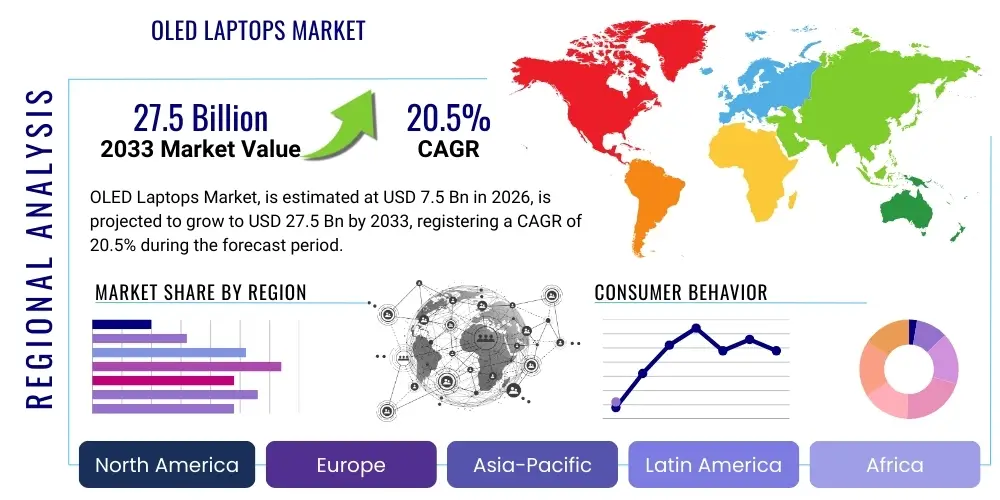

OLED Laptops Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437802 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

OLED Laptops Market Size

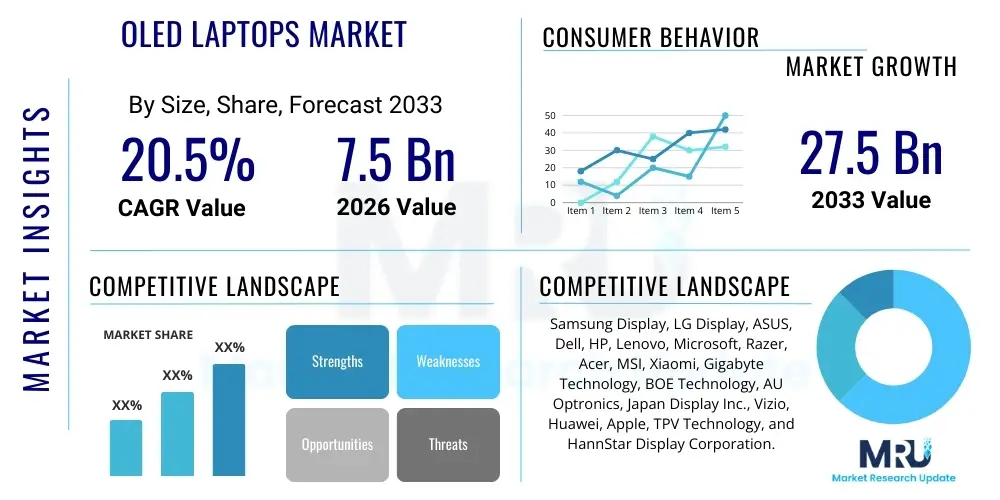

The OLED Laptops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $27.5 Billion by the end of the forecast period in 2033.

OLED Laptops Market introduction

The Organic Light-Emitting Diode (OLED) Laptops Market encompasses the sale and distribution of portable computing devices utilizing OLED display technology. OLED technology distinguishes itself from traditional Liquid Crystal Displays (LCDs) by offering superior display characteristics, including infinite contrast ratios, perfect blacks (as pixels are individually lit or turned off), exceptionally vibrant color reproduction (100% DCI-P3 coverage), and near-instantaneous response times, often measured in microseconds. These high-performance attributes position OLED laptops as premium devices catering primarily to demanding professional and consumer segments.

Major applications for OLED laptops span high-fidelity content creation, professional design, high-end gaming, and enterprise use where visual accuracy is paramount. Content creators, including video editors and graphic designers, rely heavily on the precise color calibration and deep blacks offered by OLED panels to ensure fidelity between the digital workspace and final output. Similarly, gamers benefit from the swift response times, which eliminate motion blur and ghosting, providing a competitive advantage and a highly immersive visual experience. The technology’s efficiency in displaying dark scenes also contributes to lower power consumption in specific usage scenarios.

Driving factors for market acceleration include the decreasing cost of manufacturing OLED panels, increased adoption by major laptop original equipment manufacturers (OEMs) such as Dell, HP, Lenovo, and ASUS, and growing consumer awareness regarding the tangible visual advantages over standard LCD screens. Furthermore, the rise of hybrid work models and the increased consumption of high-resolution streaming content have spurred demand for devices that can deliver cinema-quality visuals on a portable platform. Continuous innovation in panel longevity and brightness, particularly through technologies like Tandem OLED architecture, is further mitigating previous market restraints and bolstering confidence among end-users.

OLED Laptops Market Executive Summary

The OLED Laptops market is characterized by robust business trends driven by premiumization and technological advancements focused on mitigating panel degradation. Key business trends include aggressive adoption strategies by Tier 1 OEMs positioning OLED models as flagship offerings, and strategic partnerships between panel manufacturers, primarily Samsung Display and LG Display, and laptop assemblers to secure high-volume panel supply. Furthermore, the industry is witnessing significant investment in larger and higher-resolution OLED panels (e.g., 16-inch and 18-inch 4K resolutions), catering specifically to the professional gaming and content creation segments, reinforcing the market’s orientation toward high Average Selling Price (ASP) products.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by a concentrated manufacturing base, a strong consumer electronics market, and high demand from technically literate populations in South Korea, China, and Japan, who are quick to adopt cutting-edge display technologies. North America and Europe also contribute significantly, driven by corporate refresh cycles requiring high-performance devices and a strong enthusiast gaming community willing to invest in superior visual fidelity. Latin America and the Middle East and Africa (MEA) are emerging, albeit at a slower pace, contingent on improved economic conditions and wider availability of high-speed internet necessary for high-definition content consumption.

Segment trends indicate a pronounced shift toward higher screen sizes (15.6 inches and above) and increasing diversification into specialized applications. The content creation segment remains the largest consumer, valuing color accuracy and contrast, while the gaming segment is rapidly accelerating, prioritizing the near-zero response time characteristic of OLEDs. Technologically, the segment is moving away from purely rigid panels toward flexible and nascent foldable OLED designs, signaling a future where form factor innovation, coupled with superior display quality, will define market leadership and consumer preference.

AI Impact Analysis on OLED Laptops Market

Common user questions regarding the integration of Artificial Intelligence (AI) in the OLED Laptops market often center on whether AI processing demands require superior displays, how generative AI impacts content creation workflows, and the potential for AI to optimize OLED power consumption and longevity. Users are highly interested in how dedicated AI accelerators (NPUs) influence the visual output of creative applications, such as AI-powered image editing or video rendering previews. Concerns also exist about whether increased computational load associated with AI tasks might accelerate heat generation, potentially impacting the lifespan of the highly sensitive organic materials in the display. The consensus expectation is that the visual demands of advanced generative AI models, which produce complex, high-resolution outputs, necessitate the color accuracy and detail fidelity unique to OLED displays, driving demand for premium AI-enabled machines.

- AI processors (NPUs) require high-fidelity displays to showcase complex generative content and rendering previews accurately.

- AI-driven optimization algorithms are being implemented to manage pixel usage and brightness, potentially reducing the risk of permanent burn-in and extending panel lifespan.

- Increased demand for AI workloads in content creation (e.g., Stable Diffusion, advanced video processing) necessitates the superior contrast and color volume of OLED for accurate visual representation.

- AI tools enhance color correction and grading processes, making the intrinsic accuracy of OLED panels crucial for professional workflows.

- AI-enabled power management features dynamically adjust display refresh rates and brightness based on application usage, improving battery life efficiency.

DRO & Impact Forces Of OLED Laptops Market

The OLED Laptops Market is primarily driven by the unmatched visual quality, including true blacks, infinite contrast, and superior color gamut, which is indispensable for professional content creation and high-end multimedia consumption. Furthermore, the rapid adoption in the premium gaming segment, necessitated by the instantaneous response times of OLED panels, acts as a strong market accelerant. Restraints mainly revolve around the higher manufacturing cost compared to competing Mini-LED or high-end LCD technologies, translating into a higher sticker price for consumers. Perceived risks of permanent image retention (burn-in), although significantly reduced by technological advances, still influence consumer purchasing decisions in certain segments, acting as a behavioral restraint.

Opportunities for expansion are abundant, particularly in the growing trend toward flexible and foldable OLED display technology, which promises innovative laptop form factors, catering to users who demand extreme portability coupled with large screen real estate. The integration of 5G connectivity and increased focus on thin-and-light designs also provide fertile ground for OLED adoption, as the technology inherently allows for thinner display stacks compared to backlit LCDs. The increasing penetration of OLED technology in smaller devices (smartphones, tablets) helps familiarize consumers with its advantages, creating pull-through demand for larger laptop screens.

Impact forces currently shaping the market include technological advancements, where continuous investments in improving brightness and efficiency (like Tandem stack structures) are overcoming historical drawbacks. Competitive intensity from rival technologies, such as Mini-LED, forces OLED manufacturers to maintain aggressive pricing strategies and further differentiate their product offerings based on response time and perfect black levels. Economic factors, including disposable income levels and global supply chain stability, significantly affect the adoption rate of these typically high-cost premium devices, influencing overall market trajectory.

Segmentation Analysis

The OLED Laptops market is extensively segmented across several critical dimensions, including display type, screen size, and primary application, allowing manufacturers to precisely target various consumer and professional niches. Analyzing these segments provides crucial insights into market maturity and growth vectors. The segmentation by display type, encompassing rigid, flexible, and foldable formats, reflects the technological evolution, with flexible OLEDs gaining traction in premium convertible models due to their durability and design flexibility. Screen size segmentation delineates products catering to extreme portability (under 14 inches) versus professional performance (16 inches and above), showing a clear trend toward larger, high-resolution screens for productivity and gaming.

Application-based segmentation is perhaps the most defining characteristic of the market, dividing demand between content creators, hardcore gamers, and general business/consumer use. Content creation segments consistently demand the highest color accuracy and contrast, justifying the premium OLED price. The gaming segment, recognizing the response time advantages, is rapidly becoming a major driver. Furthermore, the distinction between resolution types—FHD (Full High Definition), QHD (Quad High Definition), and UHD (Ultra High Definition)—illustrates the market’s shift towards high-pixel-density panels to maximize the visual potential of the OLED technology, appealing directly to users seeking unparalleled visual detail.

- By Display Type

- Rigid OLED

- Flexible OLED

- Foldable OLED

- By Screen Size

- Below 14 Inches

- 14 to 16 Inches

- Above 16 Inches

- By Resolution

- FHD (1920x1080)

- QHD (2560x1440)

- UHD/4K (3840x2160 and above)

- By Application

- Content Creation & Design

- Gaming

- Business & Enterprise

- General Consumer

Value Chain Analysis For OLED Laptops Market

The value chain for the OLED Laptops market begins with the upstream segment dominated by a few highly specialized panel manufacturers, primarily Samsung Display and LG Display, who produce the core OLED panels, backplanes (using technologies like LTPO or LTPS), and encapsulated organic materials. This upstream concentration dictates pricing power and technological roadmaps for the entire industry. These manufacturers invest heavily in R&D to improve yield rates, luminance, and panel longevity, which are critical competitive factors. Key material suppliers for components such as emissive layers, encapsulation films, and specialized glass substrates form the earliest tier of the supply chain, requiring extremely stringent quality control due to the sensitive nature of organic materials.

The midstream involves the Original Equipment Manufacturers (OEMs)—companies like ASUS, Dell, HP, and Lenovo—who procure the panels, integrate them with CPU/GPU components, chassis, batteries, and cooling systems, and assemble the final product. The manufacturing process at this stage focuses on optimizing thermal management to protect the OLED screen and ensuring precise calibration of the display's color profiles, a critical feature advertised to professional users. OEMs also handle branding, marketing, and securing strategic panel supply agreements to ensure stable production volumes, particularly during peak sales seasons.

The downstream distribution channel includes a complex network of direct sales through company websites, indirect sales via large format electronics retailers (e.g., Best Buy, MediaMarkt), specialized IT distributors catering to enterprise clients, and the highly efficient e-commerce platforms (Amazon, JD.com). Direct channels allow OEMs to capture higher margins and maintain direct customer relationships, while indirect channels provide essential market reach and physical touchpoints for consumers to evaluate the visual difference offered by OLED displays before purchase. Efficient logistics management is crucial due to the high value and relatively fragile nature of the final product, demanding specialized handling and secure transit.

OLED Laptops Market Potential Customers

Potential customers for OLED laptops are primarily situated within high-demand, performance-critical user segments who prioritize display quality and responsiveness over baseline cost. The largest and most influential customer group comprises professional content creators, including graphic designers, 3D modelers, video editors, and photographers. These end-users require perfect color fidelity (often 100% DCI-P3 coverage) and high contrast to ensure that their digital work accurately reflects the intended final output across various mediums. For this segment, the investment in a premium OLED display is considered a necessary tool for maintaining professional quality standards.

Another rapidly expanding segment consists of high-end and enthusiast PC gamers. While historically focusing on high refresh rates (Hz) offered by LCDs, modern gamers increasingly value the near-zero response time (sub-1ms GtG) and artifact-free motion provided by OLEDs, enhancing competitive play and immersion. Gaming applications drive demand for larger screens (16 inches and above) and high refresh rate OLED panels (120Hz and higher). Furthermore, discerning general consumers and affluent professionals seeking top-tier portable multimedia devices constitute a substantial user base, desiring the best visual experience for streaming high-definition media, virtual meetings, and daily productivity tasks, viewing the OLED display as a significant luxury and performance upgrade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $27.5 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Display, LG Display, ASUS, Dell, HP, Lenovo, Microsoft, Razer, Acer, MSI, Xiaomi, Gigabyte Technology, BOE Technology, AU Optronics, Japan Display Inc., Vizio, Huawei, Apple, TPV Technology, and HannStar Display Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

OLED Laptops Market Key Technology Landscape

The technological landscape of the OLED Laptops market is characterized by relentless innovation aimed at improving fundamental metrics such as brightness, efficiency, and longevity. A pivotal development is the adoption of Low-Temperature Polycrystalline Oxide (LTPO) backplane technology, which allows for dynamic adjustment of the display refresh rate (Variable Refresh Rate, or VRR). This capability significantly reduces power consumption, especially when displaying static content, directly addressing a primary historical limitation of OLEDs concerning battery life in portable devices. Furthermore, VRR functionality, often coupled with high native refresh rates (120Hz+), enhances the gaming and multimedia viewing experience while conserving energy.

Another critical technological innovation is the Tandem Stack Structure (or multi-stack structure), pioneered primarily by LG Display for larger panels. This design layers two or more emitting layers (EML) on top of each other, dramatically increasing luminance output while simultaneously improving efficiency and extending the overall lifespan of the panel, as the current density through each layer is reduced. This advancement is essential for professional laptops, which require sustained high brightness (e.g., 500 nits or more) for HDR content creation and outdoor visibility, effectively closing the brightness gap previously exploited by Mini-LED competitors.

Furthermore, manufacturers are heavily investing in proprietary compensation algorithms and burn-in prevention mechanisms. These include advanced pixel shifting, localized brightness monitoring, and AI-driven static element detection to subtly adjust pixel brightness and usage patterns, thus minimizing the risk of permanent image retention. The shift toward flexible encapsulation materials and thin glass substrates also facilitates the development of lighter, thinner, and more robust laptop designs, particularly crucial for convertible and emerging foldable OLED devices that demand physical resilience alongside superior visual performance.

Regional Highlights

Regional dynamics are crucial in understanding the global distribution and growth trajectory of the OLED Laptops market, reflecting differences in consumer wealth, manufacturing presence, and technological adoption rates.

- Asia Pacific (APAC): APAC dominates the global OLED Laptops market both in manufacturing capability and consumption. The presence of major panel suppliers (South Korea, China) and leading laptop OEMs drives supply-side momentum. High demand in technology-centric markets like China and South Korea, fueled by high digital literacy and rapid adoption of premium consumer electronics, ensures strong segment growth. APAC is the primary region for the commercialization of new OLED technologies, including foldable screens.

- North America: North America represents the largest market in terms of value, driven by a strong appetite for high-end professional and gaming devices. The presence of major corporate headquarters and a robust content creation industry (Hollywood, Silicon Valley) mandates the use of color-accurate, high-performance laptops. High disposable income levels support the purchase of premium-priced OLED models, positioning the region as an early adopter of the most advanced, highest-ASP configurations.

- Europe: The European market demonstrates steady growth, balancing between professional use in countries like Germany and the UK, and robust consumer demand in Western Europe. Regulatory focus on energy efficiency and sustainability slightly favors the efficient aspects of OLED displays, but market growth is generally paced by competitive pressure from high-end Mini-LED alternatives. Enterprise demand for aesthetically pleasing and high-performing executive laptops is a significant contributor.

- Latin America (LAMEA): This region is characterized by nascent adoption, primarily concentrated in economically advanced urban centers (Brazil, Mexico). Market growth is constrained by higher import duties and lower average disposable incomes, limiting OLED adoption mainly to the niche enthusiast or high-corporate executive segments. However, the region offers long-term potential as economic stability and digital infrastructure improve.

- Middle East and Africa (MEA): The MEA region shows highly selective demand, concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where high wealth levels support the purchase of premium electronics. The adoption rate is slower overall, heavily reliant on international brand presence and local distribution networks. Gaming and high-end multimedia consumption are the primary driving applications in these markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the OLED Laptops Market.- Samsung Display

- LG Display

- ASUS (ASUSTeK Computer Inc.)

- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Ltd.

- Microsoft Corporation

- Razer Inc.

- Acer Inc.

- MSI (Micro-Star International Co., Ltd.)

- Xiaomi Corporation

- Gigabyte Technology Co., Ltd.

- BOE Technology Group Co., Ltd.

- AU Optronics Corp. (AUO)

- Japan Display Inc. (JDI)

- Vizio Holding Corp.

- Huawei Technologies Co., Ltd.

- Apple Inc. (Emerging player in large OLED displays)

- TPV Technology Limited

- HannStar Display Corporation

Frequently Asked Questions

Analyze common user questions about the OLED Laptops market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of an OLED laptop screen compared to a standard LCD or Mini-LED screen?

The primary advantage of OLED is its ability to achieve perfect black levels and infinite contrast ratios because each pixel generates its own light and can be completely turned off. This results in superior image depth, exceptional color accuracy (often 100% DCI-P3 coverage), and instantaneous response times, making it ideal for professional content creation and high-speed gaming.

Are OLED laptops prone to screen burn-in (permanent image retention)?

While early generations of OLED technology carried a risk of burn-in, modern OLED laptop panels incorporate significant technological advancements, including pixel shifting, localized brightness management, and advanced compensation algorithms (like Tandem architecture), which drastically mitigate the risk. Under typical usage scenarios and with standard operating system configurations, burn-in is highly unlikely.

How do OLED laptop displays affect battery life compared to traditional displays?

OLED efficiency is highly dependent on the content displayed. When showing dark themes or black content, OLED consumes significantly less power than an LCD display because the individual pixels are off. However, when displaying predominantly white or bright content, power consumption can be higher than an LCD. Advanced technologies like LTPO backplanes help optimize refresh rates dynamically to improve overall battery efficiency.

Why are OLED laptops generally more expensive than non-OLED models?

The higher cost of OLED laptops stems from the complexity and specialized manufacturing processes required for the organic emitting materials and intricate thin-film encapsulation used in the panels. This results in higher upstream costs for panel suppliers (like Samsung and LG), which are then passed down to OEMs and ultimately to the consumer, positioning OLED models in the premium market segment.

What screen sizes are most popular for professional OLED laptops?

For professional use, screen sizes ranging from 14 inches to 16 inches are the most popular. The 14-inch size offers an excellent balance of portability and high-resolution display area, while the 15.6-inch and 16-inch models are preferred by content creators and gamers who require maximum screen real estate and high-resolution (QHD or 4K) capabilities for detailed workflow management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager