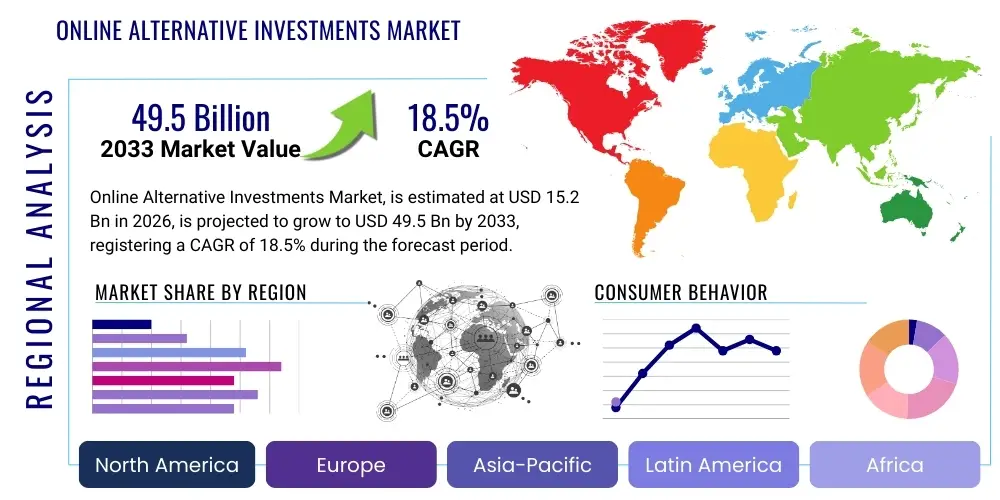

Online Alternative Investments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438963 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Online Alternative Investments Market Size

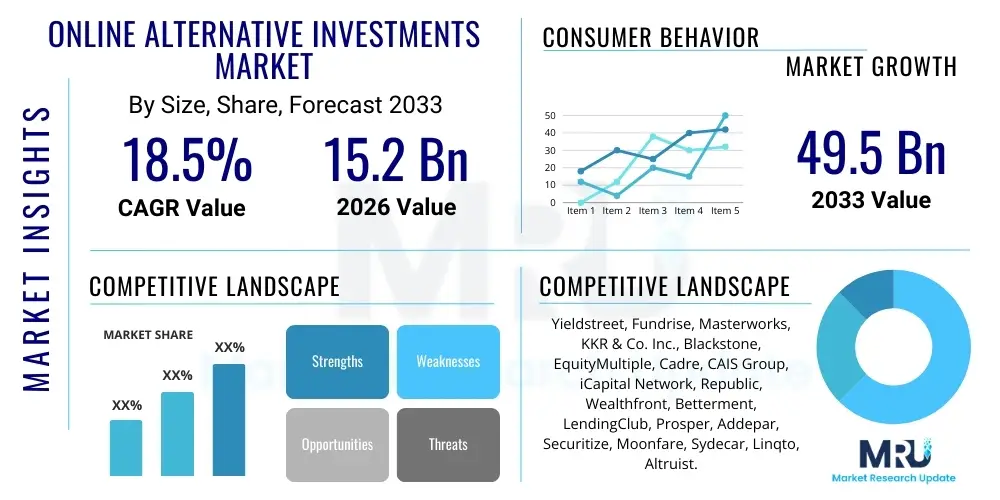

The Online Alternative Investments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 49.5 Billion by the end of the forecast period in 2033.

Online Alternative Investments Market introduction

The Online Alternative Investments Market encompasses digital platforms that facilitate investment in non-traditional assets, such as private equity, real estate, hedge funds, venture capital, commodities, and collectibles, which are typically inaccessible to standard retail investors due to high minimum capital requirements and opacity. These platforms leverage financial technology (FinTech) to democratize access, utilizing models like crowdfunding, fractional ownership, peer-to-peer lending, and sophisticated robo-advisory services. The fundamental product offered is fractionalized or digitized shares in illiquid assets, allowing a broader pool of investors to diversify their portfolios beyond traditional stocks and bonds. This shift is crucial for managing systemic portfolio risk and seeking uncorrelated returns, especially in volatile public markets, positioning online platforms as critical gateways to previously institutional-only opportunities.

Major applications of online alternative investment platforms span individual portfolio diversification, long-term capital appreciation strategies, and inflation hedging, particularly through asset classes like real estate and infrastructure. The primary benefits driving market adoption include significantly lowered entry barriers, increased transparency through digital record-keeping (often powered by Distributed Ledger Technology or DLT), and enhanced liquidity provided by secondary trading markets facilitated by some platforms. Driving factors propelling this growth include global interest rates remaining persistently low, prompting investors to search for yield in non-traditional venues; the technological maturity of crowdfunding and blockchain solutions making fractional ownership feasible; and evolving regulatory frameworks (such as the JOBS Act in the US) that favor retail participation in private markets.

Online Alternative Investments Market Executive Summary

The Online Alternative Investments Market is characterized by robust global expansion, driven predominantly by technological disruption and shifting investor demographics, focusing heavily on democratization and accessibility. Key business trends indicate a strong move toward vertical integration, where platform providers are expanding services to include escrow, compliance, and secondary market liquidity mechanisms, enhancing the overall investor experience and mitigating historical risks associated with illiquid assets. Furthermore, consolidation is increasing among smaller niche platforms, seeking greater scale and regulatory capital, while established financial institutions are actively partnering with or acquiring FinTech startups to integrate sophisticated alternative offerings into their wealth management suites. The confluence of low interest rates and high inflation expectations globally has cemented the role of private markets as essential components of modern diversified portfolios.

Regionally, North America maintains market leadership due to a mature regulatory environment supportive of private capital formation and a high density of innovative FinTech firms, particularly in venture capital and real estate crowdfunding sectors. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by a rapidly expanding high-net-worth individual (HNWI) population, significant urbanization driving demand for private infrastructure and real estate investments, and accelerated adoption of digital financial services in emerging economies. Segment trends reveal that Real Estate remains the largest asset class due to its tangible nature and established regulatory precedents, but Private Equity/Venture Capital (PE/VC) is experiencing the highest proportional growth, particularly through tokenization platforms, as investors seek exposure to early-stage technology growth often delayed in the public listing process. The retail investor segment is the primary growth engine, leveraging low-minimum platforms, while institutional investors are utilizing specialized portals (e.g., iCapital, CAIS) for streamlined access and operational efficiency.

AI Impact Analysis on Online Alternative Investments Market

User queries regarding AI's influence in alternative investments frequently center on themes of enhanced due diligence, predictive modeling capabilities, and algorithmic allocation tailored to illiquid assets. Investors are keen to understand how AI can reduce the information asymmetry inherent in private markets, specifically asking whether machine learning models can accurately assess risk profiles for non-standard assets like vintage cars or specific private credit tranches, and how AI-driven sentiment analysis can predict the success of early-stage startups. A significant concern revolves around the black-box nature of these advanced algorithms, requiring platforms to demonstrate clear explainability (XAI) for investment decisions to maintain trust. Expectations are high that AI will move beyond simple data aggregation to become a core tool for automating personalized, multi-asset allocation strategies, dramatically lowering management fees and operational complexity associated with managing diverse, specialized asset portfolios.

The practical application of Artificial Intelligence (AI) is transforming the operational backbone of the Online Alternative Investments Market, most notably in automating the screening and due diligence process for new offerings. AI algorithms are adept at processing vast datasets—including legal filings, historical property performance metrics, and proprietary startup financials—far exceeding human analytical capacity, thereby enhancing risk assessment precision and speeding up the underwriting lifecycle. This technological shift is crucial for private market efficiency, where timely decisions and complex regulatory adherence are paramount, simultaneously reducing platform costs and providing investors with higher quality, verified investment opportunities that are less prone to manual error or bias.

- AI-powered predictive modeling forecasts liquidity events and valuation trends for illiquid assets (e.g., private equity portfolio exits).

- Enhanced algorithmic matching connects investors with specific asset profiles (e.g., regional real estate projects or sector-specific VC funds).

- Automated compliance monitoring uses Natural Language Processing (NLP) to review legal documents and flag regulatory inconsistencies instantly.

- Sentiment analysis models evaluate public perception and social indicators related to collectible assets (e.g., fine art, wine), influencing appraisal values.

- Robo-advisory tools specifically designed for alternative asset allocation optimize diversification across various illiquid asset classes based on investor risk tolerance and time horizon.

- AI-driven chatbots and support systems provide instant, specialized information regarding complex investment structures, improving investor education and platform usability.

DRO & Impact Forces Of Online Alternative Investments Market

The Online Alternative Investments Market is fundamentally driven by the persistent global demand for yield and diversification away from increasingly volatile public markets, propelled by the technological feasibility of fractional ownership and reduced regulatory barriers for retail investors. The primary restraint centers on the inherent illiquidity and complexity of alternative assets, compounded by heterogeneous and often ambiguous global regulatory oversight, which poses challenges to cross-border platform scaling. Significant opportunities are emerging through the adoption of Distributed Ledger Technology (DLT) for asset tokenization, promising to revolutionize security issuance, enhance asset traceability, and potentially unlock secondary market liquidity for previously locked-up investments. These internal and external pressures result in a high impact force environment, pushing platforms toward enhanced transparency, specialized regulatory compliance, and technological innovation to capture market share and sustain investor trust.

Drivers: Democratization and Yield Seeking

The primary driver is the widespread democratization of access to sophisticated investment opportunities, previously exclusive to institutional investors or UHNWIs. Online platforms dramatically lower minimum investment thresholds (often from millions to hundreds or thousands of dollars), making assets like private equity funds, commercial real estate, and fine art accessible to the mass affluent and retail segments. This inclusion is critical in markets where conventional fixed-income returns are minimal, pushing investors, especially millennials and Generation Z, toward higher-yield, higher-risk private market assets to meet long-term financial goals. Additionally, the inherent low correlation of alternative assets with public stock market fluctuations offers crucial portfolio diversification benefits, significantly appealing to professional wealth managers seeking to reduce systemic risk exposure for their clients.

Furthermore, technological advancements in data processing and user interface design have reduced the complexity associated with evaluating alternative investments. Platforms now provide detailed, standardized performance metrics, transparent fee structures, and streamlined digital onboarding processes, overcoming traditional obstacles of opacity and operational difficulty. This focus on digital efficiency not only attracts new investors but also reduces the operational burden on the platforms themselves, allowing them to scale their offerings rapidly across different asset classes and geographies while maintaining high standards of compliance and investor reporting, thereby continuously expanding the addressable market.

Restraints: Illiquidity and Regulatory Complexity

A significant restraint remains the inherent illiquidity of most underlying alternative assets, particularly private equity and direct real estate investments, which typically require multi-year holding periods. Although online platforms attempt to mitigate this through occasional secondary market offerings or specialized repurchase programs, investors face the risk of needing to sell assets below fair value or being unable to exit their positions when necessary. This liquidity premium, coupled with the complex nature of private market valuations—which lack the constant pricing mechanisms of public exchanges—introduces volatility in perceived returns, complicating due diligence for standard retail users who may not fully grasp the long-term capital commitment required.

Moreover, the fragmented and often lagging regulatory environment poses substantial operational constraints. Online platforms frequently operate across multiple jurisdictions, each with differing rules regarding investor accreditation, solicitation limits, asset custody, and secondary trading of fractionalized securities. Navigating this compliance maze demands significant legal and technological resources, often hindering rapid international expansion and increasing the cost of capital. Regulatory uncertainty, especially concerning the classification of tokenized assets and digital securities, continues to inject risk, forcing platforms to operate conservatively and sometimes limiting the scope of truly innovative offerings until clearer guidelines are established.

Opportunities: Tokenization and Institutional Integration

The most compelling opportunity lies in the widespread adoption of Distributed Ledger Technology (DLT) and asset tokenization. Tokenization involves issuing digital tokens representing fractional ownership of real-world assets (RWAs), such as commercial buildings or private fund shares. This technology promises to solve the critical liquidity restraint by creating immutable, transparent ownership records and facilitating near-instantaneous, cost-effective transfer of ownership on blockchain rails, thereby unlocking secondary markets that are currently fragmented and costly. The ability to trade fractionalized assets 24/7 on global exchanges dramatically enhances the appeal of alternatives for investors seeking greater flexibility.

Another powerful opportunity resides in the deeper integration of alternative asset platforms with established institutional finance ecosystems. Wealth management firms, registered investment advisors (RIAs), and family offices are increasingly seeking sophisticated digital tools to seamlessly allocate client capital into private markets. Platforms that offer robust APIs, white-label solutions, and superior reporting capabilities—integrating effortlessly with existing portfolio management software (e.g., custodians and aggregators)—are positioned to capture substantial institutional flows. This shift transforms alternatives from niche investments into a mainstream component of fiduciary responsibility, exponentially expanding the Total Addressable Market (TAM) beyond self-directed retail investors.

Impact Forces:

The convergence of powerful technological drivers and persistent regulatory restraints creates significant impact forces shaping market direction. High investor demand for yield and diversification acts as a potent driving force, continuously pulling capital toward online platforms. Simultaneously, the force of regulatory scrutiny, particularly concerning consumer protection and financial stability, applies pressure, compelling platforms to enhance KYC/AML protocols and disclosure standards. The disruptive force of tokenization acts as a catalyst, threatening to fundamentally change how private market securities are issued, managed, and traded. These combined forces mandate that successful market players must excel not only in sourcing attractive investment deals but also in establishing superior technological infrastructures that ensure regulatory compliance and provide transparent liquidity mechanisms.

Segmentation Analysis

The Online Alternative Investments Market is multifaceted, segmented primarily based on the underlying asset type, the specific platform technology utilized to facilitate the investment, and the demographic profile of the investor. This structural breakdown helps in understanding the varying risk appetites, regulatory constraints, and technological maturity across different market niches. The segmentation reveals that while established assets like Real Estate dominate current volume due to their tangible nature and historical performance data, rapidly evolving segments like Venture Capital and Collectibles, powered by innovative fractionalization models and blockchain technology, are driving the highest growth rates, indicating a future shift toward more digitally native and specialized asset classes.

Understanding these segments is crucial for strategic planning. For instance, platforms targeting institutional investors prioritize robust compliance, detailed API integrations, and access to large, diversified private equity funds, while platforms focusing on retail investors emphasize low minimums, educational content, and user-friendly mobile interfaces, often specializing in unique assets like art or wine. The ongoing interplay between regulatory advancements and technological capabilities dictates the viability and scalability of each segment, with the most robust growth occurring in areas where digital efficiency effectively mitigates traditional investment barriers.

- By Asset Type:

- Real Estate (Commercial, Residential, Debt/Equity)

- Private Equity/Venture Capital (Growth Funds, Early-Stage VC, Secondary PE)

- Hedge Funds (Long/Short Equity, Global Macro, Event-Driven)

- Commodities and Natural Resources

- Collectibles and Specialty Assets (Art, Wine, Memorabilia, Intellectual Property)

- Private Credit and Debt (P2P Lending, Mezzanine Financing)

- By Platform Model:

- Crowdfunding Platforms (Equity-based, Debt-based)

- Peer-to-Peer (P2P) Lending Platforms

- Robo-Advisory Platforms (Dedicated Alternative Allocation)

- Digital Broker-Dealer Platforms (Institutional Access)

- Tokenization/DLT Platforms (Fractionalized Digital Securities)

- By Investor Type:

- Retail Investors (Non-Accredited)

- Accredited/High Net Worth Individuals (HNWIs)

- Institutional Investors (Pension Funds, Endowments, Sovereign Wealth Funds)

- Family Offices

Value Chain Analysis For Online Alternative Investments Market

The value chain for Online Alternative Investments starts with the Upstream Analysis, which involves the sourcing, structuring, and standardization of the underlying assets. This crucial stage requires expertise in deal origination, rigorous due diligence, legal structuring (converting illiquid assets into investable digital securities or fractions), and securing regulatory approval for offering memorandum. Key upstream participants include asset managers, specialized real estate developers, private fund GPs, and legal/compliance teams, often leveraging proprietary data analysis and local expertise to identify high-quality assets that meet platform criteria for digitization and investor appeal. Success at this stage dictates the quality and variety of offerings available to the end investor.

The midstream segment is dominated by the Online Investment Platforms themselves, acting as the primary aggregators and facilitators. These platforms host the digital marketplace, handle technology infrastructure, manage user authentication (KYC/AML), process transactions, and provide investor reporting. Distribution channels are predominantly direct, leveraging sophisticated digital interfaces and mobile applications to reach a global investor base without traditional intermediary costs. Indirect distribution, though less common, occurs through wealth management firms and RIAs who utilize platform APIs or specialized portals (like CAIS or iCapital) to allocate client capital. Downstream analysis focuses on post-investment services, including asset servicing, ongoing regulatory compliance, performance monitoring, quarterly reporting, handling distributions, and, increasingly, facilitating secondary market liquidity mechanisms, which sustain investor interest and capital recycling.

Online Alternative Investments Market Potential Customers

The core potential customer base for online alternative investments is rapidly expanding beyond the traditional institutional sphere to encompass the affluent and mass affluent retail segments, driven by technological accessibility. High Net Worth Individuals (HNWIs) and Family Offices remain pivotal customers, utilizing these platforms for efficient access to exclusive private equity and hedge fund strategies, valuing the streamlined due diligence and diversified access offered by platforms like Moonfare and iCapital. These customers often seek specialized, complex offerings designed for large capital commitments and long-term wealth preservation, prioritizing tax efficiency and robust reporting capabilities.

However, the largest growth segment consists of accredited and non-accredited retail investors who are seeking better returns than conventional savings or bonds can offer. These end-users, typically younger, digitally savvy professionals, are attracted by low minimum investments (often $100 to $10,000) and the ability to invest in tangible assets like fractionalized real estate or curated art collections that align with their personal interests. Platforms must prioritize ease of use, robust educational content, and clear risk disclosures to serve this diverse and rapidly growing demographic effectively, positioning themselves as indispensable tools for portfolio diversification and achieving long-term financial independence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 49.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yieldstreet, Fundrise, Masterworks, KKR & Co. Inc., Blackstone, EquityMultiple, Cadre, CAIS Group, iCapital Network, Republic, Wealthfront, Betterment, LendingClub, Prosper, Addepar, Securitize, Moonfare, Sydecar, Linqto, Altruist. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Alternative Investments Market Key Technology Landscape

The technological landscape of the Online Alternative Investments Market is dominated by the synergy between advanced financial technology (FinTech), Distributed Ledger Technology (DLT), and sophisticated data analytics, all aimed at solving the core problems of illiquidity, information asymmetry, and high transaction costs inherent in private markets. Investment platforms rely heavily on cloud-based infrastructure to ensure scalability, robust security protocols, and high availability, essential for managing large volumes of sensitive financial data and handling global transactions. Furthermore, regulatory technology (RegTech) solutions are integrated deeply to automate KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance across diverse jurisdictions, utilizing biometric verification and automated document processing to streamline investor onboarding and adherence to securities laws, reducing manual errors and operational lag.

Crucially, the ongoing adoption of blockchain technology is reshaping the structure of alternative investments, moving beyond simple record-keeping to facilitating true asset tokenization. Security Token Offerings (STOs) leverage smart contracts to digitize ownership rights, automating the complexities of capital distribution, voting rights, and transfer restrictions, thereby creating the foundation for seamless secondary trading of previously illiquid assets. Concurrently, machine learning and AI are employed across the value chain, from automated deal screening using predictive algorithms to personalized portfolio construction and risk modeling that accounts for non-traditional factors, dramatically enhancing the efficiency and accuracy of investment recommendations and due diligence procedures for specialized asset classes.

Regional Highlights

Regional dynamics play a significant role in shaping the Online Alternative Investments Market, influenced by local regulatory maturity, investor wealth concentration, and the specific prevalence of high-growth asset classes. North America, particularly the United States, represents the largest market share due to its established infrastructure, high penetration of venture capital and private equity funds, and regulatory environments (like Regulation A+ and D) that actively facilitate online capital formation. The U.S. market is characterized by intense competition among platforms specializing in technology-focused crowdfunding and high-end institutional access portals, driving continuous innovation in digital security offerings and investor reporting standards.

Europe, while regulatory constrained by fragmented jurisdictional requirements, is rapidly expanding, primarily driven by strong demand for sustainable infrastructure and real estate investments facilitated through pan-European platforms. The focus in Europe is often on compliant tokenization (MiCA regulation providing future clarity) and utilizing platforms to meet ESG mandates. Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid wealth creation in countries like China, India, and Southeast Asia. APAC investors are keen on accessing global alternatives, utilizing platforms that can bridge international capital flows, with local platforms focusing strongly on P2P lending and region-specific real estate development funding.

- North America (Dominant Market): Characterized by mature FinTech ecosystems, regulatory support for private capital (e.g., JOBS Act), and leading platforms specializing in Private Equity access and commercial real estate crowdfunding (e.g., Yieldstreet, Fundrise).

- Europe (High Regulatory Focus): Growth driven by infrastructure assets and regional real estate. Emphasis on compliance with GDPR and anticipation of the Markets in Crypto-Assets (MiCA) regulation to standardize digital asset issuance, favoring platforms focused on security tokens.

- Asia Pacific (Fastest Growth): Driven by rising HNWI populations in emerging economies and high demand for yield. Strong development in P2P lending and venture debt platforms, with rapid digital adoption accelerating platform usage across major financial hubs like Singapore and Hong Kong.

- Latin America (Emerging Potential): Focus on local real estate development funding and natural resources projects. Market growth is contingent on regulatory stability and increased trust in digital financial platforms amidst economic volatility.

- Middle East and Africa (MEA) (Specialized Growth): Growth centered around oil wealth diversification into global alternative assets (via institutional portals) and regional focus on large infrastructure and sovereign-backed projects, often utilizing specialized Sharia-compliant investment structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Alternative Investments Market.- Yieldstreet

- Fundrise

- Masterworks

- KKR & Co. Inc.

- Blackstone

- EquityMultiple

- Cadre

- CAIS Group

- iCapital Network

- Republic

- Wealthfront (Advisory Role)

- Betterment (Advisory Role)

- LendingClub

- Prosper

- Addepar (Technology Provider)

- Securitize

- Moonfare

- Sydecar

- Linqto

- Altruist

Frequently Asked Questions

Analyze common user questions about the Online Alternative Investments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of alternative assets are most commonly available through online platforms?

The most common online alternative assets are commercial and residential real estate, private equity/venture capital fund interests (often fractionalized), private credit/P2P loans, and increasingly, specialized collectibles like fine art and vintage wine, facilitated via fractional ownership platforms.

How does asset tokenization impact the liquidity of alternative investments?

Asset tokenization, powered by blockchain technology, significantly enhances liquidity by digitizing ownership into tradable security tokens. This allows for fractional ownership, reduces settlement times, and potentially opens up 24/7 secondary trading markets, mitigating the traditional illiquidity of private assets.

Are online alternative investment platforms regulated, and who can invest?

Yes, these platforms are regulated, typically as broker-dealers, funding portals, or registered investment advisors (RIAs), depending on their jurisdiction and service model. Investment eligibility varies, often restricted to 'accredited investors,' but many crowdfunding platforms now offer opportunities to 'non-accredited' retail investors under specific regulatory exemptions like Reg A+ or Reg CF.

What are the key risks associated with investing via these platforms?

Primary risks include reduced liquidity (inability to sell quickly), higher complexity and valuation uncertainty compared to public assets, reliance on platform operational security, and heightened credit/default risk, particularly in private credit and early-stage venture capital offerings.

How does AI contribute to decision-making in the Online Alternative Investments Market?

AI models are utilized for rigorous, high-speed due diligence, predictive risk modeling for illiquid assets, automating compliance checks (RegTech), and optimizing personalized portfolio allocation strategies that diversify across non-traditional asset classes based on investor risk profiles and market trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager