Olivine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431394 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Olivine Market Size

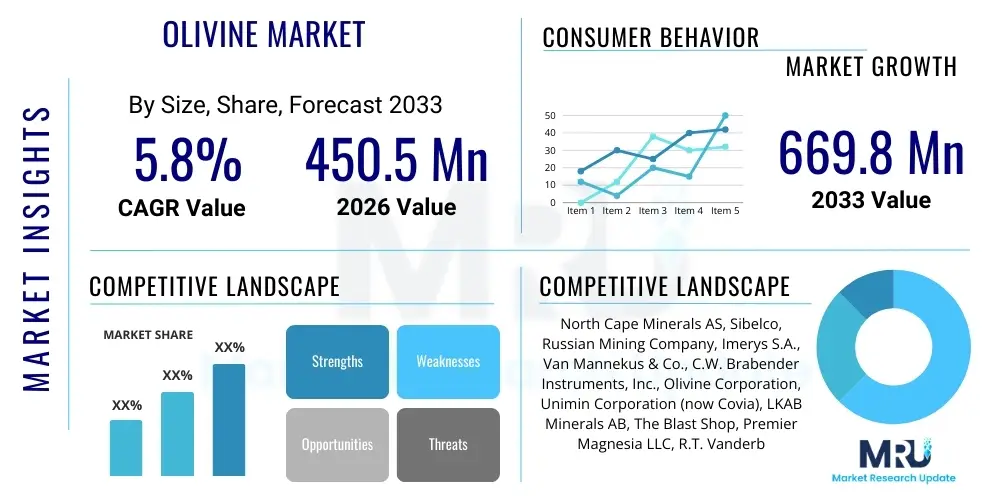

The Olivine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450.5 Million in 2026 and is projected to reach $669.8 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by increasing demand from specialized industrial applications, particularly in the metallurgical and construction sectors, coupled with emerging applications in environmental remediation and advanced material synthesis. The resilience of olivine as a highly stable, non-toxic mineral positioned for high-temperature processes ensures its sustained market traction globally. Furthermore, the strategic focus on reducing carbon footprints across heavy industries provides a significant impetus for olivine utilization in innovative sequestration technologies, bolstering its valuation growth trajectory over the assessment period.

Olivine Market introduction

The Olivine Market encompasses the global trade and utilization of olivine, a magnesium iron silicate mineral (Mg, Fe)₂SiO₄, prized primarily for its high melting point, superior refractoriness, and inert chemical properties. Market expansion is fundamentally underpinned by its widespread use in foundry applications as a high-quality molding sand, providing a cost-effective alternative to silica sand, especially where thermal stability and minimizing expansion defects are critical. Furthermore, olivine plays an indispensable role in steel production, acting as a slag conditioner and fluxing agent, optimizing the efficiency of electric arc furnaces (EAFs) and basic oxygen furnaces (BOFs). The inherent characteristics of olivine, including its stability under extreme thermal stress and its non-silicosis risk profile compared to quartz, solidify its status as a premium industrial mineral across diverse manufacturing verticals, ensuring steady demand accumulation.

Product description centers on the various grades of olivine mineral available, categorized mainly by grain size, purity, and iron-to-magnesium ratio, which dictates the specific end-use application. Key applications extend beyond traditional metallurgy and foundries into areas like abrasive blasting, where its density and hardness are beneficial, and increasingly, in emerging environmental technologies such as enhanced weathering and carbon capture and storage (CCS). The mineral’s unique crystal structure allows for a geochemical reaction with atmospheric or dissolved CO₂, locking it into stable carbonate forms. This environmental potential has rapidly transformed olivine from a conventional refractory raw material into a strategic component in climate mitigation strategies, influencing investment and research direction significantly across the next decade.

The core benefits driving the market include olivine's excellent thermal stability and resistance to thermal shock, minimizing operational disruptions in high-temperature industrial settings. Its non-toxic nature, particularly its avoidance of free crystalline silica, enhances workplace safety compared to alternatives. Major driving factors include the revitalization of the global steel industry, the sustained growth of complex casting processes requiring precision foundry sands, and, critically, governmental mandates and industry commitments toward decarbonization efforts, which favor minerals with demonstrable CO₂ uptake capabilities. The geographic proximity of major olivine deposits to industrial hubs and the efficiency of processing technologies further contribute to favorable market dynamics, promoting accessible supply chains and consistent material quality necessary for specialized industrial processes requiring stringent chemical and physical specifications.

Olivine Market Executive Summary

The Olivine Market Executive Summary highlights robust business trends characterized by strong vertical integration among leading mining companies aiming to control quality and supply chain efficiency, mitigating volatility in raw material sourcing and pricing. A key trend is the increasing diversification of olivine applications beyond traditional refractory uses, with significant research and commercial pilot projects focusing on environmental applications such as soil amendment, ocean alkalinity enhancement, and large-scale geological carbon mineralization. This shift is attracting novel investment and fostering collaborations between materials producers and environmental technology firms, accelerating the development of specialized, high-purity olivine products optimized for geochemical reactivity. Furthermore, strategic mergers and acquisitions targeting smaller, high-grade deposit holders are common, consolidating market power and ensuring long-term supply stability to meet the escalating demands of the global metallurgical sector and the nascent but rapidly growing carbon sequestration industry.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China and India, remains the dominant consumption hub, driven by massive infrastructure spending and robust steel and automotive manufacturing sectors that heavily rely on olivine-based foundry materials and slag conditioners. North America and Europe, while having mature industrial bases, are witnessing slower but more value-driven growth, largely focused on advanced applications, including high-specification refractory linings and innovative environmental projects capitalizing on olivine’s non-toxic and reactive properties. Specifically, European regulatory frameworks encouraging sustainable materials usage are accelerating the adoption of olivine as a replacement for less eco-friendly alternatives in various construction and abrasive cleaning applications. The Middle East and Africa (MEA) are emerging as critical supply regions, leveraging untapped high-quality reserves and improved logistics infrastructure to service global demand, altering traditional trade flows and diversifying the sourcing landscape.

Segmentation trends show that the "Sand/Grit" product type segment continues to hold the largest market share due to its entrenched position in foundry applications and abrasive blasting. However, the "Powder" segment is projected to exhibit the fastest growth, primarily driven by its suitability for advanced refractory formulations, chemical processing, and specialized geochemical applications where fine particle size maximizes surface area for reaction kinetics, crucial for efficient carbon capture. Application-wise, the Foundry segment maintains primacy, but the Iron and Steel segment, particularly its use as a fluxing agent, is experiencing significant volume growth corresponding to global crude steel production increases. Crucially, the Environmental Applications segment, though currently minor, is poised for exponential growth, reflecting a strong global consensus on climate change mitigation and the unique position of olivine as a naturally abundant, safe, and effective mineralization agent, signaling a substantial long-term shift in market dynamics and end-user priorities.

AI Impact Analysis on Olivine Market

User queries regarding AI's influence on the Olivine market often revolve around optimizing mineral extraction efficiency, enhancing quality control during processing, and predicting fluctuating supply-demand dynamics driven by environmental regulatory shifts. Users commonly seek to understand how machine learning models can be deployed to analyze geological survey data for identifying high-grade olivine deposits with greater precision, thereby reducing exploration costs and maximizing yield recovery from established mines. Furthermore, concerns frequently arise about using predictive AI to model the effectiveness of olivine in complex, large-scale carbon sequestration projects, particularly regarding reaction rates and long-term storage stability under varied environmental conditions. The core thematic concern is leveraging AI and data analytics to transform olivine production from a traditional, manually optimized industry into a highly efficient, demand-responsive supply chain, capable of servicing both cyclical metallurgical needs and burgeoning, highly variable environmental technology demands with optimized resource utilization and minimized operational expenditure across the value chain. This focus on operational efficiency and predictive maintenance marks a major area of anticipated technological transformation. The integration of advanced computational methods, particularly deep learning algorithms, into existing operational frameworks promises substantial improvements in material consistency, which is paramount for high-stakes applications such as advanced refractory systems where material failure is costly and hazardous.

The implementation of AI is expected to revolutionize the processing stage, moving beyond simple automation to prescriptive control systems. For instance, sensors deployed within crushing and milling facilities can generate real-time data on particle size distribution and chemical composition. AI algorithms process this massive dataset instantaneously, adjusting mill settings or segregation processes to ensure the final product meets stringent quality specifications for specialized applications, such as high-purity olivine required for advanced heat storage batteries or niche chemical feedstock. This ability to maintain tighter tolerance limits on parameters like specific gravity and chemical trace elements reduces waste, improves batch consistency, and significantly enhances the commercial viability of higher-value applications. The transition towards smart mining operations, where drone surveying and robotic sampling feed data into predictive models, is set to drastically reduce the environmental footprint and operational complexity associated with traditional extraction methodologies, offering a sustainable competitive advantage to early adopters in the olivine supply sector.

In the commercial sphere, AI applications are crucial for strategic market planning. Predictive analytics models can correlate global steel production forecasts, specific regional infrastructure project timelines, and evolving carbon pricing mechanisms to accurately project future demand curves for different olivine grades. This foresight allows mining companies to optimize inventory management, plan capital expenditure for processing plant upgrades, and negotiate advantageous long-term supply contracts. The integration of AI tools for supply chain transparency, utilizing blockchain technologies combined with machine learning, also addresses user concerns about ethical sourcing and verifiable provenance, increasingly important factors for corporate buyers committed to sustainability protocols. Consequently, while AI may not alter the inherent material properties of olivine, its role in optimizing extraction, processing, quality assurance, and global distribution is critical for supporting the market's projected growth and facilitating its pivotal role in the green transition across heavy industry sectors and environmental engineering projects.

- AI optimizes geological surveying, identifying high-grade deposits and improving extraction yield.

- Machine Learning enhances real-time quality control in processing plants, ensuring chemical and physical specification consistency.

- Predictive maintenance algorithms reduce downtime for crushing and milling equipment, maximizing operational throughput.

- Advanced analytics model carbon sequestration reaction rates (enhanced weathering) under varying environmental conditions.

- AI-driven supply chain management forecasts demand fluctuations based on global industrial indices and regulatory changes.

- Robotics and drone technology, managed by AI, improve safety and efficiency in mining site operations.

- Utilizes computer vision for automated sorting of different mineral grades based on visual and spectral analysis.

DRO & Impact Forces Of Olivine Market

The Olivine Market is significantly shaped by a confluence of internal market dynamics and external macro-environmental factors, encapsulated by its Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Major drivers include the necessity for superior refractory materials in high-temperature industrial processes, particularly the steel and non-ferrous metals sectors, where olivine’s resistance to slag corrosion and thermal spalling is highly valued. Simultaneously, the accelerating global regulatory push towards environmental sustainability acts as a pivotal driver, elevating olivine’s prominence as a non-toxic, sustainable alternative to traditional silica-based materials and positioning it favorably in the rapidly expanding carbon capture and utilization (CCU) market segment. These strong demand drivers are tempered by significant restraints, primarily centered around logistical challenges associated with transporting bulk, low-value mineral commodities over long distances, which adds substantial cost to the end product and often limits market reach to regions geographically proximal to major mining operations, necessitating localized processing or costly intermodal transportation strategies.

Further driving forces include technological advancements in foundry practices, which increasingly favor materials that offer reduced casting defects and improved surface finish, areas where high-purity olivine sand excels due to its low thermal expansion coefficient. Opportunities within the market are abundant and focus predominantly on the commercial scaling of enhanced weathering technologies, leveraging olivine to absorb significant volumes of atmospheric CO₂ when applied to agricultural lands or coastal areas. This large-scale, climate-focused application represents a paradigm shift for the commodity, transitioning it from a specialized industrial input to a vital component in global climate engineering portfolios. Another opportunity lies in the development of specialized, synthetic olivine compositions tailored for novel high-performance applications, such as thermal energy storage systems and advanced battery cathode materials, capitalizing on its chemical stability and thermal characteristics beyond its conventional industrial use cases. Successfully capitalizing on these environmental and technological opportunities requires substantial initial investment in research and development and strategic partnerships with energy technology firms.

The principal restraint impacting long-term growth is the competition from alternative industrial minerals and synthetic refractory materials, such as magnesite, chromite, or specialized alumina-silicate blends, which may offer superior performance or localized supply chain advantages in certain niche applications, thereby limiting olivine's market penetration in specific, high-specification refractory segments. Furthermore, the market faces price volatility issues tied to energy costs, as the crushing, grinding, and screening processes required to produce specification-grade olivine are energy-intensive operations. The combined impact forces suggest a market moving towards specialization: while the traditional bulk market will experience steady, GDP-driven growth, the high-growth trajectory will be concentrated in segments where olivine provides a clear environmental or high-performance advantage, effectively decoupling future revenue growth from reliance solely on the cyclical nature of the global steel industry. Successfully managing these forces requires proactive supply chain optimization and sustained focus on exploiting the mineral's unique sustainability attributes to secure premium pricing and long-term contracts in the emerging green technology sector.

Segmentation Analysis

The Olivine Market segmentation is crucial for understanding the diverse applications and end-user requirements that drive demand across various industries. Segmentation is primarily conducted based on Product Type (Sand/Grit, Powder, Aggregates), Application (Foundry, Iron & Steel, Refractories, Abrasives, Environmental), and Geography (Regional breakdown). The distinct properties required for each application necessitate specialized processing, leading to significant variations in pricing and volume demand across segments. For example, foundry sand requires strict control over particle size distribution and angularity, whereas olivine used for enhanced weathering must be ground to an extremely fine powder to maximize reactive surface area, representing fundamentally different production and distribution challenges and market entry points for suppliers aiming for specialization or generalized market coverage. This diversity ensures market resilience but necessitates highly adaptable operational strategies for producers.

Analyzing the product type segmentation, Sand/Grit typically represents the foundational and highest-volume segment, serving the traditional foundry and blast cleaning markets globally due to its balance of cost-effectiveness, durability, and non-toxic profile. In contrast, the Powder segment, characterized by ultrafine particle sizes, commands a premium price point and is vital for advanced refractory coatings, specialized chemical filler applications, and, most importantly, high-efficiency carbon mineralization projects. The Aggregates segment, composed of larger lump sizes, is typically utilized in low-specification applications such as metallurgical fluxing, ground stabilization, and ballasting. Growth forecasting indicates that while Sand/Grit will maintain volume dominance, the Powder segment is poised for the most rapid value growth, propelled by the increasing commercial viability of CO₂ sequestration technologies which demand ultra-fine, highly reactive mineral inputs to meet ambitious reaction kinetic targets necessary for economic feasibility.

From an application perspective, the Foundry industry remains the single largest consumer, relying on olivine for producing high-quality molds and cores for ferrous and non-ferrous metal casting, particularly due to its superior expansion characteristics compared to silica. However, the fastest emerging application is Environmental Management, encompassing enhanced weathering, pH buffering in water treatment, and specialized filtration media. This segment's growth trajectory is dependent on regulatory incentives and carbon credit valuation mechanisms, potentially offering the highest long-term revenue diversification for the industry. Understanding these intricate segment dynamics allows stakeholders to align their production capacity and strategic investments with areas of highest expected growth, shifting focus from high-volume, low-margin traditional applications towards niche, high-value, technology-driven end-uses that promise sustainable and accelerated market development.

- Product Type:

- Sand/Grit (Dominant in volume, used in foundries and blasting)

- Powder (Fastest growing in value, critical for refractories and environmental applications)

- Aggregates (Used for metallurgical flux and construction ballasting)

- Application:

- Foundry (Molding and core sands)

- Iron & Steel (Slag conditioning and fluxing agent)

- Refractories (Lining materials, specialty bricks, coatings)

- Abrasives and Blast Cleaning (Non-silica blasting media)

- Environmental Applications (Carbon sequestration, water treatment, soil remediation)

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Olivine Market

The Value Chain for the Olivine Market commences with Upstream Analysis, which encompasses the geological exploration, mining, and initial extraction of the raw mineral from open-pit or specialized underground operations. Due to olivine’s relative geological abundance but varying quality and impurity levels, upstream activities are focused on identifying high-grade deposits that minimize processing costs. Key upstream factors include securing mining rights, large-scale capital investment in heavy machinery, and rigorous geological assessment to ensure reserve sustainability. Processing immediately follows extraction, involving crushing, grinding, magnetic separation (to remove undesirable metal impurities), screening, and washing to achieve specified grain size distributions and purity levels required by diverse industrial consumers. The efficiency and quality of this initial processing step are paramount, as they directly determine the suitability of the olivine product for high-specification end-uses, such as advanced refractories or environmental sequestration, differentiating basic commodity suppliers from premium-grade producers.

The Midstream component focuses on the logistics, storage, and initial commercialization of the processed material. Distribution channels are critical due to olivine's high bulk density and low value per unit volume relative to many other industrial minerals, making efficient, cost-optimized transport the primary determinant of competitive viability. The market utilizes both Direct and Indirect distribution channels. Direct channels involve large-volume sales directly from the producer to major end-users, such as steel mills, integrated refractory manufacturers, or large centralized foundries, often under long-term supply contracts. This minimizes intermediary costs and ensures consistent supply for continuous operations. Indirect channels utilize specialized mineral distributors and trading houses, which manage smaller, varied orders for medium and small-sized foundries, regional abrasive companies, or specialty chemical formulators, providing localized warehousing and just-in-time inventory management services crucial for geographically dispersed customer bases.

Downstream analysis centers on the integration of olivine into final manufacturing processes and specialized service industries. For foundries, it involves blending the olivine sand into molding mixtures. In the steel industry, it is integrated into the flux charge optimization system. The emerging downstream segment, Environmental Applications, involves specialized engineering firms that design and deploy large-scale mineralization reactors or soil application programs, demonstrating a shift toward service-based value addition rather than purely material supply. Key value addition points downstream include technical support for application-specific material formulation, quality certification adherence, and strategic partnerships that validate the performance of olivine in novel, high-tech environmental solutions. The overall chain seeks to maximize the inherent thermal and chemical advantages of the mineral while rigorously controlling logistics costs, thereby maximizing margin realization and enhancing customer value perception in a highly competitive global mineral market landscape.

Olivine Market Potential Customers

The Olivine Market serves a diverse yet highly specialized range of industrial and environmental customers, dictated by the unique physical and chemical properties of the mineral. The primary end-users, or buyers, of processed olivine fall predominantly within the heavy industrial sectors, specifically the metal manufacturing and fabrication industries. These customers include large integrated steel producers who utilize olivine as a fundamental slag conditioning agent to lower the liquidus temperature of the slag, enhancing fluidity and improving the removal of impurities like phosphorus during the refining process in electric arc furnaces and basic oxygen furnaces. Independent commercial foundries, ranging from large automotive casting suppliers to smaller jobbing shops specializing in precision component manufacturing, constitute another major customer base, purchasing substantial volumes of olivine sand for molding and core production where its thermal stability and low expansion characteristics minimize casting defects, justifying its premium cost over standard silica sand in critical applications demanding high precision.

Beyond the core metallurgical segments, a significant and rapidly growing potential customer base exists within the Refractory industry, where manufacturers of specialized bricks, monolithic linings, and high-temperature coatings rely on high-purity olivine powder. These customers require materials with exceptional thermal shock resistance and non-wetting properties to prolong the lifespan of industrial furnaces, kilns, and ladles in processes operating at extreme temperatures. Furthermore, specialized environmental engineering firms and large-scale agricultural operations represent a critical emerging customer segment. These entities are interested in procuring fine-ground, reactive olivine powder for use in innovative technologies aimed at neutralizing acidic runoff, enhancing soil productivity through mineral amendments, and, most notably, in developing industrial and oceanic carbon dioxide removal (CDR) projects based on accelerated mineral carbonation or enhanced weathering techniques, indicating a pivotal shift towards sustainability-driven consumption patterns across global industries.

Additional potential customers include abrasive blasting service providers, particularly those operating in confined spaces or sensitive environments where the use of crystalline silica is prohibited due to health hazards, favoring olivine grit as a safer, effective, and non-toxic blasting medium. The construction industry also utilizes olivine in niche applications, such as heavy aggregate fill or as a component in certain specialized concrete mixes designed for enhanced thermal properties or radiation shielding. For market participants, targeting these diverse customer groups requires tailored product specifications and differentiated marketing strategies: bulk supply logistics for high-volume steel mills contrast sharply with the technical support and certification requirements demanded by the high-value environmental technology integrators. Strategic success hinges on balancing foundational demand from mature industrial users with capturing the exponential growth opportunities presented by the nascent environmental and advanced material application sectors globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million |

| Market Forecast in 2033 | $669.8 Million |

| Growth Rate | CAGR of 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | North Cape Minerals AS, Sibelco, Russian Mining Company, Imerys S.A., Van Mannekus & Co., C.W. Brabender Instruments, Inc., Olivine Corporation, Unimin Corporation (now Covia), LKAB Minerals AB, The Blast Shop, Premier Magnesia LLC, R.T. Vanderbilt Holding Company, Inc., Minerali Industriali S.p.A., Cometals, Inc., Norwegian Mineral Company AS (NOMAC), U.S. Silica Holdings, Inc., Washington Mills, Qingdao Jimo Olivine Sand Co., Ltd., China Minmetals Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Olivine Market Key Technology Landscape

The Key Technology Landscape of the Olivine Market is primarily centered around advanced mineral processing techniques aimed at enhancing material purity, optimizing particle size distribution, and improving energy efficiency during production. While olivine extraction relies on conventional large-scale open-pit mining methods, the technological differentiation occurs in the downstream handling and refinement. Crucial technologies include high-intensity magnetic separation, utilized to effectively remove trace amounts of iron oxides and other paramagnetic impurities, ensuring the resulting product meets the stringent low-impurity standards demanded by the premium refractory and chemical industries. Furthermore, sophisticated air classification and screening technologies are employed to achieve narrow, precise particle size cuts, essential for highly sensitive applications such as investment casting molds and high-reactivity powders used in environmental sequestration trials, where slight variations in grain size can drastically affect performance and economic viability. The continuous evolution of these mechanical processing technologies aims to maximize recovery rates and minimize the generation of unusable fines.

In addition to mechanical processing, chemical and thermal treatment technologies are increasingly relevant, particularly for developing specialized, high-performance olivine products. Technologies involving calcination or mild acid washing may be employed to alter the surface chemistry of the olivine grains, enhancing their compatibility with specific binders in foundry systems or accelerating their reactivity profile for carbon mineralization projects. Furthermore, advancements in real-time sensor technology and data analytics, driven by the principles outlined in the AI impact analysis, are revolutionizing process control. Modern processing plants are integrating optical sorting technology and continuous online X-ray fluorescence (XRF) analysis systems. These technologies provide immediate feedback on the chemical composition and purity of the mineral stream, enabling automated adjustments to crushing ratios or separation parameters, thereby reducing material variability and increasing operational yield, offering a substantial competitive advantage in a market increasingly focused on quality assurance and material consistency across diverse global supply chains.

A significant, emerging technological area involves the engineering solutions surrounding olivine utilization in carbon capture and storage (CCS) or utilization (CCU). This includes developing optimized reactor designs for accelerated mineral carbonation processes, where factors like pressure, temperature, and solvent chemistry are precisely controlled to maximize the reaction rate between CO₂ and fine olivine powder. Research is focused on developing hybrid technologies that combine olivine use with industrial waste streams (e.g., steel slag) to create composite materials for enhanced sequestration effectiveness and cost reduction. The overall technology landscape is moving towards higher precision in mineral specification, greater energy efficiency in bulk processing, and the strategic integration of olivine into novel, environmentally focused chemical engineering solutions, ensuring the material remains technologically relevant and economically competitive against both natural and synthetic mineral substitutes in the critical industrial and environmental markets of the future, supporting long-term, sustainable commercial deployment.

Regional Highlights

The global Olivine Market exhibits distinct regional consumption and production patterns, largely mirroring the global distribution of heavy industries, particularly steel manufacturing, foundry activities, and construction cycles. Asia Pacific (APAC) holds the dominant market share in terms of volume consumption, primarily driven by rapid urbanization, massive infrastructure development, and the concentration of high-volume manufacturing hubs in China, India, and Southeast Asian nations. The relentless growth in these economies necessitates vast quantities of ferrous and non-ferrous castings, bolstering demand for high-quality olivine foundry sand. Furthermore, the burgeoning refractory industry in APAC, serving blast furnaces and cement kilns, is a significant end-user. Supply chain logistics in the region are complex, often involving imports from Scandinavian and Turkish sources, although domestic production is also expanding, creating a dynamic competitive environment characterized by both low-cost domestic supply and high-quality imported mineral products for specialized applications, necessitating intricate planning for market entry and distribution efficiency across diverse national markets.

Europe represents a mature market characterized by stringent environmental regulations and a strong focus on high-specification, niche applications. Scandinavian countries, particularly Norway, are major global exporters of high-grade olivine, possessing some of the purest deposits worldwide. Consumption in Europe is concentrated in advanced foundry applications, high-performance refractories, and is witnessing a crucial acceleration in environmental deployment, specifically enhanced weathering pilots and filtration applications, driven by European Union directives promoting sustainable and non-toxic materials usage in industrial processes. The demand in Europe is less driven by sheer volume growth and more by substitution, where olivine replaces silica or other potentially hazardous materials, thus commanding a steady, value-added price premium. Regulatory clarity and governmental subsidies for climate technology are crucial factors influencing the European market trajectory, fostering innovation in specialized olivine product development tailored for geochemical reactivity and material circularity programs.

North America maintains a stable market position, supported by resilient domestic steel and automotive manufacturing sectors, alongside a high-volume abrasive blasting industry that prefers olivine grit due to its superior safety profile compared to quartz. Production is decentralized, with major players ensuring supply continuity across the United States and Canada. Latin America, while smaller in size, presents pockets of strong growth, particularly in countries with significant mining and raw material processing capabilities. The Middle East and Africa (MEA) are emerging as critical suppliers due to strategically located, high-quality deposits in countries like Turkey, and increasing industrialization leading to greater regional demand for refractory materials and fluxing agents. This region is increasingly positioned to supply European and parts of the Asian market, enhancing global supply resilience but also intensifying competition among global miners. The differential growth rates and specific application focus across these regions necessitate highly customized marketing and technical support strategies to successfully navigate the multifaceted global olivine trade landscape.

- Asia Pacific (APAC): Volume leader driven by infrastructure, steel production, and large foundry sectors (China, India).

- Europe: High-value market focused on advanced refractories, environmental applications, and non-toxic material substitution; major producer (Norway).

- North America: Stable demand from steel, automotive, and abrasive blasting industries, emphasis on safety standards.

- Latin America: Growing industrial base, niche demand from regional metallurgical operations.

- Middle East & Africa (MEA): Important source of high-quality mineral supply; increasing regional consumption driven by local industrialization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Olivine Market.- North Cape Minerals AS

- Sibelco

- Russian Mining Company

- Imerys S.A.

- Van Mannekus & Co.

- C.W. Brabender Instruments, Inc.

- Olivine Corporation

- Unimin Corporation (now Covia)

- LKAB Minerals AB

- The Blast Shop

- Premier Magnesia LLC

- R.T. Vanderbilt Holding Company, Inc.

- Minerali Industriali S.p.A.

- Cometals, Inc.

- Norwegian Mineral Company AS (NOMAC)

- U.S. Silica Holdings, Inc.

- Washington Mills

- Qingdao Jimo Olivine Sand Co., Ltd.

- China Minmetals Corporation

- Diatomaceous Earth & Clay Co.

Frequently Asked Questions

Analyze common user questions about the Olivine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving current demand in the Olivine Market?

The primary applications driving demand are the foundry industry, where olivine is used as high-performance molding sand due to its low thermal expansion, and the iron and steel industry, where it functions as an essential slag conditioner and fluxing agent to improve metal purity and furnace efficiency during high-temperature operations.

How does the use of olivine contribute to environmental sustainability efforts?

Olivine contributes significantly to sustainability by acting as a naturally occurring, non-toxic substitute for silica in abrasive blasting, reducing health risks. Crucially, it is central to carbon dioxide removal (CDR) techniques, specifically enhanced weathering, where fine-ground olivine chemically reacts with atmospheric CO₂ to sequester it permanently as stable carbonates.

Which geographical region dominates the global consumption of olivine?

The Asia Pacific (APAC) region dominates global consumption, driven by its extensive and rapidly growing steel production, automotive manufacturing, and construction industries, particularly in economic powerhouses like China and India, necessitating vast quantities of both foundry and refractory materials.

What is the key difference between olivine sand and traditional silica sand in industrial use?

The key difference lies in the mineral composition and safety profile; olivine is a magnesium iron silicate that does not contain free crystalline silica, minimizing the risk of silicosis. Furthermore, olivine exhibits superior thermal stability and lower thermal expansion, leading to reduced casting defects in high-specification foundry applications compared to conventional silica sand.

What major restraints are challenging the growth trajectory of the Olivine Market?

The primary restraints challenging market growth include the substantial costs associated with the long-distance bulk transportation of this low-value-per-ton commodity, which limits market competitiveness, and intense competition from established alternative refractory minerals like magnesite and chromite in specific high-performance industrial segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager