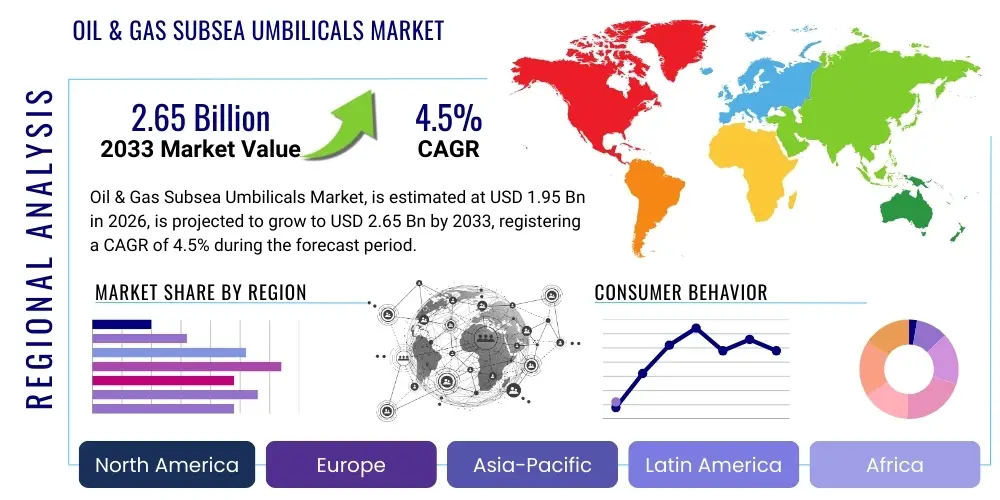

Oil & Gas Subsea Umbilicals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436079 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Oil & Gas Subsea Umbilicals Market Size

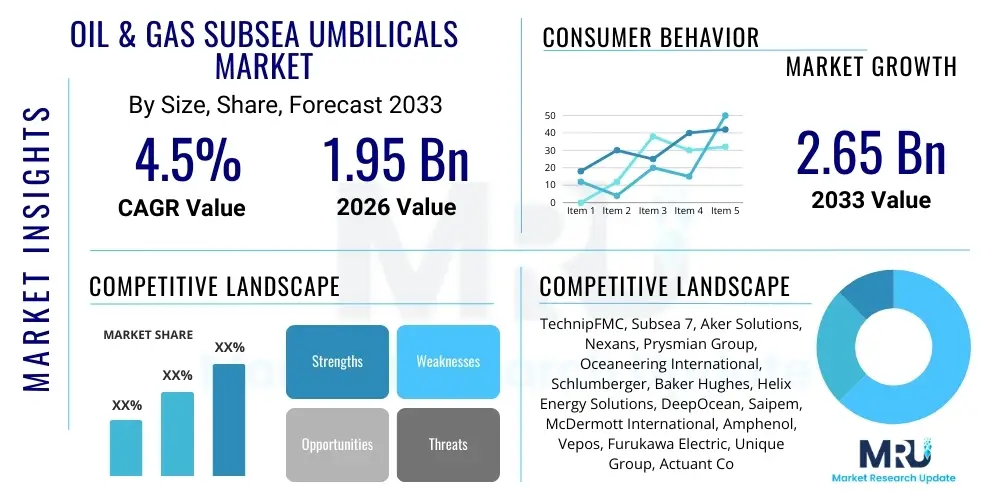

The Oil & Gas Subsea Umbilicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.65 Billion by the end of the forecast period in 2033.

Oil & Gas Subsea Umbilicals Market introduction

The Oil & Gas Subsea Umbilicals Market encompasses the engineering, manufacturing, and deployment of complex cable and hose bundles essential for connecting subsea production systems to surface facilities, such as Floating Production Storage and Offloading (FPSO) units, drilling rigs, or fixed platforms. These umbilicals serve as the critical lifeline, transmitting electrical power, hydraulic fluids, chemicals, and optical signals necessary for controlling, monitoring, and operating sophisticated subsea equipment like Blowout Preventers (BOPs), valves, and pumps located deep beneath the ocean surface. The increasing global demand for energy, coupled with the necessity of exploiting deepwater and ultra-deepwater reserves, forms the foundational driver for this specialized infrastructure market. Technological advancements, particularly in high-pressure and high-temperature (HP/HT) environments, are continually pushing the capabilities and complexity of modern subsea umbilical systems.

Subsea umbilicals are customized products, designed meticulously to withstand extreme operational conditions, including high external pressures, corrosive seawater environments, and mechanical stresses from installation and movement. They are broadly categorized based on their function, incorporating features such as hydraulic lines for actuation, electrical conductors for power delivery to submersible pumps or heating elements, and fiber optic elements for high-speed data transmission required for real-time monitoring and control. The primary applications span the entire lifecycle of subsea fields, including exploration, drilling, field development, and production operations, ensuring reliable communication and energy supply essential for maximizing hydrocarbon recovery efficiently and safely.

The market benefits significantly from the inherent advantages umbilicals offer in remote and challenging locations, enabling safe system management from a distance. Key driving factors include the substantial rise in offshore capital expenditure (CAPEX) for new deepwater projects, the maturation of existing shallow-water fields requiring advanced boosting and recovery technologies, and global regulatory mandates demanding stringent safety and environmental monitoring, which necessitates sophisticated fiber optic sensing within the umbilical structure. Furthermore, the push towards standardized, modular subsea equipment packages also influences umbilical design, aiming for faster installation times and reduced project costs.

Oil & Gas Subsea Umbilicals Market Executive Summary

The Oil & Gas Subsea Umbilicals Market is positioned for steady growth, driven primarily by favorable business trends centered around increased investments in high-potential deepwater regions such as the Gulf of Mexico, offshore Brazil, and West Africa. Global energy majors are increasingly prioritizing long-term, high-yield deepwater projects, necessitating resilient and technologically advanced subsea infrastructure. The transition towards all-electric subsea systems, aimed at improving efficiency and reducing reliance on hydraulic fluids, represents a significant technological shift impacting the design and manufacturing of future umbilicals. Business strategies are focused on standardization, localized manufacturing to mitigate supply chain risks, and developing hybrid umbilicals that integrate higher capacity electrical and fiber optic components to handle complex subsea processing demands.

Regionally, Latin America, specifically Brazil, remains a core growth engine due to pre-salt exploration and development activities, requiring extensive ultra-deepwater umbilical networks. Asia Pacific is emerging as a critical growth region, fueled by offshore field development in countries like Australia, Malaysia, and Indonesia, often characterized by challenging reservoir conditions. North America, driven by the expansion of the US Gulf of Mexico deepwater sector, continues to be a mature but highly innovative market demanding cutting-edge dynamic umbilical solutions for floating facilities. European markets, dominated by the Norwegian and UK Continental Shelves, focus heavily on life extension and tie-back projects, demanding high-integrity static umbilicals.

Segment trends indicate that the Static Umbilicals segment holds the largest market share due to their use in conventional tie-back and fixed platform scenarios, although the Dynamic Umbilicals segment is projected to exhibit the highest CAGR, reflecting the rise in floating production systems (FPSOs and TLPs). By type, Electro-Hydraulic Umbilicals (EHUs) currently dominate but are facing gradual displacement by Hybrid Umbilicals and increasingly by all-electric systems, particularly in new deepwater installations requiring substantial power delivery and real-time control capabilities. The emphasis on minimizing downtime and enhancing reliability ensures that quality and material resilience remain paramount across all functional segments.

AI Impact Analysis on Oil & Gas Subsea Umbilicals Market

Common user inquiries regarding AI in the Oil & Gas Subsea Umbilicals Market center on how artificial intelligence can enhance the operational lifespan, improve real-time diagnostic capabilities, and optimize the preventive maintenance schedules of these critical assets. Users are keen to understand if AI can predict potential failures, such as sheath breaches or conductor degradation, before they become catastrophic, thereby minimizing costly downtime and ensuring regulatory compliance. The consensus expectation is that AI algorithms, particularly those utilizing machine learning on vast datasets generated by integrated fiber optic sensors within the umbilicals, will revolutionize condition monitoring, moving the industry from time-based maintenance to predictive, necessity-driven maintenance. This shift promises significant reductions in operational expenditures (OPEX) and extended asset life, though concerns about data security and the integration cost of advanced monitoring hardware persist.

- AI-driven predictive maintenance models analyze sensor data (temperature, strain, pressure) to anticipate umbilical failures.

- Machine learning algorithms optimize the deployment path and operational stress mitigation during installation.

- Enhanced integrity management systems use AI to process real-time fiber optic distributed sensing data for anomaly detection.

- AI aids in optimizing chemical injection dosage transmitted via umbilicals, reducing operational costs and environmental impact.

- Automated inspection routines using AI-powered remotely operated vehicles (ROVs) reduce human intervention and increase inspection accuracy.

- Improved efficiency in subsea processing control loops, managed and optimized by advanced AI controllers communicating via umbilical fiber optics.

DRO & Impact Forces Of Oil & Gas Subsea Umbilicals Market

The market dynamics are defined by a complex interplay of increasing global energy demand (Driver), heightened environmental regulations restricting new offshore leases (Restraint), the rapid advancement of ultra-deepwater drilling technologies (Opportunity), and geopolitical instability influencing long-term project viability (Impact Force). The persistent need for stable energy supply globally mandates continuous offshore exploration, providing a robust long-term driver for umbilical infrastructure, particularly for fields requiring complex subsea tie-backs. However, the high capital intensity of subsea projects and the volatility of crude oil prices periodically restrain investment decisions, leading to project deferrals and fluctuations in demand for new umbilicals.

A primary driver is the accelerating development of deepwater and ultra-deepwater oil and gas fields, which are inaccessible without the advanced control and power systems provided by subsea umbilicals. As easily accessible shallow-water reserves deplete, operators are forced into more challenging operational domains, demanding more robust, high-pressure, and highly insulated umbilicals. Conversely, significant constraints include the long manufacturing lead times, the specialized and costly installation processes, and the increasing push towards renewable energy sources, which, over the long term, may temper new large-scale hydrocarbon developments, diverting capital away from deepwater projects.

The key opportunities lie in the proliferation of subsea processing and boosting technologies, such as subsea compression and pumping stations, which require extensive, high-power umbilical connections. Furthermore, the requirement for enhanced oil recovery (EOR) techniques in mature fields creates demand for complex chemical injection umbilicals. Impact forces, driven by stringent safety standards imposed after major incidents, force manufacturers to invest heavily in material science and system integrity testing. Additionally, supply chain consolidation and competitive bidding strategies among major EPCI contractors shape the pricing and market penetration strategies within the umbilical manufacturing sector, dictating project economics and risk profiles.

Segmentation Analysis

The Oil & Gas Subsea Umbilicals Market is extensively segmented based on their functional purpose, construction type, and application depth, providing a clear map of technological specialization and market demand areas. Segmentation by type differentiates between those components solely carrying hydraulic fluids (Hydraulic Umbilicals), those combining electrical and hydraulic elements (Electro-Hydraulic Umbilicals, or EHUs), and advanced systems that integrate high-voltage power lines and fiber optics for communications (Electro-Fibre-Optic-Hydraulic Umbilicals, or Hybrid). This detailed categorization allows market participants to tailor their offerings precisely to the technical requirements of specific subsea field architectures, such as greenfield deepwater developments versus brownfield tie-back expansions.

Segmentation by functionality—Static versus Dynamic—is crucial, as static umbilicals are fixed structures typically laid on the seabed, connecting stationary assets (e.g., fixed platforms or onshore facilities) to stationary subsea equipment. Dynamic umbilicals, conversely, are designed to endure continuous motion and fatigue, connecting floating production units (like FPSOs, SPARs, or TLPs) that move with the waves and currents, demanding superior material durability and complex fatigue management designs. The rising deployment of floating infrastructure globally elevates the importance and technological complexity of the dynamic segment.

Further granularity is achieved through segmentation by component structure, which includes the specialized conductors, tubes, and the protective outer sheath materials used. The selection of these materials, such as carbon steel or super duplex stainless steel for hydraulic tubes and specialized polymers for insulation and sheathing, significantly affects the umbilical’s cost, longevity, and performance in harsh environments. Understanding these segmented demands is essential for forecasting material requirements, investment in R&D, and identifying high-growth application niches like those requiring high-pressure gas injection lines.

- By Type:

- Electro-Hydraulic Umbilicals (EHU)

- Hydraulic Umbilicals

- Electro-Fibre-Optic Umbilicals (EFO)

- Hybrid Umbilicals

- By Functionality:

- Static Umbilicals

- Dynamic Umbilicals

- By Depth:

- Shallow Water

- Deep Water

- Ultra-Deep Water

- By Application:

- Drilling

- Production

- Subsea Processing

- Others (Intervention, Testing)

Value Chain Analysis For Oil & Gas Subsea Umbilicals Market

The value chain for the Oil & Gas Subsea Umbilicals Market is characterized by a high degree of integration and specialization, beginning with the upstream supply of specialized raw materials. This includes high-grade steel tubes (carbon or stainless/super duplex steel) for hydraulic and chemical lines, high-purity copper and specialized insulating polymers for electrical conductors, and sophisticated fiber optic components. Upstream material suppliers must meet extremely stringent quality and performance specifications, as defects at this stage can compromise the entire umbilical system integrity. The procurement phase is critical, often involving long-term contracts with specialized metallurgical and plastics manufacturers who adhere to international standards (e.g., API 17E).

The core midstream stage involves the highly specialized manufacturing and assembly process carried out by Tier 1 umbilical suppliers. This phase involves stranding the various elements (electrical cables, hydraulic hoses, fiber optics) into a compact, protective core, followed by the application of multiple layers of armor and sheathing. The integration of components is meticulously engineered to manage thermal stresses, electrical cross-talk, and mechanical fatigue, particularly for dynamic systems. Following manufacturing, the logistics and distribution channel focus on spooling and transporting these massive, heavy, and often kilometer-long products to mobilization ports, requiring specialized vessels and handling equipment.

The downstream segment is dominated by the Engineering, Procurement, Construction, and Installation (EPCI) contractors, who are the direct buyers and integrators of the umbilicals into the broader subsea field architecture. Direct distribution usually occurs from the manufacturer's facility or dedicated port to the EPCI project site offshore. Indirect influence comes from oil and gas field operators (the end-users) who dictate the specifications and budget constraints, driving design choices. The value chain concludes with installation via specialized lay vessels and subsequent operation, monitoring, and maintenance, often involving long-term service contracts with the original equipment manufacturers (OEMs) or specialized service providers. Efficiency and project management expertise are paramount throughout the downstream process due to the substantial capital expenditure involved.

Oil & Gas Subsea Umbilicals Market Potential Customers

The potential customers and primary end-users for Oil & Gas Subsea Umbilicals are predominantly large, integrated national and international oil companies (NOCs and IOCs) engaged in offshore exploration and production activities. These entities, such as Petrobras, ExxonMobil, Shell, TotalEnergies, and Equinor, require umbilicals for their capital-intensive deepwater and ultra-deepwater development projects, where reliable subsea control is non-negotiable. Their demand is driven by field size, depth, and the complexity of the required subsea processing infrastructure, making them the ultimate decision-makers influencing specifications and procurement strategies.

A secondary, yet crucial, customer base consists of major Engineering, Procurement, Construction, and Installation (EPCI) companies and subsea service providers (e.g., TechnipFMC, Subsea 7, Saipem, Aker Solutions). These contractors act as intermediaries, purchasing umbilicals directly from manufacturers as part of larger, integrated project scopes delivered to the oil and gas operators. Their purchasing power is significant, and their selection often dictates which umbilical manufacturers secure contracts based on proven track records, ability to meet project deadlines, and capacity for advanced installation techniques.

Furthermore, specialized drilling contractors and floating production facility owners (e.g., FPSO operators) represent niche customer segments. Drilling contractors often require temporary or mobile umbilicals for control systems during exploration and drilling phases, while FPSO operators require dynamic umbilicals for permanent connection to subsea manifolds. The purchasing decisions across all these customer groups are heavily influenced by regulatory compliance, the long-term total cost of ownership (TCO), and the supplier's capacity to deliver high-integrity solutions that minimize the risk of expensive subsea failure or production shutdowns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.65 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TechnipFMC, Subsea 7, Aker Solutions, Nexans, Prysmian Group, Oceaneering International, Schlumberger, Baker Hughes, Helix Energy Solutions, DeepOcean, Saipem, McDermott International, Amphenol, Vepos, Furukawa Electric, Unique Group, Actuant Corporation, NKT A/S, JDR Cable Systems, Hellenic Cables. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil & Gas Subsea Umbilicals Market Key Technology Landscape

The technological landscape of the Oil & Gas Subsea Umbilicals Market is rapidly evolving, driven by the shift towards high-voltage power transmission and real-time data requirements in increasingly remote and harsh deepwater environments. A major technological advancement involves the development of hybrid umbilicals that effectively integrate high-power electrical conductors (up to 35 kV or more) with sensitive fiber optic cables and high-pressure hydraulic/chemical injection tubes within a single, optimized structure. This integration requires sophisticated material science, particularly in developing robust insulation materials and high-strength, corrosion-resistant steel tubes (such as Super Duplex or Inconel) to handle extremely high pressures and aggressive chemical agents used in flow assurance.

Another crucial innovation is the adoption of all-electric subsea systems. Unlike traditional Electro-Hydraulic Umbilicals (EHUs) which rely on hydraulic lines for valve actuation, all-electric systems use electrical power for control and actuation, minimizing fluid leakage risks and improving response times. This transition necessitates umbilicals capable of transmitting higher and more stable electrical power signals, driving demand for Electro-Fibre-Optic (EFO) designs and advanced power management technologies within the umbilical structure. Furthermore, the fatigue performance of dynamic umbilicals used with floating facilities is constantly being improved through better modeling and testing techniques, ensuring structural integrity over lifecycles often exceeding 25 years in high-current environments.

Fiber optic sensing technology represents a transformative element, enabling Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS) along the entire length of the umbilical. This allows operators to monitor the health and operational conditions of the umbilical and connected subsea assets in real-time, detecting leaks, temperature anomalies, and structural strain changes instantly. These advanced sensing capabilities, coupled with enhanced protective armoring technologies (e.g., specialized polymer coatings and interlocking steel layers), are key to extending asset life, reducing maintenance costs, and ensuring compliance with increasingly strict safety and environmental standards in deepwater operations.

Regional Highlights

The global distribution of the Oil & Gas Subsea Umbilicals Market is heavily correlated with offshore capital expenditure and the maturity of deepwater fields, resulting in distinct regional growth patterns and technological needs.

- North America (NA): Dominated by the US Gulf of Mexico (GOM) deepwater segment. This region focuses on ultra-deepwater exploration and high-pressure/high-temperature (HP/HT) developments, driving demand for complex, high-spec dynamic umbilicals connecting to large floating facilities. The market here is mature but characterized by continuous innovation and standardization efforts.

- Europe: Centered around the Norwegian Continental Shelf (NCS) and the UK North Sea. This region is distinguished by extensive brownfield developments, focusing on tie-backs, field life extension, and harsh-environment static umbilicals requiring high-integrity insulation and mechanical protection. Emphasis is also placed on developing subsea processing equipment, boosting demand for high-power umbilicals.

- Asia Pacific (APAC): Emerging as a high-growth region, driven by new field developments in Australia (e.g., Gorgon, Prelude), Malaysia, and Indonesia. Projects often involve long tie-backs and diverse water depths, creating demand for both static and dynamic solutions. Infrastructure investment in this region is rapidly accelerating, making it a critical focus area for manufacturers.

- Latin America (LATAM): A major global market growth engine, primarily led by Brazil’s pre-salt ultra-deepwater reserves. Petrobras's massive deepwater investments necessitate robust dynamic umbilicals capable of handling extreme depth and complex fluid compositions, making it a demanding market segment with high project volumes.

- Middle East and Africa (MEA): Growth is primarily concentrated in West Africa (Nigeria, Angola) deepwater basins, characterized by high exploration activity and large-scale deepwater production infrastructure. The Middle East, while traditionally focused on onshore and shallow-water assets, is seeing incremental increases in specialized offshore field development requiring umbilicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil & Gas Subsea Umbilicals Market.- TechnipFMC

- Subsea 7

- Aker Solutions

- Nexans

- Prysmian Group

- Oceaneering International

- Schlumberger

- Baker Hughes

- Helix Energy Solutions

- DeepOcean

- Saipem

- McDermott International

- Amphenol

- Vepos

- Furukawa Electric

- Unique Group

- Actuant Corporation

- NKT A/S

- JDR Cable Systems

- Hellenic Cables

Frequently Asked Questions

Analyze common user questions about the Oil & Gas Subsea Umbilicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a subsea umbilical in oil and gas production?

The primary function of a subsea umbilical is to serve as a critical link, providing hydraulic power, electrical energy, chemical injection lines, and fiber optic communication signals necessary for the remote control and monitoring of subsea equipment such as manifolds, valves, and pumps.

How do Dynamic Umbilicals differ from Static Umbilicals?

Static Umbilicals are fixed to the seabed and used for stationary connections, whereas Dynamic Umbilicals are specifically engineered to withstand continuous movement, high fatigue, and bending stress, making them essential for connecting subsea infrastructure to floating production facilities like FPSOs.

Which technological trends are currently dominating the subsea umbilicals market?

Key trends include the increasing adoption of Hybrid Umbilicals (integrating high-power electrical and fiber optic elements), the transition towards All-Electric Subsea Systems, and the incorporation of advanced Distributed Fiber Optic Sensing (DTS/DAS) for real-time asset integrity monitoring and predictive maintenance.

Which geographical region represents the highest growth potential for subsea umbilical demand?

Latin America, particularly offshore Brazil, currently exhibits the highest demand and growth potential due to extensive pre-salt exploration and development activities requiring sophisticated ultra-deepwater dynamic and static umbilical systems for complex field architectures.

What are the main risks associated with the operation and maintenance of subsea umbilicals?

Major risks include external mechanical damage (e.g., fishing trawlers, anchors), internal corrosion or blockage of hydraulic lines, fatigue failure in dynamic applications, and breaches in the outer sheath leading to water ingress, all of which necessitate advanced inspection and repair technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager