One Time Password (OTP) Display Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437900 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

One Time Password (OTP) Display Card Market Size

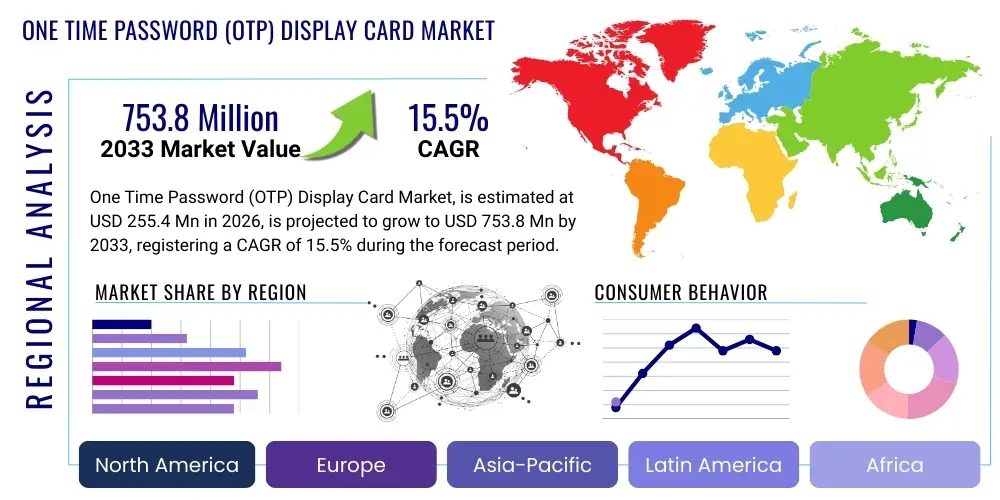

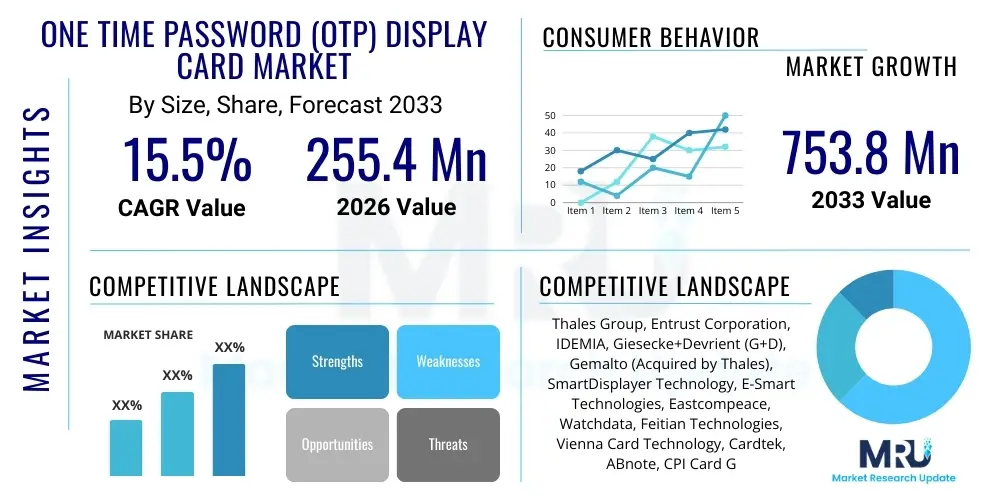

The One Time Password (OTP) Display Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $255.4 Million in 2026 and is projected to reach $753.8 Million by the end of the forecast period in 2033.

One Time Password (OTP) Display Card Market introduction

The One Time Password (OTP) Display Card Market encompasses specialized hardware devices, typically standardized in the size and shape of a traditional credit card, designed to generate a unique, temporary password for secure authentication. These cards feature an embedded micro-display, often LCD or E-Ink, and a small battery, allowing users to generate a verifiable, time-synchronized six-to-eight digit code upon demand. This technology serves as a crucial component of multi-factor authentication (MFA) systems, significantly enhancing security over SMS-based OTPs, which are vulnerable to interception via SIM swap attacks or malware.

The core product within this market is the physical display card, which integrates secure element technology to run cryptographic algorithms, typically based on the Time-based One-Time Password (TOTP) or HMAC-based One-Time Password (HOTP) standards. Major applications are predominantly found in the financial services sector, where stringent regulatory compliance and high-value transactions necessitate robust security measures. Beyond banking, adoption is growing rapidly in large enterprises, government organizations requiring secure access to sensitive networks, and emerging fields like cryptocurrency exchange security and high-assurance identity verification services. The benefit these cards offer is the combination of high security with user convenience and hardware reliability, eliminating reliance on mobile network coverage or vulnerable software tokens.

Driving factors for market expansion include the escalating global threat of cyberattacks targeting digital identities and financial assets, increasing governmental mandates for strong customer authentication (SCA) in regions like Europe, and the consumer shift toward digital banking and e-commerce. Furthermore, the inherent vulnerabilities of traditional authentication methods, such as static passwords and SMS OTPs, are pushing institutions to invest in dedicated, tamper-resistant hardware solutions, thereby propelling the demand for OTP display cards globally. Continuous advancements in battery longevity and card form factor are making these devices more practical for widespread deployment.

One Time Password (OTP) Display Card Market Executive Summary

The One Time Password (OTP) Display Card Market is currently characterized by robust growth, fueled primarily by sustained investment in digital security infrastructure across major economies. Business trends indicate a strong move by financial institutions and large corporate entities away from less secure software-based or SMS-based authentication methods towards dedicated hardware tokens. Key players are focusing intensely on miniaturization, enhancing the lifespan of embedded batteries, and integrating additional functionalities, such as EMV chip compatibility and secure transaction signing capabilities, positioning the display card as a multi-utility security asset rather than a single-function device. Furthermore, strategic partnerships between card manufacturers and core banking software providers are streamlining deployment processes, making the migration to hardware OTP solutions more accessible for smaller institutions.

Regional trends show Asia Pacific (APAC) emerging as a powerhouse of adoption, driven by rapid digitalization, high population density leveraging mobile and online banking services, and supportive government initiatives focusing on cybersecurity readiness, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while established markets, maintain steady growth due to rigorous adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, coupled with the need to protect against sophisticated state-sponsored cyber threats. Market consolidation is also a noticeable trend, with larger security solution providers acquiring niche card technology specialists to integrate comprehensive authentication suites.

Segment trends highlight the dominance of the banking, financial services, and insurance (BFSI) sector in terms of revenue generation. Within the BFSI segment, the demand for cards featuring embedded transaction authorization codes (TAC) functionality is growing rapidly, providing an extra layer of security where the user verifies the transaction details (e.g., recipient and amount) directly on the card display before generating the OTP. Concurrently, the government and defense segments are showing accelerating demand for high-security access control and identity management applications, often favoring customized, highly ruggedized OTP display cards. Technology-wise, time-synchronous OTP (TOTP) cards maintain the largest share, although hybrid authentication systems are gaining traction.

AI Impact Analysis on One Time Password (OTP) Display Card Market

User queries regarding the impact of Artificial Intelligence (AI) on the OTP Display Card Market often center on two primary themes: whether AI-driven behavioral biometrics or adaptive authentication systems will render physical hardware obsolete, and conversely, how AI can enhance the issuance and deployment security of these cards. Concerns frequently revolve around AI's ability to detect anomalous behavior patterns in real-time, theoretically mitigating the risk even if an OTP is compromised, leading some users to question the sustained necessity of dedicated physical tokens. However, the prevailing expert opinion is that AI primarily acts as a complementary layer, strengthening the overall MFA architecture by analyzing the context of the login attempt (location, device ID, typical access time) and requesting an OTP only when suspicious activity is flagged. This integration moves authentication from a reactive measure to a proactive, risk-adaptive process.

Conversely, AI is proving invaluable in the manufacturing and deployment phase, specifically through predictive maintenance for card components and optimizing logistical security. AI algorithms are used to analyze the performance lifespan of embedded batteries and display units, predicting failure points and informing manufacturers on design improvements. Moreover, in fraud detection systems used by banks, AI acts as the first line of defense, determining the risk score of a transaction before prompting the user for the hardware OTP. High-risk transactions trigger the use of the physical display card, while low-risk transactions might proceed with simpler authentication, thereby optimizing security resource allocation and improving user experience.

The net impact of AI is transformation rather than displacement. AI-powered authentication engines decide *when* and *if* the physical OTP card is needed, ensuring that the hardware is reserved for the highest-risk scenarios, thereby maximizing its protective value. This adaptive approach ensures that the OTP display card remains a critical, tamper-proof root of trust for high-value operations where the device itself must be isolated from the general computing environment, which is constantly exposed to software threats, phishing, and remote access Trojans (RATs). AI validates the environment; the OTP card validates the identity.

- AI drives adaptive authentication engines, reducing reliance on OTP cards for low-risk transactions.

- Predictive analytics powered by AI optimize battery life and manufacturing processes for display cards.

- AI enhances fraud detection upstream, ensuring OTP cards are deployed for high-value or high-risk activity.

- Behavioral biometrics, facilitated by AI, act as a supplementary factor alongside the physical OTP card.

- AI aids in real-time analysis of authentication attempts, identifying credential stuffing attacks targeting OTP generation systems.

DRO & Impact Forces Of One Time Password (OTP) Display Card Market

The dynamics of the OTP Display Card Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces determining market trajectory. Key drivers include the exponential increase in sophisticated cyber threats, specifically phishing attacks aimed at obtaining software tokens or SMS OTPs, which highlights the superior security provided by hardware isolation. Furthermore, stringent global regulatory requirements, such as the Payment Services Directive (PSD2) in Europe and similar mandates worldwide emphasizing Strong Customer Authentication (SCA), compel financial institutions to adopt certified, tamper-resistant hardware solutions. However, these positive influences are counterbalanced by significant restraints, primarily the high initial manufacturing cost associated with integrating micro-displays, batteries, and secure chips into a slim card form factor, making large-scale deployment expensive compared to free mobile applications. Moreover, the finite lifespan of the embedded battery and the environmental challenge of hardware disposal present logistical and sustainability concerns for mass adopters.

Opportunities for growth are concentrated in emerging geographical markets where digitalization is accelerating rapidly but security infrastructure remains immature, particularly across Latin America and parts of APAC. Furthermore, technological opportunities exist in expanding the card's utility beyond simple OTP generation to include secure transaction signing (what-you-see-is-what-you-sign) and integration into physical access control systems, turning the card into a multi-purpose identity token. The ongoing technological battle against mobile-based security solutions, such as biometric MFA and FIDO tokens, represents the primary competitive impact force, requiring continuous innovation in hardware security and cost reduction to maintain market viability. The impact forces dictate that sustained innovation in battery technology and production efficiency is mandatory for OTP display cards to remain a competitive and scalable authentication solution in the long term.

Ultimately, the impact forces create a polarized environment: high security demand pushes adoption, but high implementation cost and evolving software alternatives restrain maximum penetration. The market finds equilibrium through niche application in high-assurance environments (BFSI, Government) where the cost of a security breach far outweighs the cost of the hardware. The regulatory environment acts as a stable, positive force, mandating the baseline for security that these cards often meet or exceed. Manufacturers must therefore focus on communicating Total Cost of Ownership (TCO) benefits, emphasizing reduced fraud losses and regulatory fines, rather than just initial purchase price, to overcome the restraint of manufacturing expense.

Segmentation Analysis

The One Time Password (OTP) Display Card Market is comprehensively segmented based on technology, end-user industry, and geographical region, reflecting the diverse applications and security requirements globally. The technology segmentation differentiates solutions based on how the unique code is generated and synchronized, primarily into time-based and event-based methods. Segmentation by end-user provides clarity on the primary consumer base, with the BFSI sector leading due to its acute need for fraud mitigation in online banking and trading. Other rapidly expanding segments include government services, particularly defense and social security agencies, and large-scale enterprises seeking internal access control.

Further analysis of the segmentation reveals critical trends, such as the increasing popularity of hybrid cards that combine OTP functionality with standard EMV chip features for dual-use (physical payment and online security). The market structure reflects a tendency toward customization, especially in the government sector, where cards often require specialized encryption algorithms and integration with legacy authentication frameworks. Understanding these segments is vital for vendors to tailor their products, whether focusing on high-volume, cost-effective TOTP cards for mass banking deployment or specialized, highly secure event-based solutions for critical infrastructure protection.

Regional segmentation is crucial, identifying disparities in adoption rates and regulatory compliance. North America and Europe demand high-standard compliance solutions, driving the TOTP segment, while APAC's growth is often driven by mass deployment and cost-efficiency considerations. The overall segmentation structure underscores the market's maturity, moving beyond a single product offering to provide tailored security instruments designed for specific risk profiles and regulatory landscapes, ensuring maximum efficacy and adherence across different sectors and regions.

- By Technology

- Time-based One Time Password (TOTP)

- Event-based One Time Password (HOTP)

- Hybrid Solutions (Combining TOTP/HOTP with physical transaction signing)

- By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Healthcare

- Information Technology and Telecommunication

- E-commerce and Retail

- Others (Utilities, Education)

- By Application

- Online Banking Authentication

- Remote Access Security

- Transaction Verification/Signing

- Physical Access Control (Integrated)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For One Time Password (OTP) Display Card Market

The value chain for the OTP Display Card Market begins in the upstream segment, dominated by specialized component manufacturers responsible for crucial hardware inputs. This includes semiconductor firms providing the secure element chips and microprocessors necessary for cryptographic operations, battery suppliers focusing on thin, flexible, long-life power cells, and display technology providers (LCD/E-Ink). The quality and security certification of these upstream components are paramount, as the card's overall integrity hinges on the secure element. Upstream analysis also involves highly specialized material science firms that produce the flexible PCB substrates and robust card materials capable of withstanding physical stress while housing sensitive electronics, highlighting a high barrier to entry at this foundational level.

The midstream segment involves the core manufacturing, personalization, and software integration processes. Card manufacturers take the raw components and assemble the final product, embedding the display, battery, and secure chip within the plastic card body. Crucially, this stage includes the proprietary software integration and cryptographic key injection, which must be performed in highly secured, certified facilities (often meeting strict ISO standards) to prevent tampering. Distribution channels are varied: direct sales are common for large government or Tier 1 bank contracts where customization is high, while indirect channels utilize specialized security distributors and system integrators who bundle OTP cards with broader security solutions, such as access management platforms and VPNs, reaching smaller enterprises globally.

The downstream analysis focuses on the deployment and end-user support phases. Once manufactured, cards are distributed to end-user organizations (e.g., banks), which then manage the logistics of personalization, activation, and issuance to their customers or employees. Direct channels involve manufacturers delivering finished, personalized cards directly to the client bank's issuance center. Indirect channels often involve third-party personalization bureaus or large-scale identity service providers who manage the end-to-end lifecycle, including replacement and disposal services. The market relies heavily on this downstream support ecosystem to manage the large volume of cards and address customer concerns regarding battery life and synchronization errors, ensuring high customer satisfaction and maintaining the perceived reliability of the security token.

One Time Password (OTP) Display Card Market Potential Customers

The primary end-users and buyers of OTP Display Card products are organizations requiring the highest level of assurance for digital identity verification and transaction integrity, prioritizing security over pure cost efficiency. Historically, the largest consumer base has been the Banking, Financial Services, and Insurance (BFSI) sector, encompassing commercial banks, investment firms, wealth management agencies, and online brokerages. These entities use OTP cards extensively for securing remote access to core banking systems, authorizing high-value wire transfers, and complying with global strong authentication mandates. Their need is driven by the significant financial risk associated with fraud and regulatory penalties, making the hardware security of OTP cards an essential investment.

A second major category of potential customers includes large Government agencies, particularly those involved in National Defense, Intelligence, and sensitive infrastructure management. These entities require tokens that are not reliant on public telecommunications networks (unlike SMS OTPs) and are certified for use in highly controlled environments. Government use cases range from securing classified network access for remote workers to authenticating the identity of citizens accessing critical services, where the physical token serves as undeniable proof of possession and identity. This sector often demands cards with enhanced physical durability and customized encryption protocols.

Finally, the Enterprise segment, including large multinational corporations in technology, manufacturing, and healthcare, represents a growing customer base. These companies utilize OTP cards to secure corporate VPN access, protect intellectual property housed on internal servers, and comply with data privacy regulations (like HIPAA or GDPR). For these enterprises, the target buyer is the Chief Information Security Officer (CISO), who seeks to minimize attack surface risks and provide seamless, yet highly secure, authentication methods to both in-house employees and external contractors accessing corporate resources remotely. The decision is often driven by integration capabilities with existing identity management infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $255.4 Million |

| Market Forecast in 2033 | $753.8 Million |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thales Group, Entrust Corporation, IDEMIA, Giesecke+Devrient (G+D), Gemalto (Acquired by Thales), SmartDisplayer Technology, E-Smart Technologies, Eastcompeace, Watchdata, Feitian Technologies, Vienna Card Technology, Cardtek, ABnote, CPI Card Group, Kona I, Yubico, AuthenTrend, Next Biometrics, Oberthur Technologies (now part of IDEMIA) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

One Time Password (OTP) Display Card Market Key Technology Landscape

The technological landscape of the OTP Display Card Market is defined by the critical need to embed complex computational and display capabilities within a constrained, highly durable form factor. Key innovations center around secure element technology, which acts as the tamper-proof vault housing the cryptographic keys and algorithms. These secure elements (eSEs) must meet rigorous certification standards, such as Common Criteria, ensuring that the card is resistant to physical and logical attacks. The efficiency and processing speed of these chips are paramount for generating time-sensitive OTPs without user delay. Furthermore, the core cryptographic algorithms, typically based on industry standards like RFC 6238 (TOTP) or proprietary algorithms tailored for enhanced security, dictate the card's security level and synchronization stability across various environments.

Another dominant technological focus is on power management and display innovation. Given that these cards must operate for several years without recharging or battery replacement, manufacturers employ ultra-low-power microprocessors and sophisticated energy harvesting techniques, often involving highly efficient, thin-film batteries designed for low current draw. The display technology itself is crucial; while segment LCDs are common for simplicity and low cost, high-end cards increasingly utilize E-Ink or flexible OLED displays. E-Ink displays offer superior power efficiency and better contrast, enhancing user readability, which is especially important in high-assurance applications where verification errors must be minimized. Integrating these technologies necessitates advancements in flexible PCB manufacturing, allowing components to be layered and interconnected within the card's minimal thickness.

Beyond the core components, integration technology, specifically the seamless merger of OTP functionality with standard payment features, is gaining importance. Many advanced cards are now incorporating EMV contact or contactless chips, transforming the security token into a dual-purpose payment and authentication device. This integration requires sophisticated software stacks to manage the separate yet interconnected functions securely, often necessitating advanced transaction signing protocols (WYS-WYG, What You See Is What You Get) where the OTP calculation incorporates transaction data displayed on the card screen. The maturity of the technology landscape is characterized by a push for higher integration density, improved durability, and standardized APIs for easier deployment within banking security ecosystems.

Regional Highlights

- North America

North America, particularly the United States and Canada, represents a mature, high-value market driven by large enterprise demand, stringent corporate governance, and a high concentration of sophisticated financial institutions. The region focuses heavily on adopting high-assurance OTP solutions for securing corporate intellectual property (IP) and critical infrastructure access. Although mobile authentication methods are prevalent, OTP display cards maintain a significant presence in sectors where regulatory bodies mandate hardware tokens or where internal corporate policies prohibit employees from using personal devices for critical business functions. The demand here is less volume-driven and more quality- and integration-driven, focusing on seamless incorporation with existing identity and access management (IAM) platforms.

Market dynamics in North America are influenced by the necessity for compliance with various federal and state-level cybersecurity frameworks. Financial service providers are continually upgrading their security protocols to combat rising account takeover fraud, ensuring a steady replacement cycle for older authentication tokens. Key players focus on providing cards with extended features, such as integrated biometrics or transaction-specific signing capabilities, catering to the sophisticated security requirements of the region's top-tier banks and government contractors. Competition is intense, often focusing on advanced cryptographic standards and robust supply chain security.

The high average value of transactions and the severe reputational damage associated with security breaches compel institutions to favor the physical security guarantees offered by dedicated display cards over software alternatives. Furthermore, the region is a leader in technology adoption, often being the first to pilot and deploy cards featuring next-generation capabilities like flexible displays and improved power management. The U.S. government remains a substantial customer, utilizing these tokens for high-security PIV (Personal Identity Verification) credentials and secure remote access for personnel.

- Europe

Europe stands out as a highly regulated market segment, primarily propelled by the implementation of the revised Payment Services Directive (PSD2), which enforces Strong Customer Authentication (SCA) for electronic payments. This regulatory environment has created a mandatory baseline demand for secure, multi-factor authentication devices, which OTP display cards fulfill effectively. The market is characterized by high adoption rates in countries like France, Germany, and the UK, where banks have had to overhaul their authentication processes rapidly to meet compliance deadlines. European banks often favor solutions that can be dual-purpose: functioning as both a standard payment card (EMV) and a secure online authentication token.

The European market is competitive, with a strong presence of local and international card manufacturers who often partner closely with large regional banking groups. Key drivers include minimizing transaction abandonment rates, which can sometimes occur with cumbersome authentication processes, meaning there is a strong push for user-friendly, reliable hardware. The emphasis is on highly certified security solutions that provide auditable proof of transaction verification, which transaction signing cards offer. While mobile tokens are also utilized, the display card remains essential for clients who may not use smartphones or who require the highest level of security isolation from mobile device operating system vulnerabilities.

Concerns over data sovereignty and regional certification standards (like eIDAS) are significant forces shaping product development. Manufacturers must ensure their cryptographic key injection and personalization facilities meet strict EU-specific security requirements. Furthermore, Europe is actively engaged in reducing environmental impact, meaning sustainable manufacturing processes and lifecycle management of these electronic cards are becoming increasingly important competitive differentiators, influencing purchasing decisions by environmentally conscious institutions.

- Asia Pacific (APAC)

The Asia Pacific region is the fastest-growing market segment, characterized by massive volume potential, rapid digital transformation, and surging mobile internet penetration across emerging economies. Countries such as China, India, and Indonesia are witnessing explosive growth in online banking and mobile payments, simultaneously leading to increased vulnerability to cyber fraud. The demand in APAC is often price-sensitive but high-volume, necessitating cost-effective and highly scalable OTP display card solutions. Government initiatives to promote digital identity and financial inclusion also drive significant card issuance, particularly for accessing social benefits and establishing secure digital financial footprints.

Market growth is highly driven by the sheer scale of banking customers moving from traditional branch-based services to online platforms. Many banks in this region leverage OTP display cards as a standardized, reliable method for providing high-level security to a vast, heterogeneous customer base that may use a variety of mobile devices or lack consistent internet connectivity for receiving SMS OTPs reliably. The challenge in APAC lies in logistics, distribution across wide geographical areas, and managing the total cost of ownership for deployments in the tens of millions.

Technologically, APAC sees a mix of basic TOTP cards for mass market security and advanced transaction signing cards for high-net-worth clients and corporate treasuries. Manufacturers focusing on this region must prioritize robust manufacturing capacity, efficient supply chain management, and often, partnership with local mobile operators and financial technology firms to effectively penetrate diverse national markets. Regulatory oversight is tightening across major economies in APAC, creating a sustainable foundation for long-term growth in hardware authentication solutions.

- Latin America, Middle East, and Africa (MEA)

LATAM, MEA represent emerging markets with high potential, driven by accelerating urbanization, improving financial infrastructure, and a relatively high incidence of financial fraud, particularly in Latin America. In these regions, OTP display cards are viewed as a necessary security measure to build customer trust in nascent digital banking platforms. The market penetration is currently lower than in developed regions, but the growth rate is robust, particularly in financial hubs like Brazil, UAE, and South Africa.

In the Middle East, high-security standards in the banking sector and increasing government investment in smart infrastructure are primary drivers. UAE and Saudi Arabia are investing heavily in technologies that enhance secure access to government services, often deploying hardware tokens for employees and citizens accessing sensitive portals. The demand here often focuses on quality and integration with national identity schemes.

In LATAM and Africa, the challenge of inconsistent or unreliable mobile network coverage makes hardware OTP cards an attractive alternative to SMS OTPs. Cards provide a network-independent authentication mechanism, crucial for maintaining security in geographically dispersed areas. The key opportunity lies in partnering with regional banks and microfinance institutions targeting populations newly entering the digital economy, focusing on basic, durable, and highly reliable TOTP solutions to counter prevalent online phishing attempts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the One Time Password (OTP) Display Card Market.- Thales Group

- Entrust Corporation

- IDEMIA

- Giesecke+Devrient (G+D)

- SmartDisplayer Technology

- E-Smart Technologies

- Eastcompeace

- Watchdata

- Feitian Technologies

- Vienna Card Technology

- Cardtek

- ABnote

- CPI Card Group

- Kona I

- Yubico

- AuthenTrend

- Next Biometrics

- Oberthur Technologies (now part of IDEMIA)

- HID Global

- Valid S.A.

Frequently Asked Questions

Analyze common user questions about the One Time Password (OTP) Display Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary security advantage of OTP display cards over mobile SMS OTPs?

The primary advantage is hardware isolation; the OTP card is physically separated from malware-prone devices and mobile network vulnerabilities like SIM swap attacks. The card generates the code internally, making it tamper-resistant and immune to interception methods used against software-based authentication.

How long do OTP display card batteries typically last?

OTP display cards are designed with ultra-low-power components, and their batteries are typically engineered to last between three to seven years, depending on usage frequency and card model. Advanced models use thin-film battery technology to achieve maximum longevity without external charging.

Are OTP display cards expensive to deploy for large customer bases?

While the initial unit manufacturing cost for an OTP display card is significantly higher than using free mobile authentication apps, the Total Cost of Ownership (TCO) is often justified by the substantial reduction in fraud losses, improved regulatory compliance, and avoidance of high fines, making them cost-effective for high-risk applications like banking.

What is the difference between TOTP and HOTP cards?

TOTP (Time-based One-Time Password) cards generate codes synchronized by time, requiring accurate internal clocks. HOTP (HMAC-based One-Time Password) cards generate codes based on an event counter, advancing the counter only after successful use. TOTP is more common for general banking, while HOTP is sometimes used in specific enterprise scenarios.

How is AI influencing the future demand for hardware OTP solutions?

AI is driving Adaptive Authentication, where physical OTP cards are reserved specifically for high-risk transactions detected by AI engines. This integration ensures that the hardware token remains a vital, high-assurance security layer, optimizing its use rather than replacing it entirely, sustaining long-term demand.

Which industry segment is the largest consumer of OTP display cards globally?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest consumer globally. This is driven by strict regulatory mandates for Strong Customer Authentication (SCA), the need to secure high-value transactions, and the constant threat of financial cyber fraud targeting customer accounts.

What role do secure elements play in OTP display card technology?

The secure element (eSE) is a tamper-proof microcontroller chip embedded in the card that securely stores the cryptographic keys and executes the OTP generation algorithm. It is critical for ensuring the integrity and confidentiality of the secret key, making the card resilient against physical and logical attacks.

What are "transaction signing" features in advanced OTP cards?

Transaction signing involves the card displaying sensitive transaction details (like amount and recipient) and incorporating those details into the OTP calculation. The generated code verifies both the user's identity and the integrity of the transaction data, preventing man-in-the-middle manipulation of funds transfers.

How do regional regulations, like PSD2 in Europe, impact market growth?

Regulations like PSD2 mandate the use of strong, multi-factor authentication methods for electronic payments. This regulatory pressure forces financial institutions to adopt certified hardware solutions like OTP display cards, thus serving as a major, stable driver of market growth, especially in compliant regions.

What challenges do manufacturers face regarding the environmental impact of these cards?

Manufacturers face challenges related to the finite lifespan and eventual disposal of embedded batteries and electronic components. This necessitates a focus on designing cards for longer life, implementing sustainable manufacturing practices, and developing clear end-of-life recycling and disposal programs to address environmental concerns.

Why is the Asia Pacific region projected to be the fastest-growing market?

APAC's rapid growth is due to aggressive digitalization, massive population adoption of online banking services, large-scale financial inclusion initiatives, and the need for scalable, reliable security solutions in high-volume, often network-inconsistent environments.

How do OTP cards integrate with existing Identity and Access Management (IAM) systems?

OTP cards typically integrate via standardized protocols such as RADIUS, SAML, or proprietary vendor APIs. This allows enterprises to deploy the cards as hardware tokens within their existing single sign-on (SSO) and VPN infrastructure, requiring minimal overhaul of core network security systems.

What technological advancements are extending the battery life of these cards?

Battery life is extended through the use of ultra-low-power microprocessors, highly efficient thin-film flexible batteries, and optimized energy management firmware that minimizes current draw, ensuring the card remains functional for its expected deployment cycle without user intervention.

Are there flexible or biometric OTP display cards available?

Yes, the market is seeing increased innovation, including flexible display cards built on bendable substrates and cards integrating small fingerprint sensors (biometric cards). Biometrics add a third factor (something you are) to the existing two factors (something you have and something you know), enhancing security considerably.

What is the role of E-Ink displays compared to traditional LCDs in these cards?

E-Ink displays consume significantly less power than traditional LCDs, requiring power only when the display content is changed. This contributes to longer battery life and better readability in various lighting conditions, making them preferable for premium or high-end security tokens.

How does the high manufacturing cost of OTP display cards act as a restraint?

The high cost of integrating specialized components—secure chips, thin batteries, and micro-displays—into a credit card form factor creates a high initial investment barrier, especially for mass deployments compared to the negligible cost of software tokens, thereby restraining adoption in less security-critical or cost-sensitive markets.

Why are government and defense sectors major customers for OTP cards?

These sectors require robust, certified hardware tokens for secure access to classified networks and sensitive information. OTP cards offer a high level of physical security and resistance to remote hacking, which is crucial for protecting national security interests and maintaining regulatory integrity.

What impact does supply chain complexity have on the market?

The reliance on specialized suppliers for secure chips and thin-film batteries, coupled with the need for secure key injection facilities, creates a complex, high-security supply chain. Any disruption or vulnerability in this chain can significantly impact production capacity and security assurance, necessitating tight vertical integration or specialized vendor agreements.

How do OTP cards mitigate phishing attacks effectively?

Since OTP display cards are not connected to the internet or exposed to phishing links, the generated code cannot be stolen remotely via typical malware or fake login pages. Furthermore, transaction signing cards explicitly mitigate sophisticated man-in-the-middle attacks by verifying transaction details before code generation.

What are the limitations of time synchronization in TOTP cards?

Synchronization issues can arise if the card's internal clock drifts significantly from the authentication server's time. Manufacturers counter this by using highly precise resonators and implementing small acceptance windows (drift tolerance) on the server side to ensure slight timing discrepancies do not invalidate the generated OTP.

What emerging technology is competing directly with OTP display cards?

FIDO (Fast Identity Online) compliant security keys and advanced biometric authentication methods integrated into mobile devices are the primary competing technologies, offering high security potentially at a lower total cost, challenging the dominance of physical display cards in some enterprise and consumer segments.

How do manufacturers ensure the secure key injection process?

Key injection occurs in highly secure, physically controlled manufacturing environments that comply with stringent security standards (like ISO 27001 and specific payment card industry certifications). This process ensures that the cryptographic secret key is installed securely into the secure element and never exposed externally, maintaining the root of trust.

Is the market moving towards hybrid solutions combining payment and security features?

Yes, there is a clear trend toward hybrid solutions. Integrating the OTP display with EMV chip technology allows banks to issue a single card that serves as both a physical payment instrument and a strong online authentication token, improving customer convenience and consolidating technology infrastructure.

What is the relevance of the OTP card market in the context of IoT security?

OTP cards are increasingly relevant in IoT security, particularly in industrial IoT (IIoT) and critical infrastructure environments. They provide a reliable, hardware-based mechanism for authenticating operators or devices accessing control systems, where network reliability and software vulnerability are major concerns.

What defines the upstream segment of the OTP Display Card value chain?

The upstream segment is defined by the sourcing and manufacturing of core electronic components, including the secure element chips, ultra-thin batteries, flexible circuit boards, and the micro-display units. This segment requires high specialization in microelectronics and material science.

What are the key factors driving high adoption rates in the Middle East?

The Middle East market is driven by high investment in secure digital government services (e-government initiatives), sophisticated financial institutions requiring enhanced AML/KYC compliance, and the commitment to deploying robust infrastructure resistant to regional cyber threats, favoring high-quality hardware security tokens.

What is the primary function of the LCD or E-Ink display on the card?

The display's primary function is to securely show the dynamically generated One Time Password (OTP) or, in advanced models, to display transaction details that the user must verify before generating the verification code. It serves as the physical interface for the secure element.

How does standardization, like the TOTP standard (RFC 6238), affect the market?

Standardization ensures interoperability, allowing OTP cards from different manufacturers to work with a wide range of authentication servers and enterprise security systems. This reduces vendor lock-in and facilitates easier integration and widespread market adoption.

Why is robustness and durability a key design consideration for OTP cards?

Since OTP cards are carried in wallets and subjected to bending, temperature fluctuations, and pressure, they must be extremely robust. Maintaining durability ensures the longevity of the embedded electronics and battery, preventing premature failure and reducing costly replacement cycles for issuers.

What role do third-party personalization bureaus play in the downstream market?

Personalization bureaus manage the secure process of linking the card to the end-user's identity, including printing the user's name, injecting account-specific data, and securely binding the card to the issuer's authentication system before the card is physically delivered and activated by the customer.

How is the healthcare industry utilizing OTP display cards?

Healthcare utilizes OTP cards primarily for securing remote access to sensitive patient records (EHR/EMR) and internal networks. This is essential for complying with strict data privacy regulations like HIPAA, ensuring that only authorized medical professionals or administrative staff can access confidential patient information.

What is the significance of integrating biometrics into future OTP card designs?

Biometric integration provides an added layer of authentication by verifying the cardholder's fingerprint before the OTP is generated. This ensures that even if the card is lost or stolen, it cannot be used by an unauthorized person, significantly raising the security baseline.

Do display cards require specific readers or infrastructure for usage?

No, one of the key benefits of the OTP display card is that it is infrastructure-independent for the user. The card simply displays the code, which the user then manually inputs into any standard login interface (web browser or application), requiring no specialized hardware readers or drivers.

What is driving the demand for advanced transaction signing capabilities?

Demand is driven by the need to prevent sophisticated wire transfer fraud and account takeover attacks where fraudsters attempt to change payee details after the user has logged in. Transaction signing provides undeniable proof that the user verified the specific transaction parameters before authorizing the transfer.

What constitutes the midstream segment of the OTP display card value chain?

The midstream segment involves the core manufacturing process: assembling the components, laminating the card body, integrating the flexible circuits, and performing the highly critical secure key injection and initial programming of the authentication algorithm before the card is ready for personalization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager