Omega-3 Polyunsaturated Fatty Acids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436050 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Omega-3 Polyunsaturated Fatty Acids Market Size

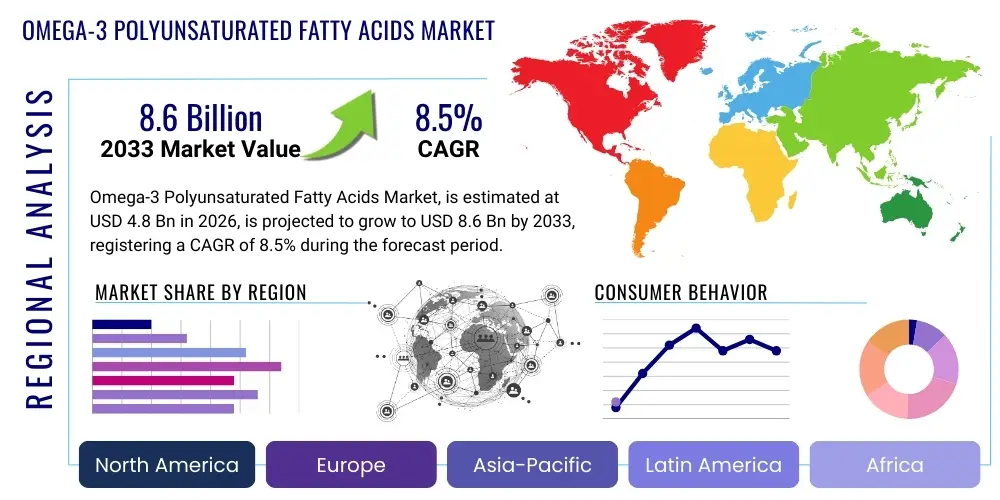

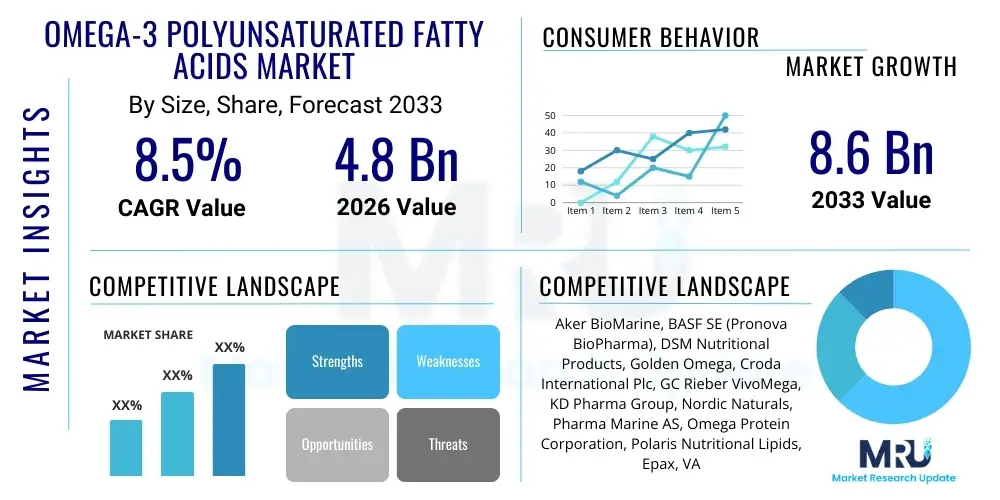

The Omega-3 Polyunsaturated Fatty Acids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Omega-3 Polyunsaturated Fatty Acids Market introduction

The global market for Omega-3 Polyunsaturated Fatty Acids (PUFAs), primarily encompassing Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA), represents a crucial segment within the nutritional and pharmaceutical industries, driven by the scientifically substantiated benefits these essential nutrients offer across various dimensions of human health. These long-chain fatty acids are integral structural components of cell membranes, particularly concentrated in the brain and retina, and serve as precursors for eicosanoids, docosanoids, and specialized pro-resolving mediators (SPMs) that play critical roles in regulating inflammation, immune function, and neurological signaling. Since the human body’s capacity to synthesize sufficient quantities of EPA and DHA from precursor Alpha-Linolenic Acid (ALA) is often limited, dietary intake or supplementation is necessary, solidifying the market’s necessity. Products are derived predominantly from marine sources, such as fish oil from fatty fish like anchovies, sardines, and mackerel, and krill oil, but increasingly from sustainable non-marine sources like microalgae. The sophisticated process involves crude oil extraction, rigorous refinement, and molecular distillation to produce high-purity concentrates used in finished dosage forms, including softgels, liquids, and ingredients for fortification. Growing public health campaigns emphasizing preventative cardiology and cognitive wellness are persistently expanding the consumer base for these high-value ingredients, making market growth structurally resilient against minor economic fluctuations. The adaptability of omega-3s for pharmaceutical use, dietary enhancement, and clinical applications further diversifies and stabilizes the revenue streams across the value chain, ensuring high investor confidence and continuous research investment into novel applications and efficient delivery systems.

The functional diversity of Omega-3 PUFAs drives their broad application across multiple vertical sectors. In the pharmaceutical realm, highly purified, often ethyl ester-based, formulations of EPA or combined EPA/DHA are prescribed for the management of severe hypertriglyceridemia and for reducing residual cardiovascular risk in patients already on statin therapy, a major endorsement that elevates the perceived value of these compounds. The dietary supplements segment, which accounts for the largest volume of sales, caters to daily wellness needs, targeting cognitive function support, joint mobility, and general inflammatory balance, necessitating a constant supply of consumer-friendly, palatable formats. Beyond these core uses, omega-3s are vital components in specialized clinical nutrition products designed for intensive care, post-surgical recovery, and malnutrition, where their immune-modulating properties are leveraged to improve patient outcomes. Furthermore, the functional food and beverage industry integrates encapsulated omega-3 powders and stable oils into infant formulas—crucial for early brain and visual development—dairy products, and fortified juices, providing consumers with convenient, non-pill delivery methods. The ongoing expansion of research into new therapeutic areas, such as dry eye syndrome, specific mood disorders, and athletic performance optimization, ensures the continuous creation of high-value niche markets, sustaining robust investment in clinical trials and ingredient standardization necessary for market legitimacy.

Driving factors underpinning the robust Compound Annual Growth Rate include significant demographic shifts, particularly the global aging population that requires specialized nutrition to combat age-related cognitive decline and cardiovascular morbidities. Simultaneously, enhanced global scientific dissemination has cemented the understanding of the essentiality of these fatty acids among healthcare practitioners and consumers alike, leading to increased recommendations and compliance. Technological advancements in refinement, particularly chromatography and proprietary solvent-free purification methods, have successfully addressed historical concerns related to contaminants (heavy metals, PCBs) and oxidation, allowing manufacturers to offer superior purity products with longer shelf lives, thereby boosting consumer trust and product quality differentiation. Moreover, the critical movement towards sustainability and ethical sourcing has spurred immense innovation in algal cultivation and controlled fermentation, mitigating resource depletion risks associated with reliance solely on wild-catch fisheries and catering to the expanding vegan and environmentally conscious consumer segments. The synergistic effect of these scientific validations, technological breakthroughs, demographic pressures, and evolving consumer ethics creates a powerful, multi-faceted engine propelling the global Omega-3 PUFAs market forward, emphasizing quality, purity, and environmental responsibility as critical market entry requirements.

Omega-3 Polyunsaturated Fatty Acids Market Executive Summary

The global Omega-3 Polyunsaturated Fatty Acids market is currently defined by a confluence of evolving business trends, pronounced regional growth divergence, and significant specialization within core segments. Strategic business focus is increasingly shifting toward vertical integration—allowing key players to control the supply chain from raw material sourcing (marine harvest or algal fermentation) through to final product formulation—which is crucial for ensuring product traceability, quality consistency, and cost optimization in a highly competitive landscape. A significant business trend involves the rapid transition from low-concentration, bulk fish oils to scientifically validated, ultra-high-concentration formulations (80% EPA/DHA and above), often packaged with co-factors or proprietary delivery technologies designed to enhance bioavailability, such as phospholipid or liposomal structures. Mergers and acquisitions are common, particularly involving traditional marine suppliers acquiring advanced biotechnology firms specialized in algae production, thereby diversifying supply risk and immediately accessing sustainable, non-marine market segments. Furthermore, enhanced digital transparency via blockchain technology is being explored to allow consumers to track the provenance of the oil, confirming sustainability claims and purity certifications like IFOS, responding directly to the prevailing consumer demand for ethical sourcing and verifiable quality standards, thereby redefining competitive barriers in the premium supplement category.

Regional dynamics illustrate a mature yet high-value market in North America and Europe, which continue to set pricing standards and innovation benchmarks due to sophisticated regulatory environments and high discretionary health spending. These regions focus heavily on pharmaceutical applications and premium dietary supplements. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest growth rate, fundamentally transforming the global market landscape. This surge is driven by rapid socio-economic development, expansive population growth, increased prevalence of cardiovascular issues linked to changing diets, and government initiatives promoting nutritional fortification, particularly in China and India. While North America focuses on high-purity therapeutic doses, APAC’s volume growth is largely concentrated in functional foods, beverages, and infant nutrition applications. Emerging markets in Latin America and the Middle East and Africa, while smaller, offer immense long-term potential, conditioned upon improvements in local health literacy, distribution infrastructure, and the stabilization of regional regulatory harmonization. Investment strategies are thus tailored: R&D focus in the West targeting therapeutic innovation, and infrastructure/distribution focus in the East targeting mass market accessibility and fortification mandates.

Segmentation trends highlight specialization across all product categories. By source, while traditional marine oils (fish and krill) still capture the largest volume share, non-marine sources, particularly algal oil (rich in DHA), are experiencing exponential growth, driven by environmental advocacy and the fast-expanding global vegan and vegetarian populations. In terms of application, cardiovascular health remains the foundational demand driver, but applications targeting maternal health (prenatal DHA supplementation) and cognitive health across all age groups are showing superior CAGR, attracting significant venture capital and clinical study focus. Furthermore, the format segmentation is evolving rapidly, moving beyond standard softgels to include highly palatable functional formats such as chewable gummies, emulsions, and personalized liquid doses that target specific consumer compliance issues (e.g., pill fatigue, taste aversion). This diversification in delivery methods broadens market appeal, particularly among pediatric and elderly demographics. The overall trend signifies a market moving toward highly specialized, bioavailable, and ethically sourced products, prioritizing clinical proof and consumer experience over pure cost considerations.

AI Impact Analysis on Omega-3 Polyunsaturated Fatty Acids Market

User queries regarding Artificial Intelligence's role in the Omega-3 PUFAs market frequently address the capability of advanced algorithms to solve critical supply chain sustainability issues, enhance product efficacy through personalization, and ensure unparalleled quality assurance. Stakeholders are keen to understand how AI and Machine Learning (ML) can provide predictive models for marine resource management—specifically, forecasting wild fish population dynamics and optimizing sustainable harvest quotas to minimize ecological disruption, a major public relations concern for the industry. A significant theme revolves around the application of ML in biotechnological innovation, analyzing vast datasets from algal bioreactors to identify optimal growing conditions (e.g., light spectrum, nutrient concentration, shear rate) necessary for maximizing DHA yield and maintaining strain purity on an industrial scale. Furthermore, the most transformative area of user inquiry concerns personalized nutrition: how AI can integrate individual genomic data, blood lipid panels, and inflammatory markers (e.g., Omega-3 Index) to create dynamically adjusted, patient-specific dosing recommendations and proprietary EPA/DHA ratios, moving the industry beyond one-size-fits-all supplementation and into precision healthcare delivery, fundamentally altering the relationship between consumer and product efficacy validation.

The implementation of Artificial Intelligence and advanced Machine Learning models is rapidly transitioning the Omega-3 Polyunsaturated Fatty Acids production and delivery processes from traditional, reactive methods to sophisticated, predictive, and highly efficient operations. In the resource acquisition phase, sophisticated AI algorithms are utilized to analyze satellite imagery, oceanic temperature shifts, historical fishing data, and migratory patterns, allowing commercial fishing fleets and krill harvesters to optimize their operations by targeting sustainable stocks within regulatory limits, thereby reducing fuel consumption, operational waste, and non-target catch (bycatch). For producers relying on controlled microbial or algal cultivation, ML systems continuously monitor environmental parameters within fermentation tanks, such as dissolved oxygen levels, pH balance, and biomass density, employing closed-loop control mechanisms to adjust inputs in real-time. This level of granular, automated optimization ensures maximum biosynthesis efficiency of EPA and DHA, significantly lowering batch variation, minimizing cultivation cycle duration, and consequently reducing overall manufacturing cost, making sustainable sourcing economically competitive with traditional marine harvesting.

In the downstream refinement and quality control segments, AI-driven technologies are crucial for elevating purity standards to meet pharmaceutical specifications. High-resolution sensors and computer vision systems, integrated within molecular distillation and chromatographic separation equipment, analyze oil quality markers, including oxidation levels (TOTOX), purity percentages, and the presence of trace contaminants in real-time. ML models can identify complex impurity signatures undetectable by human analysis or conventional chemical testing, flagging potential quality deviations immediately for automated process adjustment or rejection. This pre-emptive, high-speed quality assurance drastically minimizes product recalls and ensures that final ingredients adhere strictly to global regulatory thresholds, bolstering consumer safety and brand reputation. Furthermore, on the consumer engagement side, AI-powered health platforms are beginning to interface directly with wearable technology and clinical data, providing personalized omega-3 insights. These platforms calculate an individual's specific inflammatory needs and recommend an appropriate EPA:DHA ratio, dosage, and delivery format, thereby maximizing the therapeutic benefit and improving consumer adherence, setting a new paradigm for efficacy in the supplement market.

- Enhanced predictive modeling for sustainable marine resource management, optimizing wild-catch quotas and minimizing environmental impact.

- Optimization of microalgae bioreactors using Machine Learning to fine-tune nutrient delivery and light exposure, maximizing DHA yield and minimizing production cycles.

- Real-time quality control and contamination detection (heavy metals, oxidation) through AI-powered spectroscopy and analytical monitoring during the molecular distillation process.

- Development of personalized nutrition platforms analyzing patient genomics, biomarker data (e.g., Omega-3 Index), and dietary intake to recommend tailored EPA/DHA supplement regimens.

- Streamlining of complex global supply chain logistics using predictive analytics to mitigate risks associated with raw material price volatility and geopolitical instability.

- Automated formulation testing and stability prediction for new encapsulation technologies, accelerating R&D cycles for palatable and stable omega-3 products.

- Leveraging natural language processing (NLP) to analyze vast quantities of clinical trial data, identifying emerging therapeutic targets and optimizing proprietary ingredient blends for specific health outcomes.

DRO & Impact Forces Of Omega-3 Polyunsaturated Fatty Acids Market

The dynamics of the Omega-3 Polyunsaturated Fatty Acids market are shaped by a complex interplay of powerful growth drivers, persistent operational restraints, and compelling opportunities that influence strategic investment and technological innovation. The primary driver is the undeniable and constantly expanding body of clinical evidence substantiating the benefits of EPA and DHA in chronic disease prevention and management, particularly in cardiology, neurology, and inflammatory disorders, which is reinforced by favorable medical guidelines globally. This scientific validation is mirrored by a fundamental shift in consumer behavior towards proactive, preventative healthcare, especially among affluent and aging populations who are willing to pay a premium for clinically effective nutritional solutions. Furthermore, regulatory approvals of prescription-strength omega-3 drugs (like those for severe hypertriglyceridemia) validate the therapeutic power of the molecules, enhancing overall consumer and medical practitioner acceptance of the entire category, creating a powerful positive feedback loop that propels continuous market expansion and justifies substantial research investment into formulation development and clinical substantiation across all application segments, from supplements to fortified foods.

Counterbalancing these drivers are significant constraints, most notably the inherent challenges of raw material sourcing and product stability. Dependence on finite and climate-sensitive wild-catch fisheries introduces severe volatility in supply and pricing, exacerbated by stringent international fishing quotas and environmental uncertainties, creating significant supply chain risk for marine-based manufacturers. Moreover, the chemical structure of PUFAs makes them highly susceptible to oxidation (rancidity), which degrades efficacy, produces unpleasant odors, and requires expensive, complex stabilization technologies, such as advanced microencapsulation and proprietary antioxidant systems. This complexity contributes to higher manufacturing costs and necessitates rigorous quality assurance protocols. Public perception, often fueled by sensationalized media reports, regarding the presence of micro-contaminants (heavy metals, dioxins) in marine oils also acts as a psychological barrier, despite the industry's significant advancements in molecular distillation and purification, demanding constant investment in third-party purity verification (e.g., IFOS) and consumer education campaigns focused on transparency.

Opportunities for market differentiation and explosive growth are primarily concentrated in technological innovation, particularly the decoupling of supply from marine ecosystems. The continued advancement and large-scale commercialization of microalgae and fermentation technologies represent a critical opportunity, providing a highly scalable, contaminant-free, and vegan-friendly source of DHA and specialized EPA, directly addressing both sustainability concerns and the burgeoning ethical consumer market. Market players are also capitalizing on the high-growth niche of personalized nutrition, utilizing genetic testing and Omega-3 Index monitoring to develop tailored dosages and specialized ratio products for specific patient populations, transitioning omega-3 supplementation into a precision health tool. Finally, significant untapped potential lies in expanding the therapeutic application portfolio through targeted clinical trials exploring omega-3s' efficacy in managing conditions like age-related macular degeneration (AMD), specific mental health issues, and recovery from neurological trauma, which could unlock new, high-value prescription and clinical nutrition market segments globally, driving innovation in delivery formats designed for maximum bioavailability, such as specialized emulsions and soft-chews.

Segmentation Analysis

The Omega-3 Polyunsaturated Fatty Acids market is meticulously stratified across several dimensions, reflecting the diversity in raw material sourcing, degree of processing, targeted end-use, and final consumer delivery method. This segmentation is crucial for understanding the market's value distribution, as segments requiring higher purity, such as pharmaceuticals, command significantly higher pricing than high-volume consumer supplement segments. The fundamental dichotomy exists between marine sources (fish and krill oils) and non-marine sources (algal, flaxseed, and chia oils), with the latter driving market expansion in the ethical and specialty food segments. Application segmentation clearly highlights the dual regulatory pathway of the products: high-value pharmaceutical ingredients versus mass-market dietary and food fortification ingredients. Trends indicate rapid technological investment aimed at enhancing purity and bioavailability, particularly in the high-concentration segments, aligning production capabilities with increasing regulatory scrutiny and sophisticated consumer demands for verifiable quality and sustainable origins.

- By Source:

- Marine Sources (Anchovy, Sardine, Mackerel Oil, Tuna Oil, Krill Oil, Other Marine Animals)

- Non-Marine Sources (Algal Oil, Flaxseed Oil, Chia Seed Oil, Hemp Seed Oil, Canola Oil)

- By Type:

- Docosahexaenoic Acid (DHA)

- Eicosapentaenoic Acid (EPA)

- Alpha-Linolenic Acid (ALA)

- Combined EPA and DHA Formulations

- By Form:

- Natural Triglycerides (TG)

- Ethyl Esters (EE)

- Re-esterified Triglycerides (rTG)

- Phospholipids (PL)

- Free Fatty Acids (FFA)

- By Application:

- Dietary Supplements (Capsules, Liquids, Gummies)

- Functional Foods & Beverages (Dairy Products, Infant Formula, Bakery & Confectionery, Juices and Functional Drinks)

- Pharmaceuticals (Prescription Drugs and Active Pharmaceutical Ingredients)

- Clinical Nutrition and Medical Foods

- Animal Feed and Pet Food

- By Distribution Channel:

- Online Retail (E-commerce platforms, Direct-to-Consumer Websites)

- Offline Retail (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Health & Specialty Stores)

- By Concentration Grade:

- Low Concentration (<50% Omega-3)

- Medium Concentration (50%-75% Omega-3)

- High Concentration (>75% Omega-3, including pharmaceutical grade)

- By Regional Outlook:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, South Africa, Rest of MEA)

Value Chain Analysis For Omega-3 Polyunsaturated Fatty Acids Market

The Omega-3 Polyunsaturated Fatty Acids value chain is a complex sequence commencing with volatile raw material procurement and culminating in highly refined, branded consumer products, with value addition occurring significantly during midstream processing. Upstream analysis focuses on secure and sustainable sourcing. For marine omega-3s, this involves controlled harvesting (e.g., purse seining for small pelagic fish or specific krill harvesting in Antarctic waters), requiring highly regulated fishing licenses, specialized deep-sea vessels, and immediate on-board stabilization to prevent initial oxidation of the crude oil. For algal sources, the upstream stage involves high-capital investment in sterile, large-scale fermentation bioreactors and the proprietary cultivation of specific microalgae strains rich in DHA. Challenges at this stage include managing fluctuating environmental impact costs, adhering to international regulations (e.g., CCAMLR for krill), and establishing reliable contracts for high-volume feedstock, as the primary source dictates the subsequent refinement pathway and associated contaminant risks, placing considerable pressure on primary resource providers to maintain certified sustainability practices.

The midstream phase, involving processing and refinement, is the most technologically intensive and critical stage for generating market value. Crude oil, regardless of source, must undergo extensive purification processes. These processes typically include degumming, neutralization, bleaching, and deodorization, followed by highly advanced concentration techniques such as molecular distillation or supercritical fluid extraction (SFE) to concentrate EPA and DHA and remove heavy metals, dioxins, and other environmental toxins to meet stringent governmental safety standards (e.g., GOED monograph standards). Further chemical modification may convert the natural triglyceride (TG) form into ethyl esters (EE) for concentration, or subsequently re-esterify them back into highly bioavailable re-esterified triglycerides (rTG), significantly increasing the cost but also the efficacy and purity profile. This stage requires significant intellectual property protection and continuous investment in separation science and oxidation protection technologies, such as advanced nitrogen blanketing and proprietary antioxidant inclusion, directly influencing the ingredient's shelf life, taste profile, and eligibility for pharmaceutical use.

Downstream market activities focus on formulation, encapsulation, and distribution, which connect the highly specialized ingredients with diverse end-user segments through a complex network of channels. Final product manufacturing involves encapsulating the refined oil into softgels, formulating liquids, or microencapsulating the oil into stable powders for food fortification—tasks requiring precise control and GMP compliance. Distribution channels are bifurcated into direct sales of bulk Active Pharmaceutical Ingredients (APIs) and specialized ingredients to large B2B clients (Pharma and functional food manufacturers) and indirect consumer sales. Indirect channels rely heavily on retail (pharmacies, health stores) and, increasingly, e-commerce, which has become a powerful direct-to-consumer (D2C) avenue allowing smaller, niche brands to thrive by focusing on transparency and specialized formulations. Success in the downstream market hinges on effective branding, verifiable scientific claims, third-party purity certifications, and superior digital marketing strategies to educate consumers and navigate the competitive landscape of branded health supplements, where consumer trust and positive reviews are paramount.

Omega-3 Polyunsaturated Fatty Acids Market Potential Customers

The market for Omega-3 Polyunsaturated Fatty Acids targets a diverse array of end-users whose needs range from preventative daily nutrition to specific therapeutic intervention, defining distinct purchasing criteria and volume demands. The largest segment by volume is the general consumer market, comprised of individuals seeking dietary supplements for maintenance of general wellness, specifically targeting cardiovascular health, joint support, and cognitive enhancement. This group is segmented further by age: the growing senior demographic, who are high-frequency users concerned with age-related decline, and younger, affluent consumers interested in "biohacking" and performance nutrition. These customers, influenced heavily by digital media and health influencers, prioritize high EPA/DHA potency, certification of purity (like IFOS), and palatable, convenient delivery forms (e.g., gummies or flavored liquids). Their purchasing decisions are often driven by brand reputation and verifiable scientific evidence supporting product claims, making marketing based on clinical trials essential for customer conversion and loyalty.

A second crucial segment includes pharmaceutical companies and medical nutrition providers, which represent the highest-value customer base due to the non-negotiable requirement for pharmaceutical-grade purity and batch consistency. Pharmaceutical buyers procure ultra-high-concentration EPA or DHA ethyl esters, which are classified as Active Pharmaceutical Ingredients (APIs), for the manufacturing of prescription medications aimed at managing dyslipidemia and reducing cardiovascular risk, necessitating compliance with global pharmacopoeial standards (USP, EP, JP) and rigorous FDA or EMA approvals. Similarly, clinical nutrition providers purchase specialized omega-3 ingredients for integration into hospital-grade enteral and parenteral feeding formulas, leveraging the fatty acids' known anti-inflammatory and immune-supportive functions for critically ill or compromised patients. These transactions involve long-term supply contracts, comprehensive regulatory audits, and highly specialized formulation support, making quality assurance and regulatory experience the definitive barriers to entry for suppliers targeting this high-value customer category.

The third major group of potential customers encompasses functional food manufacturers and the expansive animal feed industry. Functional food producers—including companies specializing in infant formula, dairy, bakery, and fortified beverages—utilize stabilized, often microencapsulated, omega-3 ingredients to enhance the nutritional profile of consumer staples, allowing them to make authorized health claims (e.g., supporting brain development). These customers prioritize ingredient stability (resistance to oxidation during processing), minimal sensory impact (odor and taste neutrality), and competitive pricing in bulk quantities. Furthermore, the aquaculture and pet food sectors constitute a substantial and growing market. Aquaculture relies on feed-grade omega-3s to ensure farmed fish attain the required nutritional profile, while the pet food segment incorporates them for promoting canine and feline joint health, coat quality, and cognitive function. These customers require industrial-scale supply and compliance with specific feed safety standards, demonstrating the broad, cross-industry demand for customized omega-3 products tailored to distinct technical and regulatory specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aker BioMarine, BASF SE (Pronova BioPharma), DSM Nutritional Products, Golden Omega, Croda International Plc, GC Rieber VivoMega, KD Pharma Group, Nordic Naturals, Pharma Marine AS, Omega Protein Corporation, Polaris Nutritional Lipids, Epax, VAYA Pharma, Biogena Pharma GmbH, AlaskOmega, Koninklijke DSM N.V., Simris Alg AB, Cargill Inc., Novasep, Nippon Suisan Kaisha, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Omega-3 Polyunsaturated Fatty Acids Market Key Technology Landscape

The technological landscape surrounding the Omega-3 Polyunsaturated Fatty Acids market is highly advanced, defined by relentless innovation in separation science, stabilization engineering, and sustainable sourcing methods, all aimed at delivering ultra-pure, concentrated, and highly bioavailable products. Molecular distillation remains a foundational technology, utilizing precise temperature and pressure differentials to separate EPA and DHA from bulk crude oil, simultaneously volatilizing and removing environmental contaminants such as heavy metals and persistent organic pollutants (POPs). However, the pursuit of pharmaceutical-grade purity (often 90% concentration or higher) necessitates even more sophisticated techniques. Supercritical Fluid Extraction (SFE) and chromatographic methods, particularly Simulated Moving Bed (SMB) chromatography, are increasingly deployed as they allow for continuous, high-efficiency separation under lower temperatures and without aggressive chemical solvents. These methods are essential for preserving the chemical integrity of the fatty acids, minimizing thermal degradation, and achieving the required purity benchmarks for inclusion in prescription drug formulations, marking a major technological barrier to entry for new market participants.

Stabilization technology constitutes another critical technological pillar, directly impacting product quality and consumer compliance. Since omega-3 fatty acids are extremely susceptible to lipid oxidation, leading to rancidity and flavor degradation, proprietary anti-oxidation systems are essential. Current technological advancements include the use of highly synergistic antioxidant cocktails (combining tocopherols, rosemary extract, and ascorbyl palmitate) and, crucially, advanced microencapsulation. Microencapsulation involves spraying the oil into fine particles coated with a protective polymer matrix (such as modified starches, gelatin, or alginates) to shield the PUFAs from oxygen exposure. This technology is indispensable for incorporating liquid omega-3s into powdered functional food matrices (e.g., infant formula or meal replacement shakes) without compromising sensory characteristics or nutritional efficacy, simultaneously extending shelf life considerably and improving consumer acceptance by eliminating the universally disliked fishy aftertaste. Innovative softgel technologies, incorporating enhanced enteric coatings, further refine delivery by controlling where the fatty acids are released in the digestive tract, optimizing absorption and minimizing reflux-related taste issues.

Furthermore, biotechnology is reshaping the raw material sourcing landscape, specifically through advancements in fermentation technology. Large-scale, aseptic fermentation of proprietary microalgae strains (like Schizochytrium or Crypthecodinium cohnii) in closed bioreactors allows for the controlled, predictable, and sustainable production of DHA, entirely independent of marine fisheries and environmental fluctuations. Technological focus here includes optimizing genetically stable strains for high yield, perfecting the post-fermentation oil extraction process to ensure high purity, and utilizing AI/ML algorithms to manage complex bioreactor parameters in real time. This sustainable sourcing innovation is vital for catering to the vegan market and providing an ethically sound supply chain solution for infant nutrition products. Parallel research is ongoing into transgenic technologies, engineering land-based crops (e.g., canola or camelina) to produce EPA and DHA, although these biotechnologically enhanced crops face slower regulatory acceptance and commercialization pathways, primarily in North America and select European jurisdictions, reflecting the intersection of advanced science with complex consumer regulatory approval processes.

Regional Highlights

North America, particularly the United States, holds an influential position in the global Omega-3 PUFAs market, characterized by mature consumer awareness, high healthcare spending, and sophisticated regulatory structures. The region drives innovation in high-concentration and specialty products, supported by significant investment in clinical trials validating condition-specific formulations (e.g., focusing on dry eye, mental health, and personalized cardiovascular risk reduction). High market penetration is maintained through diversified distribution channels, including a powerful presence of large pharmaceutical companies marketing prescription omega-3 drugs and strong direct-to-consumer (D2C) online supplement brands that emphasize purity, sustainability, and transparency certifications (e.g., IFOS certification). Consumers in the U.S. demand premium quality, are less price-sensitive than those in other regions, and respond well to products supported by compelling scientific evidence and endorsements from medical professionals, leading to a market saturated with high-end, specialized products and technologically advanced delivery systems aimed at maximizing compliance and absorption.

Europe represents another cornerstone of the global market, distinguished by rigorous adherence to health and safety standards mandated by the European Food Safety Authority (EFSA) and strong public support for environmental sustainability. Key markets include Germany, the UK, and Scandinavian countries, where preventative health is a cultural norm. Demand is robust for krill oil and certified sustainable fish oil products, reflecting high consumer sensitivity to environmental issues and the origin of marine resources. The European pharmaceutical sector is highly developed, with prescription omega-3s playing a major role in lipid management across national health services. Furthermore, the functional food sector in Europe is rapidly integrating omega-3s into everyday staples like yogurts and spreads, leveraging EFSA-approved health claims concerning heart and brain function. Challenges include navigating the diverse language and specific national regulatory interpretations across the EU member states, requiring manufacturers to maintain highly adaptable packaging and marketing strategies to ensure regional compliance and maximize market access.

The Asia Pacific (APAC) region is indisputably the key growth engine for the future, slated to witness explosive volumetric growth driven by its immense population, accelerating urbanization, and rapid economic maturation. Countries like China and India are experiencing a massive increase in the middle-class demographic, resulting in heightened demand for imported health supplements and fortified foods, especially infant formula enriched with DHA for cognitive development. Japan, a traditionally high-consumption market, continues to innovate in the realm of functional foods tailored to its aging society. Market growth in APAC is fueled by the rising prevalence of chronic diseases linked to modernized, sedentary lifestyles and a cultural shift towards embracing Western-style preventative supplements. While price sensitivity remains higher than in Western markets, demand for quality is rising, leading to opportunities for regional manufacturers to scale sustainable production methods and for global players to customize packaging and pricing strategies to achieve mass-market penetration across geographically and culturally distinct national markets, often prioritizing convenience and established local distribution networks.

- North America: High revenue share; emphasis on pharmaceutical-grade products and personalized nutrition; demand driven by high consumer awareness and advanced regulatory environment.

- Europe: Strong focus on sustainability and ethical sourcing (krill and algal oils); regulated by EFSA standards; significant consumption in Scandinavia and Western Europe.

- Asia Pacific (APAC): Fastest projected growth rate; fueled by population growth, urbanization, and rising disposable income in China and India; key focus on infant nutrition and functional food fortification.

- Latin America: Emerging potential driven by awareness of nutritional deficiencies; growth constrained by economic instability and highly variable regulatory oversight across nations.

- Middle East and Africa (MEA): Nascent market, primarily concentrated in high-income Gulf Cooperation Council (GCC) states; growth sustained by high import rates for premium clinical nutrition and dietary supplements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Omega-3 Polyunsaturated Fatty Acids Market.- Aker BioMarine

- BASF SE (Pronova BioPharma)

- DSM Nutritional Products

- Golden Omega

- Croda International Plc

- GC Rieber VivoMega

- KD Pharma Group

- Nordic Naturals

- Pharma Marine AS

- Omega Protein Corporation

- Polaris Nutritional Lipids

- Epax (FMC Corporation)

- VAYA Pharma

- Biogena Pharma GmbH

- AlaskOmega (Wild Alaskan Salmon Oil)

- Koninklijke DSM N.V.

- Simris Alg AB

- Cargill Inc.

- Novasep

- Nippon Suisan Kaisha, Ltd.

- IFF Health

- Global Organics

Frequently Asked Questions

Analyze common user questions about the Omega-3 Polyunsaturated Fatty Acids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Omega-3 Polyunsaturated Fatty Acids market?

The primary drivers are the increasing global awareness of the established health benefits of EPA and DHA, particularly for cardiovascular and cognitive health, coupled with the rising incidence of chronic lifestyle diseases and strong endorsement from medical and regulatory bodies worldwide, prompting a shift toward preventative nutritional habits.

What are the key differences between marine-sourced and algae-sourced Omega-3s?

Marine sources (fish/krill oil) are naturally rich in both EPA and DHA. Algae-based sources primarily provide DHA, making them a preferred sustainable and vegan alternative that avoids ecological stress on fisheries and eliminates concerns about heavy metal contamination often associated with traditional marine sourcing.

Which application segment holds the largest market share for Omega-3 PUFAs?

The Dietary Supplements segment currently holds the largest volumetric market share due to widespread consumer adoption for general wellness and preventative care. However, the Pharmaceutical segment demands the highest value per unit volume due to the required ultra-high purity and stringent regulatory pathways.

How do new technologies like AI influence the Omega-3 PUFAs supply chain?

AI significantly impacts the supply chain by optimizing microalgae cultivation parameters for maximum yield, implementing predictive analytics for sustainable fish stock management, and enhancing quality control systems for real-time purity verification during the crucial refinement and molecular distillation processes, thereby boosting efficiency and consumer trust.

What are the main restraints hindering Omega-3 market expansion?

Major restraints include persistent challenges related to sustainable marine sourcing and highly regulated fishing quotas, high raw material price volatility, and the inherent chemical instability of omega-3s, which necessitates costly advanced stabilization and encapsulation technologies to maintain efficacy and palatability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager