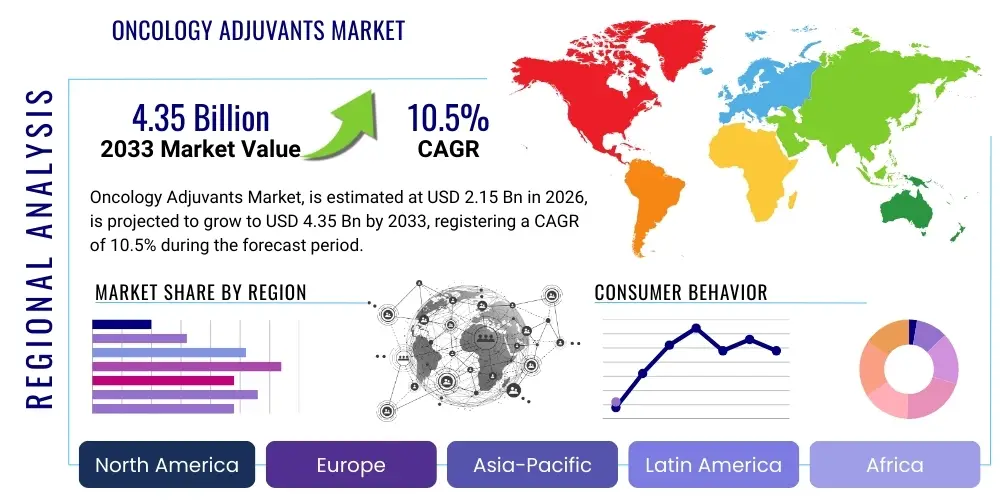

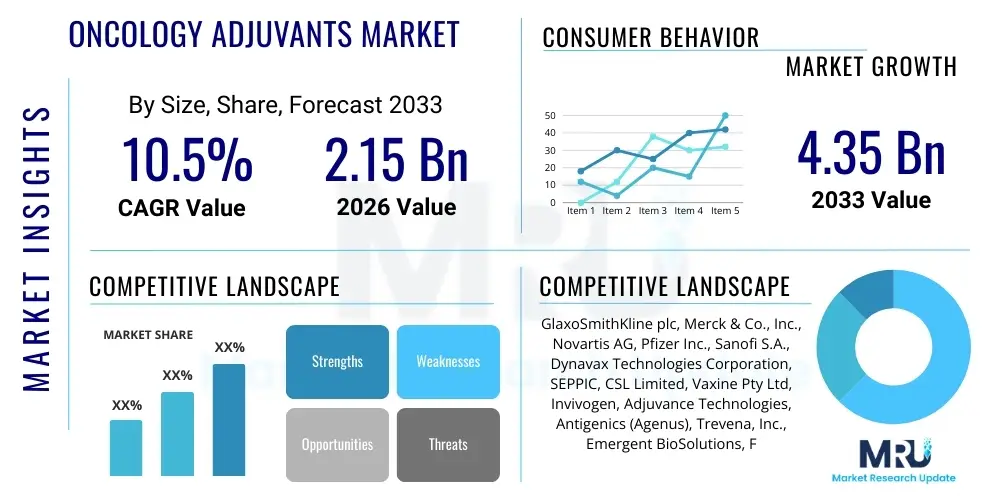

Oncology Adjuvants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435820 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Oncology Adjuvants Market Size

The Oncology Adjuvants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 2.15 billion in 2026 and is projected to reach USD 4.35 billion by the end of the forecast period in 2033.

Oncology Adjuvants Market introduction

The Oncology Adjuvants Market is defined by the global landscape dedicated to the development and commercialization of compounds designed to maximize the therapeutic index of anti-cancer immunotherapies. These specialized agents are critical pharmacological tools that enhance the magnitude and specificity of the immune response against malignant cells, primarily by activating innate immune receptors on Antigen-Presenting Cells (APCs). Adjuvants are crucial for overcoming the often potent immunosuppressive environment induced by tumors, thereby facilitating robust T-cell priming and sustained immunological memory, which is essential for long-term cancer control and prevention of recurrence. The product portfolio includes a wide array of synthetic, biological, and natural components, often integrated into highly stable and targeted delivery systems such as lipid nanoparticles and proprietary emulsions.

Major applications of oncology adjuvants are centered around personalized cancer vaccines, including those targeting neoantigens, and their strategic use in combination with established immune checkpoint inhibitors (ICIs). The utility in vaccines is paramount, ensuring that the presented antigen elicits a powerful and durable cytotoxic T-lymphocyte (CTL) response. Furthermore, in combination with ICIs, adjuvants are increasingly deployed to enhance response rates in patients refractory to monotherapy, effectively "heating up" immunologically cold tumors. The core benefits delivered by these products include increased treatment efficacy, reduced potential for systemic toxicity through targeted delivery, and the crucial ability to establish long-lasting immunity, positioning them as essential components of next-generation oncology protocols.

Market expansion is robustly driven by the continuous global increase in cancer prevalence, necessitating more effective and innovative treatment modalities. Significant technological breakthroughs in molecular immunology, coupled with massive financial commitments from pharmaceutical giants and specialized biotech firms into immuno-oncology R&D, propel the search for novel and more powerful adjuvant mechanisms, such as STING pathway activation. Favorable regulatory environments in key markets, particularly in North America and Europe, which often provide expedited review for groundbreaking oncology therapeutics, further catalyze the rapid transition of promising preclinical adjuvant candidates into viable commercial products, solidifying the market's high growth trajectory.

Oncology Adjuvants Market Executive Summary

The Oncology Adjuvants Market demonstrates dynamic commercial activity, characterized by high levels of strategic collaboration and intense focus on platform technology development. Business trends show a strong prioritization of modular adjuvant systems that can be rapidly adapted to various cancer vaccine technologies, including emerging mRNA and viral vector platforms. Companies are investing heavily in intellectual property protecting their novel delivery systems, such as advanced liposomal and nanoparticle formulations, recognizing that the efficiency and safety of delivery are as crucial as the immunogenic potency of the adjuvant molecule itself. Strategic mergers and acquisitions remain a consistent feature, as larger entities seek to integrate promising, clinic-ready adjuvant assets developed by specialized biotech innovators, consolidating the fragmented expertise across the immuno-oncology spectrum.

Geographically, North America maintains its leadership position in market share, driven by superior research infrastructure, expansive R&D investment, and a mature regulatory system that facilitates the commercialization of complex biological products. However, the Asia Pacific (APAC) region is projected to register the most substantial growth rate, fueled by improving healthcare access, significant governmental backing for domestic biotechnology sectors in nations like China and South Korea, and a large, rapidly aging population contributing to increased cancer burden. European market stability is ensured by rigorous standardization across regulatory frameworks (EMA) and a strong foundation of academic research, focusing particularly on optimizing the manufacturing and clinical deployment of approved adjuvant therapies across national health services.

Segmentation analysis highlights the increasing dominance of specialized product types, specifically Pattern Recognition Receptor (PRR) agonists like Toll-like Receptor (TLR) agonists. This segment is displacing older, less specific adjuvant classes due to its ability to induce a highly potent and targeted immune response, crucial for precision oncology applications. While Cancer Vaccines remain the largest application segment, the adoption of adjuvants in combination with Immune Checkpoint Inhibitors (ICIs) is rapidly accelerating. This combinatorial approach represents a key future growth driver, aiming to enhance ICI efficacy and circumvent resistance mechanisms. End-user consumption patterns confirm that specialized oncology centers and research institutions are the primary drivers of demand, focusing on either commercialized clinical products or high-purity research materials, respectively.

AI Impact Analysis on Oncology Adjuvants Market

Analysis of common user queries reveals that stakeholders are intensely focused on how Artificial Intelligence (AI) can fundamentally alter the discovery and optimization phases of oncology adjuvant development, traditionally a process marked by high uncertainty and cost. Users frequently seek clarity on AI's capability to predict the interaction between novel adjuvant molecules and specific human immune cell receptors, enabling a shift towards rational design rather than empirical testing. Key user concerns revolve around minimizing the development timeline and enhancing the safety profile, anticipating that AI algorithms can flag potential systemic toxicity or undesirable off-target effects of potent immune stimulants far earlier than conventional preclinical methods. The overarching expectation is that AI will be the pivotal technology for moving the field toward highly personalized, patient-specific adjuvant strategies.

AI’s influence is substantial in optimizing the molecular engineering and formulation of adjuvants. Machine learning models are proficiently utilized to screen immense chemical libraries for compounds with desired immunomodulatory properties and to predict their optimal structural modifications for enhanced stability and bioavailability. Furthermore, in manufacturing, AI-driven platforms are critical for simulating the behavior of complex delivery systems, such as lipid nanoparticles, ensuring process consistency and scalable production while adhering to stringent GMP quality requirements. This predictive capability reduces the need for extensive physical prototyping and testing, significantly compressing the development cycle and ensuring rapid translation of discovery into commercial product candidates, thereby providing a crucial competitive edge in the fast-moving immunotherapy sector.

In the clinical arena, AI technologies are revolutionizing the design and execution of clinical trials involving adjuvant-enhanced therapies. By integrating diverse patient data—including genomic sequencing, tumor microenvironment analysis, and inflammatory marker profiles—AI algorithms can identify biomarkers that predict responsiveness or resistance to specific adjuvant types. This allows for the precise selection of patient cohorts, maximizing the probability of successful trial outcomes and accelerating regulatory approval. Moreover, AI assists in continuous pharmacovigilance, monitoring patient responses and managing potential immune-related adverse events in real-time, enabling adaptive dosing strategies that enhance patient safety and therapeutic efficacy throughout the treatment lifecycle.

- AI accelerates the identification and synthesis of novel immunomodulatory compounds suitable for adjuvant development through high-throughput computational screening.

- Machine learning algorithms optimize the rational design of personalized cancer vaccines by precisely identifying patient-specific tumor neoantigens and matching the most effective adjuvant platforms.

- AI enhances clinical trial efficiency by predicting optimal patient cohorts for adjuvant-enhanced combination therapies, streamlining recruitment, and reducing overall operational time and expenditure.

- Predictive analytics tools analyze complex immune response biomarkers, including cytokine profiles and gene expression, to accurately forecast individual patient responsiveness and mitigate risks associated with systemic toxicity.

- Natural Language Processing (NLP) accelerates knowledge synthesis by structuring and analyzing vast volumes of immunological literature, informing researchers about novel mechanistic pathways for adjuvant synergy.

- AI-driven simulation models optimize the complex manufacturing parameters, stability, and quality control metrics of advanced delivery systems, such as nanocarriers, essential for commercial scalability.

- Deep learning assists in analyzing complex immunological imaging data and digital pathology slides to quantitatively assess the magnitude and duration of the anti-tumor immune changes induced by adjuvant administration in vivo.

DRO & Impact Forces Of Oncology Adjuvants Market

The dynamics of the Oncology Adjuvants Market are governed by powerful drivers, critical constraints, and significant emerging opportunities. The primary driver is the ongoing transformation in cancer treatment, with immunotherapy moving from niche status to a foundational element of oncology care. This shift necessitates highly effective immune activators like adjuvants to ensure robust clinical outcomes for increasingly sophisticated treatments such as personalized neoantigen vaccines and mRNA platforms. Furthermore, the demonstrated success of approved adjuvant-containing vaccines in preventing specific cancers (e.g., HPV) provides a strong commercial validation model. Conversely, the market is restrained by the technical complexity and high cost associated with manufacturing high-purity, pharmaceutical-grade novel biological adjuvants, coupled with the rigorous regulatory demands for demonstrating both non-toxicity and consistent efficacy in human clinical trials, which significantly delays commercialization.

Opportunities for growth are abundant, particularly in leveraging the synergistic potential of combining adjuvants with established therapeutic agents. A significant opportunity lies in developing adjuvants specifically optimized for intratumoral delivery, which promises to achieve potent local immune activation while mitigating the risk of systemic adverse effects associated with generalized immune stimulation. Furthermore, the integration of advanced bioinformatics and AI tools offers a paradigm shift in discovery, allowing companies to rationally design adjuvants tailored to specific genetic subtypes of tumors or patient immune profiles, opening up specialized, high-value precision oncology segments. Strategic licensing and co-development partnerships aimed at rapidly incorporating promising early-stage adjuvants into late-stage clinical pipelines represent a key avenue for market penetration.

The impact forces maintain high competitive pressure. The Intensity of Rivalry is high among existing market participants, driven by the race to secure proprietary adjuvant platforms that offer superior clinical advantages in combination therapies. The Threat of New Entrants is moderate; while significant capital investment and deep immunological expertise are required, specialized biotech startups can still enter the market by focusing on breakthrough mechanisms (e.g., novel STING agonists). The Bargaining Power of Buyers (major hospital networks) remains moderate, demanding demonstrated long-term clinical value and favorable pricing for approved products. The Threat of Substitutes is low, as no other treatment class currently replicates the core function of an adjuvant—the targeted potentiation of the adaptive immune response—though radical shifts in cell therapy or gene editing could present future alternatives.

Segmentation Analysis

The Oncology Adjuvants Market is strategically segmented to reflect the diversity in product technology, application focus, and end-user consumption patterns. The Product Type segmentation is crucial, distinguishing between synthetic molecules designed to activate specific immunological pathways and natural or mineral-based components. Synthetic adjuvants, particularly those targeting Pattern Recognition Receptors (PRRs) such as the Toll-like Receptor (TLR) family (TLR4, TLR9), are witnessing rapid expansion due to their predictable and potent activation profiles, which are essential for the complexity of therapeutic oncology. Conversely, established mineral salt adjuvants still maintain a significant, albeit slower growing, share, primarily in prophylactic vaccine applications where simplicity and long safety track records are prioritized over extreme immunogenic potency.

Application segmentation reveals the market’s core utility, with Cancer Vaccines—both therapeutic candidates aimed at treating existing malignancies and preventative vaccines (e.g., for virus-related cancers)—constituting the largest volume segment. However, the most robust growth driver is the rising adoption of adjuvants in combination with Immune Checkpoint Inhibitors (ICIs). This segment addresses the significant clinical challenge of ICI resistance by using adjuvants to modulate the tumor microenvironment, effectively converting non-responsive tumors into targets for existing ICI drugs. This combinatorial strategy is driving major pharmaceutical investment and expanding the addressable market for adjuvant technologies significantly beyond traditional vaccine platforms.

The End-User segment differentiates between the high-volume clinical consumers and the research-focused segment. Hospitals and Specialized Oncology Centers are the primary purchasers of approved, commercial-grade adjuvant formulations used directly in patient care. In contrast, Academic and Research Institutes, alongside Contract Research Organizations (CROs), drive the demand for novel, customized, and research-grade adjuvant reagents used in early-stage discovery and clinical trial support. Furthermore, the Route of Administration (Intramuscular, Subcutaneous, Intratumoral) is a strategic segmentation point, with intratumoral delivery gaining traction due to its potential to minimize systemic side effects while maximizing localized, potent immune activation at the tumor site.

- Product Type:

- Pathogen-Associated Molecular Patterns (PAMPs)

- Danger-Associated Molecular Patterns (DAMPs)

- Toll-like Receptor (TLR) Agonists (e.g., TLR-4, TLR-7/8, TLR-9)

- NOD-like Receptor (NLR) Agonists

- STING Pathway Agonists

- Cytokine Adjuvants (e.g., IL-2, GM-CSF)

- Saponins and Derivatives (e.g., QS-21)

- Mineral Salt Adjuvants (e.g., Aluminum salts)

- Lipid/Emulsion-Based Adjuvants (e.g., MF59, AS03)

- Application:

- Cancer Vaccines (Therapeutic and Prophylactic)

- Checkpoint Inhibitor Combination Therapies

- Adoptive Cell Transfer (ACT) Support

- Oncolytic Virotherapy Enhancement

- Other Immunotherapies

- End-User:

- Hospitals and Specialized Oncology Centers

- Academic and Government Research Institutes

- Contract Research Organizations (CROs)

- Biotechnology and Pharmaceutical Companies

- Route of Administration:

- Intramuscular Injection (IM)

- Subcutaneous Injection (SC)

- Intradermal Injection (ID)

- Intratumoral Injection (IT)

- Intravenous Administration

Value Chain Analysis For Oncology Adjuvants Market

The value chain for the Oncology Adjuvants Market commences with the rigorous Upstream Analysis phase, involving fundamental immunological discovery and high-precision sourcing of components. This initial segment is characterized by specialized chemical and biological synthesis, where small biotech firms and academic centers develop proprietary immunogenic molecules, such as complex TLR ligands or novel STING agonists. The acquisition and validation of high-purity raw materials—like pharmaceutical-grade lipids, specialized polymers, or synthetic nucleic acids—is critical, as the purity directly dictates the final product’s safety and performance profile. Robust quality control and intellectual property protection around novel molecular structures provide significant leverage to upstream innovators, defining the licensing landscape for downstream manufacturing.

Midstream activities focus on the Manufacturing and Formulation stage, where the complex adjuvant molecule is integrated into a stable delivery platform, often utilizing advanced nanotechnology (e.g., liposomes or oil-in-water emulsions). This requires state-of-the-art GMP facilities, highly skilled personnel, and specialized equipment to ensure batch-to-batch consistency and stability, particularly under cold-chain conditions. Distribution channel analysis reveals a dual approach. Direct distribution is favored by major pharmaceutical corporations for large volume sales to national vaccination programs or centralized hospital networks, allowing for tight control over logistics and cold-chain integrity. Indirect distribution utilizes specialized pharmaceutical logistics partners and wholesalers to ensure widespread geographic reach, particularly into smaller clinics and international research markets, optimizing inventory management across fragmented healthcare systems.

Downstream Analysis centers on Commercialization, Clinical Adoption, and Post-Market Surveillance. Potential customers (End-Users) receive the final product, primarily consisting of adjuvant-enhanced vaccines or combination therapy components, through established supply channels. Successful downstream execution relies heavily on favorable regulatory approvals and reimbursement policies, necessitating robust Phase III data demonstrating superior clinical outcomes. The final critical element is comprehensive pharmacovigilance, where continuous monitoring of patient outcomes and potential immune-related adverse events provides essential feedback to the research and development phases, ensuring the long-term safety and optimized clinical use of these potent immunological agents.

Oncology Adjuvants Market Potential Customers

The potential customer base for the Oncology Adjuvants Market is strategically diverse, primarily consisting of entities directly responsible for patient treatment and those engaged in the complex cycle of drug discovery and development. The most significant direct buyers are Hospitals and Specialized Oncology Centers. These institutions, driven by patient care needs and clinical efficacy data, procure high volumes of commercialized, approved adjuvant-containing therapeutics, such as therapeutic cancer vaccines and combination therapy components, ensuring strict adherence to current standard-of-care guidelines. Their purchasing decisions are primarily influenced by established safety records, proven clinical benefit demonstrated in late-stage trials, and favorable inclusion in national and institutional formularies, favoring suppliers who can ensure reliable cold-chain supply and technical support.

A second crucial segment includes Academic Research Institutions and government-funded biomedical organizations, alongside Contract Research Organizations (CROs). These organizations are the engines of early-stage discovery and preclinical validation, focusing heavily on experimental oncology and proof-of-concept studies for novel adjuvant mechanisms (e.g., synthetic TLR or STING agonists). These customers require smaller, customized quantities of highly purified research-grade reagents. Their demand is highly specialized, driven by scientific novelty and the need for comprehensive mechanistic data, often sourcing products from specialized biotech firms that offer extensive portfolios of experimental immunological reagents and cutting-edge discovery tools.

The third customer category comprises Biotechnology and Major Pharmaceutical Companies. These entities function both as end-users (for in-house pipeline development) and as strategic purchasers, engaging in high-value licensing deals and acquisitions of proprietary adjuvant platforms. Their purchasing strategy is focused on securing intellectual property that enhances their competitive standing in the immunotherapy market, particularly for fast-growing areas like mRNA vaccines and next-generation adoptive cell therapies. They seek highly potent, proprietary platforms that can be quickly scaled up for manufacturing and possess favorable regulatory profiles, making strategic business development and partnership activities a core component of market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.35 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GlaxoSmithKline plc, Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi S.A., Dynavax Technologies Corporation, SEPPIC, CSL Limited, Vaxine Pty Ltd, Invivogen, Adjuvance Technologies, Antigenics (Agenus), Trevena, Inc., Emergent BioSolutions, Fujifilm Diosynth Biotechnologies, Takeda Pharmaceutical Company Limited, CureVac, Biontech SE, Moderna Therapeutics, Bavarian Nordic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oncology Adjuvants Market Key Technology Landscape

The technological evolution of the Oncology Adjuvants Market is fundamentally driven by the shift towards targeted immune activation and sophisticated delivery mechanisms designed to maximize efficacy while minimizing off-target effects. Central to this landscape are Pattern Recognition Receptor (PRR) Agonists, particularly synthetic Toll-like Receptor (TLR) ligands (e.g., CpG DNA and specific RNA molecules) and, increasingly, STING pathway activators. These technologies require specialized organic synthesis and formulation expertise to ensure the molecules are stable, non-toxic, and capable of reaching their intracellular targets efficiently. Innovations in STING agonist delivery are particularly critical, given their poor bioavailability and the need for localized activation to generate a robust Type I interferon response crucial for effective T-cell priming against tumors.

A second paramount technological area is Delivery System Engineering, which involves moving beyond simple mineral salts to highly complex nanocarriers. Key technologies include advanced Lipid Nanoparticles (LNPs), which are vital for protecting sensitive nucleic acid payloads and mediating targeted uptake by dendritic cells in lymph nodes. Proprietary Oil-in-Water Emulsions (e.g., AS03, MF59) are also widely utilized, providing a controlled-release depot effect. These technological platforms require multidisciplinary expertise in material science, surface chemistry, and scalable GMP manufacturing. Success in this domain determines the stability, dosage consistency, and overall clinical translation potential of novel adjuvants, making intellectual property surrounding these carriers highly valued within the market.

Furthermore, the technology landscape is being augmented by computational and screening methodologies. High-Throughput Screening (HTS) platforms, coupled with functional genomics and advanced multiplex immunological assays, allow rapid assessment of immunogenicity and safety for thousands of new compounds. The integration of Artificial Intelligence (AI) provides predictive modeling capabilities, enabling researchers to perform Rational Adjuvant Design—predicting the necessary structural modifications to enhance receptor affinity or solubility prior to lab synthesis. This convergence of immunology, materials science, and AI is streamlining the discovery pipeline, allowing developers to focus on multi-functional adjuvants that simultaneously address tumor immunosuppression and induce a specific, potent anti-tumor immune response.

Regional Highlights

- North America: Maintains market dominance driven by the highest per capita spending on oncology R&D, advanced healthcare infrastructure, and the early adoption of personalized medicine and cutting-edge immunotherapy platforms. The regulatory environment (FDA) actively supports accelerated approval for innovative oncology agents, ensuring rapid commercialization. The concentrated presence of major biopharma headquarters and specialized contract research organizations further solidifies its market leadership in both technological innovation and revenue generation.

- Europe: Represents the second-largest market, characterized by stringent quality standards and a high focus on translational research, particularly in Western European nations. The European Medicines Agency (EMA) works towards harmonizing regulatory pathways, facilitating the multi-country clinical testing and adoption of advanced adjuvant-enhanced therapies. Market growth is sustained by strong governmental support for biomedical sciences and established public health programs utilizing prophylactic adjuvant-containing vaccines.

- Asia Pacific (APAC): Forecasted to be the fastest-growing market globally. This accelerated expansion is attributed to rapidly modernizing healthcare systems, significant increases in domestic R&D investment (especially in China and South Korea), and the large, growing patient pool needing access to advanced cancer treatments. Local governments are incentivizing strategic partnerships and technology transfers to build indigenous capacity for producing complex immunotherapy components, driving massive market potential.

- Latin America (LATAM): An emerging market showing increasing adoption rates of established oncology adjuvants, particularly in major economies like Brazil and Mexico. Growth is challenged by economic volatility and complex regulatory frameworks but supported by rising health awareness and investment in specialized oncology centers, gradually improving patient access to imported therapeutic vaccines and combination therapies.

- Middle East and Africa (MEA): A nascent market with growth concentrated primarily in the GCC nations, where high oil revenues fund sophisticated healthcare infrastructure capable of delivering advanced oncology care. Market activity is heavily reliant on imports of pre-approved global products. Expansion in the broader region remains slow, hindered by infrastructural limitations and lower healthcare expenditure outside of key urban and high-income areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oncology Adjuvants Market.- GlaxoSmithKline plc

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Dynavax Technologies Corporation

- SEPPIC

- CSL Limited

- Vaxine Pty Ltd

- Invivogen

- Adjuvance Technologies

- Antigenics (Agenus)

- Trevena, Inc.

- Emergent BioSolutions

- Fujifilm Diosynth Biotechnologies

- Takeda Pharmaceutical Company Limited

- CureVac

- Biontech SE

- Moderna Therapeutics

- Bavarian Nordic

Frequently Asked Questions

Analyze common user questions about the Oncology Adjuvants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for modern oncology adjuvants?

Modern oncology adjuvants primarily act by targeting specific Pattern Recognition Receptors (PRRs), such as Toll-like Receptors (TLRs) or STING, on Antigen-Presenting Cells (APCs). This activation leads to the maturation of APCs and the subsequent powerful priming of cytotoxic T lymphocytes against tumor antigens.

How do adjuvants enhance the effectiveness of immune checkpoint inhibitors (ICIs)?

Adjuvants are used in ICI combination therapies to convert immunologically "cold" tumors into "hot" tumors. By activating innate immune pathways, they increase the infiltration of T-cells into the tumor microenvironment, thereby reversing the primary or acquired resistance often seen with ICI monotherapies.

Which technological innovation is most rapidly gaining traction in the adjuvant delivery segment?

Lipid Nanoparticles (LNPs) and proprietary emulsions represent the fastest-growing delivery technologies. LNPs are critical for protecting and targetedly delivering sensitive payloads, such as nucleic acid adjuvants and mRNA components, specifically to immune cells for maximum activation.

What challenges does the manufacturing of oncology adjuvants present?

Key challenges include maintaining the batch-to-batch consistency and high purity required for regulatory approval, ensuring the long-term stability of complex nanocarrier formulations, and achieving cost-effective scalability from lab-scale synthesis to commercial production under stringent GMP guidelines.

How is AI impacting the clinical development phase of novel adjuvants?

AI impacts the clinical phase by utilizing predictive analytics on patient genomic and immunological data to identify optimized clinical trial cohorts. This stratification maximizes the likelihood of observing clear efficacy signals and accelerates the process of achieving regulatory milestones by reducing heterogeneity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager