Oncology Based Preclinical Cro Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431466 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Oncology Based Preclinical Cro Market Size

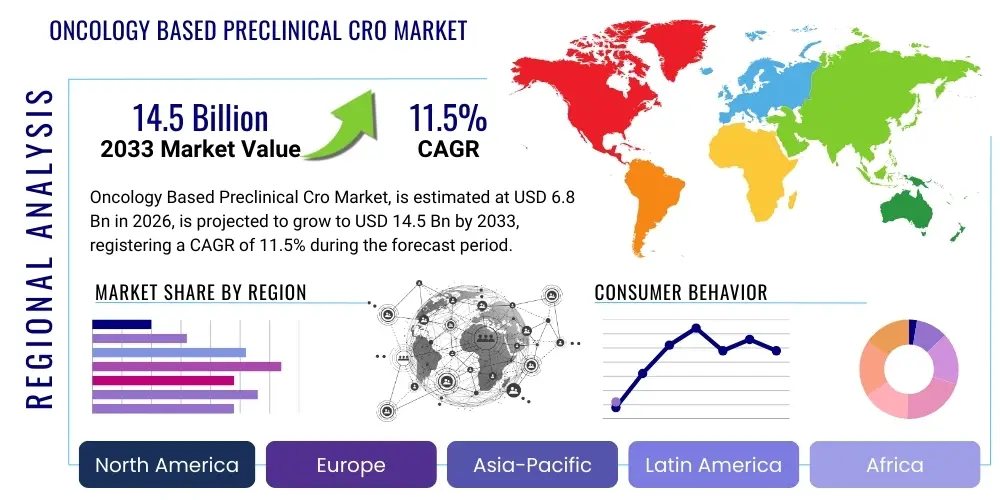

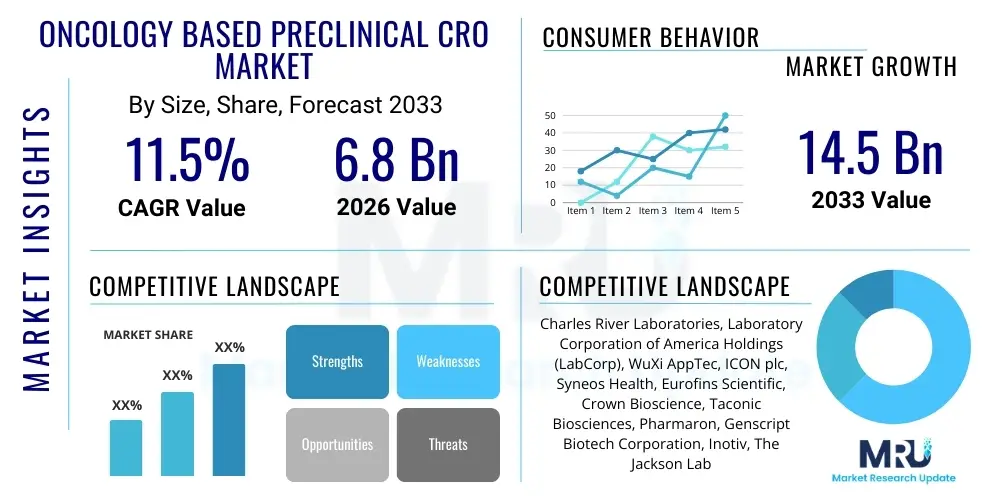

The Oncology Based Preclinical Cro Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2033.

Oncology Based Preclinical Cro Market introduction

The Oncology Based Preclinical Contract Research Organization (CRO) Market encompasses specialized services provided to pharmaceutical, biotechnology, and academic institutions for the early-stage development of novel cancer therapeutics. These services are critical for validating drug targets, assessing the efficacy and safety profiles of drug candidates, and determining optimal dosing regimens before human clinical trials commence. The product description centers around a comprehensive suite of outsourced research activities, including specialized preclinical oncology models, toxicology testing, pharmacokinetics (PK), and pharmacodynamics (PD) studies, tailored specifically for complex cancer biology.

Major applications of these CRO services span the entire spectrum of preclinical cancer research, including the development of small molecules, biologics, cell and gene therapies, and combination treatments. CROs offer expertise in creating and utilizing patient-derived xenograft (PDX) models, cell-derived xenograft (CDX) models, and humanized mouse models, which are essential for accurately predicting clinical outcomes. The primary benefits include accelerated drug development timelines, reduced operational costs for sponsors, access to specialized scientific expertise, and enhanced regulatory compliance, particularly concerning global drug approval standards.

Driving factors for sustained market growth include the escalating global incidence of various cancers, necessitating continuous innovation in therapeutic modalities. Furthermore, the increasing complexity of oncology drug mechanisms, especially in areas like immunotherapy and precision medicine, mandates the specialized infrastructure and highly skilled personnel that CROs provide. Pharmaceutical companies are increasingly adopting outsourcing strategies to focus internal resources on late-stage clinical trials, further solidifying the critical role of oncology-focused preclinical CROs in the modern biopharmaceutical ecosystem.

Oncology Based Preclinical Cro Market Executive Summary

The Oncology Based Preclinical CRO Market is characterized by robust business trends driven by rising R&D expenditures in cancer therapeutics and a strong preference for partnership models that mitigate risk and accelerate time-to-market. Key business trends include aggressive capacity expansion by major CROs, particularly in advanced model development such as organoids and genetically engineered mouse models (GEMMs), and a focus on integrating Artificial Intelligence (AI) tools for high-throughput screening and data analysis, enhancing the predictability of preclinical results. Strategic mergers and acquisitions are frequent, aimed at consolidating specialized niche expertise, particularly in immuno-oncology and cell therapy development, positioning larger entities as integrated solution providers capable of handling complex, multi-modal oncology programs.

Regionally, North America maintains market dominance due to high concentration of major pharmaceutical and biotech firms, significant government and private funding for cancer research, and well-established regulatory frameworks that support rapid innovation. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by lower operational costs, expanding talent pools, and increasing research collaborations between Western sponsors and APAC-based CROs. Europe represents a mature market focusing on high-quality specialized services, particularly in countries with strong academic research bases like the UK and Germany, emphasizing translational research capabilities.

Segmentation trends highlight the increasing demand for In-vivo studies, particularly those involving advanced humanized mouse models, reflecting the industry's drive for better translational relevance. Among therapy areas, Immunotherapy research, including CAR T-cell therapies and checkpoint inhibitors, is the fastest-growing segment, demanding highly specialized preclinical assessment methods. End-user analysis shows that Pharmaceutical and Biotechnology companies remain the largest customer segment, but academic institutions are increasingly outsourcing complex animal studies due to rising internal infrastructure and maintenance costs associated with specialized oncology models.

AI Impact Analysis on Oncology Based Preclinical Cro Market

User inquiries regarding the impact of AI on the Oncology Based Preclinical CRO market primarily revolve around three core themes: the potential for AI to dramatically accelerate target identification, the reliability of AI in predicting drug toxicity and efficacy using preclinical data, and the expected disruption to traditional laboratory roles. Users are keenly interested in how AI, particularly machine learning algorithms, can parse vast genomic, proteomic, and imaging datasets generated during preclinical studies to identify novel biomarkers and stratify tumor models more effectively than conventional bioinformatics. There is an anticipation that AI will enhance the precision of preclinical models, thereby reducing the high attrition rates seen in the transition from preclinical testing to Phase I clinical trials, which is a major concern for drug developers.

Furthermore, stakeholders frequently ask about the integration of AI platforms into existing CRO workflows, questioning the investment required and the readiness of current CRO infrastructure to handle AI-driven data generation and analysis. Concerns often center on data privacy, the validation of proprietary AI models, and the need for standardized data formats across different CRO platforms to enable effective machine learning. The expectation is that early adopters of AI tools, particularly for synthetic data generation and predictive toxicology, will gain a significant competitive edge by offering clients faster, more robust, and less resource-intensive preclinical packages. This shift is redefining the CRO offering from a service provider role to a technology-enabled strategic partner.

- AI accelerates novel oncology target identification and hit-to-lead optimization through high-dimensional data analysis.

- Predictive toxicology models powered by machine learning enhance the safety assessment of drug candidates, reducing late-stage failures.

- Improved efficacy modeling using AI to analyze complex tumor microenvironment interactions and high-content screening data.

- Automation of data processing and reporting streamlines preclinical workflows, drastically improving efficiency and turnaround times.

- Development of digital twins and synthetic preclinical models reduces reliance on lengthy and costly traditional animal studies.

- AI-driven image analysis enhances precision in histology, pathology, and quantitative analysis of tumor regression in xenograft models.

DRO & Impact Forces Of Oncology Based Preclinical Cro Market

The dynamics of the Oncology Based Preclinical CRO Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of key players. The primary Driver is the overwhelming pipeline of oncology drugs currently under development globally, fueled by sustained, high-level investment from major pharmaceutical companies and venture capital firms specifically targeting complex cancer indications. This massive influx of therapeutic candidates, coupled with the inherent difficulties in establishing reliable, translationally relevant cancer models internally, forces drug developers to rely heavily on specialized CROs. Additionally, regulatory demands, such as requirements for specialized toxicology and safety studies for novel modalities like cell and gene therapies, necessitate outsourcing to organizations with certified expertise and infrastructure, providing a foundational push for market expansion.

Conversely, significant Restraints challenge the market's seamless growth. The high cost associated with developing and maintaining advanced preclinical models, particularly patient-derived xenografts (PDX) and humanized immune system models, often limits broader accessibility, especially for smaller biotech firms. Furthermore, the variability and lack of standardization across different CRO platforms concerning model generation and reporting methodologies can lead to data inconsistency, raising concerns about the translational fidelity of preclinical results. Shortages of highly specialized scientific personnel, particularly those proficient in complex immuno-oncology assays and bioinformatics, also pose operational bottlenecks that restrict the scalability of premium CRO services.

Opportunities for growth are abundant, primarily centered on technological advancements and geographic expansion. The increasing adoption of advanced technologies, such as organ-on-a-chip and 3D bioprinting for oncology modeling, presents a lucrative niche for CROs capable of integrating these platforms. Furthermore, strategic expansion into emerging markets, particularly China and India, offers significant opportunities by accessing large, treatment-naïve patient populations for model derivation and providing cost-effective operational bases. The rising demand for specialized CRO partnerships focusing exclusively on niche areas like neoantigen identification and companion diagnostics development within the precision oncology paradigm represents a powerful future growth avenue, driving innovation and differentiation among service providers.

Segmentation Analysis

The Oncology Based Preclinical CRO Market is rigorously segmented based on the type of services offered, the specific models utilized, the therapeutic area being investigated, and the end-user profile. This structured segmentation allows market participants to tailor their offerings to specific client needs and highlights areas of maximal growth potential. The market exhibits significant variation in growth rates across these segments, driven largely by technological maturity and current trends in cancer research funding, particularly the intense focus on developing next-generation immunotherapies that demand specialized in-vivo and bioanalytical support. The increasing outsourcing trend across the entire drug development lifecycle ensures all service segments remain dynamic, though model development services often command higher premium pricing due to intellectual property and specialized infrastructure requirements.

Analysis of the Service Type segment indicates a strong shift towards integrated service offerings, combining early-stage discovery (e.g., target validation) with essential safety assessment and PK/PD studies. This full-service approach is preferred by larger pharmaceutical clients seeking streamlined project management and single-point accountability. Concurrently, the Model Type segment demonstrates the rapid displacement of traditional cell line xenograft models (CDX) by more physiologically relevant models, such as PDX and syngeneic models, which better reflect tumor heterogeneity and immune system interaction. This preference reflects an industry-wide commitment to de-risking clinical failure by improving the translational value of preclinical testing.

Geographically, while established markets in North America and Europe drive revenue through premium, complex projects, the APAC region is rapidly expanding its service capabilities, becoming a critical location for high-volume, cost-competitive early screening and efficacy studies. Understanding these segmentation nuances is vital for CROs planning strategic capacity investments, whether focusing on specialized high-value model development, expanding geographic reach, or vertically integrating technology solutions like AI-powered data analytics into existing service lines to capture market share effectively.

- Service Type:

- In-vitro Studies (e.g., High-Throughput Screening, Cell Proliferation Assays)

- In-vivo Studies (Efficacy Testing, Toxicology Studies, PK/PD)

- Bioanalytical Services and Biomarker Discovery

- Compound Management and Logistics

- Model Type:

- Xenograft Models (Patient-Derived Xenograft (PDX), Cell-Derived Xenograft (CDX))

- Syngeneic Models

- Humanized Mouse Models

- Genetically Engineered Mouse Models (GEMMs)

- Organoid Models

- Therapy Area:

- Chemotherapy and Small Molecules

- Immunotherapy (Checkpoint Inhibitors, Vaccines, CAR T-cells)

- Targeted Therapy

- Radiation Therapy and Combination Modalities

- End-User:

- Pharmaceutical & Biotechnology Companies (Large, Mid-Sized, and Emerging Biotech)

- Academic & Research Institutes

- Region:

- North America (US, Canada)

- Europe (UK, Germany, France, Italy, Spain)

- Asia Pacific (Japan, China, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (South Africa, GCC Countries)

Value Chain Analysis For Oncology Based Preclinical Cro Market

The value chain for the Oncology Based Preclinical CRO Market is highly specialized, beginning with upstream activities focused on the acquisition and preparation of biological materials, model generation, and technology development. Upstream analysis involves rigorous sourcing of quality human and animal tissues, establishing ethical procurement protocols, and developing proprietary or licensed animal models (e.g., highly complex PDX or humanized models). Key upstream suppliers include specialized biobanks, animal vendors providing specific strains (e.g., immunodeficient mice), and technology providers offering advanced instrumentation for genetic sequencing and high-content imaging. Success in the upstream segment hinges on maintaining high ethical standards, achieving rapid model generation timelines, and ensuring the stability and translational relevance of the models used for testing.

The core midstream activity involves the execution of preclinical studies, which constitutes the primary service offering of CROs. This stage encompasses efficacy testing, safety evaluation (toxicology), pharmacokinetic/pharmacodynamic (PK/PD) studies, and sophisticated biomarker analysis, demanding extensive laboratory infrastructure and highly skilled scientific teams. Distribution channels for these services are predominantly direct, characterized by highly technical contract negotiation between the CRO (service provider) and the sponsor (biopharma/academia). Indirect distribution is rare but can occur through CRO aggregators or platforms that connect small biotech companies with specialized service providers, though direct interaction remains the prevailing model due to the customized nature of oncology trials.

Downstream analysis focuses on the final output—data delivery, interpretation, and strategic consultation—which feeds directly into the client's decision-making process for clinical translation. The quality and interpretability of the data packages provided by CROs significantly influence subsequent R&D investment decisions. Clients increasingly seek strategic partnership rather than transactional services, requiring CROs to offer expert consultation on regulatory submission support and advanced translational insights. The value chain is fundamentally driven by trust, quality assurance, and the CRO's ability to seamlessly translate complex preclinical findings into actionable clinical development strategies, thereby accelerating the drug candidate's journey toward market access.

Oncology Based Preclinical Cro Market Potential Customers

The primary customers and end-users of the Oncology Based Preclinical CRO Market are organizations heavily invested in discovering, developing, and commercializing new treatments for cancer. The largest segment comprises Pharmaceutical and Biotechnology Companies, ranging from global Big Pharma giants with extensive, diversified pipelines to small, emerging biotech startups focusing on single, innovative therapeutic candidates. Big Pharma leverages CROs for capacity augmentation, access to specialized resources (like sophisticated PDX libraries), and geographical flexibility, often seeking full-service partnerships to handle large volumes of compound screening and early toxicology work to rapidly progress multiple drug candidates simultaneously.

Emerging biotech companies represent a high-growth customer segment, often lacking the internal infrastructure, animal facilities, and regulatory expertise required for complex preclinical oncology studies. For these smaller entities, outsourcing preclinical research is not just a strategic choice but a fundamental operational necessity to conserve capital and accelerate development milestones critical for securing subsequent funding rounds. Their buying criteria heavily emphasize the CRO's expertise in niche therapeutic modalities, such as gene editing or novel immunotherapy platforms, and robust project management capabilities that ensure adherence to strict development timelines.

Academic and Research Institutes form the third major customer group. While traditionally performing preclinical work in-house, universities and government-funded labs are increasingly outsourcing complex animal studies due to the escalating costs and regulatory burdens of maintaining vivarium facilities, especially those requiring specialized humanized mouse models. These clients typically seek highly specialized, protocol-specific services focused on mechanism-of-action studies, target validation, and efficacy proof-of-concept, valuing scientific collaborative support and the rapid implementation of cutting-edge preclinical technology offered by expert CRO partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles River Laboratories, Laboratory Corporation of America Holdings (LabCorp), WuXi AppTec, ICON plc, Syneos Health, Eurofins Scientific, Crown Bioscience, Taconic Biosciences, Pharmaron, Genscript Biotech Corporation, Inotiv, The Jackson Laboratory, Envigo, Vivo Biosciences, PreClinics Research. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oncology Based Preclinical Cro Market Key Technology Landscape

The technology landscape within the Oncology Based Preclinical CRO Market is rapidly evolving, moving beyond standard cell culture and basic xenograft studies toward sophisticated, high-content, and translationally predictive platforms. A cornerstone technology is the widespread adoption and continuous refinement of Patient-Derived Xenograft (PDX) Models, which are recognized for better recapitulating the genetic heterogeneity and physiological behavior of human tumors compared to traditional cell lines. CROs are investing heavily in establishing extensive, genetically characterized PDX libraries, linked with clinical patient data, making them crucial assets for personalized medicine approaches and assessing drug response in a diverse patient population subset.

Another pivotal area involves the development and utilization of Humanized Immune System (HIS) Mouse Models. As immunotherapy treatments (such as checkpoint inhibitors and CAR T-cells) dominate the oncology pipeline, models that possess functional human immune components are essential for accurately assessing efficacy, mechanism of action, and potential immune-related toxicities. This requires advanced genetic engineering techniques and specialized breeding programs. Furthermore, high-throughput technologies, including High-Content Screening (HCS) and Advanced Imaging Systems (e.g., PET, MRI, Bioluminescence Imaging), are critical for non-invasive monitoring of tumor growth and drug effects in vivo, generating massive amounts of actionable data that enhance the statistical power and translational value of the preclinical studies.

The future technology trajectory is defined by 3D Culture Systems (Organoids and Spheroids) and the integration of Artificial Intelligence (AI) and Machine Learning (ML) for data interpretation. Organoids offer an in-vitro model with improved tissue architecture and cell-to-cell communication fidelity compared to 2D cultures, providing a rapid, high-throughput screening alternative before moving to costly in-vivo studies. AI/ML platforms are increasingly applied to analyze complex multimodal data—linking genomic data from PDX models, efficacy data from imaging, and toxicity data—to predict clinical outcomes, optimize trial design, and ultimately de-risk the costly clinical phases of oncology drug development.

Regional Highlights

North America: Market Dominance and Innovation Hub

North America, particularly the United States, commands the largest share of the Oncology Based Preclinical CRO Market. This dominance is attributable to several factors, including the presence of the world's largest biopharmaceutical companies, exceptionally high levels of R&D investment in oncology, and robust governmental funding channeled through institutions like the National Cancer Institute (NCI). The region benefits from a highly developed scientific infrastructure, stringent intellectual property protection, and an advanced regulatory environment that encourages fast-paced technological adoption, especially in complex areas such as cell and gene therapy preclinical validation. CROs in North America often serve as strategic partners, integrating advanced technologies like humanized mice and sophisticated bioanalytical services, setting the global benchmark for quality and translational research.

The competitive environment in North America is highly dynamic, characterized by fierce competition among global CRO giants and specialized boutique oncology service providers. Innovation in the region centers on developing personalized oncology models, focusing heavily on linking preclinical data with patient-specific genomic information. High operational costs are offset by the premium pricing capabilities and the demand for rapid, high-quality data generation. This region is critical for market players looking to validate cutting-edge therapeutics under the most rigorous scientific standards before expanding internationally.

Europe: Specialized Expertise and Academic Integration

Europe represents a mature and critically important market, distinguished by a strong network of specialized academic research institutions and focused biotechnology clusters, particularly in the UK, Germany, and Switzerland. European CROs are renowned for their expertise in specific areas, such as toxicology, safety pharmacology, and advanced drug metabolism and pharmacokinetics (DMPK) studies, often required for navigating the centralized regulatory processes of the European Medicines Agency (EMA). Collaboration between CROs and academic centers is a defining feature, facilitating the rapid commercialization of novel basic science findings into preclinical service offerings, especially concerning novel biomarkers and specialized disease models.

While facing slightly slower overall R&D investment growth compared to North America, Europe maintains stability through robust public funding for translational cancer research and a focus on high-quality contract manufacturing and research services. The market landscape is fragmented, featuring a mix of large global CRO operations and highly specialized, regional providers that cater to niche requirements, particularly in complex areas like oncological surgical models or rare cancer indications. Emphasis is placed on standardized, compliant procedures and detailed data reporting to satisfy demanding European biopharma clients.

Asia Pacific (APAC): Rapid Growth and Cost Efficiency

The Asia Pacific region is the fastest-growing geographical segment in the Oncology Based Preclinical CRO Market. This accelerated growth is primarily driven by significant cost advantages in operational expenditure and labor, which attract increasing outsourcing volumes from Western pharmaceutical and biotechnology companies looking to optimize R&D budgets. Major economies, including China, Japan, and India, are fueling this expansion through government initiatives aimed at strengthening domestic biotechnology capabilities and actively recruiting global R&D activities.

China, in particular, has emerged as a powerhouse, with major domestic CROs rapidly expanding their capacity and expertise, often specializing in high-volume compound screening and efficacy testing using large animal colonies. Japan remains a key market focused on high-quality, specialized oncology research, though operating at a higher cost structure than mainland China or India. The key strategic appeal of APAC is its vast, genetically diverse patient populations, providing essential access to biological materials critical for developing diverse PDX models and facilitating rapid recruitment for specialized preclinical studies required for global market entry.

Latin America (LATAM) and Middle East & Africa (MEA): Emerging Opportunities

The LATAM and MEA regions currently hold smaller market shares but present emerging opportunities, primarily due to expanding healthcare infrastructure and increasing government focus on reducing cancer mortality rates. In Latin America, countries like Brazil and Mexico are seeing moderate growth, driven by regional pharmaceutical manufacturers and an increasing number of international organizations establishing local R&D hubs to serve regional markets. Growth is often constrained by regulatory variability and lower levels of indigenous R&D funding compared to developed markets.

The Middle East (e.g., UAE, Saudi Arabia) is investing significantly in diversifying its economies, leading to substantial governmental and private sector investments in biomedical research parks and translational science centers. This foundational investment aims to establish local preclinical research capabilities, reducing reliance on Western outsourcing for early-stage development. While oncology focused CROs often enter these regions through strategic partnerships, the market demand is gradually strengthening, particularly for basic safety and efficacy studies required before initiating local clinical trials, signaling future expansion potential.

- North America (US, Canada): Dominant market share; driven by Big Pharma R&D spend and advanced model usage (PDX, Humanized Mice).

- Europe (UK, Germany, France): Mature market focusing on high-quality toxicology and specialized biomarker analysis; strong academic integration.

- Asia Pacific (China, Japan, India): Fastest growth rate; driven by cost-efficiency, increasing government support for biotech, and large patient pools for model development.

- Latin America (Brazil, Mexico): Emerging growth characterized by local pharmaceutical development needs and increasing regional R&D investment.

- Middle East and Africa (MEA): Nascent market undergoing foundational investment in biomedical infrastructure, focusing initially on local validation studies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oncology Based Preclinical Cro Market.- Charles River Laboratories

- Laboratory Corporation of America Holdings (LabCorp)

- WuXi AppTec

- ICON plc

- Syneos Health

- Eurofins Scientific

- Crown Bioscience (A JSR Life Sciences Company)

- Taconic Biosciences

- Pharmaron

- Genscript Biotech Corporation

- Inotiv

- The Jackson Laboratory (JAX)

- Envigo

- Vivo Biosciences

- PreClinics Research

- Absorption Systems (A Pharmaron Company)

- Celerion

- Covance (now part of LabCorp)

- MD Biosciences

- BellBrook Labs

Frequently Asked Questions

Analyze common user questions about the Oncology Based Preclinical Cro market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Oncology Preclinical CRO Market?

The main driver is the increasing complexity of the oncology drug pipeline, particularly in immuno-oncology and cell therapies, necessitating highly specialized, high-fidelity preclinical models (like PDX and humanized mice) that most sponsors prefer to outsource.

How are CROs ensuring better translational relevance in preclinical oncology studies?

CROs are improving translational relevance by moving away from traditional models to advanced platforms such as Patient-Derived Xenografts (PDX), genetically engineered models (GEMMs), and integrating sophisticated biomarker analyses and AI-driven predictive modeling.

Which geographical region exhibits the fastest growth rate for preclinical oncology CRO services?

The Asia Pacific (APAC) region, specifically China and India, is projected to exhibit the fastest growth, driven by lower operational costs, expanding regulatory harmonization, and increased R&D investment within the region.

What role does Artificial Intelligence play in modern preclinical oncology research?

AI is increasingly utilized for target validation, rapid data interpretation, enhancing predictive toxicology, and analyzing complex multimodal data sets to de-risk clinical trials and accelerate the identification of promising drug candidates.

What are the key service segment trends in the Oncology Preclinical CRO market?

The market is shifting towards integrated service bundles, with particularly high demand for specialized In-vivo studies utilizing humanized models and advanced bioanalytical services focused on complex immunotherapeutic compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager