Oilfield Biocides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434948 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Oilfield Biocides Market Size

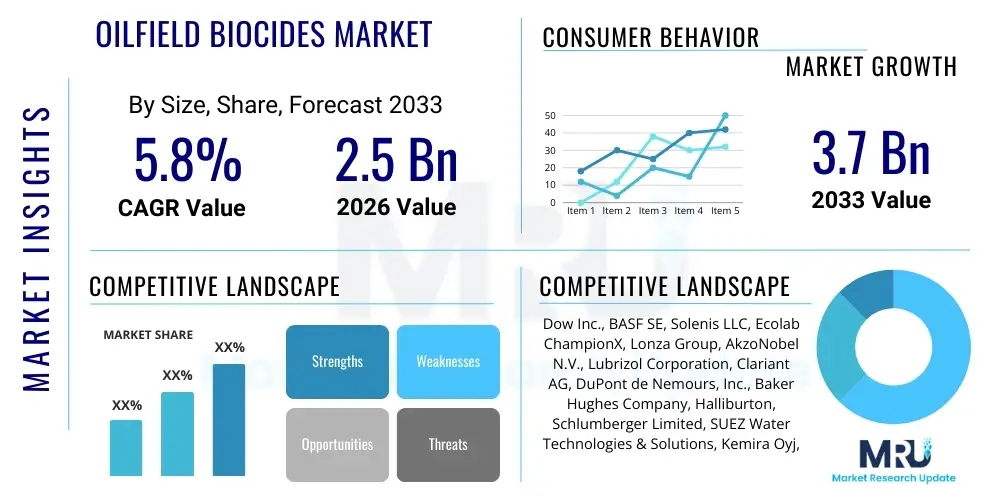

The Oilfield Biocides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033.

Oilfield Biocides Market introduction

The Oilfield Biocides Market encompasses chemical agents utilized within the exploration and production (E&P) activities of the oil and gas industry to control and eliminate harmful microbial populations. These microbes, predominantly sulfate-reducing bacteria (SRB) and acid-producing bacteria (APB), are responsible for significant operational challenges, including microbial induced corrosion (MIC), reservoir souring, and plugging of formations and pipelines. Biocides are critical in maintaining the integrity of drilling fluids, completion fluids, stimulation fluids (like hydraulic fracturing water), and produced water management systems. The necessity of these chemicals stems directly from the harsh, anaerobic conditions prevalent in subterranean environments and water systems, which create ideal breeding grounds for corrosion-causing microorganisms, thereby threatening asset longevity and operational efficiency.

The primary applications of oilfield biocides span across several crucial segments of the upstream sector. During drilling operations, biocides are incorporated into drilling muds and slurries to prevent microbial proliferation that can degrade fluid properties and induce corrosion in drill pipe components. In hydraulic fracturing, the massive volumes of water used must be treated rigorously to prevent reservoir contamination and subsequent equipment failure. Furthermore, biococidal treatment is essential for optimizing water injection systems used for enhanced oil recovery (EOR) and, increasingly, in systems managing the recycling and reuse of produced water. The continuous move towards unconventional resource development, which relies heavily on large-scale water usage and complex well architectures, has solidified the indispensable role of biocides in maximizing resource recovery while minimizing infrastructure damage and associated remediation costs.

Driving factors for market expansion include the increasing complexity of drilling environments, particularly in deepwater and high-pressure/high-temperature (HPHT) fields, where MIC risks are significantly elevated. Regulatory pressures mandating stricter water quality standards, especially concerning produced water discharge or reuse, also compel operators to adopt effective biocide treatment programs. Moreover, the industry's focus on cost reduction through asset integrity management and the prevention of catastrophic failures related to microbial damage further boosts the demand for advanced, effective, and environmentally compliant biocide solutions. These sophisticated chemical treatments ensure system uptime, reduce the need for costly mechanical interventions, and contribute positively to the overall profitability and safety of oilfield operations.

Oilfield Biocides Market Executive Summary

The Oilfield Biocides Market is characterized by a strong emphasis on sustainability and regulatory compliance, driving a significant shift toward non-toxic and environmentally friendly formulations, particularly in regions with strict discharge regulations such as Europe and North America. Key business trends include the consolidation of chemical suppliers offering integrated solutions, combining biocide treatment with complementary services like corrosion inhibition and scale management. Operators are increasingly adopting data-driven approaches, utilizing continuous monitoring and predictive modeling to optimize biocide dosing, thereby reducing chemical waste and operational expenditures (OpEx). The demand is particularly robust in unconventional plays, such as Permian and Marcellus, where high-volume hydraulic fracturing necessitates intense water treatment protocols, fueling growth in the non-oxidizing biocide segment, especially glutaraldehyde and quaternary ammonium compounds (QACs), due to their efficacy and stability in brine environments.

Regionally, North America maintains the largest market share, driven by extensive shale gas and tight oil activity, which requires continuous microbial control in vast water systems. However, the Asia Pacific region, led by China and India, presents the highest growth opportunities due to rising domestic energy demands and increased E&P investment, particularly in mature and offshore fields where infrastructure aging exacerbates MIC risks. Meanwhile, segments related to Produced Water Treatment are experiencing the fastest growth trajectory, largely because regulatory mandates and economic incentives are pushing operators toward zero-liquid discharge and high-rate water recycling. This focus on circular water management necessitates specialized, fast-acting biocides that can effectively treat high-TDS (Total Dissolved Solids) water without leaving harmful residues that could interfere with subsequent processes or environmental discharge.

Segmentation trends indicate that non-oxidizing biocides continue to dominate the market by type due to their effectiveness against a broad spectrum of oilfield microorganisms and their compatibility with other drilling fluid additives. Within application segments, hydraulic fracturing and general production chemical programs remain the primary demand centers, but the increasing complexity of deepwater reservoirs and the necessity for enhanced oil recovery (EOR) techniques are boosting the need for robust microbial control throughout the reservoir lifecycle. Overall, the market trajectory is highly sensitive to global oil and gas price volatility and E&P capital expenditure, yet the underlying requirement for asset integrity and regulatory adherence provides a stable foundational demand, pushing innovation towards high-performance, cost-effective, and environmentally responsible microbial control programs.

AI Impact Analysis on Oilfield Biocides Market

Users frequently ask how Artificial Intelligence (AI) can revolutionize the historically chemistry-driven oilfield biocide sector, focusing on questions like optimizing chemical usage, improving predictive modeling for MIC risk, and integrating real-time microbiological data with operational systems. The analysis reveals user expectation centers on AI's ability to transition from scheduled, preventative chemical slugs to highly responsive, demand-driven dosing systems. Key themes include the desire for AI to correlate operational parameters (temperature, flow rates, pressure) with sensor-derived microbial activity to preempt corrosion events, thereby minimizing biocide consumption, ensuring compliance, and significantly reducing OpEx. Users are concerned about the necessary data infrastructure and the complexity of training models on sparse or noisy field microbiological data, but remain optimistic about AI's potential to establish a superior standard for asset integrity management and environmental stewardship through precise chemical treatment.

- AI-powered predictive modeling for Microbial Induced Corrosion (MIC) risk assessment in pipelines and reservoirs.

- Optimization of biocide injection rates and schedules based on real-time sensor data and historical microbiological trends.

- Automated analysis of high-throughput DNA sequencing data for rapid identification of problematic microbial species.

- Integration of dosing control with production chemistry management systems (PCMS) to ensure chemical compatibility and efficiency.

- Enhanced supply chain management and inventory forecasting for biocide chemical procurement across multiple drilling sites.

DRO & Impact Forces Of Oilfield Biocides Market

The Oilfield Biocides Market is driven primarily by the escalating demand for asset integrity management coupled with the global shift towards unconventional resources and deepwater drilling, both of which amplify the risk of Microbial Induced Corrosion (MIC) and reservoir souring. Restraints largely center around stringent environmental regulations governing the use and discharge of certain high-efficacy, yet toxic, chemical compounds (such as certain aldehydes or heavy metals), alongside the inherent cost volatility associated with chemical procurement and logistical challenges in remote oilfield locations. Opportunities lie prominently in the development and rapid adoption of 'green chemistry' biocide alternatives—those derived from natural sources or possessing enhanced biodegradability—and in leveraging digitalization to create closed-loop, precision chemical delivery systems. The market impact forces indicate that while regulatory hurdles and oil price fluctuations exert significant pressure, the critical nature of preventing infrastructure failure and maximizing resource recovery ensures sustained, albeit optimized, demand for high-quality biocide treatments.

Segmentation Analysis

The Oilfield Biocides Market is systematically segmented based on chemical type, primary application area, and regional geography, allowing for precise market targeting and strategic development. Segmentation by type differentiates between oxidizing biocides, which kill microbes through chemical oxidation of cellular components, and non-oxidizing biocides, which interfere with metabolic and reproductive processes. Non-oxidizing chemistries, including glutaraldehyde, DBNPA, and QACs, currently dominate due to their persistence and efficacy in complex oilfield environments. Application segmentation highlights the critical areas of use: drilling fluids management, hydraulic fracturing water treatment, and long-term production chemicals management, including waterflood and produced water reuse programs. The intense growth in unconventional production has heavily weighted demand toward fracturing water treatment solutions, demanding highly effective, fast-acting, and environmentally compliant products suitable for high-volume use. Geographical segmentation reflects the global E&P landscape, with North America leading due to shale activities and rapid expansion projected in the Asia Pacific region driven by new offshore projects and enhanced regulatory oversight in mature fields.

- By Type:

- Non-oxidizing Biocides (Glutaraldehyde, Quaternary Ammonium Compounds (QACs), DBNPA, Formaldehyde Release Agents, THPS)

- Oxidizing Biocides (Chlorine Dioxide, Hypochlorites, Peracetic Acid (PAA))

- By Application:

- Drilling Fluids and Cementing

- Completion and Workover Fluids

- Hydraulic Fracturing (Frac Water Treatment)

- Produced Water Treatment and EOR (Enhanced Oil Recovery)

- Pipeline and Storage Tank Preservation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Oilfield Biocides Market

The value chain for the Oilfield Biocides Market begins with the upstream segment involving the sourcing and refinement of basic raw materials, which are often commodity chemicals like methanol, ammonia, or fatty amines required for synthesizing complex biocidal agents such as Glutaraldehyde or QACs. Major chemical manufacturers focus on large-scale production, adhering to stringent quality control and regulatory standards (e.g., REACH compliance). This phase is capital-intensive and subject to volatility in petrochemical feedstock pricing. Following synthesis, the products move to specialized formulators who blend, package, and often customize biocide formulations with corrosion inhibitors, scale inhibitors, and surfactants to create synergistic, ready-to-use oilfield products tailored for specific field conditions (e.g., high salinity, high temperature).

The midstream involves the distribution channel, which is highly specialized. Direct sales are common for large, multinational chemical service companies that maintain extensive technical support teams and long-term contracts with major Integrated Oil Companies (IOCs) and National Oil Companies (NOCs). These companies provide not just the chemical product but also essential services like microbial monitoring, dosage optimization, and logistical support. Indirect distribution occurs through regional specialty chemical distributors who cater to smaller, independent E&P companies, providing access to essential chemicals without the need for extensive in-house technical services.

The downstream segment encompasses the final application, where the biocides are injected into drilling rigs, fracturing sites, water treatment facilities, and production pipelines. The efficiency of the final application is heavily reliant on real-time monitoring and correct dosing, often managed by the chemical service providers themselves or specialized field engineers employed by the E&P company. Successful navigation of this value chain demands strong technical expertise, robust logistics to handle hazardous materials, and deep integration with E&P operations to ensure maximum chemical efficacy and compliance with local environmental regulations.

Oilfield Biocides Market Potential Customers

The primary customers for oilfield biocides are organizations actively engaged in the exploration, development, and production of crude oil and natural gas globally. This includes major multinational Integrated Oil Companies (IOCs) such as ExxonMobil, Shell, and Chevron, who require vast quantities of biocides for their extensive global operations, ranging from deepwater drilling to large-scale unconventional shale projects. National Oil Companies (NOCs), including Saudi Aramco, Sinopec, and Petrobras, also represent significant buyers, particularly as they focus on maximizing recovery from mature reservoirs, often utilizing complex enhanced oil recovery (EOR) techniques that necessitate robust microbial control.

Independent Exploration and Production (E&P) companies, especially those focused on shale plays in North America, constitute another major customer segment. These companies drive high-volume demand for biocides specifically tailored for hydraulic fracturing water management, often prioritizing cost-effectiveness and operational turnaround speed. Furthermore, oilfield service companies (like Schlumberger and Halliburton), which manage entire drilling or stimulation contracts, act as significant indirect purchasers, incorporating biocide treatment into their comprehensive service packages offered to the asset owners. Specialized water management companies and pipeline operators also purchase biocides for treating produced water slated for recycling or disposal, and for maintaining the integrity of transmission infrastructure against biological fouling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., BASF SE, Solenis LLC, Ecolab ChampionX, Lonza Group, AkzoNobel N.V., Lubrizol Corporation, Clariant AG, DuPont de Nemours, Inc., Baker Hughes Company, Halliburton, Schlumberger Limited, SUEZ Water Technologies & Solutions, Kemira Oyj, Kurita Water Industries Ltd., Thermax Limited, Veolia Water Technologies, GE Water & Process Technologies, Nalco Water (Ecolab Subsidiary), Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oilfield Biocides Market Key Technology Landscape

The technology landscape of the Oilfield Biocides Market is rapidly evolving, moving beyond traditional, high-dosage chemical treatments towards smarter, safer, and more targeted solutions. A significant technological focus is placed on enhancing the longevity and stability of active chemical ingredients, primarily through encapsulation technologies. Encapsulated biocides are designed to release their active components slowly or upon specific triggers (such as changes in pH or temperature encountered downhole), thereby providing sustained microbial control over extended periods and minimizing the required initial dosage. This controlled release mechanism is particularly valuable in deepwater and extended-reach drilling operations where re-treatment is operationally difficult and costly. Furthermore, encapsulation helps protect the biocide from degradation by other chemicals present in the drilling or fracturing fluid mixture, ensuring maximum efficacy at the point of action.

Another pivotal technological advancement involves the development of environmentally acceptable chemistries (EACs), often termed 'green biocides.' This includes the utilization of peracetic acid (PAA), enzyme-based solutions, and biodegradable quaternary ammonium compounds which meet increasingly rigorous discharge standards, especially in ecologically sensitive offshore and near-shore environments. Research and development efforts are heavily concentrated on designing formulations with lower toxicity profiles and enhanced biodegradability without compromising antimicrobial effectiveness against robust oilfield organisms like sulfate-reducing bacteria (SRB). This shift is driven by regulatory frameworks, notably in the North Sea and parts of North America, which penalize the use of highly persistent or bioaccumulative substances, compelling suppliers to innovate faster-degrading alternatives that maintain operational performance.

Crucially, the integration of advanced monitoring and detection technology is reshaping how biocides are applied. Rapid microbial detection kits utilizing ATP (Adenosine Triphosphate) measurements or quantitative Polymerase Chain Reaction (qPCR) techniques allow operators to quickly assess the microbial load and diversity in real-time. This enables proactive, data-driven decision-making regarding biocide application, moving away from generalized schedules to highly targeted treatments only when necessary. Furthermore, coupling these rapid detection technologies with sophisticated software platforms allows for the optimization of dosing strategies, ensuring chemical efficacy is maximized while the environmental footprint and operational costs associated with unnecessary chemical slugging are minimized, fundamentally improving the efficiency and sustainability of microbial control programs.

Regional Highlights

- North America: Dominates the global market, primarily driven by the prolific hydraulic fracturing activities in U.S. shale plays (e.g., Permian Basin, Eagle Ford, Marcellus). The massive volumes of water utilized and recycled in these operations necessitate stringent and high-volume biocide application, favoring efficient, cost-effective formulations like glutaraldehyde and specialized QACs. Strict environmental regulations surrounding produced water management further bolster demand for sustainable or biodegradable biocide solutions, maintaining the region's position as a technological and consumption leader.

- Asia Pacific (APAC): Exhibits the highest projected growth rate, fueled by escalating energy demand, substantial offshore exploration in the South China Sea and Indian Ocean, and increased investment in EOR projects, particularly in China, India, and Indonesia. The development of mature offshore assets often involves waterflood systems highly susceptible to MIC and souring, generating significant demand for both conventional and advanced biocide treatments. Growing awareness of asset integrity and increasing regulatory oversight are professionalizing the approach to microbial control across the region.

- Europe: Characterized by highly stringent environmental regulations, particularly in the North Sea (UK, Norway). The market here is defined by a strong preference for highly biodegradable and low-toxicity biocide formulations, such as those based on Peracetic Acid (PAA) and other eco-friendly chemistries. Although E&P activity is mature or declining in some areas, the focus on decommissioning and maintaining existing pipeline infrastructure still requires substantial microbial protection, driving innovation toward compliance-focused products.

- Middle East and Africa (MEA): Represents a stable and robust market, dominated by large-scale conventional oil production and complex reservoir management by NOCs (Saudi Aramco, ADNOC). Demand is primarily focused on controlling reservoir souring and protecting large water injection systems integral to EOR projects. The preference often leans towards proven, stable biocide chemistries that can handle the region’s high-temperature, high-salinity conditions, with increasing investment in advanced monitoring technologies to optimize existing chemical programs.

- Latin America (LATAM): Growth is primarily concentrated in Brazil (pre-salt offshore) and Mexico. Deepwater operations necessitate robust biocide solutions for corrosion prevention. Economic fluctuations and state-controlled E&P policies sometimes affect the pace of adoption, but the long-term need for microbial control in complex deepwater assets ensures consistent demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oilfield Biocides Market.- Dow Inc.

- BASF SE

- Solenis LLC

- Ecolab ChampionX

- Lonza Group

- AkzoNobel N.V.

- Lubrizol Corporation

- Clariant AG

- DuPont de Nemours, Inc.

- Baker Hughes Company

- Halliburton

- Schlumberger Limited

- SUEZ Water Technologies & Solutions

- Kemira Oyj

- Kurita Water Industries Ltd.

- Thermax Limited

- Veolia Water Technologies

- GE Water & Process Technologies

- Nalco Water (Ecolab Subsidiary)

Frequently Asked Questions

Analyze common user questions about the Oilfield Biocides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of biocides used in oilfield operations?

Oilfield operations primarily utilize two types: Non-oxidizing biocides (e.g., Glutaraldehyde, QACs, DBNPA), which disrupt microbial metabolism, and Oxidizing biocides (e.g., Chlorine Dioxide, PAA), which destroy microbes via oxidation. Non-oxidizing types are generally preferred for downhole applications due to better stability in corrosive, high-salinity environments.

How does the increasing trend of produced water recycling affect biocide demand?

Produced water recycling significantly increases biocide demand. Recycling necessitates treating large volumes of water to eliminate bacteria, prevent scaling, and mitigate microbial induced corrosion (MIC) before reuse in hydraulic fracturing or injection wells, driving the market toward highly effective, non-interfering, and cost-efficient treatment chemicals.

Which application segment holds the largest market share for oilfield biocides?

Hydraulic fracturing water treatment and associated produced water management currently account for the largest market share. This dominance is due to the large volumes of water needing sterilization in unconventional shale plays to prevent reservoir damage and equipment corrosion, making microbial control a central operational requirement.

What are the main environmental concerns associated with oilfield biocide usage?

The main concerns revolve around the toxicity and persistence of chemical residuals when discharged into the environment, particularly in offshore settings. Regulatory bodies are pushing the industry towards biodegradable and environmentally acceptable chemistries (EACs) to mitigate potential ecological impacts and bioaccumulation risks.

How is technology improving the efficiency of biocide treatments?

Technology is improving efficiency through two main avenues: the development of controlled-release (encapsulated) biocide formulations for sustained effectiveness, and the integration of rapid microbial detection (qPCR, ATP testing) and AI-driven monitoring systems to facilitate precise, optimized, and demand-based dosing, reducing waste and cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager