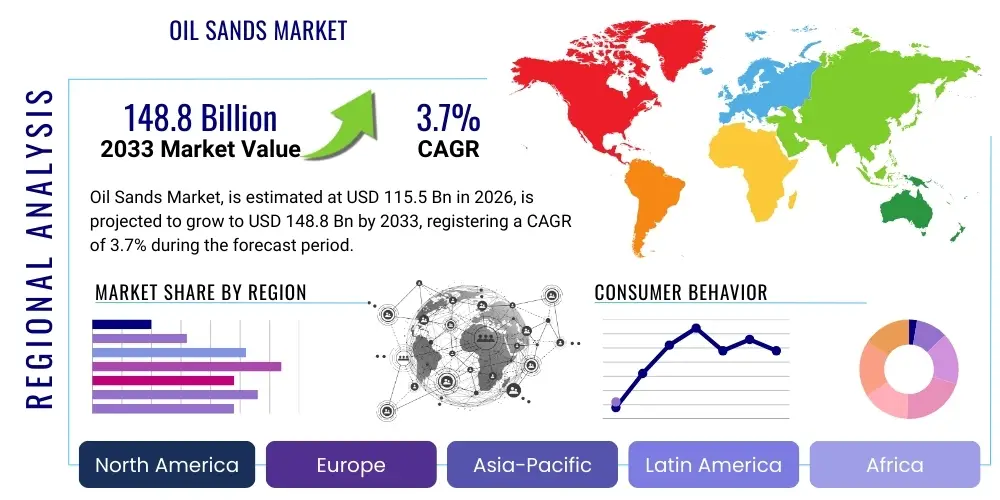

Oil Sands Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438740 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Oil Sands Market Size

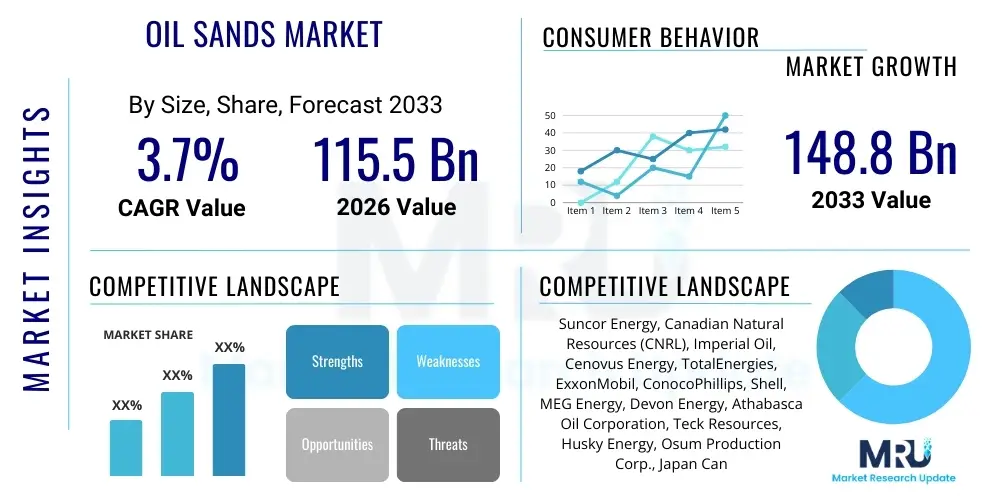

The Oil Sands Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.7% between 2026 and 2033. The market is estimated at $115.5 Billion USD in 2026 and is projected to reach $148.8 Billion USD by the end of the forecast period in 2033.

Oil Sands Market introduction

The Oil Sands Market involves the exploration, extraction, upgrading, and refining of bitumen deposits, primarily concentrated in the vast reserves of Alberta, Canada. These hydrocarbon resources represent a significant portion of global energy supplies, distinguished by the complex processes required for recovery compared to conventional crude oil. The product, raw bitumen, is a highly viscous, semi-solid form of petroleum that necessitates specialized mining techniques—such as surface mining for shallow deposits—or advanced in-situ recovery methods, like Steam-Assisted Gravity Drainage (SAGD), for deeper reserves. These operational complexities drive continuous innovation in extraction efficiency and environmental performance.

Major applications of oil sands products center around their transformation into Synthetic Crude Oil (SCO) through extensive upgrading processes, making them suitable feedstocks for conventional refineries globally. SCO is utilized in the production of various transportation fuels, including gasoline, diesel, and jet fuel, alongside numerous petrochemical products. The unique benefit of the oil sands is the stability and security of supply they offer, derived from politically stable jurisdictions, providing a long-term resource base essential for meeting global energy demand, especially as conventional oil fields mature and decline. This reliable supply chain mitigates geopolitical risk often associated with other major oil-producing regions.

Driving factors for this market include persistent global demand for energy, particularly in emerging economies, and technological advancements focusing on reducing the environmental footprint and operational costs associated with extraction. Innovations in solvent-assisted processes (SA-SAGD) and non-thermal recovery methods aim to significantly decrease natural gas consumption and water intensity, thereby enhancing the economic viability and sustainability profile of oil sands operations. Furthermore, substantial infrastructure investments, particularly in pipeline expansion and upgrading facilities, are critical components supporting the sustained growth and market accessibility of these resources.

Oil Sands Market Executive Summary

The global Oil Sands Market demonstrates resilience driven by robust structural investments and technological adaptation aimed at operational efficiency and environmental compliance. Business trends are characterized by major industry players consolidating assets and focusing capital expenditure on high-efficiency, lower-intensity in-situ projects, such as SAGD and its variants, rather than high-capital surface mining expansions. Furthermore, increasing pressure from ESG (Environmental, Social, and Governance) investors is compelling companies to allocate significant resources toward carbon capture utilization and storage (CCUS) technologies and developing net-zero roadmaps, fundamentally shifting the strategic planning horizon for long-term viability.

Regionally, North America, specifically Western Canada, remains the undisputed epicenter of oil sands production, dominating the market structure and technological innovation landscape. However, regulatory frameworks and market access challenges, particularly concerning pipeline capacity, continue to influence regional growth trajectories. While production volumes are steady or modestly increasing due to efficiency gains, export diversification towards new international markets, particularly in Asia Pacific, is a critical objective. Other regions with heavy oil potential, such as Venezuela, remain strategically significant but face major geopolitical and economic hurdles limiting current and near-term competitive participation.

Segmentation trends highlight a structural shift towards In-Situ Recovery methods over traditional Surface Mining, driven by lower capital intensity per barrel and reduced environmental disturbance requirements. Within technology segments, the adoption of advanced recovery methods like Solvent Assisted SAGD (SA-SAGD) is accelerating, aiming to reduce the Steam-Oil Ratio (SOR) and subsequent energy requirements. Furthermore, the market for Synthetic Crude Oil (SCO) continues to be the primary output value stream, although efforts are underway to develop specialized bitumen products for asphalt and chemical applications, providing diversification away from solely relying on transportation fuel markets.

AI Impact Analysis on Oil Sands Market

User inquiries regarding Artificial Intelligence (AI) in the Oil Sands Market frequently center on its role in achieving ambitious decarbonization targets, enhancing operational safety, and optimizing complex extraction processes. Key themes include the implementation of predictive maintenance to reduce costly downtime, the use of machine learning algorithms for real-time reservoir modeling and steam injection optimization in SAGD operations, and the deployment of advanced analytics for monitoring emissions and ensuring regulatory compliance. Users seek assurance that AI can simultaneously lower the energy intensity (Steam-Oil Ratio) of production and improve the accuracy of environmental stewardship reporting, addressing major concerns about cost and environmental reputation.

AI is transforming the traditionally heavy-industrial oil sands sector by enabling unprecedented levels of efficiency and control, moving the industry toward data-driven operational decision-making. Through the integration of Industrial Internet of Things (IIoT) sensors across vast mining sites and subterranean well networks, operators are gathering massive datasets. Machine learning models process this data to predict equipment failure, optimize scheduling for mining trucks, and fine-tune chemical injections in water treatment facilities, leading to substantial reductions in operating costs and enhanced labor productivity. This shift from reactive to predictive operations is critical for maintaining competitiveness in a volatile global oil pricing environment.

Furthermore, the environmental monitoring capabilities powered by AI are crucial for gaining regulatory approval and public acceptance. AI algorithms can analyze satellite imagery, aerial drone data, and continuous sensor readings to precisely track land reclamation progress, monitor wildlife migration patterns near operational sites, and detect minute methane leaks almost instantaneously. This high-fidelity environmental surveillance ensures that companies can demonstrate quantifiable progress against mandated emission reduction targets, facilitating faster responses to potential environmental incidents and bolstering transparency with stakeholders and governmental bodies. The adoption of AI is therefore viewed not just as a cost-saving measure but as a necessary component of the industry's future license to operate.

- Real-time Steam-Oil Ratio (SOR) optimization in SAGD via machine learning.

- Predictive maintenance schedules for heavy mining equipment and downhole pumps.

- Enhanced reservoir modeling and simulation using neural networks for resource estimation.

- Automated analysis of environmental sensor data for immediate methane leak detection.

- Optimization of tailing pond management and water recycling processes.

- Improved supply chain logistics and autonomous vehicle fleet management.

- AI-driven risk assessment for operational safety and regulatory compliance.

DRO & Impact Forces Of Oil Sands Market

The Oil Sands Market is significantly influenced by a unique confluence of Drivers, Restraints, and Opportunities (DRO), collectively forming crucial Impact Forces that shape investment and production strategies. Key drivers include the immense scale of the resource base, offering unparalleled long-term energy security, coupled with continuous technological innovation (e.g., non-aqueous extraction methods) aimed at reducing the environmental and economic hurdles inherent in bitumen recovery. Opportunities are emerging through the development of pathways for lower-carbon intensity products, such as blue hydrogen production utilizing natural gas associated with oil sands operations, and expanding pipeline access that improves market reach.

However, the market faces formidable restraints, primarily centered on high initial capital expenditure (CAPEX) required for large-scale projects and substantial operational expenditure (OPEX) tied to energy-intensive steam generation for in-situ recovery. Furthermore, stringent and evolving environmental regulations, particularly carbon pricing mechanisms and methane emission mandates, pose significant economic challenges and regulatory uncertainty, impacting project viability. Public and investor sentiment, increasingly focused on divestment from high-carbon intensity projects, acts as a powerful non-market restraint, limiting access to certain pools of capital necessary for major expansions.

The impact forces currently dictating market dynamics revolve heavily around policy and price volatility. Global crude oil price stability is essential for sustaining the high-cost production environment of oil sands. Simultaneously, governmental climate policies, such as Canada’s commitment to achieving net-zero emissions, compel operators to invest heavily in carbon capture and storage (CCS) and electrification, which significantly influences investment decisions and competitive positioning. The need to demonstrate quantifiable progress on ESG metrics is a non-negotiable impact force driving technological and structural change across the entire value chain, transforming the perception and economics of oil sands resources.

Segmentation Analysis

The Oil Sands Market is comprehensively segmented based on the methods used for extracting the bitumen, the resulting products, the technology deployed, and the final end-use applications. The segmentation by mining method—Surface Mining versus In-Situ Recovery—is perhaps the most fundamental, directly correlating with the depth of the bitumen deposits and defining the capital and operational requirements of a project. Surface Mining, suitable for shallower deposits, typically involves vast open-pit operations, while In-Situ methods, such as SAGD and CSS, are utilized for deeper, economically inaccessible reserves and are becoming the dominant method for new developments due to lower land disturbance. These methodological differences result in distinct cost profiles and environmental footprints.

The segmentation by technology is crucial as it reflects the industry's continuous drive for efficiency. Technologies like Steam-Assisted Gravity Drainage (SAGD) dominate the in-situ segment, but newer innovations such as Cyclic Steam Stimulation (CSS), Solvent-Assisted SAGD (SA-SAGD), and advanced non-thermal techniques like VAPEX (Vapor Extraction Process) are being piloted to lower the energy input and improve the quality of the recovered bitumen. The choice of technology directly influences the Steam-Oil Ratio (SOR), which is a key metric for energy intensity and carbon emissions, thereby impacting the economic and environmental performance of the operation.

Product type segmentation distinguishes between raw Bitumen, which often requires significant diluent for transportation, and Synthetic Crude Oil (SCO), which is produced after extensive upgrading. The majority of the market value resides in SCO, which is a premium, light crude oil readily accepted by refineries. The End-User segmentation largely comprises refineries processing SCO into transportation fuels, but also includes the petrochemical and chemical industry, which uses specialized bitumen derivatives for applications such as asphalt production and various industrial chemicals. Understanding these segments is vital for analyzing market flows and predicting future investment areas.

- Mining Method:

- Surface Mining (Open Pit)

- In-Situ Recovery (SAGD, CSS, VAPEX)

- Technology:

- Steam-Assisted Gravity Drainage (SAGD)

- Cyclic Steam Stimulation (CSS)

- Solvent Assisted SAGD (SA-SAGD)

- Non-thermal Recovery Methods

- Product Type:

- Raw Bitumen

- Synthetic Crude Oil (SCO)

- End-User:

- Refineries (Fuel Production)

- Chemical Industry

- Asphalt and Paving

Value Chain Analysis For Oil Sands Market

The Oil Sands Value Chain is lengthy and complex, beginning with extensive upstream activities encompassing exploration, reservoir characterization, and the actual extraction of bitumen, either through large-scale surface mining or energy-intensive in-situ processes. The upstream phase is characterized by high capital expenditure, reliance on specialized heavy equipment, and continuous geological and engineering innovation to maximize recovery rates and minimize environmental disruption. Key upstream inputs include vast quantities of natural gas (for steam generation), water, and specialized chemicals (for separation and processing), making this segment highly sensitive to utility costs and environmental regulations.

The midstream sector forms the crucial link between extraction and market entry, involving the crucial process of upgrading and transportation. Raw bitumen must either be diluted with light hydrocarbons (diluent) to flow through pipelines or upgraded into Synthetic Crude Oil (SCO) at massive processing facilities. Transportation typically relies on extensive pipeline networks connecting production sites to refining centers in North America (e.g., the U.S. Gulf Coast). The efficiency and capacity of this distribution channel—which includes direct pipeline routes and indirect logistical methods like rail—are paramount determinants of the realized market price for oil sands products.

The downstream segment involves the final refining of SCO or diluted bitumen into finished petroleum products, primarily transportation fuels (gasoline, diesel, jet fuel) and petrochemical feedstocks. Direct sales occur largely to integrated refinery systems owned by the major oil sands producers, while indirect distribution involves selling the upgraded product to third-party domestic or international refineries. The overall profitability of the oil sands value chain is heavily dependent on optimizing operational efficiencies upstream, securing favorable transportation economics midstream, and ensuring refinery capacity can handle the specific qualities of the crude output downstream.

Oil Sands Market Potential Customers

The primary potential customers and end-users of the Oil Sands Market are large-scale, sophisticated refining operations capable of handling heavy and synthetic crude oil feedstocks. Refineries situated predominantly in the U.S. Midwest and the U.S. Gulf Coast are foundational customers, given their complex coking and hydroprocessing capabilities specifically designed to handle the heavy, sulfur-rich characteristics of diluted bitumen (Dilbit) and the lighter, high-quality Synthetic Crude Oil (SCO). These integrated refineries seek reliable, long-term supply volumes that the oil sands provide, which are crucial for maintaining consistent operation rates and maximizing utilization of their high-conversion units.

A secondary, but increasingly important, customer segment includes the global chemical and asphalt industry. While the bulk of bitumen is upgraded into fuel, certain specialized heavy fractions and upgraded residues are highly valued as input materials for the production of asphalt for infrastructure development and specialized carbon products. Furthermore, large multinational trading houses and integrated energy companies act as indirect customers, facilitating the movement of oil sands products across global markets, particularly where pipeline bottlenecks require logistical solutions like rail transport or blending operations to meet specific market specifications.

In the context of future energy transition scenarios, new potential customers are emerging in industrial sectors focused on hydrogen production. Integrated projects aiming to produce 'blue' hydrogen—where CO2 emissions from natural gas used in oil sands operations are captured—could see oil sands producers supplying feedstocks or related infrastructure to these new energy ventures. Governments and national strategic petroleum reserves also act as significant potential buyers, valuing the long-term geopolitical security and stability associated with Canadian oil supply, treating it as a strategic resource base for energy resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115.5 Billion USD |

| Market Forecast in 2033 | $148.8 Billion USD |

| Growth Rate | 3.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suncor Energy, Canadian Natural Resources (CNRL), Imperial Oil, Cenovus Energy, TotalEnergies, ExxonMobil, ConocoPhillips, Shell, MEG Energy, Devon Energy, Athabasca Oil Corporation, Teck Resources, Husky Energy, Osum Production Corp., Japan Canada Oil Sands Limited (JCOS), China National Offshore Oil Corporation (CNOOC), Koch Industries, Equinor, BP, Petronas, Syncrude Canada Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Sands Market Key Technology Landscape

The technological landscape of the Oil Sands Market is intensely focused on mitigating the high energy intensity and environmental impact traditionally associated with bitumen extraction. The primary advancement is the continuous refinement of In-Situ techniques, particularly Steam-Assisted Gravity Drainage (SAGD), which dominates current production. Technological innovations within SAGD aim to decrease the Steam-Oil Ratio (SOR)—the volume of steam required to produce one barrel of oil—through better wellbore placement, intelligent injection control systems, and specialized additives. This optimization is crucial because natural gas consumption for steam generation is the largest operational expense and source of direct greenhouse gas emissions in these processes.

A rapidly expanding area of innovation is the development and commercial deployment of Solvent-Assisted SAGD (SA-SAGD). This technique involves injecting a light hydrocarbon solvent (such as propane or butane) mixed with steam into the reservoir. The solvent effectively reduces the viscosity of the bitumen at lower temperatures than pure steam, dramatically cutting the overall heat and energy requirements. While requiring more complex solvent recovery mechanisms, SA-SAGD offers a path toward significantly lower operating costs and a reduced carbon footprint, making it a key strategic focus for major operators seeking to enhance sustainability performance and reduce regulatory exposure under carbon pricing schemes.

Furthermore, digital technologies and industrial automation are central to the modern technology landscape. The integration of IIoT sensors, advanced process control systems, and Artificial Intelligence (AI) for predictive analytics is used to monitor reservoir conditions in real-time, predict equipment failure in remote pumping stations, and optimize the schedules of heavy haulers in surface mining operations. Beyond extraction, crucial technology development is concentrated in upgrading processes, specifically in non-hydrogen consuming methods and coking units, to efficiently convert the heavy bitumen into lighter, marketable Synthetic Crude Oil (SCO) while also advancing Carbon Capture, Utilization, and Storage (CCUS) solutions for large fixed-point emitters like upgraders and steam generation facilities.

Regional Highlights

- North America (Dominance and Innovation): North America, overwhelmingly driven by Canada (Alberta), dictates the global direction of the Oil Sands Market. The region hosts the third-largest proven petroleum reserves globally and possesses the necessary infrastructure (pipelines, upgraders, research facilities) and regulatory stability to sustain long-term production. While politically stable, the market faces significant domestic challenges related to achieving market access diversification beyond the primary U.S. refinery market and meeting increasingly strict federal and provincial climate goals. Innovation in this region is paramount, focusing on commercializing low-carbon intensity recovery methods and major investments in CCUS projects, such as the Oil Sands Pathways to Net Zero initiative, which aims to preserve competitiveness amid energy transition pressures.

- Latin America (Potential and Political Risk): Latin America holds vast heavy oil and bitumen deposits, notably in Venezuela (Orinoco Belt), which represents substantial potential reserves comparable in scale to Canadian oil sands. However, political instability, severe economic crises, international sanctions, and a lack of necessary high-technology infrastructure and foreign investment severely restrain current production and modernization efforts. Development in this region, while technically possible, remains highly speculative and is primarily dependent on significant geopolitical shifts and massive international financing commitments to rebuild and modernize the extraction and upgrading infrastructure necessary for competitive market participation.

- Asia Pacific (Demand and Strategic Markets): The Asia Pacific region is predominantly a consumer market for oil sands products, driven by rapidly industrializing economies like China and India, which maintain high, growing demand for transportation fuels and petrochemical feedstocks. While oil sands extraction is not centered here, the region represents a critical diversification target for Canadian exports, seeking to reduce over-reliance on the U.S. market. Securing long-term supply contracts with major refiners in key APAC nations is a strategic priority for oil sands operators, making efficient, secure marine export terminals (via the West Coast of Canada) a major focal point for infrastructure planning.

- Europe (Refining and Regulatory Influence): Europe is not a major producer but plays a crucial role as a policy influencer and a sophisticated refining hub. European climate policies and ESG investment mandates often set global precedents, influencing the financing and operational standards adopted by major companies with global oil sands interests. Some European refiners have specialized units capable of handling heavy crudes, though high environmental standards and declining overall demand for fossil fuels mean that oil sands are increasingly scrutinized here, demanding robust sustainability metrics for acceptance.

- Middle East and Africa (Limited Direct Competition): The Middle East and Africa hold minimal known commercial oil sands deposits. However, major national oil companies (NOCs) from the Middle East occasionally invest in Canadian oil sands projects for technological knowledge exchange and portfolio diversification. The region's production is largely dominated by conventional light crude, making it primarily a competitive force in the global oil market that heavily influences the benchmark pricing and investment profitability of oil sands projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Sands Market.- Suncor Energy Inc.

- Canadian Natural Resources Limited (CNRL)

- Imperial Oil Limited

- Cenovus Energy Inc.

- TotalEnergies SE

- ExxonMobil Corporation

- ConocoPhillips

- Shell plc

- MEG Energy Corp.

- Devon Energy Corporation

- Athabasca Oil Corporation

- Teck Resources Limited

- Husky Energy (now part of Cenovus)

- Osum Production Corp.

- Japan Canada Oil Sands Limited (JCOS)

- China National Offshore Oil Corporation (CNOOC)

- Koch Industries Inc.

- Equinor ASA

- BP p.l.c.

- Syncrude Canada Ltd.

Frequently Asked Questions

Analyze common user questions about the Oil Sands market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary method used for current oil sands extraction?

The primary method for extracting bitumen from deeper reservoirs is In-Situ Recovery, predominantly using Steam-Assisted Gravity Drainage (SAGD). SAGD involves injecting high-pressure steam underground to heat and mobilize the bitumen, allowing it to be pumped to the surface.

How are oil sands producers addressing high carbon emissions?

Producers are addressing high emissions through technological efficiency gains, such as implementing Solvent-Assisted SAGD (SA-SAGD) to lower steam requirements, and by committing to massive investment in Carbon Capture, Utilization, and Storage (CCUS) projects, often through industry collaborations like the Pathways to Net Zero initiative.

What is the current market access outlook for oil sands products?

The market access outlook is improving due to recent completion of major pipeline projects, easing historic transportation constraints. This enhancement facilitates movement to both traditional U.S. refining markets and emerging global markets, particularly in Asia Pacific, supporting price stability.

How does AI contribute to operational efficiency in oil sands operations?

AI significantly enhances operational efficiency by optimizing steam injection rates in real-time, using machine learning for predictive maintenance to prevent equipment failure, and improving logistical scheduling for heavy haul fleets, thereby reducing overall operational costs and energy usage.

Which region dominates the global Oil Sands Market?

North America, specifically the province of Alberta, Canada, overwhelmingly dominates the global Oil Sands Market, holding the largest commercially viable reserves and housing the world’s most advanced technological infrastructure for large-scale bitumen extraction and upgrading.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager