Oligonucleotide Pool Library Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435983 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Oligonucleotide Pool Library Market Size

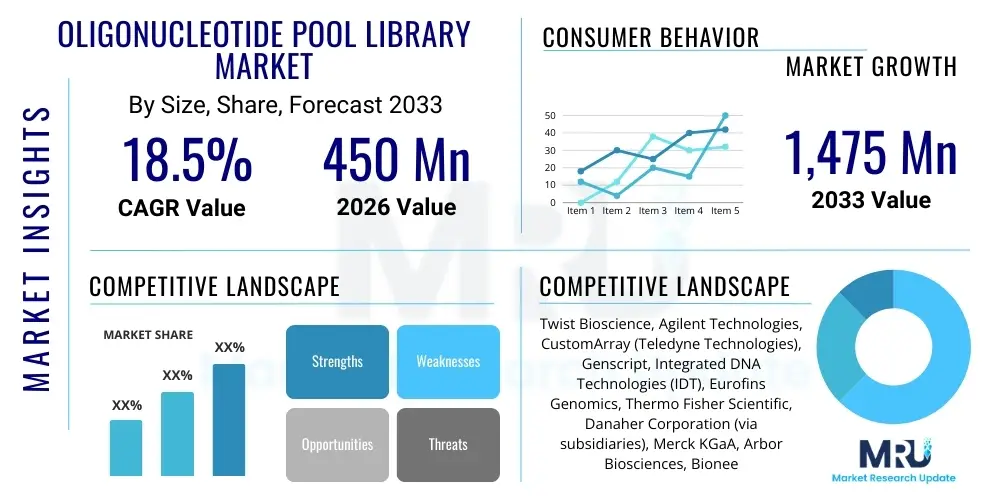

The Oligonucleotide Pool Library Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $1,475 Million by the end of the forecast period in 2033.

Oligonucleotide Pool Library Market introduction

The Oligonucleotide Pool Library Market encompasses the synthesis and utilization of complex mixtures of custom-designed DNA or RNA sequences. These libraries, often containing hundreds of thousands to millions of unique oligonucleotides, are foundational tools for high-throughput biological research, including synthetic biology, functional genomics screening, and next-generation sequencing (NGS) applications. Market growth is fundamentally tied to the accelerating pace of biomedical research and the increasing need for scalable, cost-effective methods for manipulating genetic information. These pools enable researchers to test vast sequence spaces simultaneously, dramatically reducing the time and cost associated with traditional, individualized synthesis methods. Key applications span across therapeutic development, vaccine design, and basic biological discovery, positioning OPLs as critical enablers in the genomics revolution. The decreasing cost of synthesis per base pair, combined with advancements in photolithographic and microarray-based technologies, further drives the accessibility and widespread adoption of these complex synthetic materials across academic, pharmaceutical, and biotechnology sectors.

Oligonucleotide pool libraries are utilized in diverse areas such as CRISPR screening, reporter assays, gene assembly, and protein engineering. In CRISPR screening, for instance, pooled guide RNAs (gRNAs) allow researchers to efficiently knock out or activate thousands of genes simultaneously to identify genetic elements critical for specific phenotypes or disease mechanisms. The intrinsic benefit of pooling lies in the significant scaling achieved in experimental complexity without a proportionate rise in resource allocation. High-quality synthesis and meticulous quality control are essential market dynamics, as even minor errors in sequence fidelity can compromise the integrity and reliability of high-throughput screens. The integration of bioinformatics tools capable of handling the massive datasets generated from OPL screens is also a crucial aspect of the market ecosystem, enhancing the overall utility and interpretability of these synthetic tools.

Major driving factors fueling this market expansion include the exponential growth in demand for synthetic DNA for personalized medicine initiatives, the proliferation of large-scale genomic projects, and the maturation of synthetic biology platforms seeking to construct novel biological systems. Furthermore, the pharmaceutical industry’s commitment to early-stage drug target validation using functional genomics relies heavily on the capabilities offered by comprehensive oligonucleotide pool libraries. As synthesis technologies continue to improve resolution and increase pool complexity, the potential applications expand into complex therapeutic areas like cancer immunotherapy and infectious disease modeling. The market is experiencing a shift toward ultra-high-density pools, necessitating sophisticated manufacturing processes and demanding stringent quality metrics to ensure the viability of sequences intended for cellular introduction.

Oligonucleotide Pool Library Market Executive Summary

The Oligonucleotide Pool Library Market demonstrates robust growth, propelled by sustained investment in life sciences R&D and the shift towards high-throughput screening methodologies within biotechnology and pharmaceutical sectors. Business trends emphasize strategic partnerships between synthesis providers and bioinformatics companies to offer integrated solutions, addressing the data analysis bottleneck inherent in large-scale pooled screens. Companies are heavily investing in proprietary synthesis platforms, such as improved phosphoramidite chemistry or enzymatic methods, to achieve higher fidelity and greater complexity in their manufactured pools. Regional trends indicate North America maintaining market dominance, driven by significant funding for genomics research and the presence of major biopharma headquarters, while the Asia Pacific region emerges as the fastest-growing market due to expanding research infrastructure and rising government support for biotechnology initiatives. Europe remains a strong contender, leveraging established academic excellence and regulatory support for genetic engineering applications. The global competitive landscape is characterized by moderate consolidation, with key players focusing on expanding their capacity and geographic reach to serve the burgeoning demand.

Segmentation trends highlight the dominance of functional genomics screening applications, particularly CRISPR-based screens, which utilize large, complex libraries to map gene function systematically. Libraries segmented by complexity (e.g., low, medium, and high density) show a strong upward trend in demand for ultra-high-density pools, particularly for specialized applications like single-cell genomics and complex pathway analysis. The end-user segment is heavily weighted towards pharmaceutical and biotechnology companies, which require commercial-scale libraries for drug target identification and validation, followed closely by academic and research institutions leveraging OPLs for fundamental biological studies. Furthermore, the synthesis technology segment is observing innovation focused on improving synthesis speed and reducing error rates, with microarray-based synthesis continuing to hold a strong position due to its high-density capabilities, although column synthesis is preferred for lower complexity, higher-volume needs requiring greater batch consistency. These segmentation dynamics underscore the market’s responsiveness to technological improvements and the specific requirements imposed by cutting-edge biological applications, driving product customization.

Overall, the market is structurally sound and poised for accelerated expansion, but it faces challenges related to quality assurance and the standardization of library formats, which are critical for maximizing reproducibility across different research settings. The integration of artificial intelligence and machine learning is rapidly becoming a defining feature, aiding in the design of optimized oligonucleotide pools (e.g., maximizing coverage while minimizing off-target effects) and improving the analytical capacity required to interpret results derived from highly complex screens. The strategic imperative for market participants is to address the synthesis scalability challenge while simultaneously delivering enhanced data analysis tools. Successful companies will be those that can master the synthesis-to-analysis pipeline, ensuring robust and reliable products that meet the rigorous demands of therapeutic development and advanced genomic research, thus solidifying their competitive advantage and capturing the escalating market value.

AI Impact Analysis on Oligonucleotide Pool Library Market

User inquiries concerning AI's role in the Oligonucleotide Pool Library Market primarily revolve around three critical areas: optimization of library design, enhanced quality control during synthesis, and acceleration of data interpretation from pooled screens. Users frequently ask how AI can predict optimal sequence candidates for specific functional screens (e.g., gRNA efficiency prediction), thereby reducing the reliance on purely empirical approaches and minimizing the inclusion of non-functional or toxic sequences in the pool. Another major theme is the expectation that machine learning algorithms will be deployed to analyze synthesis failure patterns and defects in real-time, drastically improving the overall fidelity of complex libraries, a persistent challenge in high-density pool manufacturing. Finally, there is significant interest in using AI/ML to sift through the massive output data from functional genomic screens (often involving millions of reads per pool), automating the identification of hit genes or therapeutic candidates that human analysts might overlook, thereby translating complex sequence data into actionable biological insights much faster than conventional bioinformatics pipelines. The consensus is that AI is moving OPL usage from a hypothesis-testing tool to a predictive, discovery engine.

The implementation of AI algorithms, particularly deep learning models, is revolutionizing the computational steps necessary for oligonucleotide pool library utilization. For instance, AI is adept at managing sequence constraints and optimizing tile design in pooled screens, which is essential for ensuring uniform representation and minimal positional bias across the library. By simulating molecular interactions and predicting the folding energy or secondary structure of synthesized oligonucleotides, AI can proactively flag sequences prone to aggregation or poor amplification, thus improving the overall experimental signal-to-noise ratio. This predictive capacity is particularly valuable in therapeutic development where even small biases in the starting material can lead to misleading results. Furthermore, the application of machine vision and machine learning in the synthesis monitoring phase, particularly in microarray-based synthesis, allows for rapid identification of spot defects or uneven synthesis yields, ensuring high uniformity across the physical library surface before cleavage and pooling.

Beyond design and manufacturing, the most immediate and profound impact of AI is observed in post-synthesis data analysis, specifically in handling the immense complexity of high-throughput screening data. AI models can integrate multi-omic data (genomic, transcriptomic, and proteomic) with the sequencing results from pooled screens to build robust predictive models of gene function or therapeutic response. This is crucial for applications like genome-wide CRISPR screens where identifying causative genetic variants among millions of possibilities requires sophisticated pattern recognition capabilities that conventional statistical methods cannot easily provide. Therefore, the long-term expectation is that AI will shift the value proposition of OPL providers from merely synthesizing sequences to delivering high-confidence, pre-analyzed pools and comprehensive analytical services, significantly enhancing the overall research pipeline efficiency for end-users and accelerating the pace of biological discovery.

- AI optimizes oligonucleotide sequence design, maximizing functional efficiency and reducing synthesis errors.

- Machine learning algorithms enhance quality control by predicting and identifying synthesis failure patterns in real-time, improving library fidelity.

- AI accelerates the analysis of complex pooled screening data (e.g., CRISPR screens), automating the identification of critical gene hits and therapeutic targets.

- Predictive modeling powered by AI minimizes experimental bias and ensures uniform representation of sequences across high-density pools.

- Integration of AI tools enables personalized medicine applications by rapidly correlating genetic variants with functional outcomes derived from OPL testing.

- Deep learning contributes to the design of sophisticated synthetic gene circuits and pathways using computationally optimized pools.

- AI aids in automated sequence error correction and filtering of low-quality reads during post-sequencing data processing.

DRO & Impact Forces Of Oligonucleotide Pool Library Market

The Oligonucleotide Pool Library Market is shaped by powerful biological and technological forces, encapsulated by key Drivers, significant Restraints, and transformative Opportunities. Primary Drivers include the global expansion of functional genomics research, particularly the widespread adoption of advanced tools like CRISPR/Cas9 systems, which necessitate highly complex and cost-effective oligonucleotide pools for comprehensive genome editing screens. The increasing investment by pharmaceutical and biotechnology firms into drug discovery pipelines, focusing on high-throughput screening for novel targets, further accelerates demand. Restraints primarily involve challenges related to the quality and consistency of ultra-complex synthesis; maintaining high fidelity across millions of sequences remains technologically challenging and crucial for experimental reproducibility. Furthermore, the specialized bioinformatics expertise required to manage and interpret the enormous datasets generated by OPL screens acts as a market constraint, particularly for smaller research labs. Opportunities abound in emerging applications such as synthetic viral genome assembly, next-generation vaccine development, and the burgeoning field of DNA data storage, offering new, high-value avenues for library utilization.

The impact forces influencing this market operate across technological and economic dimensions. Technologically, continuous improvements in synthesis chemistry, such as increased coupling efficiency and reduced failure rates, exert a strong positive force, lowering the effective cost per base pair and enabling the creation of larger, more complex libraries. Economically, the pressure to reduce R&D timelines and costs within the biopharma sector compels researchers to adopt pooled screening methods over slower, serial approaches. This cost-efficiency dynamic strongly favors OPL adoption. Conversely, the intellectual property landscape surrounding novel synthesis methods and key applications (like specific CRISPR gRNA libraries) can act as a restricting force, leading to market fragmentation or costly licensing agreements. Geopolitical factors influencing international research collaborations and regulatory pathways for synthetic biology products also contribute to market volatility and impact the pace of global adoption.

The long-term success of the Oligonucleotide Pool Library Market depends on overcoming the synthesis scale and quality conundrum while effectively integrating the data analysis component. The convergence of hardware innovation (synthesis platforms) and software innovation (AI-driven design and analysis) creates a positive impact loop, reinforcing the utility of the libraries. Market players must navigate the tension between producing standardized, high-volume products and offering custom, low-volume specialty pools tailored for unique applications. The growing demand for personalized medicine requires highly customizable synthetic tools, pushing manufacturers towards flexible, rapid-turnaround production capabilities. Ultimately, the market trajectory is highly correlated with the successful translation of basic genomic discoveries enabled by OPLs into viable commercial products, solidifying their role as indispensable components of the modern life science toolkit.

Segmentation Analysis

The Oligonucleotide Pool Library Market is segmented based on key functional attributes, including the type of synthesis employed, the primary application area, and the characteristics of the end-user. This structural breakdown helps in understanding the varying demands across the research and commercial landscape. Segmentation by synthesis technology distinguishes between high-density, typically microarray-based methods, and high-fidelity, traditionally column-based synthesis, reflecting a trade-off between library complexity and sequence quality. Application segmentation reveals the dominant usage areas, with functional genomics screening and targeted sequencing preparation capturing the largest market shares, reflecting the high utility of these pools in discovery-phase research. End-user segmentation emphasizes the critical role of pharmaceutical and biotechnology companies as major revenue generators due to their commercialization-focused R&D activities and high consumption volumes of customized libraries.

The detailed segmentation structure allows market players to tailor their synthesis services and product offerings. For example, libraries intended for CRISPR screening must meet rigorous quality standards regarding gRNA representation and sequence integrity, driving demand for specialized quality control procedures. In contrast, pools used for massive DNA data storage proof-of-concept require extreme density and cost-efficiency, prioritizing the microarray synthesis approach. Analyzing these segments provides strategic insights into investment priorities; manufacturers are increasingly focusing on scaling up high-density synthesis while simultaneously enhancing the fidelity of these complex pools through process optimization and integrated quality assurance metrics. The evolution of next-generation sequencing sample preparation applications, which utilize OPLs for index tagging and multiplexing, ensures consistent demand, acting as a crucial underpinning segment for market stability and continuous technological refinement.

Understanding the interplay between these segments is vital for accurate market forecasting. The rapid growth of synthetic biology is accelerating the need for gene assembly pools, a subsegment requiring highly reliable, medium-complexity libraries used to construct novel genetic circuits or synthetic genes. Similarly, the growing adoption of single-cell sequencing techniques is creating a niche market for specialized barcoded oligonucleotide pools, demanding ultra-high precision and low batch-to-batch variation. These specialized, high-growth subsegments illustrate the market’s dynamism and its ability to absorb technological advancements that enable new experimental designs, thereby driving the overall market towards greater complexity and customization in oligonucleotide pool offerings.

- By Synthesis Type:

- Microarray-Based Synthesis (High Density)

- Column-Based Synthesis (High Fidelity)

- Enzymatic Synthesis (Emerging)

- By Application:

- Functional Genomics Screening (e.g., CRISPR/gRNA Libraries)

- Targeted Sequencing and Sample Preparation

- Synthetic Gene Assembly and Pathways

- Drug Discovery and Target Validation

- DNA Data Storage

- Others (e.g., Directed Evolution, Barcoding)

- By Complexity:

- Low-Complexity Pools (Below 10,000 unique sequences)

- Medium-Complexity Pools (10,000 to 100,000 unique sequences)

- High-Complexity Pools (Above 100,000 unique sequences)

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs)

Value Chain Analysis For Oligonucleotide Pool Library Market

The value chain for the Oligonucleotide Pool Library Market begins with the upstream supply of raw materials, primarily high-quality phosphoramidites and critical chemical reagents necessary for chemical synthesis. Upstream analysis involves assessing the reliability and pricing power of specialized chemical suppliers; dependency on a few high-purity chemical providers can introduce supply chain risks, compelling larger manufacturers to vertically integrate or establish strategic sourcing agreements. Efficient logistics and chemical purity management at this stage are paramount, as the quality of the starting materials directly impacts the final fidelity of the synthesized oligonucleotide pool, especially given the millions of coupling reactions involved in high-density pool manufacturing. Innovation in upstream segments focuses on developing novel, more efficient, and greener synthesis chemistries to reduce waste and improve coupling yields, addressing both economic and environmental concerns inherent in chemical synthesis processes.

The middle segment of the value chain is dominated by the synthesis and processing stages, encompassing sequence design (often computationally driven, increasingly using AI/ML tools), the physical synthesis (microarray or column-based), and rigorous quality control (QC) procedures, including mass spectrometry and sequencing validation. This core segment holds the highest value addition, characterized by intense intellectual property development and capital expenditure in specialized synthesis equipment. Distribution channels are generally short and highly technical. Direct channels involve the synthesis provider shipping the final, QC-validated oligonucleotide pool (usually lyophilized or in solution) directly to the end-user lab. Indirect channels might involve distribution through specialized scientific reagent or equipment distributors, particularly for smaller academic customers or international markets lacking a direct presence from the manufacturer. Due to the high-value, custom nature of the product, direct engagement remains the predominant distribution model, facilitating direct technical support and consultation.

Downstream analysis focuses on the end-use applications, where customers employ the OPLs for applications such as CRISPR screening or gene assembly. The downstream success heavily relies on the availability of robust bioinformatics tools and services to analyze the resultant sequencing data. Many synthesis providers now offer integrated bioinformatics packages, extending their reach further downstream to provide a complete solution, thereby capturing additional revenue streams and enhancing customer loyalty. The feedback loop from downstream usage—where customers report on the functional performance of the libraries—is crucial for continuous process improvement in the upstream synthesis stage. The direct connection between synthesis fidelity (upstream) and functional outcomes (downstream) emphasizes the highly interconnected nature of this specialized value chain, where product reliability is the ultimate determinant of market value and adoption across diverse research institutions and commercial drug discovery platforms.

Oligonucleotide Pool Library Market Potential Customers

The primary consumers of Oligonucleotide Pool Libraries are institutions and entities deeply involved in advanced life science research, drug development, and synthetic biology applications. Leading the customer base are Pharmaceutical and Biotechnology Companies, particularly those with active pipelines in target validation, lead optimization, and functional genomics. These commercial entities utilize OPLs on a massive scale for high-throughput screening of therapeutic targets, essential for identifying mechanisms of action for novel drugs or conducting genome-wide screens to understand disease pathology. Their demand profile typically features requirements for ultra-high-density, commercially scalable pools with stringent quality control and reliable batch-to-batch consistency, reflecting the direct impact of library quality on costly downstream clinical development decisions. As personalized medicine accelerates, the pharmaceutical sector's reliance on OPLs for complex genetic screens continues to expand, maintaining their position as the market's largest revenue drivers.

Academic and Research Institutes constitute the second major customer segment. University laboratories, government research centers, and non-profit genomics consortia rely heavily on oligonucleotide pool libraries for fundamental biological discoveries, genetic function mapping, and basic research into molecular mechanisms. While these customers typically purchase smaller volumes compared to biopharma, their demand is characterized by high diversity in library design, often seeking specialized, cutting-edge pool types for novel applications such as complex gene circuit construction or directed evolution experiments. Price sensitivity is generally higher in this segment, though access to grant funding and core facility budgets ensures sustained demand. Their unique requirements often push the boundaries of current synthesis technology, acting as crucial early adopters for new, highly complex pool formats and driving innovation through academic publications and proof-of-concept studies.

The third critical customer group includes Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs), which provide specialized high-throughput screening and functional genomics services on behalf of pharmaceutical or smaller biotech companies. CROs are significant buyers because they operationalize the high-volume screening projects, requiring reliable, standardized access to diverse OPL formats to support their varied client needs. Their buying decisions prioritize vendor reliability, turnaround time, and the ability to integrate the library supply seamlessly into their automated screening platforms. The increasing trend of outsourcing complex R&D services further cements the importance of CROs and CDMOs as crucial intermediaries and high-volume consumers within the oligonucleotide pool library market, requiring synthesis partners capable of meeting stringent industrial quality and delivery standards for outsourced drug discovery efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $1,475 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Twist Bioscience, Agilent Technologies, CustomArray (Teledyne Technologies), Genscript, Integrated DNA Technologies (IDT), Eurofins Genomics, Thermo Fisher Scientific, Danaher Corporation (via subsidiaries), Merck KGaA, Arbor Biosciences, Bioneer Corporation, Synthego, Bio-Rad Laboratories, Genewiz, Codex DNA, SGI-DNA (Synthetic Genomics). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oligonucleotide Pool Library Market Key Technology Landscape

The technology landscape of the Oligonucleotide Pool Library Market is defined by continuous innovation in synthesis methods aimed at increasing throughput, improving sequence accuracy, and lowering cost per base pair. The two dominant established technologies are Microarray-Based Synthesis (often referred to as chip-based or photolithographic synthesis) and Column-Based Synthesis (traditional solid-phase synthesis). Microarray technology allows for the simultaneous, high-density synthesis of hundreds of thousands to millions of unique sequences on a small substrate, making it ideal for ultra-complex libraries used in applications like large-scale CRISPR screens and targeted sequencing panel preparation. While microarray synthesis offers unparalleled scale, it historically faces challenges regarding synthesis fidelity and the maximum length of individual oligonucleotides, although recent advancements in chip design and chemistry are mitigating these limitations. Providers utilizing this technology prioritize throughput and complexity, making them essential for high-volume discovery research.

Column-based synthesis, though inherently lower in throughput and limited in the complexity of the pool that can be practically produced, excels in delivering superior sequence fidelity and purity, particularly for longer oligonucleotides. This method is preferred when extremely high quality and guaranteed integrity of every sequence are non-negotiable, often for smaller, custom pools intended for high-stakes applications such as the creation of synthetic genes or crucial therapeutic components. However, the future is increasingly leaning toward next-generation methods, most notably Enzymatic Synthesis (DNA synthesis using terminal deoxynucleotidyl transferase or TdT). Enzymatic methods promise to overcome the size and fidelity limitations of chemical synthesis, offering the potential for faster synthesis cycles, reduced environmental footprint, and significantly higher accuracy, positioning it as a potentially disruptive technology poised to revolutionize the manufacturing of oligonucleotide pools over the forecast period, driving competition among established players and startups alike.

Supporting these core synthesis platforms is a rapidly evolving suite of ancillary technologies, including advanced computational design tools (often incorporating machine learning to optimize sequence properties), robust purification and quality control systems (like high-resolution mass spectrometry and next-generation sequencing validation), and microfluidic integration. Microfluidics plays a vital role in automating liquid handling for both column and enzymatic synthesis, enabling greater parallelization and process control. Furthermore, the integration of sequencing technologies for post-synthesis quality assessment is non-negotiable; market leaders provide comprehensive QC data packages to assure customers of the pool quality. The overall technological direction emphasizes highly automated, end-to-end synthesis pipelines that move beyond mere manufacturing to offering integrated design, synthesis, and bioinformatic analysis services, catering to the sophisticated demands of modern genetic engineering and drug development.

Regional Highlights

- North America: Market Dominance and Innovation Hub

North America, particularly the United States, commands the largest share of the Oligonucleotide Pool Library Market, a dominance driven by several synergistic factors. The region benefits from massive governmental and private sector funding directed towards life sciences, genomics, and personalized medicine research, providing substantial capital for academic and industry adoption of high-throughput tools like OPLs. The presence of a high concentration of major pharmaceutical companies, leading biotechnology firms, and specialized synthesis providers (including market leaders like Twist Bioscience, Agilent, and IDT) creates a robust ecosystem that fosters both technological innovation and high-volume demand. Furthermore, the aggressive adoption of advanced genomic technologies, such as large-scale CRISPR screening and synthetic biology applications, solidifies the region’s position as a key consumer and innovator. The regulatory environment generally supports genetic engineering research, further accelerating the translation of basic research into commercial applications, maintaining high growth momentum.

The competitive landscape in North America is highly dynamic, characterized by intense efforts to improve synthesis technology fidelity and complexity. R&D spending in the U.S. remains globally unparalleled, driving continuous demand for customized, complex pools essential for target identification in oncology, neurodegeneration, and infectious disease modeling. Specialized synthesis startups focused on enzymatic DNA synthesis are concentrated in this region, particularly around key biotech clusters such as Boston and the San Francisco Bay Area, pushing the technological envelope. The requirement for OPLs in clinical research, particularly in the preparation of specialized targeted sequencing panels for patient diagnostics and biomarker discovery, ensures a consistent and high-value market stream. This continuous focus on translational research ensures North America remains the epicenter for market development and key strategic acquisitions.

Key countries like the United States are characterized by strong intellectual property protections that encourage the development of proprietary synthesis chemistries and library design algorithms, providing companies with a significant competitive edge. Canada also contributes substantially, particularly through government-backed genomics initiatives and strong academic research programs. The mature infrastructure for distributing complex biological reagents and the presence of highly skilled bioinformatics specialists necessary for OPL usage further cement North America's leadership. The region serves as the benchmark for quality, speed, and complexity standards for the global oligonucleotide pool library industry, driving market trends and product development cycles worldwide.

- Europe: Established Research Base and Strategic Growth

Europe holds a substantial market share, ranking second globally, supported by a strong foundation of world-class academic institutions and robust funding from the European Union (e.g., Horizon Europe programs) dedicated to biological and synthetic biology research. Countries such as Germany, the UK, Switzerland, and France are leading contributors, hosting major pharmaceutical headquarters and specialized genomics centers that rely heavily on OPLs for fundamental research and early-stage drug discovery. The European market distinguishes itself through a stringent focus on quality assurance and standardization, often driving demand for high-fidelity, column-synthesized pools, particularly in therapeutic and diagnostic applications where regulatory compliance is paramount. The collaborative nature of European research consortia frequently generates complex project demands that require custom oligonucleotide pool libraries, ensuring consistent market activity.

The UK, despite post-Brexit changes, maintains a formidable presence in genomics and biotechnology, fueled by significant private investment and the legacy of institutions dedicated to genomic sequencing and analysis. Germany, with its strong chemical and manufacturing base, is home to major synthesis providers and large biotech firms that utilize pools for industrial biotechnology applications, including enzyme engineering and metabolic pathway optimization. European market growth is also increasingly tied to specialized areas like personalized medicine and advanced cell and gene therapies, which require precision-engineered synthetic components. Efforts to streamline regulatory pathways for advanced therapeutic medicinal products (ATMPs) are expected to further stimulate the demand for high-quality synthetic genetic materials.

While often facing slightly higher regulatory hurdles than North America, the European market benefits from widespread public healthcare systems that support research into complex diseases, creating a steady demand for high-throughput screening tools. Challenges include market fragmentation across different member states, which can complicate distribution and standardization efforts. However, strategic investments in centralized research infrastructure and growing collaborations between synthesis providers and regional genomics cores are driving efficiency and accessibility. The region is poised for consistent growth, capitalizing on its expertise in molecular biology and its established pharmaceutical manufacturing capabilities, ensuring it remains a vital segment of the global OPL market.

- Asia Pacific (APAC): Fastest Growing Market

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by rapidly expanding economic development, escalating healthcare expenditure, and substantial government initiatives supporting biotechnology and genomic sequencing projects in countries like China, Japan, South Korea, and India. China, in particular, has emerged as a powerhouse in genomics research and synthetic biology manufacturing, investing billions in establishing state-of-the-art research infrastructure and fostering domestic synthesis capabilities. This has led to a dramatic increase in the volume of research requiring high-throughput oligonucleotide tools, thereby creating a huge, untapped demand for OPLs. The market here is characterized by a strong focus on price competitiveness and rapid capacity expansion.

Japan and South Korea possess technologically mature biotechnology sectors, with robust academic-industry collaborations focusing on applications such as drug discovery, vaccine development, and advanced diagnostics. These countries prioritize high-quality research outcomes, driving demand for technologically advanced and high-fidelity oligonucleotide pool libraries. India, while still emerging, is showing accelerated growth in its biopharma and contract research sectors, leveraging a large pool of scientific talent and lower operating costs to become a significant hub for outsourced genomic services, increasing its consumption of OPLs for target validation and screening projects. The regional expansion is largely supported by increasing affordability of sequencing technologies, making pooled screening methods accessible to a wider range of institutions.

Despite being a high-growth region, the APAC market faces challenges related to intellectual property protection and varying regulatory standards across countries. However, the sheer volume of population-based genomics studies and the emphasis on developing domestic capacity for synthetic biology applications guarantee sustained high growth. Market players are strategically establishing local synthesis and distribution centers to mitigate logistical challenges and capture local demand. The increasing focus on local development of biological therapeutics and innovative agricultural biotechnology provides powerful downstream applications for oligonucleotide pool libraries, solidifying APAC’s role as the crucial engine of future market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oligonucleotide Pool Library Market.- Twist Bioscience

- Agilent Technologies

- Integrated DNA Technologies (IDT) (Danaher Corporation)

- Genscript

- Eurofins Genomics

- Thermo Fisher Scientific Inc.

- CustomArray (Teledyne Technologies)

- Merck KGaA

- Arbor Biosciences

- Bioneer Corporation

- Synthego

- Bio-Rad Laboratories

- Genewiz

- Codex DNA

- SGI-DNA (Synthetic Genomics)

- OriGene Technologies

- Takara Bio Inc.

- New England Biolabs (NEB)

- Creative Biogene

- Novartis AG (internal capabilities)

Frequently Asked Questions

Analyze common user questions about the Oligonucleotide Pool Library market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Oligonucleotide Pool Libraries?

The primary applications driving demand are Functional Genomics Screening, particularly CRISPR-based screens (gRNA libraries), Next-Generation Sequencing (NGS) targeted panel preparation, and Synthetic Gene Assembly for engineering biological systems. These applications require the ability to test millions of sequences simultaneously.

How does Microarray-Based Synthesis differ from Column-Based Synthesis for OPLs?

Microarray-based synthesis offers ultra-high throughput and complexity (millions of sequences) on a chip, ideal for large screens, but may have lower fidelity for longer sequences. Column-based synthesis offers superior fidelity and purity for shorter sequences but is lower in throughput and complexity.

What is the main restraint limiting the growth of the high-complexity Oligonucleotide Pool Market?

The main restraint is the challenge of maintaining extremely high sequence fidelity and homogeneity across all sequences within an ultra-complex pool. Even minor synthesis errors can lead to uneven representation or non-functional sequences, impacting experimental reliability and reproducibility.

Which end-user segment contributes most significantly to the Oligonucleotide Pool Library Market revenue?

Pharmaceutical and Biotechnology Companies are the most significant end-user segment, driven by their extensive R&D pipelines, high-throughput requirements for drug target identification and validation, and greater capacity for large-scale, commercial purchases.

How is Artificial Intelligence (AI) influencing the future of Oligonucleotide Pool Library utilization?

AI is crucial for optimizing OPL utility by enhancing design (predicting highly functional sequences), improving quality control during manufacturing, and accelerating the complex bioinformatic analysis of screening results, thereby increasing the efficiency of biological discovery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager