. This offers enhanced scalability, reduced IT infrastructure overhead, accelerated deployment, and facilitates advanced data analytics by providing elastic high-performance computing (HPC) resources on demand, especially beneficial for global operators.

What role does Artificial Intelligence play in modern Oil & Gas software?

AI plays a transformative role by enabling predictive maintenance, optimizing drilling and production processes in real-time, automating seismic interpretation, and enhancing safety protocols through complex pattern recognition, thereby shifting operations towards greater autonomy and precision.

What are the major challenges restraining the growth of this market?

Major restraints include the substantial initial capital expenditure required for large-scale enterprise system implementation, significant cybersecurity risks associated with critical infrastructure, and the persistent industry-wide skill gap in hiring personnel proficient in both energy operations and data science.

***

The detailed segmentation breakdown reveals that within the Upstream sector, the demand for Drilling and Production Optimization software is experiencing an accelerated uptake. This growth is directly linked to the industry’s push towards "smart fields," where real-time data acquisition from downhole sensors and surface facilities is fed into AI/ML models to dynamically adjust production variables. The increasing sophistication of horizontal drilling and multi-lateral wells necessitates software that can model complex bore paths and manage flow assurance under varying pressure and temperature conditions, ensuring optimal resource extraction throughout the well’s lifecycle. The focus on reducing non-productive time (NPT) is driving investments in software solutions that provide immediate diagnostic feedback and automation of critical downhole interventions, moving operations closer to full autonomous control, which is the ultimate goal of digital oilfield implementation.

In the Midstream segment, the imperative is centered on maintaining the integrity and throughput of extensive pipeline networks and storage facilities, which are crucial for global energy supply security. Key software demand here includes Pipeline Integrity Management Systems (PIMS), which utilize advanced sensors, drone data, and predictive analytics to detect corrosion, strain, and potential leak risks before failure occurs. Furthermore, sophisticated logistics and scheduling software, often integrated with large-scale SCM platforms, are essential for managing the flow of crude oil, natural gas, and refined products across international borders, optimizing tanker and truck movements, and ensuring regulatory compliance across multiple jurisdictions. The demand for transactional transparency in commodity trading is also driving niche software adoption leveraging distributed ledger technology (blockchain) to secure trading processes.

For the Downstream sector, the software market is dominated by Manufacturing Execution Systems (MES) and Advanced Process Control (APC) solutions aimed at maximizing refinery yields and ensuring product specifications meet stringent market standards. Refinery operations involve complex chemical processes requiring high-fidelity simulation software to model reactions, manage inventory of intermediates, and comply with strict environmental emission limits. The convergence of IT (Information Technology) and OT (Operational Technology) is most pronounced here, with integrated platforms managing everything from feedstock input optimization to final product distribution. The ongoing energy transition also drives specific software needs for managing co-processing of biofuels and handling new low-carbon production methods, necessitating flexible and future-proof digital architectures.

The strategic deployment of these software solutions, particularly the shift toward cloud and subscription-based licensing, has profound implications for how Oil & Gas companies manage their capital expenditure (CapEx) and operational expenditure (OpEx). Moving high-cost simulation and data processing from dedicated, aging data centers to hyperscale cloud environments allows operators to transform CapEx into predictable OpEx, enhancing financial flexibility, which is critical in a volatile market. Furthermore, the accessibility of cloud-based platforms democratizes access to high-end analytical tools, enabling smaller independent operators, who traditionally could not afford proprietary on-premise supercomputing facilities, to leverage sophisticated geological and engineering models, thereby leveling the technological playing field and fostering greater innovation within the smaller segment of the market.

In terms of technology type, the Geoscience and Reservoir Modeling segment, although mature, continues to see innovation through the incorporation of quantum computing and advanced visualization tools, allowing geoscientists to handle larger, higher-resolution seismic datasets with improved interpretive accuracy. This reduces exploration risk, a core concern for all E&P companies. Meanwhile, the ERP segment is evolving rapidly, with major vendors offering industry-specific modules tailored to handle unique O&G complexities such as joint venture accounting (JVA), production sharing agreements (PSAs), and detailed regulatory tax calculations across various global regions, moving beyond generic financial and HR management systems to become truly integrated operational backbones. The ongoing push for seamless data flow across these diverse applications, from the subsurface modeling tools to the financial ledgers, highlights the growing importance of integration capabilities as a critical factor in software vendor selection.

The impact of cybersecurity risks cannot be overstated, particularly given the increasing connectivity of industrial control systems (ICS) in both midstream pipelines and downstream refineries. Advanced software solutions now incorporate machine learning to detect anomalous behavior within OT networks, providing a layer of protection against sophisticated attacks that could lead to physical damage or catastrophic operational shutdowns. The requirement for strong, verifiable compliance with international standards such as ISA/IEC 62443 is now a baseline expectation for any software deployed in critical infrastructure, driving specialized demand for risk assessment and security management platforms that operate in real-time, further solidifying the necessity for specialized, sector-aware software development and rigorous testing protocols within the Oil & Gas software domain.

Looking ahead, the market dynamics are increasingly shaped by the energy transition agenda. Software solutions focused on environmental performance monitoring, carbon accounting, and the optimization of renewable energy assets (like offshore wind farms integrated into oil company portfolios) are becoming high-growth niche segments. This demonstrates a strategic shift among leading software providers to support their clients’ transition goals, ensuring their platforms are flexible enough to manage both traditional hydrocarbon assets and emerging clean energy technologies. This duality of focus—maximizing traditional asset value while enabling new energy operations—will define competitive advantage in the latter half of the forecast period, driving significant R&D investment into novel data analytics and simulation tools for sustainable energy management and verification.

The role of vendor ecosystem partnerships is also becoming more pronounced, particularly in cloud environments. Major O&G software vendors are increasingly forming strategic alliances with hyperscalers (e.g., Microsoft Azure, AWS, Google Cloud) to co-develop industry-specific cloud services and data lakes. These collaborations accelerate innovation, enhance security, and ensure that the software running critical operations is optimized for the underlying infrastructure. This ecosystem strategy also supports the development of robust marketplace environments, allowing smaller, specialized independent software vendors to distribute their niche applications and tools directly to large O&G clients, fostering an open and diverse digital innovation environment within the sector, essential for rapid adaptation to changing market conditions and technological breakthroughs in drilling and production techniques.

The demand for training and professional services, often categorized alongside software implementation, remains a high-value component of the market. Since advanced software requires specialized user expertise, major vendors and integrators derive substantial revenue from implementation support, customization, and user training programs. This service element is crucial for ensuring successful technology adoption and realizing the full potential ROI from complex digital deployments. The scarcity of personnel proficient in both O&G domain knowledge and advanced analytical tools means that companies offering integrated software and training/consulting packages gain a significant competitive edge, bridging the talent gap faced by many operational companies globally.

Regional variations in regulatory requirements also heavily influence software features. For instance, in regions with complex environmental permitting processes, the demand for sophisticated regulatory compliance and document management software is higher. Similarly, in areas prone to seismic activity or geopolitical instability, software tools that offer robust scenario planning, disaster recovery, and enhanced security features are prioritized. This regional heterogeneity necessitates that leading global software vendors maintain flexible platforms capable of rapid customization and localization to meet specific operational and legal mandates of diverse markets, ensuring that compliance is maintained automatically throughout the asset lifecycle, reducing legal and financial exposure.

The continuous optimization of the supply chain, particularly relevant in the midstream and downstream segments, is another key focus area driven by software. Supply chain software, enhanced with AI, can predict demand fluctuations, optimize inventory levels for critical components (e.g., drilling pipes, valves), and manage complex logistics from sourcing raw materials to distributing finished products. The efficiency gained in this area, sometimes amounting to millions in savings annually, justifies the high cost of sophisticated SCM and ERP integration, positioning these administrative software segments as crucial enablers of operational profitability. The ongoing shift towards sustainability is also integrating emissions tracking and supplier auditing into these SCM platforms, making responsible sourcing a software-managed function.

The overall market trajectory indicates a clear move away from point solutions towards highly integrated, platform-based offerings that provide a unified view of the entire enterprise. Companies seek fewer, but more powerful, vendor relationships capable of delivering solutions that span the entire value chain—from reservoir to refinery. This preference for comprehensive digital ecosystems facilitates better decision-making, breaks down internal data silos, and supports the vision of a truly ‘integrated operating center’ where geographically dispersed assets are managed remotely and autonomously, solidifying the long-term growth and strategic importance of the Oil & Gas Software Market.

The future technology pipeline includes augmented reality (AR) and virtual reality (VR) software, specifically designed for field service and training. AR applications allow field technicians to overlay digital diagnostic data and repair instructions onto real-world equipment, enhancing maintenance efficiency and safety without requiring constant expert oversight. Furthermore, the development of physics-informed neural networks (PINNs) is set to revolutionize reservoir simulation and fluid dynamics modeling, offering highly accurate predictions at speeds previously unattainable by traditional computational fluid dynamics (CFD) software. These emerging technologies promise to significantly reduce both the cost and time required for complex analysis, representing the next frontier in O&G software innovation and adoption.

The implementation life cycle of modern O&G software is also shortening due to modular design and cloud delivery. Unlike the multi-year, highly customized deployments of older ERP systems, modern platforms offer rapid deployment capabilities, often utilizing pre-configured industry templates. This agility is vital for smaller independents and for departments needing immediate analytical capabilities. Furthermore, the use of open source components and standardized APIs (Application Programming Interfaces) within vendor offerings fosters greater interoperability, allowing clients to mix and match best-of-breed solutions rather than being locked into a single vendor's proprietary ecosystem, injecting greater flexibility and competition into the vendor landscape.

Finally, the growing environmental consciousness and stringent government requirements regarding methane leak detection and reporting are fueling demand for specialized environmental monitoring software. These solutions utilize satellite data, drone imagery, and IoT sensors combined with geospatial mapping and regulatory reporting features to provide real-time, auditable proof of compliance. This specialized niche, focused on ESG reporting and sustainability metrics, represents a critical area of growth that is directly responsive to global pressure on the industry to decarbonize and operate with greater environmental transparency, embedding sustainability into the core functionality of the next generation of O&G software platforms.

***

The competitive intensity within the Oil & Gas Software Market is high, characterized by a mix of large, diversified technology conglomerates, established O&G service providers with strong in-house software capabilities, and niche pure-play software vendors specializing in highly technical areas like seismic processing or fluid dynamics. Large entities like SAP and Oracle dominate the enterprise application layer (ERP, SCM), leveraging their extensive installed base and integration prowess. Conversely, domain specialists like Schlumberger and Baker Hughes utilize software as a core component of their service delivery, embedding proprietary algorithms and expertise into their platforms to enhance drilling and reservoir performance. The strategic acquisition of smaller, innovative tech start-ups focused on AI and data analytics by these major players is a consistent trend aimed at quickly integrating next-generation capabilities and maintaining a competitive edge in advanced operational technology (OT).

Pricing models are a significant point of differentiation. The transition from perpetual licensing to subscription-based models (SaaS/PaaS) has made advanced software more accessible, particularly to smaller exploration firms, but also necessitates continuous value delivery by vendors to justify recurring costs. Success hinges not just on software features but on robust customer success programs, reliable technical support, and the ability to integrate seamlessly with both legacy systems and emerging cloud environments. Vendors that can offer demonstrably superior TCO (Total Cost of Ownership) through efficient cloud utilization and minimal integration hassle are gaining significant market traction.

Moreover, the emphasis on data governance and security compliance differentiates high-trust vendors in this sensitive industry. Since O&G software handles proprietary geological data, financial models, and controls over critical infrastructure, vendors must prove adherence to the highest international security standards (e.g., ISO 27001, SOC 2). The capability to provide secure, air-gapped or hybrid solutions for highly sensitive state-owned enterprises (NOCs) remains a key competitive factor, especially in the Middle East and parts of Asia, where data sovereignty and control are paramount concerns, reinforcing the need for specialized deployment strategies beyond simple public cloud offerings. The overall trajectory suggests a market rewarding technological integration, domain expertise, and demonstrable security compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager