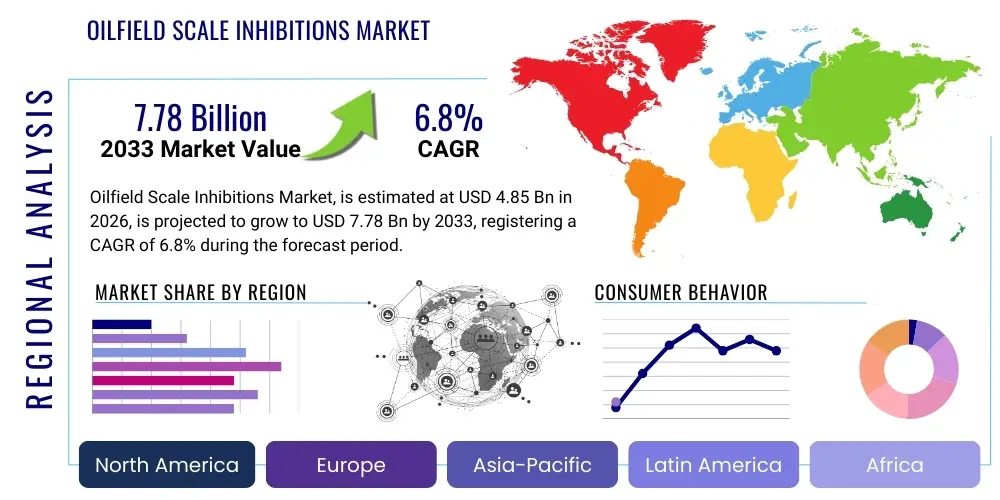

Oilfield Scale Inhibitions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437968 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Oilfield Scale Inhibitions Market Size

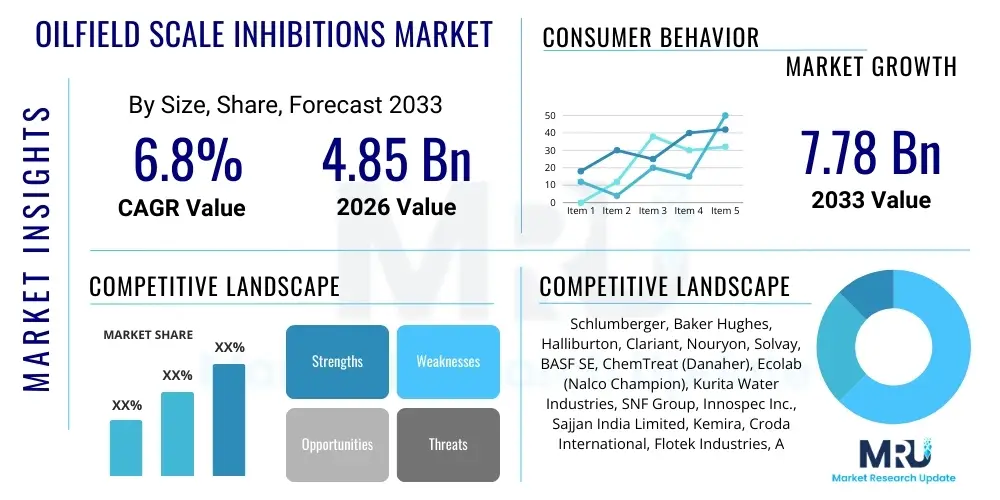

The Oilfield Scale Inhibitions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 7.78 Billion by the end of the forecast period in 2033.

Oilfield Scale Inhibitions Market introduction

The Oilfield Scale Inhibitions Market is defined by the chemical treatment solutions utilized within the upstream oil and gas sector to prevent the deposition of mineral salts, commonly referred to as scale, on critical production equipment. These depositions, which include calcium carbonate, barium sulfate, and strontium sulfate, severely restrict flow, decrease equipment efficiency, and necessitate costly interventions if left untreated. Scale inhibitors are specialized chemical agents, typically phosphonates, polymers, or carboxylates, injected directly into the wellbore or production stream to keep these mineral salts dissolved, thus maintaining optimal productivity and extending the lifespan of tubulars, pumps, and separation units. The primary applications span downhole treatments, pipeline flow assurance, and water injection systems integral to enhanced oil recovery (EOR) operations.

The core benefit derived from effective scale inhibition is the assurance of uninterrupted flow and reduced operational expenditure associated with mechanical cleaning or equipment replacement. High-performing scale inhibitors offer thermal stability and effectiveness across varying temperatures and pressures characteristic of deepwater and unconventional resource plays. Driving factors propelling this market include the increasing complexity of hydrocarbon reservoirs, the necessity for sustained production from mature fields, and the aggressive expansion of EOR techniques, which often involve the injection of incompatible waters leading to severe scaling challenges. Furthermore, stringent regulatory requirements concerning asset integrity and operational safety are compelling operators globally to adopt robust and environmentally compliant scale inhibition programs.

Oilfield Scale Inhibitions Market Executive Summary

The Oilfield Scale Inhibitions Market is characterized by robust growth, primarily driven by the intensified focus on maintaining asset integrity and maximizing recovery rates, especially in deepwater and unconventional operations where scale formation is accelerated due to high pressures and temperatures. Business trends indicate a shift toward sophisticated, "green chemistry" formulations, emphasizing biodegradable and low-toxicity inhibitors to comply with evolving environmental, social, and governance (ESG) standards. Key market players are increasingly investing in continuous monitoring systems and smart chemical management programs, leveraging digitalization to optimize inhibitor dosage and deployment efficiency, thereby minimizing chemical spend while ensuring performance stability.

Regional trends highlight the dominance of North America, particularly the U.S. Permian Basin, owing to extensive shale gas production and high water-cut operations requiring aggressive scale management. However, the Middle East and Africa (MEA) region is exhibiting the fastest growth due to massive offshore drilling projects and large-scale water injection EOR schemes in mature Gulf fields. Segment-wise, the phosphonates segment retains a significant market share due to its proven efficacy and cost-effectiveness, though the polymeric inhibitors segment is expanding rapidly, favored for its higher compatibility in challenging reservoir chemistries. Application-wise, the production phase remains the largest consumer, reflecting the persistent need to manage scale throughout the life cycle of the well.

AI Impact Analysis on Oilfield Scale Inhibitions Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the oilfield scale inhibition market revolve primarily around predictive maintenance capabilities, optimizing chemical logistics, and enhancing the precision of dosage injection. Users are keen to understand how AI-driven analytics can move scale management from a reactive or time-based approach to a condition-based predictive strategy, thereby reducing chemical overuse and preventing costly failures. Key concerns include the integration challenges of new AI platforms with legacy operational technology (OT) systems and the reliability of machine learning models in predicting complex scaling tendencies under dynamic reservoir conditions. Expectations center on AI significantly improving the efficiency of squeeze treatments, enhancing real-time monitoring of inhibitor concentration downhole, and automating the analysis of produced water chemistry to proactively adjust treatment protocols.

The deployment of AI and machine learning algorithms allows for the analysis of vast datasets encompassing production parameters, water chemistry, injection rates, and historical scaling incidents. This advanced data processing capability enables the creation of highly accurate predictive models that forecast the probability and location of scale formation before it becomes critical. Consequently, operators can fine-tune the inhibitor type and concentration dynamically, significantly extending the efficacy period of squeeze treatments and reducing intervention frequency. This move towards intelligent chemical management is crucial for deepwater and remote operations where physical monitoring is difficult and expensive, positioning AI as a critical tool for operational excellence and cost reduction in scale inhibition programs.

- Predictive Scaling Modeling: AI algorithms utilize historical data and real-time sensor readings to predict the precise onset and type of scale formation, optimizing preventive action.

- Optimized Chemical Dosage: Machine learning ensures the minimum effective concentration (MEC) of inhibitors is maintained, reducing chemical spend and environmental impact.

- Automated Squeeze Planning: AI analyzes reservoir permeability and flow dynamics to determine the ideal timing and volume for scale inhibitor squeeze treatments, maximizing treatment life.

- Real-Time Performance Monitoring: Integration of AI with distributed fiber optic sensing and downhole pressure gauges allows for continuous, high-fidelity monitoring of inhibitor performance.

- Supply Chain Optimization: AI predicts inhibitor consumption rates across different fields, optimizing inventory management and logistics for specialized chemicals.

DRO & Impact Forces Of Oilfield Scale Inhibitions Market

The market dynamics are governed by powerful drivers such as the increasing global energy demand necessitating deeper and more complex drilling, the widespread adoption of Enhanced Oil Recovery (EOR) techniques which introduce incompatible injection waters, and the economic imperative to maximize production efficiency from aging wells. Restraints primarily involve the volatility of crude oil prices, which directly impacts upstream capital expenditure (CAPEX) on chemicals, and the high cost associated with developing and deploying novel, environmentally friendly scale inhibitors that meet stringent governmental regulations. Opportunities are abundant in the development of multi-functional chemicals that address corrosion and scale simultaneously, and the expansion into niche markets like geothermal energy production, which also faces severe scaling challenges. The primary impact forces shaping the market include technological advancements in sensing and monitoring (push factor) and increasingly strict environmental compliance requirements (pull factor).

Key drivers include the technological shift towards ultra-deepwater exploration and high-pressure, high-temperature (HPHT) environments, where mineral solubility is drastically reduced, thus accelerating scaling rates. Furthermore, the reliance on produced water for reuse or disposal mandates comprehensive water treatment programs, often integrating specialized scale inhibition to protect reprocessing equipment. Conversely, major restraints include the technical complexities associated with selecting the correct inhibitor for specific reservoir chemistries—a misalignment can lead to formation damage or precipitate different types of scale—and the fluctuating regulatory landscape concerning the use of certain chemical classes, particularly in environmentally sensitive regions like the North Sea or the Arctic. The balance between maximizing production and ensuring environmental stewardship dictates the strategic direction of research and development in this sector.

Segmentation Analysis

The Oilfield Scale Inhibitions Market is broadly segmented based on the chemical type used, the application phase in the oilfield, and the specific formulation technology deployed. Segmentation by chemical type is crucial as it dictates effectiveness, cost, and environmental profile, encompassing widely used categories such as phosphonates and polymers. Application-based segmentation provides insights into consumption patterns across drilling, production, and water treatment phases, with production representing the highest immediate consumption due to continuous flow assurance requirements. Furthermore, segmentation by formulation (e.g., liquid, solid, or extended-release systems) is vital for understanding delivery mechanism trends, especially the growing demand for specialized solid treatments that offer longer protection intervals downhole, minimizing costly interventions and maximizing well uptime.

- By Chemical Type: Phosphonates (e.g., HEDP, DTPMP), Carboxylates, Polymeric Inhibitors (e.g., Polyacrylates, Sulfonated Copolymers), Others.

- By Application: Production (Downhole, Surface Facilities), Drilling and Completion, Water Treatment (Injection Water, Produced Water).

- By Formulation Type: Liquid Inhibitors, Solid Inhibitors (e.g., Sticks, Capillaries), Extended-Release Inhibitors.

- By End-Use Sector: Onshore, Offshore (Shallow Water, Deepwater, Ultra-Deepwater).

Value Chain Analysis For Oilfield Scale Inhibitions Market

The value chain for the Oilfield Scale Inhibitions Market begins upstream with the raw material suppliers, primarily chemical producers providing base ingredients such as phosphorus derivatives, acrylic acid, or specialized monomers used to synthesize the active inhibitor compounds. This stage is highly consolidated and relies on global petrochemical supply chains, making it susceptible to commodity price volatility. Next is the formulation stage, where specialized chemical service companies process these raw materials, synthesize the final scale inhibitor molecules, and formulate them into proprietary products, often incorporating surfactants, solvents, and stabilizers to meet specific oilfield conditions (e.g., HPHT compatibility or low-toxicity requirements). Innovation at this stage is focused on enhancing thermal stability and biodegradability.

The distribution channel involves both direct and indirect routes. Direct sales are common for major, long-term contracts where large integrated oil companies (IOCs) or national oil companies (NOCs) purchase customized formulations directly from the primary service providers (e.g., Schlumberger, Baker Hughes, Halliburton). Indirect distribution involves smaller regional distributors or chemical suppliers who provide standardized scale inhibitors to independent operators or small-to-mid-sized oil companies (SMEs). Technical support and field application services are critical downstream elements, differentiating providers based on their ability to offer real-time monitoring, laboratory testing (scaling tendency prediction), and effective deployment strategies, such as precise pump delivery and squeeze optimization techniques.

The downstream stage focuses heavily on application efficiency and technical partnership. Service providers deploy highly trained field personnel and specialized equipment for inhibitor injection, particularly for complex downhole squeeze treatments that require precise shut-in and flow-back protocols to ensure maximum efficacy. The profitability of the value chain is increasingly shifting towards the provision of high-value integrated services, including predictive analytics and digital chemical management systems, rather than solely the margin on the bulk chemical sales. This integration of chemicals, equipment, and digital services ensures superior performance and strengthens customer retention in a competitive market.

Oilfield Scale Inhibitions Market Potential Customers

The primary customers for oilfield scale inhibition products are organizations directly involved in the exploration, extraction, and processing of hydrocarbons. This includes major International Oil Companies (IOCs) such as ExxonMobil, Shell, and Chevron, and large National Oil Companies (NOCs) like Saudi Aramco, Petrobras, and CNPC, which operate extensive portfolios of mature and new wells globally, demanding large volumes of customized chemical solutions. These entities require continuous flow assurance management across complex onshore, offshore, and deepwater assets, often prioritizing performance stability and robust safety compliance in their procurement decisions.

A secondary, yet significant, customer base includes Independent Oil and Gas Operators focused on unconventional plays, such as shale gas and tight oil, particularly in North America. These operators face severe scaling issues due to high water cuts and complex hydraulic fracturing fluid interactions, requiring specialized, high-volume treatments. Furthermore, specialized oilfield service companies (OFS providers) that manage production chemicals as a service for smaller operators represent key intermediate buyers. These customers seek reliable, cost-effective, and rapidly deployable solutions to maintain well profitability and adhere to increasing environmental standards, driving demand for biodegradable and low-toxicity inhibitor formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 7.78 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Clariant, Nouryon, Solvay, BASF SE, ChemTreat (Danaher), Ecolab (Nalco Champion), Kurita Water Industries, SNF Group, Innospec Inc., Sajjan India Limited, Kemira, Croda International, Flotek Industries, Arkema, ChampionX, The Dow Chemical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oilfield Scale Inhibitions Market Key Technology Landscape

The technology landscape of the Oilfield Scale Inhibitions Market is rapidly evolving, moving beyond conventional batch treatments towards intelligent, continuous, and highly targeted chemical delivery systems. A major technological focus is the development of next-generation chemical formulations, specifically aiming for enhanced thermal and shear stability to perform effectively in aggressive HPHT environments characteristic of modern deep wells. Furthermore, there is significant investment in creating environmentally acceptable scale inhibitors (EASIs) or "green chemistries" that are biodegradable and meet strict OECD standards for toxicity, reducing the ecological footprint, especially in sensitive offshore marine environments. These advanced formulations often involve specialized polymers designed for high sequestration efficiency across a wider range of pH levels.

Another pivotal technological advancement involves the deployment and monitoring of inhibitor chemicals. The "squeeze treatment" technology, where inhibitors are adsorbed onto the reservoir rock and then slowly released, is being optimized through advanced modeling and chemical tagging. Tagging technologies allow operators to trace the inhibitor concentration in the produced fluid in real-time, providing highly accurate data to determine the residual inhibition concentration (RIC) and predict the optimal timing for the next treatment. This integration of chemical science with sensor technology and real-time data analytics is fundamental to improving treatment efficiency and extending well life, significantly impacting operational cost reduction.

Furthermore, microencapsulation and solid inhibitor delivery systems represent a growing technological segment. Solid inhibitors, often delivered in stick or capillary form, offer an extended release profile, which is particularly beneficial in wells that are difficult to access or have low intervention frequency. These controlled-release systems minimize the need for continuous surface injection equipment and reduce logistical complexities. The convergence of computational fluid dynamics (CFD) modeling for understanding downhole flow dynamics and the precise selection of customized chemical blends, aided by AI-driven predictive analytics, defines the leading edge of scale inhibition technology today, ensuring maximal protection with minimal chemical use.

Regional Highlights

North America currently holds the largest share of the Oilfield Scale Inhibitions Market, primarily due to the vast scale of unconventional oil and gas production, particularly in the Permian and Appalachian Basins. High water-cut operations in mature fields and extensive hydraulic fracturing activities, which often utilize high salinity source water, accelerate mineral precipitation, creating a persistent and substantial demand for continuous scale management solutions. The region benefits from technological readiness, with operators quickly adopting advanced chemical management systems, real-time monitoring, and highly tailored inhibitor formulations optimized for shale reservoir conditions. Regulatory frameworks, while generally supportive of technological advancement, are increasingly pressuring operators towards low-toxicity and environmentally friendly chemical options, driving innovation within the regional supply chain.

The Middle East and Africa (MEA) region is projected to be the fastest-growing market segment. This growth is fueled by massive capital investment in major offshore projects (e.g., in Saudi Arabia, UAE, and Qatar) and the sustained reliance on large-scale water flooding and CO2 injection EOR projects in aging, yet highly productive, onshore fields. The deep, hot, and high-pressure reservoirs prevalent in the Gulf require extremely robust and thermally stable scale inhibitors, leading to high-value product consumption. NOCs in this region prioritize long-term asset integrity and production sustainability, often leading to substantial, multi-year contracts for advanced chemical services, thus boosting market size and sophistication.

Asia Pacific (APAC) represents a significant growth opportunity, largely driven by increasing exploration and production activities in countries like China, India, and Australia, particularly in deepwater areas. While China focuses on developing its challenging shale gas reserves, requiring specialized chemical treatments, Southeast Asian nations are heavily invested in offshore conventional fields where seawater injection is common, necessitating effective barium and strontium sulfate inhibition. Europe, conversely, is characterized by stringent environmental regulations, particularly in the North Sea, which mandates the use of highly specialized, fully biodegradable chemistries, creating a premium market for "green" scale inhibitors despite a general decline in new exploration activity.

- North America: Market leader driven by high-volume, high water-cut unconventional drilling; focus on predictive scale management using AI.

- Middle East and Africa (MEA): Fastest growth attributed to mega-offshore projects and extensive EOR schemes requiring robust, thermally stable inhibitors.

- Asia Pacific (APAC): Emerging growth market driven by deepwater exploration (e.g., Australia) and complex shale development (China).

- Europe: Mature market defined by strict environmental regulations, prioritizing biodegradable and low-toxicity scale inhibitor formulations (EASIs).

- Latin America: Moderate growth linked to offshore Brazil pre-salt developments and Venezuelan heavy oil operations, demanding specialized flow assurance chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oilfield Scale Inhibitions Market.- Schlumberger

- Baker Hughes

- Halliburton

- Ecolab (Nalco Champion)

- Clariant

- Nouryon

- BASF SE

- Solvay

- Kemira

- Kurita Water Industries

- SNF Group

- ChampionX (formerly Apergy)

- Innospec Inc.

- Sajjan India Limited

- Flotek Industries

- Croda International

- Arkema

- The Dow Chemical Company

- Chemtreat (Danaher)

Frequently Asked Questions

Analyze common user questions about the Oilfield Scale Inhibitions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of chemical scale inhibitors used in oilfields?

The primary types include phosphonates (such as DTPMP and HEDP), which are highly effective against carbonate scale; polymeric inhibitors (like polyacrylates and co-polymers), often used for sulfate scale inhibition and flow assurance; and specialized carboxylates, chosen for specific temperature or compatibility requirements in complex reservoirs. Selection depends strictly on the produced water chemistry.

How does the increasing adoption of Enhanced Oil Recovery (EOR) techniques affect the demand for scale inhibitors?

EOR techniques, especially water flooding, significantly increase the demand for scale inhibitors because they often involve injecting incompatible waters (e.g., seawater mixed with formation water) or introducing CO2, which alters pH and pressure. This leads to severe mineral precipitation risk, necessitating continuous and robust scale management to protect injection and production wells.

What is the 'squeeze treatment' method and why is it crucial for scale inhibition?

The squeeze treatment is a key downhole application method where the scale inhibitor chemical is injected into the formation rock, allowed to adsorb, and then slowly released over weeks or months as formation fluids flow through the treated zone. This method ensures long-term, continuous protection deep within the wellbore, minimizing the need for frequent surface chemical injections.

Which geographical region exhibits the fastest growth rate in the Oilfield Scale Inhibitions Market?

The Middle East and Africa (MEA) region is projected to register the fastest growth rate. This accelerated expansion is primarily driven by massive long-term offshore development projects and extensive EOR schemes in established onshore fields, requiring advanced, thermally stable scale inhibition chemistries for severe operational environments.

What role does digitalization play in optimizing scale inhibition programs?

Digitalization, powered by AI and IIoT sensors, enables predictive scale management. It allows for real-time monitoring of residual inhibitor concentration (RIC) and water chemistry, optimizing chemical dosage (Minimum Effective Concentration or MEC), extending treatment lifespan, and significantly reducing operational costs associated with chemical overuse and reactive interventions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager