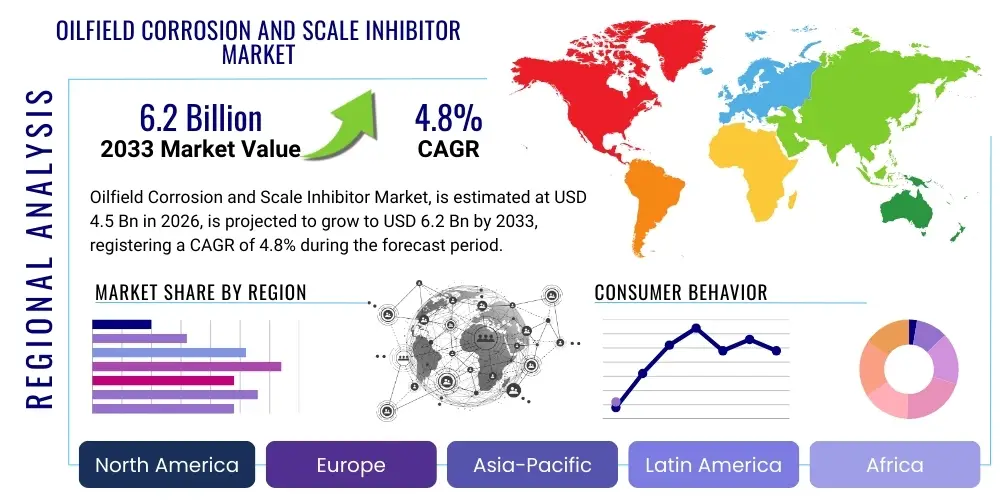

Oilfield Corrosion and Scale Inhibitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438510 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Oilfield Corrosion and Scale Inhibitor Market Size

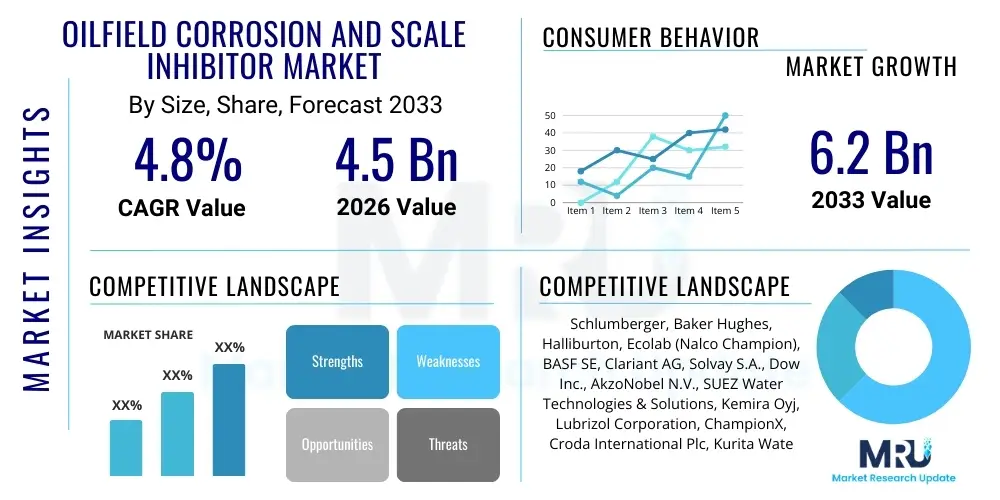

The Oilfield Corrosion and Scale Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.2 billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating global demand for crude oil and natural gas, necessitating increased exploration and production activities, particularly in technically challenging environments such as deepwater and mature fields. Maintaining the integrity of expensive oilfield assets, including drilling tools, pipelines, and processing facilities, is paramount, making corrosion and scale management a critical operational expenditure. The economic implications of equipment failure due to deterioration significantly boost the adoption rate of specialized chemical solutions.

The valuation reflects the increasing complexity of hydrocarbon reservoirs, which often contain higher concentrations of corrosive elements like carbon dioxide, hydrogen sulfide, and various organic acids, alongside brine that exacerbates scaling issues. Operators are moving away from reactive maintenance towards proactive chemical dosing and monitoring programs to minimize downtime and extend asset lifespan. Furthermore, stringent safety and environmental regulations imposed by governmental bodies globally are accelerating the shift towards high-performance, environmentally acceptable corrosion and scale inhibitors (EACIs), particularly those offering improved biodegradability and lower toxicity profiles, thereby contributing substantially to the market's value proposition and sustained growth trajectory across all operational segments.

Oilfield Corrosion and Scale Inhibitor Market introduction

The Oilfield Corrosion and Scale Inhibitor Market encompasses specialized chemical formulations designed to protect equipment and infrastructure used in oil and gas exploration, production, and processing from deterioration caused by aggressive fluids and extreme operating conditions. These essential chemical products mitigate two primary threats: corrosion, typically resulting from interactions with water, dissolved gases (CO2, H2S), and organic acids, which degrades metallic components; and scale, which involves the precipitation and deposition of mineral salts (e.g., calcium carbonate, barium sulfate) onto surfaces, leading to blockages and reduced flow efficiency. The inhibitors are crucial for maintaining asset integrity, ensuring operational safety, and maximizing hydrocarbon recovery rates across the entire spectrum of oilfield activities, from downhole operations to surface facilities and transportation pipelines.

Major applications span drilling, completion, production, enhanced oil recovery (EOR), and water management, where these chemicals are injected continuously or in batches to form a protective layer on metallic surfaces or to interfere with the crystallization process of scale-forming minerals. The primary benefits derived from the consistent use of these inhibitors include the prevention of catastrophic equipment failure, substantial reduction in maintenance and replacement costs, minimization of production downtime, and optimization of energy consumption associated with fluid transfer. The formulations are diverse, incorporating compounds such as imidazolines, quaternary ammonium salts, phosphonates, and polymers, tailored to specific temperature, pressure, and fluid chemistry profiles encountered in diverse operational settings worldwide.

Driving factors for this market include the global expansion of unconventional drilling techniques, the increasing average age of existing oilfield infrastructure which requires intensified protection measures, and the growing operational emphasis on deepwater and ultra-deepwater projects where conditions are highly severe and corrosive. Additionally, the shift towards utilizing recycled and produced water in hydraulic fracturing and EOR operations introduces complex water chemistry challenges, amplifying the need for sophisticated scale management solutions. Regulatory pressures pushing for greater environmental stewardship are simultaneously driving innovation toward high-performance, green chemistry alternatives that comply with strict discharge limits in sensitive ecological areas.

Oilfield Corrosion and Scale Inhibitor Market Executive Summary

The Oilfield Corrosion and Scale Inhibitor Market is characterized by robust resilience, driven by non-negotiable requirements for asset preservation and regulatory compliance within the global energy sector. Business trends indicate a strong move towards specialization and performance enhancement, with major chemical providers focusing heavily on developing multifunctional inhibitors that address both corrosion and scale simultaneously, optimized for severe service conditions in deep reservoirs and high-pressure/high-temperature (HPHT) environments. Mergers and acquisitions remain pivotal, allowing companies to consolidate technical expertise and expand geographical reach, particularly into rapidly developing frontier markets. A significant strategic pivot involves integrating digital monitoring and real-time chemical injection systems, transforming chemical treatment from a batch process into a dynamic, data-driven service model designed to minimize chemical overuse and environmental impact.

Regional trends highlight the Middle East and Africa (MEA) and North America as dominant market segments. MEA benefits from massive investments in mega-projects and aging infrastructure requiring extensive protection, supported by National Oil Companies (NOCs) prioritizing long-term field maintenance. North America, especially the US shale plays, drives demand for highly efficient, low-dosage inhibitors suited for high-volume hydraulic fracturing and horizontal drilling environments, characterized by complex water management needs. Asia Pacific is emerging as the fastest-growing region, fueled by expanding exploration activities in offshore areas like the South China Sea and heavy investment in refinery and petrochemical infrastructure, which requires comprehensive corrosion management.

Segment trends emphasize the escalating importance of environmentally acceptable chemical formulations (EACs), primarily within the Production application segment, which commands the largest market share due to the continuous nature of required treatments throughout the life of a well. The chemical type segmentation sees phosphonates and polymers maintaining leadership in scale inhibition due to their efficacy and cost-effectiveness, while the corrosion inhibitor segment is heavily influenced by advanced amine and imidazoline derivatives offering superior temperature stability and film persistence. The offshore segment presents particularly high-value opportunities due to the premium cost associated with intervention and replacement in marine environments, favoring premium-priced, high-performance chemical solutions optimized for minimal environmental impact.

AI Impact Analysis on Oilfield Corrosion and Scale Inhibitor Market

Common user questions regarding AI's influence in the oilfield chemical sector revolve around predictability, optimization, and material discovery. Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can predict the onset of corrosion or scale deposition before they become critical issues, thereby allowing for proactive chemical treatment adjustments. Key concerns focus on the accuracy of predictive models, the integration of diverse sensor data (pressure, temperature, flow, chemical concentration), and the potential for AI algorithms to automatically optimize inhibitor dosage, ensuring maximum protection while minimizing chemical costs and environmental loading. There is also significant interest in AI's role in accelerating the research and development pipeline for novel, high-efficacy, and environmentally friendly inhibitor molecules by simulating complex chemical interactions and screening candidates far faster than traditional laboratory methods.

- AI enables highly accurate predictive maintenance models for asset integrity management, forecasting corrosion rates based on real-time operational and environmental variables.

- Machine Learning algorithms optimize inhibitor injection rates and locations, leading to significant reductions in chemical consumption (typically 10-20% savings) and operational expenditure.

- AI facilitates automated analysis of water chemistry and produced fluid composition, allowing for dynamic adjustment of chemical selection and formulation dosage in complex multi-phase systems.

- Generative AI models accelerate the discovery and synthesis of novel inhibitor molecules by simulating molecular structures and predicting performance and toxicity profiles.

- Real-time data integration via AI enhances the effectiveness of digital twins, providing a comprehensive virtual representation of the asset and its chemical protection status.

DRO & Impact Forces Of Oilfield Corrosion and Scale Inhibitor Market

The dynamics of the Oilfield Corrosion and Scale Inhibitor Market are shaped by a powerful interplay of operational necessities, technological advancements, and regulatory constraints. Key drivers include the critical need to preserve multi-billion dollar oilfield assets from premature failure, which mandates the continuous application of inhibitors. The global push for enhanced oil recovery (EOR) techniques, which often involves injecting complex fluid mixtures that increase the corrosivity and scaling potential of reservoir fluids, further accelerates demand. Moreover, the increasing average age of global oil and gas infrastructure, particularly aging pipelines and legacy facilities, necessitates aggressive and advanced chemical protection strategies to ensure extended operational life and safety compliance. These factors collectively create a captive and expanding demand base for specialized chemical solutions.

Restraints primarily stem from external volatility and regulatory complexity. Fluctuations in global crude oil prices directly impact capital expenditure (CAPEX) and operational expenditure (OPEX) budgets of E&P companies, leading to potential deferrals or reductions in chemical treatment programs during prolonged downturns. Furthermore, the market faces increasing pressure from stringent environmental regulations, particularly concerning the use and discharge of chemical products into sensitive marine environments. This regulatory scrutiny demands costly and time-consuming reformulation efforts to develop less toxic, more biodegradable inhibitors, which can initially increase product costs and manufacturing complexity, potentially slowing adoption rates for established, less environmentally compliant products.

Opportunities for market expansion are abundant, particularly in the convergence of green chemistry and digital technologies. The development of high-performance, bio-based and non-toxic inhibitors represents a significant growth pathway, appealing to companies aiming for net-zero operational footprints and compliance with evolving legislation like REACH in Europe and similar mandates globally. Digitalization offers opportunities for service providers to transition toward offering integrated chemical monitoring and predictive analytics services, generating higher-margin revenue streams. Impact forces, such as technological innovation in smart inhibitors (chemicals responsive to environmental changes) and continuous pressure from regulators to adopt best available techniques (BAT) for environmental protection, fundamentally reshape the competitive landscape, favoring companies that invest heavily in research and development and possess strong technical service capabilities.

Segmentation Analysis

The Oilfield Corrosion and Scale Inhibitor Market is highly differentiated based on chemical composition, functional mechanism, and end-use application, allowing for precise targeting of solutions to specific operational challenges. Segmentation provides a framework for analyzing market dynamics, revealing that the production phase application consistently represents the largest segment due to the requirement for long-term, continuous chemical injection throughout the well's lifespan. Geographically, regions with extensive deepwater and mature fields, such as the Middle East and Gulf of Mexico, drive demand for specialized, high-temperature, and high-pressure tolerant formulations. The distinction between corrosion and scale inhibitors dictates the primary technology focus, with corrosion inhibitors typically commanding a higher price point due to the critical nature of asset protection, while scale inhibitors address high-volume water management issues integral to production sustainability.

- By Type:

- Corrosion Inhibitors (Oxygen Scavengers, Filming Amines, Imidazoline Derivatives, Quaternary Ammonium Compounds)

- Scale Inhibitors (Phosphonates, Phosphinocarboxylic Acids (PCA), Polymeric Inhibitors (Polyacrylates, Copolymers), Chelating Agents)

- By Application:

- Drilling and Completion

- Production and Stimulation (Largest Segment)

- Water Treatment and Management

- Pipeline and Transportation

- Refining and Processing

- By End-Use Location:

- Onshore Applications (Shale Gas, Conventional Land-based Wells)

- Offshore Applications (Shallow Water, Deepwater, Ultra-Deepwater)

Value Chain Analysis For Oilfield Corrosion and Scale Inhibitor Market

The value chain for oilfield corrosion and scale inhibitors is complex and highly specialized, beginning with the upstream supply of fundamental raw materials. This includes basic commodity chemicals such as ethylene amines, fatty acids, phosphonic acid derivatives, and various monomers used in polymer synthesis, sourced from major petrochemical producers. The pricing and availability of these upstream inputs directly influence the manufacturing costs and profit margins of the specialized chemical companies. Since many of these materials are oil or gas derivatives, price volatility in the energy market can introduce cost pressures throughout the entire chain. Quality control at this initial stage is paramount, as the purity of raw materials dictates the final performance efficacy and environmental compliance of the formulated inhibitors.

The central stage of the value chain is occupied by specialized chemical manufacturers and formulators. These entities invest heavily in research and development to create proprietary chemical blends tailored for extreme operational environments (e.g., HPHT, high brine content). Their expertise lies in precise formulation, blending, and quality assurance, ensuring the products meet strict industry performance standards (e.g., NACE standards) and regulatory requirements (e.g., OSPAR limits). Distribution channels are critical downstream components. Due to the technical nature of these products and the need for localized technical support, distribution is often handled directly by major global service companies or through a network of specialized, regional chemical distributors who maintain local inventories and provide essential technical services, including application monitoring and dosage recommendations.

The final segment involves the end-users—primarily international oil companies (IOCs), national oil companies (NOCs), and independent exploration and production (E&P) firms. These buyers demand not just the chemicals, but also comprehensive technical service packages, including continuous monitoring, predictive modeling, and troubleshooting support. Direct sales routes are common for high-volume, long-term contracts with major IOCs, facilitating deep collaborative relationships for customized chemical programs. Indirect sales through oilfield service providers integrate chemical supply into broader service contracts, such as cementing, completion, or stimulation. Effective knowledge transfer and technical consulting at this downstream level are crucial differentiators, ensuring optimized chemical performance and maximum return on investment for the operator.

Oilfield Corrosion and Scale Inhibitor Market Potential Customers

The primary customers for oilfield corrosion and scale inhibitors are entities directly involved in the exploration, extraction, transportation, and initial processing of hydrocarbons. This group is broadly segmented into three main categories: International Oil Companies (IOCs) such as ExxonMobil, Shell, and TotalEnergies; National Oil Companies (NOCs) like Saudi Aramco, ADNOC, and CNPC; and independent Exploration and Production (E&P) companies. These organizations purchase inhibitors as critical operational consumables required to maintain the safety, functionality, and longevity of their substantial asset base, which includes drilling rigs, offshore platforms, subsea manifolds, thousands of kilometers of pipelines, and large processing facilities. For these end-users, the consistent, reliable supply of high-performance chemical treatments is a core necessity for maintaining continuous production flow and regulatory compliance.

A second major customer segment includes oilfield service providers (OFS), such as Schlumberger, Baker Hughes, and Halliburton. While these companies sometimes manufacture their own chemical lines, they also frequently procure specialized inhibitor formulations from third-party chemical experts to integrate into their comprehensive service offerings, particularly for complex drilling, cementing, and well stimulation jobs. By incorporating sophisticated chemical solutions, OFS companies enhance the efficacy and safety profile of their overall service packages, making them more attractive to E&P clients. The selection process is driven by chemical compatibility with other drilling fluids and the ability of the inhibitor to perform reliably under the specific extreme conditions of the wellbore.

Furthermore, midstream and refining companies constitute an important customer base, especially those responsible for long-distance pipeline transmission and crude oil processing. Midstream operators require robust corrosion inhibitors to protect trunk lines from degradation caused by multi-phase flow and varying fluid characteristics. Refineries utilize specialized scale and corrosion inhibitors in heat exchangers, distillation columns, and water cooling systems to prevent fouling and maximize efficiency. The purchasing decision in these segments is highly focused on long-term cost-of-ownership, environmental standards adherence, and the proven ability of the chemicals to perform under continuous high-throughput operations with minimal intervention required.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.2 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Ecolab (Nalco Champion), BASF SE, Clariant AG, Solvay S.A., Dow Inc., AkzoNobel N.V., SUEZ Water Technologies & Solutions, Kemira Oyj, Lubrizol Corporation, ChampionX, Croda International Plc, Kurita Water Industries Ltd., Innospec Inc., Tenaris S.A., TCI Chemicals (India) Pvt. Ltd., Flotek Industries, Inc., Dorf Ketal Chemicals India Private Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oilfield Corrosion and Scale Inhibitor Market Key Technology Landscape

The technology landscape for oilfield corrosion and scale inhibitors is rapidly evolving, moving beyond conventional chemical formulations towards intelligent, sustainable, and highly efficient systems. A central focus is placed on Green Chemistry principles, leading to the development of Environmentally Acceptable Chemicals (EACs). This includes designing inhibitors that are inherently less toxic, readily biodegradable, and comply with stringent international standards like OSPAR regulations for offshore discharge. Significant technological innovation involves replacing traditional heavy metal-based components with novel chemistries, such as specialized polymers and modified natural compounds, which offer comparable or superior protection while minimizing ecological impact. This technological shift requires substantial investment in molecular modeling and toxicology testing to validate performance and safety credentials.

Another pivotal technological advancement is the integration of digitalization and smart chemical delivery systems. This involves utilizing IoT sensors and real-time monitoring tools—including linear polarization resistance (LPR) probes, electrical resistance (ER) probes, and sophisticated chemical tracers—to continuously assess corrosion rates and scale deposition in pipelines and downhole. The data gathered is then fed into AI/ML models to create predictive failure indices and automatically adjust the dosage of chemical inhibitors via smart injection systems. This shift transforms chemical treatment from periodic guesswork to precise, condition-based maintenance, significantly improving efficacy and reducing chemical waste, which is particularly vital in geographically dispersed or remote operational sites.

Furthermore, advancements in materials science are leading to the proliferation of smart or responsive inhibitors. These are chemicals engineered to activate or enhance their protective properties only when specific triggers are present, such as changes in pH, temperature, or the concentration of a corrosive agent (e.g., H2S). Encapsulated or delayed-release systems represent another frontier, ensuring that the inhibitor reaches the precise target area (e.g., deep into a high-temperature zone) before dissolving, providing long-lasting protection with a single treatment. The convergence of nanotechnology with traditional inhibitor chemistry is also being explored to develop nano-scale protective films that offer enhanced barrier properties and durability against harsh environments, promising extended periods between required treatments and reduced overall operational expenditure.

Regional Highlights

- Middle East & Africa (MEA): This region dominates the market due to the high volume of crude oil production, reliance on aging super-fields (requiring continuous, aggressive protection), and substantial ongoing investments in major expansion projects, especially in Saudi Arabia, the UAE, and Qatar. MEA operations, particularly those managed by NOCs, demand reliable, high-specification inhibitors suitable for high-salinity and high-temperature environments.

- North America: Driven by the dynamic nature of unconventional resource extraction (shale gas and tight oil), North America shows robust demand for sophisticated scale inhibitors, primarily for managing the vast volumes of produced and flowback water associated with hydraulic fracturing. The region also exhibits a high adoption rate of digital monitoring solutions and specialized corrosion inhibitors for complex horizontal well geometries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising energy consumption and increasing E&P activity in countries like China, India, and Australia. Significant investments in offshore Vietnam and Indonesia, coupled with the expansion of petrochemical infrastructure, drive the demand for both protective and processing chemicals, emphasizing the need for cost-effective, regionally manufactured solutions.

- Europe: The market in Europe is mature but highly specialized, characterized by stringent environmental regulations (especially in the North Sea). Demand is focused heavily on high-performance, environmentally friendly, and biodegradable inhibitors (EACs). Decommissioning and late-life asset management also contribute to sustained, though stable, chemical demand.

- Latin America: This region, particularly Brazil (deepwater Pre-Salt fields) and Mexico, presents critical technical challenges related to high pressure, deep water, and significant CO2/H2S content. This drives demand for premium, highly effective corrosion control and flow assurance chemicals, often supplied under long-term service contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oilfield Corrosion and Scale Inhibitor Market.- Schlumberger (SLB)

- Baker Hughes Company

- Halliburton

- Ecolab (Nalco Champion)

- BASF SE

- Clariant AG

- Solvay S.A.

- Dow Inc.

- AkzoNobel N.V.

- SUEZ Water Technologies & Solutions

- Kemira Oyj

- Lubrizol Corporation (A Berkshire Hathaway Company)

- ChampionX (Previously Apergy Corporation)

- Croda International Plc

- Kurita Water Industries Ltd.

- Innospec Inc.

- Tenaris S.A.

- TCI Chemicals (India) Pvt. Ltd.

- Flotek Industries, Inc.

- Dorf Ketal Chemicals India Private Limited

Frequently Asked Questions

Analyze common user questions about the Oilfield Corrosion and Scale Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Environmentally Acceptable Chemicals (EACs) and how are they impacting the market?

EACs are low-toxicity, biodegradable chemical formulations designed to meet strict regulatory standards, such as OSPAR requirements, for discharge into marine environments. Their growing mandate, particularly in offshore and sensitive areas, is forcing manufacturers to phase out older, non-compliant chemistries, driving significant R&D investment and reshaping the supply chain towards sustainable green chemistry solutions, often at a premium cost.

How do volatile oil prices influence the adoption and usage rates of these inhibitors?

Volatile oil prices introduce budgetary instability. During downturns, operators often prioritize minimizing OPEX, potentially reducing chemical injection rates or deferring necessary maintenance, which risks asset integrity. However, consistent production demands and the high cost of catastrophic failure often necessitate baseline usage, stabilizing demand for core inhibitor products despite short-term fluctuations.

What is the primary technical difference between corrosion and scale inhibition?

Corrosion inhibition involves applying a chemical film (e.g., filming amines) to create a barrier between the metallic surface and corrosive fluids (H2O, H2S, CO2). Scale inhibition focuses on managing mineral deposition (e.g., barium sulfate, calcium carbonate) by using threshold or crystal distortion mechanisms (via phosphonates or polymers) to prevent mineral precipitation and blockage in pipelines and downhole equipment.

Which application segment holds the largest share of the Oilfield Corrosion and Scale Inhibitor Market?

The Production and Stimulation application segment accounts for the largest market share. This is due to the continuous and long-term requirement for chemical injection throughout the productive life of an oil or gas well to ensure sustained flow assurance, protect complex downhole equipment, and manage produced water challenges inherent in prolonged extraction activities.

What role does digitalization play in optimizing inhibitor performance in the field?

Digitalization leverages IoT sensors, real-time data analytics, and Artificial Intelligence (AI) to monitor corrosive conditions and predict scaling potential dynamically. This enables precise, automated adjustments to chemical dosage and injection timing, moving away from scheduled batch treatments to condition-based treatment, significantly reducing chemical consumption, optimizing performance, and lowering associated environmental impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager