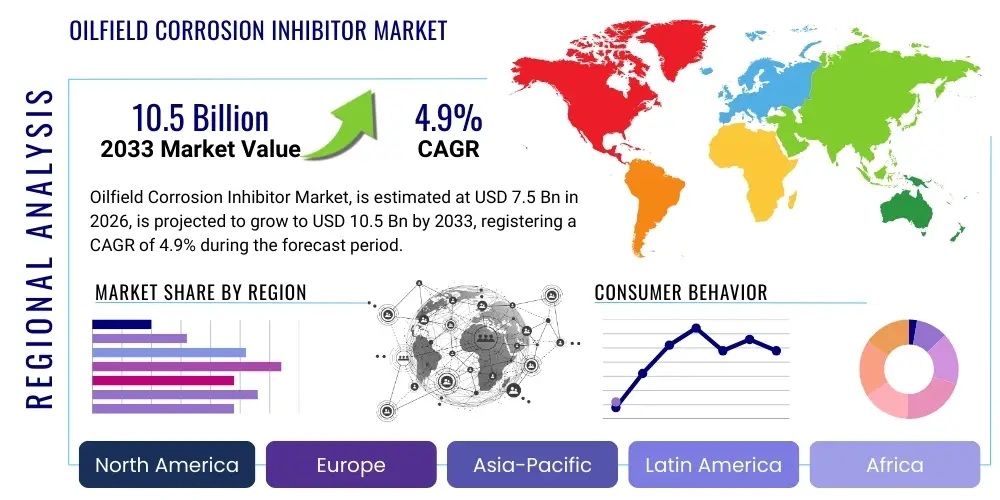

Oilfield Corrosion Inhibitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434969 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Oilfield Corrosion Inhibitor Market Size

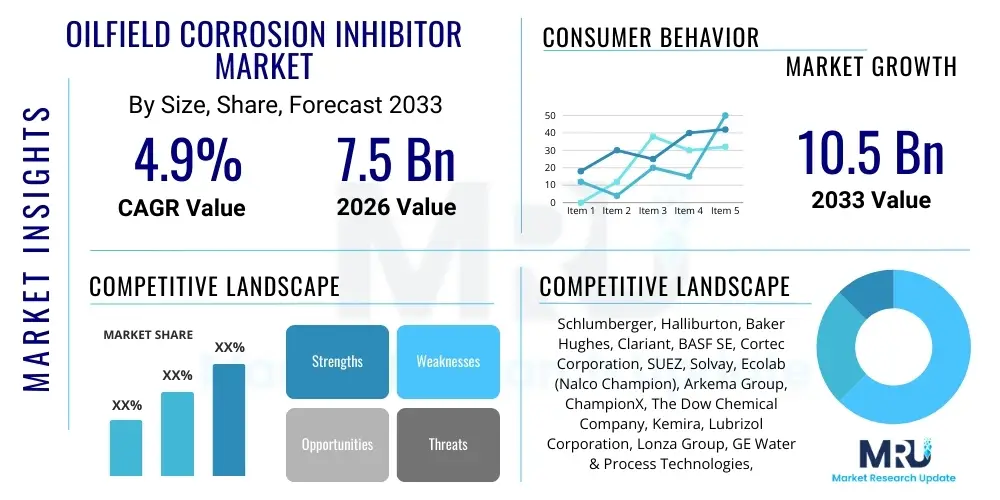

The Oilfield Corrosion Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.9% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing age of existing oil and gas infrastructure globally, which necessitates continuous maintenance and protective measures against aggressive corrosive environments inherent in hydrocarbon extraction and transport. Deepwater and ultra-deepwater drilling activities, characterized by high temperatures, elevated pressures, and high concentrations of H2S and CO2, further amplify the demand for high-performance and environmentally compliant corrosion inhibition solutions.

The imperative to maximize recovery rates from mature fields necessitates enhanced oil recovery (EOR) techniques, which often introduce complex chemical mixtures and increase operational stress on pipelines and equipment. Corrosion inhibitors are critical in mitigating equipment failure, preventing costly downtime, and ensuring the structural integrity of assets, thereby directly impacting the economic viability and safety of exploration and production (E&P) activities. Furthermore, stricter environmental regulations concerning the use of conventional chemical inhibitors are fueling innovation toward greener, biodegradable, and less toxic formulations, positioning novel chemistry as a significant growth catalyst in the forecast period.

Oilfield Corrosion Inhibitor Market introduction

The Oilfield Corrosion Inhibitor Market encompasses specialized chemical compounds designed to protect metallic surfaces of oil and gas infrastructure—including pipelines, drilling rigs, storage tanks, and production vessels—from degradation caused by corrosive agents such as hydrogen sulfide (H2S), carbon dioxide (CO2), organic acids, and produced water containing various salts. These inhibitors function by forming a protective film or barrier on the metal surface, effectively slowing down the electrochemical corrosion process. The key products include oxygen scavengers, filming amines, quaternary ammonium salts, and phosphonates, tailored for specific application environments such as drilling, cementing, production, and processing segments. Major applications span across upstream E&P operations, midstream pipeline transportation, and downstream refining processes, ensuring asset longevity and operational safety across the entire hydrocarbon value chain.

The primary benefits of utilizing advanced corrosion inhibitors include significant reduction in capital expenditure associated with equipment replacement, minimization of non-productive time (NPT), and enhanced environmental compliance by preventing leaks and spills. Driving factors for market growth are multifaceted, rooted in the aggressive nature of sour gas reserves, the global increase in drilling activities in challenging environments, and the economic pressure on operators to extend the lifespan of aging infrastructure. The global shift towards deeper and more technically demanding reservoirs necessitates highly stable and efficient chemical treatments capable of performing under extreme conditions of temperature and pressure, thereby continually pushing the boundaries of chemical R&D.

Moreover, the increasing focus on shale gas extraction and unconventional resources, which often involve complex fluid dynamics and the presence of highly acidic environments, reinforces the crucial role of chemical protection. The industry is currently witnessing a transition towards 'smart chemistry'—inhibitors that can be monitored in real-time and adjusted based on fluid conditions—improving efficiency and reducing chemical overuse. Regulatory mandates across regions such as North America and Europe, requiring stringent integrity management systems for infrastructure, further institutionalize the demand for reliable corrosion inhibition programs, making them an indispensable operational expense rather than a discretionary chemical treatment.

Oilfield Corrosion Inhibitor Market Executive Summary

The Oilfield Corrosion Inhibitor Market is characterized by robust business trends driven by digitalization in monitoring and the shift towards sustainable chemistry. Major industry players are focusing on developing biodegradable and non-toxic inhibitor formulations to meet increasingly strict environmental regulations, especially in offshore and sensitive ecological zones. Strategic collaborations between chemical suppliers and major oilfield service providers are intensifying, leading to integrated chemical management solutions that offer end-to-end asset integrity services. Furthermore, economic pressures on operators globally are spurring demand for multi-functional inhibitors that can address scale deposition and microbial corrosion alongside standard metal protection, maximizing the value derived from each chemical application. Advanced deployment methods, including continuous injection systems and batch treatments optimized through sophisticated simulation, are key operational trends.

Regionally, North America remains the dominant market due to extensive unconventional drilling (shale oil and gas) requiring specialized corrosion control in highly complex well architectures and high-volume water usage. Asia Pacific is emerging as the fastest-growing region, fueled by massive offshore investments in countries like China, India, and Malaysia, coupled with rapidly expanding midstream infrastructure development. The Middle East continues to be a crucial consumer, given the prevalence of sour gas reserves (high H2S content) that necessitate high-performance, heat-stable inhibitors. Regional trends indicate heightened investment in localized R&D centers in MEA and APAC to customize formulations for unique reservoir chemistries.

Segment trends highlight the dominance of the oil-soluble segment, primarily utilized in downhole and crude oil transport applications, though the water-soluble segment is growing rapidly due to increased produced water handling and EOR operations. In terms of application, the production and transport segment accounts for the largest market share, driven by the vast network of existing pipelines vulnerable to long-term degradation. The growth in specialized application segments, such as acidizing and fracturing fluid additives, demonstrates the increasing chemical complexity of modern well treatments. Amine-based inhibitors maintain their traditional lead due to effectiveness, but phosphate and quaternary ammonium compounds are gaining traction, especially in scenarios requiring enhanced microbial control and scale inhibition capabilities.

AI Impact Analysis on Oilfield Corrosion Inhibitor Market

User queries concerning AI's role in the Oilfield Corrosion Inhibitor Market primarily revolve around predictive maintenance, optimization of chemical dosing, and the use of machine learning (ML) for material selection and failure prediction. Key themes center on the potential for AI algorithms to analyze vast streams of sensor data—such as flow rates, pH levels, temperature, and inhibitor residual concentrations—to forecast corrosion rates accurately. Users seek to understand how AI can transition corrosion management from reactive or scheduled treatments to precise, condition-based treatments, thereby reducing chemical expenditure and environmental footprint while simultaneously improving asset uptime. Concerns often focus on data quality requirements, the initial investment in IoT infrastructure, and the complexity of integrating diverse legacy monitoring systems with sophisticated ML platforms capable of handling the highly complex, multi-phase fluid dynamics typical of oilfield environments.

AI and Machine Learning (ML) are fundamentally transforming corrosion management practices by enabling real-time monitoring and predictive modeling. Traditionally, inhibitor dosing relied on periodic sampling, leading to periods of under-treatment (risk of corrosion) or over-treatment (chemical waste). AI systems utilize predictive analytics applied to sensor data from downhole tools and topside facilities to create digital twins of pipeline systems. These models can instantaneously calculate the optimal inhibitor dosage required to maintain the protection film thickness, dynamically adjusting injection rates based on changing environmental conditions like variations in water cut or gas composition. This precision enhances chemical efficiency by 15-25% and significantly extends the service life of critical infrastructure.

Furthermore, advanced computer vision coupled with deep learning is being utilized during pipeline inspection gauges (PIGs) runs. AI algorithms rapidly process high-resolution inspection data to identify subtle signs of pitting and wall thinning much faster and more reliably than human analysis. This capability allows operators to pinpoint vulnerable sections requiring localized repair or intensified chemical attention before a critical failure occurs. The adoption of AI-driven control systems also supports the transition to 'smart inhibitors' by managing the complex interactions between multi-functional chemical packages and reservoir fluids, providing immediate feedback on efficacy and integrity status, thereby moving the industry toward truly proactive asset integrity management.

- AI-powered predictive corrosion modeling reduces unscheduled downtime by forecasting failure points.

- Machine learning optimizes chemical injection rates based on real-time flow and fluid composition data, ensuring AEO (Application Efficiency Optimization).

- IoT sensors and AI integrate to provide continuous monitoring of inhibitor residuals and film persistence.

- AI aids in processing non-destructive testing (NDT) data for automated defect detection in pipelines and vessels.

- Advanced robotics utilizing computer vision for inspections are guided by AI to focus on high-risk corrosion zones.

- Digital twin technology simulates inhibitor performance under varying pressure and temperature conditions.

DRO & Impact Forces Of Oilfield Corrosion Inhibitor Market

The market is significantly driven by the continuous global investment in upstream oil and gas production, particularly in harsh environments like deepwater and ultra-deepwater, which inherently pose higher corrosion risks due to extreme operating parameters. The aging global infrastructure necessitates sustained maintenance expenditure to prevent catastrophic failures, acting as a structural driver for consistent inhibitor demand. Restraints include the volatility of crude oil prices, which directly impacts E&P spending and can lead to immediate cuts in chemical consumption during downturns. Additionally, increasingly stringent environmental regulations, particularly regarding chemical discharge and toxicity, challenge manufacturers to reformulate products, increasing R&D costs and potentially limiting the applicability of established, cost-effective chemistries. Opportunities lie primarily in the development and commercialization of next-generation, environmentally friendly (green) inhibitors and the integration of digital solutions (AI/IoT) for precise dosing and monitoring, offering added value and efficiency gains to operators.

Key impact forces include technological advancements in inhibitor synthesis, particularly the rise of highly effective, low-dosage chemical formulations that offer better cost-performance ratios. Regulatory shifts, such as the implementation of stricter guidelines by organizations like the European Chemicals Agency (ECHA) and national environmental bodies, strongly influence material selection and market entry. Furthermore, the geopolitical landscape, affecting energy trade and supply chain stability, indirectly impacts the market by influencing global drilling budgets. The substitution force is low, as chemical corrosion inhibition remains the most technically viable and cost-effective method for widespread asset protection, although material science advancements (e.g., highly corrosion-resistant alloys) pose a long-term, specialized threat in certain high-cost applications.

Segmentation Analysis

The Oilfield Corrosion Inhibitor Market is rigorously segmented based on product type, application, compound composition, and geography to cater to the diverse and complex operational requirements of the oil and gas industry. Segmentation allows stakeholders to accurately gauge demand dynamics and technological shifts within specific operational niches, such as high-temperature drilling or sour gas production. The composition segment, for instance, distinguishes between established chemistries like amine-based inhibitors and emerging, more sustainable alternatives like ionic liquids or certain specialized biodegradable polymers. This delineation is critical for compliance and performance targeting. The application segmentation, ranging from drilling fluids to pipeline integrity management, reflects the varied exposure scenarios and required inhibitor properties, where an inhibitor for a drilling mud must withstand shearing and temperature, while a production inhibitor must persist in a multi-phase fluid stream.

The most significant market segment by volume remains the production and processing applications, driven by the sheer scale of operational assets and the continuous exposure to corrosive produced fluids over decades. However, the drilling and completion segment exhibits faster growth, fueled by the complexity and depth of modern wells, demanding high-performance treatments to protect specialized tools and casing materials during the short but intense drilling phase. Geographically, the market is highly fragmented but centered around key hydrocarbon basins, with regional regulatory frameworks dictating the permissible chemistry, particularly influencing the preference for water-soluble versus oil-soluble formulations. Understanding these segment dynamics is paramount for developing targeted marketing strategies and optimizing global supply chain logistics.

- By Type:

- Oil-Soluble Corrosion Inhibitors

- Water-Soluble Corrosion Inhibitors

- Dual-Action Corrosion Inhibitors

- By Compound:

- Amine-Based (e.g., Imidazolines, Fatty Amines)

- Phosphate and Phosphonate Compounds

- Quaternary Ammonium Compounds

- Oxygen Scavengers (e.g., Sulfites, Hydrazine)

- Other Organic Compounds (e.g., Mercaptans, Polymers)

- By Application:

- Drilling and Completion Fluids

- Production and Processing (Downhole and Topside)

- Pipeline and Transportation Integrity Management

- Acidizing and Fracturing Fluids

- Water Treatment and EOR Operations

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Norway, UK, Russia)

- Asia Pacific (China, Australia, Indonesia)

- Latin America (Brazil, Argentina)

- Middle East and Africa (Saudi Arabia, UAE, Nigeria)

Value Chain Analysis For Oilfield Corrosion Inhibitor Market

The value chain for the Oilfield Corrosion Inhibitor Market begins with the upstream procurement of essential raw materials, primarily specialty chemicals, petrochemical derivatives (like fatty acids and amines), and organic intermediates. This initial phase involves suppliers providing critical building blocks such as ethanolamines, polyamines, and various phosphorus compounds. The key challenge in the upstream sector is managing the price volatility of these chemical precursors, which directly impacts manufacturing costs. Manufacturers of inhibitors—often large specialty chemical firms or divisions of major oilfield service companies—then engage in complex synthesis and formulation processes, tailoring the chemical package to specific environmental conditions (e.g., high H2S, high CO2, or extreme temperatures) and regulatory requirements.

The downstream analysis focuses on the distribution and application phases. Inhibitors are typically distributed directly through manufacturers' global supply networks, or via specialized chemical distributors and major oilfield service companies (OFS providers) who integrate the chemicals into broader well stimulation or integrity management packages. Direct channels involve manufacturers selling high-volume commodity inhibitors directly to National Oil Companies (NOCs) and International Oil Companies (IOCs), allowing for close technical support. Indirect channels, primarily through OFS companies like Schlumberger or Halliburton, see the inhibitors bundled with broader drilling, completion, or production optimization services. End-users (E&P operators) apply these chemicals continuously or in batches, requiring ongoing technical service for monitoring and performance optimization.

The efficiency of the value chain is increasingly reliant on digitalization and logistics. Given that the chemical composition must often be customized for specific fields, prompt and reliable delivery of specialized, sometimes hazardous, chemicals to remote operational sites (offshore rigs, desert fields) is critical. The distribution channel must ensure robust regulatory compliance for handling and transport. Technical service provided post-sale, including fluid analysis and dosage calibration, represents a significant portion of the value added, cementing the relationship between the chemical provider and the E&P operator. Environmental compliance expertise throughout the chain, from raw material sourcing to end-use disposal, is becoming a mandatory value driver.

Oilfield Corrosion Inhibitor Market Potential Customers

The primary customers for oilfield corrosion inhibitors are the operators and asset holders across the upstream and midstream sectors of the petroleum industry, who bear the responsibility for asset integrity, safety, and regulatory compliance. This includes International Oil Companies (IOCs) such as ExxonMobil, Shell, and BP, who manage vast global portfolios of mature and new oil and gas fields, requiring substantial volumes of inhibitors for continuous production maintenance. National Oil Companies (NOCs) like Saudi Aramco, Sinopec, and Petrobras represent another crucial customer segment, particularly due to their long-term infrastructure projects and dominant positions in major basins (Middle East, Russia, China). These customers procure both high-volume standard inhibitors and highly specialized formulations for deep sour gas environments.

Additionally, independent exploration and production (E&P) companies, especially those focused on shale and unconventional resources in North America, are major purchasers. Their operations often involve high water cuts and complex flow regimes that require specific corrosion control measures tailored for hydraulic fracturing and enhanced oil recovery (EOR) operations. Midstream pipeline operators and pipeline transmission companies, responsible for transporting crude oil and natural gas across long distances, constitute a distinct and growing customer base. For these entities, corrosion inhibitors are essential for preventing pitting and stress corrosion cracking in high-pressure transport lines, where failure carries enormous safety, financial, and environmental liabilities. Finally, specialized oilfield service companies often act as intermediaries, procuring large volumes of chemicals to incorporate into their integrated service offerings for smaller operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 4.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton, Baker Hughes, Clariant, BASF SE, Cortec Corporation, SUEZ, Solvay, Ecolab (Nalco Champion), Arkema Group, ChampionX, The Dow Chemical Company, Kemira, Lubrizol Corporation, Lonza Group, GE Water & Process Technologies, Chemtreat, Inc., Dorf Ketal, Zinkan Enterprises, Inc., Ashland Global Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oilfield Corrosion Inhibitor Market Key Technology Landscape

The technology landscape for oilfield corrosion inhibitors is undergoing rapid evolution, moving away from purely commodity chemicals towards specialized, engineered solutions designed for extreme operating conditions and stringent environmental criteria. A significant technological shift involves the development of hybrid inhibitor chemistries that incorporate both organic and inorganic components, providing enhanced film persistence and thermal stability, crucial for high-pressure, high-temperature (HPHT) deepwater wells. Furthermore, the industry is increasingly adopting polymeric inhibitors and specialized ionic liquids, which offer superior performance in multiphase flow systems and reduced toxicity profiles compared to traditional amine or phosphate compounds. These advancements focus on minimizing the required dosage while maximizing protection efficiency, adhering to the principle of cost-effective chemical injection.

Monitoring technology is intrinsically linked to the chemical composition of inhibitors. The rise of "smart chemistry" involves tagging inhibitors with tracers or incorporating them into microencapsulated systems that release the chemical upon reaching a specific condition (e.g., pH change or temperature). Coupled with advancements in wireless sensor networks (WSNs) and downhole monitoring tools, this allows operators to accurately measure the inhibitor residual concentration and film formation kinetics in real time. Electrochemical Noise (ECN) techniques and high-frequency resistance measurements are becoming standard tools for validating inhibitor performance downhole without requiring intrusive sampling, significantly improving the precision of chemical management and reducing the risk of asset failure.

The drive for sustainability has cemented the technological focus on "green inhibitors." Researchers are heavily investing in synthesizing biodegradable compounds derived from natural sources, such as plant extracts, amino acids, and specialized polymers that degrade quickly and safely in the environment, minimizing ecological impact. Key technological challenges remain in matching the cost-effectiveness and performance of these green alternatives with traditional chemistries, particularly under severe sour conditions. However, regulatory pressure and corporate sustainability mandates are accelerating the commercial readiness and adoption of these novel, environmentally preferred alternatives, positioning them as the inevitable future standard for offshore and environmentally sensitive operations.

Regional Highlights

- North America: Dominates the global market, driven primarily by the high volume of unconventional oil and gas production (shale formations) in the U.S. and Canada. The vast network of pipelines and the aggressive corrosive nature of fluids associated with hydraulic fracturing necessitate specialized, high-performance inhibitors. The region is a leader in adopting advanced AI and digital monitoring solutions for optimizing chemical use and integrity management in complex well geometries.

- Asia Pacific (APAC): Exhibits the highest growth rate, fueled by substantial offshore exploration investments, particularly in Southeast Asia (Malaysia, Indonesia) and the rapid expansion of midstream infrastructure in China and India. Growing demand for natural gas and aging national infrastructure are key factors, alongside the increasing focus on strict environmental standards in countries like Australia.

- Middle East and Africa (MEA): A critical consumption region due to the prevalence of extremely sour gas fields (high H2S and CO2 concentrations), demanding robust, thermally stable, and highly effective amine-based and specialty organic inhibitors. Government-led mega-projects in Saudi Arabia, UAE, and Qatar necessitate long-term contracts for chemical supplies and technical services to protect decades-old infrastructure.

- Europe: Characterized by mature fields in the North Sea (UK, Norway) and stringent environmental regulations. This region is at the forefront of adopting non-toxic, biodegradable, and low-dose inhibitor chemistries, driven by European Union directives regarding chemical discharge and marine protection. High operational costs also push operators towards high-efficiency, monitored chemical solutions.

- Latin America: Market growth is concentrated in offshore Brazil (Pre-Salt fields) and onshore developments in Argentina. Deepwater exploration requires specialized HPHT inhibitors, while government policy and economic stability often dictate procurement and investment cycles in countries like Mexico and Colombia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oilfield Corrosion Inhibitor Market.- Schlumberger (SLB)

- Halliburton

- Baker Hughes Company

- Ecolab (Nalco Champion)

- Clariant

- BASF SE

- The Dow Chemical Company

- Solvay

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- ChampionX (formerly Apergy)

- Cortec Corporation

- Kemira

- SUEZ

- Arkema Group

- Ashland Global Holdings Inc.

- Lonza Group

- Lubrizol Corporation

- Dorf Ketal

- GE Water & Process Technologies

- Zinkan Enterprises, Inc.

Frequently Asked Questions

Analyze common user questions about the Oilfield Corrosion Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of corrosion inhibitors used in oil and gas operations?

The primary types are categorized based on their solubility: oil-soluble inhibitors, used predominantly in crude oil lines and downhole environments, and water-soluble inhibitors, critical for managing corrosion in produced water systems and EOR applications. Chemical composition often includes amine derivatives (like imidazolines), phosphonates, and quaternary ammonium compounds.

How does the shift towards green chemistry impact the Oilfield Corrosion Inhibitor Market?

The shift towards green chemistry is driving innovation towards biodegradable, non-toxic, and environmentally safe inhibitors, often derived from natural sources. This trend responds to stricter environmental regulations, particularly in offshore and sensitive regions, leading to higher R&D investment and a growing commercial segment for sustainable formulations.

Which application segment holds the largest share in the corrosion inhibitor market?

The Production and Processing segment holds the largest market share. This is due to the continuous nature of production operations and the necessity to protect extensive, long-lived assets, including separators, vessels, and long-distance pipelines, from continuous exposure to corrosive produced fluids.

How is Artificial Intelligence (AI) being utilized to enhance corrosion inhibition efficiency?

AI is employed for predictive maintenance and dosing optimization. Machine learning algorithms analyze real-time sensor data (pressure, temperature, flow, residual chemistry) to accurately predict corrosion rates and dynamically adjust inhibitor injection rates, minimizing chemical waste and maximizing asset protection efficiency.

What are the main drivers of the market growth in the Middle East and Africa (MEA) region?

Market growth in MEA is primarily driven by the exploitation of vast reserves of sour gas (high H2S and CO2 content), which requires highly specialized and thermally stable corrosion inhibitors. Furthermore, the imperative to manage and extend the lifespan of existing, often decades-old, state-owned infrastructure significantly boosts demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager