Olfactory Technology Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436073 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Olfactory Technology Product Market Size

The Olfactory Technology Product Market is experiencing robust expansion driven by increasing integration across consumer electronics, healthcare diagnostics, and environmental monitoring systems. This specialized sector, which focuses on digitalizing or mimicking the sense of smell through advanced sensors and chemical analysis, is critical for next-generation interfaces and industrial safety protocols. The core drivers include miniaturization of sensor technology and significant advancements in artificial intelligence (AI) algorithms capable of processing complex odor profiles, allowing for real-time analysis and classification of volatile organic compounds (VOCs).

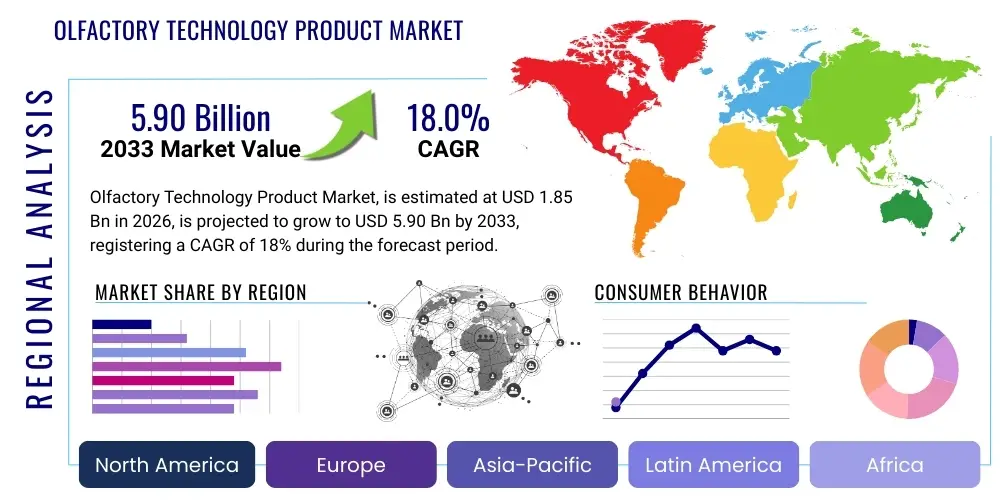

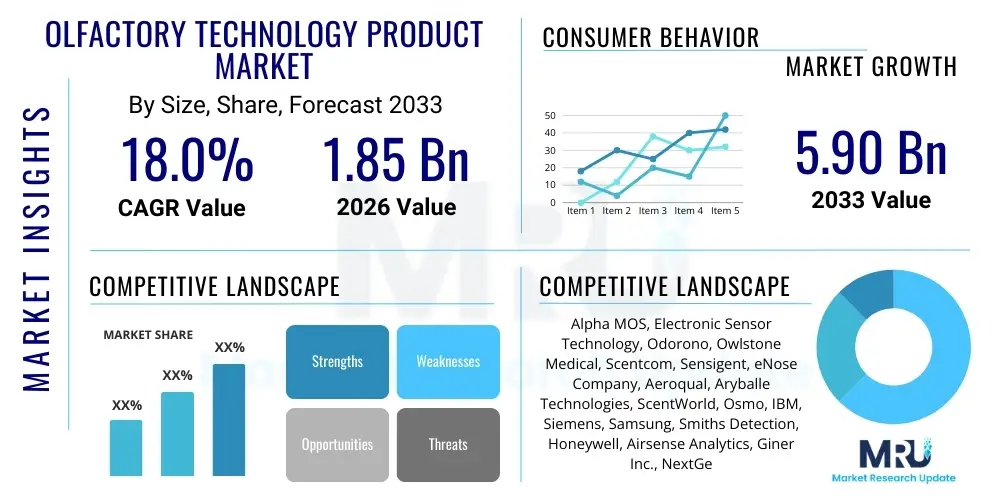

The market valuation reflects the growing investment in electronic nose (e-nose) systems and associated consumables required for maintenance and calibration. The global Olfactory Technology Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.0% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $5.90 Billion by the end of the forecast period in 2033, indicating a rapid adoption curve fueled by regulatory mandates in food safety and the pursuit of immersive virtual reality experiences.

Olfactory Technology Product Market introduction

The Olfactory Technology Product Market encompasses devices, software, and services dedicated to detecting, identifying, and synthesizing odors. Products range from sophisticated electronic noses utilized in medical diagnostics and quality control, to consumer-grade scent diffusers integrated with smart home ecosystems, and advanced olfactory display systems designed for gaming and virtual reality. These technologies rely primarily on chemical sensors (such as polymer, metal oxide semiconductor, or quartz crystal microbalance sensors) paired with pattern recognition software, often powered by machine learning, to translate complex chemical signatures into recognizable data. The primary goal is to replicate or enhance the function of the biological nose, providing objective, repeatable, and non-intrusive analysis across various environments.

Major applications of olfactory technology span critical sectors including food and beverage quality assurance, where products are used to detect spoilage or authenticate origins; environmental monitoring for identifying hazardous gases and pollutants; and medical diagnostics, particularly in breath analysis for early disease detection (e.g., certain cancers or diabetes). Benefits derived from these products include enhanced safety, superior quality control, reduced reliance on subjective human sensory panels, and the potential for non-invasive, low-cost healthcare screening tools. Furthermore, the burgeoning field of digital scent communication aims to revolutionize human-computer interaction by adding an often-overlooked dimension to digital content, creating more immersive and impactful user experiences.

Key driving factors accelerating market growth include stringent global regulations concerning air quality and industrial emissions, necessitating accurate and continuous monitoring solutions. Simultaneously, the consumer demand for personalized and immersive technological experiences, especially within the context of Virtual Reality (VR) and Augmented Reality (AR), is pushing investment into scent synthesis and delivery systems. Moreover, the shift towards predictive maintenance and quality assurance in manufacturing processes, coupled with substantial research breakthroughs in sensor material science, is making olfactory technology more sensitive, cost-effective, and adaptable for widespread commercial deployment, moving it beyond niche scientific applications.

Olfactory Technology Product Market Executive Summary

The global Olfactory Technology Product Market is characterized by intense research and development focused on improving sensor specificity and data processing capabilities, leading to rapid commercialization across diverse end-use sectors. Business trends highlight strategic collaborations between sensor manufacturers and AI software developers, aiming to create integrated solutions that offer superior analytical performance. Venture capital funding is increasingly directed toward start-ups focusing on volatile organic compound (VOC) breathalyzer technology for non-invasive disease screening, signaling a major potential shift in clinical diagnostics. Furthermore, established consumer electronics giants are exploring integration opportunities, recognizing olfaction as a crucial frontier in ambient computing and personalized user interaction, thereby driving miniaturization and cost reduction of sensor arrays.

Regionally, North America maintains market dominance due to high investment in R&D, coupled with strong regulatory frameworks promoting environmental monitoring and advanced healthcare technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by expansive manufacturing sectors demanding rigorous quality control systems, rapid urbanization leading to increased pollution monitoring requirements, and large populations providing fertile ground for adoption of e-nose technology in clinical settings. Europe is characterized by early adoption in the food and beverage industry, leveraging olfactory technology for rigorous traceability and quality assurance standards mandated by the European Union.

Segment trends reveal that hardware components, particularly advanced sensor arrays, currently command the largest market share, but the software and service segment, encompassing AI algorithms for pattern recognition and cloud-based data analytics, is growing at the fastest rate. Within application areas, medical diagnostics and environmental monitoring are poised for significant expansion, fueled by technological breakthroughs that enhance reliability and reduce false positives. The competitive landscape is fragmented, with specialized sensor companies competing alongside major industrial players and software providers, indicating a dynamic environment where intellectual property related to odor signatures and analysis algorithms is becoming a key differentiator.

AI Impact Analysis on Olfactory Technology Product Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Olfactory Technology Product Market frequently center on the ability of AI to overcome the historical limitations of electronic noses, such as cross-sensitivity and drift, and how machine learning enables the identification of complex, overlapping odor mixtures. Users are particularly interested in AI's role in medical diagnostics—specifically, the reliability of AI algorithms in interpreting subtle disease-specific volatile organic compound (VOC) profiles in breath analysis—and the expected time frame for consumer-grade, AI-enhanced olfactory devices becoming commonplace. The key themes revolve around enhancing analytical accuracy, enabling real-time classification of novel odors, and facilitating the creation of comprehensive digital odor libraries that scale with complexity.

- AI drives the development of sophisticated pattern recognition algorithms necessary to differentiate complex chemical mixtures and signatures, moving beyond simple detection to precise identification.

- Machine learning models enable real-time calibration and drift compensation in sensor arrays, significantly improving the long-term reliability and stability of electronic nose devices.

- Deep learning accelerates the creation of digital scent libraries, allowing olfactory systems to be rapidly trained on new odors and applications, crucial for forensic, environmental, and military uses.

- AI integration supports non-invasive medical diagnostics by accurately interpreting low-concentration VOC biomarkers indicative of diseases like cancer, kidney failure, or neurological disorders.

- Generative AI techniques are being explored for scent synthesis and customized odor creation in digital entertainment, enhancing immersion in VR and AR environments.

- Predictive AI algorithms are used in industrial settings for early detection of equipment failure or material degradation through subtle changes in ambient chemical composition.

DRO & Impact Forces Of Olfactory Technology Product Market

The Olfactory Technology Product Market is governed by a confluence of powerful drivers (D), significant restraints (R), and transformative opportunities (O), which collectively shape the market’s impact forces. The primary driver is the increasing global demand for enhanced safety and security, pushing adoption in sectors like homeland security and industrial monitoring for leak detection. This is counterbalanced by major restraints, including the high cost associated with advanced sensor fabrication and the current technological difficulty in achieving the same level of specificity and sensitivity as the biological olfactory system, often leading to performance limitations, especially in complex environmental matrices.

A significant opportunity lies in the convergence of olfactory technology with wearable devices and the Internet of Things (IoT), enabling personalized health monitoring and seamless integration into smart environments. This integration provides a pathway for high-volume, low-cost applications, vastly expanding the addressable market beyond expensive industrial instruments. Furthermore, the ongoing standardization efforts in digital olfaction protocols present a chance to accelerate global adoption by ensuring interoperability and reliable data comparison across different platforms and vendors.

The key impact forces driving market progression include rapidly decreasing sensor manufacturing costs due to advancements in MEMS (Micro-Electro-Mechanical Systems) technology, which allow for the creation of multi-sensor arrays on a single chip. Simultaneously, regulatory pressures, such as stricter emissions standards and mandated food safety testing, act as persistent catalysts for adoption. However, a restraining force remains the challenge of sensory fusion, where integrating olfactory data meaningfully with visual and auditory digital outputs requires complex software integration and cognitive modeling research, which is still in its nascent stages.

Segmentation Analysis

The Olfactory Technology Product Market is comprehensively segmented based on technology type, application area, and end-use industry, reflecting the diverse applications of digital sensing and scent delivery. Analysis of these segments is crucial for understanding specific growth pockets and investment priorities. Technological segmentation differentiates between various sensor materials and architectural designs, while application segmentation highlights the distinct requirements of industries ranging from military defense to personal healthcare. This multi-dimensional analysis reveals that while industrial automation currently utilizes the largest installed base of these products, the fastest growth is anticipated in consumer electronics and non-invasive medical diagnostic tools, driven by miniaturization and the development of highly selective sensor coatings.

- By Technology Type:

- Hardware (Sensor Arrays, Microheaters, Sample Delivery Systems)

- Software and Services (AI/ML Algorithms, Cloud-based Data Analytics, Odor Libraries)

- By Sensor Type:

- Metal Oxide Semiconductor (MOS) Sensors

- Quartz Crystal Microbalance (QCM) Sensors

- Polymer-based Sensors (Conducting Polymers)

- Surface Acoustic Wave (SAW) Sensors

- By Application:

- Environmental Monitoring and Control (Air Quality, Pollution Detection)

- Medical Diagnostics (Breath Analyzers, Disease Screening)

- Food and Beverage Quality Control (Spoilage, Adulteration Detection)

- Military and Defense (Chemical Warfare Agent Detection)

- Industrial Process Monitoring (Leak Detection, Process Optimization)

- Consumer Electronics and Digital Scent (VR/AR, Smart Home Integration)

- By End-Use Industry:

- Healthcare and Pharmaceutical

- Food and Beverage

- Chemical and Petrochemical

- Environmental Agencies and Research

- Consumer Goods

Value Chain Analysis For Olfactory Technology Product Market

The value chain for the Olfactory Technology Product Market begins with upstream activities focused on fundamental material science and component manufacturing. This includes the development of highly sensitive sensor materials, such as novel metal oxides or specialized polymers, and the fabrication of high-precision micro-electro-mechanical systems (MEMS) or Nano-Electro-Mechanical Systems (NEMS) sensor arrays. Key upstream players are semiconductor companies, chemical research institutions, and specialized sensor component providers who supply the core technology necessary for odor detection and translation. The quality and cost-effectiveness of these foundational components directly dictate the final product's sensitivity, size, and commercial viability, emphasizing the critical role of material innovation in this stage.

Midstream activities involve the integration of these sensor arrays into functional electronic nose systems or scent delivery devices. This stage includes hardware design, integration of microcontrollers, power management, and, most importantly, the development and embedding of complex signal processing and pattern recognition software, which often relies heavily on specialized AI algorithms. Companies operating midstream focus on system calibration, robust housing design, and packaging the technology for specific end-use environments (e.g., portable handheld devices for food safety, or ruggedized stationary monitors for industrial plants). These manufacturers must ensure the device meets stringent regulatory standards applicable to its target application, such as medical device certification or industrial safety compliance.

Downstream analysis focuses on distribution channels and final market deployment. Direct distribution is common for high-cost, specialized products sold to industrial clients, healthcare providers, and military entities, often involving complex integration services and long-term maintenance contracts. Indirect channels leverage distributors, system integrators, and value-added resellers (VARs) to reach broader markets, especially in environmental monitoring and consumer electronics. The shift towards Software as a Service (SaaS) models for odor data analysis is also prominent downstream, where revenues are generated not just from the hardware sale, but from ongoing subscription fees for access to updated odor libraries, advanced diagnostic algorithms, and cloud storage capabilities.

Olfactory Technology Product Market Potential Customers

The potential customer base for Olfactory Technology Products is highly diversified, reflecting the technology's broad applicability in translating chemical signatures into actionable data. Primary end-users include governmental regulatory bodies and large industrial conglomerates that require continuous, automated monitoring solutions for compliance and efficiency. In the healthcare sector, the target customers are hospitals, diagnostic laboratories, and pharmaceutical companies adopting non-invasive diagnostic tools and quality control measures. These buyers prioritize accuracy, rapid results, and seamless integration with existing laboratory or clinical workflows, valuing the technology's potential to reduce diagnostic costs and improve patient outcomes through early detection.

In the commercial sector, major customers are found within the food and beverage industry, spanning producers, processors, and retailers. These organizations utilize olfactory technology for real-time monitoring of freshness, detection of contamination, and verification of product authenticity, ensuring consumer safety and maintaining brand integrity. Additionally, the technology is increasingly relevant to the automotive and petrochemical industries for internal monitoring of cabin air quality and rapid detection of hazardous gas leaks in manufacturing facilities, necessitating rugged, reliable, and highly specific sensor solutions that can withstand harsh operating conditions.

Furthermore, the rapidly emerging customer segment includes consumer electronics companies and developers in the Virtual and Augmented Reality space. These buyers seek cost-effective, miniaturized scent delivery systems and associated content creation tools to integrate the sense of smell into digital experiences, driving demand for innovative, high-fidelity scent synthesizing hardware. Lastly, research institutions and universities constitute a perpetual customer base, driving fundamental research into sensor materials and AI-based pattern recognition, often acquiring specialized, high-sensitivity laboratory-grade electronic nose equipment for novel applications and theoretical advancement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $5.90 Billion |

| Growth Rate | CAGR 18.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alpha MOS, Electronic Sensor Technology, Odorono, Owlstone Medical, Scentcom, Sensigent, eNose Company, Aeroqual, Aryballe Technologies, ScentWorld, Osmo, IBM, Siemens, Samsung, Smiths Detection, Honeywell, Airsense Analytics, Giner Inc., NextGen Sensing, Olorama Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Olfactory Technology Product Market Key Technology Landscape

The Olfactory Technology Product Market is defined by intense technological competition centered on developing highly stable, sensitive, and selective sensor materials coupled with advanced data processing capabilities. A primary technological focus is the perfection of electronic noses (e-noses), which utilize arrays of diverse chemical sensors—including Metal Oxide Semiconductor (MOS), Quartz Crystal Microbalance (QCM), and conducting polymers—to detect Volatile Organic Compounds (VOCs). MOS sensors are widely used for their robustness and ease of integration but suffer from cross-sensitivity and require high operating temperatures, prompting research into materials that operate effectively at or near room temperature to reduce power consumption and enable wearable applications. QCM sensors, based on mass changes upon chemical adsorption, offer high sensitivity but can be less stable in environments with varying humidity, necessitating sophisticated humidity compensation algorithms.

Significant innovation is also occurring in the realm of odor synthesis and display systems, driven by the consumer demand for immersive digital experiences. These technologies employ microfluidic systems and thermal jetting techniques to release precisely controlled mixtures of fragrance cartridges, allowing for the dynamic creation of complex scents on demand in VR/AR headsets or specialized kiosks. Furthermore, the integration of computational olfaction—the use of specialized Artificial Intelligence (AI) and Machine Learning (ML) algorithms, such as Convolutional Neural Networks (CNNs) and support vector machines (SVMs)—is crucial for processing the high-dimensional data generated by sensor arrays. These algorithms are essential for training the systems to recognize specific chemical patterns corresponding to particular odors or diseases, overcoming the inherent variability and drift associated with chemical sensors.

Biomimetic approaches represent another frontier, focusing on replicating the superior functionality of the biological olfactory system, utilizing biological receptors coupled with highly sensitive electronics, sometimes referred to as 'bio-electronic noses.' While still largely in the research phase, this technology promises ultra-high specificity, particularly beneficial for complex medical diagnostics where minute quantities of specific biomarkers must be reliably detected. Additionally, the move towards cloud-based olfactory data management is critical. Centralized platforms allow for global sharing of odor profiles, facilitating rapid training of AI models and enabling continuous, automatic system updates, thereby significantly improving the performance and utility of deployed olfactory devices across various geographical locations and specialized industrial applications.

Regional Highlights

The global distribution of the Olfactory Technology Product Market demonstrates distinct adoption patterns influenced by regional regulatory environments, technological readiness, and industrial structure. North America currently dominates the market share, primarily due to the presence of key technology developers, substantial funding for healthcare diagnostics R&D (particularly breath analysis), and high adoption rates in homeland security and military applications. Rigorous standards set by the Environmental Protection Agency (EPA) also mandate continuous monitoring of industrial emissions, providing a foundational market for high-end electronic nose systems in the U.S. and Canada. The region also leads in the commercialization of AI-enhanced olfactory software platforms.

Europe represents a mature market, driven significantly by stringent food safety regulations and a proactive approach to environmental conservation. Countries such as Germany, France, and the UK have a high penetration of olfactory technology in the food and beverage industry for traceability, freshness assessment, and spoilage detection. European regulatory bodies have also supported the development of advanced monitoring systems for air quality in urban centers, ensuring sustained demand for precision sensors. Innovation in Europe often focuses on highly specialized industrial applications and integrating e-noses into industrial IoT frameworks for predictive maintenance in chemical processing plants.

Asia Pacific (APAC) is forecast to be the fastest-growing region, propelled by rapid industrialization, massive manufacturing activity, and increasing awareness of air quality issues in densely populated urban areas, particularly in China and India. The sheer volume of food processing and export activities in countries like Japan and South Korea necessitates advanced quality control solutions. Furthermore, increasing government investment in smart city projects and local initiatives to curb pollution are creating enormous opportunities for affordable, scalable olfactory monitoring solutions. Latin America and the Middle East & Africa (MEA) are emerging markets, where adoption is accelerating, primarily focusing on oil and gas infrastructure monitoring for safety and the utilization of portable devices for early quality control in agricultural supply chains.

- North America: Market leader; strong presence in medical diagnostics, high defense spending, and early adoption of AI platforms.

- Europe: Mature market; driven by strict Food and Beverage quality and environmental regulatory compliance; significant research in industrial IoT integration.

- Asia Pacific (APAC): Highest growth rate; vast manufacturing base, urgent need for air quality monitoring, and rapid technological adoption in smart city initiatives.

- Latin America (LATAM): Emerging growth; focused on safety monitoring in resource extraction (mining, oil and gas) and improving agricultural supply chain quality.

- Middle East & Africa (MEA): Growth driven by infrastructure monitoring, specifically in petrochemical refining and large-scale environmental health initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Olfactory Technology Product Market.- Alpha MOS

- Electronic Sensor Technology

- Owlstone Medical

- Aeroqual

- Aryballe Technologies

- Scentcom

- Sensigent

- eNose Company

- ScentWorld

- Osmo

- IBM (through AI applications and cloud services)

- Siemens Healthineers

- Samsung Electronics (focusing on consumer integration)

- Smiths Detection

- Honeywell International Inc.

- Airsense Analytics GmbH

- Giner Inc.

- NextGen Sensing

- Olorama Technology

- E-Nose Systems

Frequently Asked Questions

Analyze common user questions about the Olfactory Technology Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an electronic nose (e-nose) and how does it function in practical applications?

An electronic nose (e-nose) is a device designed to mimic the human sense of smell by using an array of non-specific chemical sensors and a pattern recognition system, typically powered by AI. It detects volatile organic compounds (VOCs) and translates complex chemical signatures into digital data patterns. E-noses are practically used for applications such as rapid detection of food spoilage, environmental pollution monitoring, and non-invasive medical diagnosis via breath analysis.

What are the primary technical challenges facing the widespread adoption of olfactory technology?

The primary technical challenges include high cross-sensitivity, which means sensors may react to multiple chemicals, leading to difficulties in isolating specific odors. Other major restraints are sensor drift (performance degradation over time requiring frequent recalibration), the complexity of analyzing odor mixtures, and the high cost and power requirements of highly sensitive sensor arrays, hindering mass market consumer integration.

How is Olfactory Technology utilized in the healthcare and medical diagnostics sector?

In healthcare, olfactory technology is primarily utilized for non-invasive disease screening. Electronic noses are trained to detect specific volatile organic compound (VOC) biomarkers in a patient's breath, urine, or skin odor, which can indicate the presence of diseases such as certain cancers, diabetes, and infectious agents. This offers a potential pathway for inexpensive, early diagnostic testing outside of traditional clinical laboratory settings.

Which geographical region exhibits the fastest growth potential for the Olfactory Technology Product Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth potential. This rapid expansion is driven by vast manufacturing and food processing sectors requiring enhanced quality control, substantial government investment in smart city initiatives focusing on air quality monitoring, and increasing regulatory pressure to manage industrial emissions across densely populated urban centers.

What role does Artificial Intelligence play in improving the performance of electronic olfactory systems?

Artificial Intelligence (AI), particularly machine learning and deep learning, is crucial for olfactory systems. AI processes the complex, high-dimensional output generated by sensor arrays, enabling accurate classification and identification of specific odors from complex mixtures. It also manages sensor drift through real-time compensation and facilitates the creation and rapid updating of digital odor databases, making the technology more robust and reliable than traditional chemical analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager