On-Shelf Availability Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439468 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

On-Shelf Availability Market Size

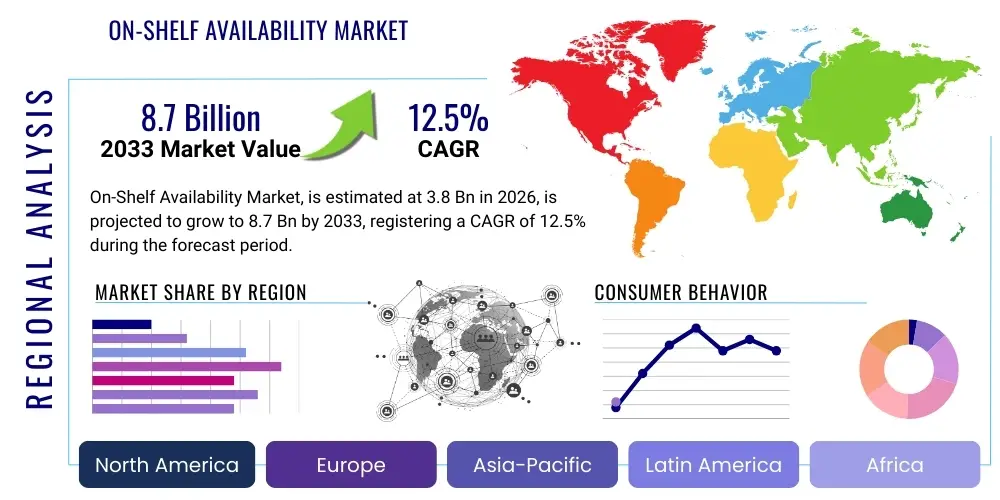

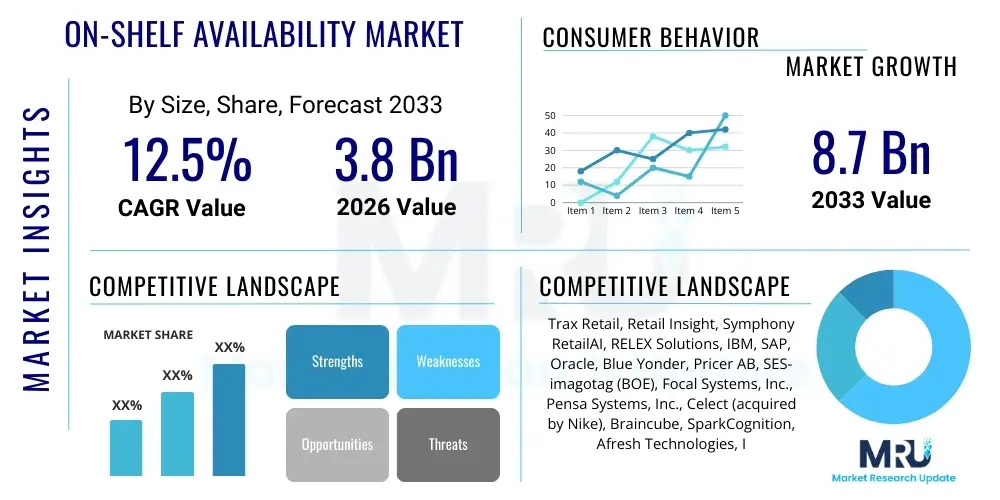

The On-Shelf Availability Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

On-Shelf Availability Market introduction

The On-Shelf Availability (OSA) market encompasses a sophisticated ecosystem of technologies, software, and services designed to ensure that products are consistently available for purchase when and where consumers expect them. This critical domain addresses the fundamental retail challenge of stockouts, which leads to lost sales, customer dissatisfaction, and brand erosion. OSA solutions leverage advanced analytics, real-time data capture, and automation to optimize inventory levels, improve planogram compliance, and enhance the overall shopping experience. The core objective is to bridge the gap between supply chain efficiency and consumer demand at the point of sale, thereby maximizing revenue opportunities and strengthening customer loyalty.

Products within the OSA market typically include a range of solutions such as real-time inventory tracking systems, shelf monitoring sensors, computer vision platforms, and predictive analytics software. These tools integrate seamlessly with existing retail infrastructure, providing actionable insights into stock levels, product placement, and potential stockout risks. Major applications span across various retail formats, including grocery stores, department stores, specialty retailers, and even extend into warehousing and logistics for proactive inventory management. The benefits derived from robust OSA strategies are multifaceted, encompassing reduced lost sales, optimized inventory holding costs, improved operational efficiency, and enhanced customer satisfaction, all contributing to a stronger competitive position.

Key driving factors propelling the growth of the On-Shelf Availability market include the exponential rise of e-commerce and omnichannel retailing, which have heightened consumer expectations for instant product availability. Retailers are under immense pressure to deliver seamless shopping experiences, whether in-store or online, making OSA a strategic imperative. Furthermore, the increasing complexity of global supply chains, coupled with fluctuating consumer demand patterns, necessitates sophisticated tools for precise inventory management. The continuous innovation in sensor technology, artificial intelligence, and machine learning further empowers OSA solutions to offer unprecedented levels of accuracy and predictive capabilities, making them indispensable for modern retail operations seeking to mitigate stockouts and maximize sales potential.

On-Shelf Availability Market Executive Summary

The On-Shelf Availability market is experiencing robust growth, primarily driven by the imperative for retailers to combat stockouts and enhance customer satisfaction in an increasingly competitive landscape. Business trends indicate a significant shift towards integrated, data-driven solutions that offer real-time visibility into inventory and shelf conditions. Retailers are moving away from manual processes to embrace automation, AI-powered analytics, and IoT sensors to gain a competitive edge. This evolution is also fueled by the expansion of omnichannel strategies, where maintaining consistent product availability across all touchpoints is paramount. Strategic partnerships between technology providers and retail giants are becoming more common, accelerating the adoption of sophisticated OSA platforms and fostering innovation in the sector.

Regionally, North America and Europe currently dominate the OSA market, largely due to early technology adoption, high retail maturity, and significant investments in advanced retail infrastructure. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by its burgeoning retail sector, increasing disposable incomes, and the rapid expansion of organized retail chains and e-commerce platforms. Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, as retailers in these regions increasingly recognize the tangible benefits of OSA in optimizing operations and improving profitability. The global trend suggests that market growth will continue to be geographically diversified, with an increasing focus on localized solutions and implementation strategies to address unique regional challenges and consumer behaviors.

From a segmentation perspective, the software component, particularly cloud-based solutions, holds the largest market share, attributed to its scalability, flexibility, and lower upfront investment costs. Services, including consulting, integration, and support, are also experiencing significant demand as retailers require expert assistance in implementing and optimizing complex OSA systems. Technology-wise, computer vision and AI/ML analytics are witnessing the fastest growth, as they offer unparalleled accuracy in shelf monitoring and predictive capabilities. End-user segments show strong adoption across grocery and specialty retail, with increasing penetration in consumer packaged goods (CPG) companies seeking to collaborate more effectively with retailers to ensure product presence. The market is also seeing a convergence of technologies, where RFID, IoT sensors, and computer vision are often combined to create more comprehensive and resilient OSA ecosystems.

AI Impact Analysis on On-Shelf Availability Market

User inquiries regarding AI's impact on On-Shelf Availability often center on its potential to revolutionize traditional retail operations, address long-standing challenges like phantom inventory and manual labor inefficiencies, and provide unprecedented predictive insights. Common questions include how AI can accurately detect stockouts in real-time, its role in optimizing planogram compliance, and its capability to forecast demand more precisely to prevent future availability issues. Users are keenly interested in the practical applications of AI-powered computer vision for shelf monitoring, the integration of machine learning algorithms for dynamic pricing and promotion adjustments based on availability, and the potential for AI to automate ordering and replenishment processes, thereby reducing human error and operational costs. There's also a strong focus on AI's ability to process vast amounts of disparate data—from POS systems, supply chain logistics, weather patterns, and social media trends—to offer holistic and actionable insights for maintaining optimal shelf presence.

- AI-powered computer vision systems enable real-time, highly accurate detection of stockouts and misplacements on shelves, significantly reducing manual auditing efforts.

- Machine learning algorithms enhance demand forecasting accuracy by analyzing historical sales data, promotional calendars, seasonal trends, and external factors like local events and weather, leading to proactive inventory management.

- Predictive analytics driven by AI identifies potential future stockout risks even before they occur, allowing retailers to initiate pre-emptive replenishment orders and avoid lost sales.

- AI optimizes planogram compliance by comparing actual shelf layouts with approved configurations, alerting staff to discrepancies and ensuring products are displayed correctly.

- Automated replenishment systems leverage AI to trigger orders based on real-time sales data and predicted demand, minimizing human intervention and optimizing stock levels.

- AI facilitates dynamic pricing strategies that can respond to current on-shelf availability, helping to clear excess stock or protect margins on high-demand, limited-availability items.

- Personalized customer experiences are enhanced as AI ensures that items frequently purchased by loyal customers are consistently available, improving satisfaction and retention.

- Integration of AI with IoT sensors provides a comprehensive view of product movement and shopper behavior, offering deeper insights into the root causes of OSA issues.

- AI assists in identifying "phantom inventory" discrepancies between system records and actual physical stock, improving inventory accuracy and reducing shrink.

- Supply chain optimization becomes more robust with AI, predicting disruptions and recommending alternative sourcing or distribution strategies to maintain product flow to stores.

DRO & Impact Forces Of On-Shelf Availability Market

The On-Shelf Availability market is fundamentally shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside significant impact forces. A primary driver is the escalating consumer expectation for seamless product availability, fueled by the convenience of e-commerce and omnichannel shopping. In today's retail landscape, a single stockout can lead to immediate lost sales and long-term brand damage as consumers readily switch to competitors. This intensified pressure on retailers to deliver consistent product presence across all channels compels investment in sophisticated OSA solutions. Furthermore, the inherent complexities of modern supply chains, characterized by global sourcing, diverse product assortments, and fluctuating demand, necessitate advanced tools for real-time visibility and predictive analytics to mitigate stockout risks effectively.

However, the market also faces notable restraints. High initial implementation costs associated with advanced OSA technologies, particularly for smaller retailers, can be a significant barrier to adoption. Integrating new OSA systems with legacy IT infrastructures, including existing POS, ERP, and inventory management systems, often presents considerable technical challenges and requires substantial investment in customization and data synchronization. Moreover, a lack of skilled personnel capable of deploying, managing, and interpreting insights from these sophisticated platforms can hinder effective utilization. Resistance to change within organizational cultures, where traditional manual processes are deeply ingrained, further impedes the seamless adoption and full realization of OSA benefits, often leading to underutilization of technology.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The proliferation of IoT sensors, computer vision, and AI/ML technologies offers unprecedented capabilities for real-time, highly accurate shelf monitoring and predictive analytics, opening new avenues for proactive issue resolution. The ongoing shift towards omnichannel retailing presents a significant opportunity for OSA solutions to ensure a unified and consistent customer experience across both physical and digital touchpoints. Emerging markets, with their rapidly expanding retail sectors and increasing consumer purchasing power, represent untapped potential for OSA adoption. Additionally, the growing focus on sustainability and waste reduction within retail encourages optimized inventory management, aligning perfectly with the core benefits of enhanced on-shelf availability, driving further investment and innovation in this critical market segment.

Segmentation Analysis

The On-Shelf Availability market is rigorously segmented to provide a comprehensive understanding of its intricate dynamics and growth trajectories across various dimensions. This segmentation helps stakeholders identify key areas of investment, target specific customer needs, and develop tailored strategies for market penetration. The primary axes of segmentation include the type of components utilized, the underlying technologies employed, the diverse applications across retail operations, and the broad range of end-user industries that benefit from OSA solutions. This multi-dimensional approach reveals distinct market clusters, each with unique growth drivers and competitive landscapes, offering a granular view of the market's structure and potential.

Analyzing the market through these segments illuminates how different solutions cater to specific operational requirements and technological maturities. For instance, the distinction between software and services highlights the evolving preference for cloud-based, subscription models, alongside the critical need for expert implementation and ongoing support. Similarly, examining the technology landscape from RFID to advanced AI-driven computer vision showcases the spectrum of innovation and adoption rates within the market. Understanding these segmentations is crucial for both market entrants and established players to position their offerings effectively, anticipate future trends, and allocate resources efficiently. This detailed breakdown provides a strategic framework for comprehending the complex interplay of factors that shape the global On-Shelf Availability market.

- By Component

- Software

- Cloud-based

- On-premise

- Services

- Consulting

- Implementation & Integration

- Support & Maintenance

- Software

- By Technology

- RFID

- Barcodes

- IoT Sensors

- Computer Vision

- Artificial Intelligence (AI) & Machine Learning (ML) Analytics

- Predictive Analytics

- By Application

- Inventory Management & Optimization

- Planogram Compliance & Shelf Monitoring

- Demand Forecasting

- Theft Prevention & Shrinkage Reduction

- Pricing & Promotion Optimization

- By End-User

- Retailers

- Grocery & Supermarkets

- Department Stores

- Specialty Stores (e.g., Electronics, Apparel, Cosmetics)

- Convenience Stores

- Drugstores & Pharmacies

- Consumer Packaged Goods (CPG) Manufacturers

- Warehousing & Logistics Providers

- Retailers

Value Chain Analysis For On-Shelf Availability Market

The value chain for the On-Shelf Availability market is intricate, involving multiple stakeholders from technology developers to end-user retailers, each contributing distinct value at different stages. It begins with upstream activities focused on research and development of core technologies such as RFID tags, IoT sensors, high-resolution cameras for computer vision, and advanced AI/ML algorithms. These technology providers, often specializing in hardware or software components, innovate to improve accuracy, efficiency, and cost-effectiveness of data capture and analysis. This upstream segment is characterized by intense R&D investment and a focus on creating robust, scalable, and interoperable solutions that can integrate seamlessly into diverse retail environments, forming the foundational layer for effective OSA strategies.

Moving downstream, the value chain encompasses the integration, implementation, and ongoing service delivery of these OSA solutions. This involves specialized system integrators who customize and deploy the technologies within a retailer's existing infrastructure, ensuring compatibility and optimal performance. Distribution channels for OSA solutions can be both direct and indirect. Direct channels typically involve large software vendors or specialized OSA providers selling directly to enterprise-level retailers, offering comprehensive packages that include software, hardware, and services. Indirect channels involve partnerships with value-added resellers (VARs), managed service providers (MSPs), and consulting firms who extend the reach of OSA solutions to a broader market, particularly to small and medium-sized retailers who may require more tailored support and localized expertise.

The final stage of the value chain involves the end-user retailers and CPG manufacturers who leverage these OSA solutions to gain actionable insights and optimize their operations. Retailers utilize the data and analytics generated by OSA systems to prevent stockouts, ensure planogram compliance, improve inventory accuracy, and enhance the overall customer shopping experience. CPG manufacturers, often collaborating with retailers, use OSA data to ensure their products are consistently available, supporting their brand presence and sales targets. The feedback loop from end-users back to technology providers is crucial for continuous product improvement and innovation, driving the evolution of the OSA market towards more intelligent, predictive, and integrated solutions that address the ever-changing demands of the retail sector.

On-Shelf Availability Market Potential Customers

The primary potential customers for On-Shelf Availability solutions are diverse entities operating within the retail ecosystem, all sharing a common objective: to optimize product presence and maximize sales. Retailers of all sizes and formats constitute the largest customer segment, ranging from vast hypermarkets and supermarket chains to specialty boutiques, department stores, and convenience outlets. These businesses directly face the challenges of stockouts, planogram non-compliance, and inventory inaccuracies, which directly impact their revenue and customer satisfaction. The imperative to compete effectively in a landscape dominated by omnichannel experiences and instant gratification drives their demand for robust OSA tools, enabling them to meet consumer expectations consistently.

Beyond traditional retailers, Consumer Packaged Goods (CPG) manufacturers represent another significant customer base. CPG companies have a vested interest in ensuring their products are always available on retailer shelves, as this directly affects their market share and brand visibility. They often collaborate with retailers, utilizing OSA data to gain insights into product performance, identify gaps in shelf presence, and optimize their supply chain and merchandising strategies. For CPG manufacturers, investing in or partnering with OSA solution providers allows them to proactively address availability issues, protect their brand equity, and foster stronger relationships with their retail partners by demonstrating a commitment to joint success in inventory management and sales.

Furthermore, warehousing and logistics providers are increasingly recognizing the value of OSA solutions. While their focus is typically on the upstream supply chain, ensuring efficient product flow to retail distribution centers and ultimately to stores is critical for maintaining on-shelf availability. These providers can leverage aspects of OSA technology, such as real-time inventory tracking and predictive analytics, to optimize their fulfillment processes, reduce lead times, and enhance the accuracy of shipments to retail locations. This proactive approach helps to prevent stockouts before they even reach the store level, making them indirect yet crucial beneficiaries and potential customers for components of the broader OSA market. The comprehensive reach of OSA benefits across the entire retail value chain underscores its broad appeal and extensive customer potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trax Retail, Retail Insight, Symphony RetailAI, RELEX Solutions, IBM, SAP, Oracle, Blue Yonder, Pricer AB, SES-imagotag (BOE), Focal Systems, Inc., Pensa Systems, Inc., Celect (acquired by Nike), Braincube, SparkCognition, Afresh Technologies, Imagr, Zebra Technologies, SoluM (Samsung), Nedap Retail |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

On-Shelf Availability Market Key Technology Landscape

The technological landscape of the On-Shelf Availability market is a confluence of advanced innovations aimed at providing real-time visibility and predictive intelligence for retail operations. At its core, the market leverages sensor technologies, prominently including IoT (Internet of Things) sensors and RFID (Radio Frequency Identification) tags. IoT sensors, often integrated into shelving units or smart cameras, continuously monitor stock levels, temperature, and even customer interactions, transmitting data wirelessly for analysis. RFID technology, either passive or active, enables rapid and accurate tracking of individual items from warehouse to shelf, significantly improving inventory accuracy and reducing manual counting errors. These foundational data capture technologies form the bedrock upon which more sophisticated analytical systems are built.

Building upon sensor data, computer vision and artificial intelligence (AI) and machine learning (ML) analytics represent the forefront of OSA technology. Computer vision systems utilize high-resolution cameras strategically placed throughout stores to analyze shelf images in real time, detecting stockouts, incorrect product placement, and planogram non-compliance with remarkable precision. These systems are powered by AI algorithms trained on vast datasets of product images, enabling them to identify specific SKUs and their quantities. Machine learning algorithms further enhance these capabilities by learning from historical sales data, promotional impacts, and external factors to provide highly accurate demand forecasts, predict potential stockouts, and recommend optimal replenishment strategies. The synergy between computer vision and AI/ML allows for proactive problem-solving rather than reactive responses to availability issues.

Beyond data capture and analysis, the technology landscape also encompasses sophisticated software platforms for inventory management, supply chain optimization, and retail execution. These platforms integrate data from various sources—POS systems, warehouse management systems, supplier databases, and OSA sensors—to provide a holistic view of product flow and availability. Cloud-based solutions are particularly prevalent due to their scalability, accessibility, and lower infrastructure costs, enabling retailers to deploy and manage OSA systems more efficiently. Furthermore, augmented reality (AR) applications are emerging as a new frontier, assisting store associates with shelf replenishment and planogram adherence by overlaying digital information onto physical displays. The continuous evolution and integration of these diverse technologies are driving the On-Shelf Availability market towards more intelligent, automated, and customer-centric solutions.

Regional Highlights

Geographically, the On-Shelf Availability market exhibits varied adoption rates and growth trajectories influenced by economic development, retail maturity, and technological infrastructure across different regions. North America currently stands as a dominant force in the global OSA market, driven by a highly competitive retail landscape, early and extensive adoption of advanced retail technologies, and significant investments by major retailers in optimizing their supply chains and in-store operations. The presence of numerous key technology providers and the prevalence of omnichannel retail strategies further bolster market growth in this region, where consumer expectations for immediate product availability are exceptionally high, compelling continuous innovation in OSA solutions.

Europe also represents a substantial market share, with countries such as the UK, Germany, and France leading the charge. This region benefits from a mature retail sector, a strong emphasis on operational efficiency, and a growing recognition among retailers of the direct link between on-shelf availability and profitability. European retailers are increasingly investing in AI-powered analytics and IoT-based shelf monitoring systems to comply with stringent consumer protection regulations and meet the demands of discerning shoppers. The adoption is particularly strong within the grocery and general merchandise segments, where managing diverse product assortments and high sales volumes necessitates sophisticated OSA technologies to minimize waste and maximize sales opportunities.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for On-Shelf Availability, characterized by a burgeoning retail sector, rapid urbanization, and a dramatic increase in disposable incomes. Countries like China, India, Japan, and Australia are witnessing a surge in organized retail formats and e-commerce penetration, driving the need for advanced inventory and shelf management solutions. The vast consumer base and the logistical complexities of serving diverse geographies within APAC present both challenges and immense opportunities for OSA providers. Latin America, along with the Middle East and Africa (MEA), though smaller in market share, are also experiencing accelerated growth as retailers in these regions seek to modernize operations, reduce inefficiencies, and cater to an increasingly demanding consumer base, thereby offering significant long-term growth potential for the OSA market.

- North America: Leading market due to high retail maturity, extensive technology adoption, omnichannel imperative, and significant investments in supply chain optimization. Key players and large retail chains drive innovation.

- Europe: Strong market with focus on operational efficiency and customer experience. Advanced OSA solutions adopted by grocery and general merchandise sectors. Regulatory compliance and diverse consumer markets are key drivers.

- Asia Pacific (APAC): Fastest-growing market fueled by rapidly expanding retail, e-commerce boom, urbanization, and increasing consumer spending. Significant growth potential in China, India, and Southeast Asian nations.

- Latin America: Emerging market with increasing modernization of retail infrastructure. Focus on reducing shrinkage, improving inventory accuracy, and meeting evolving consumer demands.

- Middle East & Africa (MEA): Growing market driven by retail expansion, tourism, and increasing investment in smart retail technologies. Focus on improving operational efficiency in diverse retail formats.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the On-Shelf Availability Market.- Trax Retail

- Retail Insight

- Symphony RetailAI

- RELEX Solutions

- IBM

- SAP

- Oracle

- Blue Yonder

- Pricer AB

- SES-imagotag (BOE)

- Focal Systems, Inc.

- Pensa Systems, Inc.

- Celect (acquired by Nike)

- Braincube

- SparkCognition

- Afresh Technologies

- Imagr

- Zebra Technologies

- SoluM (Samsung)

- Nedap Retail

Frequently Asked Questions

Analyze common user questions about the On-Shelf Availability market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is On-Shelf Availability (OSA) in retail?

On-Shelf Availability refers to the measure of whether a product is present and accessible on a store's shelf for customers to purchase at the time they wish to buy it. It's a critical metric for retailers to avoid lost sales and enhance customer satisfaction.

Why is On-Shelf Availability important for retailers?

OSA is vital because stockouts directly lead to lost sales, decreased customer loyalty, and potential brand damage. Ensuring high OSA optimizes revenue, improves customer experience, and enhances operational efficiency by reducing inventory discrepancies and waste.

How does AI impact On-Shelf Availability?

AI significantly impacts OSA by enabling real-time shelf monitoring via computer vision, improving demand forecasting accuracy through machine learning, predicting potential stockouts, and automating replenishment processes, leading to proactive issue resolution and better inventory management.

What are the key technologies used for On-Shelf Availability?

Key technologies include IoT sensors, RFID tags for real-time tracking, computer vision for visual shelf analysis, and AI/ML analytics for demand forecasting and predictive insights. Software platforms integrate these technologies for comprehensive inventory and shelf management.

What are the main challenges in achieving optimal On-Shelf Availability?

Challenges include high implementation costs of advanced systems, complex integration with legacy retail IT infrastructures, data inaccuracies (phantom inventory), inefficient manual processes, and the need for skilled personnel to manage and interpret sophisticated OSA data effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager