Olive Leaf Extract Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433434 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Olive Leaf Extract Market Size

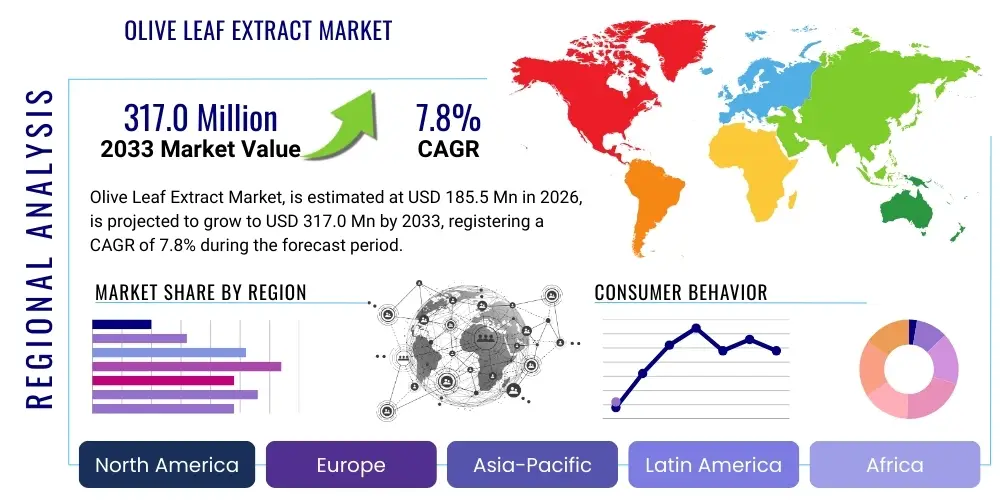

The Olive Leaf Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $317.0 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by increasing consumer awareness regarding the profound health benefits associated with natural and plant-derived ingredients, particularly the powerful antioxidant properties of oleuropein, the key bioactive compound found in olive leaves. The rising prevalence of chronic diseases, coupled with a societal shift towards preventative healthcare, further fuels the demand for standardized olive leaf extracts in nutraceutical and functional food applications across major economies worldwide.

Olive Leaf Extract Market introduction

The Olive Leaf Extract Market encompasses the global trade of standardized botanical extracts derived from the leaves of the olive tree (Olea europaea). These extracts are primarily valued for their high concentration of polyphenolic compounds, most notably oleuropein, which is credited with significant anti-inflammatory, antimicrobial, and antioxidant capabilities. Historically utilized in Mediterranean traditional medicine, olive leaf extracts have transitioned into mainstream dietary supplements and pharmaceutical raw materials due to rigorous scientific validation of their efficacy in supporting cardiovascular health, regulating blood pressure, and bolstering the immune system. The product is typically available in various forms, including capsules, liquid tinctures, powders, and specialized cosmetic formulations, catering to a diverse range of end-user needs and consumption preferences.

Major applications of olive leaf extract span across the nutraceutical, pharmaceutical, and cosmetic industries. In the nutraceutical sector, it is predominantly employed in immune support supplements and formulations targeting metabolic syndrome and cholesterol management. The functional food industry incorporates these extracts into health beverages and fortified foods to leverage their natural preservative qualities and high antioxidant capacity. Furthermore, the extract’s powerful free radical scavenging abilities make it a sought-after ingredient in high-end skincare products designed for anti-aging and skin protection. The driving factors for market expansion include the increasing demand for clean label ingredients, enhanced focus on natural immunity boosters post-global health crises, and significant advancements in extraction technologies that ensure maximum potency and bioavailability of active compounds like hydroxytyrosol.

The global marketplace for olive leaf extract is characterized by intense competition and a strong emphasis on standardization. Manufacturers face the necessity of ensuring consistent quality and purity, often certifying the oleuropein content using advanced analytical techniques such as High-Performance Liquid Chromatography (HPLC). Consumer demand is increasingly concentrated on extracts derived from sustainable and traceable sources, prompting suppliers to adhere to stringent ethical sourcing practices. Geographical variations in olive cultivation and processing infrastructure also significantly influence supply chain dynamics, with Mediterranean countries maintaining a dominant role in raw material provision and primary extraction processes, thereby defining the core competitive landscape and pricing structures for standardized products globally.

Olive Leaf Extract Market Executive Summary

The Olive Leaf Extract Market is undergoing a rapid evolutionary phase, driven by profound shifts in global health consciousness and sustained investment in clinical research validating botanical efficacy. Current business trends indicate a strong move towards vertically integrated supply chains, where key market players are acquiring or partnering with olive cultivation operations to ensure raw material security and consistent oleuropein yield. There is a palpable trend towards formulating synergistic health products, combining olive leaf extract with other potent botanicals such as turmeric or elderberry, optimizing comprehensive immune and cardiovascular support, thereby commanding premium pricing and expanding market penetration across specialized retail channels. Furthermore, the burgeoning popularity of personalized nutrition is necessitating the development of highly standardized extracts tailored for specific demographic health requirements, ensuring higher user compliance and sustained market relevance.

From a regional perspective, North America continues to dominate the market share, primarily due to high consumer expenditure on dietary supplements, established regulatory frameworks supporting botanical health claims, and robust penetration across conventional and e-commerce retail platforms. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is attributable to rising disposable incomes, rapid urbanization leading to lifestyle diseases, and increasing acceptance of Western-style supplements, particularly in health-conscious economies like China, India, and South Korea. European markets, governed by strict regulations from the European Food Safety Authority (EFSA), maintain stable growth driven by traditional usage and stringent quality standards, focusing heavily on locally sourced, high-quality raw materials.

Segmentation trends reveal that the capsule and tablet form factor remains the most favored segment due to convenience, precise dosing, and portability. However, the liquid and powder segments are experiencing accelerated adoption, especially in the functional beverage and sports nutrition categories, capitalizing on formulations that offer rapid absorption and easy incorporation into daily routines. Based on application, the dietary supplements segment holds the largest value share, but the cosmetic segment, driven by the extract's natural moisturizing and anti-inflammatory properties, is poised for significant expansion. The future market trajectory will be characterized by sustained innovation in delivery systems, including liposomal encapsulation and microencapsulation, aimed at enhancing the bioavailability and protecting the stability of the active compounds against environmental degradation during processing and storage.

AI Impact Analysis on Olive Leaf Extract Market

Common user questions regarding AI's impact on the Olive Leaf Extract Market revolve primarily around optimizing oleuropein yield in cultivation, ensuring authenticity and traceability against adulteration, and developing personalized supplement recommendations. Users frequently inquire about how AI-driven predictive analytics can forecast ingredient demand based on emerging health crises or demographic shifts. Concerns often focus on the potential for AI to optimize production costs, automate quality control processes, and enhance the efficacy of formulations by modeling complex molecular interactions. The prevailing expectation is that AI tools will revolutionize precision agriculture for olive cultivation, enabling real-time monitoring of tree health, soil nutrient levels, and optimal harvesting times to maximize the concentration of bioactive compounds, thus ensuring premium raw material quality for extraction processes and significantly improving overall supply chain efficiency and product consistency.

- AI-Powered Precision Agriculture: Utilizing machine learning algorithms to monitor environmental factors (weather, soil quality) and genetic markers to optimize olive tree health and maximize the synthesis of oleuropein in leaves before harvesting.

- Predictive Demand Forecasting: Deploying AI models to analyze global health trends, seasonal diseases, and consumer search behavior to accurately predict fluctuations in demand for immune-boosting and cardiovascular supplements containing olive leaf extract.

- Enhanced Quality Control and Authentication: Implementing computer vision and deep learning systems for automated inspection of raw extract batches, verifying purity, detecting contaminants, and ensuring standardized oleuropein concentration, combating issues of ingredient substitution or fraud.

- Personalized Formulation Development: Using AI to analyze individual user health data (genomics, microbiome profiles) to recommend specific olive leaf extract dosages or synergistic combinations with other ingredients for optimized therapeutic outcomes.

- Supply Chain Traceability: Utilizing blockchain technology integrated with AI oversight to provide immutable records of sourcing, processing, and distribution, ensuring consumer confidence regarding the extract’s origin and ethical sourcing practices.

- R&D Acceleration: Employing AI in silico drug discovery platforms to rapidly model the interaction of oleuropein and hydroxytyrosol with human biological pathways, accelerating research into new applications, such as specialized oncological support or advanced metabolic modulation.

DRO & Impact Forces Of Olive Leaf Extract Market

The Olive Leaf Extract Market is driven by compelling health trends centered around natural immunity enhancement and cardiovascular wellness, yet faces operational challenges primarily related to supply chain standardization and high extraction costs. The primary driver is the scientifically validated evidence supporting the extract's ability to lower blood pressure and combat oxidative stress, appealing directly to aging populations grappling with lifestyle-related chronic conditions. Conversely, a significant restraint is the inherent complexity and variability in the concentration of active compounds (oleuropein) due to geographical differences, seasonal variations, and varied processing techniques, making product standardization a difficult and costly endeavor. Opportunities abound in expanding applications into high-growth areas like clinical nutrition and pet supplements, leveraging the extract's broad antimicrobial spectrum, which provides a key differentiator in crowded markets seeking natural alternatives to synthetic additives.

The primary impact forces shaping the market trajectory include stringent regulatory requirements in major markets like the EU and US, which influence acceptable dosage levels and approved health claims, directly impacting market access and product labelling strategies. Technological innovations in extraction and encapsulation represent a crucial force, as advancements like Supercritical Fluid Extraction (SFE) allow for higher purity yields while maintaining the thermolabile characteristics of key polyphenols, improving product quality and overall market perception. Economic fluctuations, particularly those impacting agricultural commodity prices and energy costs associated with industrial extraction processes, also exert significant influence on the final pricing structure of high-quality standardized extracts, affecting manufacturer profitability and consumer affordability in price-sensitive regions.

Furthermore, evolving consumer education facilitated by digital platforms acts as a powerful enabling force, driving informed purchasing decisions towards efficacious, evidence-based supplements. As consumers gain access to detailed scientific literature, their preference shifts rapidly toward extracts standardized for maximum oleuropein content, compelling manufacturers to invest heavily in transparent testing and reporting. However, the occasional emergence of low-quality, non-standardized substitutes, often sourced from less reputable suppliers, acts as a downward force, potentially eroding consumer trust in the segment as a whole. Successfully navigating these forces requires manufacturers to prioritize robust clinical evidence, invest in verifiable sustainable sourcing, and focus on proprietary extraction methodologies that offer clear competitive advantages in terms of purity and concentration.

Segmentation Analysis

The Olive Leaf Extract market is fundamentally segmented based on the form of the final product, the concentration of the key active ingredient (oleuropein), the primary application area, and the distribution channel used for market outreach. Segmentation analysis provides crucial insights into targeted marketing strategies, allowing manufacturers to tailor products precisely to end-user requirements, whether they are seeking high-potency extracts for pharmaceutical purposes or lower-concentration formulations for general wellness supplements. The market is increasingly differentiating itself based on oleuropein concentration levels, recognizing that higher standardization appeals to clinical practitioners and research institutions, while lower concentrations maintain broad appeal across the mass supplement market, ensuring diversified revenue streams.

- By Form:

- Capsules/Tablets

- Liquid Extracts

- Powders

- Tinctures

- By Application:

- Dietary Supplements (Largest Share)

- Functional Foods and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Feed and Pet Supplements

- By Active Ingredient Concentration:

- Standardized 6% Oleuropein

- Standardized 15%-20% Oleuropein (High Potency)

- Other (Non-standardized or blended)

- By Distribution Channel:

- Offline (Retail Pharmacies, Specialty Stores, Supermarkets)

- Online (E-commerce platforms, Direct-to-Consumer websites)

Value Chain Analysis For Olive Leaf Extract Market

The value chain of the Olive Leaf Extract market begins with the specialized cultivation of olive trees, focusing specifically on varietals known for high leaf production and elevated oleuropein content, often sourced from traditional growing regions in the Mediterranean Basin. The upstream segment involves harvesting the leaves, which is typically done either manually or mechanically, followed immediately by drying and preliminary processing to stabilize the polyphenols. Key upstream suppliers include specialized olive farms and agricultural cooperatives that focus on sustainable practices, as the quality of the raw material fundamentally dictates the purity and potency of the final extract. Efficient logistics are critical at this stage to minimize degradation of the bioactive compounds between harvesting and the initial extraction process.

The midstream segment involves the critical extraction and purification processes. Manufacturers utilize various technologies, including solvent extraction (ethanol or water-based), supercritical fluid extraction (SFE), or maceration, depending on the desired standardization level and cost constraints. Standardization is achieved through rigorous testing, typically using High-Performance Liquid Chromatography (HPLC) to guarantee the precise concentration of oleuropein and related compounds (like hydroxytyrosol). This standardization step adds significant value and differentiates premium products. Manufacturers then convert the standardized crude extract into final product forms, such as powders or liquid concentrates, often using microencapsulation technologies to enhance stability and bioavailability before packaging into bulk quantities for downstream processing.

The downstream segment focuses on distribution and retailing. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves supplying bulk extracts to large nutraceutical or pharmaceutical companies for incorporation into their final products, often facilitated through long-term supply contracts. Indirect distribution encompasses sales through specialized nutraceutical distributors, wholesalers, and retail chains. The increasing prominence of e-commerce platforms represents a vital distribution channel, offering direct access to consumers and allowing for detailed product information dissemination and transparency. Specialty health food stores and online pharmacies remain critical touchpoints for consumer education and sales, emphasizing the extract's health benefits through targeted marketing and leveraging expert recommendations to drive sales volume and build brand loyalty.

Olive Leaf Extract Market Potential Customers

The potential customers for Olive Leaf Extract are highly diverse, spanning various demographics and industry sectors driven by distinct motivations concerning health, functionality, and formulation requirements. The primary end-users are individuals proactively seeking natural supplements for preventative health maintenance, especially those concerned with cardiovascular well-being, immune function, and managing healthy blood pressure levels. This segment largely consists of the aging population (50 years and older) in developed economies who prioritize natural solutions over conventional pharmaceutical interventions for chronic conditions. These consumers are typically well-educated regarding ingredient efficacy and are willing to pay a premium for high-potency, third-party tested standardized extracts, often purchasing through specialized online retailers or trusted supplement stores.

Another significant customer segment includes nutraceutical and dietary supplement manufacturers who require standardized bulk extracts as foundational ingredients for their proprietary health formulations. These B2B customers demand large volumes, consistent quality documentation, and extracts adhering to stringent regulatory standards (e.g., cGMP compliance). The extract is highly sought after by these companies due to its versatility and ability to address multiple health claims simultaneously—ranging from antioxidant support to metabolic health. They often purchase customized concentrations and require specific particle sizes or solubility characteristics suitable for incorporation into capsules, powders, or functional food matrices, prioritizing reliable supply and competitive bulk pricing.

Furthermore, the cosmetics and personal care industry represents a rapidly expanding customer base, utilizing olive leaf extract for its potent anti-aging, moisturizing, and anti-inflammatory properties. Skincare formulators incorporate the extract into serums, creams, and lotions targeted at reducing oxidative damage and soothing sensitive skin, aligning with the clean beauty trend. Finally, the functional food and beverage industry, including producers of health drinks, fortified yogurts, and snack bars, are emerging customers, leveraging the extract not only for its health benefits but also as a natural preservative, substituting synthetic antioxidants like BHT and BHA, appealing to consumers seeking clean label formulations and functional enhancement in their daily nutritional intake.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $317.0 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Naturex (Givaudan), Indena S.p.A., Frutarom (IFF), NOW Foods, Gaia Herbs, Comvita, Vesta Ingredients, Inc., Swisse Wellness, Natures Aid, Adams Extracts, Birolive, Olive World, Monteloeder, Robust Nutri, Viron International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Olive Leaf Extract Market Key Technology Landscape

The technological landscape in the Olive Leaf Extract market is characterized by a strong focus on enhancing extraction efficiency, maximizing the concentration of target compounds, and improving the bioavailability of the final product. Traditional maceration and percolation techniques are increasingly being superseded by advanced solvent-based extraction methods utilizing specialized hydroethanolic solvents, which are optimized for extracting high yields of polyphenols while minimizing the extraction of unwanted compounds. A critical technological evolution is the adoption of Supercritical Fluid Extraction (SFE), which uses supercritical carbon dioxide as a solvent. SFE offers a non-toxic, environmentally benign method for producing highly pure, solvent-free extracts, although its higher operational cost limits its usage primarily to premium, high-value nutraceutical products requiring exceptional purity and potency documentation.

Furthermore, analytical technology, particularly High-Performance Liquid Chromatography (HPLC) with diode-array detection (DAD), remains the gold standard for quality control and standardization. HPLC technology ensures the reliable quantification of key bioactive markers, specifically oleuropein and its metabolite hydroxytyrosol, enabling manufacturers to guarantee consistent potency across different production batches, which is a paramount concern for regulatory compliance and consumer confidence. Innovations in quality assurance also involve the integration of Near-Infrared (NIR) spectroscopy and other rapid screening tools utilized directly on the production line to quickly assess raw material quality and provide real-time feedback during the extraction process, thereby reducing waste and streamlining operational throughput.

A significant area of technological investment is in delivery systems aimed at increasing the intestinal absorption and systemic efficacy of the extract. Due to the inherent instability and poor water solubility of some polyphenols, microencapsulation and liposomal encapsulation technologies are gaining traction. These sophisticated techniques involve surrounding the olive leaf extract molecules with lipid layers or biopolymer matrices, protecting them from degradation in the acidic stomach environment and facilitating targeted delivery to intestinal absorption sites, significantly boosting bioavailability. This technological advancement is crucial for pharmaceutical-grade applications and high-end dietary supplements where optimal therapeutic effect is the primary selling proposition, differentiating innovative manufacturers in a highly competitive market environment focused on maximizing product performance.

Regional Highlights

The global Olive Leaf Extract market exhibits distinct regional dynamics influenced by varying regulatory environments, consumer health expenditures, and traditional consumption patterns. North America, encompassing the United States and Canada, holds the dominant market share due to its established dietary supplement culture, high consumer awareness regarding immune and cardiovascular health, and the readily available distribution network through massive retail and e-commerce platforms. The strong preference for natural and botanical ingredients, combined with substantial spending on preventative healthcare products, ensures sustained, high-volume demand for standardized, premium-grade olive leaf extracts across the region, making it a critical hub for market innovation and penetration strategies.

Europe, driven by Mediterranean countries like Spain, Italy, and Greece, serves as a crucial region both for raw material sourcing and consumption. While consumption is robust, deeply rooted in traditional European phytotherapy practices, market growth is strictly regulated by the European Food Safety Authority (EFSA), requiring rigorous scientific substantiation for health claims, which shapes the nature of product labeling and marketing within the Eurozone. The emphasis in Europe is placed heavily on certified organic sourcing, sustainability, and traceability from grove to final product, appealing to consumers highly sensitized to environmental and ethical production standards, contributing significantly to stable market growth in the region.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, experiencing exponential growth fueled by rapid economic expansion, increasing health consciousness, and urbanization. Countries such as China, Japan, and South Korea are witnessing a demographic shift where younger, urban consumers are integrating Western-style supplements into their routines. This is further supported by governmental initiatives promoting preventative health. The market in APAC, while currently smaller than North America, represents significant future opportunity, especially for products formulated for specific regional health concerns, such as high rates of type 2 diabetes and hypertension, creating substantial growth potential for customized functional foods incorporating olive leaf extracts.

- North America: Market dominance attributed to strong supplement culture, high healthcare expenditure, and advanced e-commerce distribution channels. Focus on immune support and cardiovascular health claims.

- Europe: Stable growth driven by traditional consumption, stringent EFSA regulations, and a strong emphasis on organic and sustainable sourcing from Mediterranean cultivation centers.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rising disposable incomes, urbanization, and increasing acceptance of Western dietary supplements, particularly in China and India for anti-diabetic and antioxidant applications.

- Latin America: Emerging market potential driven by local cultivation capabilities and increasing awareness of natural health remedies, though constrained by economic volatility and complex regulatory pathways.

- Middle East and Africa (MEA): Growth linked to traditional consumption patterns and rising demand for functional foods, particularly in regions with established olive cultivation, but limited by lower consumer spending power on non-essential supplements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Olive Leaf Extract Market.- Naturex (A Givaudan Company)

- Indena S.p.A.

- Frutarom (An IFF Company)

- Comvita Ltd.

- NOW Foods

- Gaia Herbs

- Vesta Ingredients, Inc.

- Swisse Wellness

- Monteloeder S.L.

- Birolive

- Olive World

- Robust Nutri

- Viron International

- Adams Extracts

- Natures Aid

- NutriScience Innovations, LLC

- A&D Natural Ingredients

- Botanic Healthcare

- Euromed S.A.

- P.L. Thomas & Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Olive Leaf Extract market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary active compound in Olive Leaf Extract and what are its main health benefits?

The primary active compound is Oleuropein, a powerful polyphenol. Its main health benefits include strong antioxidant capabilities, supporting cardiovascular health by potentially lowering blood pressure, providing anti-inflammatory effects, and boosting immune system function through antimicrobial properties, making it highly valuable in nutraceutical formulations.

How is the Olive Leaf Extract market segmented by application and which segment dominates?

The market is primarily segmented by applications including Dietary Supplements, Functional Foods and Beverages, Pharmaceuticals, and Cosmetics. The Dietary Supplements segment holds the largest market share globally due to the widespread consumer preference for pill and capsule forms for immune support and daily wellness maintenance.

Which extraction technology is emerging as the preferred method for high-purity Olive Leaf Extracts?

While solvent extraction remains common, Supercritical Fluid Extraction (SFE) is emerging as the preferred technology for high-purity extracts. SFE uses non-toxic CO2 as a solvent, yielding solvent-free, highly concentrated, and stable extracts with maximized oleuropein and hydroxytyrosol content, particularly appealing to premium market segments.

What are the key challenges facing manufacturers in the Olive Leaf Extract Market?

Key challenges include maintaining product standardization due to natural variability in oleuropein content across different harvests and geographical sources. Furthermore, the high operational costs associated with advanced extraction technologies (like SFE) and rigorous third-party testing pose significant restraints on market entry and competitive pricing strategies for standardized extracts.

Which region is expected to show the fastest growth rate for Olive Leaf Extract demand?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is driven by increasing consumer health awareness, rising disposable incomes, and the growing acceptance of natural, imported dietary supplements across major economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager