Online Alcohol Delivery Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433318 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Online Alcohol Delivery Service Market Size

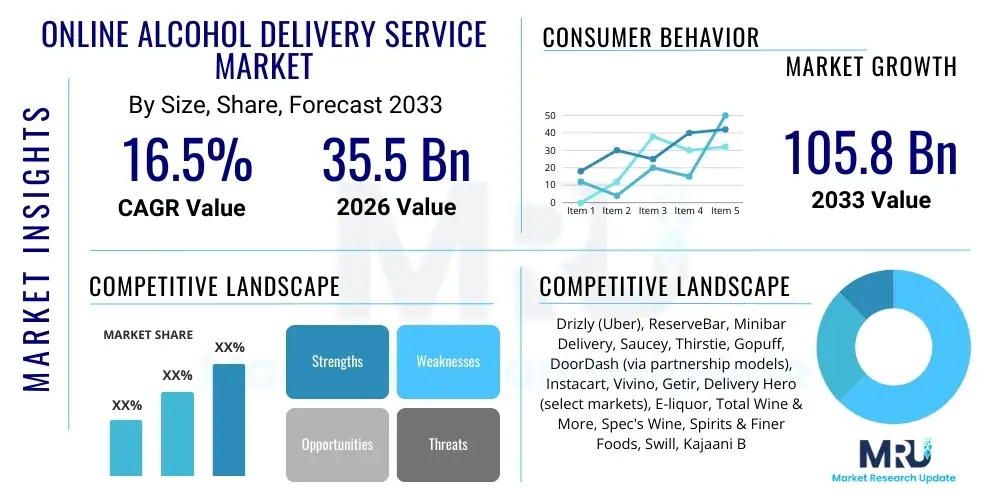

The Online Alcohol Delivery Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 105.8 Billion by the end of the forecast period in 2033.

Online Alcohol Delivery Service Market introduction

The Online Alcohol Delivery Service Market encompasses the retail distribution of alcoholic beverages directly to consumers via digital platforms, including dedicated mobile applications and e-commerce websites. This service facilitates the sale of a wide array of products, such as beer, wine, spirits, and Ready-to-Drink (RTD) cocktails, leveraging advanced logistical networks to ensure prompt and legally compliant delivery. The primary applications of this market revolve around convenience retailing, celebratory consumption planning, and supplementing traditional brick-and-mortar liquor sales, particularly catering to consumers seeking immediate fulfillment or access to specialized, niche products not readily available locally. The emergence of robust age verification technologies and streamlined supply chain processes has significantly lowered barriers to entry and enhanced consumer trust, accelerating market adoption globally.

Key benefits derived from the adoption of online alcohol delivery services include unparalleled convenience, expansive product selection that transcends local inventory limitations, and competitive pricing often enabled by direct-to-consumer models or optimized distribution chains. Furthermore, these platforms provide crucial data insights into consumer purchasing patterns, enabling personalized marketing and inventory management for retailers and brands. The structure of the market relies heavily on partnerships between technology providers, licensed retailers, and third-party logistics firms to manage the complex regulatory landscape surrounding alcohol sales, which often varies significantly by jurisdiction, mandating strict adherence to licensing, taxation, and responsible serving protocols.

The market is predominantly driven by increasing urbanization, rising disposable incomes, and the persistent shift in consumer preferences toward on-demand delivery services popularized by other sectors like food and groceries. Technological advancements, particularly in GPS tracking, inventory synchronization, and sophisticated fraud detection systems, continue to refine the customer experience and improve operational efficiency. The COVID-19 pandemic served as a pivotal accelerating factor, normalizing the concept of purchasing controlled substances online, leading to sustained demand even as restrictions eased. Regulatory modernization, where governments relax outdated restrictions on direct-to-consumer sales, also plays a crucial role in unlocking new market potential.

Online Alcohol Delivery Service Market Executive Summary

The Online Alcohol Delivery Service Market is undergoing a rapid transformation characterized by strategic consolidation, technological integration, and expansion into highly regulated international territories. Current business trends indicate a strong move toward hybrid models, where traditional licensed retailers integrate delivery capabilities powered by third-party technology platforms or establish proprietary e-commerce channels, ensuring full compliance while maintaining control over brand experience. Investment is heavily concentrated in developing sophisticated last-mile logistics solutions that guarantee fast delivery times while meeting stringent age verification requirements at the point of delivery. Furthermore, the segmentation of offerings is becoming increasingly granular, focusing on premiumization, subscription services for curated selections, and leveraging AI for highly personalized product recommendations, thereby boosting customer lifetime value and reducing churn.

Regionally, North America, particularly the United States, remains the largest and most dynamic market, driven by favorable state-level regulatory changes and high consumer comfort with e-commerce, though significant growth is projected across Asia Pacific (APAC) as regulatory environments in countries like China and India slowly liberalize. European markets exhibit maturity, emphasizing efficiency and integrating online sales within existing dense retail networks. Emerging markets in Latin America and the Middle East & Africa (MEA) are seeing initial spikes in adoption, though hampered by fragmented cold chain logistics and diverse, often restrictive, legal frameworks regarding alcohol advertisement and sales. Cross-border delivery remains minimal due to regulatory complexities, leading companies to prioritize localized fulfillment models.

Segment trends reveal that the Spirits category is experiencing the fastest revenue growth online due to higher average order values and extended shelf life, simplifying logistics compared to perishable items like craft beer. However, the Ready-to-Drink (RTD) segment is rapidly gaining traction, appealing to younger demographics due to convenience and flavor innovation, prompting platforms to optimize inventory management for these highly volatile product lines. In terms of delivery models, the scheduled delivery segment, offering greater efficiency for bulk purchases, competes closely with the on-demand segment, which dominates impulse purchases. Platform utilization shows mobile applications consistently outpacing website-based ordering, underscoring the necessity for seamless, mobile-first user interfaces optimized for speed and transactional security.

AI Impact Analysis on Online Alcohol Delivery Service Market

User queries regarding the impact of Artificial Intelligence (AI) on the online alcohol delivery sector frequently center on enhanced personalization, logistics optimization, and regulatory compliance effectiveness. Consumers and industry stakeholders are highly interested in how AI can move beyond basic recommendations to predict consumer purchasing patterns based on external factors like weather, social events, or even real-time sporting outcomes, thereby optimizing inventory placement and promotional targeting. A significant area of concern focuses on the ethical deployment of AI in age verification, ensuring biometric or data-driven checks are accurate, unbiased, and meet stringent privacy standards. Furthermore, there is substantial user expectation for AI-powered logistics routing that minimizes delivery time, reduces operational costs, and accurately forecasts demand volatility across different geographical micro-markets, directly addressing the complexities of last-mile delivery of controlled substances.

AI’s influence is revolutionizing the operational backbone of online alcohol delivery platforms by integrating advanced machine learning models into inventory management and fraud detection. These systems analyze vast datasets to anticipate stock-outs, manage inventory across multiple dispersed retail locations, and suggest optimal restocking points, drastically reducing spoilage and holding costs. Crucially, AI is deployed in sophisticated compliance frameworks; algorithms actively monitor local regulations (e.g., restricted delivery hours, volume limits) and integrate this information into the order placement process, effectively preventing illegal transactions and significantly mitigating regulatory risk for platforms and retailers. The resulting efficiency gains translate directly into more competitive pricing and faster service delivery, enhancing the market's overall value proposition.

The future application of AI is expected to deepen customer engagement through hyper-personalization, creating unique digital storefronts for each user based on past behavior, stated preferences, and external context signals. AI-driven chatbots are also gaining prominence, handling customer service inquiries related to delivery status, product inquiries, and regulatory questions instantaneously, reducing the strain on human support resources. From a strategic perspective, AI tools are critical for competitive pricing strategy, analyzing competitor pricing in real-time and dynamically adjusting prices to maximize margin while maintaining market attractiveness, ensuring platforms remain agile in a crowded digital retail environment.

- AI powers hyper-personalization of product recommendations, driving higher conversion rates.

- Machine learning algorithms optimize delivery routes and batching, reducing last-mile costs by up to 15%.

- Advanced image recognition and predictive analytics enhance age verification and fraud detection, ensuring regulatory compliance.

- AI facilitates dynamic pricing strategies based on competitor analysis and real-time demand fluctuations.

- Predictive maintenance models forecast hardware failure in logistics infrastructure, ensuring service continuity.

- Natural Language Processing (NLP) enhances customer service efficiency via sophisticated chatbots handling routine queries.

DRO & Impact Forces Of Online Alcohol Delivery Service Market

The market's dynamics are shaped by a powerful interplay of growth drivers, inherent regulatory constraints, and emerging technological opportunities. Key drivers include the accelerated digital adoption rate among millennial and Gen Z consumers, demanding seamless e-commerce experiences across all product categories, coupled with the continuous expansion of rapid delivery infrastructure (micro-fulfillment centers and dark stores). Restraints are primarily rooted in highly fragmented and often archaic local alcohol regulations, mandating state-specific licenses and complex taxation structures, which increase operational complexity and limit scalability across jurisdictions. Opportunities abound in tapping into the premium and craft beverage segments, offering subscription boxes, and expanding into B2B services, such as supplying restaurants and corporate events via dedicated online portals. The combined effect of these forces creates a high-growth environment characterized by significant compliance challenges and strong competitive rivalry.

The market is critically sensitive to consumer trust, regulatory shifts, and economic stability. Impact forces include demographic shifts—specifically the aging population in developed economies, which may favor convenience—and changes in social norms regarding alcohol consumption (e.g., the rise of moderation and low-alcohol beverages). Technological disruption is a major accelerating force, pushing platforms toward drone or autonomous vehicle delivery trials in select compliant zones, aiming for cost reduction and speed improvements. The inherent dual responsibility of these platforms—acting both as a technology provider and a regulated entity—exposes them to unique operational and legal pressures. Success hinges on a platform’s ability to navigate the Tiers of the distribution system (supplier, wholesaler, retailer) while simultaneously optimizing the customer interface and last-mile efficiency.

Market growth is also significantly influenced by competitive actions, such as aggressive pricing, exclusive brand partnerships, and mergers and acquisitions aimed at horizontal integration across multiple geographies or vertical integration with wholesale distributors. The perceived risk of regulatory crackdown due to failed age verification attempts is a continuous restraining factor that compels heavy investment in identity verification technology. Consequently, the impact forces prioritize compliance as a competitive advantage. Platforms that can demonstrate superior regulatory adherence while maintaining operational speed are best positioned to secure market dominance and gain favorable treatment from policymakers looking to modernize alcohol distribution safely.

Segmentation Analysis

The Online Alcohol Delivery Service Market is segmented based on critical operational and consumer dimensions, including Product Type, Delivery Model, and Platform Type, allowing for targeted strategic planning and resource allocation. Understanding these segments is vital as consumer behavior differs significantly between impulse buys (requiring on-demand delivery of beer) and high-value, planned purchases (like premium spirits or fine wine requiring scheduled delivery). The market analysis utilizes these segments to identify the most lucrative niches, such as the rapid growth observed in the Ready-to-Drink (RTD) cocktails category, which resonates strongly with mobile app users seeking immediate consumption options, driving investment towards rapid fulfillment infrastructure focused on refrigerated transport solutions.

Segmentation by Delivery Model—On-Demand (typically under 60 minutes) versus Scheduled (pre-planned deliveries)—is essential for optimizing logistics and cost structures. On-Demand models command higher prices and cater to immediate needs, demanding hyper-localized inventory and efficient urban logistics. Scheduled models allow for maximized delivery vehicle load capacity, serving bulk purchases, subscriptions, or consumers outside dense urban centers. Furthermore, the segmentation by Platform (Mobile App vs. Website) confirms that Mobile Apps facilitate higher engagement, faster reordering, and leverage geolocation services effectively for personalized marketing and seamless checkout experiences, leading most major providers to prioritize mobile-first development strategies and dedicated app optimization.

The Product Type segmentation is the bedrock of inventory and supply chain management. The Beer segment, characterized by high volume and lower margins, requires specialized cold chain logistics. The Wine segment attracts consumers interested in terroir, vintage, and food pairing, necessitating specialized content and curation features on the platform. Spirits, offering high value density and logistical stability, drive the largest revenue streams and focus platforms on offering rare and limited-edition bottles. The complexity of managing these diverse product requirements across different fulfillment models underlines the sophisticated technological stack required to succeed in this highly competitive retail vertical.

- Product Type:

- Beer

- Wine

- Spirits (Whiskey, Vodka, Rum, Tequila, Gin, etc.)

- Ready-to-Drink (RTDs)

- Cider and Others

- Delivery Model:

- On-Demand Delivery

- Scheduled Delivery

- Platform Type:

- Mobile Application

- Website/E-commerce Portal

- End User:

- Individual Consumers

- Commercial (Restaurants, Bars, Corporate Events)

- Geographic Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Online Alcohol Delivery Service Market

The value chain for online alcohol delivery is complex, integrating traditional three-tier systems (Supplier, Wholesaler, Retailer) with modern e-commerce and logistics technology providers. Upstream analysis begins with raw material suppliers (grapes, grains, hops) and producers/manufacturers (Breweries, Wineries, Distilleries). These entities focus on brand building, quality control, and ensuring compliance with federal labeling standards. Their direct involvement with online platforms is increasing, shifting from exclusively selling through wholesalers to leveraging Direct-to-Consumer (DTC) licenses where permissible, enabling platforms to offer exclusive, limited-run products and greater margin opportunities by bypassing intermediate steps, though this remains heavily regulated in key markets like the US.

The midstream of the value chain is dominated by licensed wholesalers and the online delivery platform technology itself. Wholesalers handle bulk storage, distribution, and mandatory state taxes (in the US model). The online platform acts as the marketplace, managing user interfaces, payment processing, age verification technology, and compliance auditing. This middle layer is the most value-add component, utilizing sophisticated algorithms for demand forecasting and managing a network of licensed retailers who hold the final license necessary for direct sales to the end consumer. Effective inventory synchronization between the platform and the retailer’s physical stock is crucial here to prevent failed fulfillment and ensure a positive customer experience. Indirect channels heavily rely on aggregators or third-party logistics (3PLs), while direct channels are typically managed by large retailers or producer-owned delivery services.

Downstream involves the crucial last-mile logistics and the end consumer. Distribution channels are bifurcated into direct channels, where the retailer or the platform operates their own fleet (common for high-volume urban markets), and indirect channels, where independent contractor delivery personnel or specialized logistics partners handle the physical transport. The point of sale and delivery requires strict age verification protocols, often involving scanning government-issued IDs and obtaining electronic signatures, representing the final, mandatory compliance checkpoint. Potential customers are heavily influenced by delivery speed, cost, and product assortment, making the efficiency of the downstream operation the primary determinant of long-term success and customer retention in this highly competitive space.

Online Alcohol Delivery Service Market Potential Customers

The primary cohort of potential customers for online alcohol delivery services comprises tech-savvy urban dwellers, predominantly millennials and Gen Z consumers (ages 21-45), who prioritize convenience, speed, and personalized digital experiences. This demographic frequently utilizes on-demand services for groceries and meal kits and expects the same seamless fulfillment for alcoholic beverages, particularly during social gatherings or when seeking specific, hard-to-find craft selections. Their purchasing behavior is highly influenced by mobile accessibility, platform user experience, and competitive pricing, making them receptive to subscription models and promotional offers that integrate recommendations based on consumption history and social context. Furthermore, the rising number of individuals opting to host social events at home rather than frequenting bars contributes significantly to the demand for efficient bulk delivery solutions.

A second substantial customer segment includes high-net-worth individuals and connoisseurs, generally aged 35-60, who seek access to premium spirits, vintage wines, and rare collectibles. These customers typically engage in planned purchases via scheduled delivery, valuing exclusivity, robust product information (including tasting notes and vintage ratings), and discreet, high-quality fulfillment packaging. Platforms targeting this segment focus less on delivery speed and more on curatorial excellence, expert customer support, and strategic partnerships with high-end suppliers and wine merchants. They represent a high Average Order Value (AOV) segment, crucial for driving overall profitability, demanding bespoke inventory management and guaranteed product authenticity.

Beyond individual consumers, the commercial sector, encompassing small to mid-sized restaurants, bars, catering companies, and corporate event planners, represents a significant B2B customer base. These businesses utilize online platforms for reliable, transparent, and often high-volume replenishment of their inventories, particularly outside of standard distributor operating hours. They require dedicated interfaces, bulk discounting options, and detailed invoicing for regulatory compliance and expense tracking. Platforms that successfully integrate inventory management tools compatible with commercial POS systems and offer competitive wholesale pricing gain a strong foothold in this essential, high-volume segment, diversifying revenue streams away from solely consumer-facing retail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 105.8 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Drizly (Uber), ReserveBar, Minibar Delivery, Saucey, Thirstie, Gopuff, DoorDash (via partnership models), Instacart, Vivino, Getir, Delivery Hero (select markets), E-liquor, Total Wine & More, Spec's Wine, Spirits & Finer Foods, Swill, Kajaani Beverages, Drinkies, Molson Coors, Diageo, Brown-Forman. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Alcohol Delivery Service Market Key Technology Landscape

The technology backbone of the online alcohol delivery sector is characterized by the integration of sophisticated e-commerce platforms with advanced logistical and compliance technologies. Central to this is the reliance on robust API integration services that allow platforms to seamlessly connect with disparate retailer Point of Sale (POS) systems and wholesaler inventory databases in real-time. This real-time inventory synchronization is critical for preventing overselling and ensuring accurate product availability displayed to the consumer. Furthermore, Geographic Information System (GIS) technology is utilized not only for efficient routing and driver tracking but also for geo-fencing to ensure deliveries are confined to legally authorized zones and times, automatically blocking transactions that violate local ordinances, thereby embedding compliance into the core transactional mechanism.

Age verification technology represents a non-negotiable component of the technical landscape. This includes advanced mobile ID scanning capabilities leveraging smartphone cameras and optical character recognition (OCR) at the point of delivery, often backed by cloud-based databases for authentication against fraud. Leading platforms are also exploring AI and machine learning models to enhance the security and speed of this verification process, ensuring regulatory integrity while minimizing friction for the customer and the delivery driver. Additionally, blockchain technology is beginning to be trialed in supply chain management to ensure product provenance, particularly for high-value spirits and wines, offering consumers verifiable assurance against counterfeit goods—a significant concern in global alcohol retail.

Customer engagement relies heavily on data analytics and marketing automation platforms. Data collected on purchase history, browsing behavior, and demographic profiles feeds into recommendation engines, often powered by AI, delivering hyper-personalized marketing campaigns and suggested pairings. Secure payment gateways, capable of handling large volumes of transactions while maintaining PCI compliance, are standard. The adoption of cloud infrastructure is paramount, enabling rapid scalability to handle seasonal demand peaks (e.g., holidays) and supporting distributed micro-fulfillment networks necessary for competitive on-demand delivery speeds across diverse urban and suburban environments. These technologies collectively reduce operational risk, optimize fulfillment costs, and dramatically improve the overall digital customer experience.

Regional Highlights

- North America: Market Leader and Regulatory Sandbox

North America, particularly the United States, holds the largest market share, driven by increasing regulatory flexibility at the state level that permits Drizly (now owned by Uber), Minibar Delivery, and similar platforms to operate more broadly. The US market is highly fragmented, necessitating hyper-localized compliance solutions. High consumer purchasing power and widespread adoption of on-demand services fuel robust growth, especially in metropolitan areas like New York, California, and Florida. Investment is focused on integrating alcohol delivery into broader e-commerce and ride-sharing ecosystems, aiming for seamless cross-platform utility. Canada follows a slightly more centralized but rapidly evolving regulatory model, with provincial monopolies gradually opening doors to private delivery partnerships, indicating significant untapped potential in the scheduled delivery segment.

The region is a key testing ground for autonomous delivery trials and advanced age verification technology. Competition is fierce, leading to consolidation (e.g., the Drizly acquisition). The primary challenge remains navigating the patchwork of "three-tier" laws, which dictate how alcohol moves from producer to consumer. Success requires platforms to establish strong, compliant partnerships with licensed brick-and-mortar retailers, transforming them into de facto fulfillment centers. The strong craft beer and local distillery movements also provide platforms with a rich, unique inventory to offer, differentiating them from traditional liquor stores.

- Europe: Maturity, Density, and Legislative Nuances

The European market shows a high degree of maturity, characterized by high population density favorable for efficient last-mile delivery, especially in Western European countries like the UK, Germany, and France. However, regulatory frameworks vary substantially by nation; some, like the UK, have relatively liberal laws favoring private e-commerce, while others maintain stricter state controls or specialized licensing requirements. Growth is steady, driven by integration with major European food delivery giants (e.g., Delivery Hero and Getir) that are diversifying into controlled product categories. The market is highly price-sensitive, placing significant pressure on platforms to achieve operational scale to minimize delivery fees.

Wine dominates the product mix in Southern European countries, while beer and spirits maintain strong positions elsewhere. A unique regional trend is the prominence of subscription models for wine and craft beer, leveraging Europe’s deep-rooted appreciation for heritage and regional specialization. European platforms prioritize seamless integration with existing postal and logistics infrastructure, focusing on sustainability in packaging and delivery methods. Challenges include overcoming cross-border regulatory hurdles which restrict international sales and distribution, forcing platforms to build a country-by-country operating presence.

- Asia Pacific (APAC): Fastest Growth Trajectory and Regulatory Barriers

APAC is projected to exhibit the fastest growth over the forecast period, fueled by massive, digitally engaged populations in China, India, and Southeast Asia, coupled with rapidly expanding logistical capabilities. While high growth is expected, the region faces the most stringent and volatile regulatory environments, including outright bans or highly restricted marketing rules in several major markets. China’s urbanization and high mobile usage make it a prime target, focusing on Spirits and luxury products through established e-commerce giants like Alibaba and JD.com. India presents a massive, price-sensitive opportunity but is heavily hampered by state-level government controls on alcohol distribution and taxation.

Logistical challenges in APAC include establishing reliable cold chain infrastructure for beer and overcoming traffic congestion in mega-cities to ensure timely delivery. Platforms often utilize partnerships with convenience stores or local kiosks as pickup and micro-fulfillment points to circumvent delivery complexities. Success in APAC hinges on navigating diverse consumer tastes—from sake and soju in East Asia to complex local spirits in Southeast Asia—and investing heavily in compliant digital marketing that respects regional cultural and legal sensitivities regarding alcohol promotion. Regulatory liberalization, even in small increments, could unlock billions in new market value.

- Latin America (LATAM): Urbanization and Evolving Infrastructure

The LATAM market, led by Brazil and Mexico, demonstrates substantial promise, benefiting from rapid urbanization and high mobile penetration. The adoption of online delivery services saw a sharp acceleration post-pandemic. Challenges include fragmented retail environments, infrastructural deficiencies outside major metropolitan centers, and high rates of cash transactions, requiring innovative payment solutions. Regulatory structures are generally less restrictive than in North America regarding the three-tier system, but they pose unique challenges related to taxation and counterfeiting.

Platforms often integrate deeply with established local delivery networks (like Rappi or iFood) to leverage existing courier fleets. The primary product focus is on beer and local spirits (like Tequila and Cachaça). Competitive strategy involves offering affordable delivery fees and building consumer trust through reliable age verification processes. Overcoming currency fluctuations and localized logistical hurdles are critical to achieving profitable scalability in this geographically diverse region.

- Middle East and Africa (MEA): Highly Restricted but High-Value Niche

The MEA region is characterized by extreme market segmentation due to cultural and religious prohibitions on alcohol consumption in numerous countries. Market activity is heavily concentrated in specific jurisdictions (e.g., UAE, South Africa) where consumption is permissible, often targeting expatriate and high-end tourism markets. In permissible zones, the market focuses on high-value, premium spirits and wines due to high import taxes and limited local production. Security and compliance are paramount, often requiring government-issued licenses for consumers to even purchase alcohol, which must be verified online.

South Africa represents the largest and most developed sub-Saharan alcohol delivery market, driven by domestic consumption and fewer legal restrictions compared to Gulf states. In the Middle East, online sales are strictly controlled, often operating under specialized licenses linked to established hotel groups or duty-free operators. The high margins associated with sales in these restricted zones attract significant investment, but the potential for widespread adoption is severely limited by legal and cultural constraints, making it a highly specialized, risk-managed niche market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Alcohol Delivery Service Market.- Drizly (Acquired by Uber Technologies Inc.)

- ReserveBar

- Minibar Delivery

- Saucey

- Thirstie

- Gopuff

- Instacart

- Vivino

- Total Wine & More

- Delivery Hero SE (Operating in select non-US markets)

- Getir

- DoorDash (Via partnership models)

- Swill

- Winc (Subscription Model Focus)

- Diageo PLC (Through e-commerce initiatives and partnerships)

- Brown-Forman Corporation

- Pernod Ricard

- Anheuser-Busch InBev (AB InBev)

- Molson Coors Beverage Company

- Tesco PLC (UK Online Delivery)

Frequently Asked Questions

Analyze common user questions about the Online Alcohol Delivery Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Online Alcohol Delivery Service Market?

The Online Alcohol Delivery Service Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 16.5% during the forecast period from 2026 to 2033, driven primarily by technological advancements and shifting consumer preferences towards convenience.

Which factors primarily drive the growth of alcohol delivery platforms?

Key drivers include rapid urbanization, high consumer adoption rates of on-demand e-commerce services, increasing disposable income, and the gradual modernization and relaxation of regulatory frameworks pertaining to direct-to-consumer (DTC) alcohol sales in major economic regions.

What are the primary operational challenges faced by online alcohol delivery services?

The main challenges involve navigating the fragmented and complex regulatory compliance landscape across various states and countries, ensuring stringent real-time age verification at the point of delivery, and optimizing last-mile logistics to maintain profitability while offering competitive speed.

How does Artificial Intelligence (AI) influence the online alcohol delivery sector?

AI significantly impacts the market by enabling hyper-personalization of product recommendations, optimizing inventory management across dispersed fulfillment centers, and enhancing the accuracy of mandatory fraud detection and age verification protocols, thereby streamlining operations and reducing risk.

Which regional market holds the largest share in the global online alcohol delivery industry?

North America currently holds the largest market share, predominantly due to a high degree of digital readiness, substantial investment in specialized logistics, and recent state-level regulatory changes in the United States favoring the expansion of delivery platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager