Oligonucleotide Therapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432438 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Oligonucleotide Therapy Market Size

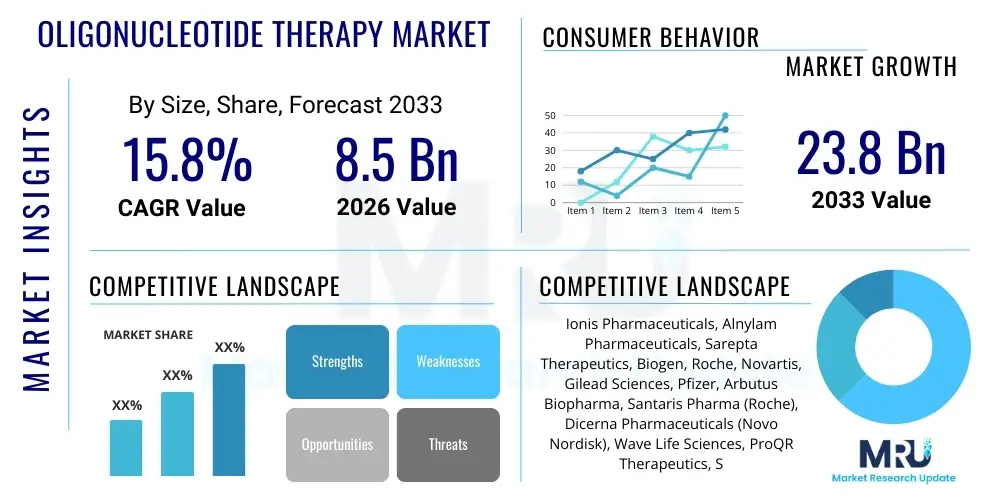

The Oligonucleotide Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 23.8 Billion by the end of the forecast period in 2033.

Oligonucleotide Therapy Market introduction

Oligonucleotide therapy represents a cutting-edge therapeutic approach leveraging short, synthetic strands of nucleic acids designed to modulate gene expression at the RNA level. These therapeutics, which include Antisense Oligonucleotides (ASOs), Small Interfering RNAs (siRNAs), microRNAs (miRNAs), and aptamers, function by directly interfering with the production of disease-causing proteins or by correcting aberrant splicing patterns. This highly specific mechanism offers significant advantages over traditional small molecules or monoclonal antibodies, enabling the targeting of pathways previously considered "undruggable" and opening new frontiers in personalized medicine for complex and genetic disorders. Key applications span a diverse spectrum of medical needs, including rare neurological disorders, oncology, cardiovascular disease management, and viral infections.

The core objective of oligonucleotide therapies is to deliver a stable and functional nucleic acid sequence to the cytosol of target cells, enabling sequence-specific binding to messenger RNA (mRNA) or pre-mRNA. The product spectrum is rapidly diversifying, driven primarily by continuous innovations in chemical modification strategies, such as the incorporation of 2’-O-Methoxyethyl (MOE) sugars and locked nucleic acids (LNA), which significantly enhance stability against nucleases and improve target binding affinity. These structural enhancements are crucial for maximizing therapeutic potency while minimizing systemic toxicity and immunogenic response, thereby improving the overall clinical profile of these complex molecules.

Market expansion is powerfully driven by a confluence of factors, including increasing investment in genomic research, rapid regulatory approvals for breakthrough therapies in areas of high unmet need (e.g., Spinraza for SMA, Onpattro for hATTR amyloidosis), and substantial technological progress in targeted delivery systems, particularly the use of N-acetylgalactosamine (GalNAc) conjugates for highly efficient liver uptake. The demonstrated clinical successes have fueled confidence across the biopharmaceutical sector, leading to extensive collaborative efforts aimed at expanding the therapeutic reach of oligonucleotides beyond hepatic tissues, focusing heavily on central nervous system (CNS) and muscle delivery, which currently represent major technical challenges but immense commercial opportunities.

- Product Description: Synthetic nucleic acid sequences (ASOs, siRNAs, aptamers) designed to modulate gene expression pathways by binding to specific RNA targets.

- Major Applications: Rare genetic disorders, oncology (cancer targets), cardiovascular diseases, neurological conditions (SMA, Huntington's), and infectious disease treatments.

- Benefits: High target specificity, potential to address "undruggable" protein targets, durable therapeutic effects, and applicability in personalized medicine.

- Driving Factors: Advancements in chemical modifications, improved delivery technologies (GalNAc, LNPs), increasing prevalence of chronic diseases, and regulatory support for orphan drugs.

Oligonucleotide Therapy Market Executive Summary

The Oligonucleotide Therapy Market is undergoing dynamic transformation characterized by accelerated scientific advancements, strategic consolidation, and a pronounced shift in therapeutic focus. Business trends reflect a high volume of licensing agreements and co-development partnerships, where large pharmaceutical entities leverage the specialized sequence design and delivery platform expertise of focused biotechnology companies. This collaborative model is essential for navigating the immense capital requirements and technological complexity inherent in oligonucleotide development. Furthermore, manufacturers are heavily investing in scalable and compliant manufacturing technologies to transition from supplying niche orphan drugs to serving broader patient populations for chronic conditions, such as cholesterol management and common cardiovascular risk factors, marking a pivotal commercial inflection point.

Geographically, the market landscape is dominated by established economies with robust R&D ecosystems. North America maintains its leadership position, underpinned by the largest concentration of innovative biotech firms, substantial venture capital funding, and regulatory frameworks that facilitate fast-track designations for novel therapies. Europe follows, driven by strong academic research and supportive policies for advanced therapy medicinal products (ATMPs). Crucially, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid healthcare modernization, increasing government support for indigenous biotechnology, and a vast patient pool, prompting global players to expand clinical trials and commercial footprints in countries like Japan, South Korea, and emerging markets in Southeast Asia.

Segment-wise, the market propulsion is heavily concentrated within the Antisense Oligonucleotides (ASOs) and Small Interfering RNAs (siRNAs) segments, which command the majority market share based on approved products and pipelines. Innovation in the technology segment is paramount, specifically within targeted drug delivery, where N-acetylgalactosamine (GalNAc) technology continues to revolutionize therapies targeting the liver, establishing it as a foundational technology for hepatic disorders. Therapeutically, the market momentum is shifting; while genetic disorders initially fueled growth, oncology is rapidly emerging as the largest area of research investment, followed closely by neurodegenerative diseases, signaling the industry's strategic expansion into larger, commercially attractive clinical segments with high therapeutic potential.

- Business Trends: Increased pharmaceutical-biotech collaborations, significant mergers and acquisitions activity focused on acquiring proprietary delivery platforms, and outsourcing of complex manufacturing processes to specialized CMOs.

- Regional Trends: Dominance of North America due to strong funding and R&D base; fastest growth anticipated in the Asia Pacific region driven by emerging economies and healthcare expansion.

- Segments trends: Continued dominance of ASOs and siRNAs modalities; Delivery technology (GalNAc conjugates, LNPs) is the fastest evolving sub-segment; Neurology and Oncology represent key therapeutic areas for future commercial success.

AI Impact Analysis on Oligonucleotide Therapy Market

User queries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in oligonucleotide therapy frequently center on the efficiency of target identification, the predictability of oligonucleotide physicochemical properties, and the optimization of delivery vehicle formulation. Users are particularly interested in how AI can streamline the complex and often labor-intensive process of designing effective sequences that demonstrate high specificity and minimal off-target activity, a challenge that currently constitutes a major bottleneck in development. Key concerns also revolve around the use of predictive models to forecast immunotoxicity and long-term efficacy, thereby reducing attrition rates in expensive late-stage clinical trials and accelerating the pipeline from discovery to commercialization.

AI algorithms are fundamentally transforming the early discovery phase by analyzing vast genomic, transcriptomic, and proteomic datasets to identify novel, disease-relevant targets that are susceptible to oligonucleotide intervention. Predictive modeling allows researchers to screen billions of potential oligonucleotide sequences computationally, selecting candidates with optimal binding affinity, desirable secondary structures, and enhanced resistance to degradation by nucleases, significantly improving the probability of selecting a high-quality lead compound. Furthermore, AI assists in the crucial area of chemical modification design, helping to predict the systemic behavior, tissue distribution, and metabolism of modified nucleotides before they enter laborious laboratory synthesis, dramatically cutting down lead optimization time and costs.

In the highly critical area of drug delivery, AI is instrumental in optimizing the complex mixture and structure of components, especially for advanced systems like Lipid Nanoparticles (LNPs). ML models can accurately predict how changes in LNP lipid composition or surface characteristics will affect cellular uptake, stability, and targeting efficiency in various tissues. This capability is paramount for addressing the long-standing challenge of non-hepatic delivery, such as delivering siRNAs efficiently to the brain or muscle. By leveraging iterative design cycles and predictive synthesis, AI allows developers to quickly converge on the most effective and scalable formulation parameters, ensuring therapeutic relevance and commercial viability, thus positioning AI as an indispensable tool for future market leaders.

- AI accelerates target identification by analyzing complex omics data, highlighting novel therapeutic intervention points.

- Machine Learning optimizes oligonucleotide sequence design for enhanced specificity, stability, and minimized off-target effects.

- Predictive modeling shortens lead optimization timelines by assessing the metabolic fate and toxicity of chemical modifications.

- AI aids in optimizing complex delivery vehicle formulations, such such as enhancing the efficacy and tissue tropism of Lipid Nanoparticles (LNPs).

- Advanced algorithms are used to forecast clinical efficacy and patient response based on individual genetic profiles, facilitating personalized medicine approaches.

- AI improves manufacturing quality control by monitoring and optimizing large-scale synthesis processes for purity and yield.

DRO & Impact Forces Of Oligonucleotide Therapy Market

The market trajectory is significantly shaped by compelling drivers and substantial technological opportunities juxtaposed against inherent logistical and cost restraints. Key drivers include the rapidly increasing prevalence of rare genetic disorders, many of which lack existing effective treatments, thus creating high demand for transformative oligonucleotide therapies. The regulatory landscape, particularly in the US and Europe, supports accelerated pathways for orphan drug development, incentivizing investment in this sector. Opportunities are expansive, centered on technological breakthroughs in tissue-specific delivery, especially tackling extra-hepatic organs like the CNS and tumor microenvironments, and the transition of successful rare disease models into high-volume treatments for chronic conditions like cardiovascular disease and diabetes management.

Conversely, the market faces significant restraints that temper aggressive growth projections. The primary restraint is the extremely high cost associated with oligonucleotide synthesis, purification, and formulation, leading to premium pricing that challenges payer willingness and limits patient access globally. Persistent biological restraints, mainly related to the stability of the molecules in systemic circulation and the difficulty in achieving targeted cellular uptake without advanced delivery systems, also impede development. Furthermore, regulatory scrutiny regarding the long-term safety profile and potential off-target effects of modified nucleic acids remains a constraint, necessitating stringent and lengthy clinical safety data collection.

The impact forces exerted on the market are predominantly technological and economic. Technologically, the success or failure of developing highly efficient, low-toxicity delivery systems—beyond the hepatic-focused GalNAc technology—will fundamentally redefine competitive advantages and market segmentation. Economically, the need for robust pharmacoeconomic data demonstrating the long-term value and curative potential of these therapies is crucial for securing favorable reimbursement decisions globally, directly impacting commercial viability. Regulatory impact forces, particularly the need for global harmonization of standards for advanced genetic therapies, are also high, affecting time-to-market and global launch strategies. The competitive intensity is high, focusing less on pricing and more on proprietary intellectual property related to novel chemistry and tissue-targeting capabilities.

- Drivers: High unmet medical needs in rare and genetic diseases; Success of approved landmark drugs; Advancements in chemical stabilization; Rising R&D expenditure in genomics.

- Restraints: High manufacturing costs and resulting premium pricing; Challenges in non-hepatic, systemic drug delivery; Regulatory uncertainty regarding long-term safety.

- Opportunity: Expansion into large markets (oncology, cardiovascular); Development of CNS-targeting delivery vehicles (e.g., LNP modifications); Personalized medicine applications leveraging genetic data.

- Impact Forces: Technological innovation in delivery systems (High Impact); Payer acceptance and reimbursement policies (Medium-High Impact); Stringent regulatory requirements for ATMPs (High Impact).

Segmentation Analysis

The oligonucleotide therapy market segmentation reveals a complex landscape categorized by the mode of action, therapeutic area, technology platform, and end-user base, reflecting the diverse applications and underlying biological mechanisms involved. Understanding these segments is critical for assessing competitive intensity, identifying growth pockets, and optimizing commercial strategy. The product type segmentation distinguishes between modalities based on their mechanism of gene silencing or modulation, while application segmentation highlights the key clinical priorities and largest addressable patient populations, guiding targeted research and development efforts across the industry.

Product type segmentation is dominated by Antisense Oligonucleotides (ASOs) and Small Interfering RNAs (siRNAs). ASOs, which primarily function via RNase H-mediated mRNA degradation or splice modulation, have shown considerable success in neurological applications administered via intrathecal injection. In contrast, siRNAs, which utilize the RNA-induced silencing complex (RISC), are commercially established for liver-targeted indications, benefiting immensely from the efficiency of GalNAc conjugation. The technology segmentation emphasizes the distinction between synthesis technologies, which ensure the foundational quality and cost of the drug substance, and delivery technologies, which dictate biological efficacy and tissue specificity, with the latter currently being the primary focus of disruptive innovation and investment.

Application-based analysis indicates that genetic disorders and neurological diseases remain high-value segments due to the high efficacy demonstrated in these areas and the associated premium pricing. However, oncology represents the largest market potential in terms of patient volume and research pipeline investment, focusing on targeting regulatory RNAs and immune checkpoint inhibitors. The end-user segment is defined by specialized clinical settings, where hospitals and specialized clinics are the primary administrators, necessitating highly specialized supply chains and patient management programs tailored to these advanced, often infusible, biological therapies. The interplay between these segments demonstrates a market moving swiftly from targeting rare monogenic disorders to tackling complex, common chronic diseases.

- Product Type:

- Antisense Oligonucleotides (ASOs)

- Small Interfering RNA (siRNA)

- Aptamers

- MicroRNA (miRNA)

- Others (e.g., Ribozymes, DNAzymes)

- Technology:

- Oligonucleotide Synthesis

- Oligonucleotide Modification

- Oligonucleotide Delivery (GalNAc, LNP, Polymeric Nanoparticles)

- Application:

- Oncology

- Neurological Disorders (SMA, Huntington's Disease)

- Infectious Diseases (HIV, Hepatitis)

- Cardiovascular Diseases

- Metabolic and Renal Disorders

- End-Use:

- Hospitals and Clinics

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Oligonucleotide Therapy Market

The value chain for oligonucleotide therapy is distinctively complex, emphasizing specialized chemical synthesis and highly regulated downstream distribution. Upstream activities involve the procurement of specialized, high-purity raw materials, chiefly nucleoside phosphoramidites, solid supports, and coupling reagents, which are essential for solid-phase oligonucleotide synthesis. This upstream segment is highly specialized and often dominated by a few key suppliers that guarantee the quality and chemical precision required for therapeutic-grade nucleic acids. Synthesis itself is typically handled by specialized Contract Manufacturing Organizations (CMOs) or integrated large pharmaceutical companies capable of cGMP-compliant large-scale production, ensuring high yield and purity that meet rigorous regulatory standards.

Midstream activities encompass the critical steps of chemical modification and drug formulation, representing the highest intellectual property value in the chain. This stage involves conjugating the oligonucleotide sequence to a delivery vehicle, such as attaching it to a GalNAc ligand or encapsulating it within a custom-designed Lipid Nanoparticle (LNP). Innovation in this midstream segment dictates the market success, as delivery efficiency and tissue specificity are paramount for therapeutic effectiveness. Development and clinical validation of the drug candidate, followed by submission for regulatory approval, further solidify the midstream R&D investment before commercial launch.

The downstream component involves the commercial manufacturing of the finished drug product, specialized logistics, and patient distribution. Distribution channels are highly controlled, usually operating through validated cold chain management systems due to the temperature sensitivity of the drug products. Direct distribution often involves specialized hospital pharmacies or infusion centers equipped to handle high-cost, high-risk biological therapies and manage strict inventory controls. Indirect distribution involves partnering with specialized third-party logistics (3PL) providers who can maintain regulatory compliance and geographical reach, ensuring the integrity of the product from the manufacturing plant to the point of care.

Oligonucleotide Therapy Market Potential Customers

The primary consumers of marketed oligonucleotide therapies are specialized healthcare providers operating within hospital systems and clinics equipped to treat complex chronic and rare diseases. These end-users, primarily specialized physicians such as neurologists, geneticists, and cardiologists, diagnose patients eligible for specific treatments and manage the administration protocols, which often require careful monitoring and specialized infusion facilities. Patient populations suffering from conditions like Spinal Muscular Atrophy, Hereditary Transthyretin-mediated Amyloidosis (hATTR), and severe hypercholesterolemia form the immediate and high-value customer base, generating substantial revenue for manufacturers.

A secondary, yet crucial, customer segment comprises pharmaceutical and biotechnology companies themselves, alongside academic research institutions and Contract Research Organizations (CROs). These entities procure custom-synthesized oligonucleotides, high-purity raw materials, and specialized synthesis services for their ongoing drug discovery and preclinical development programs. This customer segment is highly focused on innovation and demands rapid turnaround, ultra-high purity, and adherence to evolving regulatory guidelines for research-grade and preclinical materials, driving demand for specialized service providers in the upstream value chain.

Finally, governmental health agencies and private insurance payers act as essential potential customers, given their decisive role in market access and volume procurement. For a high-cost therapy to be commercially viable, pharmaceutical companies must effectively sell the long-term economic value and clinical benefit to these payers. Successful negotiation of reimbursement policies and formulary inclusions transforms patient eligibility into substantial commercial scale, making payers the indirect but critical financial decision-makers who determine the scope and profitability of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 23.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ionis Pharmaceuticals, Alnylam Pharmaceuticals, Sarepta Therapeutics, Biogen, Roche, Novartis, Gilead Sciences, Pfizer, Arbutus Biopharma, Santaris Pharma (Roche), Dicerna Pharmaceuticals (Novo Nordisk), Wave Life Sciences, ProQR Therapeutics, Silence Therapeutics, Moderna (in specialty areas), miRagen Therapeutics, Akcea Therapeutics (Ionis), Astellas Pharma, Geron Corporation, Arrowhead Pharmaceuticals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oligonucleotide Therapy Market Key Technology Landscape

The technological core of the oligonucleotide therapy market is driven by continuous innovation in two critical areas: chemical modification and advanced delivery systems. Chemical modifications involve altering the sugar, backbone, or base moieties of the nucleic acid to confer stability against ubiquitous nucleases, enhance target binding affinity, and reduce toxicity. The evolution from first-generation phosphorothioate backbones to second-generation 2’-O-MOE and third-generation Locked Nucleic Acids (LNAs) has been fundamental, significantly improving the pharmacokinetic profile and cellular permeability of these therapeutic agents. This continuous optimization of oligonucleotide chemistry is essential to overcome systemic degradation and immunological challenges, ensuring the therapeutic payload reaches the target RNA intact and functional within the cell.

The most transformative technology in recent years is targeted drug delivery, crucial for overcoming the inherent difficulty of getting large, polyanionic oligonucleotide molecules across cell membranes and out of the endosome. For liver targeting, N-acetylgalactosamine (GalNAc) conjugation technology has become the gold standard, achieving highly efficient uptake by hepatocytes via the asialoglycoprotein receptor (ASGPR). For non-hepatic targets, which represent the largest unmet need, the focus is heavily concentrated on engineering sophisticated systems like Lipid Nanoparticles (LNPs) and polymer conjugates. LNP technology, initially developed for mRNA vaccines, is being refined for siRNA delivery, with efforts focused on modulating lipid composition and surface ligands to enable specific targeting of tissues such as the central nervous system, muscle, and tumors, thereby unlocking vastly expanded therapeutic applications.

Furthermore, improvements in automated solid-phase synthesis technology are essential for the commercial scalability of oligonucleotide drugs. Advanced synthesis platforms allow for rapid, high-throughput production of high-purity sequences with complex modifications, critical for meeting clinical trial and commercial supply demands while minimizing production costs. Purification technologies, particularly ion-exchange and reversed-phase chromatography, are continuously being refined to ensure the removal of failure sequences and truncated products, achieving the stringent purity levels required for regulatory approval. The integration of continuous flow chemistry is an emerging technological trend aimed at increasing efficiency and reducing batch variability in large-scale manufacturing, underpinning the market's capacity to support treatments for broader chronic indications.

Regional Highlights

- North America (U.S. and Canada): Dominates the global market share due to the highest concentration of leading biotechnology and pharmaceutical companies (e.g., Alnylam, Ionis), robust R&D spending, favorable regulatory pathways (FDA approvals for orphan drugs), and substantial venture capital investment in genomic medicine platforms. The presence of sophisticated healthcare infrastructure and high patient affordability for high-cost therapies solidify its leadership.

- Europe (Germany, U.K., France): Represents a substantial market segment, driven by strong government support for ATMP research and development, established academic institutions focusing on genomic therapies, and increasing regulatory harmonization efforts (EMA). The U.K. and Germany are particularly strong in early-stage discovery and clinical development collaborations.

- Asia Pacific (APAC) (China, Japan, South Korea, India): Projected as the fastest-growing region, fueled by rapidly expanding healthcare expenditure, increasing incidence of chronic diseases, a large patient population, and governmental initiatives promoting domestic pharmaceutical innovation and local manufacturing capacity, particularly in China and South Korea, which are aggressively investing in nucleic acid research.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions hold emerging market potential, primarily driven by increasing awareness of genetic disorders and improving access to specialized care, although market penetration is currently restricted by challenges in regulatory infrastructure, high import costs, and limited reimbursement policies for ultra-high-cost biological therapies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oligonucleotide Therapy Market.- Ionis Pharmaceuticals

- Alnylam Pharmaceuticals

- Sarepta Therapeutics

- Biogen

- Roche

- Novartis

- Gilead Sciences

- Pfizer

- Arbutus Biopharma

- Santaris Pharma (Roche)

- Dicerna Pharmaceuticals (Novo Nordisk)

- Wave Life Sciences

- ProQR Therapeutics

- Silence Therapeutics

- Moderna (specialty platforms)

- miRagen Therapeutics

- Akcea Therapeutics (Ionis)

- Astellas Pharma

- Geron Corporation

- Arrowhead Pharmaceuticals

Frequently Asked Questions

Analyze common user questions about the Oligonucleotide Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Antisense Oligonucleotides (ASOs) and siRNA therapies?

ASOs are single-stranded molecules that typically bind directly to target mRNA, triggering its degradation by RNase H or altering splicing, and often require chemical modifications for stability. siRNA therapies are double-stranded and utilize the RNA-induced Silencing Complex (RISC) machinery to degrade target mRNA, offering potent silencing and generally requiring effective encapsulation (like LNPs) for systemic delivery.

What are the primary challenges restricting the widespread adoption of oligonucleotide therapies?

The key restrictive challenges include the difficulty of achieving efficient systemic delivery to non-hepatic tissues (like the brain and muscle), the necessity for complex and costly chemical synthesis and purification processes, and the resulting high cost of treatment, which impacts global patient access and payer willingness to reimburse.

Which technology is currently considered the gold standard for targeted oligonucleotide delivery?

The N-acetylgalactosamine (GalNAc) conjugation technology is the gold standard for targeted delivery, specifically for liver cells. GalNAc ligands enable efficient, receptor-mediated uptake of oligonucleotides by hepatocytes via the asialoglycoprotein receptor (ASGPR), making it highly effective for treating hepatic-associated diseases.

How is Artificial Intelligence (AI) influencing the oligonucleotide drug development pipeline?

AI is significantly accelerating drug development by enabling rapid, computational screening of millions of oligonucleotide sequences for optimal binding and stability. Furthermore, AI models are used to optimize delivery vehicle formulations, predict potential toxicity profiles, and enhance manufacturing process control, thereby reducing development time and cost.

Which therapeutic area is expected to drive the largest growth for oligonucleotide therapies in the coming years?

While treatments for rare genetic and neurological disorders currently hold high commercial value due to premium pricing, the oncology segment is projected to drive the largest long-term growth. Extensive research is being dedicated to leveraging oligonucleotides to target cancer pathways and enhance immunotherapies, addressing a vast patient population with high unmet needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager