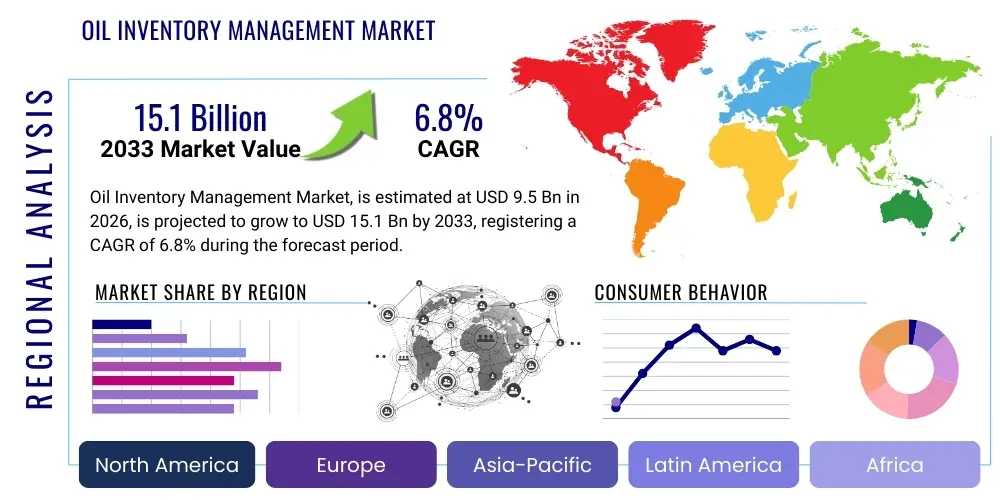

Oil Inventory Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439013 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Oil Inventory Management Market Size

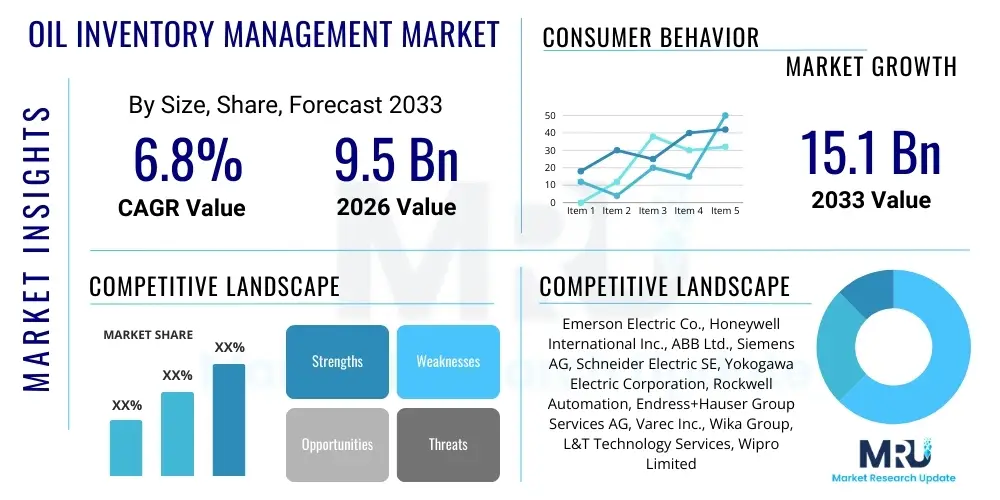

The Oil Inventory Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.1 Billion by the end of the forecast period in 2033.

Oil Inventory Management Market introduction

The Oil Inventory Management Market encompasses sophisticated software solutions, hardware components (sensors, level gauges), and integrated services designed to monitor, track, and optimize the storage and flow of crude oil and refined petroleum products across the energy supply chain. These solutions are crucial for maintaining operational efficiency, minimizing storage costs, preventing stockouts, and ensuring compliance with stringent safety and environmental regulations. The primary product offering includes real-time tank gauging systems, enterprise resource planning (ERP) modules specifically tailored for oil and gas logistics, and cloud-based analytical platforms that utilize advanced algorithms to forecast demand and manage supply chain volatility.

Major applications span the entire hydrocarbon value chain, including upstream production facilities, midstream transportation and pipeline networks, large-scale storage terminals (tank farms), and downstream refineries and retail distribution centers. The systems are employed to accurately measure inventory levels, calculate custody transfer quantities, detect leaks, and optimize scheduling for inbound and outbound product movements. Effective oil inventory management is non-negotiable for large multinational oil corporations and independent operators alike, as even minor inaccuracies in measurement or forecasting can result in substantial financial losses or regulatory penalties.

Key benefits driving market adoption include enhanced operational visibility, reduction in working capital tied up in excessive inventory, improved safety through remote monitoring, and superior risk management by detecting potential hazards like overfills or contamination early. Driving factors include the increasing volatility of global oil prices necessitating precise stock control, the imperative for digital transformation across the energy sector, and growing complexity in supply chain logistics requiring interconnected, automated inventory solutions. Furthermore, regulatory pressures mandating accurate reporting of greenhouse gas emissions and inventory balances are accelerating the adoption of high-precision management tools.

Oil Inventory Management Market Executive Summary

The Oil Inventory Management Market is experiencing robust growth fueled by the global shift towards digitalization in the oil and gas sector and the critical need for operational resilience against geopolitical and economic uncertainties. Business trends highlight a strong movement away from manual measurement systems toward integrated, cloud-native platforms that offer real-time data accessibility and predictive analytics capabilities. This transition is being led by major investments in Industrial Internet of Things (IIoT) sensors and advanced telemetry, facilitating end-to-end visibility from the wellhead to the pump. Strategic mergers, acquisitions, and partnerships between traditional industrial automation providers and specialized software developers are shaping a competitive landscape focused on delivering comprehensive, modular solutions tailored to specific segment needs, such as LNG or specialized chemical storage.

Regionally, North America maintains its dominance, driven by extensive midstream infrastructure, high technological readiness, and significant capital expenditure in modernizing existing storage facilities, particularly in the shale oil production regions. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, primarily due to rapid expansion of refining capacity in countries like China and India, coupled with substantial governmental initiatives to upgrade energy infrastructure and improve logistics efficiency. Europe is characterized by stringent environmental regulations, driving demand for inventory systems that support compliance, leakage detection, and efficient carbon accounting.

Segment trends indicate that the Software component segment, particularly AI-enabled demand forecasting and optimization software, is outpacing the growth of the hardware segment. Furthermore, among applications, the Midstream sector (pipelines and storage terminals) accounts for the largest market share, given the sheer volume of hydrocarbons managed and the associated high risks. The trend toward Software-as-a-Service (SaaS) deployment models is prevalent across all segments, offering scalability, lower upfront costs, and continuous access to the latest analytical features, appealing especially to smaller operators and entities focused on achieving operational agility.

AI Impact Analysis on Oil Inventory Management Market

User inquiries regarding the impact of Artificial Intelligence (AI) on oil inventory management frequently center on themes of predictive capability, automation, and data security. Common questions revolve around "How accurately can AI forecast crude oil demand given volatile global markets?" and "What is the ROI of implementing machine learning algorithms for optimizing tank farm operations?" Key concerns often address the required level of data infrastructure maturity and the cyber risks associated with integrating sophisticated AI models into operational technology (OT) environments. Essentially, users seek confirmation that AI can transition inventory management from a reactive, historical-data-driven process to a proactive, forward-looking, and fully optimized operational discipline, enhancing profitability while maintaining stringent safety standards.

The pervasive integration of AI and Machine Learning (ML) is fundamentally transforming oil inventory management by providing unprecedented precision in forecasting, scheduling, and risk mitigation. AI algorithms process massive, disparate datasets—including sensor data, meteorological information, geopolitical events, and macroeconomic indicators—to generate highly accurate demand forecasts that minimize holding costs and prevent pipeline congestion. This predictive capability allows operators to dynamically adjust storage levels and transfer schedules in real-time, moving beyond traditional statistical models which struggled with high-frequency market noise and unexpected disruptions.

Beyond forecasting, AI enhances operational automation through intelligent control systems. ML models are deployed to optimize tank utilization, determine optimal blending schedules in refineries, and conduct anomaly detection for leakage or sensor malfunction with minimal human intervention. This leads to a significant reduction in operational expenditure (OPEX) and maximizes the effective capacity of existing assets. The capability of AI to analyze historical inventory deviations and optimize safety margins is setting a new industry benchmark for efficiency and compliance, ensuring that operators can maintain competitive advantage in a fluctuating energy landscape.

- Enhanced demand forecasting precision through deep learning models.

- Real-time optimization of storage capacity and allocation schedules.

- Predictive maintenance for inventory hardware (sensors, gauges).

- Automated anomaly detection for leaks, theft, and contamination.

- Optimization of product blending processes in refineries.

- Improved safety management by predicting potential overfill scenarios.

- Integration of advanced robotics for autonomous physical inventory checks.

- Optimization of crude oil procurement and delivery timing.

DRO & Impact Forces Of Oil Inventory Management Market

The dynamics of the Oil Inventory Management Market are defined by a powerful convergence of growth catalysts, entrenched operational constraints, and compelling opportunities for innovation. Key Drivers include the increasing global demand for energy requiring expanded and more efficient storage capacity, the need to reduce massive financial losses associated with measurement inaccuracies (known as ‘losses in transit’ or ‘stock variations’), and the imperative for regulatory compliance, especially concerning environmental reporting and safety standards mandated by international bodies. These factors collectively push operators towards automated, high-precision management systems that guarantee transparency and reliability across complex supply chains.

Restraints primarily revolve around the substantial initial capital expenditure (CAPEX) required for implementing advanced instrumentation and integrated software platforms, particularly in older infrastructure that requires extensive retrofitting. Furthermore, the complexity of integrating new digital inventory solutions with legacy Enterprise Resource Planning (ERP) systems and Operational Technology (OT) infrastructure often presents significant technical hurdles and requires specialized IT expertise. Data security risks, particularly cyber-attacks targeting critical energy infrastructure, also pose a continuous restraint, compelling providers to invest heavily in robust cybersecurity features, which increases the overall cost of ownership.

Opportunities are predominantly driven by the accelerating trend of digitalization and the adoption of IIoT technology, creating a platform for real-time, edge-to-cloud inventory control. The expansion of midstream infrastructure globally, particularly new pipeline projects and strategic petroleum reserves (SPRs), provides greenfield opportunities for deploying state-of-the-art management systems from the outset. Moreover, the growing focus on energy transition and managing diverse fuel types (e.g., biofuels, hydrogen, LNG) is opening new specialized market niches requiring adaptive, multi-commodity inventory management software. The combined impact forces underscore a rapid technological transition where efficiency and data accuracy are paramount, punishing firms that rely on outdated manual methods while heavily rewarding early adopters of AI and IIoT-driven platforms.

Segmentation Analysis

The Oil Inventory Management Market is strategically segmented based on crucial dimensions including component, application, and deployment model, reflecting the diverse needs across the oil and gas industry. Component segmentation differentiates between the physical infrastructure necessary for data acquisition (Hardware) and the analytical tools used for processing and optimization (Software & Services). Application segmentation is essential as inventory needs vary dramatically between upstream drilling sites, midstream pipelines, and downstream retail outlets. Finally, the Deployment Model segmentation highlights the preference for traditional on-premise solutions versus modern, scalable cloud-based systems, which is increasingly influencing purchasing decisions globally due to flexibility and cost-efficiency benefits.

- By Component:

- Hardware (Sensors, Gauges, Flow Meters, Terminals)

- Software (Inventory Forecasting, Optimization, Measurement)

- Services (Implementation, Consulting, Maintenance)

- By Application:

- Upstream

- Midstream (Pipelines, Storage Terminals)

- Downstream (Refineries, Retail Outlets)

- By Deployment Model:

- On-Premise

- Cloud

Value Chain Analysis For Oil Inventory Management Market

The Value Chain for Oil Inventory Management begins with the upstream suppliers of core technological components, including specialized sensor manufacturers, industrial automation firms providing controllers and telemetry units, and software developers creating proprietary algorithms for data processing and optimization. This initial stage, encompassing research and development, raw material procurement, and precise manufacturing, dictates the quality and accuracy of the entire inventory system. Key activities at this stage include rigorous calibration, integration testing of hardware and software interfaces, and securing supply chains for sophisticated electronic components, ensuring compliance with hazardous environment (HazLoc) certifications required in oil and gas settings.

The mid-chain activities involve system integration, distribution, and implementation. Integrators play a pivotal role, combining hardware components (e.g., radar level transmitters, tank gauging systems) with complex inventory management software, often customizing the solution to fit the client's existing infrastructure, such as integrating with specific SCADA or ERP platforms. Distribution channels are typically a mix of direct sales by major Original Equipment Manufacturers (OEMs) for large-scale projects and indirect channels utilizing value-added resellers (VARs) or system integrators for localized or smaller installations. Direct channels provide greater control over deployment and maintenance, while indirect channels offer broader geographical reach and specialized regional expertise.

Downstream activities focus on the operational phase, involving maintenance, continuous optimization services, and customer support. Inventory software often necessitates ongoing updates and patches to adapt to changing regulatory requirements and new market dynamics. Service providers offer consultancy to help clients leverage predictive analytics derived from the inventory data for strategic decision-making, such as optimizing futures trading based on storage levels or ensuring optimal blending compositions in refineries. The efficiency of the downstream support structure is critical for maximizing the system's longevity and ensuring high data integrity, directly impacting the long-term ROI for the end-user.

Oil Inventory Management Market Potential Customers

The primary potential customers and end-users of Oil Inventory Management systems span the entire spectrum of the global petroleum industry, encompassing entities responsible for hydrocarbon extraction, transportation, processing, and distribution. Major Integrated Oil Companies (IOCs) such as ExxonMobil, Shell, and Chevron represent the largest customer base, requiring enterprise-wide, scalable solutions that manage inventory across thousands of assets globally, including offshore platforms, complex refinery operations, and vast networks of storage terminals. Their purchasing decisions are driven by the need for regulatory compliance, maximized operational efficiency, and minimized financial risk associated with volume reconciliation and losses.

Independent Exploration & Production (E&P) companies, especially those focusing on specific basins like the Permian or North Sea, constitute another significant customer segment. While they might not require the same scale as IOCs, they prioritize modular, cost-effective, and highly accurate solutions for managing crude oil at the wellhead and local gathering facilities. Midstream operators, who manage pipelines, pumping stations, and bulk storage facilities, represent perhaps the most critical application segment, as accurate custody transfer and real-time leakage detection are paramount for regulatory and safety reasons. These entities specifically demand high-speed data transmission and secure communication protocols.

Furthermore, downstream entities, including independent refiners, petrochemical plants, and large retail chain distributors, are crucial buyers. Refiners require sophisticated inventory management tools to optimize feedstock storage, manage intermediate product volumes, and ensure highly precise blending ratios. Government agencies responsible for managing Strategic Petroleum Reserves (SPRs) also represent a vital niche, demanding extremely secure and reliable systems capable of accurately measuring and reporting massive, strategic oil reserves. The growing complexity of product types, including low-sulfur fuels and bio-blends, is expanding the customer base to include niche chemical and energy logistics providers focused on specialized storage requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Honeywell International Inc., ABB Ltd., Siemens AG, Schneider Electric SE, Yokogawa Electric Corporation, Rockwell Automation, Endress+Hauser Group Services AG, Varec Inc., Wika Group, L&T Technology Services, Wipro Limited, SAP SE, Oracle Corporation, P&ID Technologies, Total Control Systems, General Electric (GE), Tesla Inc. (Battery Storage Management), IBM, KSS Retail (A Dunnhumby Company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Inventory Management Market Key Technology Landscape

The technology landscape of the Oil Inventory Management Market is defined by a shift toward high-precision, connected, and intelligent systems, driven primarily by the Industrial Internet of Things (IIoT). Modern inventory solutions heavily rely on advanced sensor technology, particularly high-accuracy radar level gauges (both guided wave radar and non-contact radar) which offer superior measurement precision compared to older mechanical or hydrostatic methods, especially in pressurized or high-temperature environments. These sensors are increasingly becoming 'smart,' incorporating edge computing capabilities to process data locally before transmitting critical alerts, thereby reducing latency and bandwidth requirements. The connectivity layer is supported by robust wireless communication protocols, including proprietary mesh networks and integration with 5G infrastructure in technologically mature regions, ensuring seamless, real-time data flow from remote tanks to central control systems.

Software technologies form the intellectual core of modern inventory management. Enterprise Resource Planning (ERP) systems, specifically modules dedicated to hydrocarbon accounting and logistics (often from vendors like SAP or Oracle), integrate inventory data with financial and procurement processes. Complementing these are dedicated Inventory Optimization Software (IOS) platforms, which utilize sophisticated operational research models, simulation tools, and increasingly, Machine Learning algorithms. These platforms are designed to solve complex blending, routing, and scheduling problems, minimizing variability and maximizing asset utilization by offering predictive insights rather than mere historical reporting. The move toward cloud-based Software-as-a-Service (SaaS) models is central to this shift, providing elasticity and accessibility to advanced analytics without major on-premise infrastructure investment.

Finally, emerging technologies such as Digital Twins and sophisticated cybersecurity frameworks are becoming critical differentiators. Digital Twins create virtual replicas of physical storage tanks or entire terminal operations, allowing operators to simulate various scenarios—like sudden demand spikes or equipment failure—to optimize operational procedures and prevent loss. Given the critical nature of oil infrastructure, robust cyber defenses, including advanced threat detection systems and stringent access controls, are integrated directly into the inventory management architecture, protecting both the sensor data (OT layer) and the analytical platforms (IT layer) from malicious intrusion. This convergence of high-fidelity measurement, cloud analytics, and simulation capability defines the current state-of-the-art in oil inventory management.

- IIoT and Edge Computing: Deployment of smart sensors for localized data processing and low-latency alerts.

- Advanced Tank Gauging: Non-contact radar (NCR) and guided wave radar (GWR) for high precision measurement.

- Cloud-Based Platforms (SaaS): Scalable deployment offering flexibility and continuous software updates.

- Digital Twin Technology: Virtual modeling for simulation, training, and optimizing tank utilization.

- Machine Learning & AI: Algorithms for predictive demand forecasting and automated anomaly detection.

- Hydrocarbon Accounting Software: Integrated modules for managing custody transfer and volumetric calculations.

Regional Highlights

- North America: Dominates the market share due to extensive, complex midstream infrastructure, particularly in the US and Canada. High adoption rates of IIoT technology, significant investments in shale oil inventory management, and stringent EPA regulations driving demand for high-accuracy leak detection systems are key factors. The region benefits from technological maturity and a competitive vendor landscape, focusing heavily on integration with existing ERP and SCADA systems.

- Europe: Characterized by mature markets and a strong emphasis on environmental compliance and safety standards (e.g., ATEX directives). Growth is steady, driven by modernization projects in aging infrastructure and the increasing need to manage diverse energy mixes, including biofuels and LNG, requiring highly flexible inventory solutions. Germany, the UK, and the Netherlands are key contributors, focusing on energy transition and efficient logistics.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR). This rapid expansion is driven by massive infrastructure development, especially in refining and terminal capacity across China, India, and Southeast Asia. Governments are investing heavily in new strategic storage reserves. The market here is price-sensitive, balancing the need for advanced technology with cost-effectiveness, favoring scalable cloud solutions.

- Middle East and Africa (MEA): Growth is tied directly to high crude oil production volumes and large-scale export operations. Major national oil companies (NOCs) are undertaking massive digital transformation initiatives to enhance efficiency across vast storage facilities and export hubs. The focus is on secure, reliable solutions for managing strategic inventory and optimizing custody transfer protocols.

- Latin America: Market adoption is accelerating, driven by the liberalization of the energy sector in several countries (e.g., Brazil, Mexico) and subsequent investments in midstream assets. The primary driver is the need to improve measurement accuracy and combat product theft, requiring robust monitoring and security features integrated into inventory systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Inventory Management Market.- Emerson Electric Co.

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- Rockwell Automation

- Endress+Hauser Group Services AG

- Varec Inc.

- Wika Group

- L&T Technology Services

- Wipro Limited

- SAP SE

- Oracle Corporation

- P&ID Technologies

- Total Control Systems

- General Electric (GE)

- Tesla Inc. (Battery Storage Management)

- IBM

- KSS Retail (A Dunnhumby Company)

Frequently Asked Questions

Analyze common user questions about the Oil Inventory Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Oil Inventory Management software?

The primary function of Oil Inventory Management software is to provide real-time visibility into stock levels, optimize storage capacity, forecast future demand accurately, minimize measurement discrepancies (losses), and ensure regulatory compliance for handling hydrocarbons across the supply chain, enhancing operational and financial control.

How does IIoT technology enhance inventory management in the oil and gas sector?

IIoT enhances inventory management by deploying smart sensors and connected devices (e.g., radar gauges) to continuously collect high-fidelity data, enabling remote monitoring, predictive maintenance for hardware, and instantaneous anomaly detection, drastically improving data accuracy and reducing the need for manual checks.

Which market segment is expected to show the fastest growth rate?

The Software component segment, particularly cloud-based Inventory Optimization Software (IOS) integrating AI and Machine Learning, is projected to exhibit the fastest growth rate, driven by the increasing need for predictive analytics and the scalability offered by the Software-as-a-Service (SaaS) deployment model.

What are the key differences between On-Premise and Cloud deployment models?

On-Premise deployment requires significant upfront CAPEX, internal IT management, and provides greater control over data security, whereas Cloud deployment offers lower initial costs, scalability, automated updates, and superior accessibility, increasingly favored by firms seeking agility and reduced infrastructure complexity.

What major regulatory concerns drive the adoption of sophisticated inventory systems?

Major regulatory concerns include meeting stringent environmental standards (e.g., preventing oil spills and leaks), complying with safety regulations for pressurized storage, and adhering to mandated financial reporting standards (e.g., Sarbanes-Oxley) that require accurate and auditable volumetric data for hydrocarbon accounting and custody transfer processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager