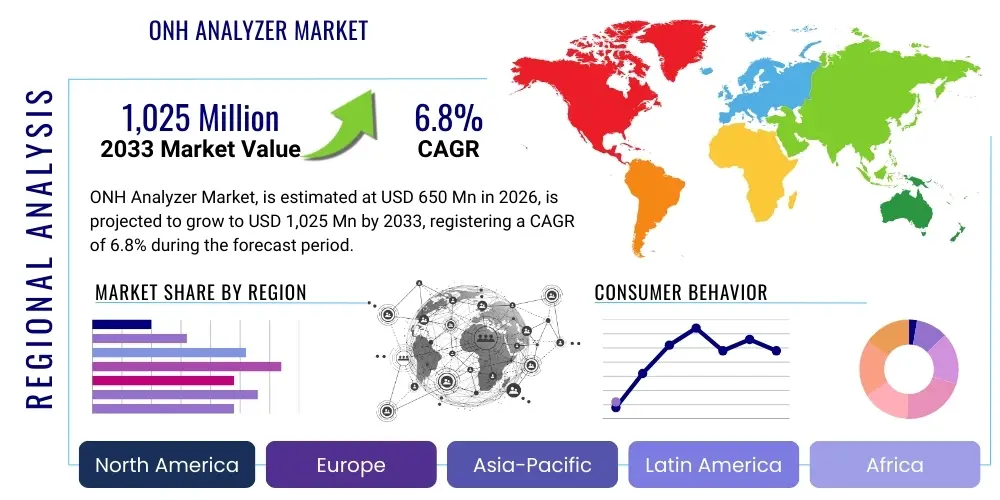

ONH Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436559 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

ONH Analyzer Market Size

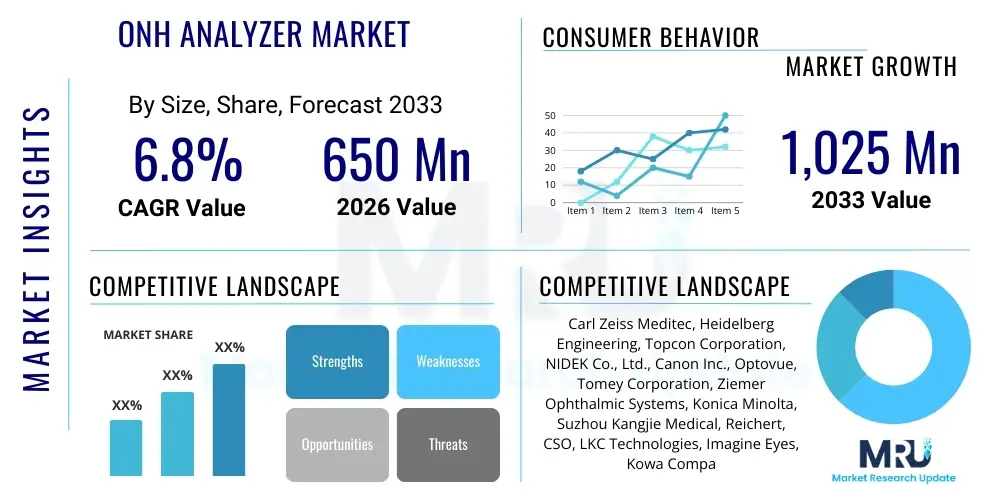

The ONH Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,025 Million by the end of the forecast period in 2033.

The substantial growth trajectory of the ONH (Optic Nerve Head) Analyzer Market is primarily fueled by the increasing global prevalence of ocular diseases, particularly glaucoma, which necessitates precise and repeatable diagnostic tools. Glaucoma is a silent disease, often asymptomatic until advanced stages, driving demand for early detection technologies that can quantify structural changes in the optic nerve head and retinal nerve fiber layer (RNFL). Healthcare modernization initiatives in developing economies, coupled with significant technological advancements in imaging modalities such as Spectral-Domain Optical Coherence Tomography (SD-OCT) and Swept-Source OCT (SS-OCT), are major factors contributing to the upward market momentum.

Furthermore, the integration of advanced artificial intelligence (AI) algorithms into ONH analysis platforms enhances diagnostic accuracy and workflow efficiency, making these devices indispensable assets in ophthalmic practices. The rising elderly population worldwide, which is inherently more susceptible to vision impairment and chronic eye conditions, guarantees a persistent patient base requiring sophisticated monitoring technologies. Investment in clinical research aimed at identifying biomarkers and optimizing treatment protocols also stimulates the adoption of high-resolution analyzers capable of providing quantifiable, objective data essential for effective disease management. This convergence of demographic pressure, technological innovation, and clinical necessity solidifies the market's robust long-term financial outlook through 2033.

ONH Analyzer Market introduction

The ONH Analyzer Market encompasses advanced diagnostic imaging devices primarily utilized in ophthalmology to assess the health and structure of the optic nerve head (ONH) and the surrounding retinal tissues. These analyzers, which often leverage technologies like Optical Coherence Tomography (OCT) or Scanning Laser Tomography (SLT), provide cross-sectional, high-resolution images and quantitative measurements of critical structures such as the Retinal Nerve Fiber Layer (RNFL) thickness, optic disc size, cup-to-disc ratio, and macular parameters. The principal application lies in the early diagnosis, progression monitoring, and management of chronic eye diseases, most notably glaucoma, but also extending to conditions like diabetic retinopathy, optic neuropathies, and multiple sclerosis-related vision changes. The sophistication of these devices allows clinicians to track minute changes over time, offering objective data superior to traditional visual field testing or fundus photography alone.

The product portfolio within this market segment includes sophisticated standalone desktop units designed for high-throughput clinical settings, as well as increasingly portable and handheld versions suitable for mobile clinics and remote screening initiatives. Major applications revolve around preventive screening programs targeting high-risk populations, detailed structural analysis for confirming initial diagnoses, and establishing baselines for treatment efficacy monitoring. Benefits derived from the adoption of ONH analyzers are manifold, including enhanced diagnostic precision, improved repeatability of measurements, non-invasiveness, and the potential for earlier intervention, which ultimately translates into better patient outcomes and reduced healthcare costs associated with advanced vision loss. The quantitative nature of the data facilitates standardized reporting and supports evidence-based clinical decision-making across global practices, further solidifying their market positioning as essential diagnostic tools.

Driving factors propelling market expansion include the escalating global burden of blinding diseases, particularly glaucoma, exacerbated by an aging demographic structure and rising incidence of co-morbidities such as diabetes and hypertension which affect ocular health. Furthermore, increasing awareness among both patients and healthcare providers regarding the importance of proactive ophthalmic screening and the subsequent capital investment in state-of-the-art diagnostic equipment by large hospital networks and specialty eye clinics in both developed and emerging economies contribute significantly to market dynamics. Regulatory approvals streamlining the market entry of highly sophisticated, user-friendly devices further accelerate their integration into routine ophthalmic examinations, thereby maintaining a consistent growth trajectory for the entire ONH Analyzer ecosystem.

ONH Analyzer Market Executive Summary

The global ONH Analyzer Market is characterized by intense technological innovation centered on improving image resolution, scan speed, and automation capabilities. Key business trends indicate a strong move toward platform consolidation, where manufacturers integrate various diagnostic modalities (such as OCT, angiography, and fundus imaging) into single, unified systems to enhance clinical utility and efficiency. Strategic collaborations between device manufacturers and AI developers are increasingly common, aimed at leveraging deep learning algorithms for automated segmentation, disease classification, and prediction of structural damage progression, which significantly impacts clinical workflow and diagnostic confidence. Furthermore, sustainability in business models is observed through increasing emphasis on subscription-based software updates and cloud-based data management services, moving away from purely hardware-centric revenue streams. The competitive landscape is dominated by a few major international players who invest heavily in R&D to maintain technological superiority, while regional players focus on cost-effective solutions for underserved markets.

Regional trends highlight North America and Europe as the dominant markets, driven by established healthcare infrastructures, high reimbursement rates for advanced diagnostics, and early adoption of sophisticated OCT technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, surging medical tourism, and a massive, underserved population base facing an escalating incidence of glaucoma and related ocular conditions. Governments in countries like China and India are increasingly investing in eye care services and screening programs, creating substantial opportunities for market penetration. In contrast, the Latin America and Middle East & Africa (MEA) markets show potential, constrained mainly by budget limitations and regulatory hurdles, though specialized private clinics continue to adopt high-end diagnostic machinery.

Segment trends reveal that the Optical Coherence Tomography (OCT) technology segment retains the largest market share owing to its superior resolution and non-invasive cross-sectional imaging capabilities, making it the gold standard for RNFL and ONH assessment. Within applications, glaucoma diagnosis remains the most crucial segment, consistently accounting for the majority of analyzer usage, given the chronic need for long-term monitoring. However, the utilization of these analyzers for tracking neuro-ophthalmic disorders and conducting broader health screenings is expanding rapidly. The End-User segment shows that Specialty Eye Clinics and independent ophthalmic practices are the primary consumers, often valuing throughput efficiency and detailed reporting features, while large hospital systems prioritize network integration and compatibility with electronic medical record (EMR) systems for centralized data management.

AI Impact Analysis on ONH Analyzer Market

Common user questions regarding AI's influence on the ONH Analyzer Market predominantly revolve around three key areas: diagnostic accuracy improvement, workflow automation, and the reliability of AI-driven prognosis. Users frequently ask: "Can AI reliably detect early glaucoma progression before human experts?" or "How will AI change the role of the ophthalmic technician in imaging?" and "What is the regulatory status and clinical validation required for AI-powered diagnostic recommendations?" The underlying expectations center on AI reducing the inter-observer variability inherent in manual interpretation, providing objective, standardized readings irrespective of the operator’s expertise, and significantly speeding up the time-to-diagnosis in high-volume settings. There is also considerable interest in AI's capacity to correlate structural data from the ONH with functional data (visual fields) for a more comprehensive predictive model of vision loss, moving beyond simple classification to true prognostic analysis.

The integration of artificial intelligence is fundamentally transforming the capabilities and utility of ONH analyzers, moving them from simple imaging tools to intelligent diagnostic assistants. AI algorithms, particularly deep learning models trained on vast datasets of healthy and diseased optic nerve images, are deployed to perform automated segmentation of retinal layers, accurate delineation of the optic nerve margin, and precise measurement of subtle structural thinning indicative of early stage pathology. This automated processing capability significantly reduces the need for manual adjustment and interpretation, thereby accelerating the diagnostic process and ensuring highly consistent reporting across different clinical sites, addressing one of the major limitations of previous generation devices.

Furthermore, AI-powered predictive analytics are emerging as a core functionality, allowing clinicians to forecast the rate of glaucoma progression and identify patients at high risk of rapid visual field decline, enabling more aggressive and personalized treatment strategies. AI systems can identify complex patterns that might be imperceptible to the human eye, improving sensitivity in detecting pre-perimetric glaucoma. This technological shift not only enhances diagnostic throughput but also democratizes access to expert-level structural analysis, allowing general practitioners or technicians in remote locations to obtain highly validated, expert-backed reports, thereby expanding the potential use cases and market reach of advanced ONH analyzer technology into telemedicine and screening environments.

- AI-driven automated retinal and ONH segmentation enhances measurement precision and reproducibility.

- Predictive algorithms estimate glaucoma progression rate, aiding personalized treatment planning.

- Increased diagnostic sensitivity allows detection of pre-perimetric glaucoma, enabling earlier intervention.

- Optimization of image acquisition parameters ensures higher quality scans with fewer user errors.

- AI facilitates teleophthalmology by providing validated remote interpretation capabilities.

- Reduction of inter-observer variability leads to standardized clinical reporting globally.

- Integration with EMR systems for seamless data flow and enhanced clinical decision support.

DRO & Impact Forces Of ONH Analyzer Market

The ONH Analyzer Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces steering its development and adoption landscape. A primary Driver is the alarming rise in the global prevalence of age-related eye disorders, especially glaucoma, coupled with an expanding elderly population worldwide, necessitating proactive screening and continuous structural monitoring. This demand is reinforced by technological leaps in imaging resolution and speed, such as SS-OCT, which provide clinicians with unprecedented detail and efficiency. However, the market faces significant Restraints, most notably the high initial capital investment required for purchasing advanced OCT and related analyzer systems, posing a substantial barrier to entry for smaller clinics and healthcare providers in economically constrained regions. Furthermore, the steep learning curve and the need for highly skilled technicians to operate and interpret complex scans can limit widespread adoption, particularly in rural or developing healthcare settings. The increasing scrutiny and evolving reimbursement policies in some major markets also introduce an element of financial uncertainty for providers.

The primary Opportunity for market growth lies in the rapid adoption of teleophthalmology and remote screening programs, leveraging portable or compact ONH analyzer devices integrated with cloud computing and AI interpretation. This allows for vast population screening in underserved areas, drastically increasing the potential user base beyond traditional specialized clinics. Another critical opportunity stems from expanding the application scope beyond glaucoma to include neuro-ophthalmology (e.g., monitoring multiple sclerosis, optic neuritis) and systemic disease management (e.g., microvascular changes related to diabetes), positioning the devices as indispensable tools across broader medical specialties. These opportunities, particularly those leveraging digital health infrastructure, act as significant compensating forces against existing market restraints.

The Impact Forces are heavily weighted towards technological advancement and demographic shifts. The collective force of Drivers, particularly the prevalence of chronic eye disease, significantly outweighs the Restraints, ensuring sustained market expansion. Technological momentum, driven by competitive R&D focusing on automation (AI) and non-invasive methods, acts as a critical impact accelerator. The market's overall trajectory is defined by a strong imperative for early detection and personalized medicine, leading to continuous investment in devices that offer quantitative, objective data. Opportunities such as geographic expansion into high-growth APAC markets and the integration of novel biomarkers further amplify the positive impact forces, making the ONH Analyzer segment a resilient and high-potential component of the overall medical diagnostics industry throughout the forecast period.

Segmentation Analysis

The ONH Analyzer Market is structurally segmented based on various critical parameters including the type of technology employed, the specific application of the analysis, the product type (portability and configuration), and the primary end-user settings. This comprehensive segmentation allows market players to precisely tailor their offerings, addressing specific clinical needs ranging from high-throughput screening in large hospitals to detailed research applications and localized monitoring in small private practices. The technological segmentation is particularly important, reflecting the competitive landscape dominated by different optical imaging principles, where performance metrics like axial resolution, scanning speed, and depth penetration are key differentiators influencing adoption rates across various price points and clinical requirements.

The application-based segmentation underscores the clinical utility hierarchy, with glaucoma management demanding the most sophisticated and routinely used analysis features, dictating much of the product design and software development within the industry. Product type segmentation, dividing the market between highly advanced standalone systems and emerging portable/handheld devices, reflects the expanding need for screening tools outside conventional clinical environments, crucial for telemedicine initiatives. Understanding these segment dynamics is essential for strategic market positioning, allowing companies to invest in technologies that align with the fastest-growing end-user segments, such as large specialty clinics or evolving ambulatory surgical centers, which require reliable, integrated, and efficient diagnostic platforms.

- By Type:

- Standalone Devices

- Portable and Handheld Devices

- By Technology:

- Optical Coherence Tomography (OCT) (Time-Domain, Spectral-Domain, Swept-Source)

- Scanning Laser Ophthalmoscopy (SLO)

- Retinal Tomography (e.g., HRT)

- By Application:

- Glaucoma Diagnosis and Progression Monitoring

- Diabetic Retinopathy Screening and Monitoring

- Macular Degeneration Assessment

- Neuro-ophthalmic Disorders Assessment (e.g., Optic Neuritis)

- By End User:

- Hospitals and Academic Medical Centers

- Specialty Eye Clinics and Ophthalmic Centers

- Ambulatory Surgical Centers (ASCs)

- Research Institutes and Clinical Trials

Value Chain Analysis For ONH Analyzer Market

The Value Chain for the ONH Analyzer Market begins with the Upstream segment, dominated by suppliers of critical high-precision components. This includes providers of sophisticated optical components (lasers, beamsplitters, detectors), high-speed computing processors necessary for rapid image reconstruction, and specialized software development companies providing advanced algorithms, particularly those focused on AI and image processing. Component quality and innovation in areas like SS-OCT laser sources are crucial here, as they directly impact the performance metrics (speed, resolution) of the final device. Manufacturing and assembly follow, where leading OEMs integrate these components, focusing heavily on quality control, regulatory compliance (FDA, CE Mark), and platform reliability. Strong relationships with specialized component suppliers ensure competitive advantage in device performance.

The Midstream segment involves distribution channels, which are bifurcated into Direct and Indirect models. Major global manufacturers often utilize a Direct distribution model for large, high-value contracts with major hospital groups and academic centers in key geographies (North America, Western Europe) to maintain margin control and direct customer relationships, crucial for post-sales support and service contracts. Conversely, an Indirect model, involving third-party distributors, is frequently employed for penetrating emerging or smaller markets. These distributors offer localized sales support, regulatory expertise, and maintenance services, bridging the gap between manufacturer and customer. Efficient logistics and a robust service network are vital in this stage, given the complexity and sensitivity of the equipment.

The Downstream segment comprises the End-Users, primarily hospitals, specialty eye clinics, and research institutions, who utilize the analyzers for patient diagnostics and monitoring. This stage also includes critical post-sales services such as ongoing software updates (especially AI algorithm enhancements), preventative maintenance, and clinical application training. The value chain concludes with the generation of clinical data, which often feeds back into R&D cycles for product improvement. Maximizing value at this stage depends on providing exceptional technical support and ensuring high device uptime, as the analyzer is a revenue-generating, essential diagnostic tool for the end-user.

ONH Analyzer Market Potential Customers

Potential customers for ONH Analyzer products are primarily institutions and specialized medical practitioners heavily involved in the diagnosis and long-term management of chronic ocular diseases, particularly those affecting the optic nerve. The core customer base includes high-volume clinical settings such as large regional Hospitals and Academic Medical Centers. These institutions require high-throughput devices capable of integration with extensive electronic health record (EHR) systems, often serving as referral centers for complex cases and utilizing the analyzers for both routine clinical care and large-scale clinical research. They prioritize features such as advanced AI tools, broad application versatility, and robust service contracts due to the mission-critical nature of the equipment.

The largest volume of sales often targets Specialty Eye Clinics and independent Ophthalmic Practices, which focus predominantly on patient management and long-term monitoring, especially for glaucoma patients. For these customers, factors like ease of use, space efficiency, and a strong return on investment (ROI) through efficient billing and patient throughput are paramount. The increasing trend of consolidating independent practices into large, multisite group practices further emphasizes the need for devices that offer data sharing capabilities and standardized analysis across multiple locations. These practices are rapidly adopting the latest SS-OCT and AI-enhanced models to maintain a competitive edge in diagnostic accuracy.

A growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and Community Screening Centers, particularly those participating in public health initiatives aimed at early disease detection, such as diabetic retinopathy screening programs. This segment shows increasing interest in portable or handheld ONH analyzers that offer mobility and simplified operation, allowing for outreach programs in rural or underserved populations. Furthermore, Pharmaceutical and Biotechnology Research Institutes represent a stable customer base, utilizing these analyzers as objective endpoint measurement tools in clinical trials assessing the efficacy of new glaucoma and neuroprotective drugs, demanding the highest standards of measurement precision and repeatability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,025 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss Meditec, Heidelberg Engineering, Topcon Corporation, NIDEK Co., Ltd., Canon Inc., Optovue, Tomey Corporation, Ziemer Ophthalmic Systems, Konica Minolta, Suzhou Kangjie Medical, Reichert, CSO, LKC Technologies, Imagine Eyes, Kowa Company, Huvitz, Visionix, Clarity Medical, Medmont International, Quantel Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ONH Analyzer Market Key Technology Landscape

The technological landscape of the ONH Analyzer market is dominated by advancements in Optical Coherence Tomography (OCT), which has become the de facto standard for quantitative optic nerve assessment. Early Time-Domain OCT (TD-OCT) has largely been superseded by Spectral-Domain OCT (SD-OCT), which offers significantly higher axial resolution (typically 5 to 7 micrometers) and vastly increased scanning speed, enabling rapid acquisition of detailed 3D volume scans of the optic nerve head and surrounding retinal nerve fiber layer (RNFL). SD-OCT’s speed minimizes motion artifacts, crucial for accurate thickness measurements that track minute changes associated with disease progression. This technological shift has profoundly enhanced diagnostic precision, allowing for the reliable detection of pre-perimetric glaucoma damage.

The cutting edge of technology resides in Swept-Source OCT (SS-OCT), which utilizes a longer wavelength light source (around 1050 nm) and a frequency-sweeping mechanism. SS-OCT provides deeper tissue penetration, particularly beneficial for imaging the choroid and reducing light scattering from cataracts, and achieves even faster scan speeds than SD-OCT, often exceeding 100,000 A-scans per second. This speed facilitates wide-field imaging, capturing both the ONH and macula in a single session, thereby providing holistic structural data relevant to optic nerve diseases. Furthermore, the development of OCT Angiography (OCTA) technology, which can be integrated into high-end ONH analyzers, is gaining traction. OCTA non-invasively visualizes microvascular blood flow around the optic nerve head, offering crucial functional data that complements the structural analysis, potentially improving early diagnosis and understanding of glaucoma pathophysiology.

Beyond hardware, significant technology advancements are focused on software and data processing. Advanced software algorithms are crucial for automated artifact reduction, precise segmentation of ocular layers, and standardized analysis across different patient populations. The pervasive integration of Artificial Intelligence (AI) and deep learning is perhaps the most transformative technological trend, enabling fully automated, clinically validated interpretation of complex scans, providing risk stratification, and predicting disease progression trajectories. Moreover, connectivity features, including DICOM compatibility and cloud-based data storage solutions, are essential for modernizing clinical workflow, facilitating remote consultation, and supporting large-scale epidemiological research, thereby ensuring that the ONH analyzer remains a data-rich diagnostic platform optimized for the digital healthcare environment.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most technologically advanced market for ONH analyzers. This dominance is attributable to robust healthcare expenditure, high awareness regarding preventative eye care, and favorable reimbursement policies for advanced diagnostic imaging, especially for chronic conditions like glaucoma. The market is characterized by the quick adoption of high-end SS-OCT and AI-integrated systems, driven by major academic research centers and competitive specialty clinics focused on minimizing liability through accurate, objective diagnosis. The presence of leading global manufacturers and significant investment in clinical research further solidify the region's strong market position.

- Europe: The European market is mature and highly consolidated, driven by well-established public and private healthcare systems and stringent regulatory standards ensuring device quality. Western European countries (Germany, France, UK) lead in adoption, emphasizing clinical efficiency and integration with national health records. While slightly slower in adopting the newest SS-OCT technology compared to the US, the European market shows strong growth in incorporating AI for population screening and leveraging analyzers for neuro-ophthalmological applications, reflecting a comprehensive approach to managing structural ophthalmic health.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth (highest CAGR) over the forecast period. This rapid expansion is fueled by massive patient pools (particularly in China and India) suffering from high rates of glaucoma and diabetes-related eye conditions, coupled with rapid modernization of healthcare infrastructure and increasing government funding for non-communicable disease screening. While cost remains a sensitive factor, leading to demand for value-oriented devices, increasing disposable income and rising awareness are accelerating the adoption of mid-to-high-range analyzers, especially within private clinics and medical tourism hubs.

- Latin America (LATAM): The LATAM market is developing, with growth concentrated in major economies like Brazil and Mexico. Market penetration is often constrained by economic volatility and limited healthcare budgets, favoring the purchase of refurbished equipment or more cost-effective SD-OCT systems over high-end SS-OCT. However, a growing private sector and increasing physician education are slowly driving demand for reliable diagnostic equipment to address significant backlog in ophthalmic care.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth. The Gulf Cooperation Council (GCC) countries exhibit high per capita expenditure on advanced medical technology, leading to the rapid adoption of premium ONH analyzers in specialized private hospitals. Conversely, adoption across the rest of Africa remains low, primarily limited by infrastructure and affordability, though opportunities exist through global health initiatives focused on preventable blindness and telemedicine outreach programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ONH Analyzer Market.- Carl Zeiss Meditec AG

- Heidelberg Engineering GmbH

- Topcon Corporation

- NIDEK Co., Ltd.

- Canon Inc.

- Optovue, Inc.

- Tomey Corporation

- Ziemer Ophthalmic Systems AG

- Konica Minolta, Inc.

- Suzhou Kangjie Medical Co., Ltd.

- Reichert, Inc.

- CSO S.p.A.

- LKC Technologies, Inc.

- Imagine Eyes SA

- Kowa Company, Ltd.

- Huvitz Co., Ltd.

- Visionix (Luneau Technology)

- Clarity Medical Systems

- Medmont International Pty Ltd

- Quantel Medical (Lumibird Group)

Frequently Asked Questions

Analyze common user questions about the ONH Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the ONH Analyzer Market?

The primary technology driving market growth is Swept-Source Optical Coherence Tomography (SS-OCT). SS-OCT provides superior speed, deeper penetration, and higher resolution compared to older Spectral-Domain OCT (SD-OCT), making it essential for detailed optic nerve head (ONH) and retinal nerve fiber layer (RNFL) assessment, particularly in complex cases or high-throughput clinical settings.

How is Artificial Intelligence (AI) being utilized in ONH analyzers?

AI is utilized for automated image segmentation, artifact reduction, and precise measurement of structural parameters like RNFL thickness. Crucially, AI algorithms enhance diagnostic confidence by classifying optic nerve health status and predicting the rate of glaucoma progression, improving efficiency and standardization across different users and locations.

Which geographical region offers the highest growth potential for ONH analyzer manufacturers?

The Asia Pacific (APAC) region is projected to offer the highest Compound Annual Growth Rate (CAGR). This acceleration is due to rising prevalence of ocular diseases, increased healthcare infrastructure investment, growing public awareness of eye care, and expansion of ophthalmic services in populous nations like China and India.

What are the key differences between standalone and portable ONH analyzer devices?

Standalone devices are high-performance, stationary units designed for large clinics, offering maximum resolution and speed, often integrated with complex software suites. Portable devices are compact and cost-effective, prioritizing mobility for use in community screening, remote diagnosis, and teleophthalmology outreach programs, often sacrificing some image resolution for operational flexibility.

Beyond glaucoma, what other clinical applications utilize ONH analyzer technology?

While glaucoma diagnosis is the core application, ONH analyzers are increasingly used for monitoring diabetic retinopathy, assessing macular degeneration, and evaluating various neuro-ophthalmic disorders such as optic neuritis and papilledema, providing objective structural markers for disease progression related to systemic health conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager